|

市場調查報告書

商品編碼

1436003

疫苗物流 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Vaccine Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

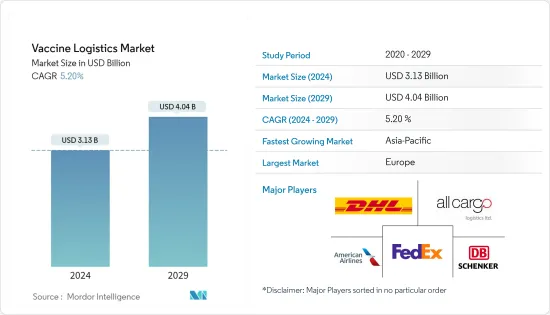

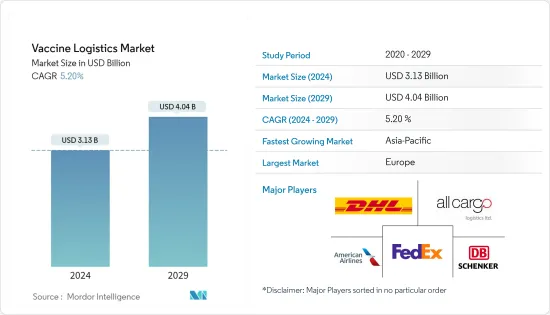

2024年疫苗物流市場規模估計為31.3億美元,預計到2029年將達到40.4億美元,在預測期內(2024-2029年)CAGR為5.20%。

新疫苗、免疫計劃和服務提供策略的多樣性、目標人群的擴大、冷鏈基礎設施要求的增加以及資金不足是可能進一步影響疫苗運輸市場的一些新現實。

現有系統難以跟上國家和國際免疫規劃不斷變化的步伐,特別是在開發出 COVID-19 疫苗之後,導致缺貨、本可避免的浪費和冷鏈能力不足。所有上述因素都具有相當大的覆蓋範圍、性能和成本影響。

由於COVID-19疫情帶來的疫苗儲存服務需求大幅成長,藥廠著力打造冷鏈物流。因此,隨著研發力道的加大,未來幾年疫苗冷鏈物流市場可能會出現新的成長前景。

疫苗物流市場趨勢

製藥業的成長

隨著政府採取措施促進全球製藥業的成長並加劇市場內的競爭,全球對製藥物流的需求可能會增加。隨著全球製藥業持續強勁成長,溫控產品子類別也蓬勃發展。世界各地的製藥商越來越關注產品品質和敏感度。複雜生物藥物的開發以及荷爾蒙治療、疫苗和複雜蛋白質的運輸需要冷鏈改進,需要溫控運輸和倉儲。

藥品和醫療器材的溫控物流是醫療保健物流業中一個顯著成長的區隔。此外,對有效的冷鏈物流服務以維持商品品質的需求的增加推動市場的成長。

到2027年,對創新藥物的需求將推動腫瘤學支出達到約 3,700 億美元,幾乎是目前水準的兩倍。

印度是全球最大的學名藥供應商,佔全球供應量的20%,也是全球領先的疫苗製造商,市佔率達60%。

醫療保健領域快速通道援助的重要性日益增加,也推動了醫藥物流市場的發展。此外,透過建立單一來源配銷通路來降低分銷成本推動對醫藥物流的需求。

冷鏈物流發展

大多數疫苗不具備熱穩定性,包括用於白喉、破傷風、百日咳(DTP)以及麻疹、腮腺炎和德國麻疹(MMR)的疫苗。通常,非熱穩定且未正確冷藏的疫苗會在短時間內變質,因為這些疫苗含有生物物質,如果不在 2°C 至 8°C 之間儲存,就會分解。因此,大多數疫苗依賴冷藏或冷鏈配送,其中包括幾個階段。

能夠在不同溫度下分多個部分裝載貨物的冷藏車進一步開發並受到歡迎。冷鏈服務供應商還安裝無線射頻識別(RFID)和工業物聯網(IIoT),透過提供對敏感產品的位置、屬性和狀況的更多了解來幫助解決冷鏈效率低下的問題。

