|

市場調查報告書

商品編碼

1273547

醋酸乙烯酯市場 - 增長、趨勢和預測 (2023-2028)Vinyl Acetate Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,醋酸乙烯酯市場預計將以超過 4% 的複合年增長率增長。

COVID-19 對 2020 年的市場產生了負面影響。 然而,現在估計已達到大流行前的水平,市場有望穩步增長。

主要亮點

- 粘合劑在食品包裝中的使用越來越多以及在光伏領域的使用不斷擴大正在推動市場增長。

- 嚴格的健康和環境法規以及原材料價格的波動可能會阻礙市場增長。

- 將 EVA 用於 3D 打印醫療藥物輸送設備有望成為未來市場的機遇。

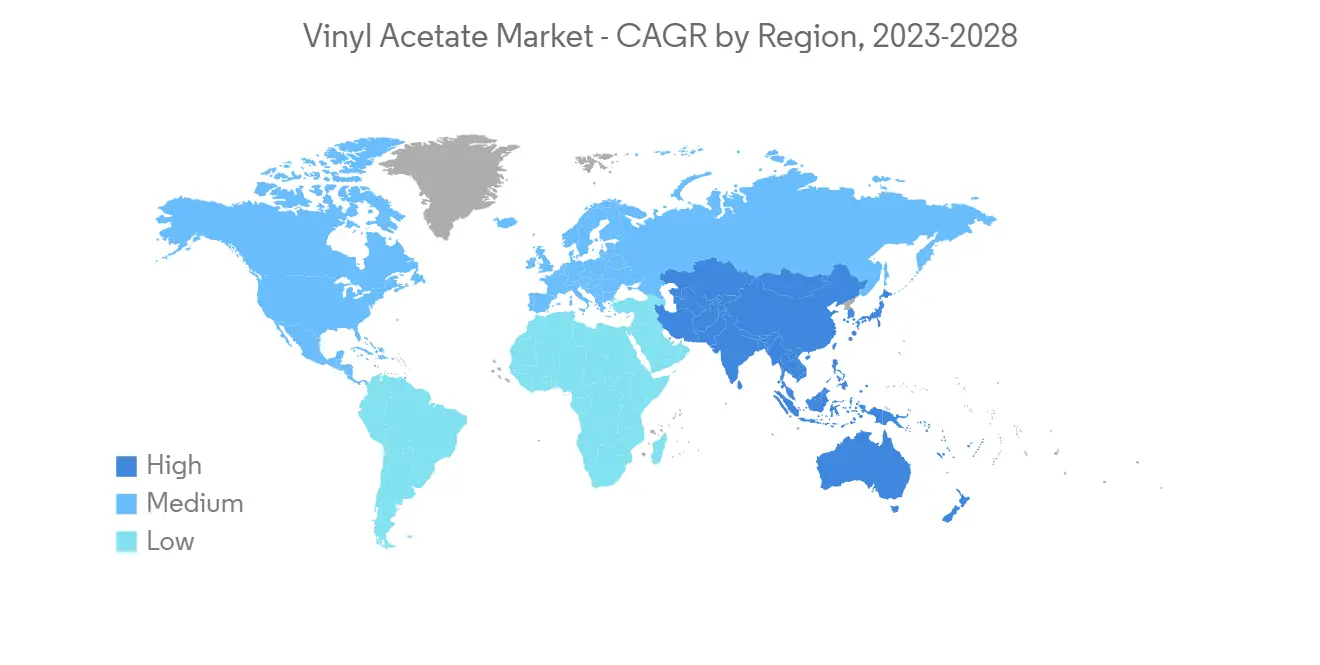

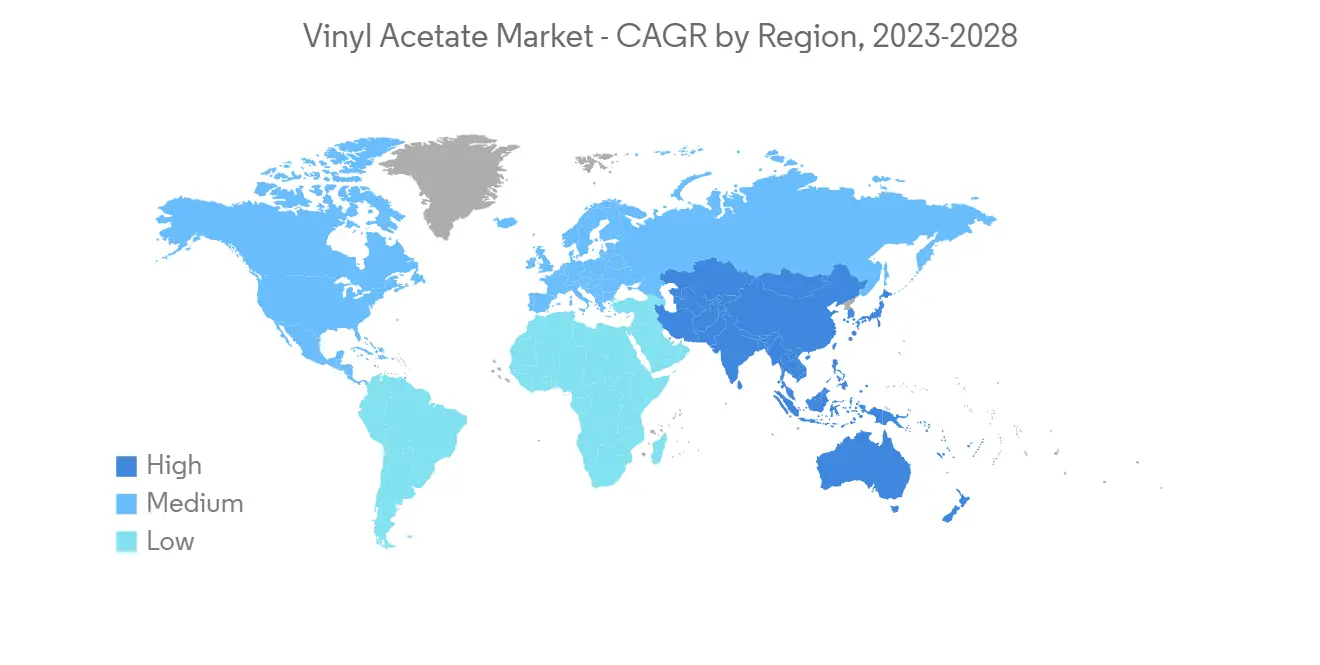

- 由於中國、印度和日本等國家/地區的需求不斷增長,亞太地區的增長率最高。

醋酸乙烯市場趨勢

太陽能行業需求增加

- 大多數太陽能電池使用乙烯醋酸乙烯酯 (EVA) 封裝光伏 (PV) 模塊。 這是因為它具有良好的透光性和彈性、優良的熔體流動性、較低的加工溫度和附著力等優點。

