|

市場調查報告書

商品編碼

1435246

幾丁聚醣-全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Chitosan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

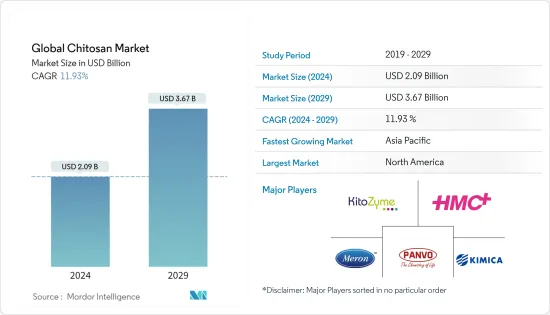

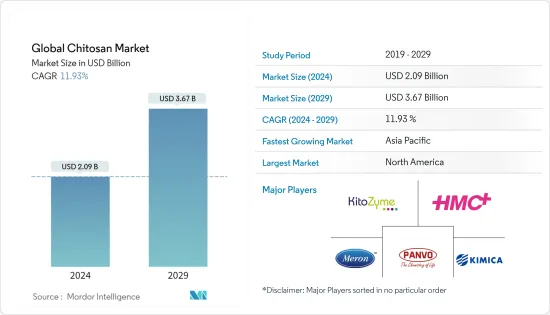

預計2024年全球幾丁聚醣市場規模為20.9億美元,預估至2029年將達36.7億美元,預測期間(2024-2029年)複合年成長率為11.93%。

世界各地的研究人員對將幾丁聚醣作為預防和治療感染疾病的潛在藥物在製藥和生物醫學領域的應用表現出了興趣。 2019 年 12 月,中國成為 SARS-CoV-2 疫情的震央,此後疫情在國際上蔓延。 2020 年,世界衛生組織 (WHO) 宣布 COVID-19 為全球衛生緊急事件。應對新型冠狀病毒感染疾病(COVID-19) 等病毒性疾病爆發的影響需要世界各地研究人員的研究和開發工作。因此,新型COVID-19的爆發可能會對市場成長產生積極影響,因為幾丁聚醣聚合物作為病毒抑制劑的應用將在不久的將來創造顯著的成長機會。

此外,幾丁聚醣等生物聚合物具有固有的抗病毒特性。基於奈米結構藥物傳遞系統(NDDS)的碳水化合物粘合劑,例如硫酸化聚合物,也會改變病毒的進入過程,阻斷病毒的陽離子表面受體並與宿主細胞表面的硫酸乙醯肝素蛋白聚醣相互作用,從而可以避免這種影響。然而,到目前為止,還沒有 NDDS 被用作治療方法COVID-19 疾病的報告。它可能在不久的將來成為治療 COVID-19 的新方法。

其他推動市場成長的因素包括生物醫學、化妝品、食品和飲料行業產品應用的增加、全球水處理活動的增加以及已開發國家醫療保健/醫療行業的重大進步。

由幾丁聚醣組成的系統利用幾丁聚醣的特性來達到優異的治療效果。例如,幾丁聚醣的黏合特性可用於非侵入性黏膜疫苗載體。因此,由幾丁聚醣組成的系統在治療感染疾病方面具有巨大的潛力。

幾丁聚醣是一種天然多醣,具有生物分解性、無毒、生物相容性、止血和黏合以及滲透增強特性等特性。此外,它還具有抗菌特性。

據美國國家生物技術資訊中心(NCBI)稱,去乙醯幾丁聚醣是過濾和水處理中必不可少的添加劑,可去除 99% 的濁度。此外,幾丁聚醣是一種從漁業廢棄物中提取的現成產品,在其他行業中具有多種用途,例如製藥行業中的傷口護理材料,用作天然調味劑,並用於食品行業。水分控制,增加了對這些聚合物的需求,並進一步提振了整個市場。

此外,嚴格的政府法規迫使製造商減少塑膠袋,導致對生物分解性塑膠的需求增加,其中甲殼素被廣泛使用。這增加了幾丁聚醣的採用,進一步推動預測期內的市場成長。

幾丁聚醣市場趨勢

根據應用,水處理預計在預測期內呈現健康成長速度

由於工業、商業和市政水處理廠對幾丁聚醣的需求不斷增加,未來水處理可望健康成長。由於其能夠去除水中的農藥、表面活性劑和酚類等優點,它在水處理廠中受到高度青睞。由於幾丁聚醣無毒、不過敏和生物分解性的特性,其作為水質淨化劑的需求不斷增加,也將推動該產業的成長。

