|

市場調查報告書

商品編碼

1435768

陶瓷基板:市場佔有率分析、產業趨勢、成長預測(2024-2029)Ceramic Substrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

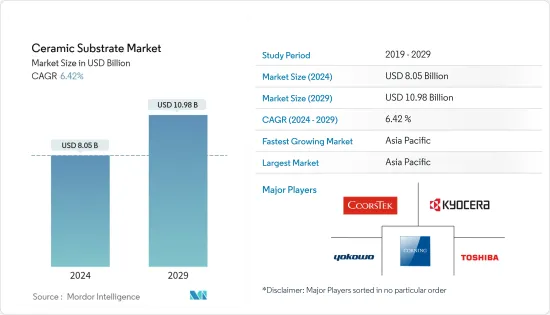

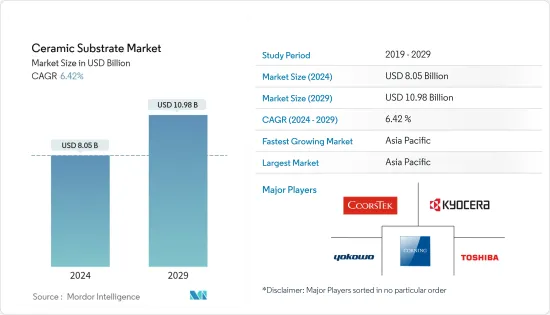

陶瓷基板市場規模預計到2024年為80.5億美元,預計到2029年將達到109.8億美元,在預測期內(2024-2029年)複合年成長率為6.42%,預計將會成長。

2020年,陶瓷基板市場受到新型冠狀病毒感染疾病(COVID-19)的負面影響。然而,在COVID-19感染疾病之後,該行業迅速復甦,預計未來幾年將出現成長,這有望刺激陶瓷基板市場的需求。

主要亮點

- 推動市場研究的關鍵因素是陶瓷基板相對金屬的需求不斷成長,以及陶瓷基板在電子應用中的採用不斷增加。

- 陶瓷基板的使用成本高、易於損壞以及組裝和測試過程中需要小心處理,預計將成為預測期內陶瓷基板市場的限制因素。

- 醫療產業和汽車行業新興應用需求的增加是預測期內陶瓷基板市場的機會。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

陶瓷基板市場趨勢

半導體產業需求增加

- 陶瓷基板透過其在製造中的重要作用,對促進半導體產業的發展發揮關鍵作用。

- 半導體製造商使用陶瓷基板,例如氧化鋁、氧化鈹和氮化鋁。這些材料因其硬度、耐磨性、高溫下耐強酸強鹼、良好的導熱性、非常高的體積電阻率以及非常低的介電常數和損耗角正切等特性而被用於半導體工業。

- 由於自動駕駛、人工智慧等技術的需求,全球半導體產業近年來穩步成長。

- 根據半導體產業協會(SIA)的數據,2022年全球半導體銷售額達5,740億美元,較2021年的5,559億美元成長3.3%。

- 根據世界半導體貿易統計 (WSTS),2022 年所有地理區域的半導體貿易呈現兩位數成長。美洲銷售額成長 17.0%,歐洲銷售額成長 12.6%,日本銷售額成長 10.0%。然而,同年亞太地區的成長率卻下降了2.0%。

- 因此,不斷成長的半導體產業預計將在未來幾年增加對陶瓷基板的需求。

亞太地區主導市場

- 預計亞太地區將佔據最大的市場,也預計將成為預測期內陶瓷基板成長最快的地區。

- 預計中國將在未來幾年成為電子和半導體產品的最大市場。國際產業科技策略中心(ISTI)表示,由於人工智慧應用對積體電路(IC)元件的需求增加,台灣半導體產業產值預計將大幅成長。

