|

市場調查報告書

商品編碼

1273435

聚對苯二甲酸乙二醇酯 (PET) 收縮膜市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Polyethylene Terephthalate (PET) Shrink Films Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,聚對苯二甲酸乙二醇酯收縮膜市場預計將實現健康增長,預計複合年增長率超過 4%。

COVID-19 對 2020 年的市場產生了負面影響。 大流行情況已使世界上多個國家處於封鎖狀態,以遏制病毒的傳播。 然而,這種情況將在 2021 年恢復,有利於預測期內研究的市場增長。

主要亮點

- 市場增長的主要驅動力是食品和飲料行業不斷增長的需求。

- PET 收縮膜替代品的出現可能會阻礙市場增長。

- 對環保包裝材料不斷增長的需求預計將在未來幾年帶來市場機遇。

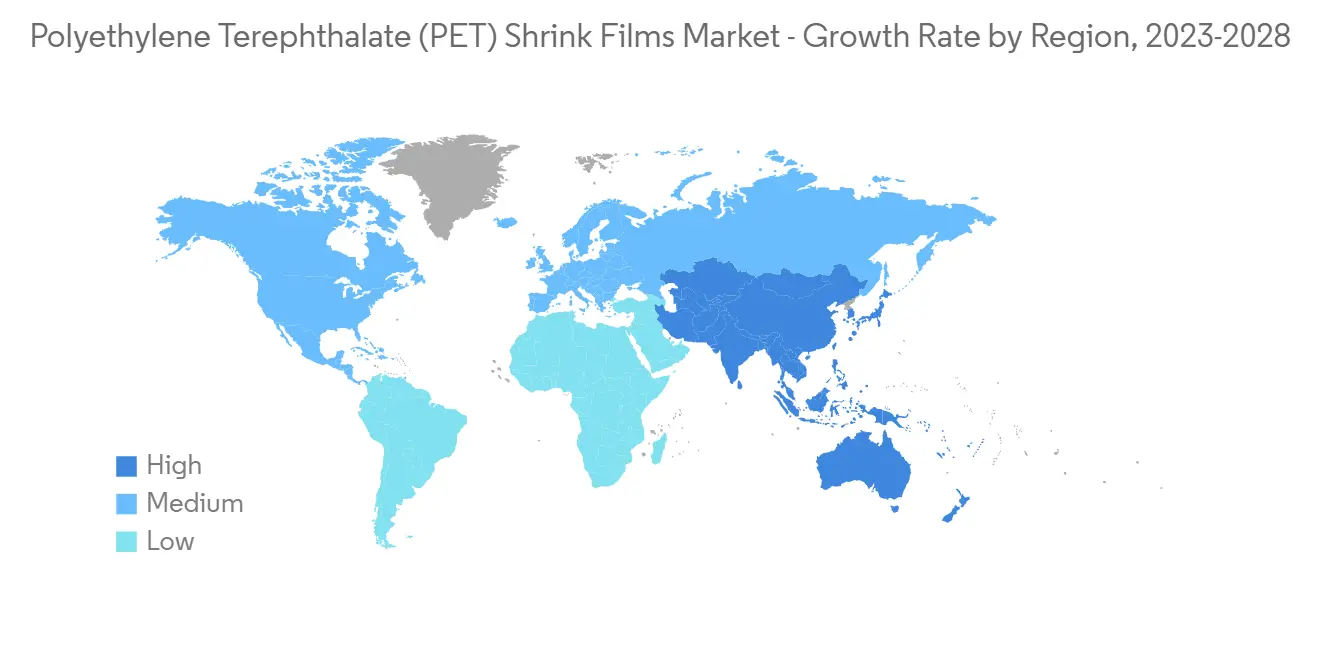