最近有報告指出,水和污水中存在嚴重急性呼吸症候群冠狀病毒 2 (SARS-CoV-2)。 COVID-19患者的糞便和口罩被認為是冠狀病毒傳播到水和污水的主要途徑。

例如,Hai Nguyen Tran 等人發表在《環境研究雜誌 2021》上的一篇研究論文證實,在進水污水中檢測到了 SARS-CoV-2 RNA。然而,已證實進水中存在 SARS-CoV-2。因此,未來我們將檢視不同操作條件下SARS-CoV-2在水和污水中的生存狀況,以及將受COVID-19污染的水傳播給人類是否是一個新出現的問題,值得研究重點。因此,預計在不久的將來,使用幾丁聚醣進行水處理將有助於預防新型冠狀病毒感染疾病(COVID-19)等病毒性疾病。

此外,幾丁聚醣具有更快的沉積速率、更高的COD(有機物)、金屬離子和SS(懸浮固體)去除效率等特性,是自來水處理的優異凝聚劑。此外,隨著世界各國更加重視污水處理以盡量減少污染,未來幾年對幾丁聚醣的需求可能會持續增加。

由於地下水位下降和城市人口快速成長,亞太國家正面臨可用淡水的嚴重短缺。這導致政府和私人公司(主要是印度、中國和馬來西亞)對水處理進行投資。

以印度為例,2012年至2017年,印度規劃委員會累計約265億美元,為印度都市區所有人提供安全用水。污水處理、污水處理、固體、液體和化學廢棄物、水技術、環境服務、海水淡化公司、諮詢、工程等是印度應對水挑戰所需的一些服務。

此外,2019年,印度政府與巴巴核能研究中心(BARC)合作,計畫在村莊建立水質淨化廠。政府的目標是到2024年為所有人提供乾淨的飲用水。因此,預計上述因素將在預測期內推動該細分市場的成長。

預計北美在預測期內將佔據重要市場佔有率

由於主要參與者的存在以及美國對水處理的認知不斷提高以及對化妝品的需求不斷成長,預計北美將在全球幾丁聚醣市場中佔據重要的市場佔有率。此外,不斷成長的醫療保健支出和成熟的醫療保健基礎設施也顯著推動了整個區域市場的成長。

由於在疾病管理中基於幾丁聚醣的治療和防護設備開發的研究和開發的增加,COVID-19感染疾病大流行對幾丁聚醣市場產生了積極的反應。 2021年,正在進行臨床研究,調查含有幾丁聚醣奈米粒子的過濾元件的新型口罩的防護效果,已被證明對市場產生正面影響。

該地區日益嚴重的肥胖和超重問題,以及人們健康意識的提高,是幾丁聚醣市場的關鍵機會。例如,根據加拿大健康資訊研究所的數據,肥胖是加拿大主要的國民健康問題之一,五分之一的加拿大成年人患有肥胖症。根據2017年加拿大肥胖網路報告,700萬加拿大人患有肥胖症。

由於日本、中國、印度和韓國終端用戶產業的快速發展,預計亞太地區在預測期內也將出現健康成長。對生物基產品的需求不斷成長以及政府的支持和舉措預計也將推動幾丁聚醣市場的發展。

推動亞太地區幾丁聚醣需求的主要因素之一是從漁業廢棄物中獲得的原料的現成可用。例如,根據聯合國糧食及農業組織統計,2019年上半年,中國進口蝦28.59萬噸,主要來自厄瓜多爾、印度和沙烏地阿拉伯,比中國進口10萬噸增加186% 。做過。因此,由於上述因素,市場可能會成長。

幾丁聚醣產業概況

幾丁聚醣市場分散,競爭激烈,由幾個主要企業組成。從市場佔有率來看,目前幾家大公司佔據市場主導地位。目前主導市場的公司包括Panvo Organics Pvt Ltd、GTC Bio Corporation、Dupont Corporation、KitoZyme SA、KIMICA Corporation、Dainichiseika Color & Chemicals Mfg、Heppe Medical Chitosan GmbH、Meron Biopolymers、青島雲洲、Biophrame Technologies等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 活性化水處理活動

- 擴大產品在生物醫學、化妝品、食品和飲料產業的應用

- 醫療保健/醫療產業的強勁進步

- 市場限制因素

- 法律規範

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按原料分

- 蝦(蝦)

- 蝦(蝦)

