|

市場調查報告書

商品編碼

1444605

智慧標籤:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

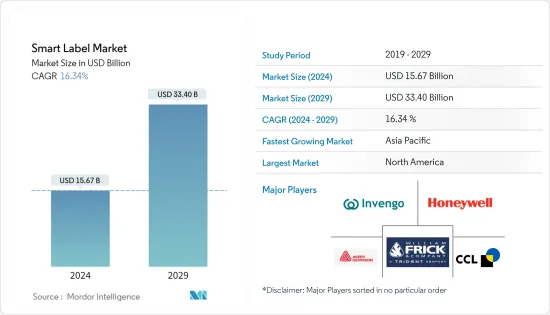

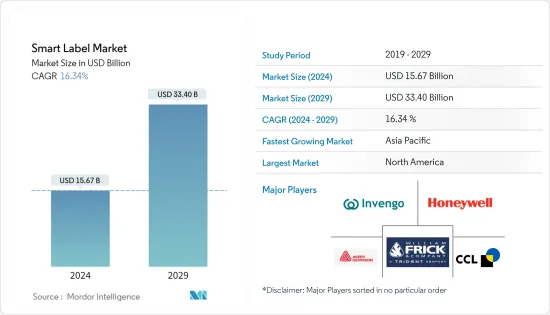

智慧標籤市場規模預計到 2024 年為 156.7 億美元,預計到 2029 年將達到 334 億美元,在預測期內(2024-2029 年)年複合成長率為 16.34%。

智慧標籤正在成為零售、醫療保健和物流領域最受歡迎的技術之一,它提高了效率和盈利,同時提供了從倉庫到配送中心的產品真實性和可追溯性,被視為實現這一目標的理想手段。供應鏈。

主要亮點

- COVID-19 引起的行為變化增加了人們對電子商務平台上安全和可追溯食品的興趣,並提高了整體的健康和安全意識。 IBM 研究表明,71% 的消費者願意為提供完全透明度和可追溯性的公司支付平均 37% 的溢價。食品供應鏈是最複雜、最分散的供應鏈之一,但 70% 的公司在其第一家供應商和內部客戶系統之間存在「可見性差距」。

- 這些標籤被用作實現智慧供應鏈的工具,並且在消費品的行銷和廣告中發揮著重要作用。這可以透過提供產品資訊和分析消費者購買模式來實現,這些資訊可以從這些標籤收集的資料中獲取。製造商降低整個供應鏈的成本以接近最接近的效率水平已成為推動需求和積極採用這些解決方案以獲得先發優勢的關鍵因素。

- 此外,顧客消費模式的不斷增強以及網際網路的快速普及也對電子商務的擴張產生了直接影響。因此,電子商務可能會產生對智慧標籤的持續需求,用於產品追蹤和追溯。為了從這種情況中獲得最大利益,領先的智慧標籤製造商正在推出先進的標籤解決方案,特別是針對電子商務領域。

- 由於列印過程中使用的溶劑具有可溶性,智慧標籤在運輸過程中承受惡劣氣候條件和陽光照射的能力起著重要作用。標籤必須能夠承受運輸、儲存或使用過程中的惡劣條件,因為許多標籤可能會因暴露在陽光、化學物質、骯髒或潮濕的環境中而損壞。

智慧標籤市場趨勢

零售終端用戶產業佔據重要市場佔有率

- 智慧標籤在零售業中越來越受歡迎,用於追蹤和識別產品。這些標籤使用 RFID(無線射頻識別)或其他技術來追蹤整個供應鏈和店內的產品。智慧標籤有潛力透過提供有關存量基準和位置的即時資訊來幫助商家更有效地管理庫存。商家可以輕鬆更新標籤上的產品資訊,這也可以實現更準確的定價和行銷。

- 此外,透過將RFID技術融入電子商務,企業可以避免諸如可用庫存與實際庫存不符等錯誤,從而導致銷售損失、客戶信任度下降、客戶出貨擔憂等問題。網路購物管理起來更加複雜,因為它與實體店和倉庫一起使用。

