|

市場調查報告書

商品編碼

1432382

壓敏黏著劑(PSA)的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pressure Sensitive Adhesives (PSA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

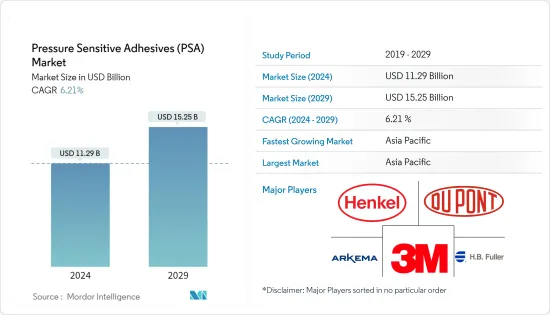

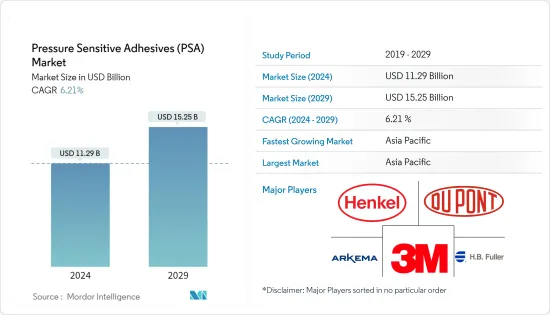

2024 年全球壓敏膠 (PSA) 市場規模估計為 112.9 億美元,預計到 2029 年將達到 152.5 億美元,在預測期間(2024~2029 年)以 6.21% 的複合年增長率增長。

2020 年,COVID-19 爆發導致全國封鎖、製造活動和供應鏈中斷以及世界各地生產停頓,對市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 推動市場的主要因素是低成本軟包裝市場的不斷開拓以及壓敏黏著劑由於其固化時間短而使用量的增加。

- 另一方面,有關揮發性有機化合物排放的嚴格環境法規以及紫外線固化黏劑等替代品的使用增加預計將阻礙市場成長。

- 磁帶市場主導市場,預計在預測期內將成長。這是因為包裝、醫療保健和運輸等最終用途行業正在成長。

- 未來的機會可能包括採用生物基壓敏黏著劑和開發基於奈米技術的功能性黏劑。

- 亞太地區主導全球市場,其中中國和印度等國家的消費量最高。

壓敏黏著劑市場趨勢

包裝產業主導市場

- 黏劑可確保產品包裝在到達消費者手中之前保持完整。包裝業務需要可靠的黏劑來滿足由於多種新產品和產品擴散而日益複雜的包裝需求。

- 壓敏黏著劑(PSA) 特別為包裝產業帶來好處:

- 快速返工:返工和重新包裝會增加成本。 PSA 提供及時的方法來確保產品符合標準並上架。壓敏黏著劑比膠棒更安全,比傳統膠帶更謹慎。與膠棒不同,壓敏黏著劑在塗布中不需要加熱。由於沒有熱量,因此不存在燒燙傷風險,提高了工廠工作人員的安全性。此外,PSA 不會干擾包裝圖形,並在不損害品牌形象的情況下提供必要的黏合力。壓敏黏著劑是謹慎的包裝解決方案,可保持並最大限度地提高您的品牌影響力。

- 即時黏合:塗布壓敏黏著劑可以節省時間,因為您不必等待它們固化。當塗布壓敏黏著劑時,它會在黏合時壓縮基材。即時黏合可加快加工速度並提高生產力。

- 維護品牌形象:品牌形像很大程度上取決於包裝的外觀。 PSA 提供了黏劑,不會損壞包裝或留下任何殘留物。維護品牌形象可以吸引消費者。

- 此外,近年來,隨著製造業和工業部門適應軟包裝,包裝產業正在經歷轉型。

- 軟包裝因其重量輕、易於搬運、不佔用太多空間、保存期限長、易於運輸、不易損壞、印刷適性優良等優點而受到普及。

- 隨著電子商務、電子零售、線上食品和宅配服務的成長趨勢,對包裝材料(尤其是軟包裝)的需求不斷增加,並可能在預測期內推動對紫外線固化黏劑的需求。越來越貴了。在德國,2022年紙包裝產業與往年相比顯著成長。

