|

市場調查報告書

商品編碼

1348030

微履行市場:到 2030 年將達到 72 億美元,安裝超過 5,600 個 MFC(第四版)Micro Fulfillment Market to reach $7.2 Billion by 2030 with an installed base of more than 5600 MFCs (4th Edition) |

||||||

預計到 2030 年,微履行市場規模將達到 72 億美元,安裝的 MFC 數量將超過 5,600 個。

微型履行中心 (MFC) 被廣泛推薦作為一種電子商務履行策略,以解決日益增長的運輸量、不斷變化的電子商務需求地理性質以及日益增長的當日或當日送達需求。方法。MFC 的安裝量超過 5,600 台,如果技術和概念經久耐用,預計到 2030 年,未來七年該市場將帶來價值 320 億美元的累積機會。到 2025 年,微訂單履行市場的安裝量預計將達到近 30 億美元,為未來奠定了基礎。

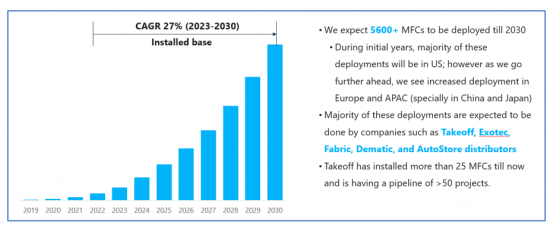

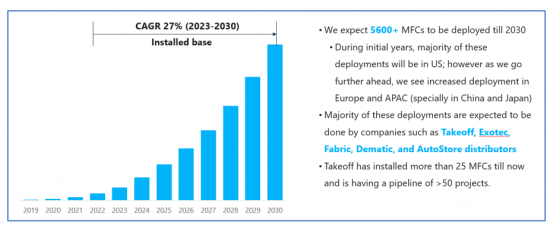

到 2030 年,每年微型配送中心的安裝數量將增加 20 倍以上,從目前的約 250 個安裝數量增加到 2030 年的 5,600 個。到 2023 年,超過 50% 的微型配送中心將位於美國。與目前市場規模(2022 年)相比,微型履行市場預計到 2025 年將成長 2 倍,到 2030 年將成長 12 倍。到 2030 年,MFC 服務預計將貢獻約 20 億美元。

美國將成為未來10年的主要市場,其次是英國、中國、日本和法國。到2030年,預計將安裝約2,700個MFC,全球市場近50%將由美國主導。

該報告深入探討了全球微型履行市場,包括競爭格局、SWOT 分析、到 2033 年的市場預測、COVID-19 的影響以及區域和國家趨勢。

目錄

第一章簡介與背景

第 2 章 微型配送中心 - 驅動因素與挑戰

第三章 成本比較與效益

第 4 章 案例研究

第五章微型配送中心市場、價值、數量、安裝基礎與服務收入

- 全球微履行市場—安裝基數與 2030 年預測

- 各國 MFC 安裝數量及 2030 年預測

- 全球微履行市場(百萬美元)與 2030 年預測

- 按國家/地區劃分的全球微配送市場(百萬美元)以及到 2030 年的預測

- 全球微履行市場-服務收入(百萬美元)

第六章微型履行市場-按技術解決方案劃分的安裝基數和市場規模(百萬美元)

第 7 章 微型履行市場 – 安裝基礎與市場規模(百萬美元),依最終用戶劃分

第 8 章 微型配送市場 – 按倉庫規模劃分的安裝基數和市場規模(百萬美元)

第 9 章 微型配送市場 - 按商店類型部署劃分的安裝基數和市場規模(百萬美元)

第 10 章 微型履約市場 - 安裝基礎和市場規模(百萬美元),按地區和國家劃分

- 履行和運輸的區域動態

- 北美

- 歐洲

- 亞太地區

- 中東

- 拉丁美洲

第十一章競爭格局

第十二章 待分析公司

- 創新新創企業的企業快照

- 產品供應

- 公司簡介

- Addverb Technologies

- Alert Innovation

- Attabotics

- AutoStore

- BrightPick

- Cleveron

- Dematic

- Exotec

- Geek+

- Fabric

- Fulfil

- HDS Global

- Honeywell Intelligrated

- Instock

- i-Collector

- Knapp

- Myrmex (Ocado)

- Ocado Technologies

- OPEX Corporation

- Takeoff Technologies

- Tompkins Robotics

- Vanderlande (Toyota Industries Corp.)

