|

市場調查報告書

商品編碼

1070455

石油精製的全球市場 (2022年~2032年):各類型 (直餾、Hydroskimming、轉化式、深度轉化式煉油廠)、各處理機組、各投資內容的預測,各地區、各國分析,主要企業,新型冠狀病毒感染疾病 (COVID-19) 的復甦情境Oil Refinery Market Report 2022-2032: Forecasts by Type (Topping, Hydroskimming, Conversion, Deep Conversion Refineries), by Processing Unit, by Investment, Regional & Leading National Market Analysis, Leading Companies, COVID-19 Recovery Scenarios |

||||||

本報告提供全球石油精製的市場相關分析,市場基本結構和最新形勢,主要的促進、阻礙因素,市場規模的估計值、預測值 (2022年~2032年),各類型、各投資內容、各處理機組、各類型及各地區、主要國家詳細趨勢,主要企業的簡介,COVID-19影響與復甦情境等彙整資訊,為您概述為以下內容。

本文中的圖表樣品

目錄

第1章 分析概要

第2章 摘要整理

- COVID-19對石油精製市場的影響

第3章 俄羅斯、烏克蘭間的現在進行中的戰爭對石油煉製用催化劑產業的影響

第4章 世界市場力學

- 全球市場的目前趨勢

- 市場促進因素

- 市場阻礙因素

- 世界市場機會

- 世界市場課題

- SWOT分析

- PEST分析

- 波特的五力分析

第5章 全球石油精製市場分析

- 全球市場規模的估計、預測

- COVID-19前的市場情境

- COVID-19後的市場情境 (V字型、W字型、U字型、L字型的復甦分析)

第6章 全球石油精製市場分析:各地區

- 北美

- 歐洲

- 亞太地區

- 南美、中東、非洲

- 市場規模的估計、預測:各地區

第7章 全球石油精製市場分析:各投資內容

- 設備投資 (CAPEX)

- 運用費用 (OPEX)

- 市場規模的估計、預測:各投資內容

第8章 全球石油精製市場分析:各處理機組

- 原油蒸餾裝置 (CDU)

- 減壓蒸餾設備 (VDU)

- 柴油氫處理設備 (DHT)

- 半再生改性 (SRR)

- 流體化媒裂設備 (FCC)

- 硫磺回收設備 (SRU)

- 市場規模的估計、預測:各處理機組

第9章 全球石油精製市場分析:各類型

- 直餾煉油廠

- Hydroskimming煉油廠

- 轉化式煉油廠

- 深度轉化式煉油廠

- 市場規模的估計、預測:各類型

第10章 北美的石油精製市場分析

- 北美的市場規模的估計、預測

- 市場規模的估計、預測:各國

- 市場規模的估計、預測:各投資內容

- 市場規模的估計、預測:各處理機組

- 市場規模的估計、預測:各類型

- 美國市場的分析

- 加拿大市場分析

- 墨西哥市場分析

第11章 歐洲的石油精製市場分析

- 歐洲的市場規模的估計、預測

- 市場規模的估計、預測:各國

- 市場規模的估計、預測:各投資內容

- 市場規模的估計、預測:各處理機組

- 市場規模的估計、預測:各類型

- 俄羅斯市場分析

- 挪威市場分析

- 英國市場分析

- 丹麥市場分析

- 義大利市場分析

- 其他的歐洲各國的市場分析

第12章 亞太地區石油精製市場分析

- 亞太地區的市場規模的估計、預測

- 市場規模的估計、預測:各國

- 市場規模的估計、預測:各投資內容

- 市場規模的估計、預測:各處理機組

- 市場規模的估計、預測:各類型

- 中國市場的分析

- 印度市場分析

- 印尼市場分析

- 馬來西亞市場分析

- 澳洲市場分析

- 其他的亞太地區各國的市場分析

第13章 南美、中東、非洲 (LAMEA) 的石油精製市場分析

- LAMEA的市場規模的估計、預測

- 市場規模的估計、預測:各國

- 市場規模的估計、預測:各投資內容

- 市場規模的估計、預測:各處理機組

- 市場規模的估計、預測:各類型

- 巴西市場分析

- 南非市場分析

- 沙烏地阿拉伯市場分析

- 伊朗市場分析

- 伊拉克市場分析

- 其他的LAMEA各國的市場分析

第14章 主要企業簡介

- Royal Dutch Shell Plc

- 企業簡介

- 企業概要

- 財務簡介

- 產品的基準

- 近幾年趨勢

- BP Plc

- Exxon Mobil Corporation

- TotalEnergies SE

- Chevron Corporation

- Marathon Petroleum Corporation

- China Petroleum & Chemical Corp

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Valero Energy Corporation

- S-Oil Corporation

- Fluor Corporation

- PBF Energy Inc.

- Phillips 66

- Saudi Arabian Oil Co

- PJSC Rosneft Oil Company

- Eneos Holdings Inc

- Gazprom PAO

第15章 結論

第16章 建議

第17章 詞彙表

Title:

Oil Refinery Market Report 2022-2032

Forecasts by Type (Topping Oil Refinery, Hydroskimming Oil Refinery, Conversion Oil Refineries, Deep Conversion Refineries), by Processing Unit (Crude Oil Distillation Unit (CDU), Vacuum Distillation Unit (VDU), Diesel Hydrotreating Unit (DHT), Semiregenerative Reforming (SRR), Fluid Catalytic Cracking Unit (FCC), Sulphur Recovery Unit (SRU)), by Investment (CAPEX, OPEX) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Recovery Scenarios.

The Oil Refinery Market Report 2022-2032: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

Growing Demand For Petroleum Products

The product demand in each region has an impact on refinery configuration as well. Propane, butane, petrochemical feedstock, gasolines (naphtha specialities, aviation gasoline, motor gasoline), distillates (jet fuels, diesel, stove oil, kerosene, furnace oil), heavy fuel oil, lubricating oils, waxes, asphalt, and still gas are just a few of the goods that refineries create. Gasoline contributes for over 40% of demand nationwide, with distillate fuels accounting for nearly a third of sales and heavy fuel oil accounting for barely 8%.

