|

市場調查報告書

商品編碼

1273423

包裝塗料市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Packaging Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,包裝塗料市場的複合年增長率將超過 5%。

主要亮點

- COVID-19 影響了全球包裝塗料行業的發展。 然而,大流行期間和之後對包裝食品和在線食品配送的需求增加推動了包裝塗料的消費。

- 推動市場發展的主要因素是軟包裝塗料需求的增加以及食品和飲料包裝的增加。 另一方面,更嚴格的監管預計會阻礙市場增長。

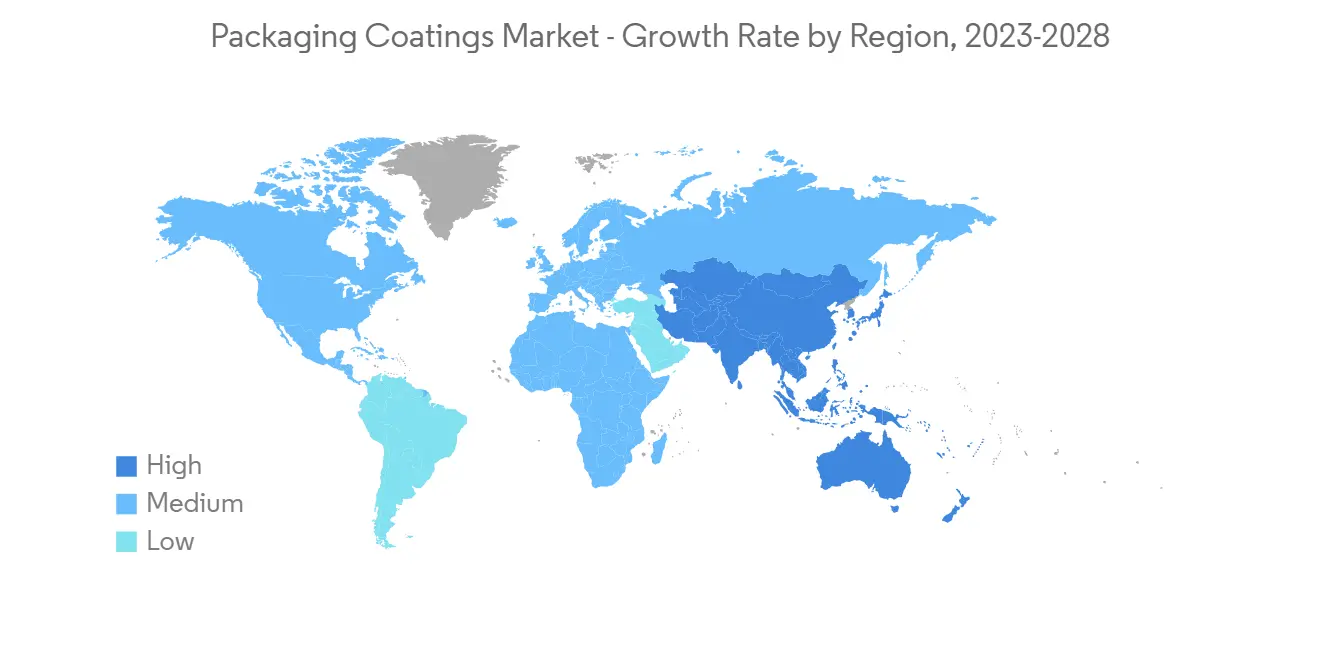

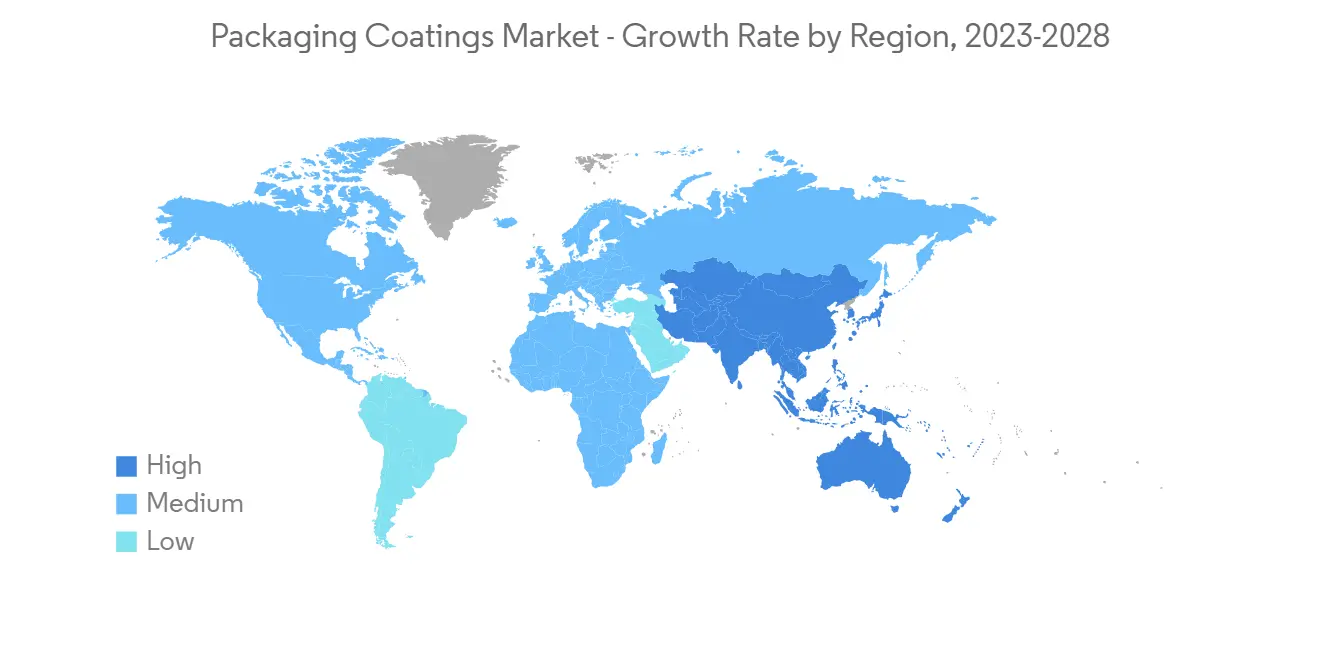

- 此外,向環保塗料的持續轉變預計將為未來的市場擴張提供機會。 亞太地區主導著全球市場,中國、印度和日本等國家的消費量最大。

包裝塗料的市場趨勢