- Savoye

- TGW Logistics Group

- 關鍵績效指標解決方案

第十三章 新動向

- 從貨物到機器人(G2R)

- 工件拾取機器人

- 最後一哩交付

第14章研究方法論

第15章致謝

第 16 章關於 LogisticsIQ

Micro Fulfillment Market to reach $7.2 Billion by 2030 with an installed base of more than 5600 MFCs.

Introduction

Micro Fulfillment Centers (MFCs), a highly recommended popular e-commerce fulfillment strategy, is an effective way to meet the rising volumes, the changing geographical nature of e-commerce demand, and the growing desire for same-day or same-hour delivery. As per the latest market research study (4th Edition), Micro Fulfillment Market is expected to have a cumulative opportunity worth $32B in next 7 years by 2030 with an installed base of 5600+ MFCs if the technology and concept remains permanent. Year 2025 is expected to have an inflection point for Micro Fulfillment market touching almost ~$3B installed mark and setting the base for the future.

The 4th edition of this study is having a market analysis of more than 250 players (part of our exclusive Market Map), Key Technologies, Targeted Warehouse Sizes, End-User Industries, Store Types and more than 20 countries/regions although this market is getting adopted mainly in U.S. and U.K. at present. Our analysis is also validated through 70+ in-depth interviews across the value chain with components and technology providers, system integrators & manufacturers, grocery stores and end-user industry verticals. Market size tables (85+) are also available in pivot-excel format to analyse further along with 200 pages in-depth market study. It is a best reference to analyse the market attractiveness, to identify the partner, customer or supplier, to check the competitive landscape, to benchmark the new technologies and to select the right geography & industry vertical for your products and services. Voice and opinion of grocery stores, dark stores and instant delivery service providers have been taken as the key parameter for this market forecast.

Highlights of Micro-Fulfillment Market Study:

- Annual Micro-Fulfillment Center installations will grow more than 20x by 2030, from current installed base of ~250 to be around ~5600 in 2030

- More than 50% of these micro fulfilment centers will be deployed in United States in 2023.

- Micro-Fulfillment Market is supposed to grow 2X by 2025 and 12X by 2030 as compared to current market size of 2022. MFC Services itself will contribute approximate $2 Billion by 2030 in this emerging space.

- Almost 60% installation are supposed to be deployed with Shuttle-Based and Cube-Storage technologies in 2030 led by AutoStore and Takeoff Technologies. Players like Geek Plus, Grey Orange and Hai Robotics have also entered in this market through their AMR based solutions to give a tough competition to traditional players.

- It is expected to have more than $5B market revenue of Micro-Fulfillment automation from Grocery Omnichannel (Walmart, Kroger, Ocado, Tesco, Albertsons, Meijer, Ahold Delhaize, Target, Carrefour) and Pure-Play E-commerce/Q-commerce players (Amazon, Gopuff, Instacart, Grofers, Missfresh, Dingdong) players by 2030.

- We have forecasted ~1000 MFC installation for In-store deployment and ~120 installation for dark stores in 2030 although there can be some installation within existing or new DC/FC as well.

- More than 50% of such MFC installations are supposed to be targeted for warehouses having a size of between 5000 sq. ft. and 25,000 sq. ft. We are also expecting a good growth for less than 5000 sq. ft. segment due to new dark stores opened by ultrafast delivery players but it is less than our prior estimates due to current challenges faced by rapid service players.

- It is not a sustainable or profitable business for delivery service providers like Getir, Grofers, GoPuff, Instacart, Uber, Jokr, Fridge No More, Gorillas, Buyk, Delivery Hero, Swiggy, Zapp, Rappi, DoorDash, Weezy, Picnic, Jiffy, Shipt, Deliveroo, 1520, Dijas, Caviar, Rakuten, Flink, Justo, BevMo etc. to fulfil and deliver the order manually although they can expect advertisement revenue from FMCG players.

