|

市場調查報告書

商品編碼

1273504

尿液分析市場 - 增長、趨勢和預測 (2023-2028)Urinalysis Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,尿液分析市場預計將以 7.5% 的複合年增長率增長。

COVID-19 爆發影響了尿液分析市場,因為醫院和醫療保健服務因社會疏遠而限制了服務。 冠狀病毒感染患者的空前增加減少了獲得其他初級保健服務的機會,並顯著減少了非 COVID-19 相關診斷,如尿路感染和腎臟疾病。 例如,根據 2021 年 7 月發表在《國際外科雜誌》上的一篇研究論文,在 COVID-19 大流行期間延遲或推遲的泌尿外科手術包括尿路感染、壓力性尿失禁、膀胱過度活動症 (OAB)、神經源性膀胱等。 同樣,2021 年 12 月發表在 ADIAN Journal 上的一項研究發現,接受初級保健服務的患者更少,診斷也更少,包括尿路結石。 同一消息來源還表示,在 2020 年 3 月 30 日至 4 月 24 日期間,英格蘭每週每 10 萬人的尿路結石診斷率從平均 30-35 人下降到不到 10 人。 自 4 月以來,它比正常情況增加了 50%。 因此,在大流行期間,市場出現了不利影響。 然而,由於放鬆管制和 COVID-19 病例減少,市場已開始蓄勢待發,預計在預測期內將繼續呈上升趨勢。

糖尿病和慢性腎病等慢性病負擔的增加、即時檢測適應症的擴大等預計將成為市場增長的主要驅動力。 尿路感染是影響泌尿系統任何部分的感染。 例如,根據國際糖尿病聯合會 (IDF) 2021 年 12 月更新,2021 年約有 5.37 億 20-79 歲的成年人患有糖尿病,到 2030 年將有 6 億。預計到 2045 年將增加到 4300 萬和 7.83 億. 據同一消息來源稱,四分之三的成人糖尿病患者生活在低收入和中等收入國家,其中近二分之一(2.4 億)未被確診。 根據同一消息來源,2021 年將有 670 萬人死於糖尿病。 尿液分析已被證明是確定糖尿病患者葡萄糖水平的重要測試。

此外,全球慢性腎病病例的增加預計也將在預測期內推動市場增長。 例如,慢性腎病(CKD)是一種腎功能在一段時間內下降的疾病。 它可以發展多年並導致終末期腎病 (ESRD)。 這是一個巨大的公共衛生問題。 例如,美國疾病預防控制中心 2021 年的一份報告估計,美國超過 15.0% 的成年人(約 3700 萬人)患有 CKD。 同樣,由國際腎髒病學會 (ISN) 和國際腎臟基金會聯合會 (IFKF) 聯合組織的 2021 年世界腎臟日發布的數據顯示,腎臟疾病影響著全球約 8.5 億人。 同一份文件還報告說,每 10 個成年人中就有 1 個患有慢性腎病 (CKD)。 CKD 的全球負擔持續增加,預計到 2040 年將成為全球損失生命年的第五大原因。

