|

市場調查報告書

商品編碼

1432825

奈米感測器:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Nanosensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

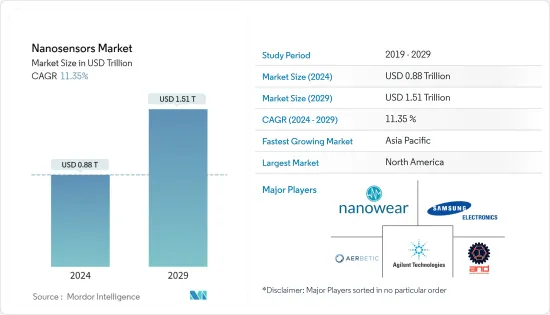

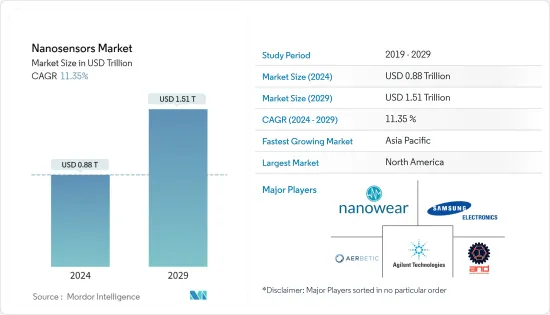

預計2024年奈米感測器市場規模將達到8,800億美元,預計2029年將達到1.51兆美元,在預測期內(2024-2029年)複合年成長率為11.35%。

半導體和感測器的小型化促進了奈米技術和奈米材料在感測器製造中的應用,從而催生了奈米感測器。預計需求將主要由整體的廣泛使用推動,其中診斷和醫療保健領域的應用將發揮關鍵作用。

奈米感測器廣泛應用於各種行業,包括電子、醫療保健、製造、航太和國防,因為它們可以收集較大感測器難以處理的奈米級資料。預計推動需求的主要因素是這種廣泛使用以及政府對研究和生產的支持的增加。

感測器應用廣泛應用於世界各地的各個領域來檢測和監控參數。奈米感測器與傳統感測器的唯一區別在於使用奈米材料的製造過程。然而,先進的技術總是鼓勵新的視野和不斷的發展。奈米技術和奈米材料等最尖端科技的持續研發可以為奈米感測器製造商帶來競爭優勢。

例如,多年來,奈米感測器市場見證了奈米技術的重大進步和創新,例如奈米碳管和奈米線的生產,對該產業產生了重大影響,並成為許多發展途徑的基石。目前,多項研究和開發正在進行中,研究市場可能會在未來幾年見證進一步的技術創新,這將影響市場形勢。

政府計劃支持的奈米技術進步推動了市場擴張。奈米技術標誌性計劃等舉措強調了加速奈米科學技術進步、滿足需求並開拓從研究到商業化的機會的關鍵領域和願景。同樣,MeitY 發起的印度奈米電子用戶計劃-創意創新 (INUP-i2i) 正在奈米電子研究中心 (CEN) 實施,例如 IISc、IIT Delhi、IIT Bombay、IIT Madras 等。發展社區有大量機會使用最先進的舉措設施來進行技能開發和研究活動。

此外,由於小型化趨勢和許多行業使用極小的產品,市場正在擴大。然而,由於奈米感測器的製造困難以及一些消費者對採用新技術持謹慎態度而不願使用奈米感測器,市場擴張受到阻礙。

由於 COVID-19 爆發,測試、追蹤和追蹤病毒的需求增加,奈米感測器產業的需求將大幅增加。疫情影響了主要奈米感測器市場的需求,特別是歐洲國家和亞太地區(印度、中國、韓國),世界各地的製造商因封鎖期間供應鏈的變動而陷入困境。然而,隨著研究和開發預計將增加,以開發使用奈米感測器的創新醫療設備和治療方法,市場預計將在後新冠時期獲得牽引力。

