|

市場調查報告書

商品編碼

1432540

M2M 連結:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)M2M Connections - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

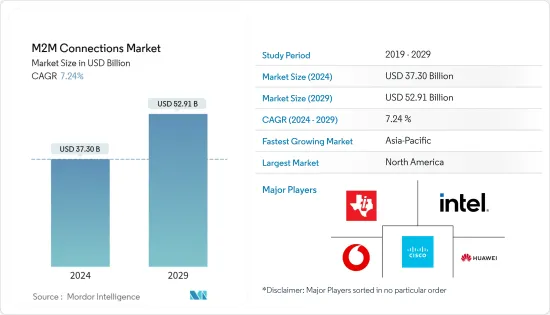

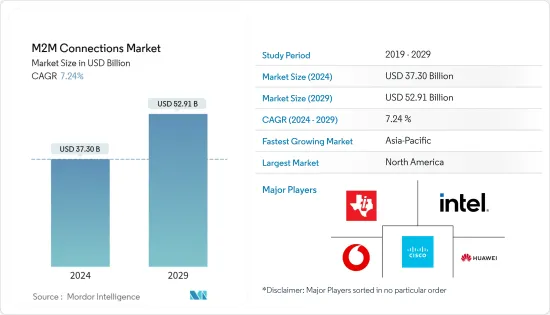

M2M連接市場規模預計到2024年為373億美元,預計到2029年將達到529.1億美元,在預測期內(2024-2029年)複合年成長率為7.24%。

由於網際網路使用量的增加和法規環境的改善,預計該行業將在預測期內成長。此外,由於跨行業 M2M 連接的增加以及 4G/LTE 和藍牙智慧/BLE 等新通訊技術的使用增加,預計該市場將在預測期內擴大。

主要亮點

- 過去幾十年來,隨著世界網際網路和IP網路系統的發展,M2M連線發生了變化。這使得遠距通訊大量設備之間的通訊變得更加容易和有效。根據Cisco系統公司預測,到年終,全球M2M連線數將達到147億個。 2018年至2023年連接量年均成長率預估為19%。

- 減少人類參與和與工作相關的活動是機器對機器通訊的基本好處之一。自動資料收集使機器控制系統能夠執行許多先前由人工干預執行的業務。操作員和技術人員可以騰出時間來執行需要人機互動的更高價值的任務。

- 印度等新興國家已經認知到 M2M 的重要性,因此廣泛關注擴大 M2M的普及。此外,2022年2月,印度政府宣布M2M/物聯網(IoT)是世界上發展最快的技術之一,為社會、企業和消費者提供豐富而有利的可能性。 。政府措施鼓勵增加機器對機器 (M2M) 產業的使用和創新。

- 機器對機器 (M2M) 連接市場的推動因素包括擴大網路覆蓋範圍、無線通訊進步、快速數位化、工業化、研發活動、投資激增以及各行業垂直領域 M2M 連接的增加。受到了增加的正面影響在預測期內,進入機器對機器(M2M)連接市場的公司也可能受益於對聯網汽車和智慧城市不斷成長的需求,以及與系統整合商的策略合作夥伴關係。

- 然而,隱私和安全問題以及複雜的應用開發是阻礙該行業持續擴張的主要因素。此外,缺乏擴充性和高昂的交付成本也導致市場難以發展。

- COVID-19的疫情對M2M業務產生了積極影響,對遠端監控和操作工具產生了迫切需求,增加了對M2M技術和解決方案的需求。此外,這些解決方案還幫助醫生和護士監測單獨接受治療的患者。

M2M連結市場趨勢

擴大網路使用正在推動市場成長

- 網路主要透過計量型的高速連線的普及,在工作時間和地點方面提供了更大的彈性。您可以使用多種方法(包括行動網際網路設備)在任何地方存取網際網路。用戶可使用行動電話、資料卡、掌上遊戲機、行動電話路由器等無線上網。

- 根據 Speedtest 的數據,截至 2023 年 4 月,卡達擁有世界上最快的平均行動網路連線速度,約為 190 Mbps。其次是阿拉伯聯合大公國 (UAE) 和澳門,這兩個國家的平均中位數速度均超過 170 Mbps。

