|

市場調查報告書

商品編碼

1432777

垃圾焚化發電(WtE) -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Waste-to-Energy (WtE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

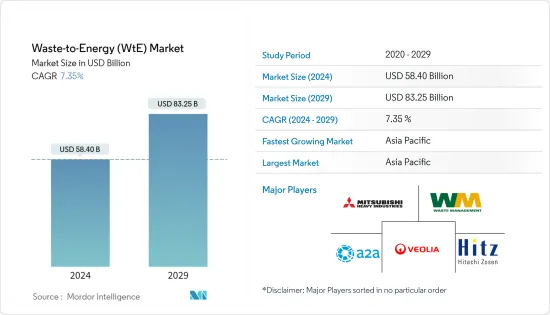

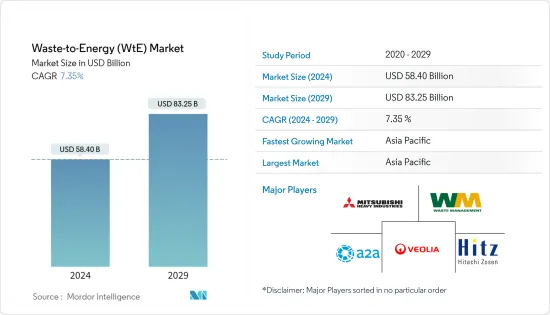

垃圾焚化發電(WtE)市場規模預計到 2024 年為 584 億美元,預計到 2029 年將達到 832.5 億美元,在預測期內(2024-2029 年)複合年成長率為 7.35%。

主要亮點

- 從中期來看,廢棄物產生量的增加、為滿足永續城市生活的需求而對廢棄物管理的興趣日益濃厚以及對非石化燃料能源來源的日益關注等因素將導致對垃圾焚化發電(WtE)的需求增加正在拉動市場需求。

- 另一方面,焚化廠的高成本意味著一些工廠無法支付其營運成本,特別是在能源價格下跌的情況下。這對預測期內的垃圾焚化發電(WtE)市場構成威脅。

- 也就是說,新的垃圾焚化發電(WtE) 技術,例如 Dendro Liquid Energy (DLE),其發電效率提高了四倍,並且具有無現場排放或污水問題的額外優勢。這預計將帶來顯著的經濟效益。未來幾年市場相關人員的商機。

- 亞太地區預計將主導全球市場,大部分需求來自中國、印度和日本等國家。

垃圾焚化發電(WtE) 市場趨勢

熱廢棄物發電領域主導市場

- 隨著世界各地正在開拓廢棄物焚化設施的新興市場,預計熱技術將在預測期內佔據垃圾焚化發電(WtE)市場的最高市場佔有率。

- 利用熱電汽電共生(暖氣、冷氣)和發電的工廠預計可達到 80% 的最佳效率。根據國際可再生能源機構預測,2022年全球生質能源裝置容量為148.9GW,與前一年同期比較成長率為5.3%。

- 在目前的情況下,焚燒是最著名的都市固態廢棄物(MSW)處理廢棄物技術。然而,垃圾焚化發電(WtE)技術,尤其是焚化技術,會產生污染並帶來潛在的健康和安全風險。為了減少顆粒物和氣相排放,焚化廠業主採用了一系列製程裝置來淨化廢氣流,從而顯著改善環境的永續性。

- 2022年2月,索爾維和威立雅開始建造汽電共生設施,以垃圾固態燃料(RDF)取代煤炭,為法國Donbasseur-sur-Meurthe堿灰製造廠提供可再生能源。該計劃將用一個鍋爐房取代三台燃煤鍋爐,該鍋爐房配備兩台使用以前儲存的無害廢棄物製成的 RDF運作的爐子。

