|

市場調查報告書

商品編碼

1274859

臨床檢驗服務市場:第8版Clinical Laboratory Services Market, 8th Edition |

||||||

本報告提供全球臨床檢驗服務市場相關調查,市場概要,以及2022年~2027年的市場預測,市場收益,供應商趨勢,及加入此市場的主要企業簡介等資訊。

樣本圖

目錄

第1章 摘要整理

第2章 產業概要

第3章 各專門領域的檢驗服務

- 檢驗和服務概要

- 臨床化學- 日常及必需的檢驗

- 日常性的臨床化學

- 膽固醇值檢驗

- 尿液檢查

- 血液學

- 凝固

- 內分泌學

- 免疫學和微生物學

- 過敏和食物不耐症

- 腫瘤標記(癌症篩檢)

- 心臟標記

- HIV檢驗

- 細胞學及組織學檢驗

- 遺傳基因檢驗

- 毒性實驗

- COVID-19病毒檢驗

第4章 全球臨床檢驗市場,各供應商群組

- 臨床檢驗市場:供應商概要

- 醫院、急救醫療機關

- 門診病人醫療機關

- 診療所

- 全球看護設施和生活看護設施

- 全球透析診所

- 獨立型檢驗機關

第5章 北美市場

第6章 EMEA市場

第7章 亞太地區市場

第8章 南美市場

第9章 主要市場參與企業

- 全球競爭概要

- 美國的競爭分析

- 企業簡介

- Quest Diagnostics, Inc

- Laboratory Corporation of America

- Exact Sciences Corp.

- Sonic Healthcare Limited

- BioReference Laboratories - An OPKO Health Subsidiary

- Myriad Genetics, Inc.

- SYNLAB International GmbH (SYNLAB Bondco PLC)

- Eurofins Scientific SE

- H.U. Group Holdings

- Siemens Healthineers

- Unilabs

- Medicover AB

第10章 市場趨勢和概要

- 全球市場概要

- 地區概要

- 人口增加

- 人口的高齡化

- 病的負擔增加

- 發展途中地區的經濟發展

- 先進地區的經濟的穩定化

- 價格設定的壓力

- 有效率的醫療系統為焦點

- 醫療保健服務的需求整體增加

- COVID-19

- 多重試驗

- AI和機器學習的研究室趨勢

- 分子檢驗及其他高度的檢驗打開新的方向

- 數位病理趨勢

Your Resource for Business Planning in the Clinical Laboratory Market

What's the size of the service market for clinical testing? What type of tests are selling? Where is this market going next five years? Which companies will earn those revenues? Where is growth coming from? How will LDT regulation affect the market? What are companies planning with COVID-19 largely endemic?

These questions and more are answered in Kalorama's Clinical Laboratory Services report. laboratories are the workhorse of diagnostic services for the IVD market. These laboratories play a vital role in providing analysis of a wide range of disorders and diseases including pathology, immunology, cholesterol testing, allergy testing, urinalysis, genetic testing and many more.

Now in 8 Editions, Kalorama's Report on the Market Opportunity in Lab Services

SAMPLE VIEW

‘Clinical Laboratory Services Market, 8th Edition’ provides an overview of the clinical laboratory industry and the trends driving growth.

Included in the report are statistics influencing the industry, incidence of diseases in the U.S. and worldwide demographics, life expectancy, and company strategies.

The laboratory services market is covered by specialty, including:

- Essential and Routine Testing (Clinical Chemistry, Hematology, Coagulation, Endocrinology)

- Immunology Testing

- Microbiology Testing

- Cytology and Histology Testing (HPV, Tumor Pathology)

- Genetic Testing (Prenatal and Other Genetic)

- Toxicology Testing (Drugs of Abuse)

- COVID-19

The clinical lab test is competitive in hospitals, reference laboratories, and in physician office labs and clinics. This report covers all of these markets. A global market analysis by laboratory type is also displayed, including:

- Independent and Reference Laboratories

- Hospital-based Laboratories

- Clinic-based Laboratories

Clinical lab tests are sold worldwide. Information is presented as a global focused market report, with key regions discussed including:

- North America (United States, Canada)

- Europe, Middle East, and Africa - EMEA (Germany, France, Italy, Spain, United Kingdom, Switzerland)

- Asia Pacific (Japan, China, India, South Korea, Australia)

- Latin America (Brazil, Mexico)

Also included is a competitive analysis of leading clinical laboratory providers.

