|

市場調查報告書

商品編碼

1432868

氫氣壓縮機:市場佔有率分析、產業趨勢、成長預測(2024-2029)Hydrogen Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

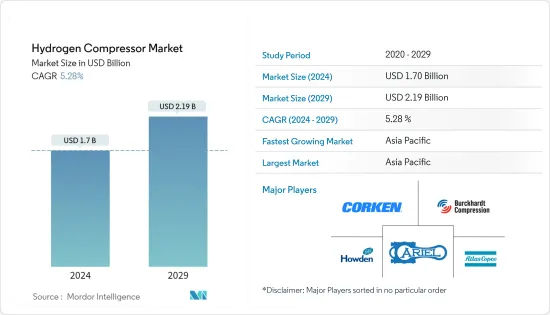

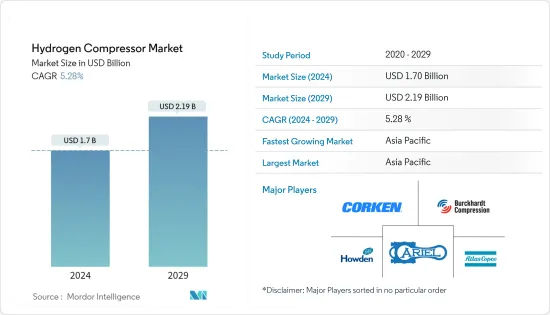

氫壓縮機市場規模預計到 2024 年為 17 億美元,預計到 2029 年將達到 21.9 億美元,在預測期內(2024-2029 年)複合年成長率為 5.28%。

主要亮點

- 從中期來看,化肥和精製等終端用戶產業對氫氣的需求不斷增加,以及全球運輸用氫氣管道基礎設施的部署不斷增加等因素預計將在預測期內推動氫氣壓縮機市場的發展。

- 另一方面,由於關稅上升和貿易政策長期不確定性導致製造業活動急劇下降,以及全球貿易低迷導致工業和經濟活動放緩,將減少使用資本貨物的行業對資本財的需求。氫:預計這將減少所研究市場的成長。

- 然而,技術進步和透過電解生產氫氣的新來源與太陽能和風能等清潔能源相結合,可能為市場成長提供充足的機會。

- 在預測期內,亞太地區預計將主導氫氣壓縮機市場,大部分需求來自中國、印度和日本。

氫氣壓縮機市場趨勢

油基型細分市場佔據主導地位

- 油基潤滑壓縮機比無油壓縮機具有更低的成本和更長的使用壽命,對油污染非常敏感,不適合商業和工業應用,除非該行業需要無油壓縮機,被認為是最佳選擇。

- 油基壓縮機比無油壓縮機效率更高,因為油充當冷卻介質,在壓縮過程中帶走壓縮機約 80% 的熱量,使其適用於需要高壓縮比的工業應用。 。

- 就資本支出而言,潤滑油壓縮機被認為比無油壓縮機便宜,價差通常在 30-40% 範圍內。根據容量和特定產業要求等因素,甚至可以達到 50%,從而導致對油基氫氣壓縮機的需求增加。

- 油基壓縮機比無油壓縮機更實惠,但需要持續維護並更加註意更換過濾器和其他零件,以消除漏油的風險。持續的油污染可能會產生嚴重後果,包括產品污染、安全性降低、生產停頓和法律問題。