雖然市場有望增長,但與尿液分析相關的嚴格監管框架可能會阻礙預測期內的市場增長。

尿液分析市場趨勢

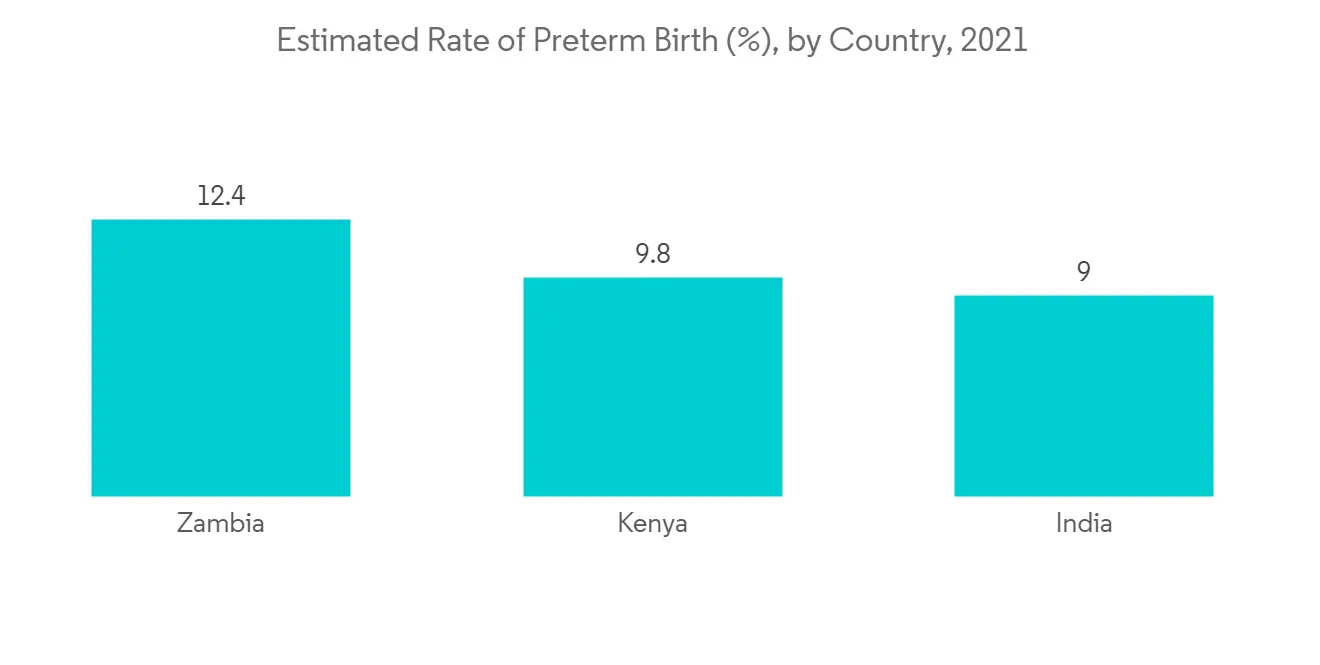

預計在預測期內懷孕和不育面積將顯著增長

尿液分析可用於診斷糖尿病、脫水、腎臟或膀胱感染以及先兆子癇。 高血糖可能是妊娠糖尿病的徵兆,可能出現在懷孕第 20 週左右。 人絨毛膜促性腺激素 (hCG) 是一種獨特的激素,僅在懷孕期間才會在女性體內產生,並可在妊娠試驗中檢測到。 這些測試可以在血液和尿液中尋找 hCG。 懷孕的家庭尿液檢測價格實惠且受歡迎。 如果正確完成,家庭妊娠試驗是相當準確的。

越來越多地使用尿液檢測來檢測懷孕和不孕症,預計將推動這一細分市場的增長。 已經進行了幾項研究來了解尿檢確定懷孕的準確性。 例如,美國國立衛生研究院在 2021 年 9 月發表的一篇論文指出,導致患者尿液妊娠試驗 (UPT) 假陰性的原因一般有兩種可能,我來了。 早孕病例是指患者可能無法產生足夠的人絨毛膜促性腺激素 (hCG) 而呈陽性。 從 15 到 100 mIU/mL 的閾值代表第一種也是最可能的情況。 其次,更令人擔憂的是,晚期妊娠患者可能會出現“鉤子效應”(hCG 的升高或過量會淹沒尿液妊娠試驗,從而導致假陰性)。 雖然也有尿檢呈陰性的情況,但它是懷孕的首選檢查。 此外,主要參與者繼續推出妊娠試驗也有望促進這一細分市場的增長。 例如,2022年4月,Mankind Pharma推出了一款用於驗尿確認懷孕的快速驗孕儀。