All market data pertains to the world market at the manufacturers' level. The base year for data is 2021. Historical data is provided for the years 2011 through 2020, with forecast data provided for 2022 through 2026. Compound annual growth rates (CAGRs) are provided for the 2021-2026 periods for each segment covered. A U.S. competitive analysis is provided for the year 2021. The forecasted market analysis through 2026 was largely based on demographic trends, disease trends, new developments, company performance trends, merger and acquisitions, and national expansion.

Among the scores of tables included in this report the following information is provided:

- Markets and Forecasts for Chemistry Testing Lab Services , 2022-2027

- Markets for Infectious Disease Testing Lab Services, 2022-2027

- Markets for COVID-19 Testing Lab Services, 2022-2027

- Markets for Genetic Testing Lab Services, 2022-2027

- Markets for Prenatal Testing Lab Services, 2022-2027

- Other Lab Services Markets Lab Services , 2022-2027

- Market Share of Top Laboratories

- Market Revenues by Venue

- CLIA Clinical Laboratory Registration by Primary Laboratory Type: April 2023

- Growth in Clinical Laboratories, 2000-2023

- Leading U.S. Independent Laboratory Groups, Distribution of Center

- Growth in U.S. Hospital Laboratory Locations, June 2011 through April 2023

- Growth in U.S. Pharmacy-Based Laboratories, mid-2011 through April 2023

- Global Health Spending as a Percentage of GDP, by Country

- Global Population Trends Age 65+, 2000-2050 (Millions)

- Global Prevalence of Disease, 2000, 2015 and Projected 2030 (Hypertension, Diabetes, Depression, Asthma, CHD, COPD, Epilepsy, Alzheimer's Disease, HIV/AIDS, Stroke, Cancer, TB, Parkinson's)

- Medical Doctors per 1,000 Population by Country, 2019/2020

- Global Nursing Establishments and Assisted Living Facilities

- Global Dialysis Clinics

- Independent Laboratory Providers

- COVID-19 Impact on Independent Laboratory Testing Markets, $millions

A Resource for IVD Manufacturers as Well as Laboratory Businesses

Many of Kalorama's IVD manufacturer customers have found this annual review of the clinical labs market essential. Clinical laboratories are the workhorse of diagnostic services for the IVD market. These laboratories play a vital role in providing analysis of a wide range of disorders and diseases including pathology, immunology, cholesterol testing, allergy testing, urinalysis, genetic testing and many more. Clinical laboratories are an essential part of the health industry.

It is estimated that between 70% - 80% of physicians' diagnoses are a result of laboratory tests.

In addition to diagnosing patients, clinical lab testing is performed to evaluate disease progression, monitor drug treatment and conditions, determine individual therapy, and several other reasons. In oncology indications, clinical laboratory services are involved in 100% of patient care plans. Hospital and independent laboratories were the two listed types of laboratories for several years with hospitals accounting for approximately 90% of laboratory facilities.

Today, there is a shift in healthcare utilization primarily due to reducing healthcare spending, which makes the laboratory an even more valuable part of the treatment plan. In efforts to reduce health-related costs, hospitals have been striving to reduce length of stays. Although stays in U.S. hospitals were thought to have declined to about 4.3 days on average there has been some indication of an increase among some demographics in recent years. In recent years, the average length of hospital stay has been estimated at around 4.7 days. To continue to try and keep stays at a minimum and ultimately reduce cost, monitoring technologies, diagnostic imaging and laboratory measures and disease/treatment monitoring through diagnostic laboratory practices are primary ways physicians and administrators are continuing to meet optimal healthcare outcomes while also reduce costs.

