|

市場調查報告書

商品編碼

1326391

蒸壓加氣混凝土 (AAC) 市場規模和份額分析 - 增長趨勢和預測 (2023-2028)Autoclaved Aerated Concrete (AAC) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

蒸壓加氣混凝土 (AAC) 市場規模預計將從 2023 年的 52.6 億美元增長到 2028 年的 70.5 億美元,預測期內(2023-2028 年)複合年增長率為 6.05%。

COVID-19 大流行對市場產生了負面影響。世界各地的建築工程已陷入停頓,尤其是在中國和印度等重要建築中心。但2021年,行業復甦,市場需求恢復。

主要亮點

- 短期內,市場增長是由全球建設和重建項目數量不斷增加推動的。

- 另一方面,加氣混凝土砌塊的製造成本高於普通水泥或粘土砌塊,預計這將阻礙市場增長。

- 然而,對阻燃建築材料使用的重視預計將成為未來市場增長的機會。

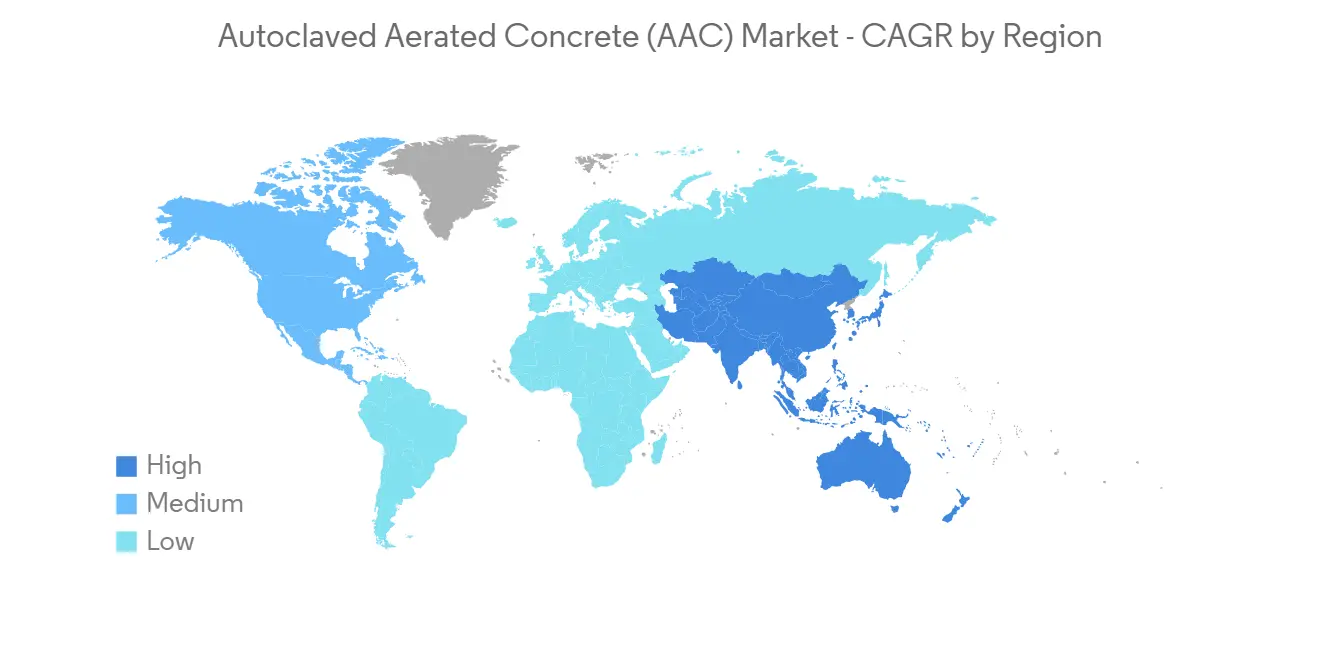

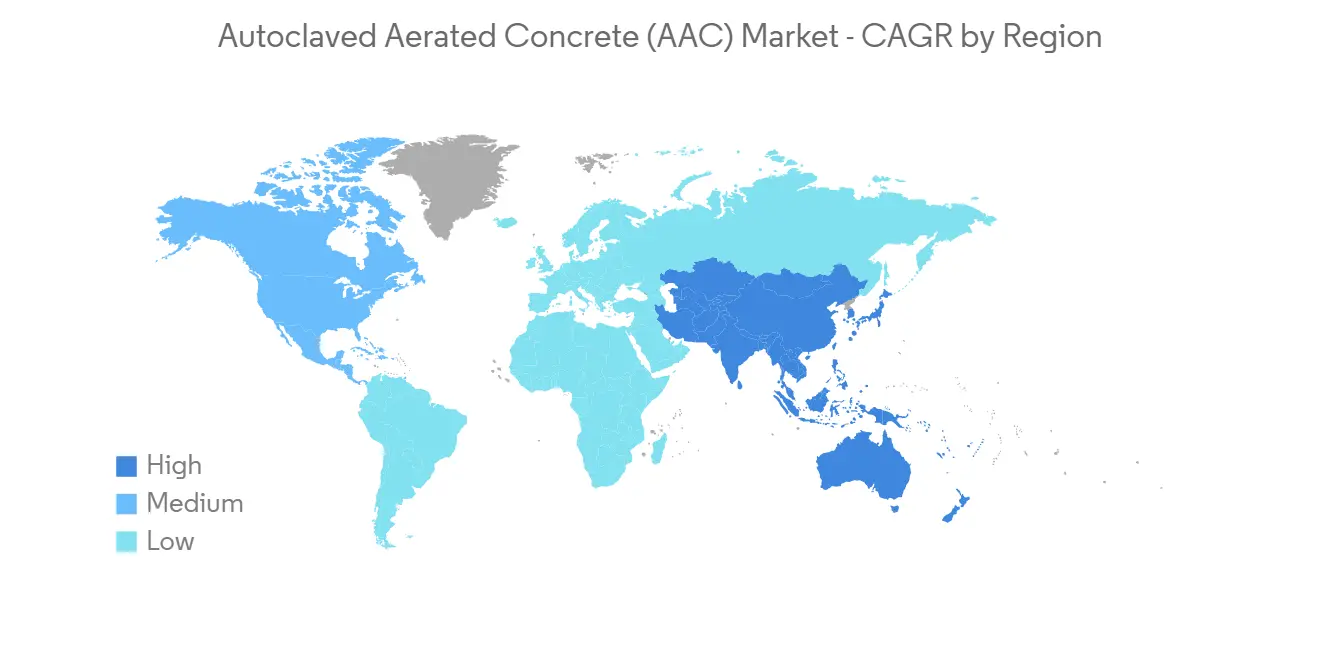

- 亞太地區預計將主導市場,其中中國、印度和日本的消費量最大。

蒸壓加氣混凝土(AAC)市場趨勢

建築行業需求不斷增長

- AAC 用於建築,因為它具有防火、防白蟻、防蟲害、抗震、輕質、可持續、快速且易於安裝、以及隔熱和節能等特點。

- 由於該國投資和建設活動的增加,預計在預測期內對自細胞混凝土的需求將增加。近年來,中國一直是世界基礎設施建設的主要投資者之一,做出了重要貢獻。例如,根據國家統計局(NBS)的數據,2022年中國建築業產值達到27.63萬億元人民幣(4.11萬億美元),比2021年增長6.6%。因此,國內建築業的不斷增長預計將為自加氣混凝土市場創造向上的需求。

