|

市場調查報告書

商品編碼

1406084

抗菌添加劑:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Antimicrobial Additive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

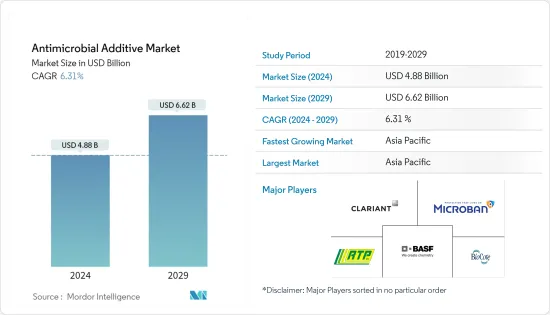

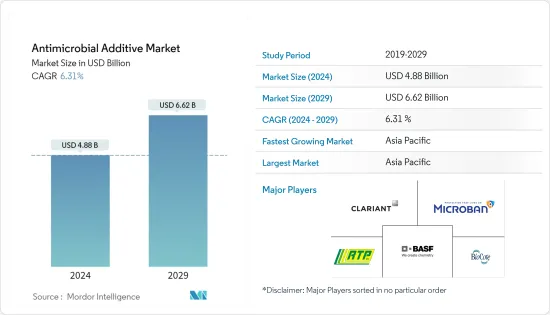

抗菌添加劑市場規模預計到 2024 年為 48.8 億美元,預計到 2029 年將達到 66.2 億美元,在預測期內(2024-2029 年)複合年成長率為 6.31%。

抗菌添加劑可在產品的整個使用壽命中抑制微生物的生長,從而提高產品的使用壽命和衛生水平,並付加最終產品的價值。這些添加劑在製造過程中被注入產品中。塑膠和醫療領域產品應用的擴大正在推動市場成長。

