|

市場調查報告書

商品編碼

1441693

企業資源規劃:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

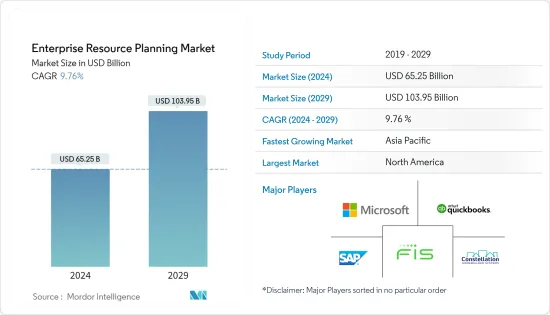

企業資源規劃市場規模預計到2024年為652.5億美元,預計到2029年將達到1039.5億美元,在預測期內(2024-2029年)成長9.76%,複合年成長率成長。

ERP 軟體可協助組織規劃、預算、預測和報告其財務結果。全球公司數量的快速增加以及對雲端基礎的ERP 平台的需求增加了對供應商關係管理和客戶關係管理的需求,推動了市場的成長速度。

更多地採用創新和先進技術、擴大現有 ERP 系統的價值、最大限度地減少對第三方的依賴、更高安全性的資源、不斷發展的財務系統以及其他顯著趨勢。對 ERP 軟體(尤其雲端基礎的ERP 軟體)的需求正在增加關鍵因素。

企業資源規劃 (ERP) 產業受到以客戶為中心的策略日益成長的需求的推動。公司越來越認知到將客戶置於業務中心對於提高客戶滿意度、忠誠度和整體業務成功的重要性。 ERP 系統對於實現這一目標至關重要,因為它們提供全方位的整合應用程式,使公司能夠提高生產力、最佳化工作流程並提供更好的客戶服務。

行動裝置的普及增加了對行動友善 ERP 解決方案的需求。行動 ERP 應用程式可讓人們核准工作流程、存取關鍵公司資料並隨時隨地做出決策,從而幫助提高營運敏捷性。例如,智慧型手機和平板電腦使用者可以使用 SAP ERP 行動應用程式存取重要的 ERP 功能。這有助於即時決策、改善團隊合作並提高對不斷變化的公司需求的適應性。

彈性的ERP 系統可能會難以隨著您的業務變化和擴展而發展和適應。這種限制可能會使公司更難以推出新產品線、進入新市場或適應組織結構的變化。例如,如果您的業務正在快速擴張,則可能很難擴展您的 ERP 系統來處理更高的交易量,這可能會導致效能問題並為您的業務造成瓶頸。

感染疾病COVID-19時代「線上商務」概念的興起,增加了非接觸式交易的需求,製造業中小企業在競爭中舉步維艱。這就產生了製造公司對 ERP 的需求,使他們能夠即時執行所有活動。

ERP市場趨勢

大公司的市場成長率最高

- 大公司有員工250多人。對精簡和協調以在不同部門和員工之間建立有效溝通的需求日益成長,正在推動 ERP 軟體在大型企業中的實施。 ERP 讓大型組織能夠輕鬆地即時共用資訊和資料。

- 單一租戶、雲端基礎的ERP 軟體系統越來越適合大型企業。在這個系統中,每個使用者都有一個單獨的軟體實例,託管在公共基礎設施的專用硬體上,從而獲得更高層級的控制和擴展的客製化功能。

- 大多數 ERP 解決方案(包括 SAP 解決方案)都是為了幫助大公司追蹤其區域業務而開發的。使用 ERP 的領先製造公司已成功管理和自動化其生產和供應鏈活動,推動了該領域的成長。

- 此外,複雜的 ERP 解決方案價格昂貴,只有擁有大量 IT 預算的大公司才能負擔得起。對於大型企業來說,實施ERP計劃需要大量的技術專家和諮詢服務團隊。因此,大公司需要聘請ERP專家來完成計劃。此外,大型企業跨多個站點部署 ERP 解決方案,這增加了複雜性。