Knowing the Clinical Lab Market, with the Aid of an Independent Resource, is Essential to Knowing the IVD Business

Global markets are also feeling pressures to reduce health spending. The length of stay on a global level is estimated at 6.6 days on average with Russia and Japan among the higher days of hospitalization. We can expect to see a consolidation in the number of clinical laboratories, particularly in the independent and community sectors, as these trends continue to influence the industry and add pressure to smaller clinical laboratories in an effort to reduce costs and still provide adequate healthcare.

Table of Contents

Chapter One: Executive Summary

- Industry at a Glance

- Scope and Methodology

- Global Market Overview

- Table 1-1: Global Clinical Laboratory Market Analysis, 2017-2027 (in millions of dollars at the manufacturer's level)

- Figure 1-1: Global Clinical Laboratory Market Analysis: 2017-2027

- Key Issues and Trends Affecting the Market

- Leading Market Participants

Chapter Two: Industry Overview

- Clinical Laboratory Description

- Figure 2-1: Hospital Length of Stay in Days (2018-2019 Average)

- Number of Laboratory Health Workers by Country

- Figure 2-2: Laboratory Health Workers by Country, 2010-2021 Average

- The Largest Clinical Laboratory Market: The United States

- Structure and Regulation in the U.S.

- Table 2-1: Selected CLIA Waived Laboratory Tests

- Table 2-2: Provider-Performed Microscopy Procedures

- Figure 2-3: Clinical Laboratory Certificate of Accreditation Issued by Organization (non-exempt laboratories only), [ACHC, ASHI, AABB, JC, COLA, CAP] by % April 2023

- Table 2-3: Clinical Laboratory Certificates Issued by Type (non-exempt laboratories only), as of April 2023

- Figure 2-4: Laboratory Certificate Trends by Application Type (Compliance, Waiver, PPM, Accredidation), July 2010 - April 2023

- Table 2-4: CLIA Exempt States, Number of Laboratories, as of April 2023

- Laboratory Developed Test Regulations

- Payers and Reimbursement

- Laboratory Service Payer Types

- Table 2-5: U.S. Clinical Laboratory Revenues by Client and Payer Type (%), [Medicare and Medicaid, Private Patient, Commercial Insurance, Managed Care], 2022

- Figure 2-5: Clinical Laboratory Revenues by Client and Payer Type, 2022 Estimates (Managed Care, Medicare and Medicaid, Private Patient, Commercial Insurance]

- Trends in Medicare Reimbursement

- Figure 2-6: Medicare Reimbursement Trends, Average Reimbursement for Clinical Laboratory Services, 2009 through 2023

- Health Care Reform

- Protecting Access to Medicare Act (PAMA) of 2014

- Table 2-6: Proposed Clinical Diagnostic Laboratory Test Rates, 2020-2026

- Advanced Laboratory Tests (ADLT)

- Table 2-7: List of Approved ADLTs, March 2022 (Lab Name, Test Name, Test Descriptor, Approval Date, New ADLT Initial Period, Payment Amount)

- Bundled Insurance Payments for ESRD Patients

- Table 2-8: Laboratory Tests Subject to ESRD Consolidated Billing (CY 2022)

- Commercial Insurance Providers

- Table 2-9: National Commercial Insurance Provider List, 2022 (Commercial Insurance Company, Membership, Total Revenues)

- Figure 2-7: National Commercial Insurance Providers by Membership and Total Revenues, 2022

- Transparency in Pricing

- Figure 2-8: Revenue and Test Volume Trends, Quest Diagnostics

- Direct-to-Consumer Testing

- Table 2-10: Select DTC Tests and Prices by Laboratory Service Provider (Quest Direct and Labcorp On Demand) 2022 (in US $)

- DTC in Genetic Testing

- Expanding Cancer Test Utilization and Technologies

- Labcorp and QIAGEN Launch new Companion Diagnostic for Metastatic Breast Cancer Therapy

- Labcorp Launches New Test for NSCLC

- Labcorp Offers First FDA Test for Monitoring Residual Blood Cancer Cells

- Labcorp Launches New Test for Skin Cancer

- Quest Diagnostics Attention to Oncology

- Quest Collaborates with GRAIL on Oncology

- Quest Releases Companion Diagnostic

- Quest Offers Biocept's Liquid Biopsy Test for Lung Cancer

- Quest Acquires Haystack Oncology

- The Role of Information Technology

- Industry Drivers

- Global Demographics

- Table 2-12: The Global Population, 1980-2050

- Figure 2-9: The Global Population, 1980-2050 (in millions)

