|

市場調查報告書

商品編碼

1433856

紡織品:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

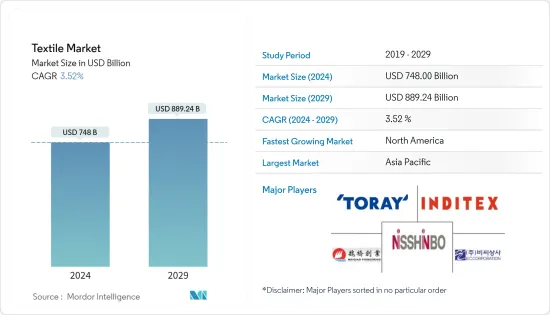

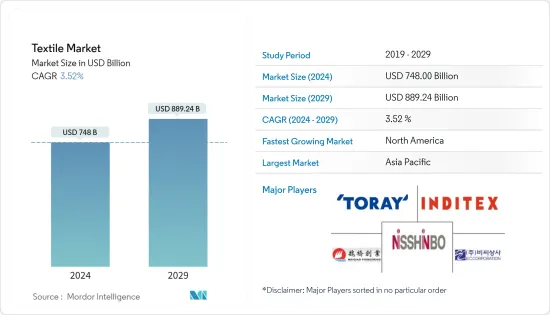

預計2024年紡織品市場規模將達7,480億美元,預計2029年將達8,892.4億美元,預測期內(2024-2029年)複合年成長率為3.52%。

COVID-19大流行為2020年的紡織業帶來了巨大的挑戰。亞洲是全球最大的紡織業市場之一,受到長期封鎖和限制的影響,大多數亞洲國家對產品的國際需求急劇下降。在紡織業占出口比重較大的國家,損失尤其嚴重。國際勞工組織 (ILO) 的一項研究顯示,2020 年上半年全球紡織品貿易崩壞。此外,對歐盟、美國、日本等主要採購地區的出口下降了約70%。由於棉花和其他原料短缺,該行業也遭受了多次供應鏈中斷。

紡織業是一個不斷成長的市場,主要競爭對手是中國、歐盟、美國和印度。中國在紡織品和服飾的生產和出口方面均處於世界領先地位。美國是主要的原棉生產國和出口國,也是主要的紡織品和服飾進口國。歐盟(EU)紡織業佔世界紡織業的五分之一以上,以德國、西班牙、法國、義大利和葡萄牙為首。印度是第三大紡織品製造國,佔全球整體紡織品產量的6%以上。已開發國家和開發中國家的快速工業化和技術進步幫助紡織業擁有了能夠高效生產織物的現代化設備。這些因素幫助紡織業在研究期間錄得更高的收益,預計也將有助於紡織業在預測期間的進一步發展。

紡織市場趨勢

對天然纖維的需求增加

天然纖維複合材料由於比傳統纖維相對更輕、強度更高,因此廣泛應用於汽車產業的內部和外部應用。從植物和動物中獲得的天然纖維包括棉、絲、亞麻、羊毛、亞麻、黃麻和羊絨。這些纖維廣泛應用於服飾、服飾、建築材料、醫用敷料、汽車內裝等。中國、印度和美國擁有豐富的天然纖維,尤其是棉花,為全球紡織品市場的成長做出了巨大貢獻。絲綢有細絲和粗絲之分,可用於室內裝飾和服飾。羊毛和黃麻因其彈性、拉伸性和柔軟性而被用作纖維材料。棉花、絲綢、羊毛和黃麻等天然纖維消費的增加可能會在預測期內推動全球紡織品市場。

轉向不織布

出生率上升和人口老化正在增加對嬰兒尿布、衛生棉和成人失禁用品等衛生用品的需求,預計這將推動對不織布的需求。不織布以地工織物的形式用於道路建設,以提高道路的耐用性。與不織布相關的低維護成本預計將推動建築應用的需求。全球汽車和運輸業的積極前景預計將在未來幾年進一步推動不織布市場的成長。由於非織造布的耐用性,汽車行業使用不織布來製造許多外部和內部零件。快速工業化和紡織技術領域的最新創新是推動全球不織布需求的其他因素。

紡織業概況

本報告重點介紹了紡織業的主要企業。由於市場競爭激烈且分散,每家公司在全球紡織業的市場佔有率都很有限。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與動態

- 市場概況

- 市場促進因素

- 市場限制因素/問題

- 市場機會

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 產業創新

- COVID-19 對紡織業的影響

第5章市場區隔

- 目的

- 服飾

- 產業/職能

- 家

- 材料

- 棉布

- 黃麻

- 絲綢

- 合成纖維

- 羊毛

- 過程

- 機織品

- 不織布

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 市場競爭概況

- 公司簡介

- Toray Industries Inc.

