|

市場調查報告書

商品編碼

1432804

虛擬桌面:市場佔有率分析、產業趨勢與成長預測(2024-2029)Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

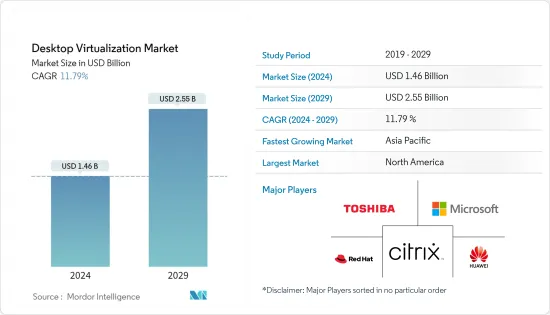

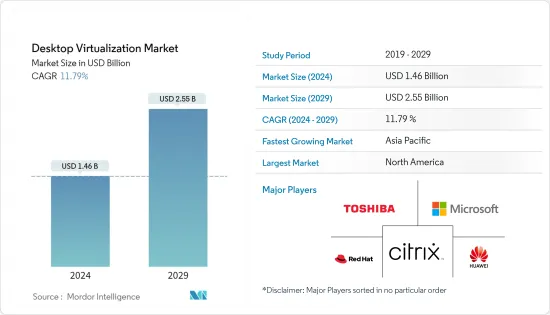

虛擬桌面市場規模預計到 2024 年為 14.6 億美元,預計到 2029 年將達到 25.5 億美元,預測期內(2024-2029 年)複合年成長率為 11.79%。

虛擬桌面也是數位工作空間的關鍵組成部分在虛擬桌面伺服器上運行的虛擬虛擬工作負載(通常在本地或公共雲端中的虛擬機器上運行)也是數位工作空間的一部分。

主要亮點

- 鑑於零售業已經展開激烈的數位轉型,實體零售商正在尋求投資電子商務和客戶參與,以加強商店營運、提高盈利並增加線上銷售額。虛擬桌面等IT技術主要由全部區域擁有多家商店的大型零售商和大賣場採用。

- 虛擬桌面使遠端工作人員能夠無縫存取公司資料和生產力應用程式。零售業的消費者態度發生了明顯轉變。隨著非接觸式零售交易的使用增加,事情正在朝這個方向發展。

- 在交易的每個關鍵階段,數據即服務允許遠端員工與客戶通訊並保持聯繫。對於服務供應商而言,採用虛擬桌面DaaS模式的公司有許多選擇。

- 然而,虛擬桌面平台的效能和相容性問題、高實施成本和訂閱成本阻礙了市場成長。

- 由於COVID-19感染疾病的正面影響,RealTil虛擬桌面市場在同一時期出現了正成長。這是由於冠狀病毒 -19感染疾病期間數字普及的急劇上升和嚴格的社交距離政策所推動的。對虛擬桌面工具等遠端操作工具的需求推動了這段時期虛擬桌面解決方案市場的成長。

虛擬桌面市場趨勢

託管虛擬桌面帳戶獲得顯著的市場佔有率

- HVD 用於將應用程式連接到遠端伺服器上儲存的資料。 (雲端)服務供應商負責資料儲存、備份、升級和安全。近年來,虛擬桌面已成為零售業全通路策略不可或缺的一部分。

- 高可用性和功耗最佳化等功能在市場上雲端基礎的產品和服務中非常常見。

- HVD 系統為員工進出職場提供了更大的彈性,同時又不犧牲安全性。此外,我們也改進了各種作業系統和桌面環境的安全性、管理和合規性。

- 此外,對於致力於雲端優先策略的零售商來說,Windows 虛擬桌面 (WVD) 是採用現代工作空間的絕佳機會。 WVD 更進一步,為組織中的所有使用者提供完整的 Windows 10 和 Office 365 體驗。另一方面,傳統的遠端桌面服務使企業能夠簡化桌面管理和資源。由於許多零售商使用 Microsoft Azure 提供虛擬桌面基礎架構,WVD 消除了管理大量虛擬機器和託管池的任務。

- 例如,競爭對手正在尋求利用 VDI 融合或超融合基礎設施平台來增強效能監控功能,以改善設備操作方面的客戶端體驗,或將虛擬融合式基礎架構與自己的雲端工作空間整合。我們專注於識別整合。

