|

市場調查報告書

商品編碼

1273397

醫用氧氣瓶市場 - 增長、趨勢、COVID-19 的影響和預測 (2023-2028)Medical Oxygen Gas Cylinders Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計在預測期內,醫用氧氣瓶市場的複合年增長率為 5.4%。

COVID-19 大流行導致對醫用氧氣瓶的需求增加,因為 COVID-19 感染者經歷了缺氧和呼吸困難。 那裡有氧氣瓶和濃縮器支持病人的正常呼吸。 高流量經鼻吸氧被認為是對 COVID-19 患者有效且安全的治療方法。 根據世衛組織 2021 年 2 月的最新消息,在大流行初期,中低收入國家超過 500,000 名 COVID-19 患者每天需要 110 萬個氧氣瓶。 疫情期間,醫用氧氣瓶的供應成為各國政府的當務之急。 包括印度、巴西和約旦在內的幾個國家報告稱,在大流行高峰期出現氧氣短缺。

此外,根據 2022 年 1 月在 NLM 上發表的一篇論文,醫用氧氣是 COVID-19 大流行期間重要的救生資源。 COVID-19 肺炎引發的低氧血症是一種潛在的致命並發症,需要補充氧氣來控制。 印度的第二波 COVID-19 增加了氧氣需求並造成了氧氣危機。 然而,隨著大流行後對醫用氧氣的需求減少,預計市場增長將放緩。

醫用氧氣市場受到哮喘、慢性阻塞性肺病 (COPD)、肺癌、囊性纖維化、睡眠呼吸暫停、職業性肺病等慢性呼吸系統疾病患病率上升的推動,預計在預測期間將增長由於技術先進產品的可用性和老年人口的增加等因素。 醫用氧氣瓶主要用於醫院重症監護病房和家庭護理設施。 氧氣瓶供有呼吸系統疾病和行動不便的老年人使用。 慢性支氣管炎和阻塞性肺病也需要氧氣瓶。

例如,根據世界衛生組織 2022 年更新,哮喘是影響兒童和成人的主要非傳染性疾病 (NCD)。 它是兒童中最常見的慢性疾病。 在這種情況下,氧氣瓶被用來穩定病人,從而促進市場增長。 此外,老年人口的增加是市場增長的主要因素之一。 在家庭護理環境和 ICU 醫院,與年齡相關的呼吸困難和其他合併症需要氧氣瓶和呼吸機來提供外部呼吸支持。 此外,呼吸健康意識將促進市場增長,因為公眾和醫生可以了解在呼吸健康中使用氧氣面罩和氣瓶的重要性。

例如,WHO 和 FIRS 已將 2022 年 9 月 25 日定為 2022 年世界肺日,以提高全球意識並採取行動改善肺部健康。

此外,氧氣瓶領域的技術進步是市場增長的主要驅動力之一。 2021 年 7 月,IIT Ropar 開發了一種名為“AMLEX”的輸氧裝置,它在吸氣時為患者提供所需的氧氣量,在患者呼出 CO2 時跳閘。 這個過程節省了不必要地浪費的氧氣。 該設備使用便攜式電源(電池)和線路電源 (220V-50Hz)。 此外,2021 年 2 月,Inox Air Products Ltd. 將投資 2,000 印度盧比(2.43 億美元),在未來 36 個月內將其醫用氧氣產能擴大 50%。與此同時,印度各地已安裝了 8 個新的空分裝置. 這是對印度醫療保健基礎設施的重要推動。

因此,由於上述因素,預計醫用氧氣瓶市場在預測期內將呈現增長態勢。 然而,嚴厲的監管情景可能會抑制市場增長。

醫用氧氣瓶市場趨勢

預計在預測期內,移動領域將佔據很大的市場份額

醫用氧氣瓶是便攜式的,存儲容量可達10升,容量為10升以上。 便攜式醫用氧氣瓶通常用於醫院急救室、救護車和家庭。 鋁製氣瓶因其便攜性和重量輕而成為患者轉運的首選。 便攜式醫用氧氣瓶由於其廣泛的應用和採用,預計將佔據主要份額。 便攜式氧氣瓶便於運輸,比大瓶更容易在各種環境中使用。 例如,根據 ALA 2022 更新,便攜式氧氣瓶/濃縮器重量輕、結構緊湊、易於運輸且處理高效,可以在旅途中補充氧氣。