- Delivery service providers may partner with retailers or may have their own dark stores to automate the fulfilment process. Gopuff itself is having more than 500 dark stores and it reflects the huge opportunity of automation in this new customer base.

- USA is going to be main market for next 10 years followed by U.K., China, Japan, and France. We do expect around 2700 MFC installed base i.e., almost 50% of worldwide market within USA by 2030.

Micro Fulfillment - Need of the hour

Industry giants such as Amazon, Walmart, Ocado, Kroger and Alibaba are driving the "best-in-class" e-commerce fulfillment strategy for the last decade. They are also investing in cutting-edge robotics and automation for their Customer Fulfillment Centers (CFCs) - that are continuously redefining target productivity and service levels. But these centralized fulfillment centers are situated far away from the city and have an additional transportation cost along with considerably more delivery time as compared to consumer's expectations, especially in grocery and F&B industry. Online grocery is already having a slim profit margin and micro-fulfillment has the ability to increase its margin and to make e-commerce accessible to a broader range of retailers because it cuts down major costs like

- The cost of storage, retrieval and picking (through automated MFC)

- The cost of the last mile delivery (through hyperlocal placement)

- The cost of real estate (through condensing fulfillment centers down into MFCs)

That's why, Micro Fulfillment Center (MFC) is a perfect solution for urban warehouses with an approximated size between 5000 SF and 25000 SF that can meet the requirement of same day delivery through in-store picking or multiple last-mile delivery options. It can even be deployed at backside of the retail store, dark stores, malls or basements. A typical MFC system is having 1-2 aisles Dry + 1-2 aisles Chilled, 5,000-8,000 totes 10-high storage to 24' x 2-deep, 2 decanting stations and 2-4 pick stations with each station picking at 700-800 UPH.

Top Factors

- It is estimated that online grocery will contribute more than 10% of overall grocery sale in US by 2025.

- It is expected that consumers will continue with habit of buying online grocery developed during pandemic.

- Delivery options may vary as Home Delivery, In-Store Pick Up, Curb side Pickup, Locker Delivery etc.

- Urban warehouses with automation will be key to meet this demand with same day delivery expectations.

- Delivery Fee is the one of the key factors to decide the digital channel in the long term.

- Key to make online grocery business more profitable as compared to current scenario of either net loss or thin profit margin

Micro Fulfillment Market Trends

Micro Fulfillment Market has been the most important and emerging trend during pandemic (covid-19) coming out from some bigger trends like eGrocery Growth, Urban Warehouses, Dark Stores and Automated Cold Storages. Huge investment in start-ups like Takeoff Technologies ($86M+), Fabric ($336M+), Attabotics ($165M+), Exotec Solutions ($446M+), BrightPick ($50M+), and Alert Innovation (Acquired by Walmart) are witnessing this growth along with presence of existing traditional players like Dematic, Swisslog, Knapp, OPEX Corporation, Muratec, SSI Schaefer, Daifuku, Honeywell Intelligrated and Vanderlande. Retailers such as Walmart, Amazon, Kroger, GAP, Nike, Woolworths, Amazon, Ocado, Carrefour, Uniqlo, Meijer, H-E-B, Albertsons, Majid-Al-Futtaim, Decathlon, Nordstorm, H-Mart and Ahold Delhaize have already started adopting and implementing these new technologies during pandemic. Apart this, piece picking robots' suppliers like Berkshire Grey, Righthand Robotics, Kindred AI, Covariant, OSARO, Plus One Robotics, XYZ Robotics, Fizyr have established a new attractive capability for order picking in ecommerce fulfillment to transfer the good-to-person (G2P) systems into good-to-robot (G2R) systems.