- 基於熱的廢棄物能源轉換預計將引領市場,特別是在亞太地區的經濟成長中,其中城市人口成長預計將成為城市固態廢棄物(MSW)成長的主要驅動力。

亞太地區主導市場

- 過去幾年,亞太地區垃圾焚化發電(WtE)產業取得了顯著發展。採取更好的城市固態廢棄物(MSW)管理方法,以資本補貼和上網電價形式獎勵垃圾焚化發電(WtE)計劃,並在成本分攤的基礎上為研發計劃提供財政支持。由於各國政府加大力度,亞太地區在全球市場中佔據主導地位

- 由於中國經濟的發展和快速的都市化,城市固體廢物(MSW)的產生量正在迅速增加。因此,都市固態廢棄物的有效處理已成為中國面臨的嚴峻環境挑戰。

- 2022 年 12 月,城市地方機構 (ULB) 部長在古爾岡為該國最大的垃圾焚化發電(WtE) 工廠的建設揭幕。廢棄物管理特許經營Ecogreen Energy 計劃在班瓦迪 (Bandwadi) 佔地 10 英畝的場地上建造一座 25 兆瓦的垃圾焚化發電(WtE) 設施。

- 日本是亞太地區垃圾焚化發電(WtE)的主要市場之一。該國的垃圾焚化發電(WtE) 市場是由高效的固態廢棄物管理以及國家和地方政府對垃圾焚化發電(WtE)計劃的財政支持所推動的。為了保護環境,國家希望引進廢棄物管理和回收技術,有效地將廢棄物轉化為資源並妥善處置。

- 因此,廢棄物產生量增加以及各國政府為解決此問題所做的努力等因素預計將在預測期內推動亞太地區垃圾焚化發電(WtE)工廠的需求。

垃圾焚化發電(WtE) 產業概覽

垃圾焚化發電(WtE)市場已減少一半。市場的主要企業(排名不分先後)包括三菱重工、廢棄物管理公司、A2A SpA、威立雅環境公司和日立造船。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模和需求預測(金額)

- 到 2028 年都市固態廢棄物(MSW) 產生量(數量)

- 政府法規政策

- 最新趨勢和發展

- 市場動態

- 促進因素

- 廢棄物產生量不斷增加,人們對廢棄物管理的興趣日益濃厚,以滿足永續城市生活的需求

- 日益關注非石化燃料能源來源

- 抑制因素

- 焚燒爐的成本

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 科技

- 身體的

- 熱

- 生物

- 按地區分類(地區市場分析、市場規模和 2028 年之前的需求預測(僅限地區))

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 其他歐洲國家

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mitsubishi Heavy Industries Ltd

- Waste Management Inc.

- A2A SpA

- Veolia Environnement SA

- Hitachi Zosen Corp

- MVV Energie AG

- Martin GmbH

- Babcock & Wilcox Enterprises Inc.

- China Jinjiang Environment Holding Co. Ltd

- Suez Group

- Xcel Energy Inc.

- Wheelabrator Technologies Holdings Inc.

- Covanta Holding Corp.

- China Everbright Group

第7章 市場機會及未來趨勢

- 新的廢棄物技術,例如 Dendro Liquid Energy (DLE)

簡介目錄

Product Code: 52528

The Waste-to-Energy Market size is estimated at USD 58.40 billion in 2024, and is expected to reach USD 83.25 billion by 2029, growing at a CAGR of 7.35% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing amount of waste generation and growing concern for waste management to meet the need for sustainable urban living, and increasing focus on non-fossil fuel sources of energy are driving the demand for the waste-to-energy market.

- On the other hand, the expensive nature of incinerators, particularly as energy prices decline and several plants are unable to cover operating costs. This poses a threat to the waste-to-energy market during the forecast period.

- Nevertheless, emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), which is four times more efficient in terms of electricity generation, with additional benefits of no emission discharge and effluence problems at plant sites, are expected to create significant opportunities for the market players, over the coming years.

- Asia-Pacific is expected to dominate the market across the world, with the majority of demand coming from the countries such as China, India, and Japan.

Waste to Energy (WTE) Market Trends

Thermal-based Waste-to-Energy Segment to Dominate the Market

- Thermal technology is expected to account for the highest market share in the waste-to-energy market during the forecast period, owing to the increasing development of waste incineration facilities across the world.