- 油基氫氣壓縮機主要首選製造業,如玻璃精製、鋼鐵工業、半導體製造、金屬焊接、退火、熱處理、發電廠(發電機冷卻水)、航太應用、製藥等。

- 根據美國地質調查局估計,2022年美國原鋼產量預估為8,200萬噸。隨著工業化的發展,鋼鐵產量可能會繼續增加,這也可能產生對油基氫氣壓縮機的需求。

- 由於缺乏潤滑而導致氫氣壓縮機零件過早磨損的威脅仍然存在,這會增加維護成本並限制對油基氫氣壓縮機的需求。

- 因此,在預測期內,油基型預計將主導氫氣壓縮機市場。

亞太地區預計將主導市場

- 由於中國、日本和印度等國家的有利政府政策,預計亞太地區在未來幾年將成為燃料電池的一個充滿前景的市場。

- 中國是全球最大、成長最快的氫氣壓縮機市場之一。近年來,該國的化學、石油、天然氣和製造業經歷了顯著成長。

- 氫氣離心壓縮機用於精製和石化行業,例如乙烯廠,用於裂解氣壓縮和冷凍服務。由於乙烯和苯產量短缺,國家正在投資增加乙烯和苯產能。

- 例如,2022 年 5 月,諾伊曼埃塞爾北京向中國內蒙古三修復材料公司 (CIMSNM) 供應了四套壓縮機系統。該壓縮機似乎在 1,4-丁二醇 (BDO) 生產過程中用於氫氣增壓和回收。 BDO 用作溶劑,用於生產某些聚合物、彈性纖維和聚氨酯。

- 日本開拓氫燃料電池汽車新興市場和建造加氫站為氫燃料電池汽車充電的目標預計將推動氫壓縮機市場的發展。

- 例如,在日本,包括汽車製造商和能源公司在內的11家國內企業已組成聯盟,決定在2022年建造80座氫燃料電池汽車加氫站,以打造下一代燃料電池汽車市場。截至2021年9月,日本有154座加氫站,還有11座處於規劃和建設階段。預計這將在預測期內推動加氫站對氫氣壓縮機的需求。

- 因此,由於這些因素,預計亞太地區在預測期內將主導氫氣壓縮機市場。

氫氣壓縮機產業概況

氫氣壓縮機市場較為分散。著名公司包括(排名不分先後)Corken Inc.、Ariel Corporation、Burckhardt Compression AG、Howden Group Ltd 和 Atlas Copco Group。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模和需求預測(金額)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 最終用戶產業對氫氣的需求增加

- 增加交通運輸氫氣管道基礎設施的部署

- 抑制因素

- 由於製造業活動和世界貿易急劇下降,工業和經濟活動放緩

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 科技

- 單級

- 多級

- 類型

- 油膩的

- 不含油

- 最終用戶產業

- 化學

- 油和氣

- 其他最終用戶產業

- 按地區分類的市場分析(到 2028 年的市場規模和需求預測(僅按地區))

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Corken Inc.

- Ariel Corporation

- Burckhardt Compression AG

- Hydro-Pac Inc.

- Haug Kompressoren AG

- Sundyne Corp.

- Howden Group Ltd

- Indian Compressors Ltd

- Atlas Copco Group

- Ingersoll Rand Inc.

第7章 市場機會及未來趨勢

- 技術進步與氫氣產生新來源

簡介目錄

Product Code: 54577

The Hydrogen Compressor Market size is estimated at USD 1.7 billion in 2024, and is expected to reach USD 2.19 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increase in demand for hydrogen from end-user industries, such as fertilizers and oil refineries, and increasing deployment of hydrogen pipeline infrastructure globally for transportation are likely to drive the hydrogen compressor market during the forecast period.

- On the other hand, the slowdown in industrial and economic activities due to a sharp decline in manufacturing activity and global trade, with higher tariffs and prolonged trade policy uncertainty, is expected to decrease the demand for capital goods from industries using hydrogen, thereby restraining the growth of the market studied.

- Nevertheless, the technological advancements and emerging sources for hydrogen production using electrolysis in combination with cleaner sources, such as solar and wind, are likely to provide ample opportunities for the market's growth.

- Asia-Pacific is expected to dominate the hydrogen compressor market during the forecast period, with the majority of the demand coming from China, India, and Japan.

Hydrogen Compressor Market Trends

Oil-based Type Segment Expected to Dominate the Market

- Oil-based lubricated compressors cost less, provide a longer service life compared to oil-free compressors, and are considered ideal for commercial and industrial applications until and unless in industries where consequences of oil contamination are considered very high and having an oil-free compressor is a must.

- Oil-based compressors are considered more efficient than the oil-free type compressors, as oil acts as a cooling medium, taking out approximately 80% of the compressor's heat during the compression process, and considered more suitable for industrial usage with requirements of a high compression ratio.