然而,安全處置問題以及這些添加劑對生態系統的有害影響可能會阻礙所調查市場的擴張。此外,COVID-19 爆發造成的不利環境也可能阻礙市場成長。

使用抗真菌保護劑來保護軟性聚氯乙烯等進步可能會在未來五年為抗菌添加劑市場提供機會。

亞太地區在塑膠和醫療領域抗菌添加劑的消費量不斷增加,在全球市場中佔據主導地位。

抗菌添加劑市場趨勢

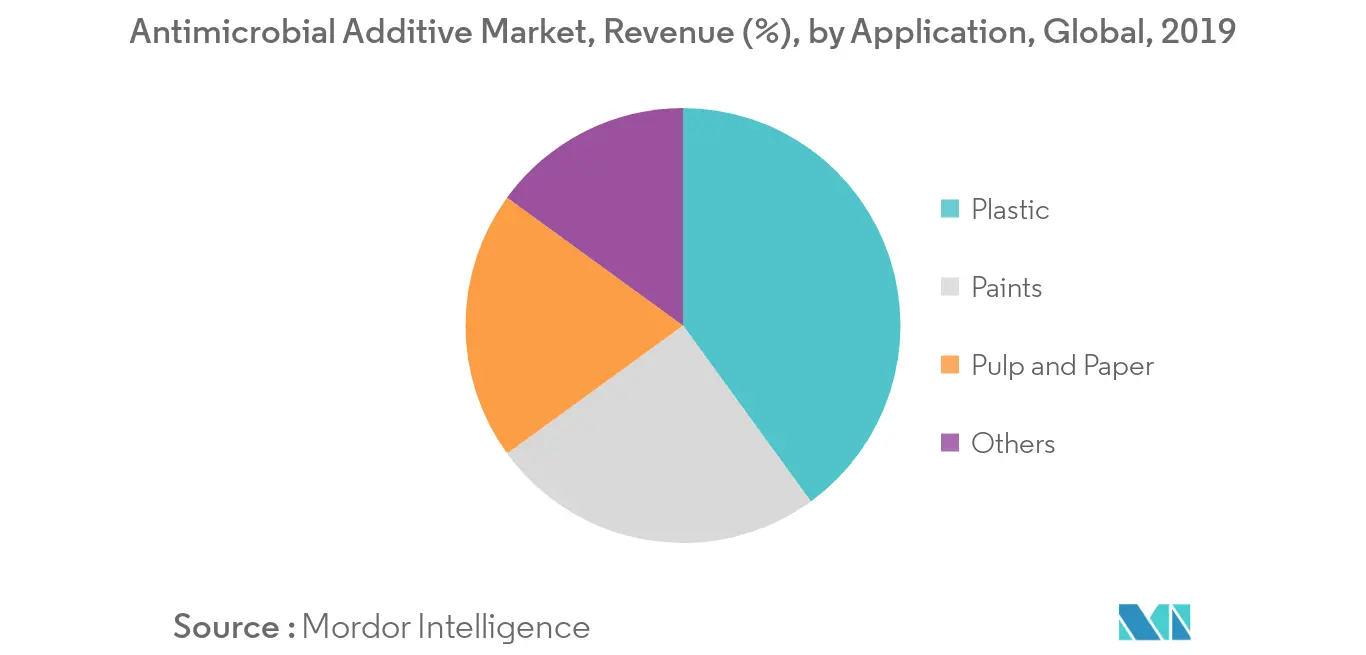

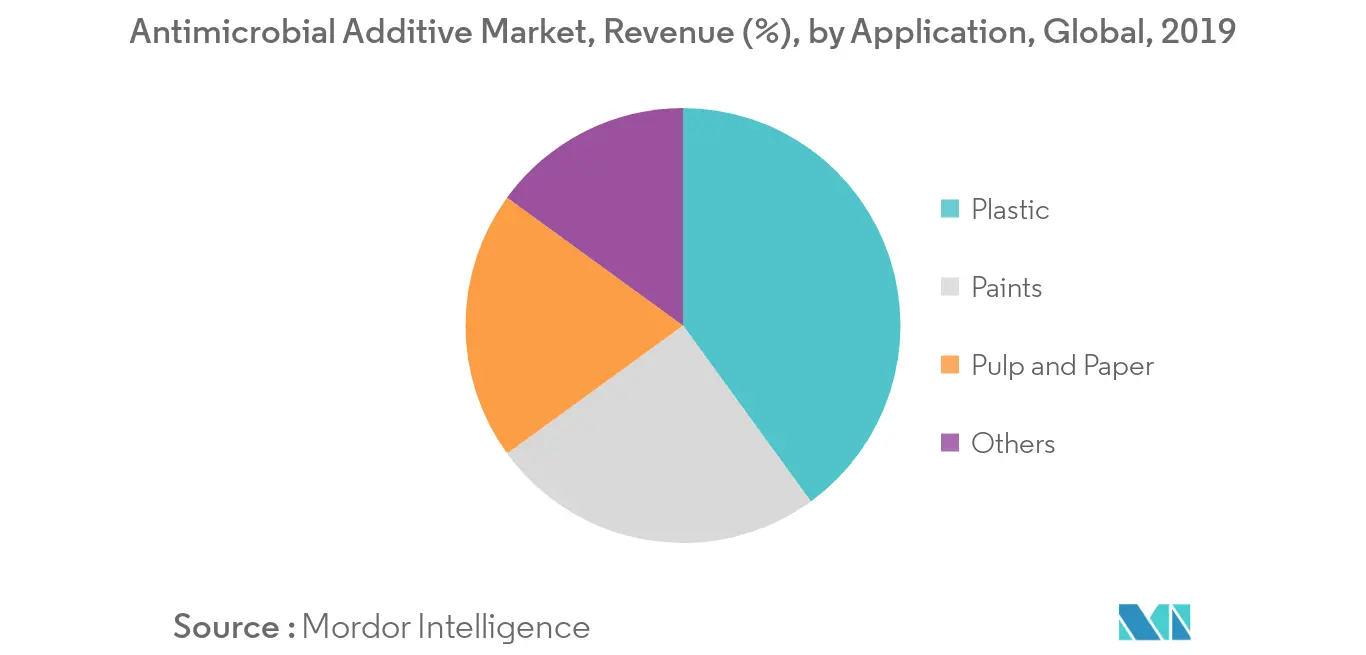

塑膠領域主導市場

- 由於包裝、汽車和建築等各種最終用戶行業對塑膠的大量消耗,塑膠領域將主導市場。

- 塑膠是細菌和黴菌等微生物的滋生地。因此,在塑膠的製造過程中加入抗菌添加劑,以提供對各種微生物的抵抗力,並提供塑膠產品的長期耐用性。

- 塑膠廣泛應用於皂液器、食品容器、外科產品、呼吸設備等,在預測期內增加了抗菌添加劑的需求。

- 中國、印度等亞太國家在食品飲料和醫療產業抗菌添加劑的使用方面錄得強勁成長,預計將在預測期內推動市場發展。

亞太地區主導市場

- 亞太地區是抗菌添加劑的最大市場。食品飲料和醫療行業的廣泛應用等因素預計將推動市場成長。

- 抗菌添加劑的有益特性,例如抑制暴露於紫外線、不衛生環境和潮濕的材料上的細菌、藻類和真菌生長,預計將推動市場成長。

- 在醫療家具和醫療設備中加入抗菌添加劑是最大限度降低醫療環境中細菌侵襲風險的一步。

- 紡織品、油漆、聚合物和塗料等廣泛應用對無機添加劑的需求不斷成長,預計將在預測期內推動市場成長。

- 在食品和飲料最終用途領域,抗菌添加劑正在被廣泛使用,食品和飲料行業的貨架、地板材料、食品加工設備、製冰機、儲存容器、飲水機、水化系統等中都持續使用抗菌添加劑。對該藥物的需求預計將會增加。