- Table 2-13: World Population by Major Geographic Region, 2010 - 2050

- Figure 2-10: World Population by Major Geographic Region, 2010-2050

- Table 2-14: Global Population Trends Age 65+, 2000-2050

- Figure 2-11: Global Population Trends Age 65+, 2000-2050 (Millions)

- Chronic Diseases and Conditions

- Figure 2-12: Global Prevalence of Disease, 2000, 2015 and Projected 2030 (Hypertension, Diabetes, Depression, Asthma, CHD, COPD, Epilepsy, Alzheimer's Disease, HIV/AIDS, Stroke, Cancer, TB, Parkinson's)

- Figure 2-13: Global Causes of Death, 2000, 2010 and 2020

- Figure 2-14: Change in Mortality Over 2000-2020 Period

- Economic Performance

- Figure 2-15: Global Health Spending as a Percentage of GDP, by Country, 2019 estimates (%)

Chapter Three: Testing Services by Specialty

- Test and Services Overview

- Figure 3-1: Global Clinical Laboratory Market Analysis: Service Revenue Trend, 2017-2027 ($millions)

- Table 3-1: Global Clinical Laboratory Market Analysis by Test Segment (Clinical Chemistry: Routine & Essential; Immunology & Microbiology; Cytology & Histology; Genetic; Toxicology; COVID-19), 2017-2027 (in millions of dollars at the manufacturers' level)

- Figure 3-2: Global Clinical Laboratory Market Analysis: Segment Growth Forecast, CAGR 2022-2027 (Clinical Chemistry, Immunology & Microbioogy, Cytology & Histology, Genetic Testing, Toxicology, COVID-19)

- Figure 3-3: Global Clinical Laboratory Market Analysis by Testing Service, Distribution of Revenues 2022, % (Clinical Chemistry, Immunology & Microbioogy, Cytology & Histology, Genetic Testing, Toxicology, COVID-19)

- Clinical Chemistry - Routine and Essential Testing

- Figure 3-4: Global Clinical Laboratory Market Analysis: Clinical Chemistry: Routine & Essential Testing Service Market Trend, 2017-2027 ($ millions)

- Table 3-2: Market Overview - Routine and Essential Testing, 2022 (Clinical Chemistry, Hematology, Coagulation, Endrocrinology, Others)

- Routine Clinical Chemistry

- Cholesterol Level Testing

- Table 3-3: High Cholesterol Risk Categories

- Urinalysis

- Table 3-4: Normal Reference Levels in a Medical Urinalysis

- Hematology

- Table 3-5: Laboratory Reference Parameters for CBC

- Coagulation

- Endocrinology

- Table 3-6: HCG Levels in Pregnant Women by Days Past Ovulation

- Immunology and Microbiology

- Figure 3-5: Global Clinical Laboratory Market Analysis: Immunology & Microbiology Testing Service Market Trend, 2017-2027 ($ millions)

- Table 3-7: Market Overview - Immunology & Microbiology Testing, 2022 [Immunology, Microbiology $ and %]

- Allergy and Food Intolerance

- Tumor Markers

- Cardiac Markers

- HIV Testing

- Table 3-8: Number of Reported HIV Tests Performed by Country, 2018

- Figure 3-6: Number of HIV Testing/Counseling Facilities per 100,000 Adult Populations and HIV Positive Population per 1,000 by Select Country (2017)

- Cytology and Histology Testing

- Figure 3-7: Global Clinical Laboratory Market Analysis: Cytology & Histology Testing Service Market Trend, 2017-2027 ($ millions)

- Table 3-9: Market Overview - Cytology & Histology Testing, 2022 (HPV, Tumor Pathology)

- Figure 3-8: Percent of Females Aged 20-69 Screened for Cervical Cancer (all screening methods), by Select Country 2019 Estimates

