|

市場調查報告書

商品編碼

1441699

貨櫃型資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

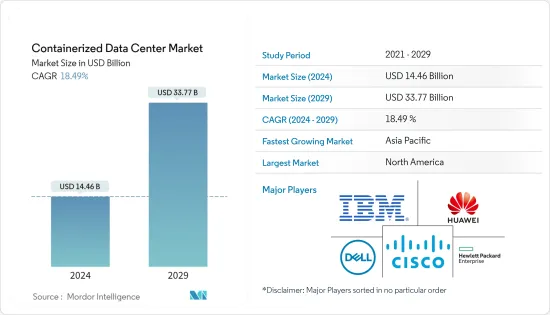

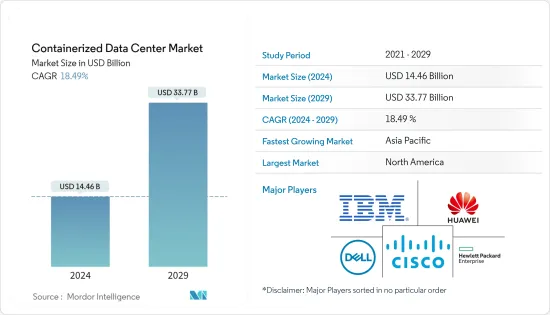

貨櫃型資料中心市場規模預計到 2024 年為 144.6 億美元,預計到 2029 年將達到 337.7 億美元,在預測期內(2024-2029 年)成長 18.49%。複合年成長率為

主要亮點

- 巨量資料和物聯網(IoT)技術將推動容器化資料中心市場的投資。世界各地的企業正在見證 IT 和通訊、BFSI、醫療保健、政府和國防等產業的大量資料產生。由於雲端運算的成長、地方政府對資料安全的監管以及國內企業的投資增加,外國雲端供應商的普及提高是推動容器化資料中心需求的一些關鍵因素。

- 政府在容器化資料中心市場的成長中發揮關鍵作用。各個政府機構都在關注數位基礎設施,以創造就業機會並推動創新。例如,今年六月,英國政府公佈了期待已久的數位計劃,以支持該國的數位經濟。英國政府聲稱,新的英國數位戰略到 2025 年可以將英國科技業的經濟貢獻增加 415 億美元。

- 近年來,隨著雲端服務的普及,對資料中心的需求不斷增加。根據《2021 年雲端基礎設施報告》中發布的調查結果,57% 的受訪者表示,他們公司一半以上的基礎設施都在雲端中,64% 的人預計未來五年內將完全是公共雲端。

- IT和通訊業每天處理和儲存大量資料的龐大需求是該領域資料中心建立市場成長的主要原因之一。此外,基於技術和服務的新興企業的出現正在將這些中小企業的注意力轉向具有成本效益的解決方案。這促使向雲端的遷移增加,從而增加了 IT解決方案供應商用於擴展其基礎設施的支出。

- COVID-19感染疾病對遠距工作、線上學習和虛擬娛樂的出現的影響,以及巨量資料和物聯網日益成長的影響力,對世界各地的容器化資料中心營運商產生了影響。容器化資料中心正在迅速增加。處理和儲存能力。因此,資料中心為全球經濟從 COVID-19感染疾病中復甦提供了巨大的機會。此外,新南威爾斯(NSW)政府針對資料 -19感染疾病對國家經濟的經濟影響,評估了資料中心(SSD)的經濟效益,並決定宣布將其暫時重新分類作為一個新的發展。

- 在包含許多設備和從公司位置運行的資料中心的大型網路中分發資料會降低網路可見性,尤其是在物聯網網路框架中,因為每個設備代表另一個潛在端點。可能存在性和控制方面的問題。使用 Edge 的其他裝置也存在類似問題。安全漏洞可以使駭客輕鬆存取您的核心網路,從而進一步限制資料中心的效能。隨著物聯網世界的引入,網路節點點的增加進一步增加了安全性問題。此外,物聯網設備也是一些經常成為目標的設備。

貨櫃型資料中心市場趨勢

對節能資料中心的需求不斷成長

- 綠色資料中心的主要目標是提高能源效率並最大限度地減少對環境的影響。綠色或永續資料中心是儲存、管理和傳輸資料的地方,資料系統(包括機械和電氣系統)都可以節省能源。降低碳排放、降低成本並提高效率。

- 此外,這些綠色資料中心使現代企業能夠節省電力並減少碳排放。它的使用正在全球範圍內的大型和小型企業中擴展。此類資料中心可以成功地服務各種企業資料用途,從收集到處理、審查和分發。

