|

市場調查報告書

商品編碼

1326363

農業測試市場規模和份額分析 - 增長趨勢和預測(2023-2028)Agricultural Testing Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

農業檢驗市場規模預計將從2023年的57.1億美元增長到2028年的75.3億美元,預測期內(2023-2028年)複合年增長率為5.70%。

主要亮點

- 農業測試可以定義為測量水、土壤和種子等各種樣品的質量和污染物含量的測試。 農業檢測市場是一個高增長的行業,在世界各地的發達和商業化地區越來越受歡迎。 與環境安全和農業生產力相關的法規和立法是農業檢測市場增長的主要驅動力。

- 從中期來看,由於農產品需求增加、產量增加以及定期土壤測試的需要,市場預計將強勁復甦。 同樣,消費者對化學殘留物方面的食品安全和質量標準的偏好轉變,產生了保持土壤特性以實現高質量生產的需求,並將在預測期內繼續增長,從而支持市場增長。

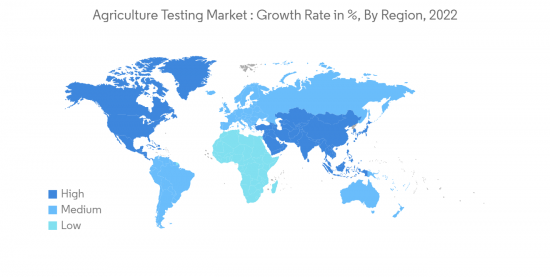

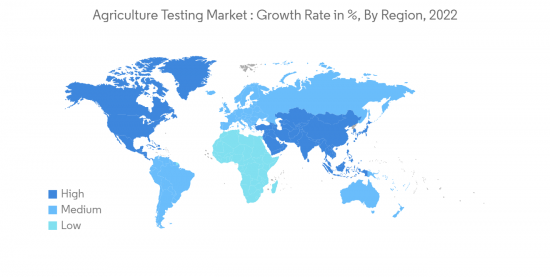

- 北美在農業檢驗市場上佔據主導地位。 該地區的主導份額歸因於嚴格的食品安全、環境、農業法規、營養成分、化學品和標籤法律。 該地區有眾多農業檢驗服務提供商,促進了農業檢驗服務市場的增長。

農業檢驗市場趨勢

農業和環境安全監管和立法

- 有關環境安全和農業生產力的法規和立法是市場增長的主要驅動力。 隨著人們日益關注,各國政府正在積極朝著農業和食品安全方向採取行動,促進市場增長。 例如,美國食品和藥物管理局 (FDA) 最近提議對 FDA 食品安全現代化法案 (FSMA) 農產品安全規則 E 子部分進行修訂。 擬議的修正案旨在通過確保用於灌溉和其他農業用途的水不含可能導致食物中毒的有害污染物來提高食品安全。Masu。

- 擬議的要求將要求涵蓋的農場至少每年以及每當發生增加污染可能性的變化時進行收穫前農業用水評估。 這一監管變化旨在為農民提供更大的靈活性,減輕監管合規負擔,同時確保消費者的產品安全。

