|

市場調查報告書

商品編碼

1432874

4D 列印:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029 年)4D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

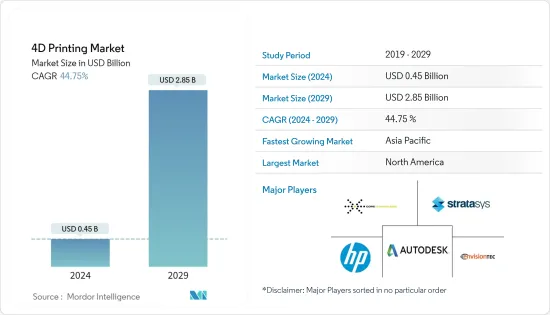

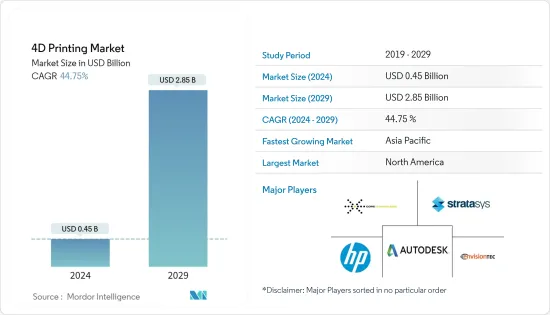

4D列印市場規模預計2024年為4.5億美元,預計到2029年將達到28.5億美元,在預測期內(2024-2029年)複合年成長率為44.75%成長。

生物製造技術的進步預計將在預測期內推動 4D 列印市場的發展。

主要亮點

- 當壓力、熱量或能量等外部能源來源與這種 3D 列印智慧材料接觸時,它會根據預編程指令而變化。這樣,4D列印技術就可以讓列印的物件隨著時間的推移而自我改變。

- 4D列印的技術進步將帶動醫療和國防領域的技術發展。例如,為了最大限度地減少手術步驟,醫生使用 4D 列印將自我轉換組件插入患者體內。

- 此外,4D列印在軍事應用中將變得更加重要。士兵可以穿著能夠適應不同環境和金屬的迷彩服。這提高了坦克和卡車應對環境變化的性能。由於 4D 列印在製造槍支、機器和其他國防技術方面的優勢,4D 列印越來越受到軍方的研究。

- 在美國,美國空軍和美國軍方正在投資 4D 列印,以加強其基礎設施,並使美國的空中力量在未來繼續佔據主導地位。

- 冠狀病毒 -19產業的感染疾病,特別是在醫療保健領域,將採用更先進的技術來製造和滿足各種醫療器材與設備的要求。例如,Leitat 技術中心設計了人工呼吸器。組裝非常快,目前每天可以生產約 100 台人工呼吸器。

- 4D列印技術的一個主要挑戰是結構設計,包括硬體和軟體部分。需要採取特殊措施來設計硬體部分。

4D列印市場趨勢

工業4.0需求的增加和工業5.0的出現推動4D列印市場

- 積層製造,也稱為 3D 列印,是工業 4.0 的一部分。最近有許多資助工作促進了這項技術的發展。例如,3D 列印公司 Essentium 先前在由 Materize 和 Genesis Park主導的A 輪融資中籌集了 2,200 萬美元。

- 積層製造技術仍在快速發展,因此企業逐漸意識到「製造即服務」是一種明智的方法。此外,積層製造的未來是能夠以更低的成本、更少的能源消耗和更少的材料廢棄物生產個人化產品,而這正是工業 5.0 所提供的。

- 工業 5.0 鼓勵 4D 列印,因為它有助於專注於設計過程而不是製造過程。設計的自由使我們能夠創造更多客製化和個性化的產品。

- 工業 5.0 預計將突破物理設計的界限。例如,在下一代飛機的開發中,工業4.0的製造能力受到限制。另一方面,在工業5.0中,製造過程將變得更加自動化,因為人類將主要關注飛機設計。

