|

市場調查報告書

商品編碼

1273378

高嶺土市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Kaolin Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,高嶺土市場的複合年增長率預計將低於 4%。

COVID-19 對 2020 年的市場產生了負面影響。 然而,現在估計市場已達到大流行前的水平,預計未來將穩定增長。

主要亮點

- 由於環保意識增強和紙漿價格上漲,造紙行業使用更多高嶺土。 這一點,連同對高品質陶瓷日益增長的需求,正在推動市場增長。

- 採礦和採用其他替代品的高成本和法規預計會阻礙市場增長。

- 此外,衛生潔具需求的增長預計將成為未來幾年的市場機遇。

- 亞太地區主導著全球市場,中國、印度和日本等國家/地區是最大的消費者。

高嶺土市場趨勢

造紙和陶瓷行業的需求不斷擴大

- 高嶺土主要用於造紙工業,使紙張更光滑、更白,並在紙張的間隙中充當填料。

- 通過使用高嶺土,可以賦予紙張表面吸墨性和不透明性,並獲得耦合等特性以覆蓋表面。可以表現出各種印刷顏色。

- 高嶺土的不透明度對於造紙工業來說是一個非常重要的特性。 高嶺土可用於賦予紙張特性,例如亮度、光澤和粘度。 根據明尼蘇達州自然資源部 (DNR) 的數據,大約 60% 的高嶺土專門用於造紙行業。