- Genetic Testing

- Figure 3-9: Global Clinical Laboratory Market Analysis: Genetic Testing Service Market Trend, 2017-2027 ($ millions)

- Table 3-10: Market Overview - Genetic Testing, 2022 (Prenatal, Other Genetic)

- Toxicology Testing

- Figure 3-10: Global Clinical Laboratory Market Analysis: Toxicology Testing Service Market Trend, 2017-2027 ($ millions)

- Table 3-11: Substance Detection Periods by Selected Test Method

- COVID-19 Virus Testing

- Figure 3-11: Global Distribution of COVID-19 Test Services: Volume, Cumulative through December 31, 2022

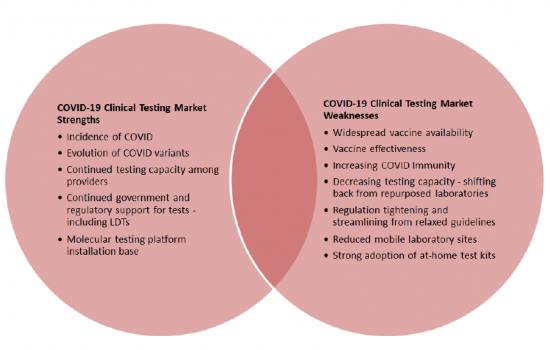

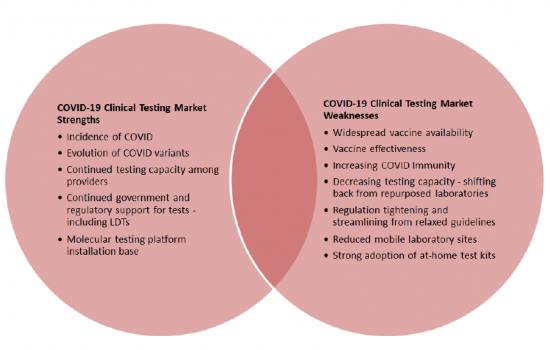

- Figure 3-12: Factors Affecting COVID-19 Clinical Testing Market, 2022 and Beyond

Chapter Four: Global Clinical Laboratory Market by Provider Group

- Clinical Laboratory Market: Provider Overview

- Table 4-1: Global Clinical Laboratory Market Analysis by Provider Segment, 2022, 2027 (Hospitals, Physician Offices/Outpatient Clinics, Independent)

- Figure 4-1: Global Clinical Laboratory Market Analysis: Provider Segment Growth Forecast, CAGR 2022-2027

- Figure 4-2: Global Clinical Laboratory Market Analysis by Provider Group, Distribution of Revenues 2022 (%)

- Hospitals and Acute Care Providers

- Figure 4-3: COVID-19 Impact on Hospital-based Laboratory Testing Markets, $millions

- Table 4-2: Global Clinical Laboratory Market Analysis: Hospital and Acute Care Laboratory Testing Market 2022 and 2027 (U.S./International Estimates)

- Figure 4-4: Hospital Beds per 1,000 Population by Country, 2020

- Physicians and Outpatient Care Providers

- Figure 4-5: COVID-19 Impact on Physician-based Laboratory Testing Markets, $millions

- Table 4-3: Global Clinical Laboratory Market Analysis: Physician and Outpatient Care Laboratory Testing Market 2022 and 2027 (U.S./International Estimates)

- Physician Offices

- Figure 4-6: Medical Doctors per 1,000 Population by Country, 2019/2020

- Global Nursing Establishments and Assisted Living Facilities

- Global Dialysis Clinics

- Independent Laboratory Providers

- Figure 4-7: COVID-19 Impact on Independent Laboratory Testing Markets, $millions

- Table 4-4: Revenues for Selected U.S.-based Reference Labs 2017-2022 ($million, estimated)

- Table 4-5: Estimated Clinical Test Volume by Select Independent Laboratory, 2021 (millions of units)

- Table 4-7: Global Clinical Laboratory Market Analysis: Independent Laboratory Testing Market 2022 and 2027 (U.S./International Estimates)