- 此外,政府也宣布了在該地區實現碳中和的計畫。例如,今年6月,日本政府發布了《清潔能源戰略》中期報告。此外,目標是到 2050 年實現碳中和,到 2030 年將溫室氣體排放減少 46%,同時透過在未來保持穩定和廉價的能源供應來實現成長。日本正加強脫碳努力,爭取到 2030 年將溫室氣體排放(GHG) 減少 46%。

- 根據荷蘭資料中心協會統計,荷蘭80%的資料中心使用綠色電力。這意味著至少20%的荷蘭資料中心仍然嚴重依賴石化燃料。使用的綠色能源通常是「淺綠色」電力(「認證電力」),並非來自荷蘭永續發電。資料中心的電力供應中只有一小部分是「深綠色」的,這意味著它是在荷蘭永續生產的。還有很多工作要做,特別是考慮到《氣候協議》和《荷蘭氣候法案》的目標,即到 2050 年基本上消除溫室氣體並在該國實現二氧化碳中和發電。

- 此外,根據Cloud scene的數據,截至今年1月,美國有2701個資料中心,德國還有487個資料中心。英國擁有 456 個資料中心,在國家中排名第三,僅次於中國(443 個)。

預計北美將佔據主要佔有率

- 北美貨櫃型資料中心市場預計在未來幾年將快速成長。推動這一擴張的因素有很多,包括巨量資料和雲端運算的興起,以及主機代管服務需求的增加。這篇部落格文章探討了北美貨櫃型資料中心市場以及推動其擴張的一些關鍵促進因素。

- Temenos AG 表示,美國BFSI 產業的雲端採用率正在上升,81% 的銀行家表示,在美國監管多年來對雲端技術的關注之後,他們的多重雲端策略不再是監管的重點。77% 的銀行家相信多重雲端策略將成為監管的先決條件。的銀行家認為,從人工智慧 (AI) 中釋放價值將是銀行獲勝與敗者的關鍵。這是因為雲端、人工智慧和物聯網的普及產生了大量資料,增加了對資料中心的需求,從而推動了所研究市場的成長。

- 4 月份, 美國擴大了雲端基礎技術的使用,但目前將繼續使用 Chaska資料中心。這家總部位於明尼阿波利斯的銀行宣布,除了關閉亞特蘭大和諾克斯維爾地區的兩個較小的資料中心外,還將使用微軟的 Azure 提供雲端服務。該銀行於 2017 年在 Chaska 開設了一個佔地 56,000 平方英尺的新資料中心。該網站由德克薩斯州 Stream 資料 Centers 建造,獲得了超過 100 萬美元的公共津貼和補貼,包括政府提供的 20 年減稅優惠。該市的評估價值約為 548,000 美元,明尼蘇達州就業和經濟發展部提供了 287,000 美元的預算,DEED 提供了 250,000 美元的贈款,用於支持基礎設施升級。

- 此外,增加資料中心建設將為所研究的市場創造成長機會。例如,今年4月,Facebook母公司Meta在密蘇裡州和德克薩斯州啟動了兩個新的資料中心計劃,使美國資料中心建設和營運的總投資達到近160億美元。位於德州德克薩斯州的工廠總合8 億美元,總面積約 90 萬平方英尺,位於密蘇裡州堪薩斯城的另一個耗資 8 億美元的工廠總合100 萬平方英尺。

- 此外,物聯網和連網型技術的興起正迫使許多公司轉型為數位化企業,對提供擴充性、快速部署、安全性、彈性和可用性的先進資料中心生態系統的需求不斷增加。業務趨勢的這種變化促進了尖端、敏捷且經濟高效的軟體定義解決方案的發展和創建。上述因素預計將推動市場成長。

貨櫃型資料中心產業概況

主要參與者包括 IBM 公司、惠普企業、思科系統、戴爾公司、Rittal GmbH &Co. KG 和華為技術有限公司等。這些公司擴大參與合併、收購和產品發布,以開發和引進新技術和產品。市場集中度將適度鞏固。

2022年5月,華為發布全新電源系統PowerPOD 3.0,定義了新一代資料中心設施。基於華為資料中心設施團隊和產業專家的集體智慧和共同努力,最新進展印證了華為發展低碳智慧資料中心的承諾。下一代資料中心建築將完全綠色且節能,所有資料中心材料將盡可能回收。整個資料中心生態系統因此變得更綠色、更永續。

2022 年 2 月,Vantage 位於德國法蘭克福的資料中心綜合體之一的第二期建設揭幕。宣佈在奧芬巴赫 55 兆瓦歐盟園區 (FRA1) 建造三棟建築中的第二棟。全面建成後,該發電廠的發電容量將達到16兆瓦,面積將達到13,000平方公尺(140,000平方英尺)。預計將於 2024 年上半年開始為客戶提供服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 市場促進因素

- 對可攜性的需求以及對可擴展資料中心解決方案不斷成長的需求

- 對節能資料中心的需求不斷成長

- 市場限制因素

- 計算性能有限

第5章市場區隔

- 依所有權類型

- 購買

- 租

- 依最終用戶

- BFSI

- 資訊科技和電訊

- 政府

- 教育

- 衛生保健

- 防禦

- 娛樂和媒體

- 其他最終用戶(工業、能源)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Hewlett Packard Enterprise Company

- IBM Corporation

- Dell Inc.