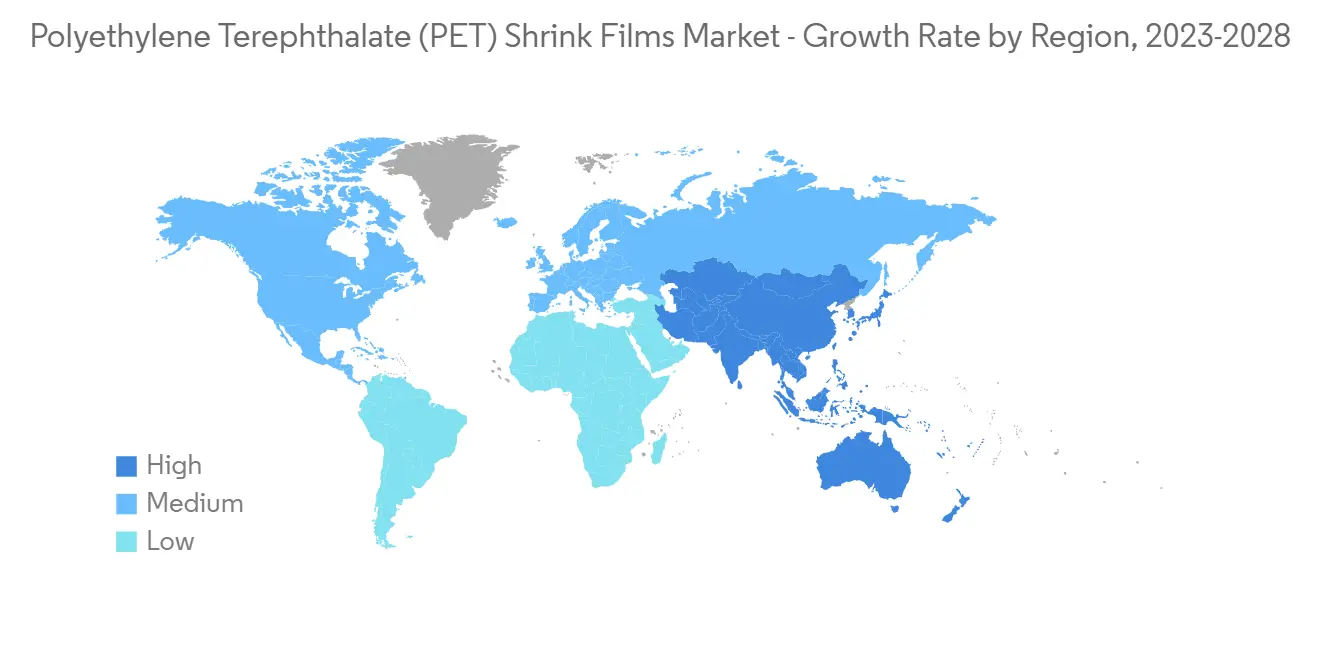

- 亞太地區主導市場,預計在預測期內將繼續保持最高的複合年增長率。

聚對苯二甲酸乙二醇酯 (PET) 收縮膜市場趨勢

食品和飲料行業的需求增加

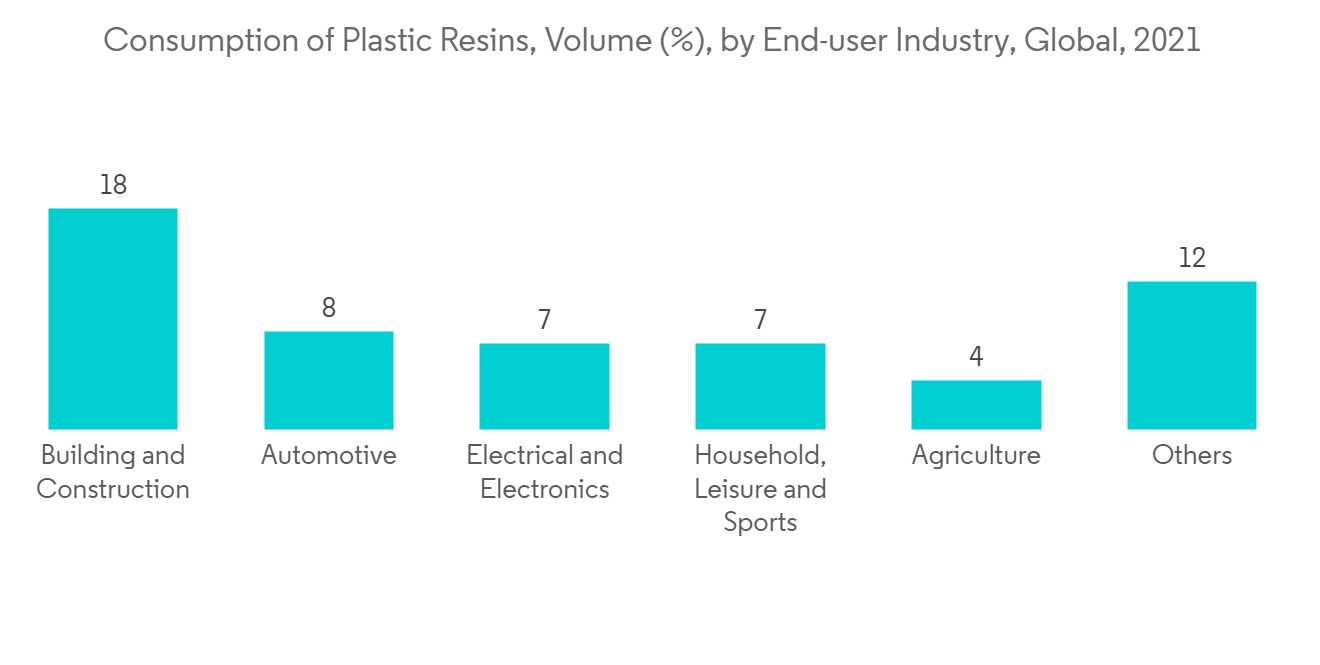

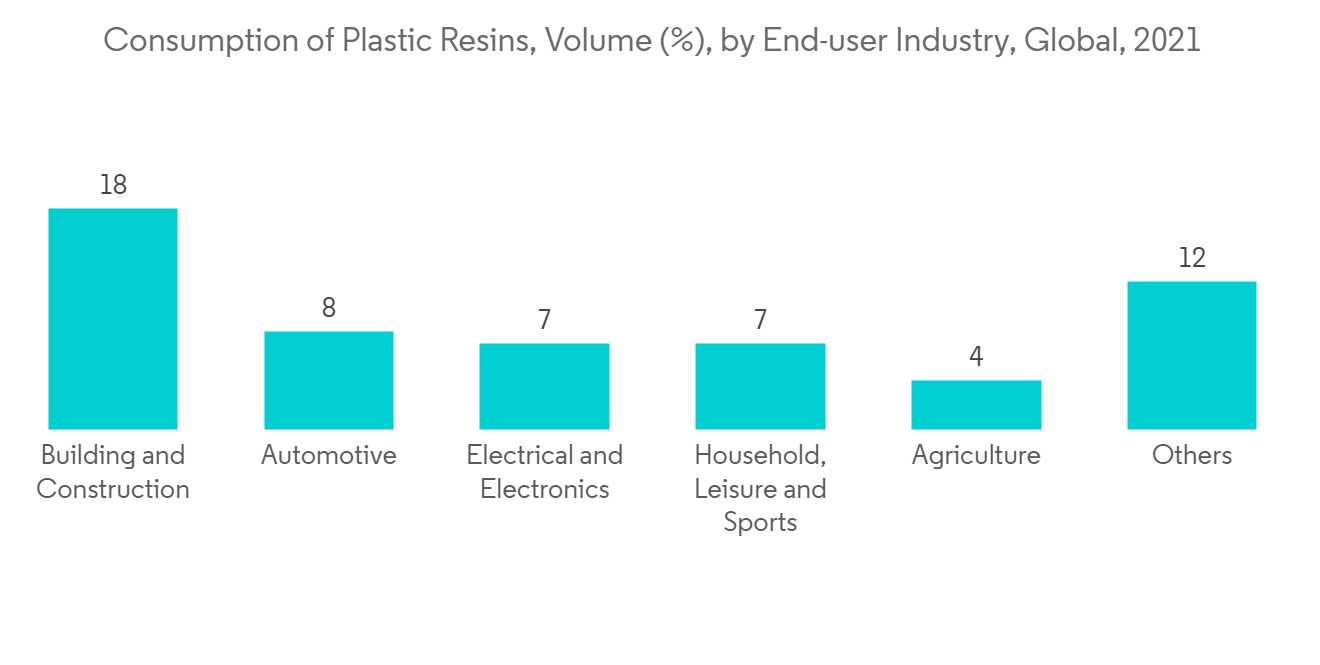

- PET 是最常用的收縮包裝材料之一,因為它可以製成各種密度,並且可以通過添加劑賦予各種功能。

- PET 收縮膜用於食品包裝,例如鬆餅、餅乾、糖果和其他糖果。 捆綁多個產品時,它用作直接與食品接觸的初級包裝。

- 它還用於捆綁小型設備和木材。 超市拖車包裝也是用 PET 收縮膜製成的。

- 根據美國能源部國家可再生能源實驗室的數據,全球每年生產超過 8200 萬噸聚對苯二甲酸乙二醇酯 (PET),用於製造一次性飲料瓶、包裝、服裝和地毯。 到2050年,這一數量預計將達到6億噸。

- PET 收縮膜在食品和飲料行業的產品周圍形成氣密密封。 它可以保護產品免受水分、灰塵和其他污染物的影響。 根據產品包裝公司 Huhtamaki 2022 年的一份報告,美國包裝和餐飲服務塑料的回收率約為 14%。 在歐洲,報告的塑料包裝回收率為 40%。