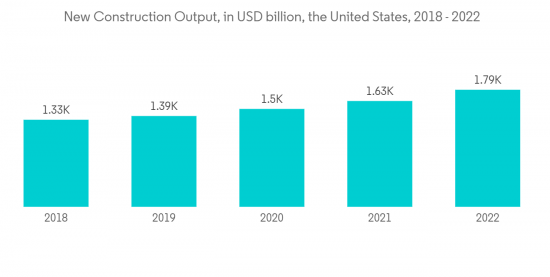

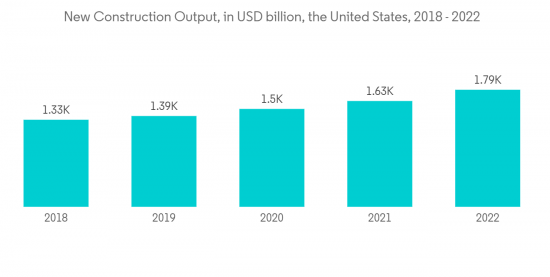

- 美國擁有世界上最大的建築業之一。據美國人口普查局統計,2022年美國新建建築產值達1.79萬億美元,較2021年增長10.40%至1.63萬億美元。另外,2022年該國商業建築總額為1147.9億美元,而2021年為910.3億美元,較2021年增長21.5%。因此,美國商業建築產量的增加預計將增加自加氣混凝土市場的需求。

- 此外,沙特阿拉伯正在開展許多商業項目,並且可能會建造更多的商業建築。Qiddiya Entertainment 是價值5000 億美元的未來巨型城市Neom 項目的一部分,計劃於2025 年竣工,包括分佈在五個島嶼和兩個內陸度假村的14 家豪華和超豪華酒店,擁有3,000 間客房;Qiddiya Entertainment City 是超豪華健康中心目的地阿瑪阿拉 (Amaala) 和讓努維爾 (Jean Nouvel) 位於歐拉 (Al-Ula) 的 Sharaan 度假村。

- 英國政府已宣佈建設新學校是當務之急。英國的學校改造項目預計將對加氣混凝土市場產生積極影響。例如,英國政府宣布,作為具有裡程碑意義的十年計劃的一部分,將對英國 239 所學校進行翻修。

- 除了學校重建計劃外,政府每年還向學校土地投入資本金。自 2015 年以來,已撥款超過 130 億英鎊(160.7 億美元)用於維護和改善英格蘭各地的學校設施,2022-23 財年將撥款 18 億英鎊(22.26 億美元)。

- 繼秋季聲明中宣佈為學校明年和後年增加 20 億英鎊(24.73 億美元)額外資金後,政府還將決定明年向地方當局分配學校資金。到 2024-25 年,每個學生的實際學校經費預計將達到歷史新高,總計達到 588 億英鎊(727.29 億美元)。因此,建築行業的此類投資預計將導致加氣混凝土的需求增加。

- 由於上述因素,預計在預測期內對自泡沫混凝土的需求將激增。

亞太地區主導市場

- 由於中國和印度等國家建築行業的高需求,亞太地區在 ACC 市場上佔據主導地位。

- 預計印度仍將是亞太地區二十國集團中增長最快的經濟體。印度政府宣布三年(2023-2025年)基礎設施投資目標為3765億美元,其中1205億美元用於發展27個產業集群,7530億美元用於公路、鐵路和港口互聯互通項目。 。

- 印度房地產行業正在崛起,政府的支持和舉措進一步提振了需求。據印度品牌股權基金會(IBEF)稱,住房和城市發展部(MoHUA)已在2022-2023年預算中撥款98.5億美元,為住房建設和完成停滯項目創造資金。

- 此外,2022年12月,印度機場管理局(AAI)等機場開發商宣布,機場部門將在未來五年內投入約10萬元人民幣,用於擴建或翻新現有航站樓、建設新航站樓、加固跑道等。其資本支出目標為 98,000 盧比(118 億美元)。因此,這些擴建工程預計將增加對自泡沫混凝土材料的需求。