Coming to MFC system architecture and technologies, AutoStore is an old and proven technology with hundreds of installations in ecommerce fulfullment including the recent partnership with Swisslog and H-E-B for micro fulfillment center in U.S. but they are going to face a very good competition in MFC space from new players like Takeoff Technologies, Fabric, Exotec Solutions, Attabotics, Berkshire Grey, Geek Plus and Alert Innovation. Established system integrators like Dematic, TGW, SSI-Schaefer, Daifuku, Honeywell Intelligrated, Vanderlande and Knapp are using the traditional shuttle and ASRS systems which are good and already proven for big fulfillment centers but not 100% ideal for micro fulfillment yet. At the same time, Attabotics, Alert Innovation, and Exotec are using emerging 3D technologies having good architecture specific to MFC with high density and no point of failure but it will too early to say anything as there are only few installations and not 100% proved yet. Apart this, software is going to be the main differentiator and value add for MFC systems as some suppliers are having their in-house software capabilities and others are having a partnership to do the needful. As per our discussion with technology suppliers and industry experts, every technology and architecture are having its own advantage and disadvantage depending upon the grocery store's location, current requirement, capital expenditure, fear of digitalization and automation from big players, and insecurity related to its consumers' information.

Key Players Analysed in Micro-Fulfillment Market Ecosystem:

SUPPLY SIDE

- Material Handling Equipment / OEM / System Integrator: Dematic, AutoStore, Swisslog, Knapp, Addverb Technologies, Alert Innovation, Honeywell Intelligrated, LG CNS, Element Logic, Attabotics, Exotec, BrightPick, Instock, Fulfil, Fortna, OPEX Corporation, Muratec, Ocado Technologies, Fabric, Hörmann Logistik, TGW Logistics, Vanderlande, ALSTEF, AM Logistic Solutions, Reesink Logistic Solutions, Lalesse Logistic Solutions, Conveyco, Dexter, KPI Solutions, S&H Systems, AHS, SSI Schaefer, Beumer Group, Koerber Group, Daifuku, GIEicom, MHS, System Logistics, Urbx Logistics, Fives Intralogistics, Kardex Group, Toyo Kanetsu Co., Ltd. (TKSL), IHI, Rocket Solution, Samsung SDS, SmartLOG, Modula, SoftBank robotics, StrongPoint, ASETEC, Klinkhammer Intralogistics GmbH, LAC Conveyors & Automation, Errevi Elettric, and Ubh Group

- Software: Takeoff Technologies, Fabric, Berkshire Grey, Food-X Technologies, Samsung SDS, Locai, Pick8ship, Boxed, Emporix, Freshop, Today, Egrowcery, Stor.ai, Homesome, Ohi, StrongPoint, Growcer, Mercato, Fresho, Fulfil, Farmstead, Local Express, Mercatus, Salesforce, My Cloud, ThryveAI, Snappy Shopper, and GrocerKey

- Mobile Robots (AMR): Geek Plus, Grey Orange, Hai Robotics, Tompkins Robotics, TARO, Magazino, CAJA Robotics, and Coalescent Mobile Robotics

- Traditional WMS: Blue Yonder, Infor, High Jump, Manhattan Associates, and SAP

- Piece Picking Robots: Righthand Robotics, Kindred AI, Robomotive, Nimble AI, Berkshire Grey, AWL, Covariant, Lyro, Plus One Robotics, Fizyr, No Magic, Osaro, XYZ Robotics, Handplus Robotics, and Mujin Corp.

- Lockers / Click to Collect: Parcel Pending, Myrmex, i-collector, pick8ship, HomeValet, Cleveron, Avery Berkel, InPost, Lozier, Locktin, Colib, ITAB, Noyes Technologies, and Retail Robotics

- Last Mile Delivery: KiwiBot, Aethon, Starship, Robby, Refraction AI, Deliv, Zipline, Pick8ship, TeleRetail, Gatik, Nuro AI, WorkHorse, Yandex, HUGO, BoxBot, Parcelly, Effidence, Dispatch, Postmates, Skycart, Flytrex, Flirtey, Neolix, Volocopter, Marble, Eliport, Panasonic, Savioke, Roadie, Udelv, Robomart, Loginext, FedEx, Mybotics, Cainiao, JD.com, Routific, Easy Mile, Scout, Matternet, Bringg, eHang, Hello World Robotics, Ubiquity Robotics, autox, Tiny Mile, Amazon Prime Air, AIRMAP, AIRIO, Wing, UVL Robotics, Deuce Drone, DroneUp, Drone Delivery Canada, Flytbase, Reliable Robotics, Ottonomy.IO, and Continental

