|

市場調查報告書

商品編碼

1432877

物聯網安全:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

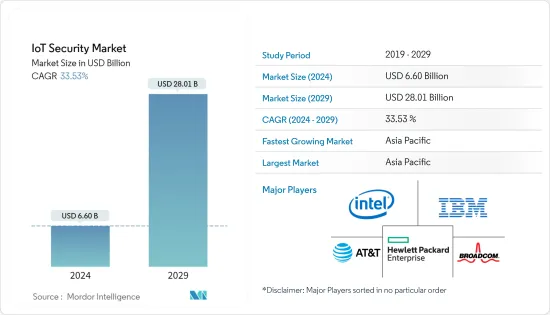

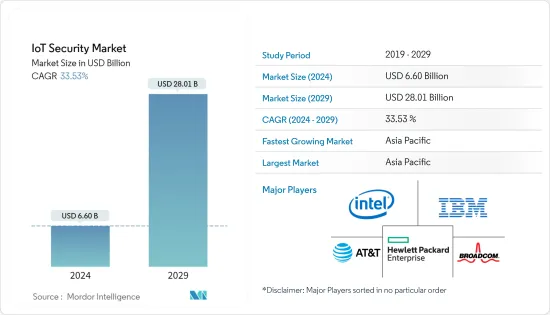

物聯網安全市場規模預計到2024年將達到66億美元,預計2029年將達到280.1億美元,在預測期內(2024-2029年)複合年成長率為33.53%。

新的應用程式和經營模式,加上裝置成本的下降,正在推動物連網的採用率,進而影響連網型設備的數量,例如聯網汽車、機器、儀表、穿戴式裝置和家用電器。

主要亮點

- 隨著對連接設備的依賴增加,確保連接設備安全的需求也在增加。 根據愛立信的數據,2016 年,估計有 4 億台蜂窩連接的物聯網設備,到 2022 年,預計將達到 15 億台。 預計這一強勁增長將受到行業對部署互聯生態系統的日益關注以及 3GPP 蜂窩物聯網技術日益標準化的推動。

- 例如,2019 年,賽門鐵克公司宣布推出新服務,使其Cloud Workload Protection (CWP) 解決方案和Amazon 的AMZN GuardDuty 能夠為Amazon Web Services (AWS) 工作負載和存儲提供自動修復和存儲,並提供增強的威脅情報。這項新服務預計將幫助企業應對複雜的安全形勢,並使 AWS 客戶能夠自動化和簡化雲端安全的關鍵組件。

- 資料外洩的增加和智慧城市的出現是推動市場的因素之一。

- 然而,缺乏技術純熟勞工和對物聯網安全解決方案重要性認知不足等因素阻礙了市場成長。

物聯網安全市場趨勢

網路安全可望創最快增速

- 物聯網網路是全球企業的主要目標和最關心的問題。網路安全部分涵蓋防火牆、伺服器、VPN、IDS、IPS、WIDPS、閘道器和網路硬體等各個子子區隔。企業中擴大採用 BYOD 和物聯網,這增加了對企業網路攻擊的安全性疑慮。例如,根據 IT Candor 的數據,2018 年全球網路硬體市場規模為 1,810 億美元。光是企業網路硬體就價值 520 億美元。

- 根據 IBM X-Force 威脅情報報告,2018 年物聯網漏洞數量比五年前報告的數量增加了 5,400%。 2016 年發生的 Mirai 攻擊是利用物聯網攻擊伺服器的一個著名例子。該惡意軟體使用殭屍網路,招募超過 150,000 台設備,每秒向供應商的伺服器發送 1TB 的資料。

- 迄今為止,大多數基於物聯網的攻擊都是以 DDoS 的形式發生的。根據賽門鐵克的報告,三種類型的 DDoS 相關惡意軟體(LightAidra、Kaiten 和 Mirai)佔 2018 年物聯網攻擊的近 80%。

- 市場上的許多供應商都專注於提供解決網路安全相關問題的解決方案。例如,Palo Alto Networks 透過防火牆提供物聯網安全作為整合服務。此功能歸功於 Palo Alto Networks 最近收購了 Zingbox。預計各供應商的此類措施將在預測期內減輕網路威脅並推動網路安全領域的市場需求。

亞太地區佔最大市場佔有率佔有率

- 亞太地區是物聯網採用率最高的地區,這得益於該地區正在建造的智慧城市計劃。亞太地區的大規模工業化和行動裝置用戶數量的增加也表明該地區預計將經歷強勁成長。

- 根據思科的 VNI 報告,到 2022 年,該地區的網路用戶數量可能達到 26 億(佔人口的 62%),而 2017 年為 17 億(佔人口的 41%)。該地區的連網裝置/連線數量預計將從 2017 年的 86 億增加到 2022 年的 131 億。然而,根據 FireEye 的報告,與世界其他地區相比,亞太地區成為高階網路攻擊目標的可能性高出 35%。