北美佔據4D列印市場最大市場佔有率

北美地區,尤其美國,是引進積層製造的主導創新者和先驅者之一。預計在預測期內將維持其市場領導的地位。

- 美國Autodesk先前推出了ADAPT。這是一個積層製造聯盟,將富有遠見的研究、可擴展的教育平台、可行的策略見解和學術產業生態系統作為平台的基礎。

- 總部位於密西根州的 EnvisionTEC 是為全球組織提供取得專利的3D 快速原型製作和製造解決方案的領先製造商和分銷商之一。憑藉在汽車、航太和醫療產業強大的客戶和合作夥伴基礎,該公司計劃在不久的將來推出 4D 列印原型。

- 根據經合組織的數據,美國醫療保健支出佔國內生產毛額的比例高於其他國家。 4D 掃描儀可用於醫療保健領域,開發人體部位的 4D 模型,然後用於製造義肢。

4D列印行業概況

4D列印技術主要供應商的主要概況是自組裝實驗室。其中包括麻省理工學院、惠普公司、Autodesk、Stratasys、ARC 電子材料科學卓越中心 (ACES) 和 Exone 公司。市場競爭激烈,沒有主導者。積層製造和 3D 列印公司正在透過投資 4D 列印研發來擴展其能力。因此,市場是分散的。

- 2023 年 3 月 - 馬德里卡洛斯三世大學 (UC3M) 的研究人員開發了一款在生物醫學領域具有潛力的 4D 列印機。可以對材料的響應進行編程,以響應外部磁場改變形狀或響應機械變形改變其電性能。這些附加功能可以由該單元控制。

- 2023 年 5 月 - I-Seed 是一款 4D 列印機器人,可評估空氣和土壤品質。這些生物分解性的機器人是與義大利特倫託大學合作開發的。根據計劃專家介紹,機器人播種可以測量土壤和空氣的溫度和濕度。此外,它還能夠檢測大氣中汞和二氧化碳等污染物的含量。為了開發和製造類似種子的機器人,研究人員利用了動態參數。據研究人員稱,該機器人是使用 4D 列印技術製造的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 工業 4.0 需求不斷增加,工業 5.0 興起

- 市場挑戰

- 開發成本高且缺乏熟練的專業人員

- 專利分析

- COVID-19 市場影響評估

第5章市場區隔

- 可程式材料類型

- 可程式碳纖維

- 可程式紡織

- 可程式生物材料

- 可程式木材

- 最終用戶

- 醫療保健

- 航太和國防

- 車

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Autodesk Inc.

- Stratasys Ltd

- Hewlett Packard Enterprise Company

- CT CoreTechnologie Group

- EnvisionTEC, Inc.

- Organovo Holdings Inc.

- Materialise NV

- Dassault Systemes SA

- The ExOne Company

- Major Initiatives by Research Agencies

第7章 投資分析

第8章 市場機會及未來趨勢

The 4D Printing Market size is estimated at USD 0.45 billion in 2024, and is expected to reach USD 2.85 billion by 2029, growing at a CAGR of 44.75% during the forecast period (2024-2029).

The advancement in bio-fabrication technology will drive the 4D printing market in the forecast period.

Key Highlights

- When external energy sources, such as pressure, heat, energy, etc., are brought in contact with this 3D printed smart material, it alters based on the instructions in the previously given program. In this way, 4D printing technology enables the printed objects to self-transform over time.

- The technological advancements in 4D printing are resulting in the development of technologies in the medical and defense sector. For instance, to minimize the procedures involved in carrying out the surgery, doctors use 4D printing to put self-transforming components into the patient's body.

- Furthermore, in military applications, 4D printing has more significance. Soldiers can have a camouflage that can adapt to different environments and metals. This is increasing the performance of tanks and trucks, according to the changes in the environment. Owing to their benefits in producing guns, machinery, and other defense technologies, 4D printing is being increasingly explored by the military.

- In the United States, the USAF and the US military are investing in 4D printing to bolster infrastructure and posture American airpower for continued dominance into the future.

- With the outbreak of Covid-19 industries, particularly healthcare will employ more advanced technology to manufacture and meet the requirements of various medical devices and equipments. For instance, Leitat Technology Centre designed the ventilator by incorporating 3D technologies and incorporating other parts found on the market. Assembly is very fast, so currently about 100 ventilators can be produced per day.

- A major challenge for 4D printing technology is the structural design that includes both the hardware section and software section. To design the hardware part, special measures need to be addressed.