丙烯酸樹脂需求擴大

- 丙烯酸樹脂分為熱塑性塑料和熱固性塑料物質。 丙烯酸樹脂是以丙烯酸、甲基丙烯酸和其他丙烯酸為原料製造的。 丙烯酸樹脂具有優異的透明度和耐久性,用於塗料。

- 由於其作為塗層材料的耐用性和耐候性,被廣泛用於飲料罐和食品罐等包裝應用。 它還具有防污、防起泡和防裂性能。 由於這些特性,丙烯酸樹脂作為塗料被高度評價。

- 高速包裝線對塗料的需求不斷增加,這推動了固體丙烯酸樹脂的使用。 固體丙烯酸樹脂具有濕/幹附著力、初始耐水性、耐腐蝕/耐化學性、硬度、塗層之間的附著力和優異的外觀耐久性等性能,被用作包裝塗料。 這些特性使丙烯酸樹脂成為飲料罐和固體罐等應用的合適塗料。

- 包裝在為各種快速消費品(例如飲料罐、食品罐、瓶蓋和氣霧劑)增值方面發揮著重要作用。 這個市場增長的主要原因是它在食品和飲料行業中的使用越來越多。

- 由於其創新性和視覺吸引力,包裝塗料中使用的丙烯酸通常用於包裝 FMCG 產品,吸引了客戶的興趣並增加了便利性。 隨著生活方式和消費模式的改變,對包裝產品的需求增加,包裝行業也在不斷發展。

