|

市場調查報告書

商品編碼

1331271

個人護理包裝市場規模和份額分析 - 增長趨勢和預測(2023-2028)Personal Care Packaging Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2023年個人護理包裝市場規模預計為305.3億美元,預計2028年將達到398.5億美元,預測期內(2023-2028年)複合年增長率為5.47,預計將增長% 。

由於供應鏈中斷,COVID-19 的傳播對市場產生了負面影響,導致全球工廠大範圍關閉。 對於裝瓶商、紙箱製造商和泵製造商來說,向個人護理公司供貨在物流上存在困難。

主要亮點

- 在大多數國家,政府將個人護理行業歸類為“必需”類別並允許其運作。 儘管如此,生產箔片、包裝材料、印刷機以及煤球和天然氣(運行鍋爐所需)等公用事業消耗品的輔助設備的操作仍需要更加明確。

- 主要容器、輔助柔性袋、蓋子、封口和噴嘴形式的塑料是化妝品行業使用的主要包裝材料之一。 塑料管是化妝品行業最重要的容器之一,因為它們可以儲存液體固體和半固體並以受控的速率分配產品。

- 各供應商正在市場上開展各種合作和創新,以滿足不斷增長的管材需求。 例如,2021 年 11 月,化妝品、皮膚護理、個人護理和口腔護理市場塑料和層壓管的領先供應商之一 Albea Tubes 與 U.T.C.G 合作。我們為美容和個人護理企業提供製造的America 管由回收後(PCR) 塑料製成。

- 此外,2021 年 11 月,Dior 選擇化妝品包裝供應商 Cosmogen 的 Tense Tube 銷售 Capture Total Super Potent Eye Serum。 這個LVMH旗下奢侈品牌的新品是一款符合人體工學的金屬塗抹器,貼合眼部輪廓,無需接觸臉部或手部,給人耳目一新的感覺。

由於 COVID-19 大流行,個人護理產品包裝市場的需求大幅下降。 部分產品類別市場需求保持穩定。 然而,某些類型的需求下降。 例如,在隔離期間,人們開始呆在家裡,減少通勤,導致洗頭週期更長,影響洗髮水需求。

