|

市場調查報告書

商品編碼

1272685

抗病毒塗料市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Antiviral Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,全球抗病毒塗層市場的複合年增長率預計將超過 14%。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 不過,預計市場將在2022年達到疫情前的水平,並繼續保持穩定增長。

- 建築行業的高需求和抗病毒塗層產品的不斷發展預計將推動市場發展。 預計原材料成本高和應用抗病毒塗層的高成本將阻礙市場增長。

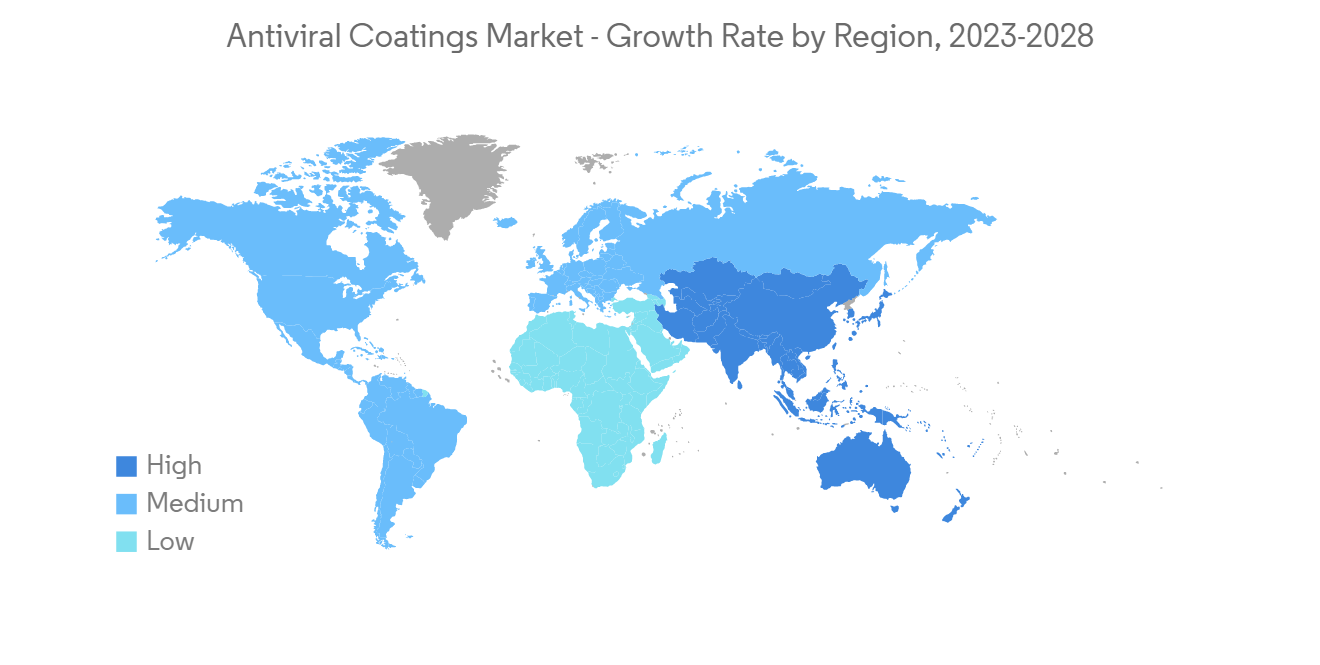

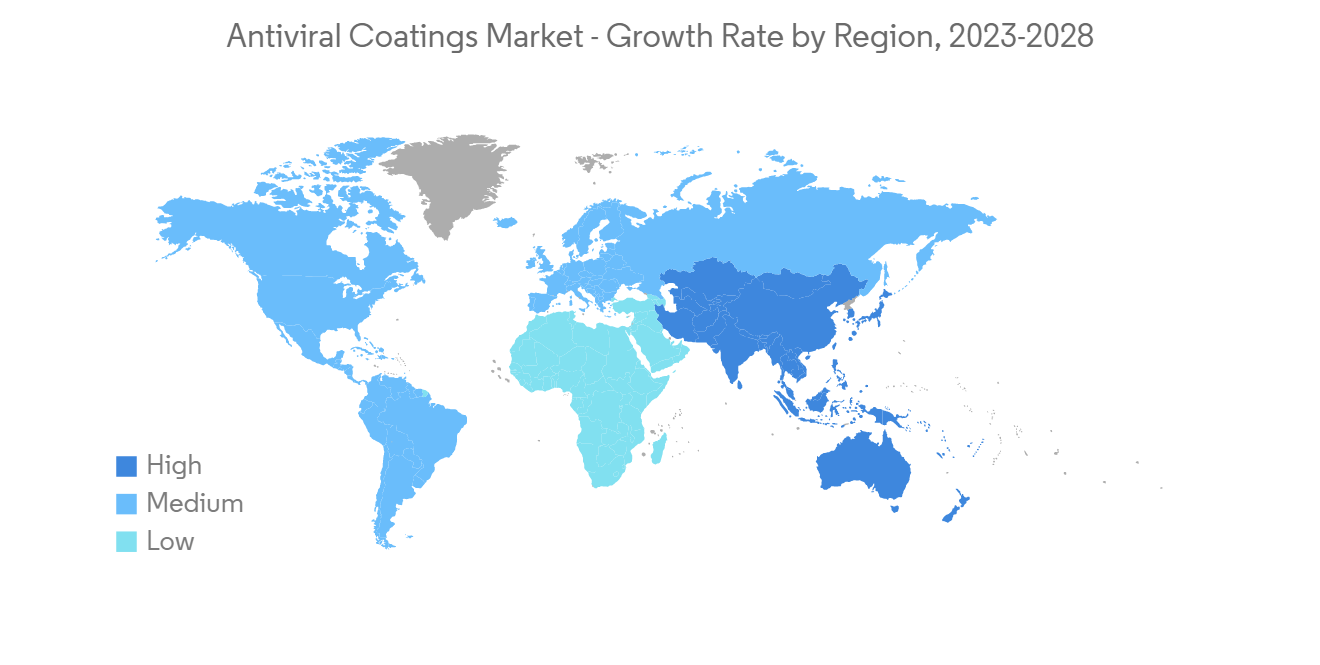

- 亞太地區主導著全球市場,中國、印度和日本等國家/地區的消費量最大。

抗病毒塗層的市場趨勢

建築行業的高需求

- 建築行業通常使用抗病毒塗層來消除門把手、工作檯面、欄桿、地板和牆壁等材料表面上的病毒。 一些油漆製造商在他們的油漆和底漆中添加殺菌劑,而其他製造商則開發具有其他化學功能的塗料。

- 例如,有機矽烷是矽基納米塗層,可形成高度拋光的表面,可有效撕裂病毒和細菌。 此外,一種常用於消毒劑的稱為季銨的化合物會導致細胞滲漏並最終殺死微生物。 其他塗層是自清潔的,例如光催化和超疏水塗層。