- 據國土交通省稱,雨季結束後日本的建築開工量將會增加。2022 年,日本將開工約 859,500 套住房。與 2021 年相比,增長了 0.4%。因此,日本新屋開工數量的增加預計將導致對自泡沫混凝土的需求增加。

- 因此,所有這些有利的發展和當地投資預計將在預測期內推動對汽車細胞混凝土的需求。

蒸壓加氣混凝土 (AAC) 行業概述

自動填充加氣混凝土 (AAC) 市場本質上高度分散。該市場的主要參與者(排名不分先後)包括 Xella International、H+H、ACICO Group、SOLBET 和 Tarmac。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查先決條件

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 促進者

- 建築行業需求不斷增長

- 越來越重視綠色建築(LEED 評級)

- 其他促進者

- 抑製劑

- 初始成本高

- 限制在承重牆中的使用

- 行業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第五章 市場細分(基於金額的市場規模)

- 類型

- 堵塞

- 楣

- 控制板

- 瓦

- 其他類型

- 用法

- 家用

- 工業的

- 商業的

- 其他用途

- 區域

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳大利亞/新西蘭

- 東盟國家

- 亞太其他地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 北歐國家

- 波蘭

- 捷克共和國

- 羅馬尼亞

- 比利時

- 荷蘭

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東/非洲

- 沙特阿拉伯

- 南非

- 卡塔爾

- 以色列

- 南非

- 其他中東和非洲

- 亞太地區

第六章 競爭格局

- 併購、合資、聯盟、協議

- 市場份額(%)**/排名分析

- 各大公司的戰略

- 公司簡介

- ACICO Group

- AERCON AAC

- AKG Gazbeton

- BAUROC AS

- Biltech Building Elements Limited

- Eastland Building Materials Co., Ltd

- Eco Green

- H+H

- HIL Limited

- JK Lakshmi Cement Ltd

- Renaatus Procon Private Limited

- SOLBET

- Tarmac

- Xella International

- Thomas Armstrong(Concrete Blocks)Limited

- UltraTech Cement Ltd.

第七章市場機會與未來趨勢

- 重點轉向使用綠色化學品

- 其他機會

The Autoclaved Aerated Concrete (AAC) Market size is expected to grow from USD 5.26 billion in 2023 to USD 7.05 billion by 2028, at a CAGR of 6.05% during the forecast period (2023-2028).

The COVID-19 pandemic negatively impacted the market. Construction work stopped worldwide, especially in significant construction hubs like China and India. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, the increasing construction and redevelopment projects across the world are some of the factors driving the growth of the market studied.

- On the flip side, the cost of manufacturing an AAC block is higher than normal cement or burnt clay blocks, which is expected to hinder the growth of the market studied.

- However, the emphasis on using fire-retardant building materials is expected to provide opportunities for the growth of the market in the future.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption coming from China, India, and Japan.

Autoclaved Aerated Concrete (AAC) Market Trends

Growing Demand from the Construction Industry

- AAC, owing to its thermally insulated and energy-efficient properties, along with being fire-resistant, termite- or pest-resistant, seismic-resistant, lightweight, sustainable, and quick and easy to apply, is used in construction.

- The demand for autoclaved aerated concrete is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4.11 trillion), an increase of 6.6% compared with 2021. Therefore, the increasing construction industry in the country is expected to create upside demand for the autoclaved aerated concrete market.

- The United States has one of the world's largest construction industries. According to the US Census Bureau, the output value of new construction in the United States amounted to USD 1.79 trillion in 2022, which showed an increase of 10.40% compared to 2021, reaching USD 1.63 trillion. Apart from that, the total commercial construction value in the country accounted for USD 91.03 billion in 2021 compared to USD 114.79 billion in 2022, which showed an increase of 21.5% compared to 2021. Therefore, increasing commercial construction output in the United States is expected to increase demand for the autoclaved aerated concrete market.