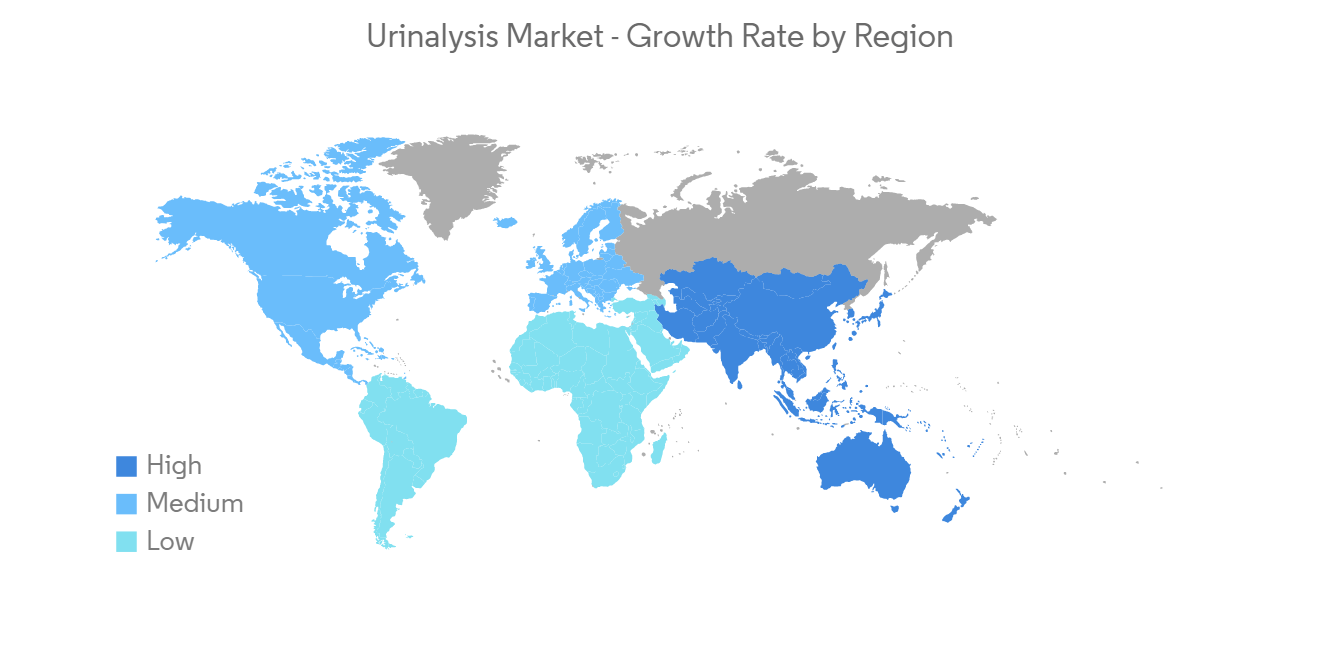

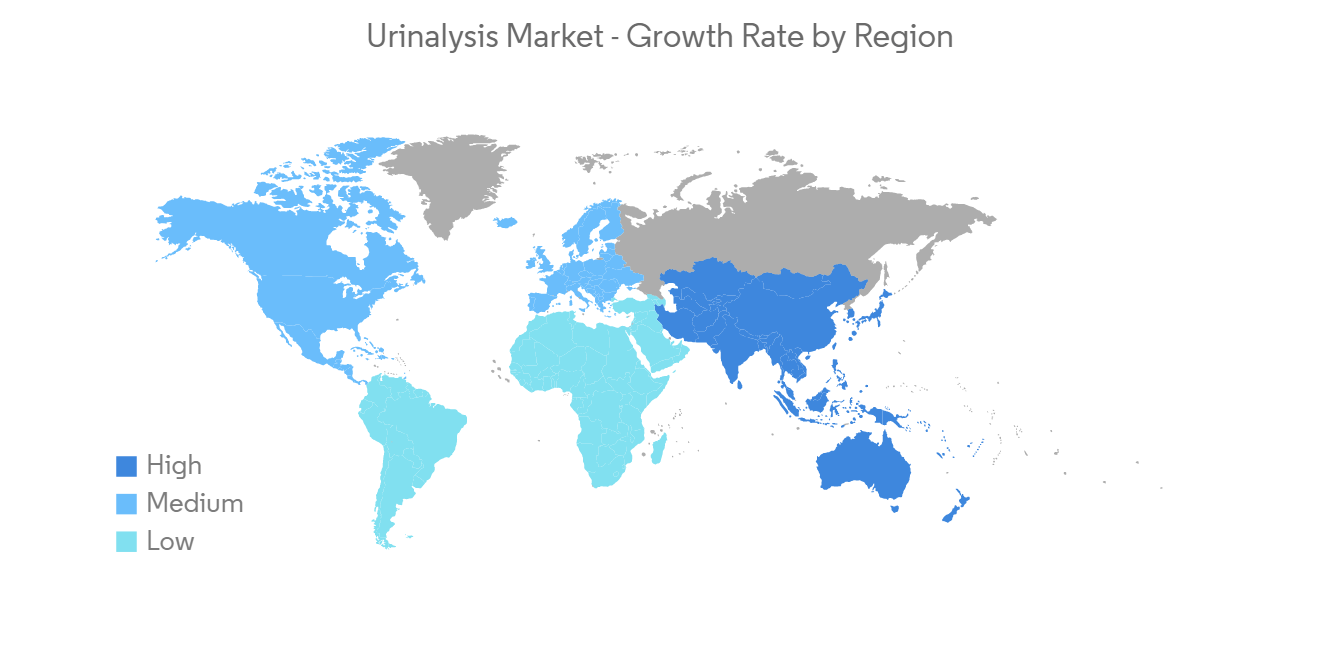

預計在預測期內北美將佔很大份額

由於社會老齡化和慢性腎髒病的高患病率,預計北美將佔據全球尿液分析市場的很大份額。 慢性腎病與腎功能衰竭有關。 根據國家腎臟基金會發布的 2021 年數據,慢性腎髒病導致的死亡人數超過乳腺癌或前列腺癌。 根據同一數據,約有 3700 萬人受到影響。 它在老年人中很常見,影響了大約 15.0% 的成年人口。 因此,該地區需要對慢性腎髒病進行適當的診斷和治療,這有望推動對尿液分析的需求。

主要產品的發布、市場參與者和製造商的高度集中、主要參與者之間的收購和合作以及美國尿石症和慢性腎病病例的增加將推動該國尿液分析市場的增長。部分因素。 例如,2021 年 11 月發表的一篇 NCBI 論文發現,單純性尿路感染的患病率很高,估計有 40% 的美國女性在其一生中會患上尿路感染 (UTI)。據說是可能的。 此外,根據《2020 年世界人口老齡化報告》,美國 65 歲及以上人口的數量到 2030 年將達到 8481.3 萬人,預計到 2050 年將上升到 22.4%。 隨著泌尿系統疾病的患病率隨著年齡的增長而增加,預計老年人口的增加也將推動該國的市場增長。

尿液分析行業概覽

尿液分析市場競爭相對激烈,只有少數公司在全球和本地開展業務。 每家公司都在做出戰略努力,以增加他們在尿液分析市場的影響力。 目前,主要參與者包括 Cardinal Health Inc.、Alere (Abbott Laboratories)、Beckman Coulter Inc.、Siemens Healthineers、Roche Diagnostics、Sysmex Corporation、Bio-Rad Laboratories Inc、Arkray Inc、Acon Laboratories Inc、Becton、Dickinson、Company 等.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 慢性腎髒病的負擔不斷增加

- 越來越喜歡即時檢測

- 市場製約因素

- 嚴格的監管框架

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(市場規模:金額)

- 按產品類型

- 分析儀器

- 自動分析儀

- 半自動分析儀

- 床旁分析儀

- 消耗品

- 試劑和試劑盒

- 試紙

- 一次性的

- 分析儀器

- 按測試類型

- 生化測試

- 妊娠和不孕症測試

- 沉積物

- 通過使用

- 疾病特異性篩查

- 懷孕/不孕

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Abbott Laboratories(Alere)

- Acon Laboratories Inc.