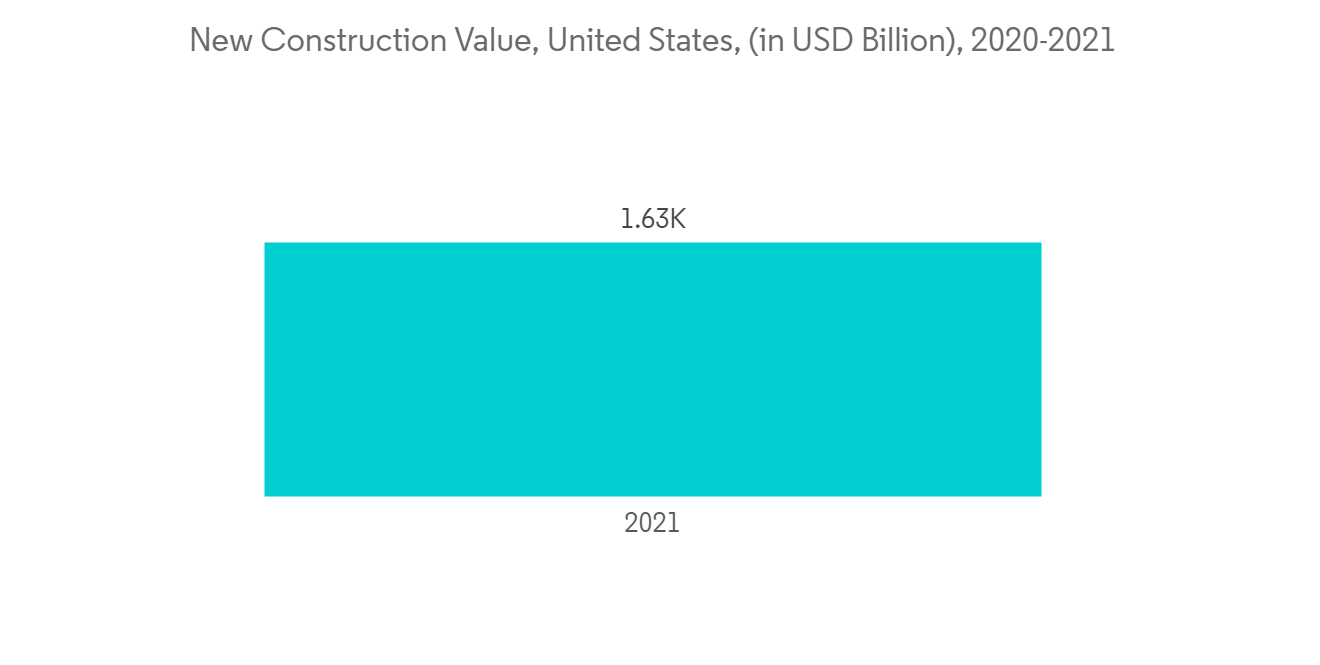

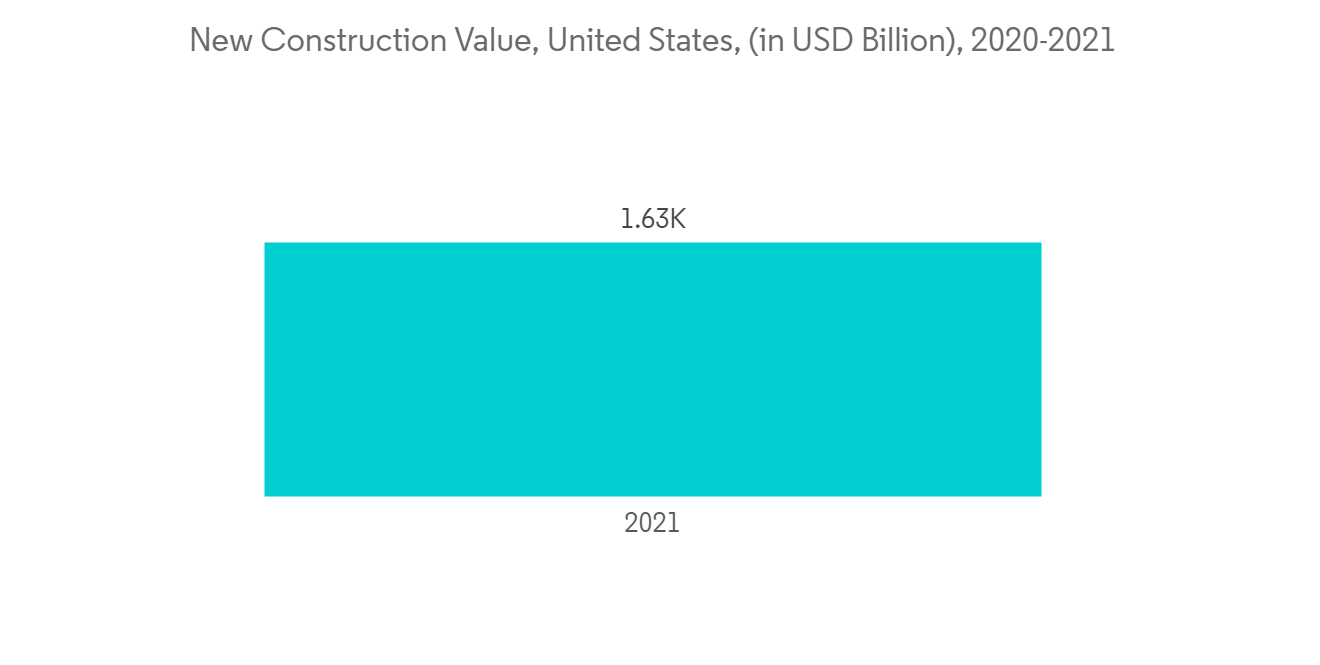

- 建築業在多個國家/地區顯著擴張,建築行業對抗病毒塗料的需求預計將飆升。 例如,根據美國人口普查局的數據,美國新建建築的年價值將從 2020 年的 14,996 億美元增長到 2021 年的 16,264 億美元,推動預測期內市場的增長。。

- 印度的商業建築行業也在不斷擴張。 該國正在進行幾個項目。 例如,價值 9 億美元的 CommerzIII 商業辦公大樓於 2022 年第一季度開工建設。 該項目將在孟買Goregaon建造一座43層、許可建築面積2,60,128平方米的商業辦公綜合體。 該項目計劃於2027年第四季度完成。 因此,這些項目將在預測期內增加抗病毒塗層的需求。

- 此外,2022 年 2 月,Nippon Holdings 在品牌“PROTECTON”的陣容中推出了一種新的抗病毒塗料,該塗料用於建築應用的內牆和地板塗料,以支持市場的增長。

- 由於上述原因,預計建築行業對抗病毒塗料的需求在預測期內將會增長。

亞太地區主導市場

- 由於來自印度和中國等國家/地區的醫療保健、建築、消費電子產品、醫療保健和紡織品等多個行業的需求增加,亞太地區在預測期內對抗病毒塗層的需求將增長。預計.

- 2022 年 4 月,來自奈良醫科大學、神奈川工業科學技術研究所和東京工業大學的科學家開發了一種新型光催化抗病毒塗層,可有效對抗 COVID-19 的不同亞種。

- 此外,2022 年 9 月,印度頂級塗料製造商之一 Kansai Nerolac Paints Ltd. (KNPL) 開發了該國首款抗病毒塗料 Excel Virus Guard。 這種室內乳膠漆具有抗病毒和抗微生物的特性,可驅除 99.9% 的細菌,極大地促進了市場的增長。

- 此外,中國占世界建築總投資的 20%,預計這將增加建築領域抗病毒塗料的使用,從而產生巨大的市場需求。 根據中國國家統計局(NBS)的數據,2021 年中國建築工程總產值將達到 3.77 萬億美元,比 2020 年增長超過 11%,從而帶動市場需求調查增加。

- 2022 年 2 月,台灣最高經濟規劃機構國家發展委員會 (NDC) 宣布,政府機構將在該國前瞻性基礎設施發展計劃的第四階段投資總計 1800 億新台幣(64 億美元)。 7000 萬美元)。 擬議預算將在 2023-2024 年期間使用。

- 因此,預計在預測期內,建築、紡織、電子等行業的此類產品創新和擴張將顯著推動亞太地區抗病毒塗層的需求。

抗病毒塗層行業概況

全球抗病毒塗料市場本質上是分散的。 市場上的主要參與者包括 BioFence、Graphene CA、Nano-Care Deutschland AG、Nippon Paint Holdings 和 Arkema。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 建築行業的高需求

- 其他司機

- 約束因素

- 應用抗病毒藥物的高成本

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於金額)

- 材料

- 銅

- 石墨烯

- 白銀

- 其他材料類型

- 申請

- 建築領域

- 家用電器

- 醫療保健

- 紡織品和服裝

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- GrapheneCA

- BioFence

- Nippon Paint Holdings Co., Ltd.

- Nano-Care Deutschland AG

- Arkema

- Hydromer

- Grand Polycoats

- Novapura AG

- Kastus Technologies Company Limited

- Bio Gate AG

- KOBE STEEL, LTD.

- PPG Industries, Inc.

第7章 市場機會與未來動向

簡介目錄

Product Code: 72023

The global antiviral coatings market is projected to register a CAGR of more than 14% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- High demand from the construction sector and the increasing development of antiviral coating products are expected to drive the market. The high cost of raw materials and the high cost of applying antiviral coatings are expected to hinder the market's growth.