- NFC(近場通訊)標籤可以在零售業中以多種方式使用,以改善客戶的購物體驗並提高效率。 NFC 標籤的應用之一是電子貨架標籤系統 (ESL)。零售商可以使用這些數位價格標籤中內建 NFC 技術的行動裝置或 PC 即時更改產品定價和資訊。這節省了時間和資源,同時也減少了定價錯誤的可能性。

- 市場上的公司正在開發新的解決方案來滿足客戶的需求。例如,2022 年 8 月,Oli-Tec 為溫度和時間敏感產品開發了新的智慧標籤技術。智慧標籤可應用於任何保存期限為 5 至 15 天的產品。整合溫度和時間敏感的視覺指示器。它逐漸從黃色變為紅色,在較低溫度下變化較慢,在較高溫度下變化較快,變化速度已知且可重複。 「這種簡單的變色指示器提供了清晰、高度可見的號召性用語,零售商和消費者一眼就能理解,」Oli-Tec 說。

- 總體而言,智慧標籤市場的未來看起來很有希望,並且有潛力透過提供即時庫存追蹤、提高客戶參與和促進永續性來徹底改變零售業。隨著零售商繼續採用先進技術並尋求創新解決方案以提高業務效率,未來幾年對智慧標籤產品的需求可能會增加。

北美佔有很大的市場佔有率

- 北美是全球最大的智慧標籤市場之一,其中美國佔據該地區的最大佔有率。該國的龐大需求可歸因於大量大大小小的零售店。沃爾瑪等零售業巨頭在美國處於主導,推動了活動的活性化,並顯著促進了該國智慧標籤市場的成長。沃爾瑪正在為牛仔褲和其他男裝添加電子識別標籤,以更好地管理庫存。

- 食品公司使用智慧標籤與消費者建立聯繫,提供額外的營養和成分資訊,並幫助減少家庭食品廢棄物。此外,美國農業部和美國食品藥物管理局(FDA)最近宣布了一項細胞肉類和其他食品標籤框架協議。此舉可望擴大國內市場規模。此外,國內供應商正在投資技術,以提高整個供應鏈的可追溯性,增加區塊鏈和智慧標籤的使用。

- 美國的員工竊盜和入店行竊事件也有所增加,其中包括有組織的零售犯罪。為了應對零售犯罪的驚人成長,相關人員正在開發基於 RFID 的智慧標籤來追蹤紡織品和服裝類。

- 數位技術的新進步正在影響加拿大的印刷業,使其更具競爭力並鼓勵公司投資該行業。數位印刷、整合系統、客戶介面軟體和後處理自動化等新技術的引入提高了業務效率,並顯著提高了交付給最終用戶的產品品質。

- 加拿大食品和消費品部 (FCPC) 宣布推出一款創新智慧標籤,讓消費者能夠即時、輕鬆地獲取無法列印在產品標籤上的資訊。這是 FCPC 成員正在努力實現的健康用餐策略的一部分,旨在提高向消費者提供的產品的透明度。加拿大的許多領先公司也致力於使用智慧標籤來加強其透明度文化。

智慧標籤產業概況

智慧標籤市場由艾利丹尼森公司、CCL工業公司、威廉弗里克公司、霍尼韋爾國際公司和遠望谷資訊科技公司等主要參與者組成,市場中的公司以合作夥伴關係、協議和產品為基礎。我們正在進行收購,以加強我們的產品和服務並獲得永續的競爭優勢。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 對安全性和追蹤解決方案的需求增加

- 市場限制因素

- 缺乏通用標準、安全問題、惡劣的氣候條件

第6章市場區隔

- 依技術

- 電子商品防盜系統 (EAS)

- RFID

- 感測標籤

- NFC

- 電子貨架標籤(ESL)

- 按最終用戶產業

- 零售

- 醫療保健和製藥

- 物流

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Avery Dennison Corporation

- CCL Industries Inc.

