|

市場調查報告書

商品編碼

1432434

碳預浸料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Carbon Prepreg - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

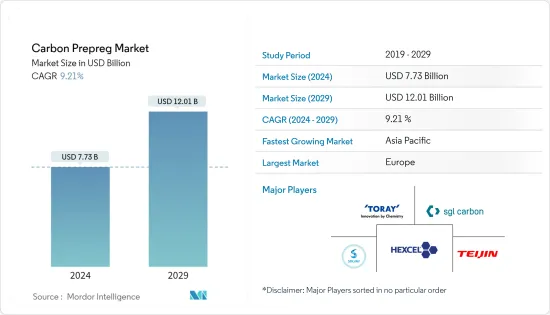

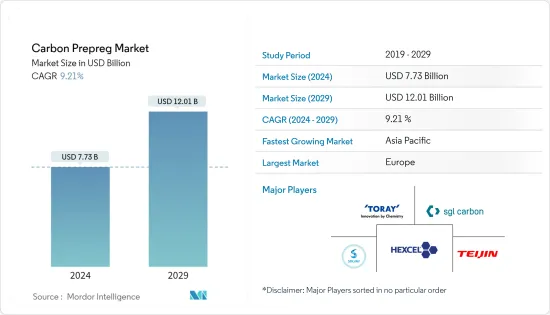

碳預浸料市場規模預計到2024年為77.3億美元,預計到2029年將達到120.1億美元,在預測期內(2024-2029年)複合年成長率為9.21%。

COVID-19 的疫情對旅遊業產生了負面影響,也影響了航太業。然而,隨著封鎖的放鬆以及各國取消旅行限制,2021年和2022年旅客人數增加,碳預浸料市場達到了疫情前的水平。

主要亮點

- 對綠色能源來源的重視、對碳纖維複合材料零件的需求不斷成長、航太和國防工業不斷成長的需求可能成為預測期內的市場促進因素。

- 然而,環保替代品的可用性可能會阻礙預測期內的市場成長。

- 電子產業中越來越多的應用可能是未來的一個機會。

- 由於國防部門需求的增加,歐洲主導了全球整體市場。

碳預浸料市場趨勢

航太和國防工業的需求增加

傳統上,航太製造商一直專注於碳複合材料,與鋁等傳統航太材料相比,碳複合材料可顯著減輕重量並節省成本。大多數航太複合材料使用碳預浸料作為原料,高壓釜是一種常見的製造流程。航太是民航機、軍用噴射機、直升機、航空引擎或太空衛星和火箭碳預浸料的最大消費者。

碳纖維複合材料因其高強度、高剛度、耐熱性、耐化學性以及各種其他熱和化學性能等特性而被用於航太和國防應用。

根據波音商業展望(2022-2041),全球商業航空服務(包括航班業務、維護和工程、地面業務、車站業務、貨運業務等)預計到 2041 年將達到 3.615 兆美元。預計這可能會推動未來幾年研究市場的需求。

最近,飛機製造商一直在尋找加快生產的方法,以填補訂單訂單。例如,波音《商業展望》(2022-2041)預計,到 2041 年,全球新飛機交付總量將達到 41,170 架。此外,報告指出,東南亞航太服務市場規模預計將達2,450億美元,歐洲將達8.5億美元。從長遠來看,航太的這種情況預計將繼續推動碳預浸料市場的成長。

歐洲主導市場

歐洲主導全球碳預浸料市場。德國經濟是歐洲第一大經濟體,世界第五大經濟體。

德國擁有眾多飛機內飾件、MRO(維修、修理和大修)、輕量化結構和材料生產基地,其中大部分位於巴伐利亞州、不來梅州、巴登符騰堡州和梅克倫堡-前波莫瑞州。

在歐洲,波音商用飛機展望(2022-2041)預計,到 2041 年,新飛機交付總量將達到 8,550 架,市場服務價值為 8,500 億美元。因此,未來該地區飛機製造對光學鍍膜的需求可能會增加。

此外,根據波音商用公司的《展望(2022-2041)》,到 2041 年,該地區的航空公司持有預計將成長 4.2%。據估計,未來20年將有超過30,000至35,000架新飛機投入使用,以滿足日益成長的航空需求。因此,飛機產量的增加預計也將有助於預測期內的市場成長。

2022 年 3000 萬歐元,包括歐洲先進雷達技術的研究 (ARTURO) 和生態設計的彈道系統,用於持久和輕型防禦平台和個人應用中當前和新興的威脅 (ECOBALLIFE) 兩個新計畫價值(約31,614,000美元)已移交給歐洲國防局(EDA)。因此,該地區行業的這種趨勢預計將在預測期內推動碳預浸料市場的成長。

碳預浸料產業概況

全球碳預浸料市場整合,主要市場佔有率由前五名公司佔據。市場主要企業(排名不分先後)包括 TEIJIN LIMITED、Hexcel Corporation、TORAY INDUSTRIES, INC.、SGL Carbon、Solvay 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 重視綠色能源來源

- 對 CFRP 零件的需求增加

- 航太和國防領域的需求不斷成長

- 抑制因素

- 環保替代品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 樹脂型

- 熱固性

- 熱塑性塑膠

- 最終用戶產業

- 航太/國防

- 能源

- 車

- 休閒

- 電子產品

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- ACP Composites, Inc.