- 根據包裝與加工協會 (PMMI) 的數據,到 2028 年,北美飲料包裝行業預計將增長 4.5%,其中美國在飲料包裝行業處於領先地位。

- PET 塑料是一種可持續的包裝選擇,也是飲料瓶中使用的主要塑料類型。 這是由於其對有機物和水俱有出色的耐化學性以及高強度重量比。

- 根據關注人們習慣的組織 Habits of Waste 的數據,通過敦促每個人反思他們的浪費行為,全世界每年大約使用 4816.1 億個塑料瓶。我在這裡。 PET 樹脂協會 (PETRA) 報告稱,美國每年回收超過 15 億磅的 PET 瓶和容器。

- 聚對苯二甲酸乙二醇酯是最常見的聚酯基熱塑性塑料,主要用於包裝行業。 許多食品和飲料必需品參與者都在其包裝中加入 PET 材料以確保可持續性。 例如,2022 年 5 月,TekniPlex 推出了一系列由 100% 聚對苯二甲酸乙二醇酯 (PET) 材料製成的處理器托盤。 PET 包裝提供了優質的產品展示,也解決了常見的包裝挑戰。

- 由於這些因素,聚對苯二甲酸乙二醇酯收縮膜市場預計在預測期內將在全球範圍內增長。

亞太地區主導市場

- 亞太地區以超過 40% 的份額主導著全球市場。 中國、印度、日本和韓國等國家不斷發展的包裝和醫療保健行業增加了該地區 PET 收縮膜的消費量。

- 中國擁有世界第二大包裝產業。 由於定制包裝的增加和對包裝商品的需求增加,預計該國在預測期內將持續增長。

- 根據國家統計局的數據,2021 年中國將生產 8004 萬噸塑料,佔世界塑料材料產量的 32%。 這使中國成為僅次於北美的全球最大塑料生產國。

- 此外,中國最近見證了快速消費品 (FMCG) 行業的快速增長。 快速消費品市場的增長歸因於該國的中產階級消費者增加了對優質和注重健康的產品的支出。

- 此外,印度擁有世界第五大包裝產業,而且發展勢頭強勁。 該國的包裝行業受到行業創新的驅動,使產品更加小巧便攜。

- PET 是世界上在包裝、汽車和電子等各個行業中使用最多的聚合物。 據中國國家統計局預測,2021年中國塑料製品總產量將達到8004萬噸。 2022年上半年,塑料製品總產量達到3821萬噸。

