|

市場調查報告書

商品編碼

1272695

大數據安全市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Big Data Security Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,大數據安全市場預計將以 17.95% 的複合年增長率增長。

安全性是限制公司選擇在本地、雲和虛擬環境中部署大數據的一個關鍵問題。

主要亮點

- 大數據對企業和網絡犯罪分子構成威脅,因為當網絡犯罪分子以大型數據集為目標時,回報往往超過突破安全層所需的努力。它具有巨大的潛力。 這就是大數據對企業和網絡犯罪分子具有巨大潛力的原因。 通過瞄準如此龐大的數據集,網絡犯罪分子可以獲得更多收益。 因此,如果企業在沒有足夠安全措施的情況下受到攻擊,將會損失慘重。

- 許多公司,尤其是那些處理大量數據的公司,需要傳統的數據挖掘和網絡攻擊對抗工具和技術。 因此,網絡安全專業人員正在轉向大數據分析。 大數據環境是脆弱的,並且是入侵者的寶貴目標,因為數據從數據源(例如 CRM 和傳感器)路由到數據存儲和分析。

- 公司使用 Hadoop 開源框架等部署大數據平台,但這些框架需要全面的安全計劃。 固有機制有局限性,可能需要比數據加密更安全。 許多科技公司正在將雲解決方案推向市場以解決這個問題。 例如,2021 年 8 月,McAfee Enterprise 宣布 MVISION Cloud 將提供名為 MVISION Unified Cloud Edge (UCE) 的安全訪問服務邊緣 (SASE)。 該解決方案利用基於 API 的無摩擦雲原生方法來擴展 Dynamics 365 的功能以滿足企業大數據安全需求。

- 全球 COVID-19 大流行使全球市場受益。 在 COVID-19 大流行之後,預計大數據安全行業將會興起。 冠狀病毒在世界範圍內的迅速傳播迫使許多組織轉向在家工作或遠程工作。 在線活動的增加和網絡攻擊頻率的增加導致大量新原始數據的產生,推動了大數據安全市場的增長。

根據Cyber□□ Risk Management的數據,去年上半年美國的數據洩露數量達到了817起。 同期,超過 5300 萬人受到數據盜竊的影響,包括數據洩露、洩露和暴露。 由於 COVID 流行以及缺乏對在辦公室工作的人的保護和威懾措施(例如互聯網安全),越來越多的人在家工作。