- 丙烯酸樹脂塗料目前在油漆和塗料行業中處於領先地位。 丙烯酸樹脂塗料以其持久的顏色和對環境條件的耐受性而聞名。 由於環境問題和日益嚴格的政府法規,該行業正在從溶劑型丙烯酸樹脂轉向水性丙烯酸樹脂。

- 從 2011 年到 2021 年,中國塗料製造業的市場規模每年都在增長,達到 892.5 億美元的峰值。 2021年中印貿易總額為1256.6億美元,比2020年增長43.3%。

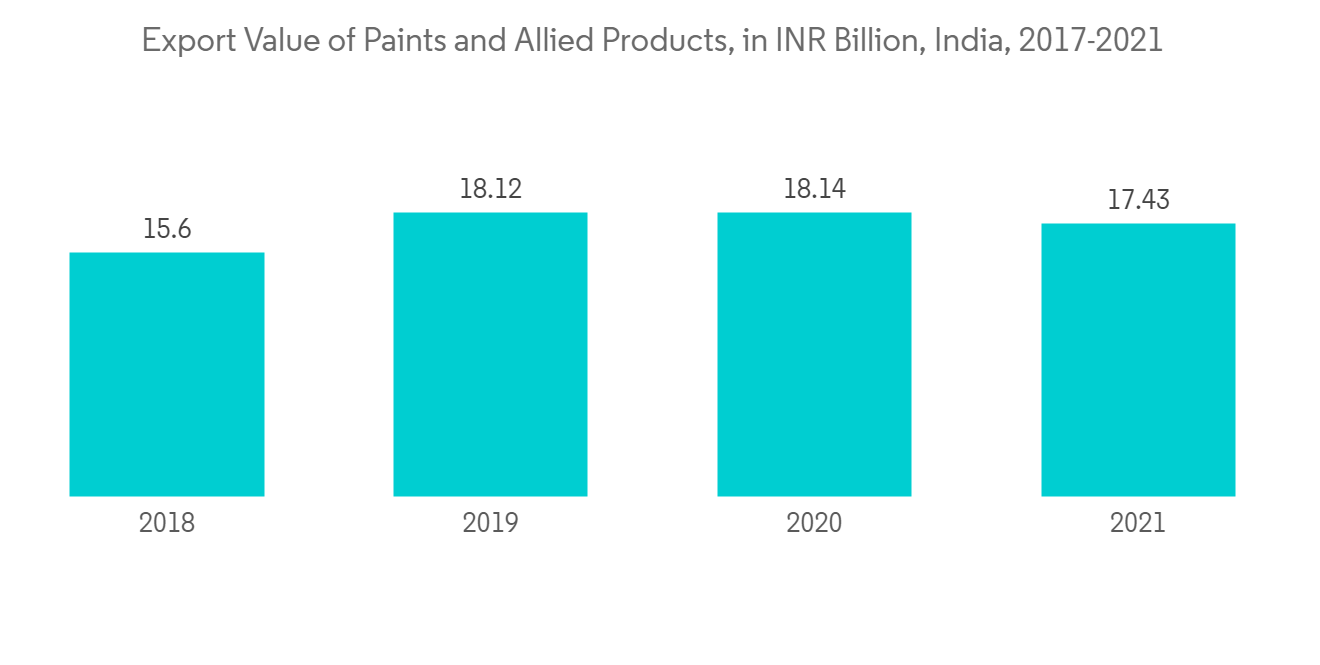

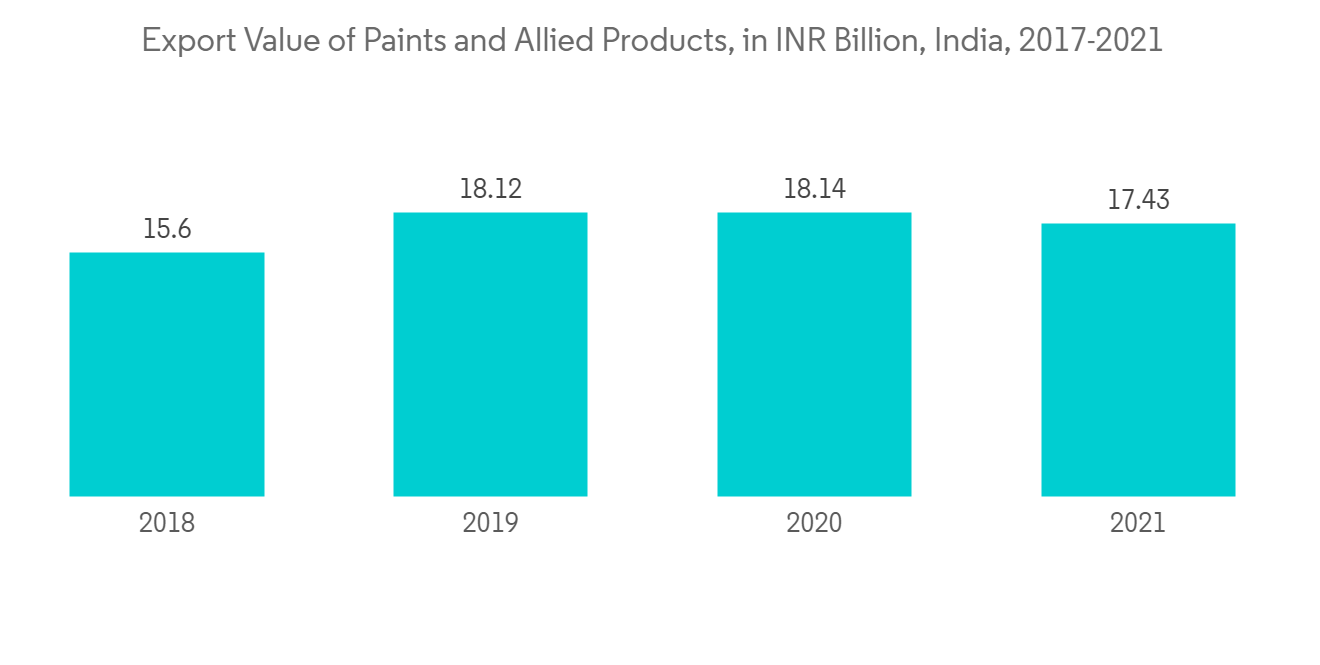

- 此外,2021 年印度塗料行業的貿易額預計將超過 460 億印度盧比(6.2 億美元)。 該國油漆及相關產品的出口價值約為 174 億印度盧比(2.34 億美元),而進口價值超過 290 億印度盧比(3.91 億美元)。

- 印度最大的塗料製造商 Asian Paints 計劃投資 96 億印度盧比(1.28 億美元)以擴大其位於古吉拉特邦 Ankleshwar 的工廠的產能。 預計丙烯酸樹脂的這種正增長將在預測期內增加包裝塗料市場的需求。

中國主導亞太

- 中國擁有世界上最大的製造業和最大的消費群。 作為世界上人口最多的國家,中國已成為各種商品的最大消費國。 出於多種原因,包裝塗料市場是中國經濟增長最快的市場之一。