- Cisco Systems Inc.

- Huawei Technologies

- Emerson Network Power(Emerson Electric Co.)

- Schneider Electric SE(acquired AST Modular)

- Rittal Gmbh &Co. KG

- Baselayer Technology, LLC.

第7章 投資分析

第8章市場的未來

The Containerized Data Center Market size is estimated at USD 14.46 billion in 2024, and is expected to reach USD 33.77 billion by 2029, growing at a CAGR of 18.49% during the forecast period (2024-2029).

Key Highlights

- Big data and Internet-of-Things (IoT) technology will expand investments in the containerized data center market. Enterprises worldwide are witnessing high data generation across industries, such as IT and telecom, BFSI, healthcare, and government and defense. The growing cloud computing increasing penetration of foreign cloud vendors, government regulations for local data security, and increasing investment by domestic players are some of the major factors driving the demand for containerized data centers.

- The government plays a crucial role in the containerized data center market growth. Various government bodies focus on digital infrastructure to fuel job opportunities and drive innovation. For instance, in June this year, the UK government revealed its eagerly expected digital plan to support the nation's digital economy. By 2025, the government claimed that the new UK Digital Strategy could boost the economy's contribution from the UK tech sector by USD 41.5 billion.

- The need for data centers has increased in recent years due to the high adoption of cloud services. According to the survey results published in the Cloud Infrastructure Report 2021, 57% of the respondents reported that more than half of their infrastructure is in the cloud, while 64% expect that they will be fully in the public cloud in the next five years.

- The significant demand in the IT and telecommunication industries for data processing and storage of vast amounts of data daily has been one of the primary reasons for the growth of the data center construction market in this segment. Moreover, with the advent of more technology and service-based startups, these SMEs have shifted focus to cost-effective solutions. This has led to increased migration to the cloud, which, in turn, has increased spending on scaling up infrastructure by IT solution providers.

- Due to the COVID-19 pandemic's impact on the advent of remote work, online learning, and virtual entertainment, as well as the expanding influence of big data and the internet of things, global containerized data center operators are seeing a sharp rise in demand for their processing and storage capacity. As a result, data centers offer a great chance for the global economy to recover from the COVID-19 pandemic. Further, the New South Wales (NSW) state government announced the interim reclassification of data centers as State Significant Developments in reaction to the financial effects of the COVID-19 epidemic on the domestic economy and in appreciation of the economic benefits of data centers (SSDs).

- Distributing data across a large network containing numerous devices and data centers operating from enterprise locations can create problems with network visibility and control, with each device representing another potential endpoint, especially in the IoT network framework. Other devices that use edge have similar problems. Security loopholes can give hackers easy access to the core network, further creating performance constraints for data centers. With the global adoption of IoT, any increase in network node points increases security concerns further. Moreover, IoT devices are some of the frequently targeted devices.

Containerized Data Center Market Trends

Rising Demand for Energy Efficient Data Centers

- An environmentally friendly data center's primary goals are energy efficiency and minimal environmental effect. A green or sustainable data center is a location for storing, managing and transmitting data where all systems, including mechanical and electrical ones, conserve energy. It produces fewer carbon footprints, which reduces costs and improves efficiency.

- Further, these green data centers enable contemporary firms to conserve electricity and cut carbon emissions. Their use is expanding globally among both large corporations and SMBs. Such data centers can successfully serve the aims of a vast array of company data, from collection to processing and review to distribution.

- Moreover, the government has released plans to achieve carbon neutrality in the region. For example, in June this year, the Japanese government released a preliminary report on its "Clean Energy Strategy." Further, growth will be attained through maintaining a reliable and inexpensive energy supply for the future while striving to achieve carbon neutrality by 2050 and a 46% decrease in greenhouse gas emissions in fiscal 2030. To reach two ambitious goals-carbon neutrality by 2050 and a 46% decrease in greenhouse emissions (GHG) in fiscal 2030 Japan has intensified its decarbonization efforts.

- According to the Dutch Data Center Association, 80% of data centers in the Netherlands use green electricity. This means that at least 20% of Dutch data centers are still largely reliant on fossil fuels. The green energy used is often 'light green' electricity ('certified power') and does not come from sustainable electricity generation in the Netherlands. Only a small part of the power supply for data centers is 'dark green,' meaning that it is generated sustainably in the Netherlands. There is still a lot of work to be done, particularly considering the Climate Accord and the objectives of the Dutch Climate Act, namely the almost eradication of greenhouse gases and CO2- neutral electricity generation in this country by 2050.