- Moreover, Saudi Arabia works on many commercial projects, likely leading to more commercial buildings. The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project, Phase 1, which is expected to be completed by 2025 and has 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala, the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula Therefore, upcoming investments from the construction industry are expected to create upside demand for the autoclaved aerated concrete market in the country.

- The government of the United Kingdom had announced initiatives to construct new schools as a top priority. School renovation projects in England are expected to create an upside for the autoclaved aerated concrete market. For instance, according to the United Kingdom government's publication, 239 school buildings are to be transformed as part of a revolutionary ten-year program in England.

- In addition to the school rebuilding program, the government invests in the school estate with annual capital funding. Over GBP 13 billion (USD 16.07 billion) has been allocated since 2015 to maintain and improve school facilities across England, including GBP 1.8 billion (USD 2.226 billion) in the financial year 2022-23.

- Moreover, the government is also setting out school funding allocations for local authorities for next year, following the extra GBP 2 billion (USD 2.473 billion) funding boost for schools for next year and the year after announced in the Autumn Statement. School funding is expected to be at its highest-ever level in real terms per pupil, totaling GBP 58.8 billion (USD 72.729 billion) by 2024-25. Therefore, these investments in the construction industry are expected to create upside demand for autoclaved aerated concrete.

- Owing to all the above factors, the demand for autoclaved aerated concrete is expected to surge during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounts for most of the ACC market owing to the high demand from the construction sector in countries like China and India.

- India is anticipated to remain the fastest-growing G20 economy in the Asia-Pacific region. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects.

- The residential sector in India is on an increasing trend, with government support and initiatives further boosting demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Moreover, in December 2022, the Airports Authority of India (AAI) and other airport developers targeted a capital outlay of approximately Rs. 98,000 crores (USD 11.8 billion) in the airport sector in the next five years for expansion and modification of existing terminals, new terminals, and strengthening of runways, among other activities. Therefore, these expansions are expected to increase the demand for autoclaved aerated concrete materials.

- According to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), building starts will increase in Japan after the rainy season. In 2022, approximately 859.5 thousand housing starts were initiated in Japan. This represents an increase of 0.4% compared to 2021. Therefore, the increasing number of housing starts in Japan is expected to create upside demand for autoclaved aerated concrete.

- Hence, all such favorable trends and regional investments are expected to drive the demand for autoclaved aerated concrete during the forecast period.

Autoclaved Aerated Concrete (AAC) Industry Overview

The autoclaved aerated concrete (AAC) market is highly fragmented in nature. The major players in this market (not in a particular order) include Xella International, H+H, ACICO Group, SOLBET, and Tarmac.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry

- 4.1.2 Increased Emphasis on Green Buildings (LEED Ratings)

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Initial Cost

- 4.2.2 Limited Usage in Load Bearing Walls

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Block

- 5.1.2 Lintel

- 5.1.3 Panel

- 5.1.4 Tile

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Industrial

- 5.2.3 Commercial

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.1.6 ASEAN Countries

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 NORDIC Countries

- 5.3.3.5 Poland

- 5.3.3.6 Czech Republic

- 5.3.3.7 Romania

- 5.3.3.8 Belgium

- 5.3.3.9 Netherlands

- 5.3.3.10 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Israel

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACICO Group

- 6.4.2 AERCON AAC

- 6.4.3 AKG Gazbeton

- 6.4.4 BAUROC AS

- 6.4.5 Biltech Building Elements Limited

- 6.4.6 Eastland Building Materials Co., Ltd

- 6.4.7 Eco Green

- 6.4.8 H+H

- 6.4.9 HIL Limited

- 6.4.10 JK Lakshmi Cement Ltd

- 6.4.11 Renaatus Procon Private Limited

- 6.4.12 SOLBET

- 6.4.13 Tarmac

- 6.4.14 Xella International

- 6.4.15 Thomas Armstrong (Concrete Blocks) Limited

- 6.4.16 UltraTech Cement Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward the Usage of Green Chemicals

- 7.2 Other Opportunities