- 在商業化農業國家,為了維持農產品出口的擴張,樣品檢測變得越來越流行。

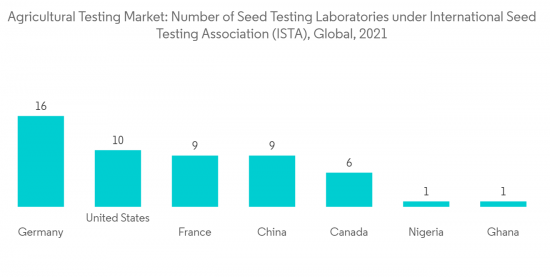

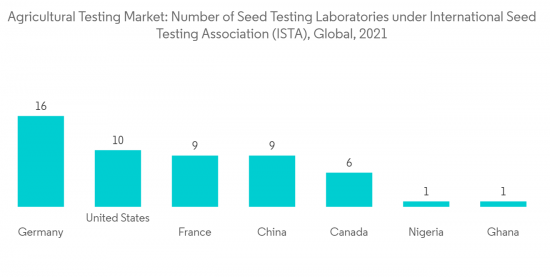

- 近年來,種子測試和土壤測試也很受歡迎。 國際種子測試協會 (ISTA) 是一個國際組織,其宗旨是製定和發布種子測試的標準程序。 國際種子測試協會 (ISTA) 被許多國家視為協調種子測試和種子貿易最新發展的重要工具。 因此,越來越需要解決整個農業供應鍊和食品安全的各種問題和挑戰,增加農業檢測產品的市場潛力。

北美主導市場

- 北美是全球最大的農業檢驗市場。 其中,美國為玩家提供了極具吸引力的市場潛力。 由於美國種子和穀物需要認證,因此該國仍然需要種子測試。

- 種子監管和測試部門 (SRTD) 測試農業和蔬菜種子,確保種子高效有序的營銷,並支持新興市場的開發和擴張。 這些正在幫助市場增長。 該地區在種子檢測中採用電泳和血清學方法的趨勢日益明顯。

- 電泳用於評估種子儲存蛋白。 此外,電泳有時還用於鑑定和測試種子的品種純度。 相反,血清學方法適用於種子的物種鑑定和混合物的物種組成的測定。 此外,血清學方法可以顯示種子蛋白的物種特異性。 隨著消費者的偏好轉向更高的食品安全和化學殘留質量標準,保持土壤特性以實現高質量生產的需求已經出現,預測期內將加強中期市場增長。

農業檢驗行業概況

全球農業檢測市場適度整合,眾多政府實驗室為世界各地的農民提供各種農業檢測服務。 一些領先的公司包括 Eurofins Scientific、R J Hill Laboratories LTD、Agilent Technologies, Inc、SCS Global Services 和 Charm Sciences Inc。 企業在農業檢測市場上的競爭以設備質量和推廣為主,並著眼於戰略舉措以搶占更大的市場份額。 新服務、合作夥伴關係和收購是世界領先公司採取的關鍵戰略。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 市場概覽

- 市場驅動因素

- 市場製約因素

- 行業吸引力 - 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第五章市場細分

- 示例

- 水質檢測

- 土壤測試

- 種子檢驗

- 生物固體檢查

- 糞便檢查

- 其他示例

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 澳大利亞

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美

第6章競爭態勢

- 最常採用的策略

- 市場份額分析

- 公司簡介

- Eurofins Scientific

- Agilent Technologies Inc.

- SCS Global Services

- Bureau Veritas SA

- ALS Limited

- Element Materials Technology

- TUV Nord Group

- Apal Agricultural Laboratory

- Intertek Group PLC

- EMD Millipore Corporation

- BioMerieux SA

- Aurea Agrosciences

- 3M Company

- Charm Sciences Inc.

- Neogen Corporation

- Biolumix Inc.

第7章 市場機會與今後動向

The Agricultural Testing Market size is expected to grow from USD 5.71 billion in 2023 to USD 7.53 billion by 2028, at a CAGR of 5.70% during the forecast period (2023-2028).

Key Highlights

- Agricultural testing can be defined as the testing of various samples, such as water, soil, seed, etc., to determine their quality and contaminant content. The agricultural testing market is a high-growth sector and is gaining popularity in developed and commercialized regions across the globe. Regulations and legalizations pertaining to environmental safety and agricultural productivity have been the major driving force for the market growth of agricultural testing.

- Over the medium term, the market is anticipated to witness robust recovery with higher demand for agricultural products, resulting in increased production and a need for periodic soil testing. Similarly, the shift in consumer preference to a higher standard of food safety and quality in terms of chemical residues creates the need to maintain the soil properties for quality production, thereby bolstering the market growth during the forecast period.

