|

市場調查報告書

商品編碼

1433012

塑膠瓶:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Plastic Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

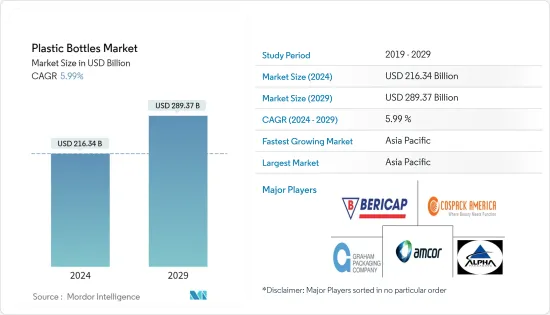

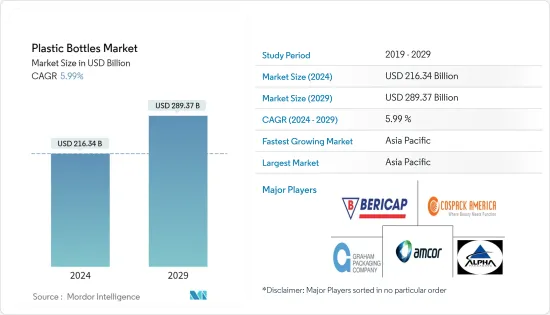

塑膠瓶市場規模預計到2024年為2,163.4億美元,預計到2029年將達到2,893.7億美元,在預測期內(2024-2029年)複合年成長率為5.99%。

塑膠包裝比其他產品更受消費者歡迎,因為它重量輕且易於操作。同樣,由於生產成本較低,各大製造商也更喜歡使用塑膠包裝解決方案。

主要亮點

- 此外,聚對聚對苯二甲酸乙二酯(PET)和高密度聚苯乙烯(HDPE)聚合物的引入正在擴大塑膠瓶的應用。瓶裝水和軟水市場對寶特瓶的需求正在增加。

- 市場上有各種各樣的創新、經濟高效和永續的包裝解決方案,塑膠作為產品正在獲得全球的認可。這就是為什麼像 Amcor 這樣的領先公司正在推出新的塑膠產品形式來滿足對瓶子的需求。

- 與其他塑膠包裝產品相比,製造商更喜歡 PET,因為 PET 在製造過程中比其他塑膠產品造成的原料損失更少。 PET 是首選,因為它可回收,並且可以添加多種顏色和設計。隨著消費者環保意識的增強,可再填充產品應運而生,從而創造了對該產品的需求。

- 此外,總部位於紐約的著名消費品公司高露潔棕欖 (Colgate-Palmolive) 的目標是到 2025 年實現所有產品類型的包裝100% 回收,將其目前的塑膠包裝回收率提高到25%。化妝品品牌歐萊雅的目標是到 2025 年使所有塑膠包裝可充電、可再填充、可回收或可堆肥。

- 隨著 COVID-19 爆發對市場的影響,世界各國似乎正在轉向使用一次性塑膠。此外,為了滿足一次性塑膠包裝和醫療用品需求激增的需求,供應鏈也面臨壓力。在印度,為應對新冠肺炎(COVID-19) 造成的破壞,多個國家政府已禁止使用一次性塑膠瓶和塑膠袋,其中泰米爾納德邦政府暫停了在零售業使用一次性塑膠瓶和塑膠袋的禁令。

塑膠瓶市場趨勢

飲料推動市場成長

- 由於對瓶裝水和非酒精飲料的持續需求,飲料行業的塑膠瓶市場預計將成長。瓶裝水的需求是由於消費者擔心飲用受污染的自來水而生病而尋求特別高品質的飲用水,以及瓶裝水的攜帶性和便利性所推動的,因為這是一種趨勢。

- 此外,在許多已開發經濟體和新興經濟體,人們更喜歡瓶裝水。瓶裝水在商店和出售各種飲料的地方出售。例如,國際瓶裝水協會(IBWA)指出,與其他包裝飲料相比,美國人更喜歡瓶裝水。此外,根據國際瓶裝水協會 (IBWA) 的數據,2018 年消耗了 138 億加侖瓶裝水。根據哈里斯民意調查代表 IBWA 在網上進行的一項新的全國調查,超過十分之九的美國人會在任何出售其他飲料的地方購買瓶裝水。

- 預計寶特瓶市場也將受益於酒精飲料領域。在葡萄酒產業,最近看到逐漸轉向寶特瓶的趨勢。例如,位於加州伯林格姆的塑膠酒瓶企業 EnVino 表示,這些容器的重量約為典型玻璃酒瓶的八分之一,並且佔用的空間更少,使釀酒師能夠透過卡車運輸它們。每輛車多出貨30% 的葡萄酒。

- 2020 年 2 月,Amkor 在北美葡萄酒和葡萄研討會上公佈了最新的自訂設計。它還宣布與英國新興企業Garcon Wines 合作。透過此次合作,Amcor 將在美國生產由消費後回收 (PCR) PET 塑膠製成的扁平酒瓶。