- BC Corporation

- Industria de Diseno Textil SA(Inditex SA)

- Shandong Weiqiao Pioneering Group Company Limited

- Nisshinbo Holdings Inc.

- Chori Co. Ltd

- Texhong Textile Group Ltd.

- Aditya Birla Nuvo Ltd

- Hyosung TNC Corp.

- PVH Corp.

- Far Eastern New Century Corp

- Arvind Ltd*

第7章 市場的未來

第8章 免責聲明

The Textile Market size is estimated at USD 748 billion in 2024, and is expected to reach USD 889.24 billion by 2029, growing at a CAGR of 3.52% during the forecast period (2024-2029).

The COVID-19 pandemic has challenged the textile industry drastically in 2020. Asia, which is one of the largest markets for the textile industry in the world, has suffered from the prolonged lockdowns and restrictions in the majority of Asian countries along with the sudden drop in international demand for their products. The loss was particularly high in countries where the textile industry accounted for a larger share of the exports. According to the study by the International Labour Organization (ILO) the global textile trade collapsed during the first half of 2020. Also, exports to the major buying regions in the European Union, the United States, and Japan fell by around 70%. The industry also suffered several supply chain disruptions due to the shortages of cotton and other raw materials.

The textile industry is an ever-growing market, with key competitors being China, the European Union, the United States, and India. China is the world's leading producer and exporter of both raw textiles and garments. The United States is the leading producer and exporter of raw cotton, while also being the top importer of raw textiles and garments. The textile industry of the European Union comprises Germany, Spain, France, Italy, and Portugal at the forefront with a value of more than 1/5th of the global textile industry. India is the third-largest textile manufacturing industry and is responsible for more than 6% of the total textile production, globally. The rapid industrialization in the developed and developing countries and the evolving technology are helping the textile industry to have modern installations which are capable of high-efficient fabric production. These factors are helping the textile industry to record more revenues during the study period and are expected to help the industry further in the forecast period.

Textile Market Trends

Increasing Demand for Natural Fibers

Natural fiber composites are relatively lighter and have more strength than conventional fibers, and therefore, find extensive application in the automotive industry for interior and exterior applications. Natural fibers obtained from plants and animals include cotton, silk, linen, wool, hemp, jute, and cashmere. These fibers are widely used to manufacture garments, apparel, construction materials, medical dressings, and interiors of automobiles, among others. The abundance of natural fibers, especially cotton, in China, India, and the United States, is contributing significantly to the growth of the global textile market. Silk is used in upholstery and apparel, as it is available in both variations fine as well as coarse. Wool and jute are used as textile materials for their resilience, elasticity, and softness. The increasing consumption of natural fibers, such as cotton, silk, wool, and jute, will drive the global textile market during the forecast period.

Shifting Focus Toward Non-woven Fabrics

The increasing birth rate and aging population has contributed to the growing demand for hygiene products, such as baby diapers, sanitary napkins, and adult incontinence products, which, in turn, is expected to fuel the demand for non-woven fabrics. Nonwovens are used in road construction in the form of geotextiles to increase the durability of roads. Low maintenance costs associated with nonwovens are expected to fuel its demand in construction applications. The positive outlook of the automobile and transportation industry, globally, is further expected to propel growth for the non-woven fabric market over the next years. The automobile industry manufactures a large number of exterior and interior parts using non-woven fabrics owing to their durability. Rapid industrialization and recent innovations in the field of textile technology are other factors fueling demand for non-woven fabrics, globally.

Textile Industry Overview

The report covers the major players operating in the textile industry. In terms of market share, the companies in the global textile industry do not have a considerable amount of market share, as the market is highly competitive and fragmented.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7 Technological Innovation in the Industry

- 4.8 Impact of COVID-19 on the Textile Industry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Clothing Application

- 5.1.2 Industrial/Technical Application

- 5.1.3 Household Application

- 5.2 Material

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 Process

- 5.3.1 Woven

- 5.3.2 Non-woven

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Toray Industries Inc.

- 6.2.2 B.C. Corporation

- 6.2.3 Industria de Diseno Textil SA (Inditex SA)

- 6.2.4 Shandong Weiqiao Pioneering Group Company Limited

- 6.2.5 Nisshinbo Holdings Inc.

- 6.2.6 Chori Co. Ltd

- 6.2.7 Texhong Textile Group Ltd.

- 6.2.8 Aditya Birla Nuvo Ltd

- 6.2.9 Hyosung TNC Corp.

- 6.2.10 PVH Corp.

- 6.2.11 Far Eastern New Century Corp

- 6.2.12 Arvind Ltd*