預計在預測期內,不斷增長的老年人口將推動便攜式醫用氧氣瓶市場。 臥床不起的老年患者更有可能使用緊急氧氣瓶來體驗穩定的呼吸。 例如,根據《WPP 2022》報告,全球65歲及以上人口的比例預計將從2022年的10%上升到2050年的16%。 到 2022 年,全球 65 歲及以上的人口預計將達到 7.71 億。 預計到 2030 年,老年人口將達到 9.94 億,到 2050 年將達到 16 億。 由於便攜式醫用氧氣瓶易於搬運和移動,老年人傾向於使用便攜式醫用氧氣瓶,這正在推動市場增長。

此外,在便攜式氧氣瓶領域,競爭對手的存在、產品發布和合作可能會促進市場增長。 這些因素預計將對市場產生積極影響,因為它們可以增加市場上的產品可用性以及競爭加劇。

例如,2022 年 9 月,總部位於甘托克的初創公司 O2 Himalaya 將提供至少 350 口呼吸,作為急救和立即緩解在山區徒步旅行時出現呼吸問題的患者。我們計劃推出便攜式氧氣氣缸提供 該產品可能會賣得很好,因為國家旅遊局要求高海拔旅行的人在船上使用氧氣。 此外,可以為適合化療的晚期肺癌患者開具長期氧療 (LTOT) 處方。 在這種情況下,肺癌患者很可能會採用便攜式醫用氧氣瓶,從而推動預測期內的市場增長。

因此,考慮到上述因素,便攜式醫用氧氣瓶在預測期內可能會出現增長。

預計在預測期內,北美將佔據很大的市場份額。

預計北美將佔據醫用氧氣瓶市場的很大份額。 隨著醫用氧氣瓶越來越受歡迎,預計在預測期內類似情況將繼續存在。 氧氣瓶可用於慢性阻塞性肺病、肺氣腫和慢性支氣管炎患者池。

根據 AAFA 2022 報告,美國約有 2500 萬人患有哮喘。 哮喘與性別、種族、民族和社會經濟水平等因素有關,在兒童時期,男性比女性更常見。 成年後,性別差距逆轉,女性比男性更容易患哮喘。

此外,該地區存在的競爭對手、合併、聯盟和政府舉措正在推動市場的增長。 例如,到 2022 年 4 月,印度將有 4,055 家變壓吸附 (PSA) 工廠,包括那些在 PM-CARES 下運營的工廠,以提高設施級醫用氧氣生產和供應能力。 此外,根據 AAFA 2021 年 4 月的統計數據,美國約有 2000 萬 18 歲及以上的成年人患有哮喘。 因此,此類疾病的流行表明該國對氧氣瓶的需求穩定。 因此,它正在為美國氧氣瓶市場的增長做出貢獻。

此外,根據 2021 年加拿大哮喘報告,哮喘是加拿大第三大常見慢性病,影響著超過 380 萬加拿大人的生活。

以上統計數據表明,隨著哮喘患病率的增加,對醫用氧氣瓶的需求也在增加。 因此,預計北美地區在預測期內將佔據很大的市場份額。

醫用氧氣瓶行業概況

醫用氧氣瓶市場競爭適中,全球有多家參與者。 例如,Invacare Corporation、Medical Depot、Me.Ber.SRL、B.N.O.S. Meditech Ltd、OrientMEd International、Royax、O2 CONCEPTS、Precision Medical Inc.、Catalina Cylinders 和 Luxfer Gas Cylinders 等公司在調查市場中佔有很大份額.佔據

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 慢性呼吸道疾病患病率上升

- 技術先進產品的可用性

- 老年人口增加

- 市場製約因素

- 嚴格的監管場景

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(基於價值的市場規模)

- 按產品類型

- 便攜式

- 重

- 按產品尺寸

- 少於 10 升

- 10 升到 50 升

- 50 升或更多

- 最終用戶

- 醫院

- 家庭保健

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Invacare Corporation

- Medical Depot

- Desco Medical India

- B.N.O.S. Meditech Ltd

- ProRack Gas Control Products

- Royax

- O2 CONCEPTS

- Precision Medical Inc.

- Catalina Cylinders

- Luxfer Gas Cylinders

第七章市場機會與未來趨勢

The medical oxygen gas cylinders market is expected to register a CAGR of 5.4% during the forecast period.

The COVID-19 pandemic led to increased demand for medical oxygen gas cylinders as COVID-19-affected people experienced oxygen deficiency and breathing difficulties. So, oxygen cylinders and concentrators supported patients in normal breathing. High-flow nasal oxygen was considered an efficient and safe treatment for COVID-19 patients. According to the WHO February 2021 update, during the initial phases of the pandemic, more than half a million COVID-19 patients in low and middle-income countries required 1.1 million cylinders of oxygen per day. The supply of medical oxygen gas cylinders became a high priority for governments during the pandemic. Several countries, such as India, Brazil, and Jordan, reported oxygen shortages during the peak of the pandemic.