大數據安全市場趨勢

製造業對數據安全的高要求推動市場增長

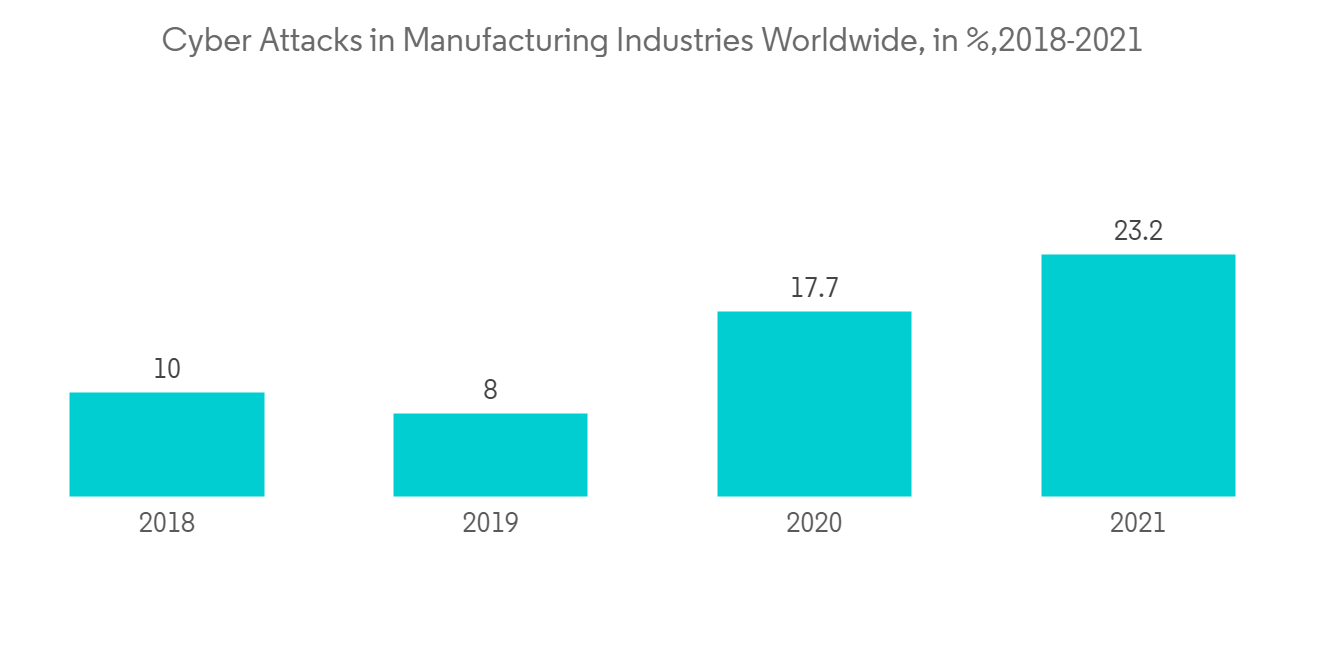

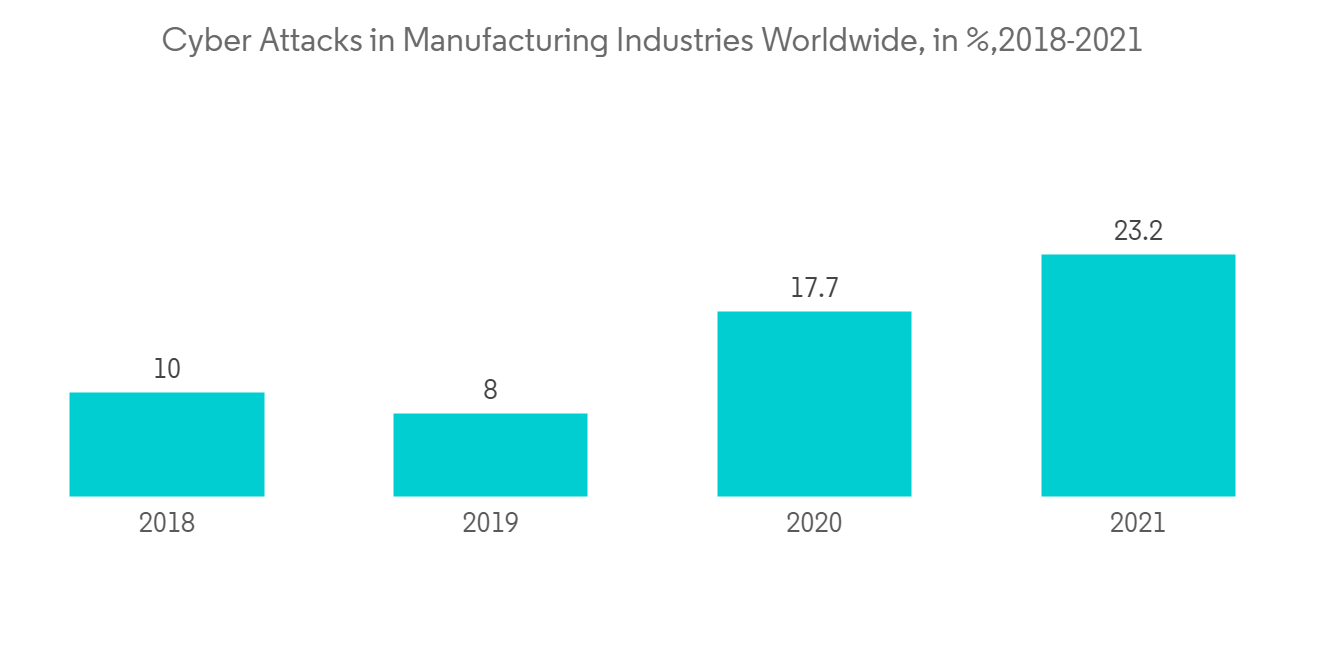

- 根據 IBM X-Force 威脅情報研究,這些嘗試僅次於 SQL 注入,在某些情況下甚至是出於政治動機。

- 網絡攻擊是一場席捲製造業的數字流行病,使公司損失了數百萬美元的銷售額並縮短了生產週期。 去年第三季度,製造業佔企業勒索軟件事件的 68%。 此外,Dragos 透露,製造業經歷的工業勒索軟件事件是食品和飲料行業的七倍。 去年的網絡攻擊迫使 44% 的公司暫時停止生產線。