- 太陽能電池的使用在世界範圍內不斷增加。 隨著政府支持的增加,在過去十年中,全球新安裝的太陽能電池的容量有所增加。

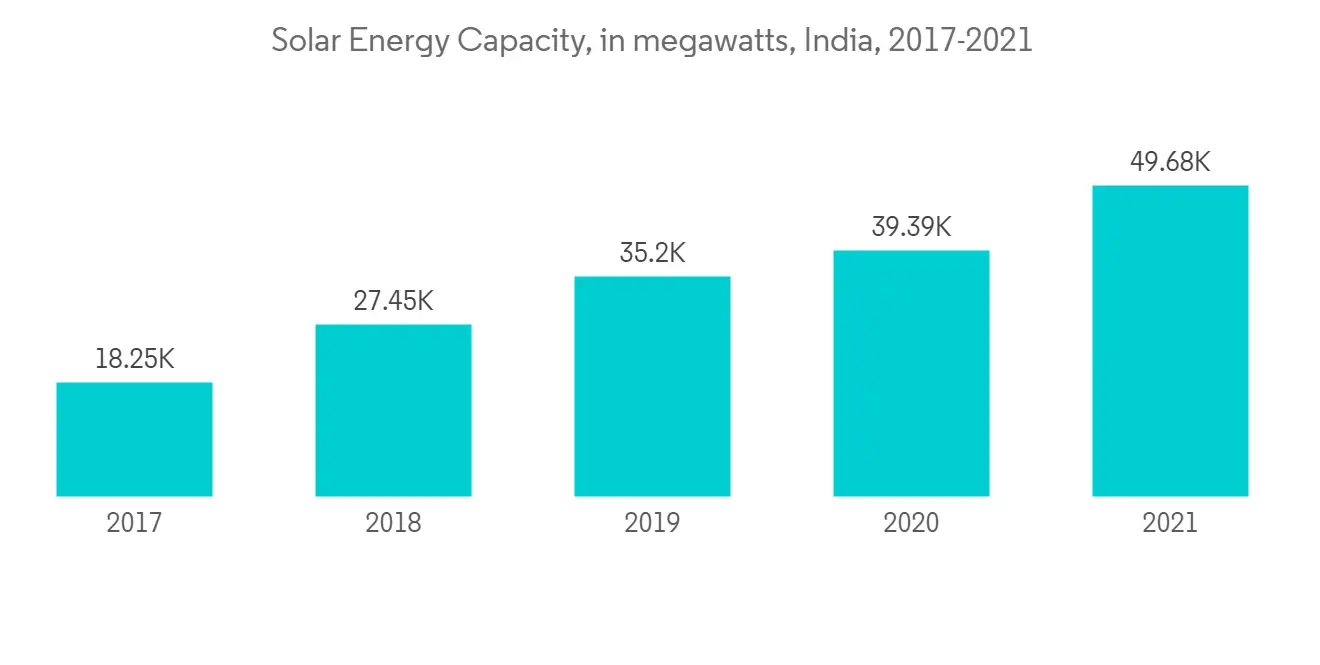

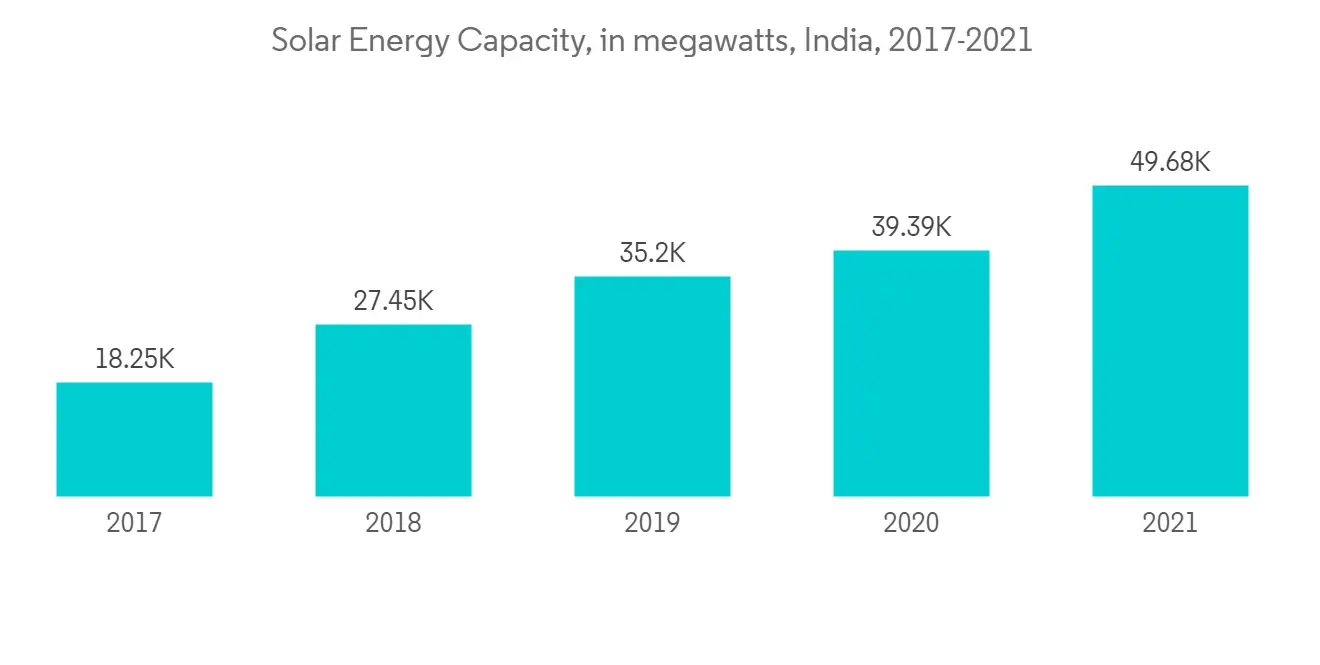

- 光伏發電總裝機容量持續增加。 據SolarPower Europe稱,2021年全球太陽能累計裝機容量將達到940GW。

- 光伏市場的增長代表了向分佈式和可再生能源技術的轉變。 此外,預計未來三年太陽能光伏裝機容量將超過2.3TW,比2021年增長超過1.4TW。 此外,2021年新增光伏裝機容量約168GW。

- 此外,根據國際可再生能源署 (IRENA) 的數據,印度的太陽能裝機容量將在 2021 年達到 49.7GW 左右的峰值。 從而促進所研究市場的增長。

- 因此,預計上述因素將提高太陽能的利用率,並在預測期內增加對醋酸乙烯的需求。

亞太地區主導市場

- 由於中國等國家/地區在建築和汽車行業的支出增加,預計亞太地區的醋酸乙烯酯市場將出現強勁增長。

- 中國是汽車行業最大的生產國。 根據中國汽車工業協會的數據,2022 年 12 月我國新能源乘用車產量同比增長 97.8%。

- 此外,到 2022 年 12 月,中國的新能源商用車產量將同比增長 81%。 因此,預計汽車市場的擴張將增加該地區對醋酸乙烯的需求。

- 醋酸乙烯酯廣泛用於油漆、塗料、粘合劑和包裝材料的生產。 中國在這些市場中發揮著關鍵作用,預計在預測期內對醋酸乙烯的需求將增長。

- 此外,印度政府還增加了基礎設施方面的公共支出。 例如,統計和計劃實施部基礎設施和項目監測司發現,截至 2022 年 5 月,政府有 1,559 個項目在籌備中,價值約 3,540 億美元。

- 此外,印度的建築業預計在預測期內將顯著增長,這要歸功於多個行業的大量基礎設施項目。

- 因此,醋酸乙烯酯用於塗料、粘合劑和底漆等最終用戶行業的各種應用,預計在預測期內,該國對醋酸乙烯酯的需求將會增加。

醋酸乙烯行業概況

醋酸乙烯市場具有綜合性。 市場上的主要參與者包括塞拉尼斯公司、中國石油化工集團公司、埃克森美孚公司、可樂麗、LyondellBasell Industries Holdings B.V.(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 粘合劑在食品包裝中的使用增加

- 增加光伏行業的使用

- 約束因素

- 嚴格的健康和環境法規

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 申請

- 聚醋酸乙烯酯

- 聚乙烯醇

- 乙烯醋酸乙烯酯 (EVA)

- 其他用途

- 最終用戶行業

- 太陽能電池

- 汽車

- 建築和建築材料

- 包裝

- 纖維

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 俄羅斯

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- Arkema

- Celanese Corporation

- China Petrochemical Corporation

- CLARIANT

- DCC

- Exxon Mobil Corporation

- INEOS

- Innospec

- Kemipex

- LyondellBasell Industries Holdings B.V.

- Nippon Chemical Industrial CO., LTD.