Furthermore, as per the article published in NLM in January 2022, medical oxygen became a critical lifesaving resource during the COVID-19 pandemic. Hypoxemia triggered by COVID-19 pneumonia was a potentially fatal complication that required oxygen supplementation to manage. During the second wave of COVID-19 in India, oxygen demand increased, resulting in an oxygen crisis. However, market growth is expected to slow down with the decreasing need for medical oxygen in the post-pandemic scenario.

The medical oxygen market is anticipated to grow during the forecast period owing to the factors such as the rise in the prevalence of chronic respiratory diseases, like asthma, chronic obstructive pulmonary disease (COPD), lung cancer, cystic fibrosis, sleep apnoea and occupational lung diseases, the availability of technologically advanced products, and an increase in the geriatric population. Medical oxygen gas cylinders are majorly used in the hospital ICU unit and home care settings. They are used by geriatric people with respiratory diseases having mobility issues. Oxygen cylinders are also required in chronic bronchitis and obstructive pulmonary diseases.

For instance, according to the WHO 2022 update, asthma is a major noncommunicable disease (NCD) affecting children and adults. It is the most common chronic disease among children. In such a scenario, oxygen cylinders are utilized to stabilize patients, hence boosting market growth. Additionally, an increase in the geriatric population is one of the major factors for market growth. The geriatric population in homecare settings and ICU hospitals needs oxygen cylinders or ventilators as external support for breathing due to age-related difficulties or other comorbidities. Moreover, awareness regarding respiratory health drives market growth as the public and health can understand the importance of utilizing oxygen masks and cylinders in respiratory health.

For instance, WHO and FIRS designated '25th September 2022' as World Lung Day 2022 to raise global awareness and action toward better lung health.

Furthermore, technological advancements in the field of oxygen gas cylinders are one of the major driving factors for market growth. In July 2021, IIT Ropar developed an oxygen rationing device named 'AMLEX' that supplies a required volume of oxygen to the patient during inhalation and trips when the patient exhales CO2. This process saves oxygen which otherwise unnecessarily gets wasted. The device can operate on a portable power supply (battery) and a line supply (220V-50Hz). Furthermore, in February 2021, INOX-Air Products Inc. invested an amount of INR 2,000 (USD 243 million) crore in expanding the medical oxygen capacity of the company by 50%, with eight new air separation units across India over the next 36 months. It provides a critical boost to the medical infrastructure in India.

Hence, as per the factors mentioned above, the medical oxygen gas cylinder market is anticipated to witness growth during the forecast period. However, stringent regulatory scenarios are likely to restrain the market growth.

Medical Oxygen Gas Cylinders Market Trends

Portable Segment is Expected to Hold a Significant Share in the Market During the Forecast Period

Medical oxygen gas cylinders are portable with up to 10 liter of storage capacity and more than 10 liter of capacity. Portable medical oxygen gas cylinders are usually used in hospital emergency units, ambulances, and homes. Aluminum cylinders are easier to carry and are preferred during patient transfer due to their lightweight. The portable medical oxygen cylinder segment is expected to hold a major share because of its wide application and adoption. They are easy to move and can be easily employed in different settings compared to bigger cylinders. For instance, as per the ALA 2022 update, portable oxygen cylinders/concentrators are light and small, allowing supplemental oxygen while out of the home due to their ease of moving and handling efficiencies.

An increase in the geriatric population is anticipated to drive the portable medical oxygen cylinders market during the forecast period. Bedridden geriatric patients are likely to use emergency oxygen supplies to experience stable breathing. For instance, as per the 'WPP 2022' report, the share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. In 2022, there are expected to be 771 million people aged 65 years or over globally. The older population is projected to reach 994 million by 2030 and 1.6 billion by 2050. Since portable medical oxygen cylinders are easy to handle and move, the geriatric population tends to adopt portable cylinders thereby boosting the market growth.

Furthermore, the presence of competitors, product launches, and collaboration in the field of portable oxygen cylinders are likely to boost market growth. These factors can increase the product's availability in the market along with greater competition, which is anticipated to impact the market positively.