- 中國政府推出了「中國製造2025」政策,目標是到2025年將積體電路生產自給率提高到70%。

- 根據半導體產業協會(SIA)的數據,中國在半導體市場佔據主導地位,2022年銷售額為1804億美元,較2021年下降6.2%。

- 印度電子與半導體協會預計,到2025年,該國半導體元件市場規模預計將達到323.5億美元,複合年成長率為10.1%。此外,政府正在進行的「印度製造」計畫預計將刺激對該國半導體產業的投資。

- 此外,印度電子和半導體協會(IESA)與新加坡半導體行業協會(SSIA)簽署了一份合作備忘錄,以建立和發展兩國電子和半導體行業之間的貿易和技術合作。這有望帶動各種突破性半導體製造技術的發展,進一步擴大印度半導體製造中陶瓷基板的消費範圍。

- 目前,日本半導體製造業約有30家公司,涉及製造各類半導體晶片。日本的半導體供應鏈提供了全球三分之一的半導體製造設備和一半以上的產業材料。

- 此外,菲律賓和韓國等國家也為最近研究的市場成長做出了貢獻。

- 上述因素預計將在預測期內進一步推動亞太陶瓷基板市場的需求。

陶瓷基板產業概況

由於市場上存在重要競爭對手,全球陶瓷基板市場部分已整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對陶瓷基板的需求超過金屬基板

- 電子應用中擴大採用陶瓷基板

- 其他司機

- 抑制因素

- 與使用陶瓷基板相關的高成本

- 容易損壞,在組裝和測試過程中需要小心處理

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

第5章市場區隔(以金額為準的市場規模)

- 類型

- 氧化鋁

- 氮化鋁

- 氮化矽

- 氧化鈹

- 其他

- 最終用戶產業

- 消費性電子產品

- 航太/國防

- 車

- 半導體

- 通訊

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- CeramTec GmbH

- CoorsTek Inc.

- Corning Incorporated

- ICP TECHNOLOGY Co.,LTD

- KOA Speer Electronics INC.

- KYOCERA Corporation

- LEATEC Fine Ceramics Co,.Ltd.

- MARUWA Co., Ltd.

- NEOTech

- NIPPON CARBIDE INDUSTRIES CO., INC.

- Niterra Co., Ltd.

- Ortech Advanced Ceramics

- TOSHIBA MATERIALS Co. LTD.,

- TTM Technologies Inc.

- Yokowo co., ltd.

第7章 市場機會及未來趨勢

The Ceramic Substrate Market size is estimated at USD 8.05 billion in 2024, and is expected to reach USD 10.98 billion by 2029, growing at a CAGR of 6.42% during the forecast period (2024-2029).

The ceramic substrate market was negatively impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the industries are recovering fast and are estimated to rise in the coming years, which will stimulate the demand for the ceramic substrate market.

Key Highlights

- The major factor driving the market studied are the increasing demand for ceramic substrates over metal and the rise in the adoption of ceramic substrates in electronics applications.

- The high cost associated with the use of ceramic substrate and prone to damage and need careful handling during assembly and testing is expected to act as a restraint for the ceramic substrate market during the forecast period.

- Increasing demand from the medical industry and emerging applications in the automotive industry is an opportunity for ceramic substrate market during the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Ceramic Substrate Market Trends

Increasing Demand from the Semiconductor Industry

- Ceramic substrate plays an important role in enabling developments in the semiconductor industry through their essential role in manufacturing.

- Semiconductor manufacturers use ceramic substrates such as alumina, beryllium oxide, and aluminum nitride. These materials are used in the semiconductor industry owing to their properties such as hard and resistant to wear, resistant to strong acid and alkali at high temperatures, good thermal conductivity, extremely high bulk resistivity, very low dielectric constant and loss tangent among others.

- The global semiconductor industry is growing at a healthy rate in recent times, owing to the demand for technologies such as autonomous driving, artificial intelligence, etc.

- According to the Semiconductor Industry Association (SIA), in 2022, the worldwide sales of semiconductors reached to USD 574 billion which was increase by 3.3% compared to 2021 at USD 555.9 billion.