預計北美將佔據主要佔有率

- 由於社交媒體、行動技術、高級分析工具、雲端運算和物聯網 (IoT) 等廣泛領域的採用不斷增加,北美已成為將虛擬桌面解決方案推向市場的先驅。 。製造業、零售業等

- 此外,該地區在虛擬軟體供應商市場中佔據重要地位,並為其成長做出了貢獻。其中包括 VMware Inc.、Citrix Systems、Oracle Corporation 和 SolarWinds Corporation。

- 遠端員工可以使用虛擬桌面輕鬆存取業務資料和生產力應用程式。在零售方面,我們看到全部區域的消費者行為發生了重大變化。非接觸式零售交易的趨勢正在成長,對促進更快結帳、減少資本支出和最佳化員工生產力的解決方案的需求也在成長。

- 鑑於數位轉型可能在零售業最為激烈,實體店可能會專注於改善店內業績、提高盈利,並透過對電子商務和客戶參與的投資來推動線上銷售。主要零售商和擁有多家商店的區域性大賣場正在實施虛擬桌面等 IT 技術。

- 此外,駭客擴大使用行動模擬器,以便在執行其他攻擊之前顯得更加合法。為了防止這種威脅,全部區域的零售企業擴大使用虛擬桌面。

虛擬桌面產業概況

由於眾多參與者的存在,零售虛擬桌面市場高度分散。該市場的主要企業包括思傑系統公司、東芝公司、紅帽公司(IBM公司)、華為技術公司、微軟公司等。市場的技術進步也為公司提供了永續的競爭優勢。市場上還發生了各種聯盟和合併。

- 2023 年 7 月 - Citrix Systems Inc 宣布針對混合世界增強其雲端和本地解決方案。作為此擴充功能的一部分,桌面即服務 (DaaS) 和虛擬桌面基礎架構 (VDI) 產品已整合到 Citrix Universal 訂閱中。

- 2022 年 8 月 - VMware Inc 和 IBM 宣布擴大 atan 合作夥伴關係,旨在幫助全球合作夥伴和客戶實現混合雲端環境中關鍵任務工作負載的現代化,並加快實現價值的速度。解決與雲端遷移和任務更新相關的成本、複雜性和風險。關鍵工作負載對於 IBM 和 VMware 幫助銀行、零售、醫療保健和政府等受監管行業的客戶至關重要。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概覽(包括 COVID-19 的影響)

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 擴大雲端運算的採用

- 零售業自動化的發展

- 市場限制因素

- 基礎設施實施限制

第6章市場區隔

- 透過桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 依部署型態

- 本地

- 雲

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Citrix Systems Inc.

- Toshiba Corporation

- Red Hat Inc.(IBM Corporation)

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Parallels International GmbH

- Dell Inc.

- Ncomputing, Inc.

- Ericom Software Inc.

- Tems, Inc

- Vmware Inc.

第8章投資分析

第9章市場的未來

The Desktop Virtualization Market size is estimated at USD 1.46 billion in 2024, and is expected to reach USD 2.55 billion by 2029, growing at a CAGR of 11.79% during the forecast period (2024-2029).

Desktop virtualization is also a one of key component of digital workspace Virtual desktop workload running on desktop virtualization servers, which are typically run on virtual machines, either on premises or in the public cloud, is also a key component of digital workspace.

Key Highlights

- In light of the intense Digital Transformation that is already being played out in the Retail Sector, it can be expected that brick and mortar retailers will ramp up their store operations, improve profitability, increase online sales by investing in e commerce and customer engagement. IT technologies, like Desktop virtualization, have been mainly adopted by large retailers and hypermarkets with multiple stores across regions.

- Virtual desktops enable remote workers to have seamless access to enterprise data and productivity applications. There is a marked change of attitude among consumers within the retailing sector. With the increased use of contactless retail transactions, things are moving in that direction.

- At every critical stage of the transaction, Data as a Service enables remote employees to communicate and keep in touch with their customers. As far as service providers are concerned, enterprises adopting the DaaS model of desktop virtualization have a lot of choice.

- However, the market growth has been hindered by problems in performance and compatibility as well as expensive implementation and subscription costs for desktop virtualisation platforms.

- The Desktop Virtualization market in reatil was positively affected by the COVID-19 pandemic and showcased a positive growth rate during the period, owing to dramatically increased digital penetration during the period of COVID-19-induced lockdowns and stringent social distancing policies, which further fueled the demand for remote operational tools such as desktop virtualization tools, which contributed towards the growth of the Desktop Virtualization solutions market during the period.

Desktop Virtualization Market Trends

Hosted Virtual Desktop Accounts for Significant Market Share

- HVD is used to connect applications to the data stored on remote servers. The (cloud) service provider is responsible for data storage, backup, upgrade, and security. In recent years, virtual desktops have become an integral part of omnichannel strategies in the retail sector.

- Features, such as high availability and power optimization are quite common, the across cloud-based products and services available in the market.

- With the HVD system, employees can be given more flexibility in and out of their work places without having to sacrifice security. In addition, the security, management and compliance of different operating systems and desktop environments have improved.

- Further, for retailers committing to cloud-first strategies, Windows Virtual Desktop (WVD) is the perfect opportunity to embrace that modern workspace. WVD takes a step further by providing a fullfat Windows 10 and Office 365 experience to all users within an organization, while traditional remote desktop services have enabled companies to streamline the management and resources of their desktops. WVD has eliminated the task of managing a number of virtual machines and hosting pools, since many retailers have been using Microsoft Azure to provide their virtual desktop infrastructure.

- Competitors are focusing on, for instance, increasing the capabilities of performance monitoring to improve client experience with device operation and identifying integration into VDI converged or hyperconverged infrastructure platforms as they integrate Virtual Desktop Infrastructure With their Cloud Workspace.

North America is Expected to Hold Major Share

- North America has been an early leader in adopting desktop virtualization solutions on the market as of the increasing adoption of social media, mobile technology, advanced analytic tools, cloud computing, and the Internet of Things (IoT) throughout a wide range of sectors such as manufacturing, retail, etc.

- Furthermore, the region has a key position in the virtualization software vendor market that contributes to its growth. Some include VMware Inc., Citrix Systems, Oracle Corporation, and SolarWinds Corporation.

- Remote employees can easily access business data and productivity applications with virtual desktops. There's been a significant change in consumer behavior throughout the region regarding retailing. As well as the need for a solution that facilitates quicker checkouts reduces capital expenditure, and optimizes employee productivity, there has been an increasing trend toward contactless retail transactions.

- Given that digital transformation is arguably at its most fierce within the retail sector, brick-and-mortar stores are likely to focus on boosting store performance, increasing profitability, and driving online sales through investment in e-commerce and customer engagement. Major retailers and hypermarkets with several regional stores have adopted IT technologies such as desktop virtualization.

- Moreover, before carrying out other attacks, hackers increasingly use mobile emulators to make them appear more legitimate. To prevent this threat, desktop virtualization is increasingly used in retail across the region.

Desktop Virtualization Industry Overview

The Desktop Virtualization Market in Retail is quite fragmented due to the presence of many players. Some key players in the market include Citrix Systems Inc.,Toshiba Corporation,Red Hat Inc. (IBM Corporation ), Huawei Technologies Co. Ltd, Microsoft Corporation etc. Technological advancements in the market also bring sustainable competitive advantage to the companies. The market is also witnessing various partnerships and mergers.

- July 2023 - Citrix Systems Inc has announced expanded capabilities for its cloud and on-premises solutions for the hybrid world. As part of this expansion, Desktop-as-a-Service (DaaS) and virtual desktop infrastructure (VDI) offerings are now combined in a Citrix Universal subscription.

- August 2022 - VMware Inc and IBM has announced atan expanded partnership to offer partners and global clients modernize mission-critical workloads and expedite time-to-value in hybrid cloud environments, where Addressing the costs, complexity and risks associated with cloud migration and updating mission critical workloads will be a matter for IBM and VMware to help clients in regulated industries like banking, retail, healthcare and government

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview ( Includes the impact due to COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud Computing

- 5.1.2 Growth in Automation in Retail

- 5.2 Market Restraints

- 5.2.1 Infrastructure Deployment Constraints

6 MARKET SEGMENTATION

- 6.1 By Desktop delivery platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 Toshiba Corporation

- 7.1.3 Red Hat Inc. (IBM Corporation )

- 7.1.4 Huawei Technologies Co. Ltd.

- 7.1.5 Microsoft Corporation

- 7.1.6 Parallels International GmbH

- 7.1.7 Dell Inc.

- 7.1.8 Ncomputing, Inc.

- 7.1.9 Ericom Software Inc.

- 7.1.10 Tems, Inc

- 7.1.11 Vmware Inc.