The demand for petroleum products is approximately evenly split among the regions, with Atlantic/Quebec, Ontario, and the West accounting for almost one-third of total sales each. The product mix, on the other hand, varies a lot between locations. Distillate fuels account for 40% of product demand in the Atlantic provinces, where furnace oil (light heating oil) is the predominant source of home heating, and heavy fuel oil (used to generate power) accounts for another 24%. Gasoline sales make up less than 30% of total product demand.

Raw Material Price Volatility And Rapidly Depleting Crude Oil

Refined petroleum products, chemicals and chemical products, coke, and intermediate goods were among the industries that were heavily impacted. Many businesses rely on crude oil as a direct source of raw materials: the chemical sector employs naphtha, kerosene, and other products whose costs are directly affected by changes in crude oil prices, therefore as crude oil prices rise, production in these industries decreases. Plastics and synthetic rubber are made largely from crude oil constituents. Materials suppliers are struggling to make a profit, while tier suppliers and OEMs are stuck between raising prices and experiencing cost hikes. Given that raw materials can account for up to 70% of a company's expenses, variations in raw material input costs must be taken into account.

What Are These Questions You Should Ask Before Buying A Market Research Report?

- How is the oil refinery market evolving?

- What is driving and restraining the oil refinery market?

- How will each oil refinery submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2032?

- How will the market shares for each oil refinery submarket develop from 2022 to 2032?

- What will be the main driver for the overall market from 2022 to 2032?

- Will leading oil refinery markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

- How will the market shares of the national markets change by 2032 and which geographical region will lead the market in 2032?

- Who are the leading players and what are their prospects over the forecast period?

- What are the oil refinery projects for these leading companies?

- How will the industry evolve during the period between 2020 and 2032? What are the implication of oil refinery projects taking place now and over the next 10 years?

- Is there a greater need for product commercialisation to further scale the oil refinery market?

- Where is the oil refinery market heading? And how can you ensure you are at the forefront of the market?

- What can be the best investment options for new product and service lines?

- What are the key prospects for moving companies into a new growth path? C-suite?

You need to discover how this will impact the oil refinery market today, and over the next 10 years:

- Our 550+ page report provides 324 tables and 320 charts/graphs exclusively to you.

- The report highlights key lucrative areas in the industry so you can target them - NOW.

- Contains in-depth analyse of global, regional and national sales and growth

- Highlights for you the key successful trends, changes and revenue projections made by your competitors

This report tells you TODAY how the oil refinery market will develop in the next 10 years, and in-line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2032 and other analyses reveal the commercial prospects

- In addition to revenue forecasting to 2032, our new study provides you with recent results, growth rates, and market shares.

- You find original analyses, with business outlooks and developments.

- Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising oil refinery prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, V, L, W and U are discussed in this report.

Global Oil Refinery Market (COVID Impact Analysis) by Investment

- CAPEX

- OPEX

Global Oil Refinery Market (COVID Impact Analysis) by Processing Unit

- Crude Oil Distillation Unit (CDU)

- Vacuum Distillation Unit (VDU)

- Diesel Hydrotreating Unit (DHT)

- Semi-regenerative Reforming (SRR)

- Fluid Catalytic Cracking Unit (FCC)

- Sulfur Recovery Unit (SRU)

Global Oil Refinery Market (COVID Impact Analysis) by Type

- Topping Oil Refinery

- Hydro-skimming Oil Refinery

- Conversion Oil Refineries

- Deep Conversion Refineries

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for 4 regional and 20 leading national markets:

North America Oil Refinery Market, 2022 to 2032 Market Outlook

- U.S. Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Canada Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Mexico Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

Europe Oil Refinery Market, 2022 to 2032 Market Outlook

- Russia Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Norway Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- United Kingdom Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Demark Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Italy Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Europe Market Forecast & COVID Impact Analysis

Asia Pacific Oil Refinery Market, 2022 to 2032 Market Outlook

- China Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Indonesia Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- India Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Australia Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Malaysia Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Asia Pacific Market Forecast & COVID Impact Analysis

LAMEA Oil Refinery Market, 2022 to 2032 Market Outlook

- Brazil Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Iran Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Saudi Arabia Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- South Africa Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Iraq Oil Refinery Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Latin America, Middle East and Africa

The report also includes profiles and for some of the leading companies in the Oil Refinery Market, 2022 to 2032, with a focus on this segment of these companies' operations.

Leading companies and the potential for market growth:

- Bharat Petroleum Corporation Limited

- BP Plc

- Chevron Corporation

- China Petroleum & Chemical Corp

- Eneos Holdings Inc

- Exxon Mobil Corporation

- Fluor Corporation

- Gazprom PAO

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Limited

- Marathon Petroleum Corporation

- PBF Energy Inc.

- Phillips 66

- PJSC Rosneft Oil Company

- Reliance Industries Limited

- Royal Dutch Shell Plc

- S-Oil Corporation

- Saudi Arabian Oil Co

- TotalEnergies SE

- Valero Energy Corporation (Valero)

Overall world revenue for Oil Refinery Market, 2022 to 2032 in terms of value the market will surpass US$xx billion in 2022, our work calculates. We predict strong revenue growth through to 2032. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How the Oil Refinery Market, 2022 to 2032 Market report helps you?

In summary, our 550+ page report provides you with the following knowledge:

- Revenue forecasts to 2032 for Oil Refinery Market, 2022 to 2032 Market, with forecasts for each forecasted at a global and regional level- discover the industry's prospects, finding the most lucrative places for investments and revenues

- Revenue forecasts to 2032 for 4 regional and 20 key national markets - See forecasts for the Oil Refinery Market, 2022 to 2032 market in North America, Europe, Asia-Pacific and LAMEA. Also forecasted is the market in the US, Canada, Mexico, Russia, Norway, UK, Italy, China, India, Indonesia, and Malaysia among other prominent economies.

- Prospects for established firms and those seeking to enter the market- including company profiles for 20 of the major companies involved in the Oil Refinery Market, 2022 to 2032 Market.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with this invaluable business intelligence.

Information found nowhere else

With our newly report title, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain's study is for everybody needing commercial analyses for the Oil Refinery Market, 2022 to 2032 Market and leading companies. You will find data, trends and predictions.

