|

市場調查報告書

商品編碼

1433476

錳:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Manganese - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

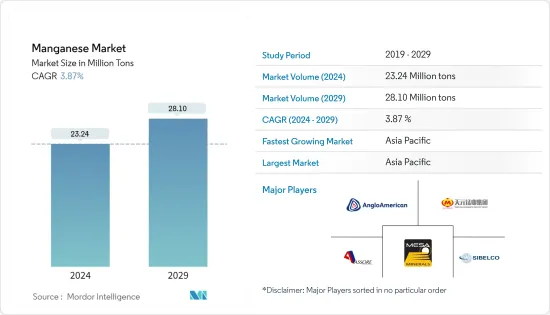

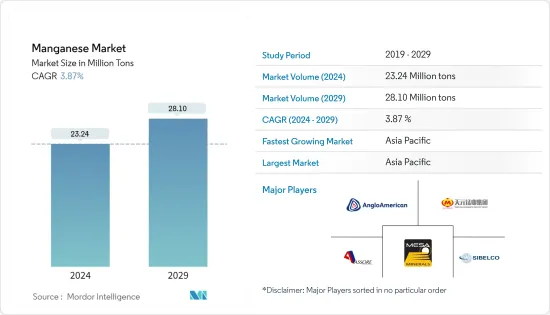

預計2024年錳市場規模為2,324萬噸,預計2029年將達到2,810萬噸,在預測期間(2024-2029年)複合年成長率為3.87%。

在 2020 年疫情大流行的情況下,由於政府為遏制新的 COVID-19感染疾病傳播而實施的封鎖期間建設活動暫時停止,建設產業對鋼材的需求下降。然而,考慮到疫情後的情況,建設產業正在加速發展,未來幾年市場需求可能會增加。

主要亮點

- 短期內,由於電動車需求增加,鋰離子電池生產對錳的需求增加預計將推動市場成長。

- 相反,限制性政府政策和不斷上升的環境問題帶來的不利條件預計將阻礙市場成長。

- 儘管如此,在電池中使用錳可以為全球市場創造利潤豐厚的成長機會。

- 預計亞太地區將主導市場,並且在預測期內也可能呈現最高的複合年成長率。

錳市場走勢

建設產業需求增加

- 錳在鋼中用於提高淬透性和抗張強度。全球超過 40% 的鋼材用於建築領域,包括建築應用(結構型材、鋼筋、板材產品、非結構鋼材等)、基礎設施和交通運輸。

- 錳也充當溫和的氧化劑。鋼材也用於海上石油鑽井平台、橋樑、土木施工機械、壓力容器、發電廠和水力發電站。

- 預計到 2030 年,全球建築業規模約 12.9 兆美元,主要由印度、中國和美國等國家推動。

- 隨著中國應對大危機(截至2021年6月,光是該公司就負債達3,000億美元)和全面的中國金融危機,中國建設產業似乎不穩定,不能排除景氣衰退的影響。

- 在美國,拜登總統推出了2兆美元的計劃,將在2021年徹底改革該國的基礎設施,並將其升級為更綠色的產業。

- 至2025年,印度建築市場產量預計年均成長7.1%。此外,到2030年,印度房地產業預計將達到1兆美元,對GDP的貢獻率達13%。

亞太地區主導市場

- 由於中國、印度和日本等國家的需求不斷成長,亞太地區主導了全球市場。

- 近年來,由於快速都市化,特別是在新興國家,新建設計劃的投資增加。亞太地區佔全球建築業投資的大部分,其中中國、印度、日本和東南亞國協的投資增加。

- 基礎設施建設活動的增加以及歐盟主要公司進入盈利的中國市場進一步加速了該行業的擴張。

- 印度建築業約佔該國GDP的9%。自動路線下的印度建築業允許100%外國直接投資,用於城鎮已竣工計劃、商場/購物中心的營運和管理以及商業建設。預計這將在預測期內推動該行業的發展。

- 根據中國國家統計局數據,2021年中國工業生產與前一年同期比較成長約9.6%。此外,繼與前一年同期比較與前一年同期比較生產年增5.0%,刺激了調查市場的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電動車需求增加

- 其他司機

- 抑制因素

- 其他限制因素

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 價格趨勢

- 生產分析

第5章市場區隔

- 按用途

- 合金

- 電解二氧化錳

- 電解

- 其他用途

- 按用途

- 工業的

- 建造

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Anglo American PLC

- Assore Limited(Assmang Proprietary Limited)

- BHP

- Carus Group Inc.