- 螃蟹

- 其他原料

- 按用途

- 水處理

- 化妝品

- 製藥/生物醫學

- 食品和飲料

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Panvo Organics Pvt Ltd

- GTC Bio Corporation

- Dupont Corporation

- KitoZyme SA

- KIMICA Corporation

- Dainichiseika Color & Chemicals Mfg Co. Ltd

- Heppe Medical Chitosan GmbH

- Meron Biopolymers

- Qingdao Yunzhou

- Biophrame Technologies

- ChitoTech

- Marshal Marine

- BIO21 Co. Ltd

- Austanz Chitin Pty Ltd

- KiOmed Pharma

第7章 市場機會及未來趨勢

The Global Chitosan Market size is estimated at USD 2.09 billion in 2024, and is expected to reach USD 3.67 billion by 2029, growing at a CAGR of 11.93% during the forecast period (2024-2029).

Globally, researchers are showing interest in the use of chitosan in the pharmaceutical and biomedical fields as a potential agent for the prevention and treatment of infectious diseases. In December 2019, China became the epicenter of the SARS-CoV-2 outbreak, which has since spread internationally. In 2020, the World Health Organization (WHO) declared COVID-19 to be a global health emergency. Countering the impacts of viral disease outbreaks such as COVID-19 required R&D activities by researchers across the globe. Thus, the COVID-19 outbreak is likely to show a positive impact on the market growth as the application of chitosan polymers as viral inhibitors would generate key growth opportunities in the near future.

Furthermore, biopolymers such as chitosan have intrinsic antiviral properties. Nanostructured drug-delivery systems (NDDS)-based carbohydrate-binding agents, such as the sulfated polymers, can also change the virus entry process, blocking the viral cationic surface receptors and avoiding its interaction with heparan sulfate proteoglycan on the host cell surface. However, there are no reports of NDDS as COVID-19 treatment so far. It can be a new approach for COVID-19 treatment in the near future.

The other factors driving the market growth include growing product applications in biomedical, cosmetics, and food and beverage industries, rising water treatment activities worldwide, and strong advancements in the healthcare/medical industry in developed countries.

Chitosan composed systems utilize the characteristics of chitosan to achieve great therapeutic effects. For instance, the adhesiveness of chitosan can be used for non-invasive mucosal vaccine vectors. Therefore, chitosan-composed systems have great potential in the therapy of infectious diseases.

Chitosan is a natural polysaccharide that exhibits properties such as biodegradability, non-toxicity, biocompatibility, hemostatic and bio-adhesiveness, and penetration-enhancing properties. Moreover, it has anti-microbial properties.

As per National Center for Biotechnology Information (NCBI), deacetylated chitosan is a vital additive in filtration and water treatment, which eliminates 99% of turbidity. Moreover, chitosan is an easily available product extracted from a waste product in the fishery industry with several uses in other industries such as wound care material in pharmaceutical industries, acts as a natural flavor, and used to control moisture in food industries leading to the high demand for these polymer and further boost the overall market.

Furthermore, stringent government regulations are forcing manufactures to reduce plastic bags, resulting in the growing demand for biodegradable plastic where chitin is being widely used. This led to the increasing adoption of chitosan and further drive the market growth over the forecast period.

Chitosan Market Trends

Under Application, Water Treatment is Expected to Witness a Healthy Growth Rate Over the Forecast Period

Water treatment is expected to witness healthy growth in the future, attributing to the growing demand for chitosan in industries, commercial, and municipal water treatment plants. Several advantages, such as the ability to remove pesticides, surfactants, and phenol from water, make it highly preferable in water treatment plants. Increasing demand for chitosan as a water cleaner because of its non-toxic, non-allergic biodegradable nature will also be leading to propel the segment growth.

The presence of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) in water and wastewater has recently been reported. The stools and masks of COVID-19 patients were considered as the primary route of coronavirus transmission into water and wastewater.

For instance, according to a research article by Hai Nguyen Tran et al. published in the Environmental Research Journal 2021, the study confirmed that SARS-CoV-2 RNA was detected in inflow wastewater. Although, the existence of SARS-CoV-2 in water influents has been confirmed. Therefore, in the future, studies should focus on the survival of SARS-CoV-2 in water and wastewater under different operational conditions and whether the transmission from COVID-19-contaminated water to humans is an emerging concern. Thus, the use of chitosan for water treatment in the near future is expected to encourage the prevention of viral diseases like COVID-19.