Table of Contents

1. Report Overview

- 1.1 Introduction to Oil Refinery Market

- 1.2 The Refinery Processes

- 1.2.1 Separation Processes

- 1.2.2 Conversion Processes

- 1.2.3 Treating Processes

- 1.2.4 Feedstock And Product Handling

- 1.2.5 Auxiliary Facilities

- 1.3 Global Oil Refinery Market Overview

- 1.4 What are the Objectives of this Report?

- 1.5 What is the Scope of the Report?

- 1.6 Why You Should Read This Report

- 1.7 What This Report Delivers

- 1.8 Key Questions Answered By This Analytical Report Include:

- 1.9 Who is This Report for?

- 1.10 Research Methodology

- 1.10.1 Primary Research

- 1.10.2 Secondary Research

- 1.10.3 Market Evaluation & Forecasting Methodology

- 1.11 Frequently Asked Questions (FAQs)

- 1.12 Associated Visiongain Reports

- 1.13 About Visiongain

2 Executive Summary

- 2.1 Covid-19 Impact On Oil Refinery Market

3 Russia-Ukraine Ongoing War Effect on Oil Refinery Catalyst Industry

- 3.1 Oil And Gas Prices Have Risen.

- 3.2 High Oil Prices Encourage Governments In Oil-Rich Countries To Pursue More Assertive Foreign Policies.

- 3.3 Russian Restrictions on Energy Exports Have Been Lifted

- 3.4 Refiners, Shippers, Insurers, And Banks Are Hesitating To Do Business With Russia For Fear Of Violating Sanctions.

- 3.5 Canada Prohibited Russian Oil Imports.

- 3.6 In Europe, A Significant Shortage And Price Increase Could Result From The War.

- 3.7 The Threat Of A Ban On Russian Oil Imports Has Increased The Need To Find New Sources Of Supply.

- 3.8 Russian Crude Oil Shipments Are Likely To Be Involved In G7 Energy Diplomacy.

- 3.9 Relations Between The United States And Saudi Arabia May Be Put To The Test.

- 3.10 Russia's Petroleum Exports To Europe And Other G7 Countries Could End Up Being Diverted Elsewhere.

- 3.11 Petrochemicals Are A Stumbling Block To Russia's Ambitious Growth Goals.

4 Global Market Dynamics

- 4.1 Current Trends in the Global Market

- 4.2 Market Driving Factors

- 4.2.1 Growing Demand For Petroleum Product

- 4.2.2 More Money Is Being Invested In Refinery Construction, Expansion, And Upgrades To Meet The Rising Demand For Petroleum Products.

- 4.2.3 The Demand For Gasoline And Gas Oil Has Risen Dramatically As The Number Of Automobiles In Various Countries Has Increased.

- 4.3 Market Restraining Factors

- 4.3.1 Increasing Adoption Of Electric Vehicles In Developed And Developing Nations Across The World

- 4.3.2 Low Margin Of Oil Prices

- 4.3.3 Raw Material Price Volatility And Rapidly Depleting Crude Oil

- 4.3.4 Carbon Emission Limitations Imposed By The Government

- 4.4 Opportunities in the Global Market

- 4.4.1 Future Trends In Petroleum Refining

- 4.4.2 Deliberate Retail Strategy

- 4.4.3 Capital Discipline

- 4.4.4 Supply Chain Management

- 4.4.5 Digital Acceleration

- 4.4.6 Talent Strategy

- 4.4.7 Building A More Resilient Refiner

- 4.5 Challenges in the Global Market

- 4.5.1 Increasing Crude And Feedstock Variability

- 4.5.2 Maintaining High Equipment Reliability

- 4.5.3 Improving The Environmental Footprint To Meet Increasingly Stringent Standard

- 4.5.4 Reducing Costs To Remain Competitive

- 4.5.5 Improving Performance To Ensure The Valorization Of Assets

- 4.5.6 Improving The Environmental Footprint To Meet Increasingly Stringent Standard

- 4.6 SWOT Analysis:

- 4.7 Strengths

- 4.7.1 Growing Demand Of Petroleum Product

- 4.7.2 More Money Is Being Invested In Refinery Construction, Expansion, And Upgrades To Meet The Rising Demand For Petroleum Products.

- 4.7.3 The Demand For Gasoline And Gas Oil Has Risen Dramatically As The Number Of Automobiles In Various Countries Has Increased.

- 4.8 Weaknesses

- 4.8.1 Increasing Adoption Of Electric Vehicles In Developed And Developing Nations Across The World

- 4.8.2 Low Margin Of Oil Prices

- 4.8.3 Raw Material Price Volatility And Rapidly Depleting Crude Oil

- 4.8.4 Carbon Emission Limitations Imposed By The Government

- 4.9 Opportunities

- 4.9.1 Future Trends In Petroleum Refining

- 4.9.2 Capital Discipline

- 4.9.3 Supply Chain Management

- 4.9.4 Digital Acceleration

- 4.9.5 Talent Strategy

- 4.9.6 Building A More Resilient Refiner

- 4.9.7 Deliberate Retail Strategy

- 4.10 Threats

- 4.10.1 Increasing Crude And Feedstock Variability

- 4.10.2 Maintaining High Equipment Reliability

- 4.10.3 Improving The Environmental Footprint To Meet Increasingly Stringent Standard

- 4.10.4 Reducing Costs To Remain Competitive

- 4.10.5 Improving Performance To Ensure The Valorization Of Assets

- 4.10.6 Improving The Environmental Footprint To Meet Increasingly Stringent Standard

- 4.11 PEST Analysis

- 4.11.1 Political Factor

- 4.11.2 Economical Factor

- 4.11.3 Social Factor

- 4.11.4 Technological Factor

- 4.12 Porter's Five Forces

- 4.12.1 Competitive Rivalry(High)

- 4.12.2 Bargaining Power of Buyers(Moderate)

- 4.12.3 Bargaining Power of Suppliers (Moderate)

- 4.12.4 Threat of Substitutes(High)

- 4.12.5 The Threat Of New Entrants(Low)

5 Global Oil Refinery Market Analysis

- 5.1 Due To Rising Industrialization And Economic Upheaval, The Oil Refining Market Will See Significant Expansion.

