|

市場調查報告書

商品編碼

1432530

居家照護包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

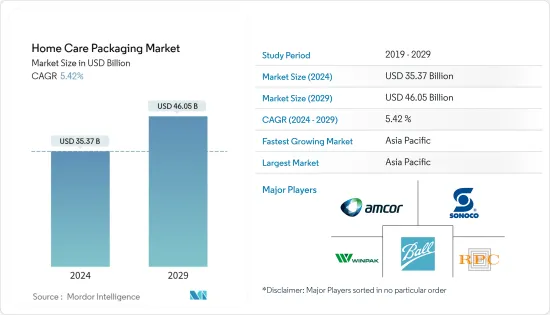

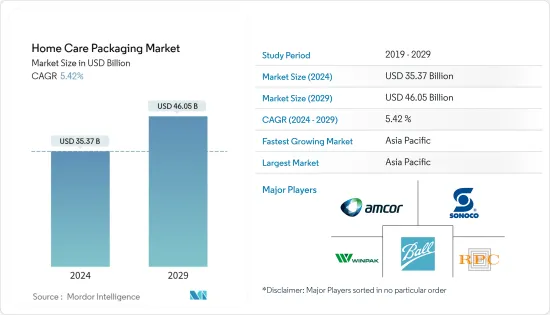

家庭護理包裝市場規模預計到 2024 年為 353.7 億美元,預計到 2029 年將達到 460.5 億美元,在預測期內(2024-2029 年)複合年成長率為 5.42%。

主要亮點

- 在回顧期內,低成本、易於使用和儲存等包裝趨勢仍是主要的消費者趨勢。小包裝尺寸為所有消費者提供了實惠的價格,正在成為品牌所有者在市場上獲得競爭優勢的更優選選擇。隨著大流行的持續,消費者正在優先考慮必需品。一些家庭護理產品和清潔劑不再被視為商品,該行業在 2020 年表現最為強勁。此外,2020 年之前,大多數市場的家庭護理類別都在下降。但現在,健康問題和在家度過的時間正在影響購物行為,而一些家庭護理產品被認為在面對 COVID-19 時至關重要。

- 人們健康意識的增強、生活水準的提高和人均收入的增加,特別是在印度和泰國等新興國家,是推動家庭照護產業成長的一些因素。

- 此外,我們觀察到整個快速消費品行業對健康和福祉的持續關注,從包裝食品和個人衛生到家庭清潔,生活方式發生了廣泛的變化,對家庭護理的思考方式也不斷發展。

- 家庭護理品牌可以透過展現自己的優勢來贏得消費者,例如使用不影響功效的天然配方,同時確保包裝上的永續性訊息清晰易懂。我們專注於

- 原料價格的波動給包裝製造商帶來了成本和供應方面的挑戰。考慮到玻璃基應用,Saeltex於2020年12月對玻璃纖維材料實施了5%的漲價。由於全球包裝商的庫存維護習慣,玻璃價格保持穩定,並定期波動。 Smurfit Kappa也在2021年2月就原料(廢紙和紙張)成本上漲發出警告。該公司表示,由於人們在疫情的威脅下停止回收,投入價格也上漲了。

- 隨著全球面臨感染疾病大流行,持續消毒已成為新常態。從手到家庭,細緻的消毒和衛生維護正在擴大。儘管有必要,但它們正在加劇塑膠廢棄物問題。清洗產品、消毒劑、一次性手套、口罩等類別的需求正在增加。同樣,這些產品的浪費量也日益增加。

居家照護包裝市場趨勢

塑膠的彈性、強度和耐用性使其成為包裝的理想選擇

- 塑膠在所有主要包裝類型中的廣泛使用塑造了塑膠材料的市場。塑膠的彈性、強度和耐用性使其成為工業中包裝許多液體、奶油和粉末產品的理想選擇。與市場上的其他材料相比,塑膠具有高度的彈性,可以模製成任何形狀。零售業需求的成長、雙收入家庭的增加以及寶特瓶需求的增加是塑膠製品的主要驅動力。

- 除了其有利的特性外,防篡改瓶蓋和瓶蓋等創新技術也越來越受歡迎,為品牌所有者帶來了重要的付加。因此,塑膠擴大用於各種產品中。

- 此外,由於便利性和永續性問題,客戶的偏好逐漸轉向採用軟質塑膠包裝而不是硬質塑膠包裝。軟質塑膠包裝比同類硬質塑膠包裝輕 80%,且成本更低。

- 製造商正在開發使用更少原始材料並具有更高水準的消費者回收 (PCR) 和工業回收 (PIR) 的包裝。雖然人們一直強調消費後回收,但許多供應商透過在整個製造過程中捕獲和重新研磨廢棄物來取得成功。此外,該公司現在正在探索生質塑膠和生物基塑膠樹脂,以改善其碳排放。