Chapter Five: North America Market

- Overview

- Table 5-1: North America Market Value by Country, 2022 (in millions of dollars at the manufacturers' level)

- United States

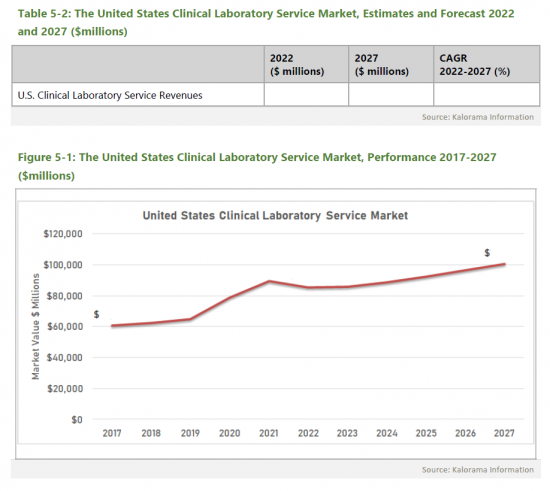

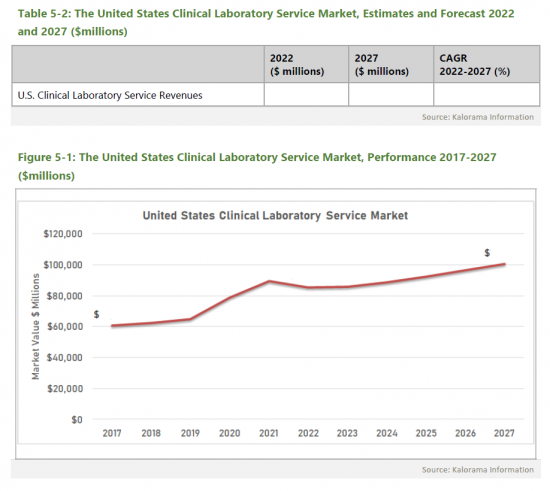

- Table 5-2: The United States Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Figure 5-1: The United States Clinical Laboratory Service Market, Performance 2017-2027 ($millions)

- U.S. Market by Test Type

- Table 5-3: The United States Clinical Laboratory Service Market by Testing Services (Essential & Routine, Immunology and Microbiology, Cytology and Pathology, Genetic, Toxicology, COVID-19) Estimates and Forecast 2022 and 2027 ($millions)

- Figure 5-2: U.S. Clinical Laboratory Market Analysis: Testing Service Revenues by Type, 2022 (Essential & Routine, Immunology and Microbiology, Cytology and Pathology, Genetic, Toxicology, COVID-19) Estimates and Forecast 2022 and 2027 ($millions)

- Figure 5-3: U.S. Clinical Laboratory Market Analysis: Testing Service Revenues Over Time by Type, 2017-2027 ($millions) (Essential & Routine, Immunology and Microbiology, Cytology and Pathology, Genetic, Toxicology, COVID-19) Estimates and Forecast 2022 and 2027

- U.S. Market by Laboratory Provider Type

- Table 5-4: The United States Clinical Laboratory Service Market by Laboratory Type, Estimates and Forecast 2022 and 2027 ($millions)

- Figure 5-4: U.S. Clinical Laboratory Market Share by Laboratory Type, 2022

- Figure 5-5: U.S. Clinical Laboratory Market Analysis: Testing Service Revenues Over Time by Laboratory Type, 2017-2027 ($millions)

- U.S. Clinical Laboratory Industry Structure

- Figure 5-6: Growth in Clinical Laboratories, 2000-2023

- Figure 5-7: U.S. CLIA Clinical Laboratory Registration by Primary Laboratory Type: April 2023

- Table 5-5: CLIA Registered Laboratories by Type of Facility (Exempt/Non-Exempt Combined) April 2023

- Figure 5-8: Growth Trends in CLIA Registered Laboratories by Type of Facility (Exempt/Non-Exempt Combined) June 2019 and April 2023

- Figure 5-9: Change in CLIA Registered Laboratories by Type of Facility, Highest and Lowest Growth Segments, % Change, Compounded Annually 2019-2023

