|

市場調查報告書

商品編碼

1404365

油田設備:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Oilfield Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

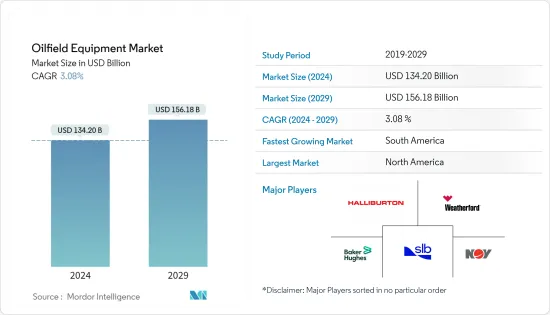

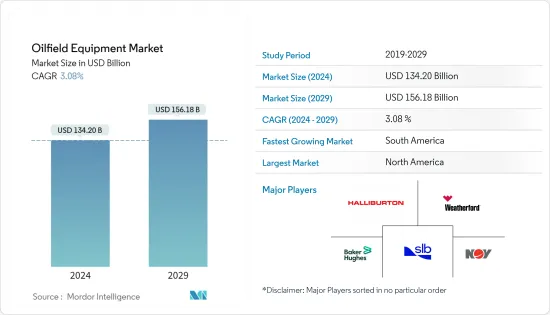

油田設備市場規模預估至2024年為1,342億美元,預估至2029年將達1,561.8億美元,預測期內(2024-2029年)複合年成長率為3.08%。

主要亮點

- 中期來看,深水和超深水油田數量的增加以及南美、北美、中東和非洲等地區鑽井作業的增加等因素預計將推動油田設備市場的發展。預測期。

- 另一方面,供需缺口和地緣政治因素導致的原油價格不穩定是限制市場成長的主要因素。

- 然而,不斷增加的石油和天然氣發現以及該行業的全球自由化為參與企業創造了新的投資機會。

油田裝備市場趨勢

主導市場的土地領域

- 陸上鑽探,包括所有位於陸地上的鑽探地點,佔世界石油產量的 70%。陸上鑽探與海上鑽探類似,但不存在平台和石油之間有深水的挑戰。

- 全球石油價格出現復甦跡象並迅速改善。因此,借助原油價格復甦的樂觀情緒,預計陸上計劃將在預測期內顯著成長,並帶動油田設備市場的需求。

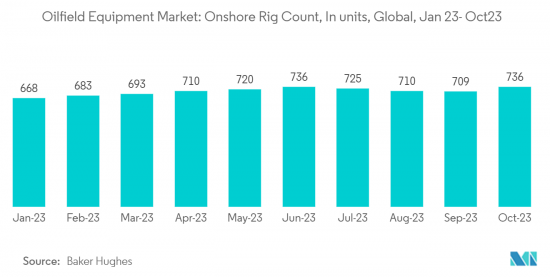

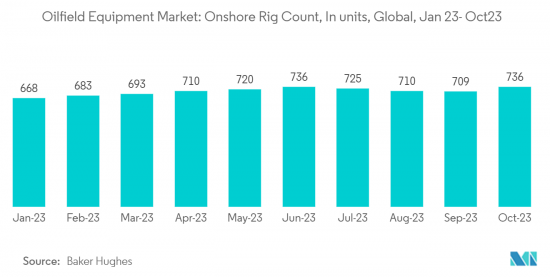

- 根據貝克休斯公司統計,截至2023年10月,陸上鑽井平台總數為736座,約佔鑽井平台總數的75%。隨著陸上地區鑽機數量的增加,預計對鑽井、生產和其他油田活動的需求。反過來,預計這將推動陸上地區的油田設備市場。

- 油田服務提供商斯倫貝謝 (SLB) 表示,將在 2023 年將季度股息提高 43%(至每股 25 美分),並重啟股票回購計劃,以應對強勁的能源市場。 2021年企業收益為5.86億美元,其中田徑部門收入4.39億美元,佔總收入的75%。離岸部門累計1.47億美元,佔總收益的25%。

- 此外,2021 年全球石油產量成長 1.6%。 2021 年石油產量為 89,877,000 桶/日,而 2020 年為 88,494,000 桶/日。

- 因此,陸上設備預計將主導全球油田設備市場。

預計北美將主導市場

- 預計到 2023 年,北美將主導油田設備市場。預計這種主導地位將在預測期內持續下去。

- 北美佔全球原油產量的佔有率從2013年的17.3%增加到2021年的22.7%左右,導致該地區對油田設備的需求增加。

- 此外,在加拿大的石油和天然氣產業,雖然石油豐富的亞伯達省價格大幅下跌,但隨著紐芬蘭和拉布拉多省積極推動該產業,未來投資胃口有望增加。

- 由於石油和天然氣價格好於預期,加拿大能源承包協會在第一季表現強勁後,於 2022 年 5 月上調了石油和天然氣鑽探預測。修訂後的鑽井預測現在要求每年運作天數為 62,121 個,高於先前預測的 58,111 天,運作鑽機數量也從 159 台增加到 170 台。

- 此外,油價上漲和鑽井成本下降顯著增加了美國海上鑽井平台的數量和海上石油產量,這表明不僅海上開採而且生產活動都在增加。反過來,它有望成為該國油田設備市場的主要驅動力。

- 因此,石油和天然氣活動活性化等因素預計將在預測期內成長油田設備市場。

油田裝備產業概況

油田裝備市場整合,一些頭部企業佔據了主要市場佔有率。其中包括(排名不分先後)斯倫貝謝有限公司、貝克休斯公司、哈里伯頓公司、威德福國際有限公司和國民油井華高公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 到 2028 年陸上和海上鑽井平台的數量和預測

- 2028 年石油和天然氣產量及預測

- 2028 年之前的資本支出歷史和需求預測(十億美元,陸路和海上)

- 即將實施的重大上游計劃

- 最新趨勢和發展

- 市場動態

- 促進因素

- 深海和超深海礦區增加

- 地區鑽探作業增加(南美洲、北美、中東/非洲等)

- 抑制因素

- 供需缺口與地緣政治導致原油價格不穩定

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 企業發展

- 陸上

- 離岸

- 設備類型

- 鑽井設備

- 生產設備

- 其他設備

- 地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Schlumberger Limited

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- Tenaris SA

- TMK Ipsco Enterprises Inc.

