|

市場調查報告書

商品編碼

1432778

快速消費品包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)FMCG Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

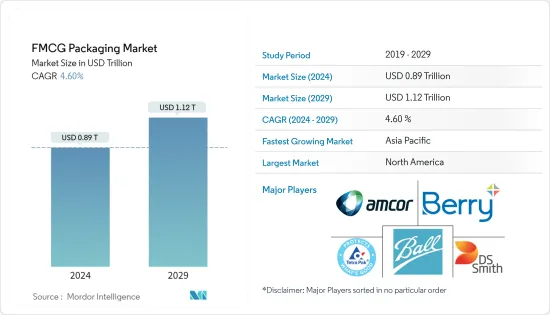

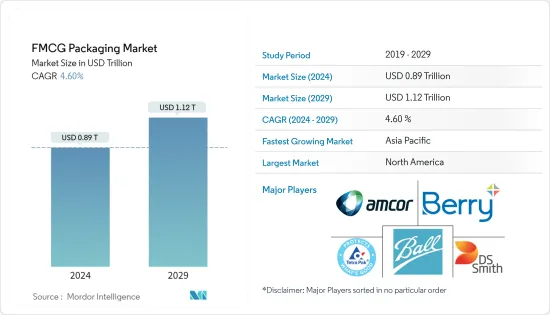

快速消費品包裝市場規模預計到2024年將達到8,900億美元,預計到2029年將達到1.12兆美元,在預測期內(2024-2029年)複合年成長率為4.60%。

主要亮點

- 由於消費者偏好的變化,食品和飲料產業正在經歷重大變革時期,要求快速消費品公司引入新技術和措施,提供符合不斷變化趨勢的包裝。包裝供應商正在採用最新的包裝技術來提高包裝質量,以服務更廣泛的客戶(快速消費品公司)並實現產品差異化。

- 運送包裝商品和消耗品可能會產生負面影響並降低包裝內容物的營養價值。隨著消費者希望獲得有關食品原產地的更多資訊,越來越多的超當地語系化供應鏈正在出現。最近的自有品牌趨勢促使主要零售商改進其包裝以吸引顧客。根據達蒙的研究,超過一半的消費者透過自有品牌忠誠於特定商店。此外,85% 的消費者對自有品牌的信任程度與對國家品牌的信任度一樣,81% 的消費者表示他們每次購物時都會購買自有品牌產品。

- 印度品牌股權基金會 (IBEF) 表示,由於消費者主導的成長和產品成本上升,特別是必需品的成本上升,印度的快速消費品產業有所成長。快速消費品產業僱用了約300萬人,約佔印度製造業總量的5%。 2022年至2023年,快速消費品銷售額預計將成長7-9%。積極的政府舉措和政策、農村市場和年輕人口的增加、新品牌產品以及電子商務平台的發展是該行業的主要成長要素。

- 水產品包裝的現代發展變得越來越複雜,並適應消費者、零售商和基本外食服務買家所擁護的社會願望。水產品永續性已成為促進幾代人健康海鮮資源的強勁趨勢。現在,同樣的想法也集中在用於保護和出貨水產品的包裝的可行性上。消費品包裝製造商 Bemis 表示,預計供應鏈各環節對永續實踐的興趣將持續增加。許多飲料公司正在尋求改造其包裝,用鋁罐代替水瓶,並實施互動式數位平台。

- 人們越來越關注和認知到快速消費品排放廢棄物的影響。一次性包裝,尤其是塑膠包裝,因造成污染、掩埋和垃圾掩埋而受到批評。隨著環境法規的不斷擴大和客戶對永續包裝解決方案的需求,尋找環保的替代品對快速消費品公司來說是一項挑戰。

