|

市場調查報告書

商品編碼

1402987

生物基平台化學品-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Bio-based Platform Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

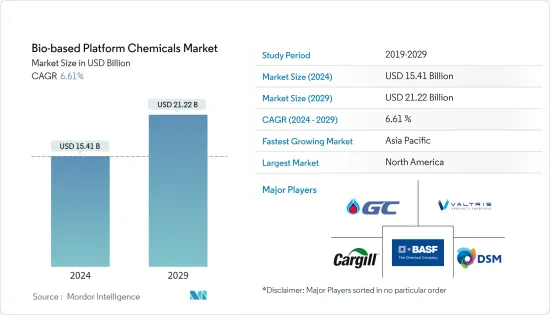

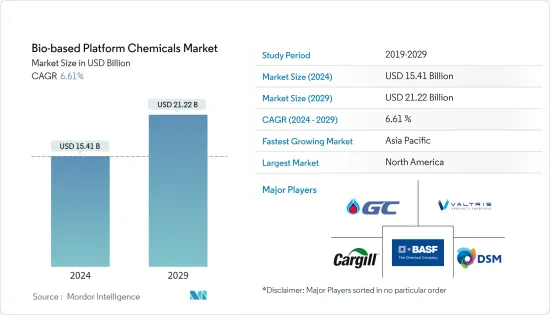

生物基平台化學品市場規模預計2024年為154.1億美元,預計2029年將達212.2億美元,預測期內(2024-2029年)複合年成長率為6.61%成長。

主要亮點

- COVID-19 大流行對生物基平台化學品產業產生了負面影響。全球封鎖和嚴格的政府法規迫使大多數生產基地關閉,給它們帶來了毀滅性的打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

- 推動該市場成長的關鍵因素是有利的政府法規和消費者使用環保和永續產品的傾向。

- 另一方面,與生物基平台化學品相關的高產品成本可能會阻礙所研究市場的成長。

- 新型生物基平台化學品的出現以及廣泛工業應用的需求激增可能會在預測期內為研究市場提供機會。

- 由於對製藥業的巨額投資和促進使用環保產品的嚴格法規,北美在全球市場佔據主導地位。

生物基平台化學品市場趨勢

生物伊康酸(IA)領域實現強勁成長

- 伊康酸(IA)也稱為亞甲基琥珀酸和亞甲基丁二酸。它是透過發酵過程產生的有機化合物。此外,它還用於生產各種化學品,主要作為石化產品(包括丙烯酸)的替代品。

- 阻礙伊康酸採用的主要因素之一是其與替代品相比成本較高。因此,IA主要用於需求量較少的領域。

- IA 可溶於多種醇,包括甲醇、乙醇和 2-丙醇,並且可生物分解性。此外,它也用於製造單酯,例如伊康酸。它也與取代的吡咯烷酮發生反應,用於洗髮精、清潔劑和藥品等應用。伊康酸及其衍生物主要應用於化學、紡織和製藥工業。

- 據歐洲個人護理協會稱,5億歐洲消費者每天使用化妝品和個人護理產品來保護自己的健康、提高幸福感並增強自尊。它們的範圍從止汗劑、香水、化妝品和洗髮精到肥皂、防曬油、牙膏和化妝品。

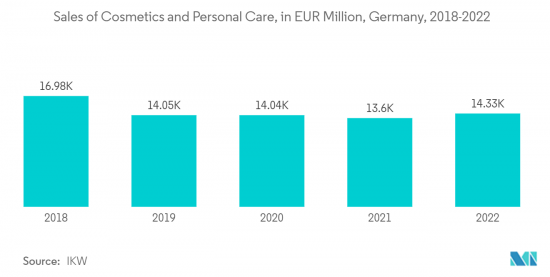

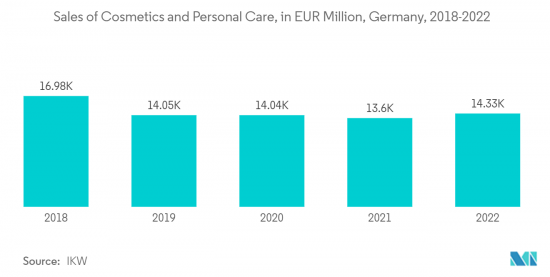

- 據歐洲化妝品協會稱,歐洲是化妝品和個人產品的主要市場之一,2022 年零售額約為 880 億歐元(856.4 億美元)。 2022年,歐洲化妝品和個人護理品的主要市場是德國(139.2億美元)、法國(125.5億美元)和義大利(111.9億美元)。

- 生物伊康酸主要用於取代丙烯酸來生產高吸水性聚合物。石化燃料枯竭和永續發展的需求預計將在預測期內增加對用於生產高吸水性聚合物的生物伊康酸的需求。

- 高吸水性聚合物在多個最終用戶行業中的應用不斷增加是推動生物伊康酸需求的因素之一。高吸水性聚合物(SAP)是一種能夠吸收和保留大量液體和水溶液的材料。這使其成為吸水應用的理想選擇,例如嬰兒尿布、成人失禁墊、吸收性醫用敷料和緩釋性藥物。