- 因此,所有這些市場趨勢預計將在預測期內推動該地區抗菌添加劑市場的需求。

抗菌添加劑產業概況

全球抗菌添加劑市場較為分散,只有少數大型企業和許多小型公司。主要公司包括BASF SE、BioCote Limited、RTP Company、Clariant 和 Microban。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食品包裝領域的成長

- 擴大抗菌添加劑在塑膠應用中的使用

- 抑制因素

- 抗菌添加劑的毒性

- 由於 COVID-19 的爆發,情況不利

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 有機的

- 無機的

- 目的

- 塑膠

- 畫

- 紙漿/紙

- 其他

- 最終用戶產業

- 建造

- 車

- 醫療保健

- 食品與飲品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- BioCote Limited

- Clariant

- LyondellBasell Industries Holdings BV

- Milliken Chemical

- Momentive

- NanoBioMatters

- PolyOne

- RTP Company

- SANITIZED AG

- The DOW Chemical Company

第7章 市場機會及未來趨勢

The Antimicrobial Additive Market size is estimated at USD 4.88 billion in 2024, and is expected to reach USD 6.62 billion by 2029, growing at a CAGR of 6.31% during the forecast period (2024-2029).

Antimicrobial additives restrain the growth of microorganisms throughout the useful life of the product, enhance product life & hygiene, and provide value addition to an end product. These additives are infused into a product during the manufacturing process. The growing product application in plastic and healthcare segment has been driving the market growth.

However, the issue of safe disposal and harmful effects of these additives on the eco-system are likely to hinder the expansion of the studied market. Moreover, unfavorable conditions arising due to the COVID-19 outbreak is also likely to hamper market growth.

The advancements such as the use of antifungal protection to preserve flexible polyvinyl chloride are likely to deliver opportunities for the antimicrobial additive market over the next five years.

Asia-Pacific region dominates the market across the world with the escalating consumption of antimicrobial additive in plastic and healthcare sector.

Antimicrobial Additives Market Trends

Plastic Segment to Dominate the Market

- Plastic segment stands to be the dominating segment owing to the extensive consumption of plastic in various end-user industries like packaging, automotive and construction amongst others.

- Plastic is susceptible to microbial growth including bacteria and mold. Therefore antimicrobial additives are incorporated during the production process of plastics and offer resistance against various microbes, thus, resulting in the long-term durability of plastic products.

- Plastics are extensively utilized in soap dispensers, food containers, surgical products, and breathing devices, etc. which augment the demand for antimicrobial additive in the forecast period.

- Asia-Pacific countries like China, India, etc have been registering strong growth in the utilization of antimicrobial additive in food and beverage and healthcare industry, which is expected to drive the market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region stands to be the largest market for antimicrobial additive. Factors, such as extensive application in food and beverage and healthcare industry are expected to propel the market growth.

- Beneficial attributes of antimicrobial additives like inhibition of bacterial, algal, and fungal growth for those materials exposed to ultraviolet radiation, unsanitary conditions and moisture are likely to drive the market growth.

- Incorporation of antimicrobial additives in healthcare furnishings and medical equipment is a step toward minimizing the risk of bacteria attack in the healthcare environment.

- Rising demand for inorganic additives in a wide range of applications, including textiles, paints, polymers, and coatings is anticipated to propel the market growth during the forecast period.

- The food and beverage end-use segment is expected to increase the demand of antimicrobial additive owing to continuous utilization of additives in shelving, flooring, and food processing equipment, ice making machines, storage containers, water coolers, and water hydration systems in the food and beverage industry.

- Hence, all such market trends are expected to drive the demand for antimicrobial additive market in the region during the forecast period.

Antimicrobial Additives Industry Overview

The global antimicrobial additive market is fragmented with the presence of a few large-sized players and a large number of small players operating. Some of the major companies are BASF SE, BioCote Limited, RTP Company, Clariant and Microban amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Food Packaging Segment

- 4.1.2 Growing Use of Antimicrobial Additive in Plastic Application

- 4.2 Restraints

- 4.2.1 Toxic Nature of Antimicrobial Additive

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.2 Application

- 5.2.1 Plastic

- 5.2.2 Paints

- 5.2.3 Pulp and Paper

- 5.2.4 Others

- 5.3 End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Food and Beverage

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BioCote Limited

- 6.4.3 Clariant

- 6.4.4 LyondellBasell Industries Holdings B.V.

- 6.4.5 Milliken Chemical

- 6.4.6 Momentive

- 6.4.7 NanoBioMatters

- 6.4.8 PolyOne

- 6.4.9 RTP Company

- 6.4.10 SANITIZED AG

- 6.4.11 The DOW Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Antifungal Additive for PVC

- 7.2 Other Opportunities