- 由於新冠肺炎 (COVID-19) 疫情的爆發,消費品被視為必需品,因此它們對經濟放緩的反應不如其他行業的產品。由於傳統商店的關閉和限制,COVID-19 為電子商務帶來了巨大的推動。消費者擴大在網路上購買快速消費品,這增加了對安全有效出貨包裝的需求。這導致對適合電子商務的包裝選擇的需求增加,例如堅固的材料、節省空間的結構和最佳化的容器尺寸。此外,俄羅斯-烏克蘭戰爭影響了整個包裝生態系統。

快消品包裝市場趨勢

飲料預計將佔據主要佔有率

- 未來的發展將由都市化、越來越多的活躍年輕人及其勞動人口、可用於購買的可支配收入的增加以及連結性的改善(尤其是在小城鎮)來推動。政府法規正在為飲料包裝市場帶來新的發展。由於包裝廢棄物被認為對環境有負面影響,因此人們努力減少廢棄物的產生。這導致該行業使用可回收且環保的包裝。

- 在過去的十年裡,由於許多問題,包括日益成長的健康問題,飲料包裝尺寸一直存在爭議。飲用過多的碳酸飲料和其他消耗品會破壞血液中的糖分平衡。它會損害肝臟代謝攝取糖分的能力,從而增加罹患第 2 型糖尿病的風險。為了讓顧客有更多的選擇並更好地控制他們的飲用量,飲料製造商面臨最大的壓力來最小化包裝尺寸。此外,許多製造商正在努力減少卡路里含量,從而需要更小的包裝。

- 商業印刷的進步使得飲料包裝上的可變印刷成為可能。終端包裝客戶正在欣賞數位印刷的好處(美觀、個人化等),客戶對某些快速消費品品牌的忠誠度正在增加。此外,快速響應(QR)碼已成為產品包裝上的標準/主流印刷,並且可以用智慧型手機掃描以顯示附加資料,例如產品資訊和促銷內容。這可以進一步增加客戶對您品牌的黏性。

- 根據克朗斯預測,2022年全球水消耗量將達到4,720億公升,使其成為最受歡迎的飲料型態。第二名是乳製品,第三名是牛奶。包裝飲料(尤其是瓶裝水)的使用不斷增加,這意味著生產商需要定期生產更多的包裝產品。

- 製造量的增加將推動對瓶子、罐頭、紙盒和袋子等快速消費品包裝材料的需求。根據克朗斯報告,到 2022 年,酒精飲料的消費量將超過 720 億公升,成為全球消費量最大的包裝飲料。

北美預計將佔據很大佔有率

- 由於美國人口眾多且當地產業擁有強大的基本客群,預計將引領北美快速消費品包裝市場。在北美,由於商品運輸、進出口活動以及政府環境和安全法規的增加,美國是主要擴張地區之一。人們對生物分解性和永續包裝材料偏好的變化預計也會影響市場需求。

- 活躍於該行業的一些主要包裝業務都位於該國。其中包括 Graphic Packaging International、WestRock、Packaging Corporation of America、Sonoco Production Company、International Paper Company 和 Packaging Corporation of America。

- 預計在整個預測期內,對生鮮食品、散裝包裝、儲存和國際商務相關活動的需求不斷成長,也將支持快速消費品包裝的擴張。根據 Progressive Grocers 的報告,截至 2022 年 5 月,美國生鮮食品銷售額從 2019 年的 636 億美元增至 758 億美元。

- 加拿大的電子商務基礎設施高度發達,與美國的電子商務基礎設施緊密相連。亞馬遜、沃爾瑪、加拿大輪胎、好市多、百思買、哈德遜灣和 Etsy 都是加拿大頂級線上商家。宅配的便利性、零售商的全通路能力以及情境消費者體驗正在推動美國電子商務支出的成長。美國商務部預計,2022年電子商務銷售額將達到1.3兆美元,較2021年成長7.44%,較2020年成長18.44%。 2022年,美國19.3%的零售額將來自電子商務。