- 世界衛生組織 (WHO)、世界銀行集團和聯合國兒童基金會等組織正在提高人們對衛生重要性的認知,特別是對婦女和少女的月經衛生管理 (MHM)。

- 在印度,世界銀行集團在 Swachh Bharat 使命下啟動了一個旗艦衛生計畫。這項工作提高了社區(包括男孩和男性)的意識,打破月經的禁忌。政府機構的這些努力增加了對生物伊康酸的需求,並支持生物基平台化學品市場的成長。

- 因此,化妝品和個人護理產品需求的激增預計將進一步推動生物基平台化學品市場的需求。

北美市場佔據主導地位

- 由於政府法規促進生物基產品的使用以及技術改進領域的持續研究和創新,北美地區在全球市場佔有率佔據主導地位,並將繼續成為生物基平台化學品市場的領先者在預測期內,可能會繼續保持其市場佔有率。

- 此外,與石油基平台化學品相關的嚴格法規和石化燃料儲備的蘊藏量正在為該地區的生物基平台化學品市場創造進一步的成長機會。

- 此外,該地區的食品和飲料、化妝品、藥品和化肥等終端用戶產業受到嚴格監管,以避免對公民健康產生負面影響。在這方面,與石油基原料相比,這些產業可能會轉向生物基原料。

- 美國醫療保健產業是該國最先進的產業之一。根據醫療保險和醫療補助服務中心的數據,到 2028 年,國家醫療支出預計將平均成長 5.4%,達到 6.2 兆美元。此外,美國的人均醫療費用大約是德國的兩倍,韓國的四倍。

- 根據美國人口普查局預測,2022年美國醫療照護用品店銷售額將達近3,993.7億美元,2021年將增加至3,870億美元。

- 根據歐洲製藥工業聯合會預測,2022年全球藥品市場規模將達12,877.36億美元,其中北美市場將佔52.3%的較大佔有率。

- 因此,該地區製藥和個人護理行業的顯著成長正在推動對生物基平台化學品的需求。

- 此外,生物基平台化學品的研究和開發以及在此類產業中探索有益應用可能會導致該地區強制使用此類生物基平台化學品。

- 因此,所有這些因素預計將在預測期內推動該地區對生物基平台化學品的需求。

生物基平台化學品產業概況

生物基平台化學品市場是一個綜合市場,少數參與企業佔據了市場需求的很大一部分。該市場的主要企業包括BASF股份公司、嘉吉公司、帝斯曼、PTT Global Chemical Public Company Limited 和 Champlor (Valtris Specialty Chemicals)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對生物基平台化學品有利的政府法規

- 消費者傾向於使用環保和永續產品

- 其他司機

- 抑制因素

- 生產成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 產品類別

- 生物甘油

- 生物谷氨酸

- 生物伊康酸

- 生物3-羥基丙酸

- 生物琥珀酸

- 其他產品類型

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- Aktin Chemicals, Inc.

- BASF SE

- Braskem

- Cargill, Incorporated

- Champlor(Valtris Specialty Chemicals)

- DSM

- DuPont

- Evonik Industries AG

- GFBiochemicals Ltd.

- LyondellBasell Industries Holdings BV

- NIPPON SHOKUBAI CO., LTD.

- Novozymes

- PTT Global Chemical Public Company Limited

- Tokyo Chemical Industry Co., Ltd.

第7章 市場機會及未來趨勢

- 新型生物基平台化學品的出現

- 廣泛的工業應用需求快速成長

The Bio-based Platform Chemicals Market size is estimated at USD 15.41 billion in 2024, and is expected to reach USD 21.22 billion by 2029, growing at a CAGR of 6.61% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a negative impact on the bio-based platform chemicals sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

- The major factors driving the growth of the market studied are favorable government regulations and consumer inclination towards the use of environmentally friendly and sustainable products.

- On the flip side, the high product cost associated with bio-based platform chemicals is likely to hinder the growth of the studied market.

- The emergence of novel bio-based platform chemicals and the surge in demand from a wide range of industrial applications are likely to provide opportunities for the studied market during the forecast period.

- North America dominated the global market, which is fueled by huge investments in its pharmaceutical industry and stringent regulations promoting the use of environmentally friendly products.

Bio-based Platform Chemicals Market Trends

Bio-Itaconic acid (IA) Segment to Witness Strong Growth

- Itaconic acid (IA) is also known as methylene succinic acid or methylene butanedioic acid. It is an organic compound manufactured through the fermentation process. Furthermore, it is primarily used as an alternative to petrochemical-derived products (including acrylic acid) during the production of various other chemicals.

- One of the major factors hindering the adoption of itaconic acid is the high cost, as compared to its substitutes. Thus, IA is primarily used in areas where less volume of it is required.