For instance, in September 2022, Gangtok-based start-up O2 Himalaya is set to launch a portable oxygen canister that offers at least 350 puffs, acts as first aid care, and provides immediate relief to patients with breathing issues while trekking in the mountains. The product is likely to sell with the State Tourism Department, requiring parties involved in high-altitude trips to have oxygen in their vehicles. Additionally, long-term oxygen therapy (LTOT) is sometimes prescribed for patients with advanced lung cancer who are potential candidates for chemotherapy. In such instances, there is a high chance of adopting portable medical oxygen gas cylinders for lung cancer patients, thereby boosting the market growth over the forecast period.

Hence, considering the above-mentioned factors, portable medical oxygen gas cylinders are likely to witness growth in the forecast period.

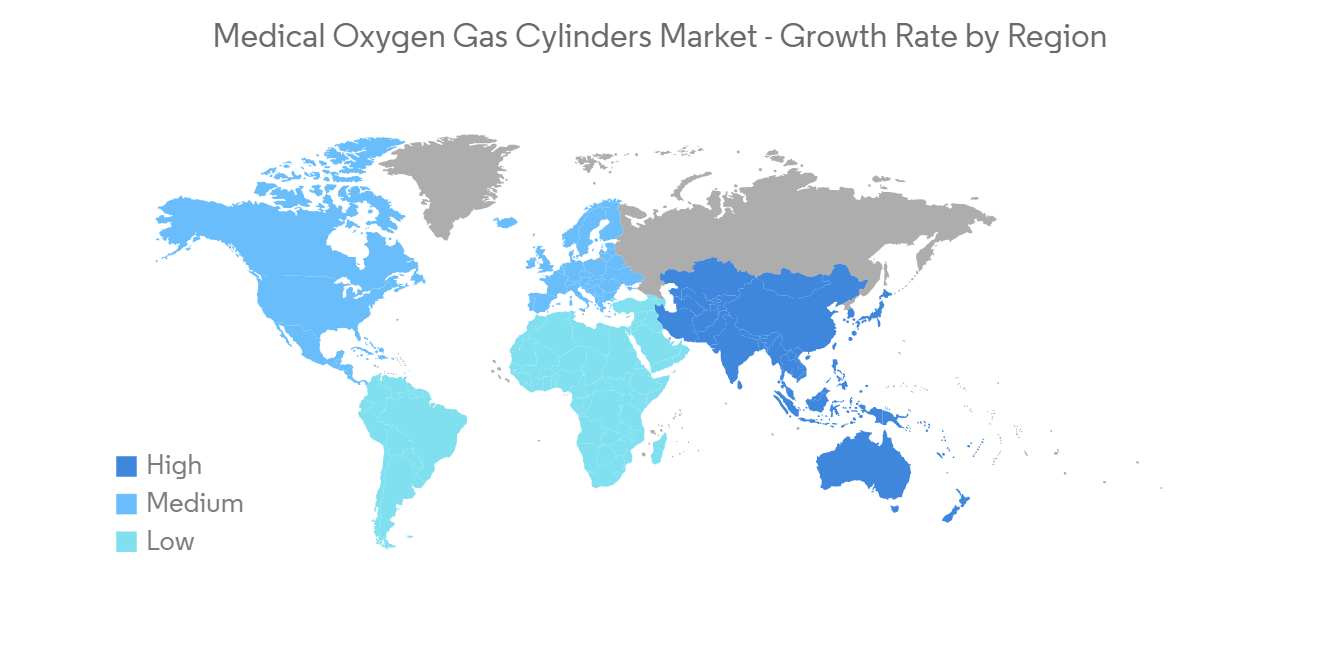

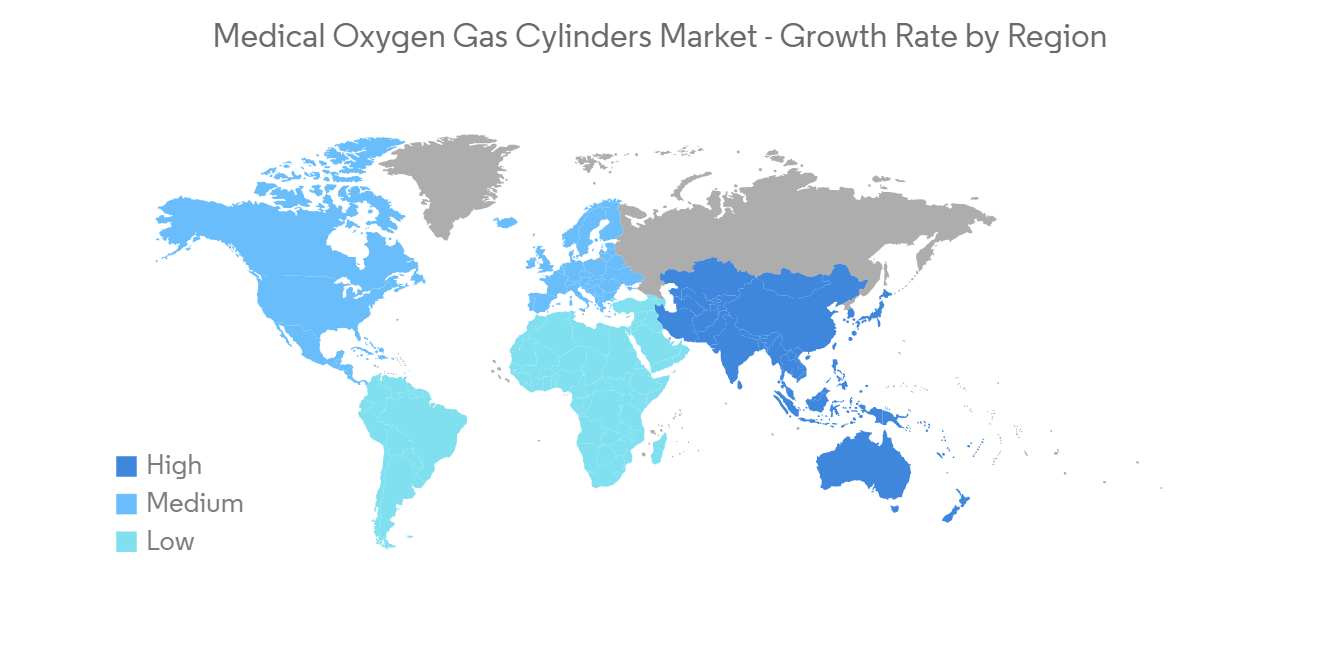

North America is Expected to Hold a Significant Share in the Market During the Forecast Period

North America is anticipated to hold a significant market share in the medical oxygen gas cylinders market. It is expected to do the same during the forecast period due to the high adoption of medical oxygen gas cylinders. Oxygen cylinders are useful in chronic obstructive pulmonary disease, emphysema, and chronic bronchitis patient pool.

According to the AAFA 2022 report, about 25 million people in the United States have asthma. Asthma relates to factors such as gender, race, ethnicity, and socioeconomic level, with the condition being more frequent in males than females in children. In maturity, the gender gap reverses, with more females than males suffering from asthma.