- 據美國國家資訊通訊技術研究所 (NIICT) 稱,針對物聯網設備的網路攻擊正在顯著增加。根據 NICT 的預測,到 2020 年,網路攻擊的設備數量可能會達到 300 億台,而 2015 年為 150 億台。此類案例促使政府和相關組織實施物聯網安全解決方案以減少損害。

- 隨著物聯網趨勢的不斷發展,中國的技術創新正在促使中國消費者對智慧家庭市場的需求不斷增加。國家智慧家庭核心系統由照明控制系統、安防系統、娛樂系統(音訊)、家電等組成。

物聯網安全產業概述

物聯網安全市場的競爭是溫和的,由在全球市場營運的一些重要市場參與者組成。從市場佔有率來看,目前少數參與者佔據市場主導地位。然而,隨著工業服務安全存取的進步,新參與者正在增加其市場佔有率,從而擴大其在新興國家的業務足跡。市場主要企業包括賽門鐵克公司、IBM公司、Check Point軟體技術有限公司、英特爾公司、惠普企業公司、思科系統公司、Fortinet公司、Trustwave Holdings、泰雷茲集團(Gemalto NV)等。

- 2019 年 9 月 - Trustwave 宣布推出雲端基礎的網路安全平台,該平台將作為該公司資安管理服務、產品和其他網路安全產品的基礎。 Trustwave Fusion 平台專為支援營運型企業擁抱數位轉型並應對不斷變化的安全環境而建置。

- 2019 年 6 月 - Symantec, Inc. 宣布推出適用於 Symantec Cloud Workload Protection (CWP) 解決方案和 Amazon Guard Duty 的新服務,為 AWS 工作負載和儲存提供自動修復和增強的威脅情報。這項新服務可協助企業應對複雜的安全形勢,並使 AWS 客戶能夠自動化和簡化雲端安全的關鍵元件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 資料外洩增加

- 智慧城市的出現

- 市場限制因素

- 設備的複雜性不斷增加,加上缺乏普遍的立法

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依安全類型

- 網路安全

- 端點安全

- 依解決方案

- 軟體

- 依服務

- 依最終用戶產業

- 車

- 衛生保健

- 政府機關

- 製造業

- 能源/電力

- 零售

- BFSI

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Broadcom Inc.(Symantec Corporation)

- IBM Corporation

- Check Point Software Technologies Ltd.

- Intel Corporation

- Hewlett Packard Enterprise Co.

- Cisco Systems Inc.

- Fortinet Inc.

- Trustwave Holdings

- Thales Group(Gemalto NV)

- AT&T Inc.

- Palo Alto Networks Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The IoT Security Market size is estimated at USD 6.60 billion in 2024, and is expected to reach USD 28.01 billion by 2029, growing at a CAGR of 33.53% during the forecast period (2024-2029).

The emerging applications and business models, coupled with the falling device costs, have been driving the adoption rate of IoT, which is, consequently, influencing the number of connected devices, such asconnected cars, machines, meters, wearable, and consumer electronics.

Key Highlights

- Increasing dependency on the connected devices is creating the need to keep the connected device secure. According to Ericsson, it is estimated that nearly 400 million IoT devices, with cellular connections in 2016, are projected to reach 1.5 billion by 2022. This robust growth is expected to be driven by the increased industry focus on deploying a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

- In 2019, for instance, Symantec Corp. announced a new service that enables its Cloud Workload Protection (CWP) solution and AMZN GuardDuty from Amazon, to provide automated remediation and enhanced threat intelligence for Amazon Web Services (AWS) workloads and storage. This new service is anticipated to help enterprises to navigate the complex security landscape, allowing AWS customers to automate and streamline critical components of cloud security.

- Increasing number data breaches, emergence of smart cities, are some of the factors driving the market.

- .However, factors, such as the dearth of skilled workforce and less awareness about the importance of the IoT security solutions hinder the market growth.

IoT Security Market Trends

Network Security Is Expected to Witness the Fastest Growth Rate

- IoT networks are the prominent targets and the primary concern for enterprises across the world. The network security segment covers various subsegments, such as firewalls, servers, VPN, IDS, IPS, WIDPS, gateway, and network hardware. The growing trend of adopting BYOD and IoTs in enterprises is increasing the security concerns of attacks on enterprise networks. For instance, according to IT Candor, the size of the global network hardware market during fiscal 2018 was valued at USD 181 billion. Enterprise network hardware alone was valued at USD 52 billion.