亞太地區推動居家照護包裝市場需求

- 由於人口成長、對家庭護理產品的新需求以及生活方式的改變,亞太地區的家庭護理產品行業預計將引領該行業。由於零售額的高成長,預計該地區的成長主要來自印度和中國等新興市場。消費品銷售成長率高、消費支出上升是推動家居護理用品產業發展的主要因素。

- 廁所清潔劑主要供該國的都市區和都市區結合部市場。 「SwachBharath」等政府措施是推動廁所清潔劑市場的主要因素。

- 此外,澳洲的家庭護理套餐計劃還為老年人提供一系列持續的個人服務、支援服務和臨床護理,以協助日常生活。健康意識的提高是該國地板清潔劑產品類型成長的關鍵因素。

- 該計劃是澳洲政府老年護理連續體的一部分,提供介於聯邦家庭支持計劃和居住老年護理之間的服務。

- 在中國和韓國等最早面臨疫情的國家,冠狀病毒危機對家庭護理包裝產業的影響最初是複雜的。食品、保健品和電子商務運輸包裝的需求也激增,而工業、奢侈品和一些 B2B 運輸包裝的市場則萎縮。

居家照護包裝產業概況

家庭護理包裝市場競爭激烈,由多家大型企業組成。從市場佔有率來看,目前幾家大公司佔據市場主導地位。這些擁有顯著市場佔有率的領先公司致力於擴大海外基本客群。這些公司正在利用策略合作措施來擴大市場佔有率並提高盈利。

- 2020 年 12 月,Mondi 為 Drylock 推出了紙尿布包。 Mondi 表示,即使在回收法規最嚴格的國家,Ecowicket 袋子也可以整合到現有的紙張流中。也提供由完全可堆肥材料製成的 EcoWicketBag。

- 2020 年 6 月,Guarapac 推出了首款 100% 單一材質可回收袋。到目前為止,市場上大多數多層、多材料層壓材料和袋子不適合收集、分類或回收。該公司的 Pouch5 不僅為飲料和果汁等食品提供永續的包裝解決方案,還為可填充用肥皂和面膜等美容和個人保健產品以及清潔劑等家庭護理產品提供永續包裝解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 產品創新、差異化與品牌化

- 人均收入增加對購買力有正面影響

- 市場限制因素

- 原物料價格波動

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 材料

- 塑膠

- 紙

- 金屬

- 玻璃

- 種類

- 瓶子/容器

- 金屬罐

- 紙箱和瓦楞紙箱

- 袋子和袋子

- 其他類型

- 產品

- 洗碗

- 殺蟲劑

- 洗衣護理

- 洗護用品

- 拋光

- 空氣護理

- 其他產品

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Amcor PLC

- Ball Corporation

- RPC Group

- Winpak Ltd.

- AptarGroup Inc

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles Group GmbH

- DS Smith PLC

- Can-Pack SA

- ProAmpac LLC

第7章 投資分析

第8章市場的未來

The Home Care Packaging Market size is estimated at USD 35.37 billion in 2024, and is expected to reach USD 46.05 billion by 2029, growing at a CAGR of 5.42% during the forecast period (2024-2029).

Key Highlights

- Packaging trends, such as low cost, ease of use, and easy storage, have remained the major consumer trends in the review period. Small pack sizes, offering affordability to the entire consumer base at large, have emerged as more favorable alternatives among the brand owners to gain a competitive edge in the market. In the face of the continuing pandemic, consumers are prioritizing essentials. Several home care products and cleaners are no longer considered commodities, and the industry was among the best performing in 2020. And, prior to 2020, the home care category was on a downward trend in most markets. Now however, health concerns and months spent at home have had an impact on shopping behavior, and several home care products are now seen as essential in the face of COVID-19.

- Increasing health awareness, improving living standards, and rise in per capita income of people, especially in the developing countries, such as India and Thailand, are some of the factors driving the growth of the home care industry.

- Moreover, a continued focus on health and wellbeing has been observed across the FMCG industry from packaged food and personal hygiene to home cleaning entails a wider lifestyle shift and evolving attitudes towards home care.

- Home care brands are focusing to win over consumers by demonstrating their strengths, such as using naturally derived formulas that do not compromise on efficacy, while keeping on-pack sustainability messages clear and easy to understand.

- Fluctuation in raw material prices nhas challenged the packaging manufacturers in terms of costs and supply. When considering the glass-based applications, in December 2020, Saertex implemented a price increase of 5% for its glass fiber material. The price of glass has been steady with volatility at regular intervals due to stock keeping habit by the packagers globally. And Smurfit Kappa in February 2021 issued a warning over the rising cost of raw materials (waste-paper and paper). As per the company, input prices have also shot up as people have recycled less during the pandemic led threats.