- 網路是加拿大客戶的主要訂購管道。過去十年,網路消費者銷售額的增幅超過傳統零售額。為了加強企業對企業和企業對消費者的聯繫,大多數加拿大零售商都採用了行動電話技術和基於網際網路的系統。

消費品(FMCG)包裝產業概述

快速消費品包裝市場有潛力改變競爭,為差異化和附加價值服務開闢許多新途徑。快速消費品包裝市場可以開闢許多差異化和附加價值服務的新途徑,企業還能夠為更專業的細分市場或個人客戶提供量身定做的產品。它還允許產品客製化,進一步增強差異化和價格實現。該市場的特點是獨特品牌和新參與企業高度集中,因此公司集中度相當高。

2023 年 4 月,全球最大的食品公司之一、被譽為全球蛋白質領導者的泰森食品 (Tyson Foods) 與 Amkor 再次聯手,為消費品推出永續的包裝。 Amkor 和 Tyson Foods 共同開發了一款率先推向市場的解決方案,可在不犧牲性能的情況下提供更環保的包裝。

2022 年 10 月,Mondi 和 Reckitt 推出了 Finish 洗碗機桶的紙質包裝,塑膠用量減少了 75%。利潔時市場領先的洗碗機「Finish」採用 Mondi 開發的創新紙質包裝,支持利潔時對永續性的追求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 需要差異化包裝產品來刺激需求

- 對小型、方便的包裝產品的需求不斷增加

- 市場限制因素

- 有關環境安全的嚴格政府法規

- 缺乏技術改進阻礙成長

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對快速消費品包裝產業的影響

第5章市場區隔

- 材料

- 紙和紙板

- 塑膠

- 金屬

- 玻璃

- 目的

- 飲料

- 食品

- 家庭和個人護理

- 其他終端使用者產業(寵物照護、菸草製品)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 波灣合作理事會(GCC)

- 埃及

- 奈及利亞

- 肯亞

- 南非

- 土耳其

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Amcor Ltd

- Ball Corporation

- Mondi Group

- Sealed Air Corporation

- DS Smith PLC

- Consol Glass(Pty)Ltd.

- Nampak Ltd.

- Astrapak Ltd(RPC Group)

- Mpact Pty Ltd.

- Crown Holdings, Inc.

- Stora Enso Oyj

- Constantia Flexibles GmbH

- Toyo Seikan Kaisha Limited

- Berry Plastics Corporation

- East African Packaging Industries Ltd(EAPI)

- Albea SA

- Tetra Pak International SA

- Bonpak(Pty)Ltd.

- Frigoglass South Africa(Pty)Ltd.

第7章 市場機會及未來趨勢

The FMCG Packaging Market size is estimated at USD 0.89 trillion in 2024, and is expected to reach USD 1.12 trillion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

Key Highlights

- The food and beverage industry is going through enormous changes due to changing consumer preferences, which prompt FMCG companies to adopt new technologies and measures to offer packaging on par with the changing trends. Packaging vendors are adopting modern packaging technology to improve the quality of packaging to serve a more extensive range of customers (FMCG companies) and to enable them to achieve product differentiation.

- The transportation of packed goods and consumables can have adverse effects and reduce the packaged contents' nutritional value. More and more hyperlocal supply chains are emerging with consumers' desire to have information about the origin of food products. With the recent trend of private labels, big retailers are ramping up their packaging to attract customers. According to a survey conducted by Daymon, more than half of consumers are loyal to a specific store due to its private-label brands. Moreover, the report also found that 85% of consumers believed they trust a private brand just as much as a national brand and 81% said that they purchase an individual brand product during every shopping trip.

- The FMCG industry in India increased due to consumer-driven growth and rising product costs, particularly for necessities, according to the India Brand Equity Foundation (IBEF). About 3 million people are employed in the FMCG industry, which accounts for about 5% of all manufacturing jobs in India. The nation's revenue growth for FMCG sales was projected to increase by 7-9% in 2022-2023. Favorable government efforts and policies, a growing rural market and young population, newly branded items, and the development of e-commerce platforms are some of the sector's main growth factors.