個人護理包裝市場趨勢

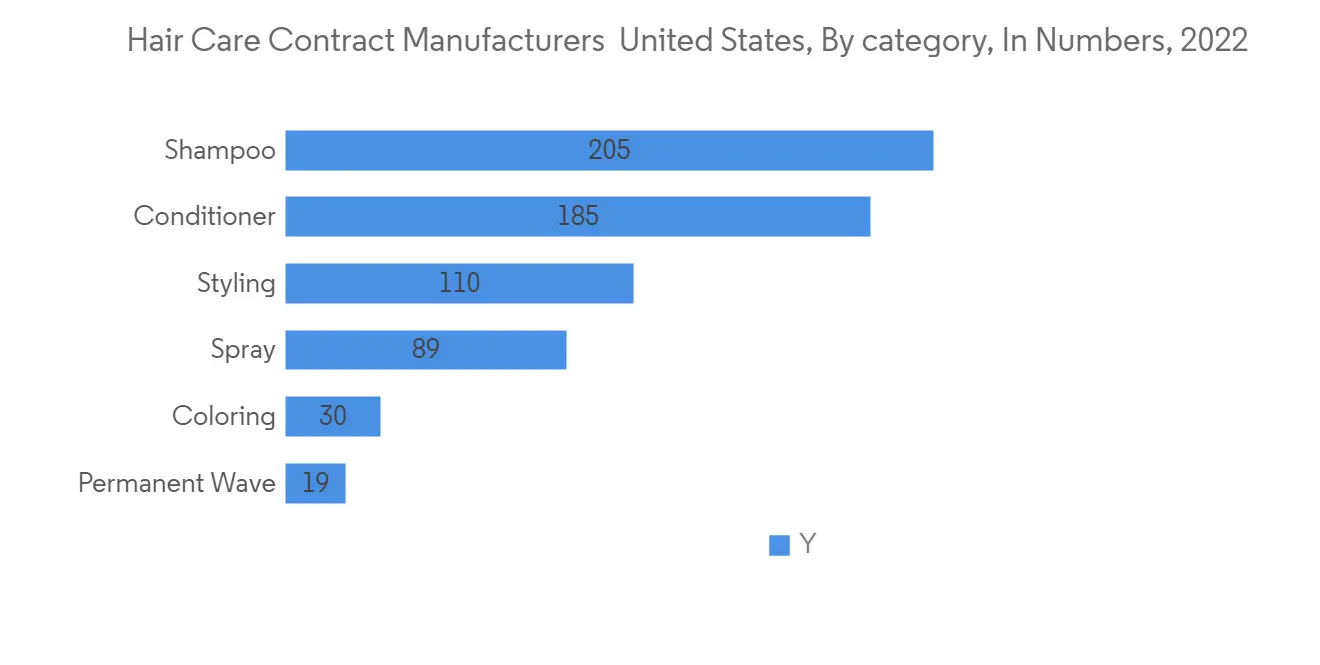

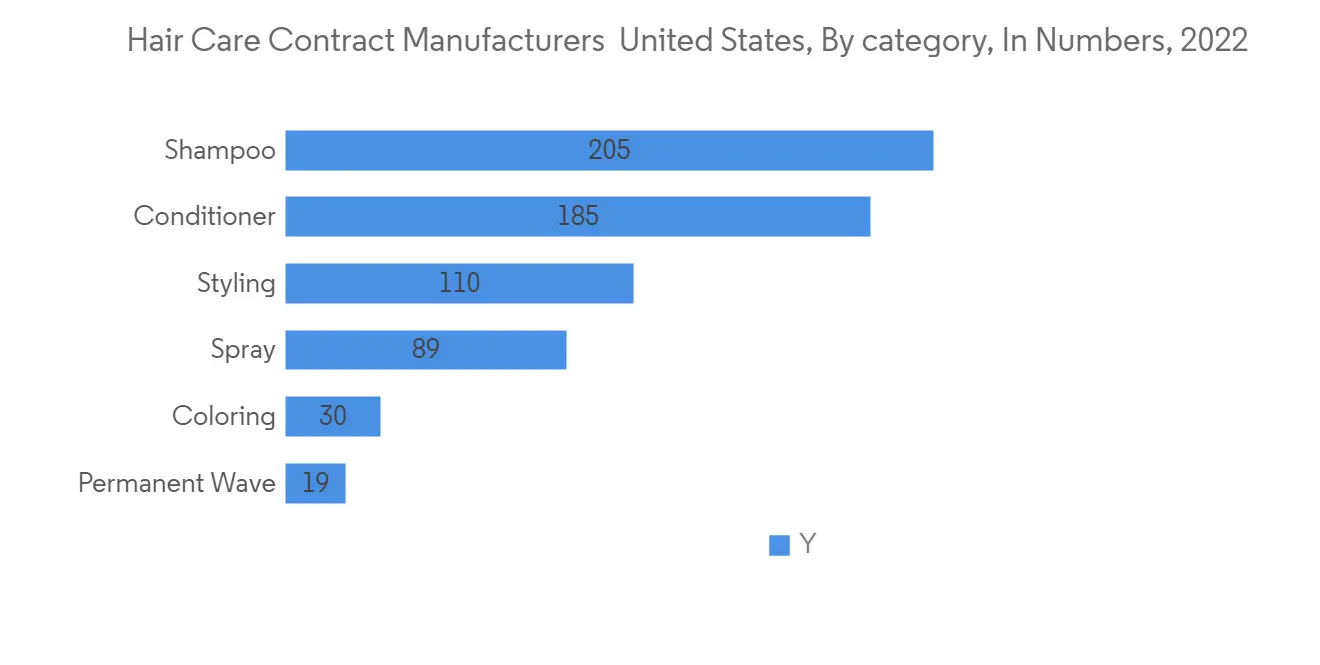

護髮預計佔據較大份額

- 護髮品牌正在利用沙龍內外的包裝。 護髮零售領域競爭激烈,護髮品牌依靠包裝差異化與消費者建立聯繫。 大多數護髮品牌越來越多地將感官元素融入其包裝中,嘗試啞光和光澤印刷技術的相互作用。 由於使用護理油來保護頭髮免受熱定型、增加光澤和減少毛躁,滴管式包裝的使用越來越多。

- 許多日本美容巨頭都迫切希望擴大在歐洲的業務。 例如,總部位於東京的花王旗下護髮品牌 Guhl 正在利用對可持續產品不斷增長的需求。 花王旗下的護髮品牌 Guhl 在德國、奧地利、瑞士和荷蘭銷售,推出了新的可持續包裝。 洗髮水瓶的 50% 由回收的聚對苯二甲酸乙二醇酯 (rPET) 製成。 此外,護髮素瓶由 100% 聚丙烯 (PP) 製成,完全可回收。