- 5.2 Increased Investment In Refinery Construction Is Driving Global Demand For Oil Refining.

- 5.3 Global Market Size Estimation and Forecast

- 5.3.1 Pre-COVID-19 Market Scenario

- 5.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

6 Global Oil Refinery Market Analysis By Region

- 6.1 North America

- 6.2 Europe

- 6.3 Asia-Pacific

- 6.4 LAMEA

- 6.5 Regional Market Size Estimation and Forecast

- 6.5.1 Pre-COVID-19 Market Scenario

- 6.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

7 Global Oil Refinery Market Analysis By Investment

- 7.1 CAPEX

- 7.2 OPEX

- 7.3 Global Market Size Estimation and Forecast By Investment

- 7.3.1 Pre-COVID-19 Market Scenario

- 7.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

8 Global Oil Refinery Market Analysis By Processing Unit

- 8.1 Crude Oil Distillation Unit (CDU)

- 8.2 Vacuum Distillation Unit (VDU)

- 8.3 Diesel Hydrotreating Unit (DHT)

- 8.4 Semi-regenerative Reforming (SRR)

- 8.5 Fluid Catalytic Cracking Unit (FCC)

- 8.6 Sulfur Recovery Unit (SRU)

- 8.7 Global Market Size Estimation and Forecast By Processing Unit

- 8.7.1 Pre-COVID-19 Market Scenario

- 8.7.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

9 Global Oil Refinery Market Analysis By Type

- 9.1 Topping Oil Refinery

- 9.2 Hydro-skimming Oil Refinery

- 9.3 Conversion Oil Refineries

- 9.4 Deep Conversion Refineries

- 9.5 Global Market Size Estimation and Forecast By Type

- 9.5.1 Pre-COVID-19 Market Scenario

- 9.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

10 North America Oil Refinery Market Analysis

- 10.1 In North America, Upcoming Start Ups Of Oil And Gas Will Drive The Market

- 10.2 The United States Is Expected To Be A Net Importer Of Petroleum.

- 10.3 North America Market Size Estimation and Forecast

- 10.3.1 Pre-COVID-19 Market Scenario

- 10.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.4 Country Market Size Estimation and Forecast

- 10.4.1 Pre-COVID-19 Market Scenario

- 10.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.5 North America Market Size Estimation and Forecast By Investment

- 10.5.1 Pre-COVID-19 Market Scenario

- 10.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.6 North America Market Size Estimation and Forecast By Processing Unit

- 10.6.1 Pre-COVID-19 Market Scenario

- 10.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.7 North America Market Size Estimation and Forecast By Type

- 10.7.1 Pre-COVID-19 Market Scenario

- 10.7.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.8 US Oil Refinery Market Analysis

- 10.8.1 In US Refining Output Is Larger Than Input

- 10.8.2 Targa Resources Corporation's Is The New Refinery Built In The United States

- 10.8.3 List of Oil Refinery In US with the Capacity

- 10.8.4 Pre-COVID-19 Market Scenario

- 10.8.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.9 Canada Oil Refinery Market Analysis

- 10.9.1 Refineries In Western Canada Are Well Connected To Local Crude Oil Production By Pipeline Systems

- 10.9.2 In Canada, The Vast Majority Of Refineries Are Cracking Refineries

- 10.9.3 List Of Oil Refinery In Canada With The Capacity

- 10.9.4 Pre-COVID-19 Market Scenario

- 10.9.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 10.10 Mexico Oil Refinery Market Analysis

- 10.10.1 The Petroleum Sector Plays Crucial Role In The Mexican Economy

- 10.10.2 Mexico Is The World's Third-Largest Oil Producer And Possesses The World's Third-Largest Proven Oil Reserves

- 10.10.3 List Of Oil Refinery In Mexico With The Capacity

- 10.10.4 Pre-COVID-19 Market Scenario

- 10.10.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

11 Europe Oil Refinery Market Analysis

- 11.1 Europe Is A Major Oil Refinery Countries

- 11.2 Europe Market Size Estimation and Forecast

- 11.2.1 Pre-COVID-19 Market Scenario

- 11.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.3 Country Market Size Estimation and Forecast

- 11.3.1 Pre-COVID-19 Market Scenario

- 11.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.4 Europe Market Size Estimation and Forecast By Investment

- 11.4.1 Pre-COVID-19 Market Scenario

- 11.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.5 Europe Market Size Estimation and Forecast By Processing Unit

- 11.5.1 Pre-COVID-19 Market Scenario

- 11.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.6 Europe Market Size Estimation and Forecast by Type

- 11.6.1 Pre-COVID-19 Market Scenario

- 11.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.7 Russia Oil Refinery Market Analysis

- 11.7.1 Russia Has One Of The World's Major Petroleum Industries.

- 11.7.2 Russia Is One Of The World's Top Three Oil Producers After The United States And Saudi Arabia

- 11.7.3 Dukkar S.A. Is One Of The First Oil Trading Corporations In The Russia

- 11.7.4 List Of Oil Refinery In Russia With The Capacity

- 11.7.5 Pre-COVID-19 Market Scenario

- 11.7.6 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.8 Norway Oil Refinery Market Analysis

- 11.8.1 The Ministry Of Petroleum And Energy (MPE) Is Managing Norway's Energy Resources

- 11.8.2 Norway has been extracting oil from the North Sea

- 11.8.3 List Of Oil Refinery In Norway With The Capacity

- 11.8.4 Pre-COVID-19 Market Scenario

- 11.8.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.9 UK Oil Refinery Market Analysis

- 11.9.1 Fawley Refinery Is A Biggest Refinery In UK

- 11.9.2 Stanlow Is Major Oil Refinery In United Kingdom

- 11.9.3 List Of Oil Refinery In UK With The Capacity

- 11.9.4 Pre-COVID-19 Market Scenario

- 11.9.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.10 Denmark Oil Refinery Market Analysis