4D Printing Market Trends

Increase in Demand for Industry 4.0 and Emergence of Industry 5.0 to Drive the 4D Printing Market

- Additive Manufacturing, also called 3D printing, is a part of Industry 4.0. Lately, there have been many funding activities which are led to developments in this technology. For instance, previously Essentium, a 3-D printing firm, raised USD 22 million in a Series A round, led by Materialise and Genesis Park.

- Additive manufacturing technology is still developing rapidly so companies have realized that 'manufacturing as a service' is a smart approach. Also, the future of additive manufacturing is the ability to produce personalized products with lower costs, less energy consumption, and less material waste, which is what exactly Industry 5.0 has to offer.

- Industry 5.0 will encourage 4-D printing since it will help in concentrating on the design process, rather than the manufacturing process. The freedom of design will lead to the creation of products that are more bespoke and personal.

- Industry 5.0 is projected to push the boundaries of physics in design. For instance, in the creation of next-generation aircraft, there is a constraint in manufacturing capabilities when it comes to Industry 4.0. On the other hand, with Industry 5.0, the manufacturing process would be better automated, since humans will mainly focus on the design of the aircraft.

North America to Account for Largest Market Share in 4D Printing Market

The North American region, particularly the United States, is among the lead innovators and pioneers, in terms of adoption, for additive manufacturing. It is expected to retain its position as the market leader, over the forecast period.

- US- based Autodesk previously launched ADAPT, which is an additive manufacturing consortium that identifies visionary research, scalable education platforms, actionable strategic insights, and academic-industry ecosystem as the basis of its platform.

- EnvisionTEC in Michigan, is one of the leading manufacturer and distributor of patented 3D rapid prototyping and manufacturing solutions for global organizations. Due to their strong customer and partner base in automotive, aerospace and medical industry, the company is planning to introduce 4-D printed prototypes in near future.

- According to OECD, The healthcare expenditure of the United States, as a percentage of GDP, is higher than any other country. 4D scanners can be brought into use in healthcare in developing 4-D models for human body parts, which can then be used for producing prosthetics.

4D Printing Industry Overview

The key profiles of the leading suppliers of 4D printing technology are self-assembly lab: Massachusetts Institute of Technology, Hewlett Packard Corporation, Autodesk Inc., Stratasys Ltd, ARC Centre of Excellence for Electromaterials Science (ACES), Exone Corporation, and others. The market is highly competitive without any dominating players. Companies in additive manufacturing and 3D printing are expanding their capabilities by investing in R&D for 4D printing. Therefore, the market is fragmented.

- March 2023 - A 4D printer with potential in the biomedical sector has been developed by researchers at Universidad Carlos III de Madrid (UC3M). The material's response can be programmed to change shape in response to an external magnetic field or to change its electric characteristics in response to mechanical deformation. These additional functions can be controlled by this machine.

- May 2023 - The I-Seed is a 4D-printed robot that can assess the quality of the air and soil. These biodegradable robots were developed in cooperation with Trento University in Italy. The robot-seed can determine the temperature and humidity of the soil and air, according to the project's experts. Additionally, it would be able to detect the presence of contaminants like mercury or the atmospheric CO2 levels. To develop and create the robot that resembles a seed, the researchers took advantage of the biomechanical parameters. The robot, according to the researchers, was created using 4D printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increase in Demand for Industry 4.0 and Emergence of Industry 5.0

- 4.5 Market Challenges

- 4.5.1 High Development Cost and Lack of Skilled Professional

- 4.6 Patent Analysis

- 4.7 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type of Programmable Material

- 5.1.1 Programmable Carbon Fiber

- 5.1.2 Programmable Textiles

- 5.1.3 Programmable Bio material

- 5.1.4 Programmable Wood

- 5.2 End User

- 5.2.1 Medical

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Autodesk Inc.

- 6.1.2 Stratasys Ltd

- 6.1.3 Hewlett Packard Enterprise Company

- 6.1.4 CT CoreTechnologie Group

- 6.1.5 EnvisionTEC, Inc.

- 6.1.6 Organovo Holdings Inc.

- 6.1.7 Materialise NV

- 6.1.8 Dassault Systemes SA

- 6.1.9 The ExOne Company

- 6.2 Major Initiatives by Research Agencies