Furthermore, the presence of competitors, mergers, collaboration, and government initiatives in the region are fuelling the market growth. For instance, in April 2022, 4,055 pressure swing adsorption (PSA) plants were commissioned in India, including those under PM-CARES, to enhance the capacity of medical oxygen production and supply at the facility level. Furthermore, as per the April 2021 statistics by the AAFA, about 20 million adults aged 18 years or above in the United States have asthma. Thus, the prevalence of such disorders indicates a consistent demand for oxygen cylinders in the country. Thereby contributing to the growth of the market studied in the United States.

Moreover, as per the Asthma Canada 2021 report, across Canada, asthma affects the lives of more than 3.8 million Canadians and is the third most common chronic disease.

The above-mentioned statistics indicate that as the prevalence of Asthma increases, the demand for medical oxygen gas cylinders also increases. Thus, the North American region is expected to hold a significant share of the market in the forecast period.

Medical Oxygen Gas Cylinders Industry Overview

The medical oxygen gas cylinders market is moderately competitive, with several players around the globe. Companies like Invacare Corporation, Medical Depot, Me.Ber. SRL, B.N.O.S. Meditech Ltd, OrientMEd International, Royax, O2 CONCEPTS, Precision Medical Inc., Catalina Cylinders, and Luxfer Gas Cylinders, among others, hold a substantial market share in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in the Prevalence of Chronic Respiratory Diseases

- 4.2.2 Availability of Technologically Advanced Products

- 4.2.3 Increase in Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Scenario

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Portable

- 5.1.2 Heavy

- 5.2 By Product Size

- 5.2.1 Less than 10 liter

- 5.2.2 10 liter - 50 liter

- 5.2.3 More than 50 liter

- 5.3 By End User

- 5.3.1 Hospital

- 5.3.2 Home Healthcare

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Invacare Corporation

- 6.1.2 Medical Depot

- 6.1.3 Desco Medical India

- 6.1.4 B.N.O.S. Meditech Ltd

- 6.1.5 ProRack Gas Control Products

- 6.1.6 Royax

- 6.1.7 O2 CONCEPTS

- 6.1.8 Precision Medical Inc.

- 6.1.9 Catalina Cylinders

- 6.1.10 Luxfer Gas Cylinders