- 由於網路和無線技術標準的改進,遙測技術在暖氣設備、電錶和連網家用電器等日常產品中的使用不斷擴大。此前,遙測技術僅用於製造、工程和純科學領域。

- 全球對M2M連接的關注和不斷成長的網際網路使用是推動M2M連接市場成長的兩個主要原因。 4G/LTE 蜂窩技術的普及和 5G 技術的出現將進一步影響 M2M 連接。

- 根據國際電信聯盟稱,到 2022 年,歐洲的網路普及將成為世界上最顯著的地區,從 2009 年的略低於 60% 上升到有數資料的最近一年的 89%。非洲的網路使用率最低,為 40%。截至同年,根據全球網路存取總數,約有 49 億人在使用網路。

- 此外,各國政府正在積極尋求新的策略來擴展網路連接技術和 M2M 連接。例如,2022 年 11 月,歐洲議會和歐盟 (EU) 成員國相關人員宣布,他們即將簽署一項價值 60 億歐元(61.8 億美元)的協議,以啟動衛星網路基礎設施。歐盟委員會表示,天基連結是歐盟在現代數位環境中保持彈性的戰略資產。它支撐著歐盟的經濟、數位領導力、技術獨立性、競爭力和社會發展。

北美預計將佔據很大佔有率

- 該地區是 AT&T、Verizon 和 Cisco 等知名通訊業者的所在地,並且不斷投資擴大和改善其基礎設施,以跟上技術創新的步伐。 M2M 連線的採用預計將在預測期內加速。

- 5G 的出現預計將在預測期內推動 M2M 連接的成長。 M2M通訊的目的可以透過5G技術成功解決,5G技術具有多樣化的應用、低延遲、高速度和巨大的頻寬。例如,自動駕駛汽車使用 5G 技術以最小的延遲和卓越的可靠性進行連接。此外,5G系統為網路技術提供了保證的QoS。

- 此外,北美5G連線數(不包括物聯網)將從2021年的14%增加到2025年的2.8億個,佔所有行動連線數的64%。預計屆時加拿大將排名第四,僅次於日本,美國將擁有僅次於韓國的全球第二高 5G 採用率。

- 多家大公司透過研發、策略聯盟、併購等方式提升了該領域的技術水準。因此,預計該地區 M2M 連接的使用量在預測期內將會增加。

- 例如,2022年12月,總部位於加州的物聯網和機器對機器(IoT和M2M)通訊供應商Aeris Communications將收購連網型的物聯網加速器和車聯網雲端業務,該計畫已公佈。該協定預計將使Aeris和愛立信的物聯網平台能夠連接全球190個國家的超過1億個物聯網設備。此外,隨著兩家公司的合併,整個物聯網市場預計將快速成長。對 4G 和 5G 的需求將包括並成長很大一部分物聯網。

M2M連結產業概況

M2M 連接市場競爭激烈,其特點是大型和小型製造商都存在。這些公司正在投資研發,以提高產能並滿足不斷擴大的市場需求。在北美和歐洲等成熟市場,競爭更加激烈。由於生產和服務擴張、收購增加以及技術進步等多種變數的影響,未來幾年該市場的競爭程度可能會繼續加劇。

- 2022 年 5 月 C-DOT 和 Vodafone Idea Limited 合作評估不同解決方案提供者的應用程式和裝置是否符合 oneM2M 要求,並授予聯合認證以解決實施中的這些困難。我們同意獨家合作和工作。通訊部 (DOT) 和遠端資訊處理發展中心 (C-DoT) 簽署了一份合作備忘錄,就印度機器對機器 (M2M) 和物聯網 (IoT) 解決方案進行合作。

- 2022 年 2 月 T-Mobile 和德國電信推出 T-IoT,這是一種用於物聯網連接、平台管理和支援的企業解決方案。 T-IoT 在全球 188 個地點和 383 個網路中可用,因此使用 T-IoT 的企業可以支援其所有國際連接。企業依賴此解決方案,因為他們知道物聯網將改變他們的行業並幫助他們為 5G 時代做好準備。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 應用擴展遠端資訊處理

- 擴大網路使用

- 移動連接增加

- 市場限制因素

- 隱私和安全問題

- 缺乏標準化

第6章市場區隔

- 按連線類型

- 有線

- 無線的

- 科技

- 蜂巢連接

- 低功率廣域 (LPWA)

- 短距離

- 男人

- 廣域固定

- 衛星

- 最終用戶產業

- 零售業

- 銀行/金融機構

- 通訊/IT產業

- 衛生保健

- 汽車產業

- 油和氣

- 運輸

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Vodafone Group

- Texas Instruments Incorporated

- VMWare Inc.