- 11.10.1 Kalundborg Is Denmark's Largest Refinery

- 11.10.2 Denmark Is The Second European Country To Prohibit New Oil And Gas Exploration

- 11.10.3 List Of Oil Refinery In Denmark With The Capacity

- 11.10.4 Pre-COVID-19 Market Scenario

- 11.10.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.11 Italy Oil Refinery Market Analysis

- 11.11.1 Italy Is The Fifth-Largest Oil Consumer In Europe

- 11.11.2 New Environmental And Ecological Protection Measures Introduced By The Italian Government

- 11.11.3 List Of Oil Refinery In Italy With The Capacity

- 11.11.4 Pre-COVID-19 Market Scenario

- 11.11.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 11.12 Rest of Europe Oil Refinery Market Analysis

- 11.12.1 List Of Oil Refinery With The Capacity

- 11.12.2 Pre-COVID-19 Market Scenario

- 11.12.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

12 Asia-Pacific Oil Refinery Market Analysis

- 12.1 Asia-Pacific Market Size Estimation and Forecast

- 12.1.1 Pre-COVID-19 Market Scenario

- 12.1.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.2 Country Market Size Estimation and Forecast

- 12.2.1 Pre-COVID-19 Market Scenario

- 12.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.3 Asia-Pacific Market Size Estimation and Forecast By Investment

- 12.3.1 Pre-COVID-19 Market Scenario

- 12.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.4 Asia-Pacific Market Size Estimation and Forecast by Processing Unit

- 12.4.1 Pre-COVID-19 Market Scenario

- 12.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.5 Asia-Pacific Market Size Estimation and Forecast By Type

- 12.5.1 Pre-COVID-19 Market Scenario

- 12.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.6 China Oil Refinery Market Analysis

- 12.6.1 China Is World's Second-Largest Oil Consumer

- 12.6.2 Sinopec And CNPC/Petrochina, Two Chinese National Oil Firms, Dominate The Oil Refinery Industry.

- 12.6.3 List Of Oil Refinery In China With The Capacity

- 12.6.4 Pre-COVID-19 Market Scenario

- 12.6.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.7 India Oil Refinery Market Analysis

- 12.7.1 Digboi Refinery Is The Oldest Oil Refinery In India

- 12.7.2 India Is The World's Fourth Largest Oil Consumer

- 12.7.3 List Of Oil Refinery In India With The Capacity

- 12.7.4 Pre-COVID-19 Market Scenario

- 12.7.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.8 Indonesia Oil Refinery Market Analysis

- 12.8.1 Indonesia Need More Oil Refining Capacity Due To Rising Fuel Demand.

- 12.8.2 Indonesia's Oil And Gas Sector Makes A Significant Contribution

- 12.8.3 List Of Oil Refinery In Indonesia With The Capacity

- 12.8.4 Pre-COVID-19 Market Scenario

- 12.8.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.9 Malaysia Oil Refinery Market Analysis

- 12.9.1 Petroliam Nasional Berhad Is The Malaysia Largest Refinery Plant

- 12.9.2 In Malaysia, The Upstream Industry Plays A Larger Role In Crude Oil Production.

- 12.9.3 List Of Oil Refinery In Malaysia With The Capacity

- 12.9.4 Pre-COVID-19 Market Scenario

- 12.9.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.10 Australia Oil Refinery Market Analysis

- 12.10.1 Australia's Conventional Oil Reserves Are Limited.

- 12.10.2 Australia Is A Net Oil Importer

- 12.10.3 List Of Oil Refinery In Australia With The Capacity

- 12.10.4 Pre-COVID-19 Market Scenario

- 12.10.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 12.11 Rest of Asia-Pacific Oil Refinery Market Analysis

- 12.11.1 List Of Oil Refinery In Rest of Asia-Pacific With The Capacity

- 12.11.2 Pre-COVID-19 Market Scenario

- 12.11.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

13 LAMEA Oil Refinery Market Analysis

- 13.1 In Latin America, Biggest Oil Producer Will Drive The Market

- 13.2 Rising Petroleum Product Demand In Latin America Will Drive The Market

- 13.3 LAMEA Market Size Estimation and Forecast

- 13.3.1 Pre-COVID-19 Market Scenario

- 13.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.4 Country Market Size Estimation and Forecast

- 13.4.1 Pre-COVID-19 Market Scenario

- 13.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.5 LAMEA Market Size Estimation and Forecast By Investment

- 13.5.1 Pre-COVID-19 Market Scenario

- 13.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.6 LAMEA Market Size Estimation and Forecast By Processing Unit

- 13.6.1 Pre-COVID-19 Market Scenario

- 13.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.7 LAMEA Market Size Estimation and Forecast By Type

- 13.7.1 Pre-COVID-19 Market Scenario

- 13.7.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.8 Brazil Oil Refinery Market Analysis

- 13.8.1 Petrobras Refinery Plays Singnificant Role In Brazil's Logistics Infrastructure

- 13.8.2 In Terms Of Oil Production, Brazil Makes A Significant Contribution

- 13.8.3 List Of Oil Refinery In Brazil With The Capacity

- 13.8.4 Pre-COVID-19 Market Scenario

- 13.8.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.9 South Africa Oil Refinery Market Analysis

- 13.9.1 SAPREF Is The South Africa Largest Crude Oil Refinery

- 13.9.2 Two Gasified Diesel-Fueled Open Cycle Gas Turbines In South Africa.

- 13.9.3 List Of Oil Refinery In South Africa With The Capacity

- 13.9.4 Pre-COVID-19 Market Scenario

- 13.9.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.10 Saudi Arabia Oil Refinery Market Analysis

- 13.10.1 Saudi Aramco Is The Second-Biggest Proven Crude Oil Reserves In Saudi Arabia

- 13.10.2 Saudi Arabia Is The World's Second-Largest Oil Producer

- 13.10.3 List Of Oil Refinery In Saudi Arabia With The Capacity

- 13.10.4 Pre-COVID-19 Market Scenario

- 13.10.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.11 Iran Oil Refinery Market Analysis

- 13.11.1 The Isfahan Refinery Plays Significant Role In Iran

- 13.11.2 Iran Is A Major Player In The Petroleum Industry

- 13.11.3 List Of Oil Refinery In Iran With The Capacity

- 13.11.4 Pre-COVID-19 Market Scenario

- 13.11.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 13.12 Iraq Oil Refinery Market Analysis

- 13.12.1 In Iraq Oil Industry Plays Significant Role After World War

- 13.12.2 Iraq Is A Member Of The Organization Of Petroleum Exporting Countries (OPEC), Which Is In Charge Of Crude Oil Production.