DEMAND SIDE

- Retail: Amazon, Walmart, PepsiCo, H-E-B, Ahold Delhaize, Super-Pharm, Ocado, Apple, Albertsons, Cdiscount, BigY, FreshDirect, fast Retailing, H-Mart, Wakefern Food Corp, Nordstrom, Loblaws, Associated Wholesale Grocery (AWS), Kroger, Sedano's, Majid Al Futtaim, Woolworths, Alpen, Carrefour, Sobeys, Meijer, Eleclerc. Redmart (Lazada), Tesco, LIDL, ALDI, Publix, Target, Costco, Lowe's, Morrisons, and Sainsbury's

- Instant / Ultrafast Delivery Services: Instacart, Gopuff, Gorillas, DoorDash, Weezy, Dijas, Getir, Caviar, Delivery Hero, Fridge No More, Picnic, Rakuten Delivery, Flink, Grofers, 1520, Yandex, Justo, Zapp, Merqueo, BevMo, Jokr, Urbx, Uber, Cajoo, Rappi, Peapod, Shipt, Deliveroo, Swiggy Instamart, Jiffy, and Buyk

Key Questions to be answered through this study:

- What are the major trends and drivers impacting the Micro Fulfillment Market?

- What is the revenue outlook (TAM), Installed base and forecast till 2030 for Micro Fulfillment Market by top segments such as Technologies, End-User, Store Type Deployment, Warehouse Size, Services, and Countries?

- What are the key investments, partnerships and M&A in Micro Fulfillment space?

- What is the impact of ultrafast delivery and dark stores on Micro-Fulfillment Market?

- What is the competitive landscape of Micro Fulfillment Market?

- What are the strategic imperative and calls to action that will define growth and success within Micro Fulfillment by 2030?

Table of Contents

1. Introduction & Background

- eCommerce re-shaping Retail Supply Chain

- Retail Supply Chain disrupted with eCommerce arrival

- Consumer prefer convenience in grocery shopping

- Evolution of online grocery and ultrafast delivery

- Existing and Emerging models in online grocery

- Ultra-fast delivery/on-demand grocery fulfilment

- Dark stores have smaller footprint, lesser SKUs

- Emerging Customer Base for MFCs

- Instant / Ultrafast Delivery Service Companies in USA

- Instant / Ultrafast Delivery Service Companies in Europe

- Ultrafast Delivery Update

- US online grocery will be a ~$250B market?

- Customer expectations have shifted to home delivery

- Pickup/click-and-collect is expected to see higher growth

- China on-demand grocery sales reach $20B GMV?

- Grocers need investments to improve customer experience and to be digitally mature

- Increased Automation essential for eCommerce/eGrocery fulfilment

- Degree of Automation at loading and unloading stations

- eGrocery demands faster, more efficient supply chains

- Economics of online grocery vs. ultra-fast delivery

- Higher AOV; better product mix critical to online grocery success

- Battle to gain market share through faster delivery times

- Different strategies used for online grocery fulfillment

- eGrocery will drive Micro-Fulfillment growth

- Introduction of Micro Fulfilment Centers (MFC)

- Centralized Fulfillment Center (CFC) vs Micro Fulfillment (MFC)

- Regional Micro-Fulfillment Center (MFC) vs True Micro-Fulfillment Center (MFC)

- Factors to be considered before MFC implementation

- Enabling Technologies for Micro Fulfillment Center (MFC)

- Key Developments in MFC space

- Market Readiness of Retailers to Invest in Micro-Fulfillment Centers

2. Micro Fulfilment Centre - Drivers and Challenges

- End-User Behaviour and eCommerce penetration

- Skilled Labour Shortage and High Labour Cost

- Advances in AI and Machine Vision are accelerating development of MFCs

- Increasing urbanization moving FCs closer to end-consumer

- Customer Expectations and last-mile delivery

- Capex and Need for complex software poses some challenges

- Pros and cons of Micro-Fulfillment Centers

3. Cost Comparison and Advantages

- Micro Fulfillment Center (MFC) vs Centralized Fulfillment Center (CFC)