- William Frick &Company

- Honeywell International Inc.

- Invengo Information Technology Co. Ltd.

- Scanbuy Inc.

- Sato Holdings Corp.

- Alien Technology

- Zebra Technologies Corp.

第8章投資分析

第9章市場的未來

The Smart Label Market size is estimated at USD 15.67 billion in 2024, and is expected to reach USD 33.40 billion by 2029, growing at a CAGR of 16.34% during the forecast period (2024-2029).

Smart labels are becoming one of the most popular technologies across the retail, healthcare, and logistics sectors and are viewed as an ideal means to achieve greater efficiencies and profitability while providing the authenticity of an item and its traceability from the warehouse to the distribution center throughout the supply chain.

Key Highlights

- The behavioral changes that have arisen due to COVID-19 have brought a higher interest for safe and traceable food on e-commerce platforms and raised public consciousness of health and safety in general. According to an IBM study, 71% of consumers are ready to pay an additional average premium of 37% for companies providing full transparency and traceability. While the food supply chain is one of the most complex and fragmented supply chains, 70% of firms have "visibility gaps" between the initial supplier and internal clients' systems.

- These labels are used as a tool to enable smart supply chains and are also playing a vital role in the marketing and advertising of consumer products. This can be achieved through the provision of product information, as well as the analysis of consumer buying patterns that can be accessed from the data collected by these labels. Cost-cutting over the supply chain, to be closer to the nearest level of efficiency, by manufacturers, has been a critical factor that has augmented the demand and prompted the proactive adoption of these solutions to gain the first-mover advantage in the individual end-user industry.

- Moreover, increasing customer spending patterns and rapid internet penetration are directly influencing the expansion of e-commerce. Thus, consistent demand for smart labels is likely to be generated by e-commerce for product tracking and tracing. To benefit the most out of this scenario, leading smart label manufacturers are launching advanced label solutions, particularly for the e-commerce sector.

- The ability of a smart label to withstand harsh climatic conditions during shipping and exposure to sunlight plays an important role, due to the dissolving nature of solvents used during printing. The labels should have the ability to face tough conditions during shipping, storage, or point-of-use, as many labels are subject to damage when exposed to sunlight, chemicals, dirty, or wet environments.

Smart Label Market Trends

Retail End User Industry to Hold Significant Market Share

- In the retail industry, smart labels are becoming increasingly popular for tracking and identifying merchandise. RFID (radio-frequency identification) or other technologies are used in these labels to track products throughout the supply chain and in-store. Smart labels have the potential to assist merchants in managing inventories more efficiently by delivering real-time information on stock levels and locations. Merchants can easily update product information on labels and also enable more accurate pricing and marketing.

- Furthermore, by incorporating RFID technology into e-commerce, firms can avoid mistakes like the available stock not matching the actual one, which results in a loss of sales and customer confidence, problems with customer shipments, and issues with a stock that does not integrate online shopping with the actual store or warehouse, which results in more complex management.

- NFC (near field communication) labels can be utilized in a variety of ways in the retail business to improve the customer shopping experience and increase efficiency. One application for NFC labels is electronic shelf labeling systems (ESL). Retailers can change product pricing and information in real-time using a mobile device or PC with NFC technology embedded into these digital price tags. This saves time and resources while also lowering the chance of price errors.

- The players in the market are developing new solutions to cater to customers. For instance, in August 2022, Oli-Tec created a new smart label technology for temperature and time-sensitive products. The smart labels can be put on any product with a five to fifteen-day shelf life. They have an integrated visual indicator that is temperature and time-sensitive. It progressively changes from yellow to red, more slowly in cool and faster in hotter temperatures, both at known, repeatable rates. This simple color-changing indicator provides a clear, highly visible call to action that both retailers and consumers can understand at a glance," according to Oli-Tec.

- Overall, the future of the smart label market looks promising, with the potential to revolutionize the retail sector by offering real-time inventory tracking, improving customer engagement, and promoting sustainability. As retailers continue to adopt advanced technologies and seek innovative solutions to improve operational efficiency, the demand for smart label products may grow in the coming years.