- Further, according to Cloud scene, 2,701 data centers were located in the United States as of January this year, and 487 more were found in Germany. With 456, the United Kingdom came in third place among nations regarding the number of data centers behind China (443).

North America is Expected to Hold Major Share

- The North American containerized data center market is predicted to grow rapidly in the next few years. Several factors fuel this expansion, including the rise of big data and cloud computing and increased demand for colocation services. This blog post will examine the North American containerized data center market and some key drivers driving its expansion.

- According to Temenos AG, the adoption of cloud is increasing in the US BFSI industry as 81% of bankers believe that a multi-cloud strategy would become a regulatory prerequisite after several years of regulatory focus on cloud technologies in the United States, and 77% of bankers believed that unlocking value from artifiical intelligence (AI) will be the differentiator between winning and losing banks. This is because the proliferation of the cloud, AI, and the IoT has generated voluminous data that increases the need for data centers, thereby stimulating the growth of the market studied.

- In April this year, US Bancorp is expanding its use of cloud-based technologies, but for the time being, it will continue to use its Chaska data center. In addition to closing two minor data centers in the Atlanta and Knoxville regions, the Minneapolis-based bank said it would use Microsoft's Azure to offer cloud services. The bank occupied a new 56,000-square-foot data center in Chaska in 2017. The site, built by Texas-based Stream Data Centers, received more than USD 1 million in total public grants and subsidies, including a 20-year tax abatement from the city valued at approximately USD 548,000, a budget of USD 287,000 from the Minnesota Department of Employment and Economic Development, and a grant of USD 250,000 from DEED to support infrastructure upgrades.

- Further, the rise in data center construction would create an opportunity for the studied market to grow. For instance, in April this year, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in US data center construction and operations to almost USD 16 billion. A USD 800 million facility in Temple, Texas, will total approximately 900,000 square feet, while another USD 800 million facility in Kansas City, Missouri, will total nearly 1 million square feet.

- Further, With the rise of IoT and connected technologies, many firms have been forced to change into digital enterprises, which has increased the need for an advanced data center ecosystem that provides scalability, rapid deployment, security, flexibility, and availability. This change in business trends enables the evolution and creation of cutting-edge, highly agile, cost-efficient, and software-defined solutions. The factors mentioned above are anticipated to propel market growth.

Containerized Data Center Industry Overview

The major players include - IBM Corporation, Hewlett Packard Enterprise, Cisco Systems Inc., Dell Inc., Rittal GmbH & Co. KG, and Huawei Technologies Co. Ltd, among others. These players increasingly undertake mergers, acquisitions, and product launches to develop and introduce new technologies and products. As a result of this, the market concentration will be Moderately consolidated.

In May 2022, Huawei unveiled PowerPOD 3.0, a brand-new power supply system, as well as the definition of the Next-Generation Data Center Facility. Based on the collective wisdom and joint efforts of the Huawei Data Center Facility Team and industry experts, the latest rollouts confirm Huawei's commitment to developing low-carbon smart data centers. Next-generation data center buildings will be completely green and energy-efficient, with all data center materials recycled to the greatest extent possible. As a result, the total data center ecosystem will be ecologically benign and sustainable.

In February 2022, the second stage of construction of one of Vantage's data center complexes in Frankfurt, Germany, was revealed. On its 55 MW EU campus (FRA1) in Offenbach, the business announced that it would erect the second of three buildings there. When fully constructed, the plant will have a 16 MW capacity and be 13,000 square meters (140,000 square feet) in size. It will begin serving customers in the first half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Market Drivers

- 4.4.1 Need for Portability and Increasing Demand for Scalable Data Center Solutions

- 4.4.2 Rising Demand for Energy Efficient Data Centers

- 4.5 Market Restraints

- 4.5.1 Limited Computing Performance

5 MARKET SEGMENTATION

- 5.1 By Ownership Type

- 5.1.1 Purchase

- 5.1.2 Lease

- 5.2 By End User

- 5.2.1 BFSI

- 5.2.2 IT and Telecommunications

- 5.2.3 Government

- 5.2.4 Education

- 5.2.5 Healthcare

- 5.2.6 Defense

- 5.2.7 Entertainment and Media

- 5.2.8 Other End Users (Industrial, Energy)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hewlett Packard Enterprise Company

- 6.1.2 IBM Corporation

- 6.1.3 Dell Inc.

- 6.1.4 Cisco Systems Inc.

- 6.1.5 Huawei Technologies

- 6.1.6 Emerson Network Power(Emerson Electric Co.)

- 6.1.7 Schneider Electric SE (acquired AST Modular)

- 6.1.8 Rittal Gmbh & Co. KG

- 6.1.9 Baselayer Technology, LLC.