- 許多護髮品牌正在合作提供更好的包裝替代方案。 公司越來越多地致力於重新灌裝計劃,鼓勵消費者將瓶子帶回家並以補貼價格重新灌裝,而不是單獨購買產品。 寶潔美容 (P&G Beauty) 宣佈在歐洲旗下海飛絲 (Head & Shoulders)、潘婷 (Pantene)、Herbal Essences 和 Aussie 品牌大規模推出首款可再填充鋁瓶系統。 該再填充系統採用新型可重複使用的 100% 鋁瓶和可回收再填充袋,每毫升的塑料用量比標準品牌瓶子少 60%。 預計它將為改變消費者購買、使用和處置洗髮水瓶的方式鋪平道路。

McKernan 提供多種用於護髮產品包裝的容器和封蓋。 該公司經營 PET、HDPE、LDPE、PVC 和 PP。 這些瓶子的尺寸從小“旅行”或“樣品”尺寸到許多洗髮水和護髮素中使用的大“經濟”尺寸。 玻璃瓶包裝非常適合盛裝護髮素和護髮油。 我們還提供適合凝膠、保濕霜、調理護理、護髮精華和定型蠟的折疊管和套裝。 可折疊管也可用於永久性和臨時性染髮劑和閃光髮飾。

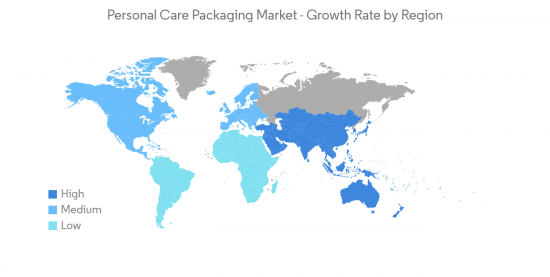

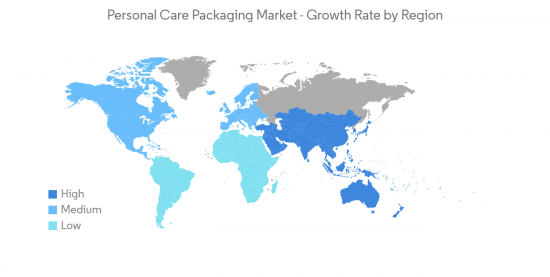

亞太地區預計將佔據較大份額

- 追求健康衛生生活方式的個人健康意識不斷增強,導致亞洲人均家居產品(包括個人護理產品)支出增加。 中國是全球最熱點、最具活力的美容市場之一,引入行業領先的創新並引領全球趨勢。

- 中國個人護理市場是近年來增長最快的行業之一,不斷擴大的消費者基礎推動了市場增長。

- 根據國家統計局 (NBS) 的數據,2021 年 11 月中國化妝品零售額為 309.9 億元人民幣。 它還指出,由於 COVID-19 大流行,化妝品行業的收入在 2020 年前幾個月大幅下降,影響了消費品的整體銷售。 不過,由於中國有效的疫情管理,零售交易額迅速恢復。 此外,男性對護膚態度的轉變正在推動中國男士化妝品市場的蓬勃發展。

- 消費者在化妝品和個人護理產品上的支出持續增長,推動了加工、包裝和昂貴產品的發展趨勢。 護膚品和裝飾化妝品健康發展,面部護理和醫療護膚品需求強勁。 此外,抗衰老產品和旨在防止環境污染的產品也有增長潛力。

- 天貓創新中心表示,新一代年輕女性已成為推動中國化妝品行業增長的最重要消費群體。 新一代擁有獨立的消費能力,同時這一人群對美容護膚興趣的增加也帶來了顯著的增長。 這支撐著中國化妝品包裝市場的發展。

- 對奢侈品的需求不斷增長預計將推動泵瓶和滴管的增長。 隨著越來越多的中國品牌開始嘗試將其定位於高端護理類別,滴管製造商 Virospack 看到了更多中國潛力。

個人護理包裝行業概覽

由於關鍵地區存在許多參與者,個人護理包裝市場高度分散。 由於全球和區域層面存在多家中小型製造商,該市場競爭激烈。 市場上還出現了各種合併和合作夥伴關係。 主要參與者包括 Amcor PLC、AptarGroup Inc.、Gerresheimer AG、Albea SA、Silgan Holdings Inc.。

2022 年 12 月,Amcor Packaging Solutions 宣佈在中國惠州開設一家最先進的製造工廠。 該工廠投資約 1 億美元,佔地 590,000 平方英尺,是中國產能最大的軟包裝工廠,將進一步增強 Amkor 滿足亞太地區不斷增長的客戶需求的能力。 新工廠將僱用超過 550 名員工,將為食品和個人護理產品生產軟包裝解決方案。