- With the world facing an infectious pandemic, continuous sanitization has become the new normal. From hands to houses, sanitization and hygiene maintenance with utmost care is growing. Despite being a necessary measure, it has been adding to the plastic waste problem. Demand for categories such as cleaning agents, sanitizers, disposable gloves, and masks is growing. And likewise, a heightened volume of these products is also being disposed of daily.

Home Care Packaging Market Trends

Flexibility, Strength, and Durability of Plastic Make it Ideal for Packaging

- The wide usage of plastic through all major packaging types creates a market for plastic as a material. The flexibility, strength, and durability of the material make it ideal for packaging many liquids, cream, and powder products in the industry. Compared to other materials available in the market, plastic remains highly flexible and can be mold into any shape. Growth in demand from the retail industry, increasing dual-income households, and rising demand for PET bottles are the major drivers for plastic products.

- Apart from its favorable properties, innovations, such as tamper-evidence caps and closures, are gaining popularity, leading to a crucial value add for the brand owners. This has driven the use of plastics across a variety of products.

- Furthermore, there is a gradual shift in customer preference toward adopting flexible plastic packaging over its rigid counterpart because of convenience and sustainability issues. Flexible plastic packaging materials are 80% lighter in weight than their equivalent rigid plastic materials and cheaper.

- Manufacturers are developing packaging that contains less virgin material and higher levels of post-consumer recycling (PCR) or post-industrial recycling (PIR). Although major emphasis has been placed on consumer recycling practices, many vendors have found success by collecting and regrinding waste material throughout the manufacturing process. Moreover, companies are now exploring bioplastics and bio-derived plastics resins to improve their carbon footprint.

Asia-Pacific is Leading the Demand in Homecare Packaging Market

- The Asia-Pacific home care product industry is forecast to lead the industry due to the increasing population, new demand for home care products, and changing lifestyles. Growth in this region is expected mainly in the developing markets, such as India and China, due to high retail sales growth. Higher sales growth percentage of consumer goods and rising consumer expenditures are the key factors boosting the home care products industry.

- Toilet cleaners largely cater to the urban and semi-urban markets in the country. Government initiatives, such as 'SwachBharath', are major enablers for the toilet cleaners market.

- Moreover, the home care packages program in Australia provides older people with access to a range of ongoing personal services, support services, and clinical care that help them with their day-to-day activities. Rising health consciousness is a key factor for the growth of the floor cleaner product category in the country.

- This program is a part of the Australian Government's continuum of care for older people in Australia, providing services between the Commonwealth Home Support Program and residential aged care.

- The impact of the coronavirus crisis on the home care packaging industry was mixed with the pattern initially playing out in countries such as China and South Korea, which were the first to confront the pandemic. Demand also rose sharply for packaging for groceries, healthcare products, and e-commerce transportation while the market for industrial, luxury, and some B2B-transport packaging shrunk.

Home Care Packaging Industry Overview

The home care packaging market is competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- December 2020, Mondi announced a paper-based diaper pack for Drylock. Mondi mentioned that the EcoWicketBag can be placed in existing paper streams, even in countries with the strictest recycling regulations. An EcoWicketBag, made out of fully compostable materials, is also available.

- June 2020, Gualapack launched the first 100% mono-material recyclable pouches. Up to now, most multilayer multi-material laminates and pouches on the market have not been suitable for collection, sorting, or recycling. The company's Pouch5 offers a sustainable packaging solution not only for food, such as drinks and juices, but also for beauty and personal care products, for example, soap refills or face masks, and home care, like detergents.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Product Innovation, Differentiation, and Branding

- 4.3.2 Rising Per Capita Income Positively Impacting Purchase Power

- 4.4 Market Restraints

- 4.4.1 Fluctuations in Raw Material Prices

- 4.5 Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 Type

- 5.2.1 Bottles & Containers

- 5.2.2 Metal Cans

- 5.2.3 Cartons & Corrugated Box

- 5.2.4 Pouches & Bags

- 5.2.5 Other Types

- 5.3 Products

- 5.3.1 Dishwashing

- 5.3.2 Insecticides

- 5.3.3 Laundry Care

- 5.3.4 Toiletries

- 5.3.5 Polishes

- 5.3.6 Air Care

- 5.3.7 Other Products

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Ball Corporation

- 6.1.3 RPC Group

- 6.1.4 Winpak Ltd.

- 6.1.5 AptarGroup Inc

- 6.1.6 Sonoco Products Company

- 6.1.7 Silgan Holdings

- 6.1.8 Constantia Flexibles Group GmbH

- 6.1.9 DS Smith PLC

- 6.1.10 Can-Pack SA

- 6.1.11 ProAmpac LLC