- 收縮包裝通常用於產品運輸和存儲。 船隻、汽車和直升機等交通工具通常使用收縮包裝進行包裹,以保護它們在儲存和運輸過程中免受損□□壞。

- 根據 OICA 的數據,2021 年全球汽車產量將達到 8010 萬輛,比上一年的 7760 萬輛增長 4%。 根據印度品牌資產基金會的數據,到 2027 年,印度汽車市場預計將達到 548.4 億美元,複合年增長率超過 9%。 印度的汽車工業製定了到 2026 年將汽車出口翻五倍的目標。 到 2022 年,印度的汽車出口總量將達到 5,617,246 輛。

- 考慮到所有這些因素,預計該地區的聚對苯二甲酸乙二醇酯收縮膜市場在預測期內將穩步增長。

聚對苯二甲酸乙二醇酯(PET)收縮膜行業概況

聚對苯二甲酸乙二醇酯收縮膜市場因其性質而部分整合。 市場上的主要參與者包括 Allen Plastic Industries、Bonset America Corporation、Polyplex、Flint Group、Klockner Pentaplast。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 食品和飲料行業的需求增加

- 其他司機

- 約束因素

- PET 收縮膜替代品的可用性

- COVID-19 大流行的影響

- 行業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 類型

- 低收縮膜

- 中等收縮膜

- 高收縮膜

- 最終用戶行業

- 食品和飲料行業

- 工業包裝

- 個人護理和化妝品

- 印刷/文具

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%) 分析**/排名分析

- 主要公司採用的策略

- 公司簡介

- Allen Plastic Industries Co., Ltd.

- Bonset America Corporation

- Flint Group

- Hubei HYF Packaging Co., Ltd.

- Klockner Pentaplast

- KWC Korea

- Plastic Suppliers, Inc.

- Polyplex

- Triton International Enterprises

- Vintech Polymers Pvt.

第7章市場機會與未來趨勢

- 對環保包裝材料的需求不斷增長

During the forecast period, the polyethylene terephthalate shrink films market is estimated to register healthy growth at an estimated CAGR of over 4%.

COVID-19 negatively impacted the market in 2020. Several countries worldwide went into lockdown to curb the virus spreading due to the pandemic scenarios. However, the condition recovered in 2021, benefiting the market growth studied over the forecast period.

Key Highlights

- The primary factor driving the studied market's growth is increasing demand from the food & beverage industry.

- Substitutes' availability for PET shrink films will likely hinder the market's growth.

- Growing demand for eco-friendly packaging material will likely create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Polyethylene Terephthalate (PET) Shrink Films Market Trends

Increasing Demand from the Food and Beverage Industry

- PET is one of the most commonly used materials for shrink wrapping because it can be produced in various densities and modified with additives to perform many functions.

- PET shrink films are used for packaging food products such as muffins, cookies, candies, and other confectionery products. For bundling multiple products, these films can be used as primary packaging coming into direct contact with the food product.

- Additionally, these films are also used to bundle smaller units and lumber. Supermarket tray wraps are also manufactured using PET shrink films.

- According to the National Renewable Energy Laboratory, US Department of Energy, more than 82 million metric tons of polyethylene terephthalate (PET) is produced each year globally to make single-use beverage bottles, packaging, clothing, and carpets. The volume is expected to reach 600 million tons by 2050.

- PET shrink films form a tight seal around the product in the food and beverage industry. It protects the product from moisture, dust, and other contaminants. According to a 2022 report by Huhtamaki, a product packaging company, the recovery rate for packaging and food service plastics in the United States was about 14%. In Europe, the plastic packaging recycling rate reported was 40%.