- 13.12.3 List Of Oil Refinery In Iraq With The Capacity

- 13.12.4 Pre-COVID-19 Market Scenario

- 13.12.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

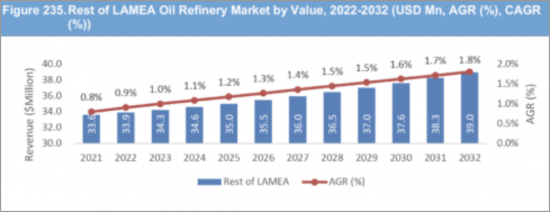

- 13.13 Rest of LAMEA Oil Refinery Market Analysis

- 13.13.1 List Of Oil Refinery In Rest of LAMEA With The Capacity

- 13.13.2 Pre-COVID-19 Market Scenario

- 13.13.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

14 Leading Company Profiles

- 14.1 Royal Dutch Shell Plc

- 14.1.1 Company Snapshot

- 14.1.2 Company Overview

- 14.1.3 Company Financial Profile

- 14.1.4 Company Product Benchmarking

- 14.1.5 Company Recent Developments

- 14.2 BP Plc

- 14.2.1 Company Snapshot

- 14.2.2 Company Overview

- 14.2.3 Company Financial Profile

- 14.2.4 Company Product Benchmarking

- 14.2.5 Company Recent Developments

- 14.3 Exxon Mobil Corporation

- 14.3.1 Company Snapshot

- 14.3.2 Company Overview

- 14.3.3 Company Financial Profile

- 14.3.4 Company Product Benchmarking

- 14.3.5 Company Recent Developments

- 14.4 TotalEnergies SE

- 14.4.1 Company Snapshot

- 14.4.2 Company Overview

- 14.4.3 Company Financial Profile

- 14.4.4 Company Recent Developments

- 14.5 Chevron Corporation

- 14.5.1 Company Snapshot

- 14.5.2 Company Overview

- 14.5.3 Company Financial Profile

- 14.5.4 Company Product Benchmarking

- 14.5.5 Company Recent Developments

- 14.6 Marathon Petroleum Corporation

- 14.6.1 Company Snapshot

- 14.6.2 Company Overview

- 14.6.3 Company Financial Profile

- 14.6.4 Company Product Benchmarking

- 14.6.5 Company Recent Developments

- 14.7 China Petroleum & Chemical Corp

- 14.7.1 Company Snapshot

- 14.7.2 Company Overview

- 14.7.3 Company Financial Profile

- 14.7.4 Company Product Benchmarking

- 14.7.5 Company Recent Developments

- 14.8 Indian Oil Corporation Limited

- 14.8.1 Company Snapshot

- 14.8.2 Company Overview

- 14.8.3 Company Financial Profile

- 14.8.4 Company Product Benchmarking

- 14.8.5 Company Recent Developments

- 14.9 Bharat Petroleum Corporation Limited

- 14.9.1 Company Snapshot

- 14.9.2 Company Overview

- 14.9.3 Company Financial Profile

- 14.9.4 Company Product Benchmarking

- 14.9.5 Company Recent Developments

- 14.10 Hindustan Petroleum Corporation Limited

- 14.10.1 Company Snapshot

- 14.10.2 Company Overview

- 14.10.3 Company Financial Profile

- 14.10.4 Company Recent Developments

- 14.11 Reliance Industries Limited

- 14.11.1 Company Snapshot

- 14.11.2 Company Overview

- 14.11.3 Company Financial Profile

- 14.11.4 Company Product Benchmarking

- 14.11.5 Company Recent Developments

- 14.12 Valero Energy Corporation

- 14.12.1 Company Snapshot

- 14.12.2 Company Overview

- 14.12.3 Company Financial Profile

- 14.12.4 Company Product Benchmarking

- 14.12.5 Company Recent Developments

- 14.13 S-Oil Corporation

- 14.13.1 Company Snapshot

- 14.13.2 Company Overview

- 14.13.3 Company Financial Profile

- 14.14 Fluor Corporation

- 14.14.1 Company Snapshot

- 14.14.2 Company Overview

- 14.14.3 Company Financial Profile

- 14.15 PBF Energy Inc.

- 14.15.1 Company Snapshot

- 14.15.2 Company Overview

- 14.15.3 Company Financial Profile

- 14.15.4 Company Product Benchmarking

- 14.16 Phillips 66

- 14.16.1 Company Snapshot

- 14.16.2 Company Overview

- 14.16.3 Company Financial Profile

- 14.16.4 Company Product Benchmarking

- 14.17 Saudi Arabian Oil Co

- 14.17.1 Company Snapshot

- 14.17.2 Company Overview

- 14.17.3 Company Financial Profile

- 14.17.4 Company Recent Developments

- 14.18 PJSC Rosneft Oil Company

- 14.18.1 Company Snapshot

- 14.18.2 Company Overview

- 14.18.3 Company Financial Profile

- 14.18.4 Company Recent Developments

- 14.19 Eneos Holdings Inc

- 14.19.1 Company Snapshot

- 14.19.2 Company Overview

- 14.19.3 Company Financial Profile

- 14.19.4 Company Product Benchmarking

- 14.20 Gazprom PAO

- 14.20.1 Company Snapshot

- 14.20.2 Company Overview

- 14.20.3 Company Financial Profile

- 14.20.4 Company Product Benchmarking

- 14.20.5 Company Recent Developments

15 Conclusion

16 Recommendations

- 16.1 LAMEA To Dominate The Market

- 16.2 Recommendation For Modest Modernization And Increase Of Production

- 16.3 List Of Companies with their Products and Quantity

17 Glossary Terms

List of Tables

- Table 1. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 2. Global Advanced Truck Technologies Market Snapshot, 2022 & 2032 (US$billion, CAGR %)