Furthermore, chitosan is a good flocculant for tap water treatment due to properties such as faster deposition rate and higher removal efficiency for COD (organic matter), metal ions, and SS (suspended solids). Moreover, as countries around the globe emphasize wastewater treatment to minimize pollution, chitosan's demand is likely to continue increasing in the coming years.

Depleting groundwater levels and the rapidly growing urban population in the Asia-Pacific countries have resulted in the acute scarcity of usable freshwater. This has led to investments by governments and private players in water treatments, mainly in India, China, and Malaysia.

For instance, in India, during 2012-2017, the Indian planning commission had budgeted around USD 26.5 billion to provide safe water to all urban and rural Indians. Treatment of sewage, wastewater treatment, solid, liquid, and chemical waste, water technology, environmental services, desalination companies, consulting, and engineering are some services that India will require to tackle the water problem.

In addition, in 2019, the Government of India, with the Bhabha Atomic Research Centre (BARC), planned to install water filtration plants in villages. The government targets to provide clean drinking water to everyone by 2024. Thus, owing to the above-mentioned factors, it is expected to drive the segment's growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the Global Chitosan Market, due to increasing awareness regarding water treatment and the growing demand for cosmetics in the United States, along with the presence of major players. Furthermore, increasing healthcare expenditure and the presence of well-established healthcare infrastructure are also fueling the growth of the overall regional market to a large extent.

The COVID-19 pandemic has shown a positive response toward the Chitosan Market as chitosan-based research and development has been increasing in the development of therapeutics or protective equipment in the management of the disease. In 2021, clinical studies are being conducted to investigate the protective effect of a new type of respirator with a filter element containing chitosan nanoparticles, which show a positive impact on the market.

Increasing obesity and overweight issues in the region and rising health awareness among people act as significant opportunities for the chitosan market. For instance, obesity is one of the major population health issues in Canada, affecting one in five Canadian adults as per the Canadian Institute for Health Information. Seven million Canadians were living with obesity, according to a 2017 Canadian Obesity Network report.

Asia-Pacific is also expected to grow at a healthy growth in the forecast period due to the rapid development of end-user industries in Japan, China, India, and South Korea. The increasing demand for biobased products, coupled with a supportive government, and initiatives would also boost the chitosan market.

One of the key factors driving the chitosan demand in the Asia-Pacific region is the easy availability of its raw material, obtained as a waste product from the fishery industry. For instance, according to the Food and Agriculture Organization of the United Nations, during the first half of 2019, China imported 285,900 tons of shrimp, mainly from Ecuador, India, and Saudi Arabia, which was 186% more compared to 100,000 tons imported in 2018. Thus, owing to the above-mentioned factors, the market is likely to grow.

Chitosan Industry Overview

The Chitosan Market is fragmented, competitive, and consists of several major players. In terms of market share, a few of the major players are currently dominating the market. Some companies currently dominating the market include Panvo Organics Pvt Ltd, GTC Bio Corporation, Dupont Corporation, KitoZyme SA, KIMICA Corporation, Dainichiseika Color & Chemicals Mfg Co. Ltd, Heppe Medical Chitosan GmbH, Meron Biopolymers, Qingdao Yunzhou, and Biophrame Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Water Treatment Activities

- 4.2.2 Growing Product Application in the Biomedical, Cosmetics, and Food and Beverage Industries

- 4.2.3 Strong Advancements in the Healthcare/Medical Industry

- 4.3 Market Restraints

- 4.3.1 Regulatory Framework

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Source

- 5.1.1 Shrimps

- 5.1.2 Prawns

- 5.1.3 Crabs

- 5.1.4 Other Sources

- 5.2 By Application

- 5.2.1 Water treatment

- 5.2.2 Cosmetics

- 5.2.3 Pharmaceutical and Biomedical

- 5.2.4 Food and Beverage

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Panvo Organics Pvt Ltd

- 6.1.2 GTC Bio Corporation

- 6.1.3 Dupont Corporation

- 6.1.4 KitoZyme SA

- 6.1.5 KIMICA Corporation

- 6.1.6 Dainichiseika Color & Chemicals Mfg Co. Ltd

- 6.1.7 Heppe Medical Chitosan GmbH

- 6.1.8 Meron Biopolymers

- 6.1.9 Qingdao Yunzhou

- 6.1.10 Biophrame Technologies

- 6.1.11 ChitoTech

- 6.1.12 Marshal Marine

- 6.1.13 BIO21 Co. Ltd

- 6.1.14 Austanz Chitin Pty Ltd

- 6.1.15 KiOmed Pharma