- 在陶瓷領域,高嶺土用於白瓷產品、絕緣體和耐火材料。 高嶺土具有出色的成型性,可增加陶瓷產品的干燒強度、尺寸穩定性和光滑的表面光潔度。

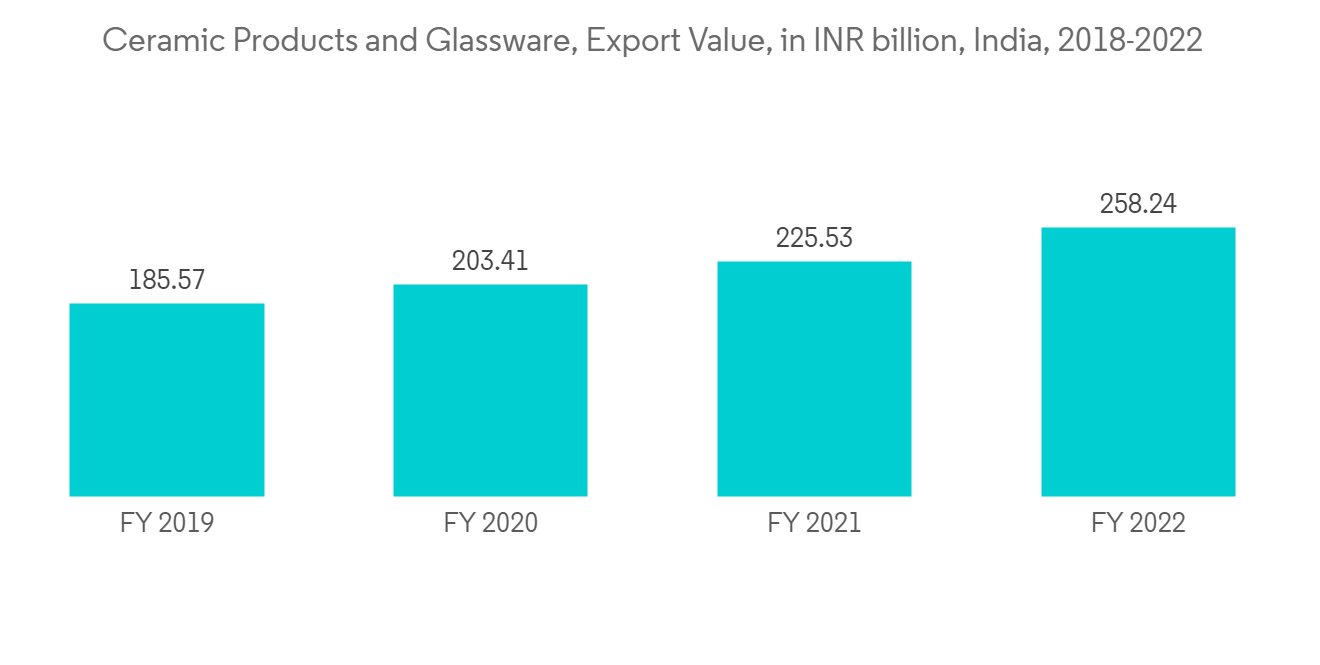

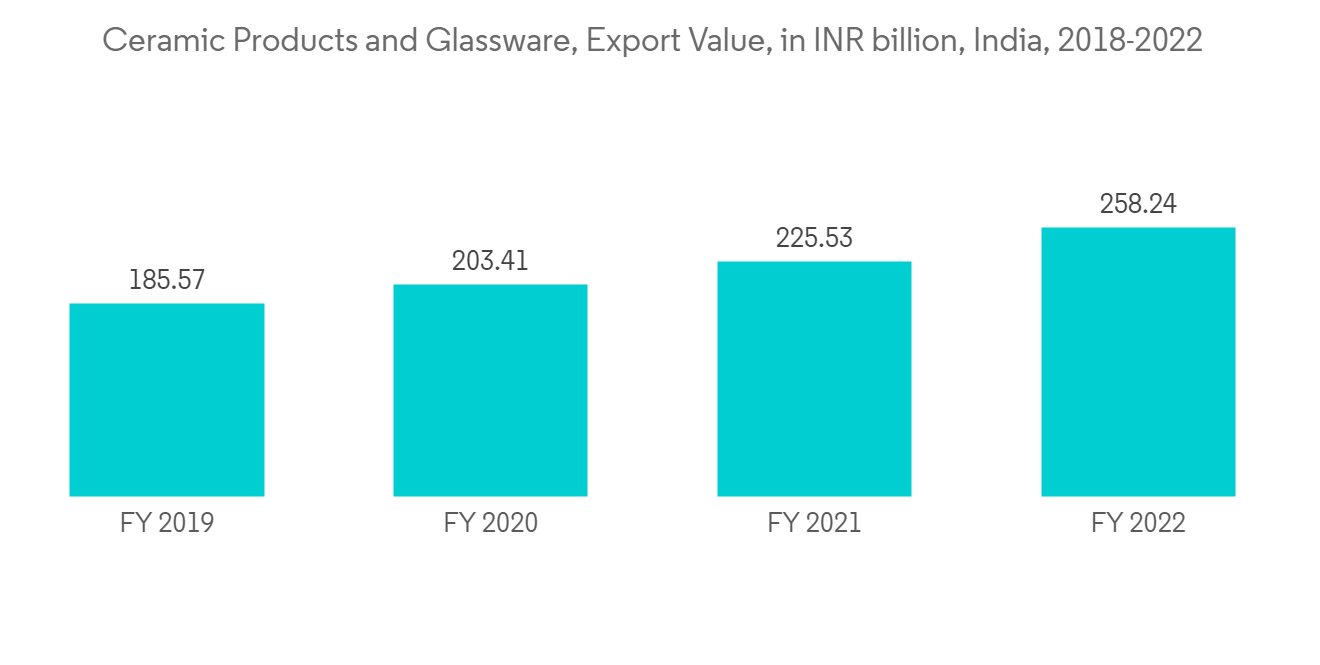

- 根據印度儲備銀行的數據,印度將在 2022 年出口超過 32.8 億美元(2582.4 億印度盧比)的陶瓷和玻璃器皿,以支持市場的增長。

- 此外,根據聯合國糧食及農業組織的數據,2021 年美國將生產 6750 萬噸紙和紙板,比上一年增長近 2%。 美國是世界第二大紙和紙板生產國。

- 因此,由於上述因素,預計在預測期內對高嶺土的需求將顯著增加。

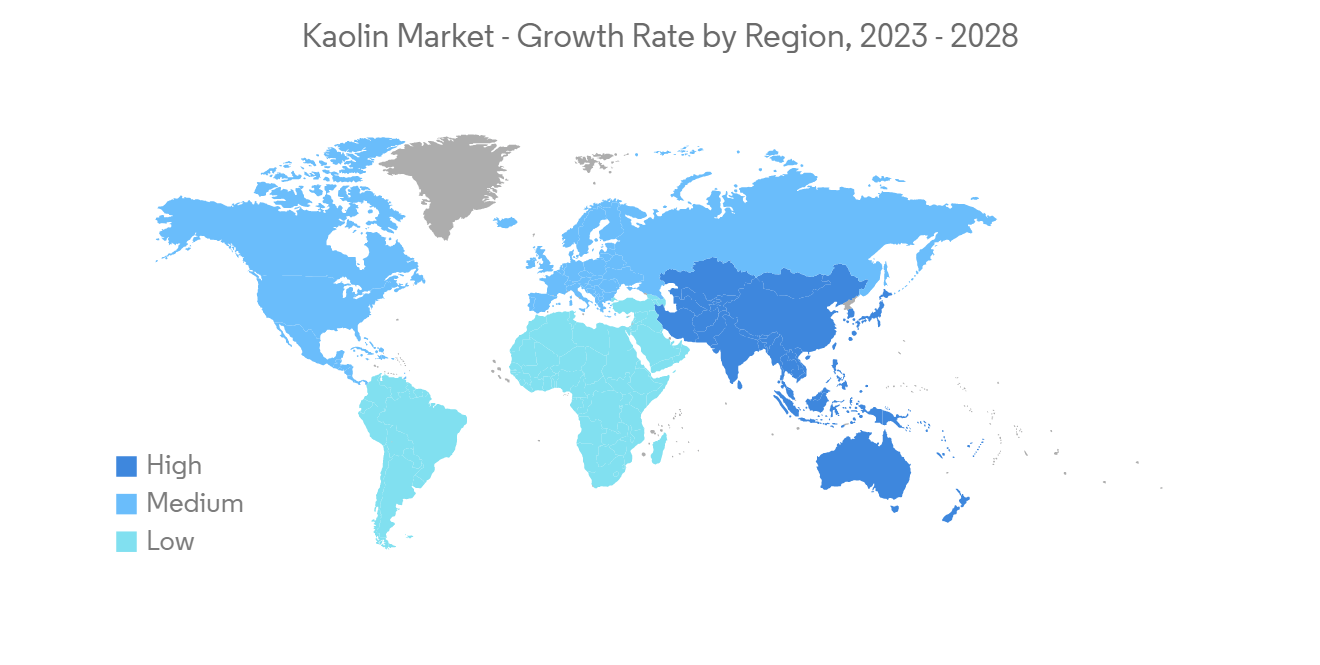

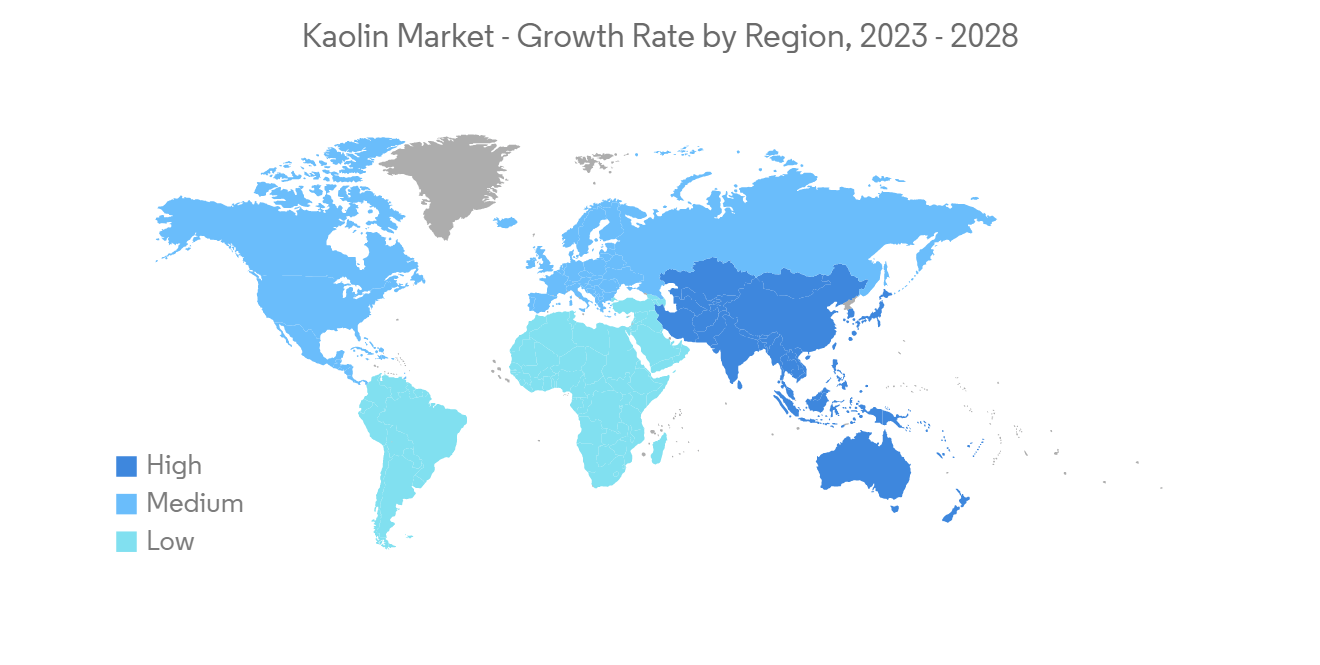

亞太地區主導市場

- 亞太地區在中國和印度擁有高度發達的陶瓷工業和紙及紙板生產,以及多年持續投資發展塑料和橡膠技術領域。因此,預計將佔據主導地位全球市場。

