|

市場調查報告書

商品編碼

1290714

歐洲辦公家具市場The European Market for Office Furniture |

||||||

本報告考察了歐洲辦公家具市場,並對關鍵歷史指標、市場前景、主要製造商的業績、產品類別和分銷渠道進行了深入分析。

內容

目錄摘要

研究方法、定義和註釋

執行摘要:推動歐洲辦公家具行業的關鍵因素

第 1 章市場情景 - 趨勢、產品類型、數據:按國家/地區

- 市場演變和數據:辦公家具產值和價格、消費和國際貿易:按國家分類(2017-2022 年)

- 需求驅動因素

- 歐洲主要集團及其市場份額

- 當前趨勢和市場預測(2023/2024 年)

第 2 章:績效 - 關鍵數據和宏觀經濟指標:地區和國家

- 北歐(丹麥、芬蘭、挪威、瑞典)

- 西歐(比利時、法國、愛爾蘭、荷蘭、英國)

- 中歐(DACH:奧地利、德國、瑞士)

- 南歐(希臘、意大利、葡萄牙、西班牙)

- 中歐和東歐(保加利亞、克羅地亞、塞浦路斯、捷克共和國、愛沙尼亞、匈牙利、立陶宛、拉脫維亞、馬耳他、波蘭、羅馬尼亞、斯洛文尼亞、斯洛伐克)

第 3 章辦公家具國際貿易

- 貿易餘額:按細分市場

- 出口:按國家、按細分市場

- 歐洲以外的出口目的地

- 進口:按國家、按細分市場

- 主要供應國

第 4 章供應結構和產品細分

- 產品細分 - 歐洲和選定國家/地區的辦公家具:按細分

- 辦公椅:樣本公司的產值,按類型細分,按類型分類和供應

- 辦公桌:樣本公司的產值、獨立式和麵板式辦公桌、供應

- 行政家具:產值

- 歸檔系統:樣本公司的產值、按類型分類、按類型供應

- 牆壁、隔板、聲學產品:樣本公司的產值、隔板類型、供應類型

- 會議室和公共區域的家具:產值和按類型細分

焦點

- 歐洲電話亭和音箱:產值、類型、平均標價、按發布年份劃分的品牌和產品樣本、價格段

- 歐洲高度可調桌子 (HAT):按主要國家/地區劃分的樣本公司坐立式辦公桌的產量以及固定式和高度可調式辦公桌的供應情況明細

- 就業和投資活動

- 可持續性和再利用

第 5 章市場和分銷 - 辦公家具銷售:按分銷渠道

- 混合辦公和居家辦公:辦公家具消費份額

- 歐式轉椅:體積和品牌定位

競爭格局

- 按產品類別劃分的主要製造商的銷售額和市場份額

- 按主要市場劃分的主要製造商的銷售額和市場份額

附錄 1:國際貿易表

附錄 2:符合條件的公司名單

The CSIL Report “ The European Market for Office Furniture ” offers an extensive analysis of the office furniture sector in Europe across 30 countries, through the historical series of key indicators, the market prospects, and delves into the performance of major manufacturers, the product categories and the distribution channels. With this in-depth research, CSIL also highlights and assesses the primary macro trends which are impacting the sector, such as features of the supply system, hybrid work solutions, and sustainability.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides a comprehensive analysis of the European office furniture sector, including demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2017-2022 values of office furniture production, consumption, imports, and exports and 2023 and 2024 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers .

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, accompanied by brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-European Union and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of over 300 office furniture companies

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

In this new edition, the analysis of the office furniture supply structure has been further deepened.

European office furniture production is broken down by types of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one the report includes production values for the time series 2017-2022. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, United Kingdom, Sweden, Spain, Poland, and the Czech Republic)

- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies.

FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2019-2022 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries.

- Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies.

FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies.

- Executive Furniture: production values.

- Filing Systems: production values, breakdown by type and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies.

FOCUS ON: Phone Booths and Acoustic Pods , values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

- Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

HYBRID WORK AND HOME OFFICE:

In the light of the latest insights and the most recent CSIL analysis, this report outlines trends in the Home-Office furniture market, through demand drivers and incidence on total European office furniture consumption.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

SELECTED COMPANIES

Ahrend, Assmann, Buzzi Space, Estel, Flokk, Framery, Haworth, MillerKnoll, Interstuhl, Isku, Kinnarps, König + Neurath, Las Mobili, Martela, Narbutas, Nowy Styl, Quadrifoglio, Sedus Stoll, Senator, Sokoa, Steelcase, Topstar-Wagner, Unifor, USM, Vitra, Wilkhahn

Highlights:

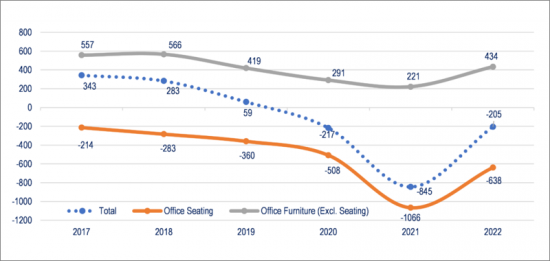

Europe. Trade balance by segment, 2017-2022.

EUR Million and percentages

Source: CSIL processing of official data.

The European office furniture sector is showing signs of recovery, exceeding the pre-pandemic levels. Growth is however strongly influenced by rising inflation. Production values increased by a remarkable +13% in 2022, driven by double-digit price increases. Consequently, the actual volume of production in Europe grew moderately.

Over the past years, we have witnessed the acceleration of various structural processes that have resulted in the demand for more flexible office spaces, multi-format environments, and remote working locations including private homes. These changes have had a noticeable impact, leading to significant shifts in the market share of different product segments.

TABLE OF CONTENTS

Abstract of Table of Contents

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

- 1.1. Market evolution and figures by country 2017-2022: Office furniture production values and prices, consumption and international trade

- 1.2. Demand drivers

- 1.3. Leading groups in Europe and their market shares

- 1.4. Current trends and market forecasts for 2023 and 2024

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1. Trade balance by segment

- 3.2. Exports: by country and segments

- 3.3. Extra-European destinations

- 3.4. Imports: by country and segments

- 3.5. Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

- 4.1. Product segments: Office furniture by segment in Europe and in selected countries

- Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- Executive furniture: production values

- Filing systems: production values, breakdown by type, supply by type in a sample of companies

- Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

- 4.2. Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

- 4.3. Height Adjustable Tables (HAT) in Europe:production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

- 4.4. Employment and investment activity

- 4.5. Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

- 5.1. Hybrid work and home office: incidence on office furniture consumption

- 5.2. Swivel chairs in Europe: volumes and brand positioning

THE COMPETITIVE LANDSCAPE

- Sales and market shares of the leading manufacturers by product category

- Sales and market shares of the leading manufacturers by major markets