- According to the Association for Packaging and Processing, PMMI, the North American beverage packaging industry is expected to increase by 4.5% by 2028, with the United States leading the beverage packaging sector.

- PET plastic is a sustainable packaging option and the leading type of plastic used for beverage bottles. It is due to its excellent chemical resistance to organic materials and water and high strength-to-weight ratio.

- According to Habits of Waste, an organization focused on people's habits by encouraging everyone to rethink wasteful behavior, about 481.61 billion PET bottles are used every year around the world. PET Resin Association (PETRA) reports that more than 1.5 billion pounds of PET plastic bottles and containers are recycled annually in the United States.

- Polyethylene terephthalate is the most common thermoplastic resin of the polyester family and is used majorly in the packaging industry. Many essential food and beverage players are incorporating PET material in their packaging to ensure sustainability. For instance, in May 2022, TekniPlex launched a new line of processor trays made of 100% polyethylene terephthalate (PET) material. PET packaging offers premium product display and also addresses common packaging challenges.

- Owing to all these factors, the market for polyethylene terephthalate shrink films will likely grow worldwide during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global market with a share of more than 40%. With growing packaging and healthcare industries in countries like China, India, Japan, and South Korea, PET shrink film consumption is increasing in the region.

- China includes the second-largest packaging industry in the world. The country is expected to witness consistent growth during the forecast period, owing to the rise of customized packaging and increased demand for packaged goods.

- According to the National Bureau of Statistics, China produced 80.04 million metric tons of plastics, accounting for 32% of global plastic materials production in 2021. It makes China the world's largest plastic producer, followed by North America.

- Moreover, China recently witnessed rapid growth in the fast-moving consumer goods (FMCG) sector. The FMCG market growth was driven by the country's increased spending on premium and healthier products by middle-class consumers.

- Additionally, India includes the fifth-largest packaging industry worldwide, which is growing significantly. The country's packaging industry is driven by growing innovation in industries to make their products compact and portable.

- PET is the most used polymer worldwide in various industries, including packaging, automotive, electronics, and others. According to the National Bureau of Statistics of China, the total production volume of plastic products in China amounted to 80.04 million metric tons in 2021. In the first half of 2022, the total plastic products manufactured reached 38.21 million metric tons.

- Shrink wrap is often used to ship and store products. Vehicles such as boats, cars, and helicopters are often wrapped using shrink wrap to protect them from storage and shipping damages.

- According to OICA, in 2021, global vehicle production reached 80.1 million units, an increase of 4% from the previous year's 77.6 million units. According to India Brand Equity Foundation, the Indian car market is expected to reach USD 54.84 billion by 2027, registering a CAGR of over 9%. Indian automotive industry is targeting to increase the export of vehicles by five times by the year 2026. In 2022, total automobile exports from India stood at 5,617,246.

- Due to all such factors, the region's market for polyethylene terephthalate shrink films is expected to grow steadily during the forecast period.

Polyethylene Terephthalate (PET) Shrink Films Industry Overview

The polyethylene terephthalate shrink films market is partially consolidated in nature. Some of the major players in the market include Allen Plastic Industries Co., Ltd., Bonset America Corporation, Polyplex, Flint Group, and Klockner Pentaplast, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Food & Beverage Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for PET Shrink Films

- 4.2.2 Impact of COVID-19 Pandemic

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Low Shrink Film

- 5.1.2 Medium Shrink Film

- 5.1.3 High Shrink Film

- 5.2 End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Industrial Packaging

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Printing and Stationery

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Allen Plastic Industries Co., Ltd.

- 6.4.2 Bonset America Corporation

- 6.4.3 Flint Group

- 6.4.4 Hubei HYF Packaging Co., Ltd.

- 6.4.5 Klockner Pentaplast

- 6.4.6 KWC Korea

- 6.4.7 Plastic Suppliers, Inc.

- 6.4.8 Polyplex

- 6.4.9 Triton International Enterprises

- 6.4.10 Vintech Polymers Pvt.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Eco-Friendly Material for Packaging