- 中國和印度的陶瓷工業正在發展,高嶺土的使用也在增加。 尤其是衛浴、餐具、瓷磚等產品,近年增長不俗。 據陶瓷世界網報導,中國目前是世界第一大瓷磚生產國,其次是印度。

- 在亞太地區,高嶺土主要用於造紙行業,因為生產紙張和紙板需要紙漿。

- 根據中國國家統計局的數據,2022 年 9 月中國生產了約 1160 萬噸加工紙和紙板產品,與 2022 年 8 月相比增長了約 8%。

- 近年來,由於高嶺土具有耐磨性、尺寸穩定性和化學惰性等特性,其在油漆、橡膠、塑料、醫藥、粘合劑和水泥等領域的使用顯著增加。

- 根據橡膠委員會的數據,到 2022 年,印度的天然橡膠消費量將超過 120 萬噸,年增長率為 13%。 到2021年,印度將成為世界第二大天然橡膠消費國。 因此,它將極大地促進該地區的市場增長。

- 因此,預計在預測期內,各種應用需求的增加將推動該地區對高嶺土的需求。

高嶺土產業概況

高嶺土市場最初是部分合併的。 市場參與者包括 BASF SE、SCR-Sibelco NV、EICL、Quartz Works GmbH、Imerys 等(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 在陶瓷和耐火材料中的應用擴展

- 造紙和橡膠行業的需求不斷擴大

- 約束因素

- 替換為其他替代品

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於金額)

- 用法

- 橡膠

- 陶瓷

- 論文

- 塑料

- 繪畫

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%) 分析**/市場排名分析

- 主要公司採用的策略

- 公司簡介

- BASF SE

- EICL

- Imerys

- KaMin LLC

- Koalin AD

- KERAMOST, a.s.

- I-Minerals

- Quartz Works GmbH

- SCR-Sibelco NV

- Thiele Kaolin Company

第七章市場機會與未來趨勢

- 衛生潔具需求不斷擴大

簡介目錄

Product Code: 69420

The kaolin market is projected to register a CAGR of less than 4% during the forecast period.