- 例如,在一家製造風力渦輪機的大公司 Nordex,Conti 勒索軟件在去年 4 月攻擊了該公司的網絡。 該公司已禁用對其風力渦輪機控制和 IT 系統的遠程訪問,以防止惡意軟件傳播並限制對其內部網絡的損害。

- 德國、美國、中國和印度等政府正在加強自動化和工業控制系統 (ICS)(SCADA、DCS、PLC 等),並專注於智能製造技術。 利用來自傳感器和其他工業控制的數據,這些技術創造了一個互聯和自動化的環境,以改善做事的方式。

- 物聯網 (IoT) 和 BYOD(自帶設備)等使製造業更加理性的行業趨勢正在成倍地增加網絡攻擊的可能性。 此類攻擊可以通過網絡間諜、分佈式拒絕服務 (DDOS)、Web 應用程序攻擊等方式對製造業的聲譽造成嚴重破壞。 如果違規情況嚴重,公司可能無法挽回因未採取適當的數據安全措施而造成的損失。

製造業的網絡安全風險包括因物理損壞、產品操縱以及知識產權和敏感數據被盜而導致的停機。 雖然在整個製造業中增加工業 4.0 實踐將為預測期內的大數據分析開闢更多空間,但據報導,安全威脅是製造業的主要關注點。 上述因素可能會阻止企業採用數字功能,從而為大數據安全解決方案創造空間。