- 根據印度包裝工業協會(PIAI)預測,印度包裝產業在預測期內預計將成長 22%。此外,到2025年,印度包裝市場預計將達到2,048.1億美元。

- 軟包裝用於低收入南美、非洲和亞太國家的食品包裝應用。隨著經濟的持續擴張和食品和飲料行業的加速發展,軟包裝在新興國家越來越受歡迎,需求也越來越大。

- 由於各種最終用途產業對非石化燃料包裝的需求不斷增加,德國紙包裝產業在 2022 年經歷了顯著成長。

- 預計這些因素將在預測期內增加對壓敏黏著劑市場的需求。

亞太地區預計將主導市場

- 亞太地區佔全球需求量的40%以上,是壓敏黏著劑最有前景的市場,並可能在不久的將來佔據主導地位。這種壟斷是由於該地區對磁帶和標籤的需求不斷成長。

- 中國、印度、日本、韓國佔壓敏黏著劑需求的80%以上。

- 中國是膠合劑產品(膠帶、標籤等)的主要出口國之一。對於許多客戶來說,重要的是產品的品質、供應商提供的產品範圍以及黏劑使用量和浪費的減少。因此,中國壓敏黏著劑市場目前由國際公司主導。同樣的因素也促使當地製造商投資於研發,以佔領該國的主要市場佔有率。

- 由於人均收入的上升和電商巨頭的崛起,中國已成為全球最大的包裝消費國。根據印度塑膠工業協會統計,印度包裝業位居世界第五,年增率約22-25%。高技能的勞動力和低廉的人事費用使得包裝和加工食品的成本比歐洲低 40%。人口的成長和對包裝的需求的增加預計將推動市場的發展。

- 此外,由於經濟擴張和高購買力中階的崛起,中國包裝產業近年來持續快速成長。食品包裝是包裝產業的主要企業,約佔中國60%的市場佔有率。 Interpak預計,在中國食品包裝領域,預計2023年包裝總量將達到4,470億件,顯示包裝產業對壓敏黏著劑的需求不斷增加。

- 印度壓敏黏著劑市場預計將有較高的成長率。其應用範圍不斷擴大,包括透明標籤和薄膜標籤、快速消費品(FMCG)製造商的收縮包裝標籤、軟性標籤和多色環繞標籤。壓敏黏著劑市場仍處於早期成長期,未來成長前景較高。

- 巨大的市場規模加上亞太地區的顯著成長正在推動壓敏黏著劑市場的擴張。

壓敏黏著劑產業概況

壓敏黏著劑市場正在整合。七大主要企業佔近60%。主要企業(排名不分先後)包括 3M、阿科瑪、杜邦、HB Fuller、Henkel AG & Co.KGaA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 加大低成本軟包裝的開發力道

- 增加 PSA 的使用並縮短固化時間

- 其他司機

- 抑制因素

- 關於VOC排放的嚴格環境法規

- 增加使用紫外線固化黏劑等替代品

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 科技

- 水性的

- 溶劑型

- 熱熔膠

- 輻射

- 樹脂

- 丙烯酸纖維

- 矽膠

- 合成橡膠

- 其他樹脂

- 目的

- 磁帶

- 標籤

- 形象的

- 其他用途

- 最終用途產業

- 包裝

- 木工/細木工

- 醫療保健

- 商業圖形

- 運輸

- 電子產品

- 其他最終用途產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟和協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema Group(Bostik SA)

- Ashland Inc.

- Avery Dennison Corp.

- DuPont

- Franklin International

- HB Fuller Co.

- Helmitin Adhesives

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- Jowat AG

- Mapei SPA

- Master Bond

- Pidilite Industries Ltd

- Sika AG

- Tesa SE(A Beiersdorf Company)

- Wacker Chemie AG

第7章 市場機會及未來趨勢

- 採用生物基壓敏黏著劑

- 基於奈米技術的功能性黏劑的開發

The Pressure Sensitive Adhesives Market size is estimated at USD 11.29 billion in 2024, and is expected to reach USD 15.25 billion by 2029, growing at a CAGR of 6.21% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factor driving the market studied is the increasing development of low-cost, flexible packaging and increasing usage of pressure-sensitive adhesives because of lesser curing time.

- On the flip side, stringent environmental regulations regarding VOC emissions and increasing usage of substitutes like UV-cured adhesives are expected to hinder the studied market's growth.

- The tapes segment dominated the market and is expected to grow during the forecast period. It is owing to the growing end-user industries, such as packaging, medical, and transportation.

- Adopting bio-based pressure-sensitive adhesives and developing nanotechnology-based functional pressure-sensitive adhesives is likely an opportunity in the future.

- Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Pressure Sensitive Adhesives Market Trends

Packaging Industry to Dominate the Market

- Adhesives ensure the product packaging remains intact until it reaches the consumer. Packaging operations require a reliable adhesive to meet the increasingly complex packaging demands as there is an increase in several new products and product proliferation.

- Pressure-sensitive adhesives (PSAs) specifically offer several advantages for the packaging industry:

- Quick reworks: Reworking or repackaging increases costs. PSAs offer a timely way to make products compliant and shelf-ready. Pressure-sensitive adhesives are safer than glue sticks and more discrete than traditional tape. Unlike glue sticks, pressure-sensitive adhesives do not require heat during application. The absence of heat eliminates burns and increases safety among plant workers. Additionally, PSAs are less intrusive on packaging graphics, providing the required adhesion without sacrificing the brand image. Pressure-sensitive adhesives are less visible packaging solutions that preserve and maximize the brand's impact.