- Inventory Carrying Cost (ICC) Saving

- Cost Comparison between MFC and other FC formats

- Current state of eGrocery fulfilment strategies

4. Case Studies

- Alert Innovation and Muratec with Alpen Group (Japan)

- Takeoff Technologies and Carrefour operated by Majid-Al-Futtaim (UAE)

- Alert Innovation and Walmart (USA)

- Dematic and PepsiCo (USA)

- Takeoff Technologies and Woolworths (Australia)

- Fabric and FreshDirect (USA)

- Swisslog and H-E-B (USA)

- Takeoff Technologies and Sedano's (USA)

- Takeoff Technologies and ShopRite (USA)

- Ocado and Kroger (USA)

5. Micro Fulfilment Center Market, By Value, Volume, Installed Base and Service Revenue

- Global Micro-Fulfillment Market - Installed Base and Forecast till 2030

- MFC Installations by Country and Forecast till 2030

- Global Micro-Fulfillment Market (USD Million) and Forecast till 2030

- Global Micro-Fulfillment Market (USD Million) by Country and Forecast till 2030

- Global Micro-Fulfillment Market - Service Revenue (USD Million)

6. Micro Fulfillment Market By Technology Solutions - Installed Base and Market Size (USD Million)

- Cube-Storage (#Installation, Market Size and Forecast till 2030)

- Shuttle Based (#Installation, Market Size and Forecast till 2030)

- AMR Based (#Installation, Market Size and Forecast till 2030)

- Others (#Installation, Market Size and Forecast till 2030)

7. Micro Fulfilment Center Market, By End-User - Installed Base and Market Size (USD Million)

- Grocery Omni-Channel (#Installation, Market Size and Forecast till 2030)

- Pure-Play E-Commerce / Q-Commerce (#Installation, Market Size and Forecast till 2030)

- Retail Omni-Channel (#Installation, Market Size and Forecast till 2030)

- Others (#Installation, Market Size and Forecast till 2030)

8. Micro Fulfilment Center Market, By Warehouse Size - Installed Base and Market Size (USD Million)

- Less than 5000 Sq. Ft. (#Installation and Forecast till 2030)

- Between 5000 Sq. Ft. and 25000 Sq. Ft. (#Installation and Forecast till 2030)

- More than 25000 Sq. Ft. (#Installation and Forecast till 2030)

9. Micro Fulfilment Center Market, By Store Type Deployment - - Installed Base and Market Size (USD Million)

- In-Store / Backside of Store (#Installation and Forecast till 2030)

- Dark Stores (#Installation and Forecast till 2030)

- Others - DC, FC, MFaaS (#Installation and Forecast till 2030)

10. Micro Fulfillment Market By Geography and Country - Installed Base and Market Size (USD Million)

- Regional Dynamics for fulfilment and delivery

- North America

- United States (U.S.) By End-User and By Technology - (#Installation, Market Size and Forecast till 2030)

- Canada By End-User and By Technology - (#Installation, Market Size and Forecast till 2030)

- Europe

- United Kingdom (U.K.) By End-User and By Technology - (#Installation, Market Size and Forecast till 2030)

- Germany - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- France - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Italy - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Spain - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Netherlands - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Nordic Region - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Rest of Europe - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Asia Pacific

- China - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Japan - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- South Korea - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Australia - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- South East Asia (ASEAN) - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Rest of APAC- By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Middle-East - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Latin America

- Mexico - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- South America - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

- Rest of World - By End-User and By Technology (#Installation, Market Size and Forecast till 2030)

11. Competitive Landscape

- Start-Up Ecosystem

- Competition Matrix (Installed Base vs Geographical Reach)

- Distributors and Partners

- Market Share Analysis

- Early adopters of MFCs by key architecture and technologies

- ~50 Projects Details related to MFC

- Investment Details of more than ~$1.5B

- Partnership along with M&A

- Key Developments

- Geographical Footprints of Suppliers by HQ

- Leading Global Retailers to target as MFC customer

12. Companies Analyzed

- Company snapshot of innovative start-ups

- Product Offerings

- Alert Innovation

- Dematic

- Exotec

- Fabric

- Company Profiles

- Addverb Technologies

- Alert Innovation

- Attabotics

- AutoStore

- BrightPick

- Cleveron

- Dematic

- Exotec

- Geek+

- Fabric

- Fulfil

- HDS Global

- Honeywell Intelligrated

- Instock

- i-Collector

- Knapp

- Myrmex (Ocado)

- Ocado Technologies

- OPEX Corporation

- Takeoff Technologies

- Tompkins Robotics

- Vanderlande (Toyota Industries Corp.)