- The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Antiviral Coatings Market Trends

High Demand from Construction Segment

- In the construction industry, antiviral coatings are commonly used to eliminate viruses on material surfaces such as doorknobs, countertops, railings, floorings, and walls. Some paint manufacturers add microbe-killing agents to paint and primer coatings, while others have created coatings leveraging other chemical capabilities.

- For example, organosilanes are silicon-based nanocoatings that form a highly abrasive surface for viruses and bacteria, effectively ripping them apart. A chemical compound, quaternary ammonium, typically used in disinfectants, causes cell leakage and the eventual death of microbes. Other strategies include photocatalytic and superhydrophobic coatings, which both exhibit self-cleaning functionalities.

- The construction industry is expanding significantly in several countries, which is expected to surge the demand for antiviral coatings in the construction segment. For example, According to the US Census Bureau, the annual value for new construction in the United States was USD 1,626.4 billion in 2021, compared to USD 1,499.6 billion in 2020, supporting the market's growth during the forecast period.

- Also, India is expanding its commercial construction sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 square meters in Goregaon, Mumbai. The project is expected to be completed in Q4 2027. Hence, these projects will increase the demand for antiviral coatings during the forecast period.

- Furthermore, in February 2022, Nippon Holdings introduced new antiviral paint products to the lineup of its brand- PROTECTON for interior wall and floor coating purposes in architectural applications, supporting the market's growth.

- The above-mentioned factors are expected to drive the demand for antiviral coatings in the construction industry during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to drive the demand for antiviral coatings during the forecast period due to increased demand from several industries such as healthcare, construction, home appliance, healthcare, textile, etc., from countries like India and China.

- In April 2022, Scientists at Nara Medical University, Kanagawa Institute of Industrial Science and Technology, and Tokyo Institute of Technology developed a new photocatalyst antiviral coating that is effective against different variants of COVID-19.

- Furthermore, in September 2022, one of the top paint manufacturers in India, Kansai Nerolac Paints Ltd. (KNPL), developed Excel Virus Guard, the country's first antiviral paint. This interior emulsion paint contains active antiviral and anti-microbial qualities that keep 99.9% of germs away, driving the market's growth significantly.

- Furthermore, the increasing usage of antiviral coatings in the construction sector will provide a huge market demand as China encompasses 20% of all construction investments globally. According to the National Bureau of Statistics (NBS) of China, the output value of the construction works in the country accounted for USD 3.77 trillion in 2021, representing an increase of more than 11% compared to 2020, thereby enhancing the demand for the market studied.

- In February 2022, the National Development Council (NDC), the top economic planning body in Taiwan, stated that government agencies had proposed a total of TWD 180 billion (USD 6.47 billion) for the fourth phase of the country's forward-looking infrastructure development plan. The proposed budget would be used from 2023-2024

- Therefore, such product innovations and expanding construction, textile, electronic sector, etc., are expected to drive the demand for antiviral coatings significantly in the Asia-Pacific region during the forecast period.

Antiviral Coatings Industry Overview

The global antiviral coatings market is fragmented in nature. Some of the major players in the market include BioFence, Graphene CA, Nano-Care Deutschland AG, Nippon Paint Holdings Co., Ltd., and Arkema, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from the Construction Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Applying Antiviral Coatings

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Copper

- 5.1.2 Graphene

- 5.1.3 Silver

- 5.1.4 Other Material Types

- 5.2 Application

- 5.2.1 Construction

- 5.2.2 Home Appliances

- 5.2.3 Healthcare

- 5.2.4 Textiles and Apparel

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 GrapheneCA

- 6.4.2 BioFence

- 6.4.3 Nippon Paint Holdings Co., Ltd.

- 6.4.4 Nano-Care Deutschland AG

- 6.4.5 Arkema

- 6.4.6 Hydromer

- 6.4.7 Grand Polycoats

- 6.4.8 Novapura AG

- 6.4.9 Kastus Technologies Company Limited

- 6.4.10 Bio Gate AG

- 6.4.11 KOBE STEEL, LTD.

- 6.4.12 PPG Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219