- 近年來,各種產品對塗料的使用顯著增加。 對裝飾性和吸引力包裝的需求不斷增長,導致對包裝塗料的需求增加。

- 中國擁有最大的電子商務市場份額。 中國的銷售額佔所有電子商務銷售額的 30% 以上。 中國是世界上增長最快的電子商務市場之一,也是電子商務巨頭阿裡巴巴的所在地。

- 2021 年,美國對中國的農產品出口將大幅增長,增長 25%,達到創紀錄的 329 億美元。 中國是美國加工食品出口的第五大市場。 2021年出口額將達到21億美元,同比增長27%。

- 到 2021 年,中國將貢獻全球電子商務零售額的一半以上,超過歐洲和美國的總和。

- 電子商務市場的發展導致對包裝行業的需求顯著增加,進而導致包裝塗料行業的需求顯著增加。 食品和飲料包裝是增長最快的領域之一。

- 6 月份,社會消費品零售總額達到 38742 億元(5720 億美元),同比增長 3.1%。 其中,非汽車消費品零售額34192億元人民幣(5050億美元),增長1.8%。 由於環境污染意識的增強,中國製定了有關有害化學物質(揮發性有機化合物 (VOC) 等)的法規。 這些因素可能會對包裝塗料市場產生不利影響。 然而,隨著公司迅速適應一系列環保替代品,這些因素因禍得福。