2022 年 4 月,天然美容公司 Olive Natural Skincare 將推出幾乎完全可回收的新包裝。 該公司最近宣布其業務已獲得新西蘭獨立 Ekos 的零碳認證。 Ecos 的零碳認證保證該公司能夠測量並抵消 100% 的二氧化碳排放量。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 行業價值鏈分析

- COVID-19 對個人護理包裝市場的影響

第五章市場動態

- 市場驅動因素

- 隨著可支配收入的增加,個人護理產品的消費量增加

- 人們越來越關注創新且有吸引力的包裝

- 市場製約因素

- 新包裝解決方案的研發和製造成本高昂

第六章市場細分

- 材料類型

- 塑料

- 玻璃

- 金屬

- 紙

- 包裝類型

- 塑料瓶和容器

- 玻璃瓶/容器

- 金屬容器

- 折疊紙盒

- 紙板箱

- 管狀和棒狀

- 瓶蓋閉合

- 泵和分配器

- 軟塑料包裝

- 其他包裝類型

- 產品類型

- 口腔護理

- 頭髮護理

- 彩妝

- 皮膚護理

- 男士美容

- 除臭劑

- 其他產品類型

- 地區

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 意大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳大利亞

- 韓國

- 印度尼西亞

- 泰國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東/非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 北美

第七章競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc(Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

- Gerresheimer AG

- Raepak Ltd

第8章 投資分析

第9章 市場機會與今後動向

The Personal Care Packaging Market size is estimated at USD 30.53 billion in 2023, and is expected to reach USD 39.85 billion by 2028, growing at a CAGR of 5.47% during the forecast period (2023-2028).

The spread of COVID-19 negatively impacted the market due to disruptions in the supply chain, resulting in extended factory closures globally. It has been difficult for bottlers, carton makers, and pump manufacturers to supply personal care companies logistically.

Key Highlights

- In most countries, the governments put the personal care industry under the "essential commodity" category, allowing it to function. Still, there needs to be more clarity on the operation of ancillary units that make the foil, packaging material, printers, and utility consumables like briquettes and gasses (required to run boilers).

- Plastic, in the form of primary containers, secondary flexible pouches, caps, and closures, as well as the nozzle, is one of the primary packaging materials used by the cosmetic industry. The plastic tube is one of the most significant containers in the cosmetic industry, as it can store liquid-solid and semi-solid materials and dispense products in controlled proportions.

- Various suppliers have come up with different collaborations and innovations in the market to cater to the increasing demand for tubes. For instance, in November 2021, Albea Tubes, one of the significant providers of plastic and laminate tubes for the cosmetic, skincare, personal care, and oral care markets, partnered with U.T.C.G. and eXpackUSA to offer Made in America tubes made from post-consumer recycled (PCR) plastics to beauty and personal care businesses.

- Additionally, in November 2021, Dior chose the Tense Tube from cosmetic packaging supplier Cosmogen to market its Capture Totale Super Potent Eye Serum. The new product from the luxury brand owned by LVMH has a fresh look because it has an ergonomic metal applicator that fits the eye contour area without touching the face or hands.

The personal care product packaging market saw a significant slump in demand due to the global outbreak of COVID-19. Specific product categories maintained stable product demand in the market. However, particular types observed a decline in demand. For instance, during the home quarantine period, people started staying home and reduced traveling to work, resulting in longer hair wash cycles and impacting the demand for shampoo.

Personal Care Packaging Market Trends

Hair Care is Expected to Hold Significant Share

- Haircare brands use packaging to their advantage, both in the salon and beyond. Haircare for the retail segment is highly competitive, and hair care brands are relying on packaging differentiation to forge a connection with consumers. Most hair care brands experiment with the interplay of matte and gloss printing techniques and are increasingly incorporating sensory elements into their packaging. The use of treatment oils for added heat styling protection, imparting shine, or decreasing frizz has led to the increased use of dropper packaging as a dosing and precision application method.

- Many Japanese beauty giants are eager to push forward their presence in Europe. For instance, Kao's haircare brand, Guhl, based in Tokyo, is tapping into the rising demand for sustainable products. Guhl, a Kao-owned hair care player available in Germany, Austria, Switzerland, and the Netherlands, has launched a new sustainable packaging, meaning its shampoo bottles now consist of 50% recycled polyethene terephthalate (rPET). Moreover, the conditioner bottles used were made of 100% polypropylene (PP) and were therefore fully recyclable.