亞太地區將經歷最高的成長

- 亞太地區多個國家的主要措施之一是減少一次性塑膠瓶和包裝的使用。然而,企業可能會轉向塑膠包裝來對抗大流行的蔓延,暫時將永續性方面放在次要地位。

- 中國的醫療保健和製藥業是全球最大的市場之一,人口老化是一個主要因素。根據醫藥科技預測,到2022年,中國醫藥市場規模預計將激增至近5,740億美國。因此,國內企業的成長潛力很大,因為這些企業對寶特瓶的需求可能會增加。

- 由於塑膠瓶消費和工業應用的不斷增加,印度寶特瓶市場預計將穩定成長。印度品牌股權基金會(IBEF)的數據顯示,該國塑膠瓶市場需求持續成長,2019年4月至2020年1月塑膠瓶出口額達70.45億美元。多個產品和行業的塑膠計劃預計將增加,包括飲料、食品、飲用水、藥品和家居行業。

- 日本是繼美國之後成長最快的製藥企業之一,持續專注於穩定的技術創新和取得專利的藥品。日本政府也透過放鬆對國際公司投資的管制來促進這一成長,從而推動日本製藥市場的發展。

- 根據 CPhI 的數據,日本藥品市場受到多種因素的推動,包括固態製劑預計成長 10%,高於 2018 年的 4.7%,以及所有藥物類別的學名藥的穩定成長,並將在2019 年恢復顯著成長。認知到這一需求,當地製藥公司可能會看到對塑膠瓶的需求增加,從而刺激市場成長。

塑膠瓶產業概況

塑膠瓶市場的競爭溫和,由幾家大公司組成。從市場佔有率來看,目前該市場由幾家大型企業佔據主導地位。這些擁有主導市場佔有率的公司正致力於擴大海外基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。以下是一些最近的市場開拓:

- 2020 年 2 月 - Amcor PLC 宣布開發並推出綜合維他命類別中採用 100% 消費後回收資源 (PCR) 樹脂的 PET 容器。該公司為健康科技公司 Ritual 開發了兩種尺寸的新型透明瓶子:100 立方厘米和 150 立方厘米,該公司重新設計了綜合維他命。

- 2019 年 10 月 - Bericap GmbH &Co KG 推出了一款新產品繫繩蓋,其中塑膠蓋在消費過程中必須保持與瓶子連接。這項創新解決方案符合新的歐盟法規,為客戶提供更高的安全性並減少化學廢棄物。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 更多採用輕量化包裝方法

- 瓶裝水產業需求增加

- 市場限制因素

- 與塑膠使用相關的環境問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 原料類型

- 聚對苯二甲酸乙二酯(PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他原料

- 依最終用戶產業

- 飲料

- 食品

- 化妝品

- 藥品

- 家庭用品

- 其他行業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Alpha Packaging

- CKS Packaging Inc.

- Bericap GmbH & Co. KG

- Plastipak Holdings Inc.

- Graham Packaging Company

- Comar LLC

- Amcor Ltd.

- Berry Global Inc.

- Alpack Plastic Packaging

- Gerresheimer AG

- Cospack America Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Plastic Bottles Market size is estimated at USD 216.34 billion in 2024, and is expected to reach USD 289.37 billion by 2029, growing at a CAGR of 5.99% during the forecast period (2024-2029).

Plastic packaging is becoming popular among consumers over other products as a plastic package is light in weight and is easier to handle. Similarly, even the major manufacturers prefer to use plastic packaging solutions, owing to their lower cost of production.

Key Highlights

- Moreover, the introduction of polyethylene terephthalate (PET) and high-density polyethylene (HDPE) polymers are expanding the plastic bottling applications. The market is witnessing an increasing demand for PET bottles in the bottled and soft water markets.

- There is a wide variety of innovative, cost-effective, sustainable packaging solutions emerging in the market, and plastic, as a product, is accepted globally. It has led to the leading players, like Amcor, introducing new plastic product formats to cater to the demand for bottles.

- Manufacturers prefer PET over other plastic packaging products, as it has a minimum loss of raw material during the manufacturing process when compared to other plastic products. Its recyclability and the feature to add multiple colors and designs augment it to become a preferred choice. Refillable products have emerged with the rising consumer awareness for the environment and have acted in creating demand for the product.

- Moreover, Colgate-Palmolive, a prominent consumer products company, based in New York, committed to 100% recyclability of packaging across all its product categories by 2025 and achieving a 25% recycled content currently from plastic packaging. L'Oreal, a cosmetics brand, is working toward ensuring that all its plastic packaging will be rechargeable, refillable, recyclable, or compostable, by 2025.

- With the COVID-19 outbreak affecting the market, countries, globally, seem to be shifting toward single-use plastics. Supply chains, additionally, are being strained to meet a surge in demand for single-use plastic packaging and medical supplies. Multiple governments, such as in India, the Tamil Nadu government suspended the ban on single-use plastic bottles and bags in retail trade in the wake of the COVID-19 disruption.