- In terms of capital outlay, lubricated oil-based compressors are often considered less expensive than oil-free compressors, with price differences often varying in the range of 30-40%. It may even reach 50%, depending upon factors such as capacity and industry-specific requirements, resulting in increased demand for oil-based hydrogen compressors.

- Although oil-based compressors are more affordable than oil-free, these compressors require continuous maintenance and greater attention in replacing filters and other components used to eliminate the risk of oil leakage. Ongoing oil contamination may result in severe consequences, such as spoiled or unsafe products, production downtime, and legal issues.

- Oil-based hydrogen compressors are mostly preferred in the manufacturing industry for glass purification, iron and steel industry, semiconductor manufacturing, etc., for welding, annealing and heat-treating of metals, in power plants (coolant for generators), aerospace applications, pharmaceuticals, etc.

- According to the United States Geological Survey, in 2022, the United States' raw steel production was estimated to be 82 million metric tons. With the increasing industrialization, steel production may continue to increase, which, in turn, may create demand for oil-based hydrogen compressors.

- There is a persistent threat of premature wear of hydrogen compressor components due to insufficient lubrication, which may add to the maintenance cost of oil-based hydrogen compressors and limit their demand.

- Therefore, based on such factors, the oil-based type segment is expected to dominate the hydrogen compressor market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to be a promising market for fuel cells in the coming years because of the favorable government policies in countries such as China, Japan, and India.

- China is one of the world's largest and fastest-growing hydrogen compressor markets. The country has witnessed significant growth in its chemical, oil, gas, and manufacturing sectors in recent years.

- Hydrogen centrifugal compressors are used in refining and petrochemical industries such as ethylene plants for cracked-gas compression and refrigeration services. Due to ethylene and benzene production shortages, the country has been investing to increase its ethylene and benzene production capacity.

- For instance, in May 2022, Neuman & Esser Beijing supplied four compressor systems to China Inner Mongolia Sanwei New Material Co. Ltd (CIMSNM). The compressors were likely used for hydrogen boosting and recycling while manufacturing 1,4-Butanediol (BDO). BDO is used in industry as a solvent and in producing specific polymers, elastic fibers, and polyurethanes.

- The development of hydrogen fuel cell vehicles and Japan's aim to build hydrogen fuel stations for recharging the vehicles are expected to drive the hydrogen compressor market.

- For instance, in Japan, 11 domestic firms, including automakers and energy firms, made a consortium to build 80 fueling stations for hydrogen fuel cell vehicles by 2022 to create a market for the next-gen fuel cell vehicle. As of September 2021, Japan has 154 hydrogen fueling stations and another 11 in the planning or construction stage. This, in turn, is expected to drive the hydrogen compressor demand for hydrogen fuel stations during the forecast period.

- Therefore, based on such factors, Asia-Pacific is expected to dominate the hydrogen compressor market during the forecast period.

Hydrogen Compressor Industry Overview

The hydrogen compressor market is semi fragmented. Some of the major companies include (in no particular order) Corken Inc., Ariel Corporation, Burckhardt Compression AG, Howden Group Ltd, and Atlas Copco Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Demand for Hydrogen from End-user Industries

- 4.5.1.2 Increasing Deployment of Hydrogen Pipeline Infrastructure for Transportation

- 4.5.2 Restraints

- 4.5.2.1 The Slowdown in Industrial and Economic Activities Due to a Sharp Decline in Manufacturing Activity and Global Trade

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Single-stage

- 5.1.2 Multistage

- 5.2 Type

- 5.2.1 Oil-based

- 5.2.2 Oil-free

- 5.3 End-user Industry

- 5.3.1 Chemical

- 5.3.2 Oil and Gas

- 5.3.3 Other End-user Industries

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Corken Inc.

- 6.3.2 Ariel Corporation

- 6.3.3 Burckhardt Compression AG

- 6.3.4 Hydro-Pac Inc.

- 6.3.5 Haug Kompressoren AG

- 6.3.6 Sundyne Corp.

- 6.3.7 Howden Group Ltd

- 6.3.8 Indian Compressors Ltd

- 6.3.9 Atlas Copco Group

- 6.3.10 Ingersoll Rand Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Emerging Sources for Hydrogen Production

02-2729-4219

+886-2-2729-4219