- Many hair care brands are entering partnerships to provide better packaging alternatives. Companies are increasingly engaging in refilling initiatives that encourage consumers to bring back their bottles and refill them at a subsidized price instead of purchasing the product independently. P&G Beauty announced its first-ever refillable aluminum bottle system to launch at scale with its Head & Shoulders, Pantene, Herbal Essences, and Aussie brands in Europe. The refill system uses a new, reusable 100% aluminum bottle and recyclable refill pouch that use 60% less plastic per mL than a standard brand bottle. It is expected to pave the way for changing the way consumers buy, use, and dispose of their shampoo bottles.

McKernan, Inc. offers a large selection of containers and closures for hair care product packaging. The company carries PET, HDPE, LDPE, PVC, and PP. These bottles range from smaller "travel" or "sample" sizes up to the larger "economy" sizes seen with many shampoos and conditioners. Packaging in glass bottles is of great use with hair serums and oils. The company also carries a line of collapsible tubes and sets perfect for gel, moisturizing creams, conditioning treatments, hair serums, and styling waxes. Collapsible tubes are also used for permanent and temporary hair coloring applications and hair glitter.

Asia Pacific is Expected to Hold Significant Share

- The increasing awareness of a healthier lifestyle among individuals for a healthy and hygienic living has contributed to the increase in per capita expenditure on household products (including personal care products) across Asia. China is one of the world's hotspots and fastest-changing beauty markets, introducing industry-leading innovations and setting trends globally.

- The personal care market in China has been one of the fastest-growing sectors in the last few years, benefiting from an increasingly engaged consumer base, which is augmenting the growth of the market studied.

- According to China's National Bureau of Statistics (NBS), the retail sales of cosmetics in China amounted to CNY 30.99 billion in November 2021. It also states that the cosmetics industry witnessed a significant decrease in revenue during the first months of 2020 due to the COVID-19 pandemic, which generally affected consumer goods sales. However, retail trade value quickly recovered due to China's effective pandemic management. In addition, the changing attitude among men toward skincare fosters the booming men's cosmetics market in China.

- Consumer spending on cosmetics and personal care products continues to grow, facilitating the trend toward adopting processed, packaged, and expensive products. Skincare and decorative cosmetics are growing soundly, with facial care and medical skincare witnessing robust demand. Moreover, growth potential is also provided by anti-aging products and those intended to protect against environmental pollution.

- According to the Tmall Innovation Center, the young women of the new generation have become the most crucial consumer group driving growth in China's cosmetic sector. The new generation has independent consuming power, and this demographic's simultaneous surge in interest in beauty and skincare has translated into significant growth. This is aiding the development of the cosmetic packaging market in the country.

- The increase in demand for luxury products is anticipated to drive the growth of pump bottles and droppers. Virospack, a company that makes droppers, thinks that China's potential is growing because more and more Chinese brands are starting to position themselves in the premium care category.

Personal Care Packaging Industry Overview

The personal care packaging market is highly fragmented, as many players are present across the key regions. The presence of several medium and small-scale manufacturers on a global and regional level keeps the market at a high rival position. The market is witnessing various mergers and partnerships as well. Key players include Amcor PLC, AptarGroup Inc., Gerresheimer AG, Albea SA, Silgan Holdings Inc., etc.

In December 2022, Amcor Packaging Solutions announced the opening of its new state-of-the-art manufacturing plant in Huizhou, China. With an investment of almost USD 100 million, the 590,000-square-foot plant is the largest flexible packaging plant by production capacity in China, further strengthening Amcor's ability to meet growing customer demand throughout Asia Pacific. The new facility is expected to employ more than 550 people, producing flexible packaging solutions for food and personal-care products.

In April 2022, natural beauty company Olive Natural Skincare is set to introduce new, almost fully recyclable packaging. Recently, the company announced that its business operations were certified zero-carbon by the independent agency Ekos in New Zealand. The Ekos Zero Carbon certification ensures that the process has measured and offset 100% of its CO2 emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact due to COVID-19 on the Personal Care Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 Packaging Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.2.10 Other Packaging Types

- 6.3 Product Type

- 6.3.1 Oral Care

- 6.3.2 Hair Care

- 6.3.3 Color Cosmetics

- 6.3.4 Skin Care

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.3.7 Other Product Types

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 South Korea

- 6.4.3.6 Indonesia

- 6.4.3.7 Thailand

- 6.4.3.8 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging Company

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Packaging Systems Ltd

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd