|

市場調查報告書

商品編碼

1436066

離網太陽能:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Off-Grid Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

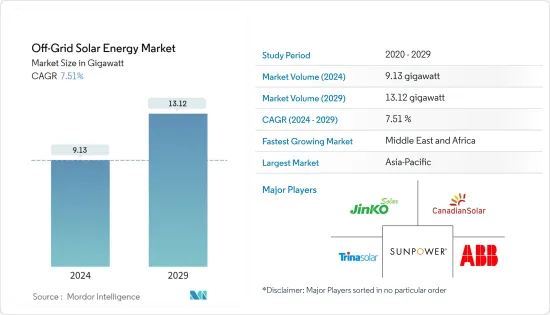

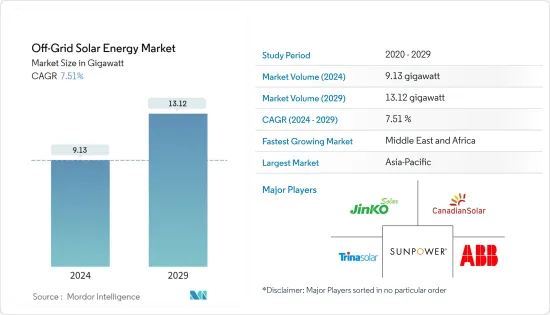

離網太陽能市場規模預計到2024年為9.13吉瓦,預計2029年將達到13.12吉瓦,在預測期內(2024-2029年)複合年成長率為7.51%。

冠狀病毒感染疾病(COVID-19)對 2020 年市場產生了負面影響。現在,市場可能達到大流行前的水平。

主要亮點

- 從長遠來看,太陽能電池板和電池價格下降等因素預計將推動市場。

- 另一方面,高昂的安裝成本和不良的維護實踐正在阻礙市場的成長。

- 儘管如此,美國、英國、德國、中國和印度等國家已經制定了雄心勃勃的目標,以增加可再生能源在其能源結構中的佔有率。這些國家的政府還計劃在未來幾年透過安裝住宅和離網太陽能系統來增加可再生能源的佔有率。這些預計將為離網太陽能市場創造巨大機會。

- 中東和非洲地區預計將主導市場成長,主要是由於非洲地區缺乏中央電網和穩定的電力供應而導致電力需求增加。

離網太陽能市場趨勢

住宅領域預計將主導市場

- 近年來,離網太陽能發電系統由於具有自我維持能力,在住宅領域越來越受歡迎。儘管離網系統和相關組件的安裝成本相對較高,但消費者變得更加自力更生,且不易受到因電網故障或停電而導致電力短缺的影響。

- 截至2021年,全球離網裝置容量為551吉瓦,而2020年為513吉瓦,成長率近7.5%。預計該成長率在預測期內將會增加。

- 此外,離網系統為偏遠地區提供電力解決方案,在這些地區,電網連接是當地電氣化的主要限制。這些地區的最終用戶主要是住宅領域。離網太陽能發電系統有利於獨立和永續發電。

- 在預測期內,由於太陽能發電成本下降、政府對住宅太陽能發電的支持政策、FIT計劃和激勵措施以及各國政府為太陽能設定的目標,對離網太陽能發電系統的需求預計將增加。

- 不斷的技術改進推動了成本降低,例如提高光伏組件的效率。這些高度模組化技術的工業化帶來了令人印象深刻的效益,從規模經濟和競爭加劇到改進的製造流程和有競爭力的供應鏈。

預計中東和非洲將主導市場成長

- 中東和非洲對離網太陽能發電系統的需求預計將大幅成長,這些地區的電力主要來自石化燃料。這些石化燃料排放碳並污染環境。

- 在這些地區的大多數國家,減少碳排放的壓力越來越大,太陽能的巨大潛力預計將為離網太陽能系統鋪平道路。許多國家配電系統的不可靠性增加了對離網太陽能發電系統的需求。

- 歷史上,該地區一直依賴柴油發電機供電。儘管如此,近年來太陽能出現了重大轉變,這主要是由於最近太陽能板和太陽能逆變器的價格下降。據世界銀行稱,估計有 6 億非洲人用不到電。鑑於將電力線路延伸到偏遠地區的成本高昂,該地區離網太陽能發電量大幅增加。

- 例如,2022年9月,德國永續性能源服務供應商Kowry Energy宣布已在西非三個國家成功試運行分散式太陽能發電系統。 Kowry Energy 在塞內加爾、奈及利亞和馬利共和國設計並運作了四個離網太陽能系統。最近推出的計劃是這些國家三年內完成的多個形成組合中的第一個。

離網太陽能產業概況

離網太陽能市場較為分散。市場主要企業包括(排名不分先後)ABB Ltd、阿特斯陽光電力有限公司、晶科能源控股公司、SunPower Corporation、天合光能有限公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查範圍

- 市場定義

- 調查先決條件

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028 年之前的市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19感染疾病對市場的影響

第5章市場區隔

- 最終用戶

- 住宅

- 商業和工業

- 地區 [2028 年之前的市場規模和需求預測(僅限地區)]

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 義大利

- 挪威

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 韓國

- 日本

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- ABB Ltd

- Schneider Electric Infrastructure Ltd

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd

- SunPower Corporation

- Trina Solar Ltd

- LONGi Green Energy Technology Co. Ltd

- JA Solar Holding

- Sharp Corporation

- Tesla Inc.

第7章市場機會與未來趨勢

The Off-Grid Solar Energy Market size is estimated at 9.13 gigawatt in 2024, and is expected to reach 13.12 gigawatt by 2029, growing at a CAGR of 7.51% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors like decreasing the price of solar panels and batteries are expected to drive the market.

- On the other hand, high installation costs and poor maintenance practices hinder the market's growth.

- Nevertheless, nations like the United States, the United Kingdom, Germany, China, India, and others have set up ambitious targets to increase the renewable share in their energy mix. Governments across these nations have also planned to increase the renewable energy share by deploying residential and off-grid solar PV systems in the coming years. These are expected to create enormous opportunities for the off-grid solar energy market.

- Middle-East and Africa region is expected to dominate the market growth primarily due to the increasing demand for electricity due to the lack of a central grid and reliable electricity supply, mainly in the African region.

Off-Grid Solar Energy Market Trends

Residential Segment Expected to Dominate the Market

- The off-grid solar system has been gaining popularity in recent years for the residential sector as it is self-sustaining. Although installing off-grid systems and associated parts is relatively expensive, the consumer becomes more self-reliant and is unaffected by power shortages due to grid failures and shutdowns.

- As of 2021, the global off-grid installed capacity was at 5.51 GW compared to 5.13 GW in 2020, registering a growth rate of almost 7.5%. This growth rate is expected to increase during the forecasted period.

- Moreover, the off-grid system provides power solutions to remote areas where grid connectivity is a major restraint in the region's electrification. Mainly end-users from residential sectors are present in those areas. Off-grid solar systems can facilitate independent and sustainable electricity generation.

- During the forecast period, the demand for off-grid solar systems is expected to increase on account of decreasing solar PV costs, supportive government policies for residential solar PV, FIT programs and incentives, and targets set by various governments for solar energy.

- The cost reductions are driven by continuous technological improvements, including higher solar PV module efficiencies. The industrialization of these highly modular technologies has yielded impressive benefits, from economies of scale and greater competition to improved manufacturing processes and competitive supply chains.

Middle-East and Africa Expected to Dominate the Market Growth

- The demand for off-grid solar systems is expected to witness significant growth in the Middle East and Africa, mainly because these countries primarily generate electricity from fossil fuels. These fossil fuels generate carbon emissions that pollute the environment.

- The increasing pressure of reducing carbon emissions and the high solar energy potential in most of the countries in these regions is expected to make way for the off-grid solar energy system. The unreliable power distribution system in many countries has increased the demand for off-grid solar systems.

- Historically, the region has relied on diesel generators for electricity supply. Still, recently there has been a significant shift towards solar energy mainly due to declining prices of solar panels and solar inverters in recent years. According to the World Bank, an estimated 600 million Africans have no access to electricity. Given the high cost of extending transmission lines into remote areas, off-grid solar has witnessed a significant rise in the region.

- For instance, in September 2022, German sustainability energy service provider Kowry Energy announced the successful commissioning of decentralized solar systems in three countries of West Africa. Kowry Energy has designed and commissioned four off-grid solar energy systems in Senegal, Nigeria, and Mali. The recently installed projects are the first of several forming portfolios in these countries that will be completed within three years.

Off-Grid Solar Energy Industry Overview

The Off-grid solar energy market is fragmented. Some of the key players in the market (in no particular order) include ABB Ltd, Canadian Solar Inc., JinkoSolar Holding Co., Ltd, SunPower Corporation, and Trina Solar Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 Norway

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Japan

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 Qatar

- 5.2.4.3 South Africa

- 5.2.4.4 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Chile

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Schneider Electric Infrastructure Ltd

- 6.3.3 Canadian Solar Inc.

- 6.3.4 JinkoSolar Holding Co., Ltd

- 6.3.5 SunPower Corporation

- 6.3.6 Trina Solar Ltd

- 6.3.7 LONGi Green Energy Technology Co. Ltd

- 6.3.8 JA Solar Holding

- 6.3.9 Sharp Corporation

- 6.3.10 Tesla Inc.