奈米感測器市場趨勢

醫療健康產業顯著成長

醫療保健產業在奈米感測器市場中佔有主要佔有率。診斷醫學的一個重要方面是提供快速、靈敏和準確的檢測。疾病的早期診斷至關重要,因為許多疾病可能直到進展到難以治癒的階段才會出現症狀。即時監測是使用奈米感測器進行診斷的常見方法,可以快速診斷疾病。

預計該市場將受到全球皮膚癌盛行率不斷上升的推動。例如,皮膚癌每天影響美國約 9,400 人,每小時奪去超過兩人的生命。據美國癌症協會(ACS)稱,到2023年,美國皮膚黑色素瘤病例估計將達到58,120名男性和39,490名女性。

皮膚癌是透過奈米醫學的應用來治療的。透過這種方式,可以用藥物和其他醫學療法有效治療目標腫瘤部位和目標細胞,而副作用最小。一種名為 nanoflare 的新技術已被開發出來,可以利用奈米醫學來檢測血液中的惡性細胞。因此,預計預測期內的市場擴張將受到奈米感測器在治療皮膚惡性的藥物中越來越多使用的推動。

此外,在皮膚癌治療中使用奈米感測器可以有效地將藥物和其他治療方法輸送到特定的腫瘤部位或目標細胞,而幾乎沒有危險的副作用。此外,智慧藥丸是指像錠劑一樣建模和設計的奈米級電子設備,但具有更先進的感測、成像和藥物傳輸功能。迄今為止,奈米技術已幫助開發了各種類型的智慧平板錠劑,包括藥丸攝影機、帶有小型攝影機的膠囊和劑量感應錠劑。

由於奈米感測器能夠在不需要外部跡象的情況下早期識別疾病,因此在該地區的診斷醫學中應用前景廣闊。理想的奈米感測器實施將嘗試透過結合診斷和耐受反應能力來模擬人體免疫細胞的反應,提供能夠監控感測器輸入和反應的資料,等等。此外,可以使用奈米感測器測試植入物的污染情況。當注意到植入周圍的細胞受到污染時,植入的奈米感測器會向醫生或其他醫療保健提供者發送電訊號。奈米感測器可確定細胞是否健康、是否發炎或是否被細菌污染。

此外,許多地區公司正專注於開發使用奈米技術平台分配抗逆轉錄病毒藥物的治療方案,最終推動奈米感測器市場的發展。奈米技術在藥物開發和傳輸中的應用具有治療愛滋病毒的潛力,透過開拓奈米尺度上不同於體積、原子或分子尺寸的材料特性,開發具有藥理優勢的藥物,從而具有治療愛滋病毒的潛力。我們致力於對抗和解決相關問題。

北美佔據主要市場佔有率

全球奈米感測器市場最大佔有率最終屬於北美市場。該地區現有的基礎設施和重要的奈米感測器供應商是主要原因。該地區的奈米感測器製造商正在研究如何將奈米感測器進一步應用於各個產業。這可能會導致先進奈米感測器產品的開發。

推動北美奈米感測器市場的主要因素是軍事和國防安全保障領域對奈米感測器的需求不斷增加,因為它們用於檢測輻射和生物毒素。該地區、尤其是美國國防預算的增加預計將推動對奈米感測器的需求,因為奈米感測器也將透過幫助開發輕型車輛和自癒帳篷等先進戰場裝備而使軍隊受益。例如,根據美國國防部的數據,2022會計年度的預算需求為7,220億美元,使得國防預算比2021年增加170億美元。

此外,奈米感測器在飛機上的使用也將推動該地區的需求,因為美國是民航機和軍用飛機的主要製造商和消費者。例如,在飛機中,感測器對於感知燃油油位、環境條件和性能更新等各種指標非常重要。在這些感測器系統中添加奈米感測器可以提高靈敏度並減輕整體重量。

此外,奈米感測器小型化帶來的成本效益製造預計將帶來奈米感測器市場的改善。此外,對更小、更快、可攜式診斷感測系統不斷成長的需求是推動北美生物醫學和醫療保健領域奈米技術發展的主要因素。所有這些因素都導致北美對奈米感測器的需求增加。