- Modern developments in seafood packaging are becoming more sophisticated and more attuned to the social inclinations touted by consumers, retailers, and for essential food service buyers who shop for them. The sustainability of seafood has been a robust trend promoting a healthy seafood resource for generations. The same idea is now being focused on the viability of packaging used to protect and ship seafood. According to consumer-facing packager Bemis, the concern for sustainable practices from all areas of the supply chain is expected to continue to increase. Many beverage companies are interested in transforming their packaging, switching from bottles to aluminum cans for water, and introducing interactive digital platforms.

- Concerns and awareness about the effects of packaging waste produced by the FMCG sector on the environment are rising. Single-use packaging, particularly plastic packaging, has drawn criticism because it contributes to pollution, litter, and landfill waste. Finding environmentally acceptable alternatives is problematic for FMCG firms due to expanding environmental restrictions and customer demand for sustainable packaging solutions.

- With the outbreak of COVID-19, consumer goods were considered necessity products and did not react to slowdowns as much as products in other sectors. COVID-19 significantly boosted e-commerce due to lockdowns and limitations on traditional shops. Consumers increasingly bought FMCG items online, which increased the need for packaging for safe and effective shipment. This increased demand for packaging options appropriate for e-commerce, such as robust materials, small-footprint constructions, and optimized container sizes. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

Fast-Moving Consumer Goods (FMCG) Packaging Market Trends

Beverage is Expected to Hold Major Share

- Future development will mostly be fueled by urbanisation, active young and their increased labour force participation, rising disposable income for purchases, and better connections, especially in smaller towns. Government regulations have caused a new development in the market for beverage packaging. There have been initiatives to reduce trash production since packaging waste is thought to be detrimental to the environment. This has encouraged the industry to use recyclable and environmentally friendly packaging.

- Due to a number of issues, including escalating health concerns, the size of beverage packaging has been a divisive topic over the past ten years. Aerated drinks and other consumables consumed in excess lead to an unbalanced level of sugar in the blood. It increases the risk of Type 2 diabetes by impairing the liver's capacity to metabolize sugar intake. In order to provide customers with more alternatives and allow them more control over how much they drink, beverage makers are under tremendous pressure to minimize the size of their packaging. Additionally, a number of producers have made commitments to lower the calorie content, necessitating smaller packaging.

- Developments on the commercial printing front have led to variable printing capabilities on beverage packaging. With packaging end-customers appreciating the benefits of digital printing (aesthetics, personalization, etc.), customer loyalty to a particular FMCG brand is heightened. Moreover, quick response (QR) codes have become a basic/mainstream print on product packaging to be scanned with a smartphone for additional display of data, such as product info, and promotional content, to name a few. This further enhances on developing customer stickiness to a brand.

- According to Krones, the amount of packed water consumed worldwide in 2022 hit 472 billion litres, making it the most popular form of beverage. Dairy products and milk came in second and third place, respectively. The rising use of packaged beverages, especially bottled water, shows that producers will need to produce more packaged goods on a regular basis.

- The need for FMCG packaging materials such bottles, cans, cartons, and pouches is driven by this increased manufacturing volume. According to Krones report, Alcoholic beverage consumption exceeded 72 billion litres in 2022, making it the world's most consumed packaged beverage.

North America is Expected to Hold Significant Share

- The United States is anticipated to lead the North American FMCG packaging market due to its large population and substantial client base for the local industry. In North America, the United States is one of the main regions that is expanding as a result of increased transportation of goods, import and export activity, and governmental environmental safety regulations. People's changing preferences for biodegradable and sustainable packaging materials are also expected to influence market demand.

- Some of the major packaging businesses that are active in the industry are based in the nation. Some of them include Graphic Packaging International, WestRock, Packaging Corporation of America, Sonoco Production Company, International Paper Company, and Packaging Corporation of America.