- Table 3. Global Oil Refinery Market SWOT Analysis 2022-2032

- Table 4. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 5. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 6. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 7. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 8. Global Oil Refinery Market Forecast, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 9. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 10. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 11. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 12. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 13. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 14. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 15. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 16. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 17. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 18. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 19. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 20. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 21. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 22. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 23. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 24. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 25. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 26. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 27. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 28. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 29. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 30. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 31. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 32. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 33. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 34. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 35. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 36. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 37. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 38. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 39. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 40. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 41. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 42. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 43. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 44. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 45. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 46. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 47. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 48. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 49. North America Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 50. North America Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 51. North America Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 52. North America Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 53. North America Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 54. List of Oil Refinery in US

- Table 55. US Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 56. US Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 57. US Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 58. US Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 59. US Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 60. List of Oil Refinery In Canada with the capacity

- Table 61. Canada Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 62. Canada Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 63. Canada Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 64. Canada Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 65. Canada Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 66. List of Oil Refinery in Mexico with Capacity

- Table 67. Mexico Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 68. Mexico Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 69. Mexico Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 70. Mexico Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 71. Mexico Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 72. Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 73. Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 74. Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 75. Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 76. Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 77. Europe Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 78. Europe Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 79. Europe Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 80. Europe Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 81. Europe Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 82. Europe Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 83. Europe Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 84. Europe Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 85. Europe Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 86. Europe Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 87. Europe Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 88. Europe Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 89. Europe Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 90. Europe Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 91. Europe Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 92. Europe Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 93. Europe Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 94. Europe Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 95. Europe Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 96. Europe Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 97. List Of Oil Refinery in Russia with the capacity

- Table 98. Russia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 99. Russia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 100. Russia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 101. Russia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 102. Russia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 103. List of Oil Refinery in Norway with the Capacity

- Table 104. Norway Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 105. Norway Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 106. Norway Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 107. Norway Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 108. Norway Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 109. List of Oil Refinery in UK with the Capacity

- Table 110. UK Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 111. UK Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 112. UK Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 113. UK Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 114. UK Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 115. List of Oil Refinery In Denmark with the capacity

- Table 116. Denmark Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 117. Denmark Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 118. Denmark Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 119. Denmark Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 120. Denmark Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 121. List of Oil Refinery in Italy with the capacity

- Table 122. Italy Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 123. Italy Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 124. Italy Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 125. Italy Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 126. Italy Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 127. List of Oil Refinery with the capacity

- Table 128. Rest of Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 129. Rest of Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 130. Rest of Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 131. Rest of Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 132. Rest of Europe Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 133. Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 134. Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 135. Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 136. Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 137. Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 138. Asia-Pacific Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 139. Asia-Pacific Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 140. Asia-Pacific Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 141. Asia-Pacific Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 142. Asia-Pacific Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 143. Asia-Pacific Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 144. Asia-Pacific Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 145. Asia-Pacific Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 146. Asia-Pacific Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 147. Asia-Pacific Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 148. Asia-Pacific Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 149. Asia-Pacific Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 150. Asia-Pacific Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 151. Asia-Pacific Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 152. Asia-Pacific Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 153. Asia-Pacific Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 154. Asia-Pacific Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 155. Asia-Pacific Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 156. Asia-Pacific Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 157. Asia-Pacific Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 158. List Of Oil Refinery In China with the capacity

- Table 159. China Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 160. China Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 161. China Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 162. China Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 163. China Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 164. List of Oil Refinery in India with the capacity

- Table 165. India Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 166. India Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 167. India Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 168. India Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 169. India Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 170. List of Oil Refinery In Indonesia with the capacity

- Table 171. Indonesia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 172. Indonesia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 173. Indonesia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 174. Indonesia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 175. Indonesia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 176. List of Oil Refinery in Malaysia with the capacity

- Table 177. Malaysia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 178. Malaysia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 179. Malaysia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 180. Malaysia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 181. Malaysia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 182. List of Oil Refinery in Australia with the capacity

- Table 183. Australia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 184. Australia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 185. Australia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 186. Australia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 187. Australia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 188. List of Oil Refinery in Rest of Asia-Pacific with thr capacity

- Table 189. Rest of Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 190. Rest of Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 191. Rest of Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 192. Rest of Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 193. Rest of Asia-Pacific Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 194. LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 195. LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 196. LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 197. LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 198. LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 199. LAMEA Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 200. LAMEA Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 201. LAMEA Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 202. LAMEA Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 203. LAMEA Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 204. LAMEA Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 205. LAMEA Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 206. LAMEA Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 207. LAMEA Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 208. LAMEA Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 209. LAMEA Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 210. LAMEA Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 211. LAMEA Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 212. LAMEA Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 213. LAMEA Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 214. LAMEA Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 215. LAMEA Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 216. LAMEA Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 217. LAMEA Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 218. LAMEA Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 219. List of Oil Refinery in Brazil with the capacity

- Table 220. Brazil Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 221. Brazil Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 222. Brazil Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 223. Brazil Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 224. Brazil Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 225. List Of Oil Refinery in South Africa with the Capacity

- Table 226. South Africa Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 227. South Africa Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 228. South Africa Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 229. South Africa Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 230. South Africa Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 231. List Of Oil Refinery In Saudi Arabia With The Capacity

- Table 232. Saudi Arabia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 233. Saudi Arabia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 234. Saudi Arabia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 235. Saudi Arabia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 236. Saudi Arabia Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 237. List Of Oil Refinery In Iran With The Capacity

- Table 238. Iran Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 239. Iran Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 240. Iran Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 241. Iran Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 242. Iran Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 243. List Of Oil Refinery In Iraq With The Capacity

- Table 244. Iraq Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 245. Iraq Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 246. Iraq Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 247. Iraq Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 248. Iraq Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 249. List Of Oil Refinery In Rest of LAMEA With The Capacity

- Table 250. Rest of LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%))

- Table 251. Rest of LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Table 252. Rest of LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Table 253. Rest of LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Table 254. Rest of LAMEA Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Table 255. China Petroleum & Chemical Corp: Company Information

- Table 256. China Petroleum & Chemical Corp: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 257. China Petroleum & Chemical Corp: Company Product and Service Benchmarking

- Table 258. China Petroleum & Chemical Corp: Company Recent Developments till Feb,2021