此外,該地區的公司專注於創建智慧包裝,這是該地區最安全的食品包裝選擇之一。它屬於智慧包裝類別,它使用奈米感測器對包裝內食品樣品的物理或化學變化做出反應,避免污染和劣化。

奈米感測器產業概述

奈米感測器市場競爭激烈,領先公司提供先進的產品來捕捉市場需求和佔有率。為了進一步擴大在市場上的影響力,主要供應商預計將在技術上進行大量投資,以保持目前的競爭優勢。主要市場參與者包括三星電子有限公司、安捷倫科技公司和應用奈米探測器有限公司。

2023 年 2 月,美國化學會 (ACS) Nano 的研究人員報告稱,使用一系列汞敏感碲奈米線開發了一種自供電奈米感測器,即摩擦電奈米感測器 (TENS)。研究人員表示,奈米感測器可以檢測水和食品中的微量汞離子,並立即報告結果。

2022年8月,Sense-Secure與美國通用電氣研究院合作,開發出全球首款一氧化碳奈米感測器密封件「Sense-PRO 1」。根據該公司介紹,新型奈米感測器是一款無需電源即可運作的智慧無線二氧化碳感測器貼紙。厚度為0.1毫米,直徑為22毫米,可黏貼在智慧型手機背面,變身為一氧化碳偵測器或分析儀。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 奈米科技產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 小型化趨勢和小型化產品的使用日益增加

- 市場挑戰

- 奈米感測器的製造流程複雜

- 市場機會

第6章市場區隔

- 按類型

- 生物奈米感測器

- 化學奈米感測器

- 物理奈米感測器

- 按最終用途行業

- 航太/國防

- 汽車和工業

- 消費性電子產品

- 衛生保健

- 發電

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Agilent Technologies, Inc.

- Nanowear, Inc.

- AerBetic

- Applied Nanodetectors Ltd

- BreathDX Ltd

- Inanon Bio Inc.

- LamdaGen Corporation

- Vista Therapeutics, Inc.

- Bruker Corporation

- GBS Inc

- Applied Nanotech, Inc.(PEN Inc.)

- Oxonica Limited

- Beijing ALT Technology Ltd. Co.

- Nanoworld AG

- Samsung Electronics co., Limited

第8章投資分析

第9章 市場機會及未來趨勢

The Nanosensors Market size is estimated at USD 0.88 trillion in 2024, and is expected to reach USD 1.51 trillion by 2029, growing at a CAGR of 11.35% during the forecast period (2024-2029).

The miniaturization of semiconductors and sensors has fueled nanotechnology and nanomaterial applications for sensor manufacturing, giving rise to nanosensors. Demand is anticipated to be primarily driven by the extensive use across industries, with applications in diagnostics and healthcare playing a significant role.

Nanosensors are widely employed in various industries, including electronics, healthcare, manufacturing, aerospace, and defense, as they can gather data at the nanoscale that would be difficult to handle with bigger sensors. The main factors driving demand are anticipated to be this widespread use and the expansion in government support for research and production.

A variety of sectors around the world have adopted sensor applications for parameter detection and monitoring. The only difference between nanosensors and conventional sensors is their production process, which uses nanomaterial. However, sophisticated technologies have always fueled new prospects and continued development. Continuous R&D on cutting-edge technologies, such as nanotechnology and nanomaterial, can give nanosensor manufacturers a competitive edge.

For instance, over the years, the market for nanosensors has seen some significant advancements and innovations in nanotechnology, such as the production of carbon nanotubes, nanowires, etc., which had a significant impact on the industry and served as the cornerstone for numerous development paths. With several research and development works currently underway, the studied market will witness further technological innovations in the next few years, which will influence the landscape of the studied market.