- It is estimated that plants that utilize thermal power cogeneration (heating and cooling) and electricity generation can reach optimum efficiencies of 80%. According to the International Renewable Energy Agency, the global bioenergy capacity accounted for 148.9 GW in 2022, with an annual growth rate of 5.3% compared to the previous year.

- In the present scenario, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing. However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks. To reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in environmental sustainability.

- In February 2022, Solvay and Veolia began constructing a cogeneration unit to provide renewable energy for France's Dombasle-sur-Meurthe soda ash production plant by replacing coal with refuse-derived fuel (RDF). The project entails replacing three coal-fired boilers with a boiler room outfitted with two furnaces that run on RDF, made of previously stored non-hazardous waste.

- The thermal-based waste-to-energy conversion is expected to lead the market, especially in Asia-Pacific's growing economies, where the rising urban population is projected to be the key contributing factor to increasing municipal solid waste (MSW).

Asia-Pacific to Dominate the Market

- Asia-Pacific witnessed significant development in the waste-to-energy industry in the past few years. It has dominated the market across the world with increasing efforts taken by the government to adopt better municipal solid waste (MSW) management practices, providing incentives for waste-to-energy projects in the form of capital subsidies and feed-in tariffs and financial support for R&D projects on a cost-sharing basis.

- Due to economic development and rapid urbanization in China, the generation of municipal solid waste (MSW) has increased rapidly. Therefore, the effective disposal of municipal solid waste has become a serious environmental challenge in China.

- In December 2022, the Minister of Urban Local Bodies (ULB) inaugurated work on the country's largest waste-to-energy (WTE) plant in Gurugram. Ecogreen Energy, a waste management concessionaire, plans to build a 25-MW waste-to-energy facility on 10 acres of property in Bandhwadi.

- Japan has been one of the leading markets for waste-to-energy in Asia-Pacific. The country's waste-to-energy market is driven by efficient solid waste management and financial support for waste-to-energy projects from both national and local governments. The country is expected to introduce waste management and recycling technologies to preserve the enviroment, effectively turning waste into resources or appropriately disposing of it.

- Therefore, factors such as the increasing amount of waste generated and the efforts taken by various governments to tackle this situation are expected to boost the demand for waste-to-energy plants in Asia-Pacific during the forecast period.

Waste to Energy (WTE) Industry Overview

The waste-to-energy (WtE) market is semi-fragmented. Some of the major players operating in this market (in no particular order) include Mitsubishi Heavy Industries Ltd, Waste Management Inc., A2A SpA, Veolia Environnement SA, and Hitachi Zosen Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2028

- 4.3 Municipal Solid Waste (MSW) Generation, in billion metric ton, till 2028

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Amount of Waste Generation, Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living

- 4.6.1.2 Increasing Focus on Non-fossil Fuel Sources of Energy

- 4.6.2 Restraints

- 4.6.2.1 Expensive Nature of Incinerators

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Physical

- 5.1.2 Thermal

- 5.1.3 Biological

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Rest of the Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 France

- 5.2.3.3 Germany

- 5.2.3.4 Italy

- 5.2.3.5 Rest of the Europe

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 South Africa

- 5.2.4.4 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Heavy Industries Ltd

- 6.3.2 Waste Management Inc.

- 6.3.3 A2A SpA

- 6.3.4 Veolia Environnement SA

- 6.3.5 Hitachi Zosen Corp

- 6.3.6 MVV Energie AG

- 6.3.7 Martin GmbH

- 6.3.8 Babcock & Wilcox Enterprises Inc.

- 6.3.9 China Jinjiang Environment Holding Co. Ltd

- 6.3.10 Suez Group

- 6.3.11 Xcel Energy Inc.

- 6.3.12 Wheelabrator Technologies Holdings Inc.

- 6.3.13 Covanta Holding Corp.

- 6.3.14 China Everbright Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Waste-to-Energy Technologies, such as Dendro Liquid Energy (DLE)

02-2729-4219

+886-2-2729-4219