- Kordsa Teknik Tekstil AS

- Barrday Inc.

- Gurit Services AG, Zurich

- Hexcel Corporation

- Lingol Corporation

- Mitsubishi Chemical Corporation

- PARK AEROSPACE CORP.

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- THE YOKOHAMA RUBBER CO., LTD

- TORAY INDUSTRIES, INC.

- ZYVEX TECHNOLOGIES

第7章 市場機會及未來趨勢

- 擴大電子領域的應用

- 其他機會

The Carbon Prepreg Market size is estimated at USD 7.73 billion in 2024, and is expected to reach USD 12.01 billion by 2029, growing at a CAGR of 9.21% during the forecast period (2024-2029).

Due to the COVID-19 outbreak tourism sector was affected negatively which affected the aerospace industry. However, the easing of lockdowns and countries lifting travel restrictions led to increased traveling in the years 2021 and 2022 which helped the carbon prepreg market reach pre-pandemic levels.

Key Highlights

- Emphasis on green energy sources, growing demand from CFRP components, and the growing demand from the aerospace and defense industry are likely to act as drivers for the market over the forecast period.

- However, the availability of eco-friendly alternatives is likely to hinder the market growth during the forecast period.

- Increasing application in the electronics industry is likely to act as an opportunity in the future.

- Europe dominated the market across the world due increased demand from the defense sector.

Carbon Prepreg Market Trends

Increasing Demand from the Aerospace and Defence Industry

- Traditionally, manufacturers in aerospace turned to carbon composites for their significant weight reductions and cost savings compared to conventional aerospace materials, such as aluminum. Most aerospace composites use carbon prepregs as raw materials, with autoclave molding as a popular fabrication process. The aerospace industry is the greatest consumer of carbon prepregs for civil aircraft, military jets, helicopters, aero-engines or space satellites, and launchers.

- Carbon fiber composites are used in aerospace and defense applications due to their properties, such as high strength, stiffness, heat and chemical resistivity, and various other thermal and chemical properties.

- According to the Boeing Commercial Outlook 2022-2041, the global forecast for commercial aviation services (which include flight operations, maintenance and engineering, ground, station, and cargo operations, and others) by 2041 is expected to be USD 3,615 billion. It will likely boost the demand for the studied market in the coming years.

- Recently, aircraft manufacturers are looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041.

- Further, according to the report, the market size of aerospace services in Southeast Asia is expected to reach USD 245 billion and in Europe USD 850 million.

- This scenario in the aerospace industry is expected to continue driving the growth of the carbon prepreg market in the long term.

Europe to Dominate the Market

- Europe dominated the global carbon prepreg market. The German economy is the largest in Europe and the fifth-largest globally.

- Germany hosts many production bases for aircraft interior components, MRO (maintenance, repair, and overhaul), and lightweight construction and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- In Europe, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion. Thereby, the demand for optical coatings from aircraft manufacturing will likely rise in the region in the future.

- Further, according to the Boeing Commercial Outlook 2022-2041, the airline fleet in the region is expected to grow by 4.2% by 2041.

- Over 30 to 35 thousand new aircraft are estimated to be operational by the next 20 years to meet the rising aviation demand. Thus, the increase in aircraft production is also expected to contribute to the market growth during the forecast period.

- Further, in the year 2022, two new projects, which include Advanced Radar Technology in Europe (ARTURO) and Research in eco-designed ballistic systems for durable, lightweight protection against current and new threats in the platform and personal applications (ECOBALLIFE), were handed to the European Defense Agency (EDA) which are worth EUR 30 million (~USD 31.614 million).

- Hence, such trends in the industry in the region are expected to drive the market growth for carbon prepreg during the forecast period.

Carbon Prepreg Industry Overview

The global carbon prepreg market is consolidated, with the top five players accounting for a major market share studied. Major players in the market (not in any particular order) include TEIJIN LIMITED, Hexcel Corporation, TORAY INDUSTRIES, INC., SGL Carbon, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emphasis on Green Energy Sources

- 4.1.2 Growing Demand for CFRP Components

- 4.1.3 Growing Demand from the Aerospace and Defense Sector

- 4.2 Restraints

- 4.2.1 Availability of Eco-Friendly Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Energy

- 5.2.3 Automotive

- 5.2.4 Leisure

- 5.2.5 Electronics

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACP Composites, Inc.

- 6.4.2 Kordsa Teknik Tekstil A.S.

- 6.4.3 Barrday Inc.

- 6.4.4 Gurit Services AG, Zurich

- 6.4.5 Hexcel Corporation

- 6.4.6 Lingol Corporation

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 PARK AEROSPACE CORP.

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TEIJIN LIMITED

- 6.4.12 THE YOKOHAMA RUBBER CO., LTD

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 ZYVEX TECHNOLOGIES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Electronics

- 7.2 Other Opportunities