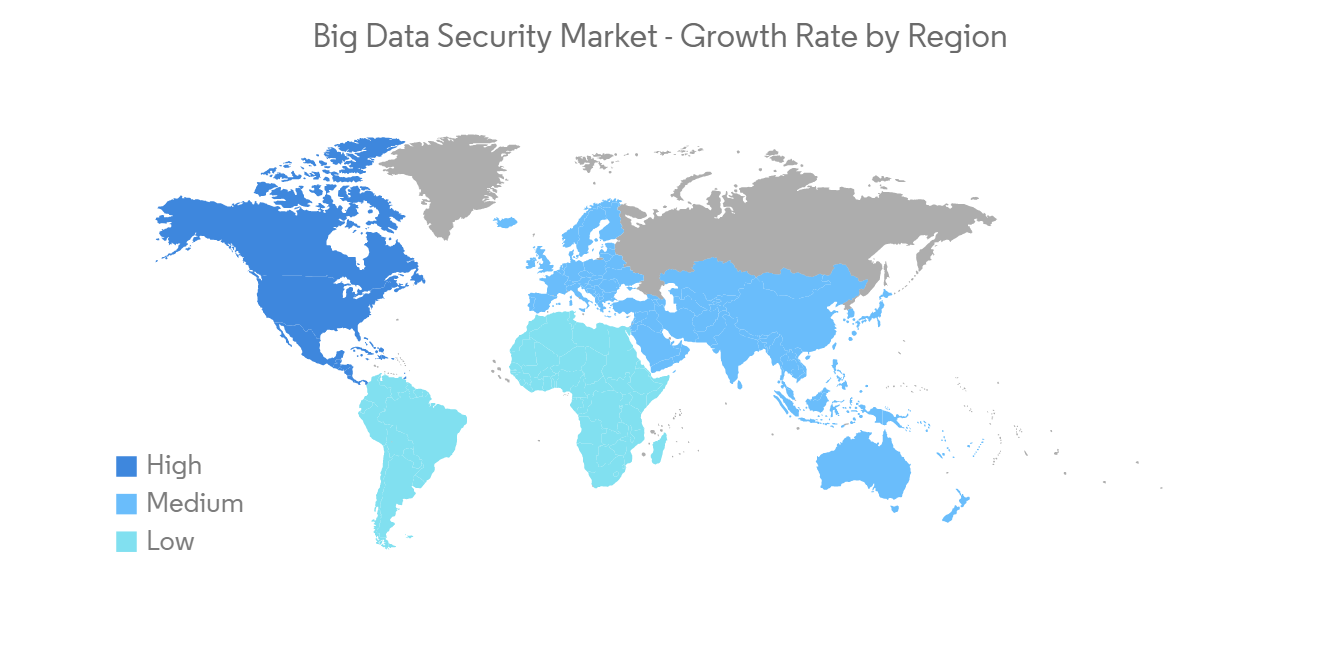

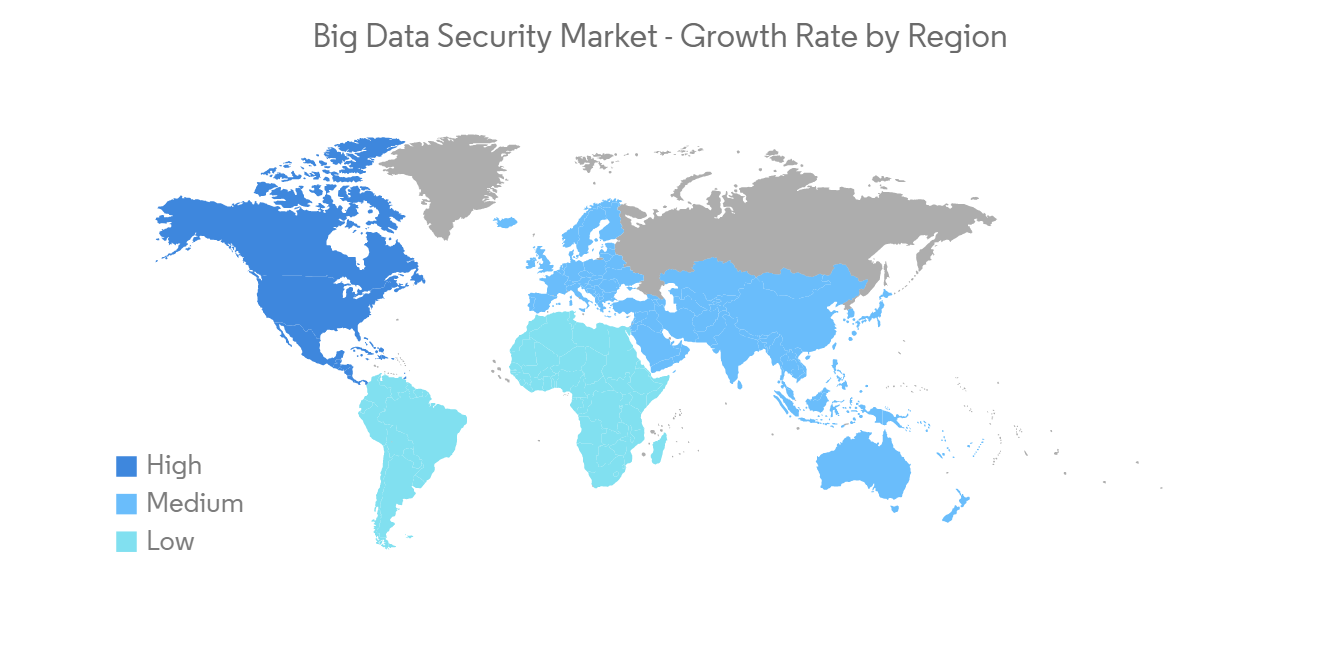

北美市場份額最大

- 包括英特爾等科技巨頭在內的大公司越來越多地採用大數據環境。 而在大數據項目方面,白宮已投入超過2億美元,使其容易受到威脅。 數據洩露事件也在增加,該地區對大數據安全的需求很大。

- 對大數據安全的需求與大數據的安全性成正比,因此產生的大數據越多,對大數據安全市場的需求就越高。 此外,該地區還是最大的創業中心(約有 20,000 家創業公司活躍)。 由於大型高科技公司對大數據安全和雲服務的採用率很高,預測期內加拿大對大數據安全的需求將會增加。