Market expansion is being fueled by advances in nanotechnology backed by government programs. Initiatives such as Nanotechnology Signature Initiatives highlight critical areas and the vision for accelerating nanoscale science and technology advancement to address needs and exploit opportunities from research through commercialization. Similarly, the Indian Nanoelectronics Users Programme-Idea to Innovation (INUP-i2i) initiated by MeitY is being implemented at the Centre of Excellence in Nanoelectronics (CEN) at IISc, IIT Delhi, IIT Bombay, IIT Madras, among others has provided significant opportunities for R&D community all over the country for accessing the state of the art nanofabrication facilities for undertaking skill development and research initiatives in Nanoelectronics.

Additionally, the market is expanding due to the trend of shrinking and the use of tiny goods in numerous industries. However, the difficulty of producing nanosensors and certain consumers' resistance to using nanosensors because of a cautious attitude toward embracing new technologies are impeding the market's expansion.

Due to the growing need for testing, tracing, and tracking the virus, the nanosensors industry will experience a considerable increase in demand due to the COVID-19 epidemic, as diagnostic labs require several capabilities to test thousands of samples daily. The pandemic has impacted the principal Nanosensors Market Demand, and manufacturers worldwide have suffered, particularly in European nations and the Asia-Pacific regions (India, China, and South Korea) due to shaky supply chains during the lockdown. However, the market is anticipated to gain traction in the post-covid period owing to an anticipated growth in R&D to develop innovative medical devices and procedures that use nanosensors.

Nanosensors Market Trends

Healthcare Industry to Show Significant Growth

The healthcare industry holds a significant share of the nanosensor market. A crucial aspect of diagnostic medicine is making quick, sensitive, and accurate detections. Since many conditions have symptoms that may not manifest until the condition has advanced to stages that may be challenging to cure, early diagnosis of diseases is crucial. Real-time monitoring is a popular method of using nanosensors in diagnostics to quickly diagnose disorders.

The market is anticipated to be driven by the increasing prevalence of skin cancer worldwide. For instance, skin cancer affects roughly 9,400 individuals in the United States daily, and over two people pass away every hour. According to the American Cancer Society (ACS), in 2023, the estimated number of melanoma of skin cases in the United States is anticipated to reach 58,120 in males and 39,490 in females.

Skin cancer is treated with the application of nanomedicine. In this manner, targeted tumor locations and target cells can be effectively treated with drugs and other medical therapies while minimizing adverse effects. A new technique dubbed Nano Flares for detecting malignant cells in the blood was developed using nanomedicine. Thus, market expansion during the forecast period is anticipated to be driven by the increased use of nanosensors in medications to treat skin malignancies.

Additionally, using nanosensors in skin cancer treatment allows for the effective delivery of medications and other treatments to particular tumor locations and target cells with little in the way of hazardous side effects. Moreover, Smart pills refer to nano-level electronic devices modeled and designed like pharmaceutical pills but perform more sophisticated sensing, imaging, and drug delivery functions. Nanotechnology has previously helped the development of various types of smart pills, such as the PillCam, capsules with mini-video cameras, and dose-sensing pills.

Due to their ability to identify diseases early without the need for external indications, nanosensors have tremendous promise for use in diagnostic medicine in the region. Ideal nanosensor implementations attempt to imitate the response of immune cells in the body by combining diagnostic and resistant response features, providing data to enable monitoring of the sensor input and response, and so on. Additionally, organ implants can be inspected with nanosensors for contamination. When it notices contamination in the cells surrounding the implant, the implanted nanosensor transmits an electric signal to a physician or other healthcare provider. The nanosensor determines whether the cells are healthy, irritated, or contaminated with bacteria.

Furthermore, many regional companies focus on developing therapeutic options using nanotechnology platforms for dispensing antiretroviral drugs, ultimately driving the nanosensor market. Nanotechnological applications in drug development and delivery promise to combat and resolve problems related to HIV treatment by enabling the development of drugs with pharmacological advantages pioneered by different materials properties at the nanoscale compared to the bulk, atomic scale, or molecular dimensions.