- Arkray Inc.

- Beckman Coulter Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Cardinal Health Inc.

- Roche Diagnostics

- Siemens Healthineers

- Sysmex Corporation

第七章市場機會與未來趨勢

The urinalysis market is expected to register a CAGR of 7.5% over the forecast period.

The outbreak of COVID-19 impacted the urinalysis market, as hospitals and healthcare services restricted services due to social distancing measures. The unprecedented increase in coronavirus-infected patients reduced access to other primary care services and resulted in a significant drop in non-COVID-19-related diagnoses, such as urinary tract infections or kidney diseases. For instance, according to a research article published in the International Journal of Surgery in July 2021, during the COVID-19 pandemic, urological procedures delayed or postponed included urinary tract infections, stress incontinence, overactive bladder (OAB), and neurogenic bladder. Similarly, according to a December 2021 study published in the ADIAN Journal, fewer patients adopted primary care services, and fewer diagnoses were done, including UTIs. The source also reports that between March 30 and April 24, 2020, the weekly rate of UTI diagnosis per 100,000 population fell from an average of 30-35 to less than 10 in England. Since April, the rate has risen by 50% of the usual rate. Thus, the market witnessed an adverse impact during the pandemic. However, with the ease of restrictions and declining cases of COVID-19, the market started to gain momentum and is expected to continue the upward trend over the forecast period.

The higher burden of chronic diseases such as diabetes and chronic kidney diseases and the rising adaptation of point-of-care testing is expected to be the major contributing factors to the market growth. Urinary tract infection refers to an infection in any part of the urinary system. For instance, as per a December 2021 update by the International Diabetes Federation (IDF), in 2021, approximately 537.0 million adults (20-79 years) had diabetes, which is projected to rise to 643.0 million by 2030 and 783.0 million by 2045. As per the same source, 3 in 4 adults with diabetes live in low- and middle-income countries and almost 1 in 2 (240 million) of them are undiagnosed. The source also reports that diabetes caused 6.7 million deaths in 2021. To identify the glucose level in diabetic people, urine analysis has proven to be an important test.

Furthermore, increasing cases of chronic kidney diseases across the globe are also expected to propel market growth over the forecast period. For instance, chronic kidney disease (CKD) is a condition that causes reduced kidney function over some time. It may develop over many years and lead to end-stage kidney (or renal) disease (ESRD). It has become an enormous public health issue. For instance, as per the 2021 report by the CDC, more than 15.0% of adults in the United States, amounting to approximately 37.0 million people, were estimated to have CKD. Similarly, in 2021, as per data released on World Kidney Day, a joint initiative of the International Society of Nephrology (ISN) and the International Federation of Kidney Foundations (IFKF), kidney disease affected around 850.0 million people globally. The same source also reported that one in ten adults has chronic kidney disease (CKD). The global burden of CKD is continuously increasing and is projected to become the 5th most common cause of years of life lost globally by 2040.

While the market is poised for growth, stringent regulatory frameworks related to urinalysis may hinder market growth over the forecast period.

Urinalysis Market Trends

The Pregnancy & Fertility Segment is Expected to Witness Considerable Segment Growth Over the Forecast Period

A urine test can be used to diagnose diabetes, dehydration, kidney or bladder infections, and preeclampsia. High sugar levels may be a sign of gestational diabetes, which may appear around week 20 of pregnancy. Human chorionic gonadotropin (hCG), a unique hormone that only arises in a woman's body during pregnancy, is what pregnancy tests seek. These tests can check for hCG in the blood or urine. Home urine tests for pregnancy are affordable and often used. Home pregnancy tests are fairly accurate when done correctly.