- Sipchem Company

- Wacker Chemie AG

第七章市場機會與未來趨勢

- 將 EVA 用於帶有 3D 打印機的醫療藥物輸送設備

The market for vinyl acetate is expected to register a CAGR of more than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Increased adhesive use in food packaging and growing use in solar power generation are augmenting the market's growth.

- Stringent health and environmental regulations and fluctuating raw material prices will likely hinder the market's growth.

- EVA uses for 3D-printed medical drug delivery devices are projected to act as an opportunity for the market in the future.

- Asia-Pacific is witnessing the highest growth rate due to the growing demand from countries such as China, India, and Japan.

Vinyl Acetate Market Trends

Increasing Demand from the Solar Industry

- Most solar cells use ethylene-vinyl acetate (EVA) to encapsulate photovoltaic (PV) modules. It is due to its advantages, such as good light transmittance and elasticity, excellent melt fluidity, low processing temperature, and adhesive property.

- The use of solar cells is constantly increasing worldwide. With increasing government support, the newly installed solar photovoltaic cell capacity increased worldwide over the past decade.

- The total installed capacity of solar photovoltaics is increasing continually. Global cumulative solar PV capacity reached 940 GW in 2021, according to SolarPower Europe.

- The solar market's growth represents a shift towards distributed and renewable energy technologies. Moreover, the solar PV capacity is expected to surpass 2.3 TW over the next three years, with an increase of over 1.4 TW compared to 2021. Additionally, around 168 GW of new PV capacity was installed in 2021.

- Further, according to the International Renewable Energy Agency (IRENA), the solar energy capacity in India peaked at nearly 49.7 GW in 2021. Thus, boosting the growth of the market studied.

- Therefore, the factors above are expected to increase solar energy usage, increasing the vinyl acetate demand during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific region is to witness robust growth in the vinyl acetate market, owing to the increasing expenditure on construction and the automotive industry in countries like China.

- China stands as the largest producer in the automotive industry. According to the China Association of Automobile Manufacturing, the production of New Energy Passenger Vehicles in the country witnessed a year-on-year increase of 97.8 % in December 2022.

- Further, the production of New Energy Commercial Vehicles in the country witnessed a year-on-year increase of 81% in December 2022. Thus, the expanding automotive market is expected to increase the demand for vinyl acetate in the region.

- Vinyl acetate is widely used to produce paints, coatings, adhesives, and packaging materials. With China being a significant player in these markets, the demand for vinyl acetate is expected to grow during the forecast period.

- Further, the Indian government increased public spending on infrastructure. For instance, according to the Ministry of Statistics and Program Implementation's Infrastructure and Project Monitoring Division, the government had 1,559 projects in the pipeline valued at approx USD 354 billion as of May 2022.

- Furthermore, owing to a strong pipeline of infrastructure projects in several sectors, the Indian construction industry will grow significantly during the forecast period.

- Therefore, as vinyl acetate finds varied applications in end-user industries, such as coatings, adhesives, primers, etc., the demand for vinyl acetate is projected to increase in the country during the forecast period.

Vinyl Acetate Industry Overview

The vinyl acetate market is consolidated in nature. Some of the major players in the market include Celanese Corporation, China Petrochemical Corporation, Exxon Mobil Corporation, KURARAY CO., LTD., and LyondellBasell Industries Holdings B.V., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Use of Adhesives in Food Packaging

- 4.1.2 Increasing Use in the Solar Power Generation Industry

- 4.2 Restraints

- 4.2.1 Stringent Health and Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Polyvinyl Acetate

- 5.1.2 Polyvinyl Alcohol

- 5.1.3 Ethylene Vinyl Acetate (EVA)

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Solar

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Packaging

- 5.2.5 Textile

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 France

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Celanese Corporation

- 6.4.3 China Petrochemical Corporation

- 6.4.4 CLARIANT

- 6.4.5 DCC

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 INEOS

- 6.4.8 Innospec

- 6.4.9 Kemipex

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 Nippon Chemical Industrial CO., LTD.

- 6.4.12 Sipchem Company

- 6.4.13 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of EVA for 3D Printed Medical Drug Delivery Devices