The COVID-19 negatively impacted the market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The paper industry uses more kaolin because people are becoming more aware of the environment and the price of pulp is going up.This, along with the growing need for high-quality ceramics, is driving market growth.

- High costs and regulations in mining and the adoption of other substitutes are expected to hinder market growth.

- Further, growing demand for sanitary ceramics is expected to act as a market opportunity in the coming years.

- The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Kaolin Market Trends

Growing Demand from Paper and Ceramics Industries

- Kaolin is primarily used in the paper industry; it makes paper smoother and whiter, and it also acts as a filler in the interstices of the sheet.

- The use of kaolin supports gaining properties such as adding ink receptivity and opacity to the paper sheet and coupling to coat the surface, which in turn supports producing sharp photographic illustrations and bright printed colors.

- Kaolin has perfect opacity, which is an extremely important property for the paper industry. The use of kaolin gives brightness, gloss, and viscosity properties to paper. According to the Minnesota Department of Natural Resources (DNR), U.S.A., about 60% of kaolin is used only by the paper industry.

- In ceramics, kaolin is used for whiteware products, insulators, and refractories. Kaolin has excellent molding properties and adds dry and fired strength, dimensional stability, and a smooth surface finish to the ceramic products.

- According to the Reserve Bank of India, India exported ceramic and glassware goods worth more than USD 3.28 billion (INR 258.24 billion) in the fiscal year 2022 thus supporting market growth.

- Further, according to the Food and Agriculture Organization of the United Nations, in 2021, the United States produced 67.5 million metric tons of paper and paperboard, a nearly 2% increase over the previous year. The United States is the world's second-largest producer of paper and paperboard.

- Therefore, owing to the above-mentioned factors, the demand for kaolin is expected to increase significantly during the forecast period.

Asia Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market owing to the highly developed ceramic sector and paper and paperboard production in China and India, coupled with the continuous investments made in the region to advance the plastic and rubber technology sectors through the years.

- The growing ceramic industry in China and India increases the utilization of kaolin. Especially products like sanitaryware, tableware, and tiles had decent growth in recent years. According to the Ceramic World Web, China stands first globally, followed by India, in ceramic tile manufacturing in the current scenario.

- In Asia-Pacific, the major usage of kaolin is in the paper industry because of the cost and limitations of pulp in the production of paper and paperboard.

- According to the National Bureau of Statistics of China, around 11.6 million metric tons of processed paper and cardboard were produced in China in September 2022, reflecting an increase of nearly 8% compared to August 2022.

- Recently, the usage of kaolin in paints, rubber, plastics, medicines, adhesives, and cement sectors has been significantly growing due to its abrasion resistance, dimensional stability, and chemical inertness properties.

- According to the Rubber Board, in FY 2022, India consumed more than 1.2 million metric tons of natural rubber, an increase of 13% annually. In 2021, India will be the world's second-largest user of natural rubber. thus boosting market growth significantly in the region.

- Thus, the increasing demand from various applications is likely to surge the demand for kaolin in the region during the forecast period.

Kaolin Industry Overview

The kaolin market is partially consolidated in nature. Some of the major players in the market include BASF SE, SCR-Sibelco NV, EICL, Quartz Works GmbH and Imerys, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Ceramics and Refractories

- 4.1.2 Growing Demand from Paper and Rubber Industries

- 4.2 Restraints

- 4.2.1 Replacement by Other Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Rubber

- 5.1.2 Ceramics

- 5.1.3 Paper

- 5.1.4 Plastics

- 5.1.5 Paintings

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 EICL

- 6.4.3 Imerys

- 6.4.4 KaMin LLC

- 6.4.5 Koalin AD

- 6.4.6 KERAMOST, a.s.

- 6.4.7 I-Minerals

- 6.4.8 Quartz Works GmbH

- 6.4.9 SCR-Sibelco NV

- 6.4.10 Thiele Kaolin Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sanitary Ceramics

02-2729-4219

+886-2-2729-4219