- 該地區的行業正在擁抱大數據安全。 該國的超市零售連鎖店正在使用大數據來更多地了解他們的客戶,並提供增值服務和促銷活動,例如折扣和獎勵。 加拿大的大數據市場預計到2025年將翻一番,有望成為繼美國之後的下一個實質性市場。

- 遠程工作的興起以及該國成千上萬家企業缺乏足夠的保護,導致許多行業出現大量不良行為者。 例如,2021 年 5 月,一家大眾汽車供應商的數據洩露事件曝光,影響了北美超過 330 萬客戶,其中包含有關貸款資格的信息,以及出生日期記錄和社會保險號碼。 . 令人驚訝的是,被確認的黑客正尋求以大約 5,000 美元的價格出售數據庫的內容。

此外,該地區的各種市場參與者正在採取不同的策略來提高競爭力和市場份額。 例如,去年 8 月,Microsoft Corporation 和 Barclays Bank PLC 宣布,Barclays 已選擇 Microsoft Teams 作為其主要協作平台,以實現其在全球主要地點的 120,000 多名員工和服務合作夥伴之間的協作。宣布它是 根據協議,巴克萊銀行將整合現有的連接和協作功能,並採用 Teams 取代之前在整個組織中使用的多點解決方案。

大數據安全行業概覽

高投入研發和先進創新以最大限度地減少惡意攻擊是市場領先供應商獲得競爭優勢的關鍵方法。 主要供應商包括 Oracle Corporation、Microsoft Corporation、Broadcom Inc. Symantec Corporation、IBM Corporation 和 Amazon Web Services。 該市場競爭激烈,由多個主要參與者組成,擁有大部分市場份額的參與者專注於在不同地區擴大客戶群。

2022 年 7 月,Sekloa 宣布與全球 IT 解決方案聚合商 TD SYNNEX 建立合作夥伴關係。 該合作夥伴關係將使企業能夠獲得一個完整的解決方案來解決他們的數據保護挑戰,提供對其數據的授權和未授權活動的實時跟蹤和可見性,並識別可疑活動。識別,改進您的數據安全策略,立即響應安全許可,甚至永久刪除以防止數據丟失。

世界上最受歡迎的數據科學平台的創建者 Anaconda Inc. 最近宣布與 Oracle Cloud Infrastructure 建立合作夥伴關係,以集成並允許 Anaconda 在 OCI 機器學習和人工智能服務上的存儲庫。提供安全和開源的 Python 和 R工具和包。 客戶無需單獨的營業執照即可使用 OCI 的 Anaconda 服務。

2022 年 11 月,Kindril 與 AWS 合作提高可見性、提高可見性和改進威脅情報,以最大限度地減少和減少檢測和解決網絡事件的關鍵事件和停機時間的時間和成本。我們著手處理和技術,以支持快速執行。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場促進和製約因素介紹

- 市場驅動因素

- 增加從各種來源生成的業務數據的類型和數量

- 網絡攻擊增加對可擴展、高安全性解決方案的需求不斷增長

- 電子商務行業的發展

- 市場製約因素

- 數據安全意識低

- 數據安全預算低,引入解決方案的成本高

- 缺乏安全專業知識和熟練人員

- 行業吸引力 - 波特五力分析

- 買方/消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第 5 章市場細分

- 按組件

- 解決方案

- 按服務

- 按組織規模

- 中小企業

- 大公司

- 按最終用戶行業

- 銀行、金融服務和保險 (BFSI)

- 製造業

- IT/通信行業

- 航空航天與國防

- 醫療保健

- 其他最終用戶

- 區域信息

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲

- 亞太地區

- 中國

- 澳大利亞

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲地區

- 中東和非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 北美

第六章競爭格局

- 公司簡介

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services

- Broadcom Inc.(Symantec Corporation)

- Hewlett Packard Enterprise

- Thales Group(Gemalto NV)

- Cloudera Inc.

- Centrify Corporation

- Mcafee, LLC

- Check Point Software Technologies Ltd.

- Imperva, Inc.

- Dell Technologies

第七章投資分析

第八章市場機會與未來趨勢

The big data security market is expected to register a CAGR of 17.95% over the forecast period. Security is a significant concern that restricts enterprises from opting for big data deployments on-premise, hosted on the cloud, or in virtual environments.