- AT&T Inc.

- Duetsche Telecom AG

- Siera Wireless

- China Mobile Ltd.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Gemalto NV(Thales Group)

- Telefonica SA

- Telit Communications

第8章投資分析

第9章市場的未來

The M2M Connections Market size is estimated at USD 37.30 billion in 2024, and is expected to reach USD 52.91 billion by 2029, growing at a CAGR of 7.24% during the forecast period (2024-2029).

The industry is anticipated to grow over the forecast period due to rising internet usage and a supportive regulatory environment. Also, the market is expected to grow during the forecast period because more M2M connections are being made between different types of businesses and because more new communication technologies like 4G/LTE and Bluetooth Smart/BLE are being used.

Key Highlights

- M2M connections have changed over the past few decades as the global Internet and IP network systems have grown. This has made it easier and more effective to communicate over long distances and between many devices. According to Cisco Systems, by the end of 2023, there will be 14.7 billion M2M connections globally. The forecasted compound annual growth rate of connections from 2018 to 2023 is 19 percent.

- Reducing human involvement and task-related activities is one of the essential benefits of machine-to-machine communication. Due to automated data collection, mechanical machine control systems can now do numerous duties that were formerly done by human intervention. Operators and technicians are freed up to perform higher-value tasks that require human interaction.

- Developing countries like India have identified the importance of M2M and are, therefore, focusing extensively on the increased penetration of M2M. Moreover, in February 2022, the government of India stated that M2M/Internet of Things (IoT) is one of the most rapidly developing technologies worldwide, offering a wealth of advantageous potential for society, businesses, and consumers. The government initiative encourages greater use and innovation in the machine-to-machine (M2M) industry.

- The market for machine-to-machine (M2M) connections is positively impacted by increased demand for expanded network coverage, wireless communication advancements, rapid digitization, industrialization, R&D activities, a surge in investment, and a rise in M2M connections among different industry verticals. During the period of the forecast, those in the machine-to-machine (M2M) connections market would also benefit from the growing demand for connected vehicles and smart cities, as well as from strategic partnerships with system integrators.

- However, issues with privacy and security and complex application development are a few of the primary factors hindering the industry under study from continuing to expand. Also, the lack of scalability and high delivery costs are making it hard to grow the market.

- The COVID-19 pandemic positively impacted the M2M business due to a sudden requirement for remote monitoring and operating tools, leading to increasing requests for M2M technology and solutions. Moreover, these solutions helped doctors and nurses keep an eye on patients who were being treated alone.

M2M Connections Market Trends

Growing Usage of Internet is Expected to Drive the Market Growth

- The Internet provides more flexibility in terms of working hours and location, due mainly to the proliferation of unmetered high-speed connections. Many methods, including mobile Internet devices, may be used to access the Internet anywhere. Users can access the Internet wirelessly using mobile phones, data cards, portable gaming consoles, and cellular routers.

- According to Speedtest, as of April 2023, Qatar had the fastest average mobile internet connections globally, nearly 190 Mbps. The United Arab Emirates (UAE) and Macau followed, with each of these countries registering average median speeds above 170 Mbps.

- Telemetry usage in daily items like heating units, electric meters, and internet-connected appliances has grown because of the Internet and better wireless technology standards. Previously, telemetry was only used in manufacturing, engineering, and pure science.

- The global focus on machine-to-machine (M2M) connections and the expansion of internet usage are the two main reasons promoting the market's growth for M2M connections. Machine-to-machine (M2M) connections are affected even more by the spread of 4G/LTE cell technologies and the coming of 5G technology.

- According to the ITU, Europe had the most significant internet penetration rate among all world regions in 2022, increasing from just under 60% in 2009 to 89% in the most recent year for which data was available. The lowest internet usage rate, at 40%, was found in Africa. Around 4.9 billion people were reportedly online as of the same year, based on total global internet access.

- Furthermore, governments are actively pursuing new strategies for broadening internet connectivity technologies, thereby increasing M2M connectivity. For instance, in November 2022, officials from the European Parliament and member states of the European Union (EU) announced that they were close to concluding a EUR 6 billion (USD 6.18 billion) agreement to launch a satellite internet infrastructure. The European Commission stated that space-based connectivity is a strategic asset for the resilience of the EU in the modern digital environment. It supports the development of its economy, digital leadership, technical independence, competitiveness, and society.