- According to World Semiconductor Trade Statistics (WSTS), In 2022, all geographical regions exhibited double-digit growth in trade of semiconductors. The Americas region has increased by 17.0%, Europe by 12.6%, and Japan by 10.0%. However, The growth of Asia-Pacific has declined by 2.0% in the same year.

- Therefore, the growing semiconductor industry is expected to boost the demand for ceramic substrates incoming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to account for the largest market and is also forecasted to be the fastest-growing region for ceramic substrates during the forecast period.

- China is expected to become the largest market for electronics and semiconductor products over the coming years. According to the Industry, Science and Technology International Strategy Center (ISTI), the production value of Taiwan's semiconductor industry is anticipated to grow substantially, owing to the increasing demand for integrated circuit (IC) devices for artificial intelligence applications.

- The Chinese government has introduced the 'Made in China 2025' policy to increase the nation's self-sufficiency in integrated circuits production to 70% by 2025.

- According to Semiconductor Industry Association (SIA), in 2022, China dominated the semiconductor market with sales of USD 180.4 billion which declined as compared to 2021 by 6.2%.

- According to India Electronics and Semiconductor Association, the semiconductor component market in the country is expected to be worth USD 32.35 billion by 2025, displaying a CAGR of 10.1%. In addition, the ongoing Make in India initiative by the government is expected to result in investments in the semiconductor industry in the country.

- Additionally, India Electronics and Semiconductor Association (IESA) signed a MoU with Singapore Semiconductor Industry Association (SSIA) to establish and develop trade and technical cooperation between the electronics and semiconductor industries of both the countries. This is expected to result in development of various break-through semiconductor manufacturing technologies that would further increase the scope for the consumption of ceramic substrate in semiconductor manufacturing in India.

- Japan currently has about 30 semiconductor fabrication industries, which are involved in manufacturing of various types of semiconductor chips. Japan's semiconductor supply chain provides one third of the world's semiconductor manufacturing equipment and more than half of the industry's materials.

- Furthermore, countries such as Philippines and South Korea have also been contributing to the growth of the market studied lately.

- The above mentioned factors are expected to further drive the demand for ceramic substrate market in Asia-Pacific over the forecast period.

Ceramic Substrate Industry Overview

The Global Ceramic Substrate market is partially consolidated with the presence of significant competitors in the market. The major companies in the market are Corning Incorporated, CoorsTek Inc. TOSHIBA MATERIALS Co. LTD., KYOCERA Corporation, and Yokowo co., ltd. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Ceramic Substrates Over Metal

- 4.1.2 Rise in the Adoption of Ceramic Substrates in Electronics Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost Associated with the Use of Ceramic Substrate

- 4.2.2 Prone to Damage and Need Careful Handling During Assembly and Testing

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Alumina

- 5.1.2 Aluminum Nitride

- 5.1.3 Silicon Nitride

- 5.1.4 Beryllium Oxide

- 5.1.5 Others

- 5.2 End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace & Defense

- 5.2.3 Automotive

- 5.2.4 Semiconductor

- 5.2.5 Telecommunication

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CeramTec GmbH

- 6.4.2 CoorsTek Inc.

- 6.4.3 Corning Incorporated

- 6.4.4 ICP TECHNOLOGY Co.,LTD

- 6.4.5 KOA Speer Electronics INC.

- 6.4.6 KYOCERA Corporation

- 6.4.7 LEATEC Fine Ceramics Co,.Ltd.

- 6.4.8 MARUWA Co., Ltd.

- 6.4.9 NEOTech

- 6.4.10 NIPPON CARBIDE INDUSTRIES CO.,INC.

- 6.4.11 Niterra Co., Ltd.

- 6.4.12 Ortech Advanced Ceramics

- 6.4.13 TOSHIBA MATERIALS Co. LTD.,

- 6.4.14 TTM Technologies Inc.

- 6.4.15 Yokowo co., ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand From Medical Industry

- 7.2 Emerging Applications in Automotive Industry