該公司還在開發具有封閉溫控系統的高科技貨櫃,以便在貨物倉庫和飛機之間無縫運送對溫度敏感的貨物。這些容器專為製藥業而設計。

2022年 8月,Azenta Inc. 同意收購 B Medical Systems S.a r.l. 及其子公司。此次收購透過提供獨特的解決方案來安全、可追溯地運輸溫度敏感樣本,擴展了 Azenta 的冷鏈能力。作為 Azenta 的一部分,B Medical 將獲得樣本管理的豐富知識和工程技能,並擴大在北美和歐洲的市場佔有率。

疫苗物流行業概況

疫苗物流市場分散,由Yamato、Deutsche Post DHL Group和Nippon Express等國際公司主導。這些國際公司正致力於透過收購來實施擴張策略。他們的強大影響力幫助他們比小企業更容易擴張市場。

隨著 COVID-19 大流行,在政府投資不斷增加的支持下,市場對冷藏倉庫、快速和受控配送服務以及疫苗大宗運輸的需求預計將增加,這為市場參與者提供了擴大其業務的機會從長遠來看,影響範圍和效率。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究成果

- 研究假設

- 研究範圍

第2章 研究方法

- 分析方法

- 研究階段

第3章 執行摘要

第4章 市場動態與洞察

- 當前的市場狀況

- 市場動態

- 促進要素

- 溫控包裝技術創新

- 加強醫療基礎設施的跨境合作與舉措

- 限制

- 供應鏈中斷和運輸瓶頸可能會阻礙疫苗的及時分發

- 機會

- 採用區塊鏈和物聯網技術可以提高透明度和可追溯性

- 促進要素

- 技術趨勢和自動化

- 政府法規和舉措

- 產業價值鏈/供應鏈分析

- 聚焦環境/溫度控制儲存

- 產業吸引力-波特五力分析

- COVID-19 對市場的影響

第5章 市場細分

- 依服務

- 運輸

- 陸(公路和鐵路)

- 空

- 海

- 倉儲

- 加值服務(包裝、標籤等)

- 運輸

- 依最終用戶

- 醫院

- 藥品製造商和分銷商

- 其他最終使用者(血庫、診所等)

- 按地理

- 亞太

- 中國

- 日本

- 澳洲

- 印度

- 新加坡

- 馬來西亞

- 印尼

- 泰國

- 韓國

- 亞太其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 哥倫比亞

- 阿根廷

- 南美洲其他地區

- 中東

- 埃及

- 卡達

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東其他地區

- 亞太

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- DHL Global Forwarding

- AllCargo Logistics

- American Airlines

- DB Schenker

- FedEx Corporation

- Kuehne Nagel

- Nippon Express

- Yamato Logistics

- Americold Logistics

- lynden international logistics

- DP World

- Coldman Logistics

- Cavalier Logistics*

- 其他公司

第7章 全球疫苗物流市場的未來

第8章 附錄

The Vaccine Logistics Market size is estimated at USD 3.13 billion in 2024, and is expected to reach USD 4.04 billion by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

The wide variety of new vaccines and immunization schedules and service delivery strategies, the expanding target population, the increased cold-chain infrastructure requirements, and insufficient funding are some of the new realities that may further impact the vaccine transportation market.

The existing systems are struggling to keep pace with the changing landscape of national and international immunization programs, especially after the development of the COVID-19 vaccine, resulting in stock-outs, avoidable wastage, and inadequate cold-chain capacity. All the aforementioned factors have considerable coverage, performance, and cost implications.

Due to the enormous rise in demand for vaccine storage services brought on by the COVID-19 epidemic, pharmaceutical companies focused their efforts on creating cold chain logistics. Therefore, the vaccine cold chain logistics market will probably see new growth prospects in the coming years due to the increasing R&D initiatives.

Vaccine Logistics Market Trends

Growth in the Pharmaceutical Sector

With government initiatives to improve the pharmaceutical industry's growth worldwide and fuel competition within the market, the demand for pharma logistics may increase globally. As strong growth continues across the global pharmaceuticals industry, the sub-category of temperature-controlled products is also surging. Pharmaceutical manufacturers around the world are increasingly focusing on product quality and sensitivity. The development of complex biological-based medicines and the shipment of hormone treatments, vaccines, and complex proteins, which require cold chain refinements, result in a need for temperature-controlled transportation and warehousing.