Plastic Bottle Market Trends

Beverages to Drive the Market Growth

- The market for plastic bottles in the beverage sector is anticipated to witness growth, owing to the never-ending demand for bottled water and non-alcoholic beverages. The demand for bottled water is credited to consumers' propensity for specifically demanding high-quality drinking water, owing to the fear of diseases as an aftermath of drinking polluted tap water and the ease of portability and convenience provided by bottled water.

- Further, in many developed and developing economies, people favor bottled water. Bottled water is sold in stores and places selling various drinks. For instance, the International Bottled Water Association (IBWA) stated that Americans favor bottled water over other packaged beverages. Moreover, as per International Bottled Water Association (IBWA), they consumed 13.8 billion gallons of bottled water in 2018. Also, according to a new national survey conducted online by The Harris Poll on behalf of the IBWA, more than 9 in 10 Americans expect bottled water to be available wherever other drinks are sold.

- The market for plastic bottles is also anticipated to benefit from the alcoholic beverage sector. The gradual shift toward plastic bottles in the wine sector is observed was the recent past. For instance, as per EnVino, a plastic wine bottle venture in Burlingame, California, the containers weigh about one-eighth of a typical glass wine bottle and take up 20% less space, thus, enabling winemakers to save fuel by shipping 30% more wine per truck.

- In February 2020, Amcor announced its latest custom designs at the Wine and Grape Symposium, North America. The company also announced a collaboration with Garcon Wines, a UK-based startup. Through this collaboration, Amcor plans to produce flat wine bottles made with post-consumer recycled (PCR) PET plastic in the United States.

Asia-Pacific to Witness Highest Growth

- One of the main initiatives across multiple countries in the Asia-Pacific region has generally been to cut down the usage of single-use plastic bottles and packaging. But, companies might likely resort to plastic packaging to combat the pandemic's spread, putting the sustainability aspect away at this time.

- The healthcare and pharmaceutical sector in China is one of the world's largest markets, primarily driven by its aging population. According to Pharmaceutical Technology, China's pharma market's size was forecasted to surge up to almost 574 billion U.S. dollars by 2022. Hence, there is a growth possibility for domestic players as they might experience an increase in demand for plastic bottles from these companies.

- The plastic bottles market in India is estimated to grow steadily, owing to the continually increasing consumption and industrial applications of plastic-made bottles. According to the India Brand Equity Foundation (IBEF), the market demand for plastic bottles continues to expand in the country, with plastic export of USD 7.045 billion during the period of April 2019 - January 2020. Plastic projects are anticipated to increase across several products and sectors, including beverage, food and water, pharmaceutical, household sectors.

- Japan has one of the fastest-growing pharmaceutical businesses after the United States and is continuously concentrating on steady innovation and patented drugs. The Government of Japan is also contributing to this growth through deregulations for international companies to invest, thereby driving the country's pharmaceutical market.

- According to CPhI, Japan's pharmaceutical market will resume growing significantly in 2019, connected to a range of factors, such as an anticipated 10% increase in solid dose formulations from 4.7% in 2018 and constant growth for generics across all drug classes. Recognizing these needs, local pharma companies will experience an increase in demand for plastic bottles, thus stressing the growth of the market.

Plastic Bottle Industry Overview

The plastic bottles market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. Some of the recent development in the market are:

- February 2020 - Amcor PLC, in the multivitamin category, showcased the development and launch of the PET container that is made from 100% post-consumer recycled content (PCR) resin. The company created the new, clear bottle in two sizes, 100 cubic centimeters and 150 cubic centimeters, for Ritual, a health meets technology company that reimagined the multivitamin.

- October 2019 - Bericap GmbH & Co KG launched its new product tethered caps, where plastic closures must remain attached to the bottle during consumption. This innovative solution offers additional security to the customers and reduces the chemical wastes by complying with the new regulations of the EU.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Lightweight Packaging Methods

- 4.2.2 Increasing Demand From Bottled-water Industry

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns Regarding Use of Plastics

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Raw Material Type

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Poly Propylene (PP)

- 5.1.3 Low-density Polyethylene (LDPE)

- 5.1.4 High-density Polyethylene (HDPE)

- 5.1.5 Other Raw Materials

- 5.2 End-user Vertical

- 5.2.1 Beverage

- 5.2.2 Food

- 5.2.3 Cosmetics

- 5.2.4 Pharmaceutical

- 5.2.5 Household Care

- 5.2.6 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alpha Packaging

- 6.1.2 CKS Packaging Inc.

- 6.1.3 Bericap GmbH & Co. KG

- 6.1.4 Plastipak Holdings Inc.

- 6.1.5 Graham Packaging Company

- 6.1.6 Comar LLC

- 6.1.7 Amcor Ltd.

- 6.1.8 Berry Global Inc.

- 6.1.9 Alpack Plastic Packaging

- 6.1.10 Gerresheimer AG

- 6.1.11 Cospack America Corporation