- Independent Clinical Laboratories

- Figure 5-10: Leading U.S. Independent Laboratory Groups, Distribution of Centers, December 2022

- Figure 5-11: Growth in U.S. Independent Laboratory Facilities, June 2011 through April 2023

- Hospital-based Laboratories

- Table 5-7: U.S. Hospital Types

- Table 5-8: AHA Statistics - U.S. Registered Hospitals by Type, 2010 through 2021

- Table 5-9: AHA Statistics for U.S. Hospitals, 2013-2021

- Figure 5-12: U.S. Hospital Length of Stay, Average by Broad Age Group, 2018

- Figure 5-13: Growth in U.S. Hospital Laboratory Locations, June 2011 through April 2023

- Physician-office and Clinic Laboratories

- Figure 5-14: Number of Physician Offices, United States, 2000-2020

- Figure 5-15: Growth in U.S. Physician Office Laboratory Locations, June 2011 through April 2023

- Nursing Facility and Home Health

- Figure 5-16: Number of Nursing Homes (United States), 2000-2020

- Figure 5-17: Growth in U.S. Nursing Facility/Home Health Laboratory Locations, June 2011 through April 2023

- Pharmacy-based Laboratories

- Figure 5-18: Growth in U.S. Pharmacy-Based Laboratories, mid-2011 through April 2023

- Dialysis Clinics

- Figure 5-19: Growth in U.S. Dialysis Clinic-based Laboratories, mid-2011 through April 2023

- Canada

- Table 5-10: Canada Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Figure 5-20: Canada Clinical Laboratory Service Market, Performance 2017-2027 ($millions)

Chapter Six: EMEA Market

- Overview

- Table 6-1: EMEA Market Value by Country, 2022 [Germany, France, Italy, Spain, United Kingdom, Switzerland, Rest of EMEA] (in millions of dollars at the manufacturers' level)

- Figure 6-1: EMEA Clinical Laboratory Service Market, Growth Projections by Country, CAGR 2022-2027

- Germany

- Table 6-2: Germany Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Figure 6-2: Leading Laboratory Service Suppliers by Estimated Distribution of Revenues, Germany, 2022

- France

- Table 6-3: France Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Italy

- Table 6-4: Italy Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Spain

- Table 6-5: Spain Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- United Kingdom

- Table 6-6: United Kingdom Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Switzerland

- Table 6-7: Switzerland Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

Chapter Seven: Asia Pacific Market

- Overview

- Table 7-1: Asia Pacific Clinical Laboratory Service Market Value by Country [China, Japan, India, South Korea, Australia], 2022 (in millions of dollars at the manufacturers' level)

- Figure 7-1: Asia Pacific Clinical Laboratory Service Market, Growth Projections by Country, CAGR 2022-2027

- Japan

- Table 7-2: Japan Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Japan Clinical Laboratory Industry Structure

- Figure 7-2: Japan Clinical Laboratory Industry by Type, 2022

- Figure 7-3: Japan Clinical Laboratory Industry by Test Classification, 2022

- Figure 7-4: Japan Clinical Laboratory Industry, Number of Laboratories by Prefecture, 2022

- China

- Table 7-3: China Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- China Clinical Laboratory Industry Structure

- Figure 7-5: China Clinical Laboratory Industry by Type, 2022

- India

- Table 7-4: India Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- South Korea

- Table 7-5: South Korea Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Australia

- Table 7-6: Australia Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

Chapter Eight: Latin America Market

- Overview

- Table 8-1: Latin America Market Value by Country, 2022 (in millions of dollars at the manufacturers' level)

- Figure 8-1: Latin America Clinical Laboratory Service Market, Growth Projections by Country, CAGR 2022-2027

- Brazil

- Table 8-2: Brazil Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

- Mexico

- Table 8-3: Mexico Clinical Laboratory Service Market, Estimates and Forecast 2022 and 2027 ($millions)

Chapter Nine: Leading Market Participants

- Global Competitor Summary

- Figure 9-1: Top 10 Market Participants, Global Service Revenues, Estimated 2021 and 2022 ($millions)

- U.S. Competitive Analysis

- Table 9-1: Estimated U.S. Laboratory Service Revenues and Market Share of Leading Clinical Laboratory Providers, 2022

- Figure 9-2: Estimated U.S. Laboratory Services, Market Share of Leading Clinical Laboratory Providers, 2022

- Select Company Profiles

- Quest Diagnostics, Inc.