North America to Hold Major Share in the Market

- North America is one of the largest markets for smart labels across the world, with the United States accounting for a significant share of the region. The country's huge demand can be attributed to the vast presence of retail stores, both small and large. Retail goliaths like Walmart and other businesses are in charge in the United States, driving the uptick in activity and significantly boosting the country's growth in the smart label market. Walmart has been putting electronic identification tags on men's clothing, like jeans, as the retailer tries to gain more control over its inventory.

- Food companies are using smart labels to connect with consumers by offering additional nutritional and ingredient information and helping to reduce food waste in the country. Also, the USDA and FDA (Food and Drug Administration) recently announced a framework agreement to label cell-based meats and potentially other food products. This is expected to augment the size of the market in the country. Moreover, vendors in the country invest in technologies that drive greater traceability throughout their supply chains, with blockchain being increasingly used along with smart labels.

- The United States is also witnessing increasing employee theft and shoplifting, including organized retail crime. To address the alarming rise in retail crimes, stakeholders are developing smart labels based on RFID to track textiles and garments.

- The effects of new advancements in digital technologies have influenced the Canadian printing industry, making it more competitive and encouraging firms to invest in this domain. The adoption of new technologies, such as digital printing, integrated systems, customer interface software, and post-process automation, has enhanced operating efficiency and significantly improved the quality of products delivered to end users.

- Food and Consumer Products of Canada (FCPC) launched an innovative smart label that gives consumers instant and easy access to information that cannot be printed on product labels. This is a part of the Healthy Eating Strategy that the members of FCPC have undertaken by ushering in higher levels of transparency in the products that they offer to consumers. Many major companies in Canada have also committed to using smart labels to enhance the culture of transparency.

Smart Label Industry Overview

The smart label market is fragmented, with the presence of major players like Avery Dennison Corporation, CCL Industries Inc., William Frick & Company, Honeywell International Inc., and Invengo Information Technology Co. Ltd. Players in the market are adopting strategies such as partnerships, agreements, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In April 2023, CCL Industries Inc. reported that the business had acquired eAgile Inc., a provider of hardware and software solutions for the healthcare sector, along with RFID inlays integrated into labels and the intellectual property of Alert Systems ApS. The new firm will provide RFID expertise to the whole organization and become a crucial component of CCL Label's Healthcare & Specialty division. Furthermore, privately held Alert in Denmark offers proprietary anti-theft products to European merchants alongside Checkpoint's merchandise availability solutions (MAS) product lines.

In January 2023, Avery Dennison signed an agreement to buy Thermopatch, a labeling, embellishment, industrial laundry, and transfer specialist for the sports, workwear, and hospitality industries. Thermopatch was expected to become part of the company's Retail Branding and Information Solutions (RBIS) Apparel Solutions business after the transaction was complete, which was expected in the first quarter of 2023. The merger is expected to allow the company to capitalize on its aggregate industry knowledge, utilizing its know-how, quality, and service to drive growth in external embellishments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Security and Tracking Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Ubiquitous Standards, Safety Concerns, and Inability to withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Electronic Article Surveillance (EAS)

- 6.1.2 RFID

- 6.1.3 Sensing Label

- 6.1.4 NFC

- 6.1.5 Electronic Shelf Label (ESL)

- 6.2 By End-user Industry

- 6.2.1 Retail

- 6.2.2 Healthcare and Pharmaceutical

- 6.2.3 Logistics

- 6.2.4 Manufacturing

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 CCL Industries Inc.

- 7.1.3 William Frick & Company

- 7.1.4 Honeywell International Inc.

- 7.1.5 Invengo Information Technology Co. Ltd.

- 7.1.6 Scanbuy Inc.

- 7.1.7 Sato Holdings Corp.

- 7.1.8 Alien Technology

- 7.1.9 Zebra Technologies Corp.