- According to the IBM X-Force threat intelligence report, in 2018 it was recorded an increase of 5,400% in the number of IoT vulnerabilities over the number reported just five years earlier. Mirai attack, back in 2016, is a prominent example of using IoT to attack servers. The malware used botnet, which enlisted over 150,000 devices to send 1TB of data per second at the vendor's servers.

- To date, the majority of the IoT based attacks have occurred in DDoS form. According to Symantec's report, three kinds of DDoS associated malware, such as LightAidra, Kaiten, and Mirai, collectively accounted for nearly 80% of the 2018 year's IoT attacks.

- Many vendors in the market are emphasizing on providing solutions specific to tackle issues related to network security. For instance, Palo Alto Networks is delivering IoT security as an integrated service through the firewall; the capability was due to the recent acquisition of Zingbox by Palo Alto Networks.Such initiatives by various vendors are expected to mitigate the network threats over the forecast period and drive the market demand for the network security segment.

Asia-Pacific Occupies The Largest Market Share

- Asia-Pacific is the most prominent region for the adoption of IoT, owing to smart city projects being built in the region. The massive industrialization and the rising number of mobile device users in Asia-Pacific also indicate that the region is expected to witness significant growth.

- According to the Cisco VNI report, by 2022, the region may have 2.6 billion internet users (62% of the population), up from 1.7 billion (41% of the population) in 2017. The region is also estimated to have 13.1 billion networked devices/connections by 2022, up from 8.6 billion in 2017. Asia-Pacific, however, is 35% more likely to be targeted by advanced cyber attacks when compared to the world, according to a report by FireEye.

- According to the National Institute of Information and Communication Technology (NIICT), there has been a significant increase in the number of cyberattacks to IoT Devices. NICT predicts that the number of cyberattacks may reach 30 billion devices by 2020, when compared to 15 billion devices in 2015. Such instances are propelling the government and the related organizations to deploy IoT security solutions to mitigate the damages.

- With a rising trend toward IoT, China's technological innovation has led to increasing demand in the smart home market from Chinese consumers. The country's central smart home systems consist of lighting control systems, security systems, entertainment systems (audio and video), home appliances, and others.

IoT Security Industry Overview

The IoT Securitymarket is moderately competitive and consists of a few significant market players operating across the globalmarket. In terms of market share, some of theplayers currently dominate the market. However, with the advancement in the security accessacross the industrialservices, new players are increasing their market presence thereby expanding their business footprint across the emerging economies. Some of the key players in the market areSymantec Corporation, IBM Corporation, Check Point Software Technologies Ltd.,Intel Corporation,Hewlett Packard Enterprise Company,Cisco Systems Inc.,Fortinet Inc.,Trustwave Holdings,Thales Group (Gemalto NV), among others.

- Sept 2019-Trustwave announced a cloud-based cybersecurity platform that serves as the foundation for the company's managed security services, products and other cybersecurity offerings. The Trustwave Fusion platform is purpose-built to meet the enterprise, where it is involved in operations as it embraces digital transformation and contend with a continuously evolving security landscape.

- June 2019 -Symantec Corp.announced a new service for Symantec's Cloud Workload Protection (CWP) solution and Amazon Guard Duty to provide automated remediation and enhanced threat intelligence for AWS workloads and storage. This new service will help enterprises to navigate the complex security landscape, allowing AWS customers to automate and streamline key components of cloud security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Data Breaches

- 4.3.2 Emergence of Smart Cities

- 4.4 Market Restraints

- 4.4.1 Growing Complexity among Devices, Coupled with the Lack of Ubiquitous Legislation

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type of Security

- 5.1.1 Network Security

- 5.1.2 End-point Security

- 5.2 By Solution

- 5.2.1 Software

- 5.2.2 Services

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Healthcare

- 5.3.3 Government

- 5.3.4 Manufacturing

- 5.3.5 Energy & power

- 5.3.6 Retail

- 5.3.7 BFSI

- 5.3.8 Others End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Broadcom Inc. (Symantec Corporation)

- 6.1.2 IBM Corporation

- 6.1.3 Check Point Software Technologies Ltd.

- 6.1.4 Intel Corporation

- 6.1.5 Hewlett Packard Enterprise Co.

- 6.1.6 Cisco Systems Inc.

- 6.1.7 Fortinet Inc.

- 6.1.8 Trustwave Holdings

- 6.1.9 Thales Group (Gemalto NV)

- 6.1.10 AT&T Inc.

- 6.1.11 Palo Alto Networks Inc.