- Savoye

- TGW Logistics Group

- KPI Solutions

13. Emerging Trends

- Goods to Robots (G2R)

- Piece Picking Robots

- Righthand Robotics

- Berkshire Grey

- Plus One Robotics

- Last Mile Delivery

14. Research Methodology

- Demand Side Analysis

- Supply Side Analysis

- Definitions

15. Acknowledgements

16. About LogisticsIQ

List of Tables

- Table 1: Microfulfilment Market by Region and Geography (# of installations)

- Table 2: Microfulfilment Market by Region and Geography (Revenue (USD m))

- Table 3: Microfulfilment Market by Technology (# of installations)

- Table 4: Microfulfilment Market by Technology (Revenue (USD m))

- Table 5: Microfulfilment Market by End-user (# of installations)

- Table 6: Microfulfilment Market by End-user (Revenue (USD m))

- Table 7: Microfulfilment Market by Store Size (# of installations)

- Table 8: Microfulfilment Market by Deployment (# of installations)

- Table 9: Microfulfilment Market in United States, By End-User (# of installations)

- Table 10: Microfulfilment Market in United States, By End-User (Revenue (USD m))

- Table 11: Microfulfilment Market in United States, By Technology (# of installations)

- Table 12: Microfulfilment Market in United States, By Technology (Revenue (USD m))

- Table 13: Microfulfilment Market in Canada, By End-User (# of installations)

- Table 14: Microfulfilment Market in Canada, By End-User (Revenue (USD m))

- Table 15: Microfulfilment Market in Canada, By Technology (# of installations)

- Table 16: Microfulfilment Market in Canada, By Technology (Revenue (USD m))

- Table 17: Microfulfilment Market in United Kingdom, By End-User (# of installations)

- Table 18: Microfulfilment Market in United Kingdom, By End-User (Revenue (USD m))

- Table 19: Microfulfilment Market in United Kingdom, By Technology (# of installations)

- Table 20: Microfulfilment Market in United Kingdom, By Technology (Revenue (USD m))

- Table 21: Microfulfilment Market in Germany, By End-User (# of installations)

- Table 22: Microfulfilment Market in Germany, By End-User (Revenue (USD m))

- Table 23: Microfulfilment Market in Germany, By Technology (# of installations)

- Table 24: Microfulfilment Market in Germany, By Technology (Revenue (USD m))

- Table 25: Microfulfilment Market in France, By End-User (# of installations)

- Table 26: Microfulfilment Market in France, By End-User (Revenue (USD m))

- Table 27: Microfulfilment Market in France, By Technology (# of installations)

- Table 28: Microfulfilment Market in France, By Technology (Revenue (USD m))

- Table 29: Microfulfilment Market in Netherlands, By End-User (# of installations)

- Table 30: Microfulfilment Market in Netherlands, By End-User (Revenue (USD m))

- Table 31: Microfulfilment Market in Netherlands, By Technology (# of installations)

- Table 32: Microfulfilment Market in Netherlands, By Technology (Revenue (USD m))

- Table 33: Microfulfilment Market in Nordics, By End-User (# of installations)

- Table 34: Microfulfilment Market in Nordics, By End-User (Revenue (USD m))

- Table 35: Microfulfilment Market in Nordics, By Technology (# of installations)

- Table 36: Microfulfilment Market in Nordics, By Technology (Revenue (USD m))

- Table 37: Microfulfilment Market in Spain, By End-User (# of installations)

- Table 38: Microfulfilment Market in Spain, By End-User (Revenue (USD m))

- Table 39: Microfulfilment Market in Spain, By Technology (# of installations)

- Table 40: Microfulfilment Market in Spain, By Technology (Revenue (USD m))