- Table 259. Royal Dutch Shell Plc: Company Information

- Table 260. Royal Dutch Shell Plc: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 261. Royal Dutch Shell Plc: Company Product and Service Benchmarking

- Table 262. Royal Dutch Shell Plc: Company Recent Developments till Feb,2021

- Table 263. BP Plc: Company Information

- Table 264. BP Plc: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 265. BP Plc: Company Product and Service Benchmarking

- Table 266. BP Plc: Company Recent Developments till Feb,2021

- Table 267. Exxon Mobil Corporation: Company Information

- Table 268. Exxon Mobil Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 269. Exxon Mobil Corporation: Company Product and Service Benchmarking

- Table 270. Exxon Mobil Corporation: Company Recent Developments till Feb,2021

- Table 271. TotalEnergies SE: Company Information

- Table 272. TotalEnergies SE: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 273. TotalEnergies SE: Company Recent Developments till Feb,2021

- Table 274. Chevron Corporation: Company Information

- Table 275. Chevron Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 276. Chevron Corporation: Company Product and Service Benchmarking

- Table 277. Chevron Corporation: Company Recent Developments till Feb,2021

- Table 278. Marathon Petroleum Corporation: Company Information

- Table 279. Marathon Petroleum Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 280. Marathon Petroleum Corporation: Company Product and Service Benchmarking

- Table 281. Marathon Petroleum Corporation: Company Recent Developments till Feb,2021

- Table 282. Indian Oil Corporation Limited: Company Information

- Table 283. Indian Oil Corporation Limited: Company Revenue 2017-2021 (US$Mn, AGR %)

- Table 284. Indian Oil Corporation Limited: Company Product and Service Benchmarking

- Table 285. Indian Oil Corporation Limited: Company Recent Developments till Feb,2021

- Table 286. Bharat Petroleum Corporation Limited: Company Information

- Table 287. Bharat Petroleum Corporation Limited: Company Revenue 2017-2021 (US$Mn, AGR %)

- Table 288. Bharat Petroleum Corporation Limited: Company Product and Service Benchmarking

- Table 289. Bharat Petroleum Corporation Limited: Company Recent Developments till Feb,2021

- Table 290. Hindustan Petroleum Corporation Limited: Company Information

- Table 291. Hindustan Petroleum Corporation Limited: Company Revenue 2017-2021 (US$Mn, AGR %)

- Table 292. Hindustan Petroleum Corporation Limited: Company Recent Developments till Feb,2021

- Table 293. Reliance Industries Limited: Company Information

- Table 294. Reliance Industries Limited: Company Revenue 2017-2021 (US$Mn, AGR %)

- Table 295. Reliance Industries Limited: Company Product and Service Benchmarking

- Table 296. Reliance Industries Limited: Company Recent Developments

- Table 297. Valero Energy Corporation: Company Information

- Table 298. Valero Energy Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 299. Valero Energy Corporation: Company Product and Service Benchmarking

- Table 300. Valero Energy Corporation: Company Recent Developments till Feb,2021

- Table 301. S-Oil Corporation: Company Information

- Table 302. S-Oil Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 303. Fluor Corporation: Company Information

- Table 304. Fluor Corporation: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 305. PBF Energy Inc.: Company Information

- Table 306. PBF Energy Inc.: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 307. PBF Energy Inc.: Company Product and Service Benchmarking

- Table 308. Phillips 66 : Company Information

- Table 309. Phillips 66 : Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 310. Phillips 66 : Company Product and Service Benchmarking

- Table 311. Saudi Arabian Oil Co: Company Information

- Table 312. Saudi Arabian Oil Co: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 313. Saudi Arabian Oil Co: Company Recent Developments till Feb,2021

- Table 314. PJSC Rosneft Oil Company: Company Information

- Table 315. PJSC Rosneft Oil Company: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 316. PJSC Rosneft Oil Company: Company Recent Developments till Feb,2021

- Table 317. Eneos Holdings Inc: Company Information

- Table 318. Eneos Holdings Inc: Company Revenue 2017-2021 (US$Mn, AGR %)

- Table 319. Eneos Holdings Inc: Company Product and Service Benchmarking

- Table 320. Gazprom PAO: Company Information

- Table 321. Gazprom PAO: Company Revenue 2016-2020 (US$Mn, AGR %)

- Table 322. Gazprom PAO: Company Product and Service Benchmarking

- Table 323. Gazprom PAO: Company Recent Developments till Feb,2021

- Table 324. List Of Companies with their Products and Quantity

List of Figures

- Figure 1. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 2. Global Oil Refinery Market Segmentation

- Figure 3. Russia's Energy Export

- Figure 4. Global Oil Refinery Market Trends :

- Figure 5. Porters Five Forces

- Figure 6. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 7. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 8. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 9. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 10. Global Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 11. Global Oil Refinery Market Share Forecast by Region 2022, 2027, 2032(%)

- Figure 12. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 13. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (V-Shaped Recovery Scenario)

- Figure 14. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (W-Shaped Recovery Scenario)

- Figure 15. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (U-Shaped Recovery Scenario)

- Figure 16. Global Oil Refinery Market by Region, 2022-2032 (USD Bn, AGR (%), CAGR(%)) (L-Shaped Recovery Scenario)

- Figure 17. Global Oil Refinery Market Share Forecast by Investment 2022, 2027, 2032(%)

- Figure 18. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 19. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 20. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 21. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 22. Global Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 23. Global Oil Refinery Market Share Forecast by Processing Unit 2022, 2027, 2032(%)

- Figure 24. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 25. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 26. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 27. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 28. Global Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 29. Global Oil Refinery Market Share Forecast by Type 2022, 2027, 2032(%)

- Figure 30. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 31. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 32. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 33. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 34. Global Oil Refinery Market by Type, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 35. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 36. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 37. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 38. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 39. North America Oil Refinery Market by Value, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 40. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 41. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 42. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 43. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 44. North America Oil Refinery Market by Country, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 45. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 46. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 47. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 48. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 49. North America Oil Refinery Market by Investment, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

- Figure 50. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%))

- Figure 51. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

- Figure 52. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

- Figure 53. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

- Figure 54. North America Oil Refinery Market by Processing Unit, 2022-2032 (USD Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)