Key Highlights

- When cybercriminals target large data sets, the payoff is frequently well worth the effort required to breach security layers, which is why big data has major potential for businesses and cyber criminals. They have a lot more to gain when they go after such a massive data set. As a result, companies lose a lot more if they are subjected to a cyberattack without adequate security measures.

- Many companies, especially those that deal with huge amounts of data, need traditional data mining and cyber-attack protection tools and techniques.As a result, cybersecurity professionals are increasingly turning to big data analytics. With data being routed through a circuitous path from a data source (such as CRM or sensors) to data storage and analysis, the big data environment is vulnerable and a valuable target for intruders.

- Although enterprises deploy big data platforms using the Hadoop open-source framework or other sources, the frameworks need comprehensive security plans. The inherent mechanisms have limitations that may need to be secured more than just by data encryption; many tech companies are bringing cloud solutions to the market to solve this issue. For instance, in August 2021, McAfee Enterprise announced that MVISION Cloud is a secure access service edge (SASE) offering called MVISION Unified Cloud Edge (UCE). This solution extends the capabilities of Dynamics 365 by utilizing a frictionless API-based cloud-native approach; this demands the security of big data in enterprises.

- The worldwide COVID-19 pandemic benefited the global market. The big data security industry was predicted to rise following the COVID-19 pandemic, as many organizations were forced to switch to working from home and remote working modes due to the fast spread of coronavirus around the globe. As a result of increasing online activity and growth in cyber-attack frequency, masses of new raw data were created, propelling the growth of the big data security market.

According to Cyber Risk Management, the amount of data compromises in the U.S. reached 817 in the first half of last year. During the same period, over 53 million people were harmed by data thefts, including data leaks, breaches, and exposure. In addition to the COVID pandemic, more people are working from home because they don't have the same level of protection or deterrent measures as those who work in an office (e.g., internet security).

Big Data Security Market Trends

High Demands for Data Security in Manufacturing Sector to Drive the Market Growth

- At the application level, a security breach can happen to any company that has a large online presence.Denial-of-service attacks on a company's website or apps are common and can have a big effect on operations all along the supply chain.According to the IBM X-Force Threat Intelligence study, these attempts are second only to SQL injection in frequency, and in some situations, they are even politically driven.

- Cyberattacks are a digital pandemic sweeping the manufacturing industry, costing organizations millions of dollars in sales and hours from the production cycle. In the third quarter of last year, manufacturing accounted for 68% of all business ransomware outbreaks. Furthermore, Dragos revealed that manufacturers experienced seven times the number of industrial ransomware instances in the food and beverage business. Cyberattacks in the last year forced 44% of firms to temporarily shut down their manufacturing lines.

- For example, Nordex, a large company that makes wind turbines, saw a Conti ransomware attack on their network in April of last year. This caused many of their systems to go offline across all of their branches.The company disabled remote access to systems that controlled wind turbines and IT systems in order to stop the malware from spreading and limit the damage to their internal network.

- Governments across regions like Germany, the US, China, and India are focusing on smart manufacturing techniques by increasing automation and industrial control systems (ICS) (like SCADA, DCS, and PLCs). Using data from sensors and other industrial control devices, these techniques create a connected, automated environment and improve how well things work.

- The same industry trends that make manufacturing more streamlined, such as the Internet of Things (IoT) and Bring Your Own Device (BYOD), also exponentially increase the potential for cyber attacks. Such attacks, whether through cyber espionage, distributed denial of service (DDOS), or Web application attacks, can wreak havoc on a manufacturing company's reputation. If the breach is severe enough, a company might never regain its losses due to not taking appropriate data security measures.

The cybersecurity risks to the manufacturing sector include operational downtime due to physical damage, product manipulation, and the theft of intellectual property and sensitive data. Although the growth in industrial 4.0 practices across manufacturing industries provides more scope for big data analytics over the forecast period, security threats are reported to be a major concern for manufacturers. The factors mentioned earlier may discourage companies from incorporating digital capabilities, thus creating scope for big data security solutions.

North America to Hold the Largest Market Share

- Large enterprises, including big tech companies in the region like Intel, increasingly embrace a big data environment. In addition, for Big Data projects, the White House has invested more than USD 200 million to make them vulnerable to threats. Data breaches are also on the rise, so the region's need for big data security is substantial.