北美佔最大市場佔有率

- 美國一些最受歡迎的 ERP 解決方案包括 Oracle NetSuite、Oracle ERP Cloud 和 Microsoft Dynamics 365。 Oracle 和 Microsoft 等大公司尤其推動了 ERP 軟體在美國的日益普及。因為企業需要透過整合業務功能來獲得市場競爭優勢。

- 此外,這些公司還提供專為大中型企業建置的 ERP 軟體解決方案,以協助財務和營運等複雜功能。許多供應商提供成熟的 ERP 解決方案,擁有數十年的專業知識和行業知識,推動了美國對此類解決方案的需求。

- Oracle Netsuite、Oracle ERP Cloud、Microsoft D365 和 Acumatica 等 ERP 解決方案針對希望升級基本會計系統並透過數位轉型發展的中小型企業。其他公司則透過專注於製造和銷售組織並提供具有極高投資收益(ROI) 的經濟高效的解決方案,在市場上建立了顯著的利基市場。

- ERP 軟體透過整合業務流程減少重複資料輸入,使加拿大組織受益。由於客戶對節省時間和提高業務功能準確性的需求不斷增加,加拿大對 ERP 解決方案的需求不斷增加。多倫多和蒙特婁正在成為加拿大的商業和技術進步中心。這些地區是地區 ERP 市場許多成熟和新興參與者的所在地。

ERP產業概況

考慮到所有行業的數位化程度不斷提高,ERP軟體市場是半整合的。鑑於供應商的市場滲透率和投資新技術的能力,預期競爭對手之間的競爭仍將激烈。一些參與者包括 SAP SE、Intuit、微軟公司和 Constellation Software。

2023 年 6 月,SAP 和貝恩合作幫助領導者推動雲端支援的 ERP 轉型。此次合作旨在幫助高階主管最大限度地發揮雲端 ERP 轉型的影響。這種合作夥伴關係使客戶能夠透過將 RISE 等解決方案與 SAP 和貝恩的主導驅動轉型專業知識相結合,更快地實現其業務目標並充分發揮 ERP 的潛力。

2023 年 5 月,微軟公司宣布微軟和 SAP 正在深化其長期合作夥伴關係,以協助客戶解決最基本的業務課題。兩家公司旨在透過將 SAP SuccessFactors 解決方案與 Microsoft 365 Copilot 和 Copilot for Microsoft Viva Learning 以及 Microsoft Azure OpenAI 服務整合來合作,以存取分析和產生自然語言的強大語言模型。這種整合帶來了新的體驗,可以改善組織吸引、留住員工和提高員工技能的方式。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估宏觀趨勢的影響

第5章市場動態

- 市場促進因素

- 對以客戶為中心的方法的需求不斷成長

- 雲端和行動應用程式的激增

- 更多採用資料集中方法和決策

- 市場課題

- 缺乏彈性和整合課題

- 維護成本

- 生態系分析

- 定價及定價模式分析

第6章市場區隔

- 依報價

- 解決方案

- 服務

- 依功能分類

- 人力資源部

- 供應鏈

- 金融

- 行銷

- 其他特性

- 依配置

- 本地

- 混合

- 依組織規模

- 中小企業

- 主要企業

- 依行業分類

- BFSI

- 資訊科技與電信

- 政府

- 零售與電子商務

- 製造業

- 石油、天然氣、能源

- 其他行業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 希臘

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 馬來西亞

- 新加坡

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- GCC

- 阿拉伯聯合大公國

- 海灣合作理事會其他國家

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- SAP SE

- Intuit

- Microsoft Corporation

- Constellation Software

- FIS

- Oracle Corporation

- IBM

- Infor Inc.

- Adobe

- Sage Group PLC

第8章廠商市場佔有率分析

第 9 章 地區級供應商排名

第10章投資分析

第11章市場的未來

The Enterprise Resource Planning Market size is estimated at USD 65.25 billion in 2024, and is expected to reach USD 103.95 billion by 2029, growing at a CAGR of 9.76% during the forecast period (2024-2029).