- 上述因素導致預測期內該國包裝塗料的消費需求增加。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查結果

- 本次調查的假設

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對軟包裝塗料的需求不斷擴大

- 增加食品和飲料包裝

- 約束因素

- VOC 排放限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於金額)

- 樹脂

- 環氧樹脂

- 亞克力

- 聚氨酯

- 聚烯烴

- 滌綸

- 其他樹脂

- 通過使用

- 食品罐頭

- 飲料罐

- 氣霧劑管

- 瓶蓋和封口

- 工業和特殊包裝

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- Axalta Coating Systems

- Akzo Nobel NV

- ALLNEX NETHERLANDS BV

- Arkema Group

- BASF SE

- Berger Paints India Limited

- Chemetall

- Chugoku Marine Paints Ltd

- Diamond Vogel

- DowDuPont

- Evonik Industries AG

- HEMPEL A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NIPPONPAINT Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- SACAL INTERNATIONAL GROUP LTD

- The Sherwin-Williams Company

- Sika AG

- Solvay

- Wacker Chemie AG

- Yip's Chemical Holdings Limited

第七章市場機會與未來趨勢

- 快速過渡到環保塗料

- 擴大食品級塗料的研究

簡介目錄

Product Code: 52777

The packaging coatings market is expected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 impacted the global packaging coatings industry's growth. However, the increased demand for packaged food and online food deliveries during the pandemic and post-pandemic propelled the consumption of packaging coatings.

- The major factors driving the market studied are increasing demand for flexible packaging coatings and rising food and beverage packaging. On the flip side, increasing regulations are expected to hinder the market's growth.

- Swiftly shifting the market to eco-friendly coatings is likely to act as an opportunity in the future. Asia-Pacific dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Packaging Coatings Market Trends

Increasing Demand for Acrylics

- Acrylic resins are segmented into thermoplastic and thermosetting plastic substances. They are produced from acrylic acid, methacrylic acid, or other acryl-based acids. Acrylic resins possess characteristics like excellent transparency and durability and are used in coatings.

- Due to their features like durability and weatherability as coating materials, these resins are used extensively in packaging applications such as beverage cans, food cans, etc. Additionally, they are also resistant to stains, blistering, and cracking. These unique characteristics make acrylic resins a noble choice as a coating material.

- The growing demand for coatings for high-speed packaging lines is enhancing the use of solid acrylics. Solid acrylic resins in packaging coating applications offer properties such as wet and dry adhesion, early water resistance, corrosion and chemical resistance, hardness, good inter-coat adhesion, and excellent exterior durability. These properties make acrylic resin a suitable coating for applications like beverage cans, solid cans, etc.

- Packaging plays a crucial role in adding value to various FMCG products such as beverage and food cans, caps and aerosols, etc. The prime reason for this market's growth is its increasing use in the food and beverage industry.

- Acrylics in packaging coatings are used heavily for packaging FMCG products owing to their innovative and visual appeal for customer attraction and convenience. The growth in lifestyle and consumption patterns has increased the demand for packaged products resulting in a growing packaging industry.

- Acrylic resin coatings are now leading the market of the paints and coatings industry. They are known for their properties of color retention and inertness to environmental conditions. Due to growing environmental concerns and governmental regulations, industries are shifting to waterborne acrylic resins from solvent-based acrylic resins.

- The market value of China's paint manufacturing sector increased annually between 2011 and 2021, reaching a peak of USD 89.25 billion. The total trade between China and India in 2021 stood at USD 125.66 billion, up 43.3% from 2020.

- Furthermore, the trade value of India's paint industry was over INR 46 billion (USD 620 million) in 2021. The value of exported paint and allied products in the country amounted to approximately INR 17.4 billion (USD 234 million) compared to over INR 29 billion (USD 391 million) import value.