- National Oilwell Varco Inc.

- Vallourec SA

- Aker Solutions ASA

- Stabil Drill

第7章 市場機會及未來趨勢

- 石油和天然氣發現的增加和產業自由化

簡介目錄

Product Code: 61086

The Oilfield Equipment Market size is estimated at USD 134.20 billion in 2024, and is expected to reach USD 156.18 billion by 2029, growing at a CAGR of 3.08% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing number of deep-water and ultra-deepwater fields and the growing drilling operations in regions (like South America, North America, the Middle East, and Africa) will likely drive the oilfield equipment market during the forecast period.

- On the other hand, the volatile oil prices due to the supply-demand gap and geopolitics are major factors restraining the market's growth.

- Nevertheless, the increasing oil and gas discoveries and the global liberalization in the industry created new opportunities for the players to invest in.

Oilfield Equipment Market Trends

Onshore Segment to Dominate the Market

- Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production. Onshore drilling is similar to offshore drilling but without the difficulty of deep water between the platform and oil.

- The global crude oil prices showed signs of recovery and are improving quickly, and the onshore projects are easier to kick start than offshore ones. Therefore, riding on the optimism associated with the recovery of crude oil prices, onshore projects are expected to record significant growth over the forecast period, driving the demand for the oilfield equipment market.

- According to Baker Hughes, as of October 2023, the total onshore rig counts accounted for 736 units, approximately 75% of the total rig counts. With the increasing rig counts on the land region, drilling, production, and other oil field activity are expected to be in demand. It, in turn, will drive the oilfield equipment market for the onshore region.

- According to Schlumberger (SLB), a provider of oilfield services, the company would increase its quarterly dividend in 2023 by 43% (to 25 cents per share) and resume its share buyback program in reaction to the strong energy markets. In 2021, the company recorded total revenue of USD 586 million, out of which the onshore segment recorded revenue of USD 439 million, representing 75% of the total revenues. The offshore segment reported USD 147 million, representing 25% of the total revenue.

- Moreover, oil Production increased by 1.6% in 2021 worldwide. In 2021, the oil production was 89877 thousand barrels per day compared to 2020, which was 88494 thousand barrels per day.

- Hence, the onshore segment is expected to dominate the oilfield equipment market worldwide.

North America is expected to Dominate the Market

- North America is expected to dominate the oilfield equipment market in 2023. It is expected to continue its dominance during the forecast period.

- The share of North America in global crude oil production increased from 17.3% in 2013 to around 22.7% in 2021, which resulted in an increased demand for oilfield equipment in the region.

- Further, Canada's oil and gas industry is expected to attract rising investment interests in the future due to an aggressive push by Newfoundland and Labrador as prices plummet in oil-rich Alberta.

- In May 2022, the Canadian Association of Energy Contractors raised its drilling prediction for oil and natural gas after a good first quarter due to higher-than-expected oil and gas prices. The revised drilling projection predicts 62,121 working days for the year, up from the earlier forecast of 58,111, and 170 active rigs, up from 159.

- Furthermore, due to higher oil prices and declining drilling costs, the offshore rig count and offshore oil production in the United States increased significantly, indicating that growth is not only offshore drilling but also production activity. It, in turn, is expected to be the major driver for the oilfield equipment market in the country.

- Therefore, factors such as rising oil and gas activities are expected to grow the oilfield equipment market in the forecast period.

Oilfield Equipment Industry Overview

The oilfield equipment market is consolidated, with some of the top companies holding the major share of the market. Some companies include (in no particular order) Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International PLC, and National Oilwell Varco Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Onshore and Offshore Active Rig Count and Forecast, till 2028

- 4.4 Crude Oil and Natural Gas Production and Forecast, till 2028

- 4.5 Historic and Demand Forecast of CAPEX in USD billion, by Onshore and Offshore, till 2028

- 4.6 Major Upcoming Upstream Projects

- 4.7 Recent Trends and Developments

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 The Increasing Number of Deep-Water and Ultra-Deepwater Fields

- 4.8.1.2 The Growing Drilling Operations in Regions (like South America, North America, and Middle-East and Africa)

- 4.8.2 Restraints

- 4.8.2.1 The Volatile Oil Prices, Owing to the Supply-Demand Gap and Geopolitics

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Equipment Type

- 5.2.1 Drilling Equipment

- 5.2.2 Production Equipment

- 5.2.3 Other Equipment Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Iran

- 5.3.5.4 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Weatherford International PLC

- 6.3.3 Baker Hughes Company

- 6.3.4 Halliburton Company

- 6.3.5 Tenaris SA

- 6.3.6 TMK Ipsco Enterprises Inc.

- 6.3.7 National Oilwell Varco Inc.

- 6.3.8 Vallourec SA

- 6.3.9 Aker Solutions ASA

- 6.3.10 Stabil Drill

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Oil and Gas Discoveries, Coupled With the Liberalization in the Industry

02-2729-4219

+886-2-2729-4219