Temperature-controlled logistics for pharmaceutical products and medical devices is a significantly growing segment of the healthcare logistics industry. Moreover, the increase in the need for effective cold chain logistics services to maintain the quality of goods is fueling the growth of the market.

Demand for innovative drugs will drive oncology spending to approximately USD 370 billion by 2027, almost double the current level.

India is the largest provider of generic medicines globally, occupying a 20% share in global supply by volume, and is the leading vaccine manufacturer globally with a market share of 60%.

The rising importance of fast-track assistance in the healthcare sector is also driving the market for pharmaceutical logistics. Moreover, decreasing the distribution cost by creating a single-source distribution channel is boosting the demand for pharmaceutical logistics.

Development in Cold Chain Logistics

Thermal stability is not a property of most vaccines, including those used against diphtheria, tetanus, pertussis (DTP), and measles, mumps, and rubella (MMR). Typically, vaccines that are not heat-stable and not properly refrigerated spoil over a short period because these vaccines contain biological matter that degrades when not stored between 2°C and 8°C. As a result, most vaccines rely on refrigerated or cold-chain distribution, which consists of several stages.

The refrigerated trucks that can hold goods in multiple segments at different temperatures are being developed further and gaining popularity. Cold chain service providers are also installing radio-frequency identification (RFID) and Industrial Internet of Things (IIoT) to help address cold chain inefficiencies by providing increased insights into the location, properties, and condition of sensitive products.

Companies are also developing high-tech containers with a closed temperature-controlled system to deliver temperature-sensitive goods between cargo warehouses and aircraft seamlessly. These containers are specially designed to serve the pharmaceutical industry.

In Aug 2022, Azenta Inc. has agreed to acquire B Medical Systems S.a r.l. and its subsidiaries. This acquisition expands Azenta's cold chain capabilities by providing distinct solutions for safely and traceably transporting temperature-sensitive specimens. As part of Azenta, B Medical will gain substantial knowledge and engineering skills in sample management and an expanded market presence in North America and Europe.

Vaccine Logistics Industry Overview

The vaccine logistics market is fragmented and is dominated by international companies, such as Yamato, Deutsche Post DHL Group, and Nippon Express. These international companies are focusing on expansion strategies through acquisitions. Their strong presence helps them expand in the market more easily than the smaller players.

With the COVID-19 pandemic, the market is expected to experience an increased demand for refrigerated warehouses, fast and controlled delivery services, and the bulk transportation of vaccines, backed by the increasing government investment providing opportunities to the players in the market to expand their reach and efficiency in the long run.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 technology innovation in temperature controlled packaging

- 4.2.1.2 Cross Border collaborations and initiative to enhance healthcare infrastructure

- 4.2.2 Restraints

- 4.2.2.1 Supply chain distruption and transportation bottlenecks can hinder timely vaccine distribution

- 4.2.3 Opportunities

- 4.2.3.1 Adoption of blockchain and IoT technology can improve transparency and tracebility

- 4.2.1 Drivers

- 4.3 Technological Trends and Automation

- 4.4 Government Regulations and Initiatives

- 4.5 Industry Value Chain/Supply Chain Analysis

- 4.6 Spotlight on Ambient/Temperature-controlled Storage

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Land (Road and Rail)

- 5.1.1.2 Air

- 5.1.1.3 Sea

- 5.1.2 Warehousing

- 5.1.3 Value-added Services (Packaging, Labeling, etc.)

- 5.1.1 Transportation

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Drug Manufacturers and Distributors

- 5.2.3 Other End Users (Blood Banks, Clinics, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 Australia

- 5.3.1.4 India

- 5.3.1.5 Singapore

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Thailand

- 5.3.1.9 South Korea

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Colombia

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Egypt

- 5.3.5.2 Qatar

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Rest of the Middle East

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles*

- 6.2.1 DHL Global Forwarding

- 6.2.2 AllCargo Logistics

- 6.2.3 American Airlines

- 6.2.4 DB Schenker

- 6.2.5 FedEx Corporation

- 6.2.6 Kuehne Nagel

- 6.2.7 Nippon Express

- 6.2.8 Yamato Logistics

- 6.2.9 Americold Logistics

- 6.2.10 lynden international logistics

- 6.2.11 DP World

- 6.2.12 Coldman Logistics

- 6.2.13 Cavalier Logistics*

- 6.3 Other Companies