North America is Expected to Hold Significant Share

- Some of the prominent telecom sector firms are based in the area, including AT&T, Verizon, Cisco, and many more, who are constantly investing in expanding and improving their infrastructure in order to stay up with technological breakthroughs. Over the projected period, it is anticipated to accelerate the adoption of M2M connections.

- The advent of 5G is expected to fuel the growth of M2M connections over the forecast period. M2M communication objectives may be successfully addressed by 5G technology, which has a wide variety of applications, low latency, greater speed, and enormous bandwidth. As an illustration, autonomous cars will use 5G technology to connect with minimal latency and great dependability. Moreover, networking technologies with assured QoS can be offered by the 5G system.

- Furthermore, the number of 5G connections (excluding IoT) in North America will increase from 14% in 2021 to 280 million by 2025, making up 64% of all mobile connections. Canada is expected to rank fourth behind Japan by then, with the United States having the world's second-highest 5G adoption rate, trailing only South Korea.

- Several big companies in the area have been able to improve the technology through research and development, strategic alliances, and mergers and acquisitions. This is expected to increase the use of M2M connections in the area during the projection period.

- For instance, in December 2022, Aeris Communications, a California-based Internet of Things and machine-to-machine (IoT and M2M) communications provider, announced plans to acquire Ericsson's IoT Accelerator and Connected Vehicle Cloud businesses. The agreement is expected to enable Aeris and Ericsson's IoT platforms to link over 100 million IoT devices worldwide in 190 different countries. Additionally, the loT market will grow faster overall owing to the two businesses' merger. The demand for 4G and 5G will include a significant and expanding portion of IoT.

M2M Connections Industry Overview

The market for M2M connections is highly competitive and distinguished by the abundance of both large- and small-scale manufacturers. These businesses have been investing in R&D to increase their production capacity and satisfy the expanding market demand. In established markets like North America and Europe, competition is more intense. The degree of rivalry in this market will continue to increase over the coming years as a result of a variety of variables, including rising production and service extensions, an increase in acquisitions, and technical advancements.

- May 2022 - C-DOT and Vodafone Idea Limited have agreed to cooperate and work on a non-exclusive basis to evaluate apps and devices from different solution providers to meet oneM2M requirements and to give joint certifications to solve these difficulties in the implementation. The Department of Telecommunications (DOT) and the Center for Development of Telematics (C-DoT) signed a memorandum of understanding (MoU) to work together on machine-to-machine (M2M) and Internet of Things (IoT) solutions for India.

- February 2022 - T-Mobile and Deutsche Telekom AG will introduce T-IoT, a corporate solution for IoT connection, platform administration, and support. Businesses using T-IoT can handle all of their international connections because it will be accessible in 188 locations and on 383 networks globally. The firms use the solution because they know that IoT can change their industries and help them get ready for the 5G era.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmenting Applications Telematics

- 5.1.2 Growing Usage of Internet

- 5.1.3 Increasing Number of Mobile Connections

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues

- 5.2.2 Lack of Standardization

6 MARKET SEGMENTATION

- 6.1 By Connection Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 Technology

- 6.2.1 Cellular Connections

- 6.2.2 Low Power Wide Area (LPWA)

- 6.2.3 Short Range

- 6.2.4 MAN

- 6.2.5 Wide Area Fixed

- 6.2.6 Satellite

- 6.3 End User Industry

- 6.3.1 Retail Sector

- 6.3.2 Banking and Financial Institution

- 6.3.3 Telecom and IT Industry

- 6.3.4 Healthcare

- 6.3.5 Automotive

- 6.3.6 Oil & Gas

- 6.3.7 Transportation

- 6.3.8 Other End User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Vodafone Group

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 VMWare Inc.

- 7.1.4 AT&T Inc.

- 7.1.5 Duetsche Telecom AG

- 7.1.6 Siera Wireless

- 7.1.7 China Mobile Ltd.

- 7.1.8 Cisco Systems, Inc.

- 7.1.9 Huawei Technologies Co., Ltd.

- 7.1.10 Intel Corporation

- 7.1.11 Gemalto NV(Thales Group)

- 7.1.12 Telefonica SA

- 7.1.13 Telit Communications