ERP software aids in planning, budgeting, forecasting, and reporting an organization's financial results. The growing need for supplier-relationship management and customer-relationship management, due to a steep surge in the number of businesses worldwide and the requirement for cloud-based ERP platforms, is augmenting the market's growth rate.

The increasing adoption of innovative and advancing technologies, broadening the value of existing ERP systems, minimizing third-party dependencies, more highly secured resources, advancing financial systems, and other notable factors are driving the demand for ERP software, especially cloud-based.

The enterprise resource planning (ERP) industry is being driven in part by the growing need for a customer-centric strategy. Businesses are realizing more and more how crucial it is to put the customer at the heart of their operations in order to increase customer satisfaction, loyalty, and overall business success. ERP systems are essential to reaching this objective because they offer a full range of integrated applications that let businesses increase productivity, optimize workflows, and provide better customer service.

Demand for mobile-friendly ERP solutions has increased due to the widespread use of mobile devices. By enabling people to approve workflows, access vital company data, and make decisions while on the move, mobile ERP apps help improve operational agility. For instance, users of smartphones or tablets can access essential ERP capabilities with SAP ERP mobile apps. This facilitates real-time decision-making, improves teamwork, and increases adaptability to shifting company needs.

ERP systems that aren't flexible may find it difficult to evolve and adapt as businesses alter or expand. This restriction may make it more difficult for companies to introduce new product lines, enter new markets, or adapt to organizational structure changes. For instance, a business that is expanding quickly could find it difficult to scale its ERP system to handle higher transaction volumes, which could cause problems with performance and create bottlenecks in the business.

The rise of the" business online" concept in the post-COVID-19 era increases the demand for contactless transactions, making manufacturing SMEs struggle to compete. This has created the need for ERP for manufacturing companies to enable them to run all activities in real time.

ERP Market Trends

Large Enterprises to Witness Highest Market Growth

- Large enterprises have a staff size of more than 250 employees. The growing need for streamlining and coordination to establish effective communication between various departments and employees propels the adoption of ERP software among large enterprises. ERP helps large organizations easily share information and data in real time.

- Single-tenant cloud-based ERP software systems are becoming more suitable for large companies. In this system, each user has a separate software instance hosted on the dedicated hardware of the public infrastructure, gaining a higher level of control and expanded customization capabilities.

- Most ERP solutions, including SAP solutions, have been developed for large corporations to help them track their regional operations. Large manufacturing companies using ERP successfully manage and automate their production and supply chain activities, augmenting segment growth.

- Furthermore, the high cost of complex ERP solutions makes them affordable only for large enterprises with high IT budgets. Implementing an ERP project requires a large team of technical experts and consulting services in large companies. Large enterprises, therefore, must hire ERP specialists to complete their projects. Additionally, big corporations implement ERP solutions across multiple sites, adding complexity.

North America to Hold the Largest Market Share

- Some of the most popular ERP solutions in the United States include Oracle NetSuite, Oracle ERP Cloud, and Microsoft Dynamics 365. The increasing adoption of ERP software in the United States is attributed to large enterprises such as Oracle and Microsoft, among others, as well as the need for businesses to gain a competitive edge in the market by integrating business functions.

- Moreover, these companies provide ERP software solutions built for mid and large-sized companies to assist them in complex functions such as finance and operations. Many providers offer mature ERP solutions owing to their decades of expertise and industry knowledge, promoting demands for such solutions in the United States.

- ERP solutions such as Oracle Netsuite, Oracle ERP Cloud, Microsoft D365, and Acumatica target small and mid-market companies looking to upgrade their basic accounting system and evolve through digital transformation. Others have defined a prominent niche in the marketplace, focusing on manufacturing distribution organizations and offering cost-effective solutions with a very high return on investment (ROI).