- India's largest paint and coating producer, Asian Paints, plans to invest INR 9.60 billion (USD 128 million) to expand the installed capacity at its facility at Ankleshwar in Gujarat. Such positive growth for acrylics will likely increase the demand for the packaging coatings market during the forecast period.

China to Dominate the Asia-Pacific Region

- China has the biggest manufacturing sector in the world and the largest consumer base. Being the most populated country, China makes it the largest consumer of various goods. Owing to various reasons, the packaging coatings market is one of the fastest-growing markets in the Chinese economy.

- The applications of coatings on various products have grown significantly in recent times. The increasing need for decorative and attractive packaging has led to an increase in the demand for coatings for packaging.

- China has the largest share of the e-commerce market. Sales in China account for more than 30% of the total e-commerce sales. China is one of the fastest-growing e-commerce markets in the world, and it is home to the e-commerce giant, Alibaba.

- The United States agricultural exports to China increased significantly in 2021, with a growth of 25% to a record high of USD 32.9 billion. China is the 5th largest market for the export of United States processed foods. Exports in 2021 were valued at USD 2.1 billion, an increase of 27% from the prior year.

- In 2021, China contributed to more than half of the world's e-commerce retail sales, with the sales value surpassing the combined total of Europe and the United States.

- The growth in the e-commerce market led to a huge increase in demand for the packaging industry and, consequently, the packaging coatings industry. Food and beverage packaging is the fastest-growing sector among them.

- In June, the total retail sales of social consumer goods reached CNY 3,874.2 billion (USD 572 billion), an increase of 3.1 percent year-on-year. Among them, the retail sales of consumer goods other than automobiles reached CNY 3,419.2 billion (USD 505 billion), an increase of 1.8 percent. In China, the awareness concerning the environment and pollution led to the formation of regulations related to harmful chemicals (such as volatile organic compounds (VOCs)). Such factors can adversely affect the market for packaging coatings. These factors have also been a blessing in disguise, as companies have quickly adapted to various eco-friendly alternatives.

- The aforementioned factors contribute to the increasing demand for packaging coatings consumption in the country during the forecast period.

Packaging Coatings Industry Overview

The packaging coatings market is consolidated. The major companies include Akzo Nobel NV, PPG Industries Inc., The Sherwin-Williams Company, Henkel AG & Co. KGaA, and Jotun, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Flexible Packaging Coatings

- 4.1.2 Rising Food and Beverage Packaging

- 4.2 Restraints

- 4.2.1 VOC Emission Constraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin

- 5.1.1 Epoxies

- 5.1.2 Acrylics

- 5.1.3 Polyurethane

- 5.1.4 Polyolefins

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 By Application

- 5.2.1 Food Cans

- 5.2.2 Beverage Cans

- 5.2.3 Aerosol and Tubes

- 5.2.4 Caps and Closures

- 5.2.5 Industrial and Specialty Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Axalta Coating Systems

- 6.4.2 Akzo Nobel NV

- 6.4.3 ALLNEX NETHERLANDS BV

- 6.4.4 Arkema Group

- 6.4.5 BASF SE

- 6.4.6 Berger Paints India Limited

- 6.4.7 Chemetall

- 6.4.8 Chugoku Marine Paints Ltd

- 6.4.9 Diamond Vogel

- 6.4.10 DowDuPont

- 6.4.11 Evonik Industries AG

- 6.4.12 HEMPEL A/S

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 Jotun

- 6.4.15 Kansai Paint Co. Ltd

- 6.4.16 Masco Corporation

- 6.4.17 NIPPONPAINT Co. Ltd

- 6.4.18 PPG Industries Inc.

- 6.4.19 RPM International Inc.

- 6.4.20 SACAL INTERNATIONAL GROUP LTD

- 6.4.21 The Sherwin-Williams Company

- 6.4.22 Sika AG

- 6.4.23 Solvay

- 6.4.24 Wacker Chemie AG

- 6.4.25 Yip's Chemical Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Swiftly Shifting Market to Eco-Friendly Coatings

- 7.2 Growing Research on Food Grade Coatings

02-2729-4219

+886-2-2729-4219