- IA can dissolve in many alcohols, including methanol, ethanol, and 2-propanol, as well as biodegradable in nature. Moreover, it is used to produce monoesters, including monomethyl itaconate. It reacts with substituted pyrrolidones, which are used in applications such as shampoos, detergents, pharmaceuticals, etc. Itaconic acid and its derivatives have major applications in the chemical, textile, and pharmaceutical industries.

- According to Cosmetics Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, and shampoos, to soaps, sunscreens and toothpaste, and cosmetics.

- According to Cosmetics Europe, Europe is amongst the major markets for cosmetics and personal products, and retail sales of these products were valued at around Euro 88 billion (USD 85.64 billion) in 2022. The major market in Europe for cosmetics and personal care are Germany (USD 13.92 billion), France (USD 12.55 billion), and Italy (USD 11.19 billion) in 2022.

- Bio-based itaconic acid is used instead of acrylic acid, primarily in the production of superabsorbent polymers. The depletion of fossil fuels and the need for sustainable development is likely to augment the demand for bio-based itaconic acid for the production of superabsorbent polymers during the forecast period.

- The increasing application of superabsorbent polymers in several end-user industries is one of the factors driving the demand for bio-based itaconic acid. Superabsorbent polymers (SAPs) are materials that possess the ability to absorb and retain large volumes of liquid or aqueous solutions. This makes them ideal for use in water-absorbing applications, such as baby nappies, adult incontinence pads, absorbent medical dressings, and controlled-release drugs.

- Organizations, such as the World Health Organization, World Bank Group, and UNICEF, are raising awareness about the importance of hygiene, especially menstrual hygiene management (MHM) for women and adolescent girls.

- In India, the World Bank Group initiated a flagship sanitation operation under the Swachh Bharath Mission. With this operation, awareness is increasing among the community, including boys and men, to break the taboo around menstruation. Such initiatives by government bodies are increasing the demand for bio-itaconic acid, in turn fueling the growth of the bio-based platform chemicals market.

- Thus, the surge in demand from cosmetics and personal care products is further expected to boost the demand for bio-based platform chemicals market.

North America Region to Dominate the Market

- North America region dominated the global market share and is likely to continue holding the major share in the bio-based platform chemicals market during the forecast period, owing to government regulations promoting the use of bio-based products and continuous research and innovations in the field of technological modification.

- Moreover, stringent regulations related to petroleum-based platform chemicals and depletion of fossil fuel reserves further provide a growth opportunity for the bio-based platform chemicals market in the region.

- In addition, end-user industries such as food and beverage, cosmetics, pharmaceuticals, and fertilizer in the region are strictly regulated in order to avoid negative effects on the health of citizens. In this regard, these industries are more likely to shift to bio-based raw materials when compared to petroleum-based raw materials.

- The healthcare sector in the United States is by far one of the most advanced sectors in the country. According to the Centers for Medicare & Medicaid Services, by 2028, it is anticipated that national health spending will have increased by an average of 5.4%, totaling USD 6.2 trillion. Moreover, Health spending per person in the United States was roughly double that of Germany and four times that of South Korea.

- According to US Census Bureau, the health and personal care store sales in the United States in 2022 accounted for nearly USD 399.37 billion, which will be USD 387.0 billion in 2021.

- According to the European Federation of Pharmaceutical Industries and Association, the world pharmaceutical market was valued at USD 1,287,736 million in 2022, in which North America accounted for a significant share of 52.3%.

- Thus, the significant growth in the pharmaceutical and personal care sector in this region is boosting the demand for biobased platform chemicals.

- Further, research and development of bio-based platform chemicals and exploration of their beneficial applications in such industries can lead to the mandate of the use of such bio-based platform chemicals in the region.

- Hence, all such factors are likely to drive the demand for bio-based platform chemicals in the region during the forecast period.

Bio-based Platform Chemicals Industry Overview

The bio-based platform chemicals market is a consolidated market, where few players account for a significant portion of the market demand. Some of the major players in the market include BASF SE, Cargill, Incorporated, DSM, PTT Global Chemical Public Company Limited, and Champlor (Valtris Specialty Chemicals), amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Regulations for Bio-Based Platform Chemicals

- 4.1.2 Consumer Inclination Towards the Use of Environmental Friendly and Sustainable Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Production

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Bio Glycerol

- 5.1.2 Bio Glutamic Acid

- 5.1.3 Bio Itaconic Acid

- 5.1.4 Bio-3-Hydroxypropionic Acid

- 5.1.5 Bio Succinic Acid

- 5.1.6 Other Product Types

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aktin Chemicals, Inc.

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Cargill, Incorporated

- 6.4.5 Champlor (Valtris Specialty Chemicals)

- 6.4.6 DSM

- 6.4.7 DuPont

- 6.4.8 Evonik Industries AG

- 6.4.9 GFBiochemicals Ltd.

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 NIPPON SHOKUBAI CO., LTD.

- 6.4.12 Novozymes

- 6.4.13 PTT Global Chemical Public Company Limited

- 6.4.14 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Novel Bio-Based Platform Chemicals

- 7.2 Surge in Demand from Wide Range of Industrial Applications