- As the demand for big data security is directly proportional to the security of big data, the more big data generated, the higher the demand for the big data security market. Moreover, the region is the biggest start-up hub (with approximately 20,000 active start-ups). The need for Canada's big data security is increasing over the forecast period due to the high adoption rate of big data security and cloud services in major tech companies.

- Industries across the region are adopting big data security. The country's supermarket retail chain uses big data to learn more about its customers and offer value-added services and promotions, such as discounts and rewards. With the big data market expected to double by 2025 in Canada, the region is expected to be a substantial market after the United States.

- With the rise of remote work and the fact that thousands of businesses across the country didn't have the right protections, there were many bad actors in many industries.For example, in May 2021, a data breach at a vendor of Volkswagen came to light, which impacted more than 3.3 million customers in North America and included information about loan eligibility, as well as date-of-birth records and Social Security numbers. Surprisingly, the hacker identified was looking to sell the contents of the database for around USD 5,000.

Furthermore, various market players in the region are involved in various strategies to gain a competitive edge and increase their market share. For instance, in August last year, Microsoft Corp. and Barclays Bank PLC announced that Barclays had chosen Microsoft Teams as its primary collaboration platform, enabling collaboration for over 120,000 employees and service partners in critical locations worldwide. Barclays is consolidating its existing connectivity and collaboration capabilities under the arrangement, with Teams replacing multiple-point solutions previously in use throughout the organization.

Big Data Security Industry Overview

High investment in research and development and advanced technological innovations to minimize malicious attacks is the key approach taken by major market vendors to gain a competitive edge. A few major players include Oracle Corporation, Microsoft Corporation, Broadcom Inc. (Symantec Corporation), IBM Corporation, and Amazon Web Services. The market is highly competitive and consists of several major players-the players with a major share of the market focus on increasing their customer base across different regions.

In July 2022, Seclore announced a partnership with global IT solutions aggregator TD SYNNEX. This partnership will enable enterprises to access complete solutions to solve their data protection challenges with real-time tracking and visibility of both authorized and unauthorized activity on the data to identify suspicious behavior, evolve data security policies, take immediate action on security permissions, and even complete removal to prevent data loss.

Anaconda Inc., which makes the most popular data science platform in the world, recently announced a partnership with Oracle Cloud Infrastructure to deliver safe, open-source Python and R tools and packages by integrating and allowing Anaconda's repository over OCI Machine Learning and Artificial Intelligence Services.Customers can use Anaconda services from OCI without the need for a separate business license.

In November 2022, Kyndryl collaborated with AWS on processes and technologies to support greater visibility, threat intelligence, and faster execution of threat intelligence to minimize and reduce time and money to detect and resolve a major incident and the downtime of a cyber event.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Variety And Volume of Business Data Generated from Various Sources

- 4.3.2 Increasing Cyber-Attacks Demand for Scalable High Security Solutions

- 4.3.3 Growth of E-Commerce Industry

- 4.4 Market Restraints

- 4.4.1 Lack of Data Security Awareness

- 4.4.2 Low Data Security Budget And High Installation Cost of Solution

- 4.4.3 Lack of Security Expertise And Skilled Personnel

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Organization Size

- 5.2.1 Small & Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 Banking, Financial Services, & Insurance (BFSI)

- 5.3.2 Manufacturing

- 5.3.3 IT & Telecommunication

- 5.3.4 Aerospace & Defense

- 5.3.5 Healthcare

- 5.3.6 Other End-users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Australia

- 5.4.3.3 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 IBM Corporation

- 6.1.3 Microsoft Corporation

- 6.1.4 Amazon Web Services

- 6.1.5 Broadcom Inc. (Symantec Corporation)

- 6.1.6 Hewlett Packard Enterprise

- 6.1.7 Thales Group (Gemalto NV)

- 6.1.8 Cloudera Inc.

- 6.1.9 Centrify Corporation

- 6.1.10 Mcafee, LLC

- 6.1.11 Check Point Software Technologies Ltd.

- 6.1.12 Imperva, Inc.

- 6.1.13 Dell Technologies