North America to Hold a Significant Market Share

The global nanosensor market's largest share ultimately belonged to the North American market. The area's existing infrastructure and significant Nano Sensors providers are among the major reason behind this. Manufacturers of nanosensors in the area are researching how nanosensors may be used further in various industries. This could lead to the development of advanced nanosensor products.

The primary factor driving the nanosensors market in North America is a growing demand for nanosensors in the military and homeland security, as they are used for detecting radiation and biotoxins. As nanosensors have also benefited the military by helping develop advanced Warfield gear, such as lighter vehicles and self-repairing tents, the increased defense budget of the region, specifically the United States, is expected to drive the demand for nanosensors. For instance, according to the United States Department of Defense, the budget for a request for the fiscal year 2022 rose to USD 722 billion, which earns a defense budget increase of USD 17 billion from 2021.

Furthermore, using nanosensors in aircraft also drives their demand in the region, as the United States is among the leading manufacturers and consumers of commercial and military aircraft. For instance, in aircraft, sensors are crucial for sensing a variety of indicators, including fuel levels, environmental conditions, and performance updates. When added to these sensor systems, nanosensors can increase their sensitivity and reduce their overall weight.

Moreover, cost-effective manufacturing due to the compactness of nanosensors is set to bring about a positive transition in the nanosensors market. Moreover, the increasing demand for smaller and faster portable diagnostic sensing systems is the primary factor driving the growth of nanotechnology in North America's biomedical and healthcare segment. All these factors contribute to the increasing demand for nanosensors in North America.

Additionally, businesses in the area are concentrating on creating smart packaging, one of the region's safest food packaging options. It belongs to the smart packaging category, which uses nanosensors to react to physical or chemical changes in food samples held within the packaging to avoid contamination or deterioration.

Nanosensors Industry Overview

The nanosensors market is competitive, with major players occupying the market demand and share with their advanced product offerings. To expand their market presence further, major vendors are expected to invest heavily in technology to maintain the competitive advantage that they are currently witnessing. Some key market players include Samsung Electronics Co., Limited, Agilant Technologies Inc., and Applied Nanodetectors Ltd.

In February 2023, researchers reporting in the American Chemical Society (ACS) Nano developed a self-powered nanosensor triboelectric nanosensor (TENS) using an array of mercury-sensitive tellurium nanowires. According to researchers, these nanosensors can discover small amounts of mercury ions in water or food and report the result immediately.

In August 2022, sense-secure developed the world's first carbon monoxide Nano Sensor Sticker called, Sense-PRO 1 in partnership with General Electric Research, USA. According to the company, the new nanosensor is a smart, wireless CO sensor sticker that can operate without any power source. Its 0.1mm thickness and 22mm in diameter make it smartphone-friendly, allowing the users to attach the sensor to the back of their smartphones and convert them into a Carbon monoxide detector and analyzer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Nanotechnology Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Miniaturization trend and Use of Miniaturized Products

- 5.2 Market Challenges

- 5.2.1 Complex Manufacturing Processes of Nanosensors

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Biological Nanosensors

- 6.1.2 Chemical Nanosensors

- 6.1.3 Physical Nanosensors

- 6.2 By End-use Verticals

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive and Industrial

- 6.2.3 Consumer Electronics

- 6.2.4 Healthcare

- 6.2.5 Power Generation

- 6.2.6 Other End-use Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Agilent Technologies, Inc.

- 7.1.2 Nanowear, Inc.

- 7.1.3 AerBetic

- 7.1.4 Applied Nanodetectors Ltd

- 7.1.5 BreathDX Ltd

- 7.1.6 Inanon Bio Inc.

- 7.1.7 LamdaGen Corporation

- 7.1.8 Vista Therapeutics, Inc.

- 7.1.9 Bruker Corporation

- 7.1.10 GBS Inc

- 7.1.11 Applied Nanotech, Inc. (PEN Inc.)

- 7.1.12 Oxonica Limited

- 7.1.13 Beijing ALT Technology Ltd. Co.

- 7.1.14 Nanoworld AG

- 7.1.15 Samsung Electronics co., Limited