- ERP software benefits Canadian organizations by reducing duplicated data entry by integrating business processes. Increasing customer demand to reduce time and increase the accuracy of business functionalities is driving the need for ERP solutions in Canada. Toronto and Montreal are rising as central hubs for business and tech advancements in Canada. The areas are witnessing many established and emerging players in the regional ERP market.

ERP Industry Overview

Given the increasing digitization across all industry verticals, the ERP software market is semi-consolidated. Considering vendors' market penetration and the ability to invest in new technologies, the competitive rivalry is expected to remain high. Some players include SAP SE, Intuit, Microsoft Corporation, and Constellation Software.

In June 2023, SAP and Bain partnered to help leaders drive cloud-enabled ERP transformation. The collaboration aimed to help executives maximize the impact of cloud-enabled ERP transformation. The partnership enables clients to reach their business goals faster and achieve their full ERP potential by combining solutions such as RISE with SAP and Bain's business-led transformation expertise.

In May 2023, Microsoft Corporation announced that Microsoft and SAP aim to deepen their longstanding partnership to help solve customers' most fundamental business challenges. The companies aim to collaborate on integrating SAP SuccessFactors solutions with Microsoft 365 Copilot and Copilot for Microsoft Viva Learning, as well as Microsoft's Azure OpenAI Service, to access powerful language models that analyze and generate natural language. The integrations enable new experiences to improve how organizations attract, retain, and skill their people.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Macroeconomics Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Customer Centric Approach

- 5.1.2 Rapid Increase in Cloud and Mobile Application

- 5.1.3 Increase in Adoption of Data-intensive Approach and Decisions

- 5.2 Market Challenges

- 5.2.1 Lack of Flexibility and Integration Challenges

- 5.2.2 Maintenance Cost

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Function

- 6.2.1 HR

- 6.2.2 Supply Chain

- 6.2.3 Finance

- 6.2.4 Marketing

- 6.2.5 Other Functions

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Hybrid

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Industry Verticals

- 6.5.1 BFSI

- 6.5.1.1 Use Cases

- 6.5.2 IT & Telecom

- 6.5.2.1 Use Cases

- 6.5.3 Government

- 6.5.3.1 Use Cases

- 6.5.4 Retail and E-commerce

- 6.5.4.1 Use Cases

- 6.5.5 Manufacturing

- 6.5.5.1 Use Cases

- 6.5.6 Oil, Gas, and Energy

- 6.5.6.1 Use Cases

- 6.5.7 Other Industry Verticals

- 6.5.7.1 Use Cases

- 6.5.1 BFSI

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 United Kingdom

- 6.6.2.2 Germany

- 6.6.2.3 France

- 6.6.2.4 Greece

- 6.6.2.5 Rest of Europe

- 6.6.3 Asia-Pacific

- 6.6.3.1 China

- 6.6.3.2 India

- 6.6.3.3 Japan

- 6.6.3.4 Australia

- 6.6.3.5 Indonesia

- 6.6.3.6 Philippines

- 6.6.3.7 Malaysia

- 6.6.3.8 Singapore

- 6.6.3.9 Rest of Asia-Pacific

- 6.6.4 Latin America

- 6.6.4.1 Brazil

- 6.6.4.2 Argentina

- 6.6.4.3 Mexico

- 6.6.4.4 Rest of Latin America

- 6.6.5 Middle East and Africa

- 6.6.5.1 Saudi Arabia

- 6.6.5.2 GCC

- 6.6.5.2.1 United Arab Emirates

- 6.6.5.2.2 Rest of GCC

- 6.6.5.3 South Africa

- 6.6.5.4 Rest of Middle East & Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Intuit

- 7.1.3 Microsoft Corporation

- 7.1.4 Constellation Software

- 7.1.5 FIS

- 7.1.6 Oracle Corporation

- 7.1.7 IBM

- 7.1.8 Infor Inc.

- 7.1.9 Adobe

- 7.1.10 Sage Group PLC

![ERP 市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1289716.png)