The increasing use of urinalysis for pregnancy and fertility detection is anticipated to propel segment growth. Several studies have been conducted to understand the accuracy of urinalysis in judging pregnancy. For instance, an article published in September 2021 by the National Institute of Health stated that, in general, there are two possible causes for a patient to have an erroneously negative Urine Pregnancy Test (UPT). Early pregnancy cases are where a patient may not produce enough human chorionic gonadotropin (hCG) to result in a positive test. A threshold that allegedly ranges from 15 to 100 mIU/mL represents the first and most likely scenario. Secondly, the circumstance that may be more worrisome is patients who are farther along in their pregnancy and suffer the "hook effect," which is when elevated or excessive amounts of hCG overwhelm the urinary pregnancy test and cause a false negative. Despite the certain cases where urine tests provide negative results, it is considered as the first line of diagnosis for pregnancy. Furthermore, continuous new launches of pregnancy tests by key players are also expected to augment the segment growth. For instance, in April 2022, Mankind Pharma launched a rapid-testing pregnancy device that is used for urinalysis to confirm pregnancy.

North America is Expected to Hold a Significant Share Over the Forecast Period

North America is expected to hold a major market share in the global urinalysis market due to the increasing aging population and higher prevalence of chronic kidney diseases. Chronic kidney disease is associated with kidney failure. According to 2021 data published by the National Kidney Foundation, chronic kidney disease causes more death than breast cancer and prostate cancer. The same source also stated that around 37.0 million people are affected by it. It is more prevalent in an older population, affecting approximately 15.0% of the adult population. Hence, the need for proper diagnosis and treatment of chronic kidney diseases in the region is expected to propel the demand for urinalysis.

Key product launches, high concentration of market players or manufacturers' presence, acquisitions and partnerships among major players, and rising cases of UTIs and chronic kidney diseases in the United States are some of the factors driving the growth of the urinalysis market in the country. For instance, as per an article published by the NCBI in November 2021, the prevalence of uncomplicated urinary tract infections is high, and an estimated 40% of women in the United States are likely to develop a Urinary Tract Infection (UTI) during their lifetime. Furthermore, the World Population Ageing Report 2020 stated that, in the United States, the number of people aged above 65 is projected to reach 84,813 thousand by 2030 and the 65-and-older age group's share in the total population may rise from 16.2% in 2021 to 22.4% by 2050. The prevalence of urological disorders increases with age, owing to which the increasing geriatric population is also expected to propel the market growth in the country.

Urinalysis Industry Overview

The urinalysis market is moderately competitive due to the presence of a few players operating globally as well as regionally. Companies are taking strategic initiatives to grow their presence in the urinalysis market. Currently, some of the major players include Cardinal Health Inc., Alere (Abbott Laboratories), Beckman Coulter Inc., Siemens Healthineers, Roche Diagnostics, Sysmex Corporation, Bio-Rad Laboratories Inc., Arkray Inc., Acon Laboratories Inc., Becton, Dickinson, and Company among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Chronic Kidney Disease

- 4.2.2 Rising Preference for Point of Care Testing

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory framework

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD Million)

- 5.1 By Product Type

- 5.1.1 Instruments

- 5.1.1.1 Automated Analyser

- 5.1.1.2 Semi-automated Analyzer

- 5.1.1.3 Point of Care Analyzer

- 5.1.2 Consumables

- 5.1.2.1 Reagents & Kits

- 5.1.2.2 Dipsticks

- 5.1.2.3 Disposables

- 5.1.1 Instruments

- 5.2 By Test Type

- 5.2.1 Biochemical

- 5.2.2 Pregnancy & Fertility

- 5.2.3 Sediment

- 5.3 By Application

- 5.3.1 Disease Screening

- 5.3.2 Pregnancy & Fertility

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories (Alere)

- 6.1.2 Acon Laboratories Inc.

- 6.1.3 Arkray Inc.

- 6.1.4 Beckman Coulter Inc.

- 6.1.5 Becton, Dickinson and Company

- 6.1.6 Bio-Rad Laboratories Inc.

- 6.1.7 Cardinal Health Inc.

- 6.1.8 Roche Diagnostics

- 6.1.9 Siemens Healthineers

- 6.1.10 Sysmex Corporation

![尿細胞分析儀市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1342043.png)