- Table 41: Microfulfilment Market in Italy, By End-User (# of installations)

- Table 42: Microfulfilment Market in Italy, By End-User (Revenue (USD m))

- Table 43: Microfulfilment Market in Italy, By Technology (# of installations)

- Table 44: Microfulfilment Market in Italy, By Technology (Revenue (USD m))

- Table 45: Microfulfilment Market in Rest of Europe, By End-User (# of installations)

- Table 46: Microfulfilment Market in Rest of Europe, By End-User (Revenue (USD m))

- Table 47: Microfulfilment Market in Rest of Europe, By Technology (# of installations)

- Table 48: Microfulfilment Market in Rest of Europe, By Technology (Revenue (USD m))

- Table 49: Microfulfilment Market in China, By End-User (# of installations)

- Table 50: Microfulfilment Market in China, By End-User (Revenue (USD m))

- Table 51: Microfulfilment Market in China, By Technology (# of installations)

- Table 52: Microfulfilment Market in China, By Technology (Revenue (USD m))

- Table 53: Microfulfilment Market in Japan, By End-User (# of installations)

- Table 54: Microfulfilment Market in Japan, By End-User (Revenue (USD m))

- Table 55: Microfulfilment Market in Japan, By Technology (# of installations)

- Table 56: Microfulfilment Market in Japan, By Technology (Revenue (USD m))

- Table 57: Microfulfilment Market in South Korea, By End-User (# of installations)

- Table 58: Microfulfilment Market in South Korea, By End-User (Revenue (USD m))

- Table 59: Microfulfilment Market in South Korea, By Technology (# of installations)

- Table 60: Microfulfilment Market in South Korea, By Technology (Revenue (USD m))

- Table 61: Microfulfilment Market in Australia, By End-User (# of installations)

- Table 62: Microfulfilment Market in Australia, By End-User (Revenue (USD m))

- Table 63: Microfulfilment Market in Australia, By Technology (# of installations)

- Table 64: Microfulfilment Market in Australia, By Technology (Revenue (USD m))

- Table 65: Microfulfilment Market in South East Asia, By End-User (# of installations)

- Table 66: Microfulfilment Market in South East Asia, By End-User (Revenue (USD m))

- Table 67: Microfulfilment Market in South East Asia, By Technology (# of installations)

- Table 68: Microfulfilment Market in South East Asia, By Technology (Revenue (USD m))

- Table 69: Microfulfilment Market in Rest of Asia, By End-User (# of installations)

- Table 70: Microfulfilment Market in Rest of Asia, By End-User (Revenue (USD m))

- Table 71: Microfulfilment Market in Rest of Asia, By Technology (# of installations)

- Table 72: Microfulfilment Market in Rest of Asia, By Technology (Revenue (USD m))

- Table 73: Microfulfilment Market in Middle East, By End-User (# of installations)

- Table 74: Microfulfilment Market in Middle East, By End-User (Revenue (USD m))

- Table 75: Microfulfilment Market in Middle East, By Technology (# of installations)

- Table 76: Microfulfilment Market in Middle East, By Technology (Revenue (USD m))

- Table 77: Microfulfilment Market in Mexico, By End-User (# of installations)

- Table 78: Microfulfilment Market in Mexico, By End-User (Revenue (USD m))

- Table 79: Microfulfilment Market in Mexico, By Technology (# of installations)

- Table 80: Microfulfilment Market in Mexico, By Technology (Revenue (USD m))

- Table 81: Microfulfilment Market in South America, By End-User (# of installations)

- Table 82: Microfulfilment Market in South America, By End-User (Revenue (USD m))

- Table 83: Microfulfilment Market in South America, By Technology (# of installations)

- Table 84: Microfulfilment Market in South America, By Technology (Revenue (USD m))

- Table 85: Microfulfilment Market in Rest of World, By End-User (# of installations)

- Table 86: Microfulfilment Market in Rest of World, By End-User (Revenue (USD m))

- Table 87: Microfulfilment Market in Rest of World, By Technology (# of installations)

- Table 88: Microfulfilment Market in Rest of World, By Technology (Revenue (USD m))