- Company Overview

- Table 9-3: Quest Diagnostics Corporate Details

- Performance Review

- Figure 9-3: Quest Diagnostics Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Laboratory Corporation of America

- Company Overview

- Table 9-4: Laboratory Corporation of America Corporate Details

- Performance Review

- Figure 9-4: Laboratory Corporation of America Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Exact Sciences Corp.

- Company Overview

- Table 9-7: Exact Sciences Corporate Details

- Performance Review

- Figure 9-7: Exact Sciences Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Sonic Healthcare Limited

- Company Overview

- Table 9-5: Sonic Healthcare Corporate Details

- Performance Review

- Figure 9-5: Sonic Healthcare Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- BioReference Laboratories - An OPKO Health Subsidiary

- Company Overview

- Table 9-11: BioReference Laboratories Corporate Details

- Key Acquisitions, Alliances, and Partnerships

- Performance Review

- Figure 9-11: BioReference Laboratories Revenue Summary, 2010-2022 ($millions)

- Products and Services

- Company Overview

- Myriad Genetics, Inc.

- Company Overview

- Table 9-10: Myriad Genetics Corporate Details

- Key Acquisitions, Alliances, and Partnerships

- Performance Review

- Figure 9-10: Myriad Genetics Revenue Summary, 2010-2022 ($millions)

- Products and Services

- Company Overview

- SYNLAB International GmbH (SYNLAB Bondco PLC)

- Company Overview

- Table 9-6: SYNLAB Corporate Details

- Performance Review

- Figure 9-6: SYNLAB Revenue Summary, 2015-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Eurofins Scientific SE

- Company Overview

- Table 9-8: Eurofins Scientific Corporate Details

- Performance Review

- Figure 9-8: Eurofins Scientific Revenue Summary, 2010-2022($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- H.U. Group Holdings

- Company Overview

- Table 9-9: H.U. Group Holdings, Inc. Corporate Details

- Performance Review

- Figure 9-9: H.U. Holdings Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Siemens Healthineers

- Company Overview

- Table 9-13: Siemens Healthineers Corporate Details

- Performance Review

- Figure 9-13: Siemens Healthineers' Revenue Summary, 2010-2022 ($millions)

- Key Acquisitions, Alliances, and Partnerships

- Products and Services

- Company Overview

- Unilabs

- Company Overview

- Table 9-12: Unilabs Corporate Details

- Performance Review

- Products and Services

- Company Overview

- Medicover AB

- Company Overview

- Table 9-10: Medicover Corporate Details

- Key Acquisitions, Alliances, and Partnerships

- Performance Review

- Figure 9-10: Medicover Revenue Summary, 2010-2022 ($millions)

- Products and Services

- Company Overview

Chapter Ten: Market Trends and Summary

- Global Market Overview

- Table 10-1: Global Clinical Laboratory Market Analysis, 2017-2027 (in millions of dollars at the manufacturer's level)

- Figure 10-1: Global Clinical Laboratory Market Analysis: 2017-2027

- Regional Overview

- Table 10-2: Global Clinical Laboratory Service Market Analysis, Revenues by Region, 2022

- Figure 10-2: Global Clinical Laboratory Market Analysis, Revenues by Region, 2022

- Figure 10-3: Global Clinical Laboratory Market Analysis: Regional Growth Forecast, CAGR 2022-2027

- Figure 10-4: Estimated COVID-19 Market Performance by Region, 2022

- Population growth

- Aging populations

- Increasing disease burden

- Economic growth in developing regions

- Stabilizing economies in developed regions

- Pricing pressures

- Focusing on Efficient health systems

- Overall growth in demand for health care services

- COVID-19

- Multiplex Testing

- AI and Machine Learning Laboratory Trends

- Molecular Testing and Other Advanced Testing Will Open New Avenues

- Digital Pathology Trends