- The expansion of FMCG packaging is also anticipated to be supported throughout the projection period by rising demand for fresh produce, bulk packaging, and storage and by activities related to international commerce. Progressive Grocers reports that fresh produce sales in the United States as a whole increased from USD 63.6 billion in 2019 to USD 75.8 billion as of May 2022.

- The e-commerce infrastructure in Canada is highly advanced and well connected to that in the US. Amazon, Wal-Mart, Canadian Tyre, Costco, Best Buy, Hudson's Bay, and Etsy are among of Canada's top online merchants.The ease of home delivery, retailers' omnichannel capabilities, and contextual consumer experiences are driving an increase in e-commerce expenditure in the United States. The U.S. Department of Commerce estimates that e-commerce sales reached USD 1.03 trillion in 2022, an increase of 7.44% over 2021 and 18.44% over 2020. 19.3% of all retail sales in the United States in 2022 were made through e-commerce.

- The Internet is the primary ordering channel for Canadian customers. In the last ten years, online consumer sales have increased more than traditional retail sales. To enhance business-to-business and business-to-consumer connections, the majority of Canadian retail businesses have embraced cellular technology and internet-based systems.

Fast-Moving Consumer Goods (FMCG) Packaging Industry Overview

The FMCG Packaging Market has the potential to shift rivalry, opening numerous new avenues for differentiation and value-added services. They will also enable firms to tailor offerings to more-specific segments of the market and even customize products for individual customers, further enhancing differentiation and price realization. The firm concentration ratio is quite high because the market is characterized by the concentration of unique brands and new players.

In April 2023, Tyson Foods, one of the largest food corporations in the world and a well-known global protein leader, and Amcor partnered once more to introduce a more sustainable package for consumer goods. Amcor and Tyson Foods have joined together to develop a first-to-market solution that offers more environmentally friendly packaging without sacrificing performance.

In October 2022, Mondi and Reckitt launched paper-based packaging for Finish dishwashing tabs that uses 75% less plastic. Reckitt's market-leading Finish dishwashing tablets now come in innovative paper-based packaging created by Mondi, which has assisted Reckitt in its quest for sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Need Of Differentiated Packaging Products To Spur Demand

- 4.3.2 Increasing Demand For Small Sized And Convenient Packaged Products

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations Regarding Environmental Safety

- 4.4.2 Lack Of Improvement In Technology To Hinder The Growth

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of COVID-19 Impact on the FMCG Packaging Industry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 Application

- 5.2.1 Beverages

- 5.2.2 Food

- 5.2.3 Household and Personal Care

- 5.2.4 Other End-User Industries (Pet Care, Tobacco products)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Gulf Cooperation Council (GCC)

- 5.3.5.2 Egypt

- 5.3.5.3 Nigeria

- 5.3.5.4 Kenya

- 5.3.5.5 South Africa

- 5.3.5.6 Turkey

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd

- 6.1.2 Ball Corporation

- 6.1.3 Mondi Group

- 6.1.4 Sealed Air Corporation

- 6.1.5 DS Smith PLC

- 6.1.6 Consol Glass (Pty) Ltd.

- 6.1.7 Nampak Ltd.

- 6.1.8 Astrapak Ltd (RPC Group)

- 6.1.9 Mpact Pty Ltd.

- 6.1.10 Crown Holdings, Inc.

- 6.1.11 Stora Enso Oyj

- 6.1.12 Constantia Flexibles GmbH

- 6.1.13 Toyo Seikan Kaisha Limited

- 6.1.14 Berry Plastics Corporation

- 6.1.15 East African Packaging Industries Ltd (EAPI)

- 6.1.16 Albea SA

- 6.1.17 Tetra Pak International S.A.

- 6.1.18 Bonpak (Pty) Ltd.

- 6.1.19 Frigoglass South Africa (Pty) Ltd.