- Eramet

- Jupiter Mines Limited

- Mesa Minerals Limited

- MOIL LIMITED

- Ningxia Tianyuan Manganese Industry Group Co. Ltd

- NIPPON DENKO CO. LTD

- Sibelco

- Tata Steel

- Vale

第7章 市場機會及未來趨勢

The Manganese Market size is estimated at 23.24 Million tons in 2024, and is expected to reach 28.10 Million tons by 2029, growing at a CAGR of 3.87% during the forecast period (2024-2029).

During the pandemic scenario in 2020, construction activities were temporarily stopped during the government-imposed lockdown to curb the spread of new COVID-19 cases, which decreased the demand for steel from the construction industry. However, considering the post-pandemic scenario, the construction industry is picking up the pace which is likely to increase the demand for the market in the coming years.

Key Highlights

- Over the short term, the increasing demand for manganese in lithium-ion battery production, owing to the rising demand for electric vehicles, is expected to drive the market's growth.

- Conversely, unfavorable conditions arising from restrictive governmental policies and growing environmental concerns are expected to hinder market growth.

- Nevertheless, the usage of manganese in batteries is likely to create lucrative growth opportunities for the global market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Manganese Market Trends

Increasing Demand from Construction Sector

- Manganese is used in steel, as it increases hardenability and tensile strength. Over 40% of the world's steel is used in the construction sector for building applications (structural sections, reinforcing bars, sheet products, non-structural steel, and others), infrastructure, and transportation.

- Manganese also acts as a mild oxidizing agent. Steels are also used in offshore oil rigs, bridges, civil engineering and construction machines, pressure vessels, power plants, and hydroelectric plants.

- The global construction industry is estimated to be about USD 12.9 trillion by 2030, primarily driven by countries such as India, China, and the United States.

- China's construction industry looks shaky as the country is dealing with the Evergrande crisis (the company has USD 300 billion of liabilities alone as of June 2021), and a full-fledged Chinese financial crisis and the effect of recession can't be ruled out.

- In the United States, President Biden introduced a USD 2 trillion plan in 2021 to overhaul and upgrade the nation's infrastructure, into a greener industry.

- By 2025, the Indian construction market output is expected to grow on average by 7.1% each year. Additionally, the real estate industry in India is expected to reach USD 1 trillion by 2030 and contribute to 13% of the GDP.

Asia Pacific to Dominate the Market

- Asia Pacific has dominated the market globally, owing to increasing demand from countries such as China, India, and Japan.

- With rapid urbanization, especially in developing countries, investments in new construction projects have been increasing over recent years. Asia Pacific has dominated the construction sector investments worldwide due to the growth in investments in China, India, Japan, and ASEAN countries.

- Increasing infrastructure construction activities and the entry of major players from the European Union into the lucrative market of China have further fueled the industry's expansion.

- The construction industry in India contributes about 9% of the country's GDP. 100% foreign direct investment in the construction industry in India under automatic route is permitted in completed projects for operations and management of townships, malls/shopping complexes, and business constructions. This is expected to boost the industry in the forecast period.

- According to the National Bureau of Statistics of China, Chinese industrial production increased by about 9.6% in 2021, as compared to the previous year. Furthermore, industrial production increased by 5.0% Y-o-Y in October 2022, following an increase of 6.3% Y-o-Y in the previous month, thereby stimulating the demand for the market studied.

Manganese Industry Overview

The manganese market is partially consolidated in nature. Some of the major players in the market (not in particular order) include Anglo American PLC, Assore Limited (Assmang Proprietary Limited), Ningxia Tianyuan Manganese Industry Group Co. Ltd, Mesa Minerals Limited, and Sibelco, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Electric Vehicles

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Price Trends

- 4.6 Production Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Alloys

- 5.1.2 Electrolytic Manganese Dioxide

- 5.1.3 Electrolytic Manganese Metals

- 5.1.4 Other Applications

- 5.2 By End-use Sector

- 5.2.1 Industrial

- 5.2.2 Construction

- 5.2.3 Power Storage and Electricity

- 5.2.4 Other End-use Sectors

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anglo American PLC

- 6.4.2 Assore Limited (Assmang Proprietary Limited)

- 6.4.3 BHP

- 6.4.4 Carus Group Inc.

- 6.4.5 Eramet

- 6.4.6 Jupiter Mines Limited

- 6.4.7 Mesa Minerals Limited

- 6.4.8 MOIL LIMITED

- 6.4.9 Ningxia Tianyuan Manganese Industry Group Co. Ltd

- 6.4.10 NIPPON DENKO CO. LTD

- 6.4.11 Sibelco

- 6.4.12 Tata Steel

- 6.4.13 Vale

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Use of Manganese in Electrical Batteries