- Instant bond: Applying pressure-sensitive adhesives is time-saving, as waiting until they cure is unnecessary. When applied, they compress the substrate right when adhesion occurs. Instant bonding increases the processing speed, as well as improves production.

- Maintaining brand image: Brand image relies heavily on the packaging appearance. PSAs provide a bond that removes cleanly without damaging the packaging or leaving behind residue. Preserving brand image adds to your consumer appeal.

- Furthermore, in the last few years, the packaging industry is experiencing a transition where the manufacturing and industrial sector is adapting to flexible packaging.

- The benefits, such as being lightweight, easy to handle, less space-consuming, longer shelf life, easy transit, damage resistance, and better printability, made packaging popular.

- With the growing trend of e-commerce, e-retail, and online food orders and delivery services, the demand for packaging materials, especially flexible packaging, is increasing, likely to drive the demand for UV-curable adhesives during the forecast period. In Germany, the paper packaging industry grew significantly in 2022 compared to previous years.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025.

- Flexible packaging is used in food packaging applications in low-income South America, Africa, and Asia-Pacific countries. The popularity and demand for flexible packaging are rising in emerging economies, and the demand is supported by continued economic expansion and an acceleration in the food and beverage industry.

- The paper packaging industry grew significantly in Germany in 2022 because of the increasing demand for non-fossil-based packaging for different end-user industries.

- Such factors will likely increase the demand for the pressure-sensitive adhesives market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- With over 40% of the global demand, Asia-Pacific is the most promising market for pressure-sensitive adhesives, which will likely dominate soon. This domination can be attributed to the region's growing demand for tapes and labels.

- China, India, Japan, and South Korea account for over 80% of the demand for pressure-sensitive adhesives.

- China is one of the major exporters of adhesive products (tapes, labels, etc.). The factors concerning most of its customers are the product quality, the product range offered by the vendor, and reducing the dosage and wastage of adhesives. Therefore, international players currently dominate the Chinese market for pressure-sensitive adhesives. The same factor encourages local producers to invest in R&D to acquire a major national market share.

- China is the world's largest packaging consumer globally, owing to growing per capita income and rising e-commerce giants. India's packaging industry is the fifth-largest globally, growing at about 22-25% per year, according to the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Furthermore, the Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023, indicating an increased demand for pressure-sensitive adhesives from the packaging industry.

- The pressure-sensitive adhesives market in India is expected to grow at a higher rate. Its usage increased with transparent and film labels, shrink-wrap labels for fast-moving consumer goods (FMCG) manufacturers, flexible labels, and multicolor wrap-around labels. The pressure-sensitive adhesives market is still in its early growth stage, with a higher scope of growth in the future.

- The large market size, coupled with the huge growth of Asia-Pacific, is instrumental in expanding the pressure-sensitive adhesives market.

Pressure Sensitive Adhesives Industry Overview

The pressure-sensitive adhesives market is consolidated. The top seven players account for almost 60%. The major companies (not in any particular order) include 3M, Arkema, DuPont, HB Fuller, and Henkel AG & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Development of Low-cost Flexible Packaging

- 4.1.2 Increasing Usage of PSA Because of Lesser Curing Time

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Increasing Usage of Subsitutes like UV Cured Adhesives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot Melt

- 5.1.4 Radiation

- 5.2 Resin

- 5.2.1 Acrylics

- 5.2.2 Silicones

- 5.2.3 Elastomers

- 5.2.4 Other Resins

- 5.3 Application

- 5.3.1 Tapes

- 5.3.2 Labels

- 5.3.3 Graphics

- 5.3.4 Other Applications

- 5.4 End-user Industry

- 5.4.1 Packaging

- 5.4.2 Woodworking and Joinery

- 5.4.3 Medical

- 5.4.4 Commercial Graphics

- 5.4.5 Transportation

- 5.4.6 Electronics

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group (Bostik SA)

- 6.4.3 Ashland Inc.

- 6.4.4 Avery Dennison Corp.

- 6.4.5 DuPont

- 6.4.6 Franklin International

- 6.4.7 H.B. Fuller Co.

- 6.4.8 Helmitin Adhesives

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Huntsman Corporation

- 6.4.11 Illinois Tool Works Inc.

- 6.4.12 Jowat AG

- 6.4.13 Mapei SPA

- 6.4.14 Master Bond

- 6.4.15 Pidilite Industries Ltd

- 6.4.16 Sika AG

- 6.4.17 Tesa SE (A Beiersdorf Company)

- 6.4.18 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Bio-based Pressure Sensitive Adhesives

- 7.2 Development of Nanotechnology based Functional Pressure Sensitive Adhesives