- North America dominates the agricultural testing market. The dominant share of the region is attributed to the stringency in food safety, environmental and agricultural regulations, and laws pertaining to nutritional content, chemicals, and labeling. The presence of numerous agriculture testing service providers in the region contributes to the growth of the agriculture testing service market.

Agricultural Testing Market Trends

Regulations and Legislations Pertaining to Agriculture and Environmental Safety

- Regulations and legalizations about environmental safety and agricultural productivity have been the major driving factor for the market growth. With the rising concerns, governments are acting proactively in the direction of agriculture and food safety, driving the market growth. For instance, the Food and Drug Administration (FDA) recently proposed revising Subpart E of the FDA Food Safety Modernization Act (FSMA) Produce Safety Rule. The proposed changes aim to enhance food safety by ensuring that the water used for irrigation and other agricultural purposes does not contain harmful contaminants that can lead to foodborne illness.

- Under the proposed requirements, covered farms would be required to conduct pre-harvest agricultural water assessments at least once annually and whenever a change occurs, increasing the likelihood of contamination. This change in the regulation aims to provide greater flexibility to farmers and reduce the burden of compliance with the regulation while also ensuring that the product is safe for consumers.

- Sample testing has become increasingly popular in commercialized agriculture countries to maintain the export growth of agricultural commodities.

- Seed and Soil testing has also gained popularity in recent times. International Seed Testing Association (ISTA) is an international organization that aims to develop and publish standard procedures in seed testing. It has gained recognization in many countries as an important tool to harmonize seed testing and modern trends in the seed trade. Therefore, the growing need to address various issues and challenges across the agricultural supply chain and food safety has increased market potential for agricultural testing products.

North America Dominates the Market

- North America is the largest market for agricultural testing across the globe. The United States, among all the regional countries, provides an attractive market potential for the players. There is an ongoing demand for seed testing in the country due to the requirements of certifications for United States seeds and grains.

- The Seed Regulatory and Testing Division (SRTD) tests agricultural and vegetable seeds to ensure the efficient, orderly marketing of seeds and to assist in developing new or expanding markets. These are aiding the growth of the market. In the region, there is an increase in the trend of following electrophoretic and serological methods in seed testing.

- The electrophoretic method is used for the assessment of seed storage proteins. Furthermore, the electrophoretic method may be used to identify and test the cultivar purity of seeds. In contrast, serological methods are suitable for species identification of seeds and determination of species composition of admixtures. In addition, the serological method allows the display of the species specificity of seed proteins. The shift in consumer preference toward a higher standard of food safety and quality, in terms of chemical residues, creates the need to maintain the soil properties for quality production, thereby bolstering the market growth during the forecast period.

Agricultural Testing Industry Overview

The global agricultural testing market is moderately consolidated, with numerous government-operated laboratories providing various agricultural testing services to farmers worldwide. Eurofins Scientific, R J Hill Laboratories LTD, Agilent Technologies, Inc, SCS Global Services, and Charm Sciences Inc. are some of the major players. Companies compete in the agricultural testing market based on equipment quality and promotion and focus on strategic moves to hold larger market shares. New services, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sample

- 5.1.1 Water Testing

- 5.1.2 Soil Testing

- 5.1.3 Seed Testing

- 5.1.4 Bio-Solids Testing

- 5.1.5 Manure Testing

- 5.1.6 Other Samples

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Eurofins Scientific

- 6.3.2 Agilent Technologies Inc.

- 6.3.3 SCS Global Services

- 6.3.4 Bureau Veritas SA

- 6.3.5 ALS Limited

- 6.3.6 Element Materials Technology

- 6.3.7 TUV Nord Group

- 6.3.8 Apal Agricultural Laboratory

- 6.3.9 Intertek Group PLC

- 6.3.10 EMD Millipore Corporation

- 6.3.11 BioMerieux SA

- 6.3.12 Aurea Agrosciences

- 6.3.13 3M Company

- 6.3.14 Charm Sciences Inc.

- 6.3.15 Neogen Corporation

- 6.3.16 Biolumix Inc.

![農業檢驗市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1341980.png)