|

市場調查報告書

商品編碼

1433000

工業空氣壓縮機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Air Compressors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

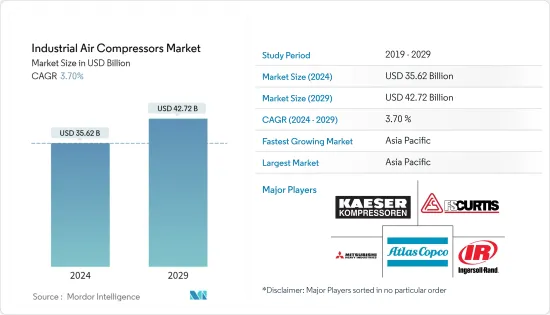

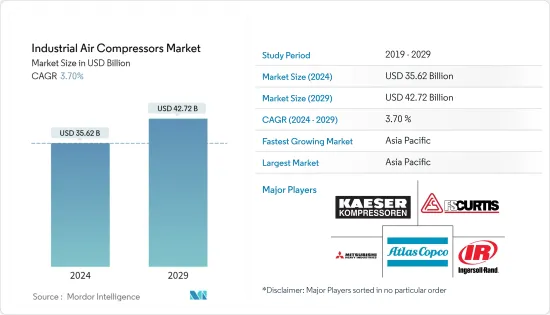

工業空氣壓縮機市場規模預計2024年為356.2億美元,預計到2029年將達到427.2億美元,預測期內(2024-2029年)複合年成長率為3.70,預計將成長%。

全球石油天然氣、石化、交通、農業和汽車行業的不斷成長以及政府對工業壓縮機技術發展的支持力度不斷加大,是顯著加速市場擴張的重要原因。

主要亮點

- 世界各地的多家公司使用空氣壓縮機來提供壓縮空氣,為複雜的工業流程提供動力。重型工業空氣壓縮機的開發目的是提供更高的壓力水平,因為它們依賴大馬力馬達和重型組件。它們用於農業設施中散佈作物和給筒倉通風、在製造業中用於為氣動機械提供動力以及在石油和天然氣作業中。

- 空氣壓縮機因其彈性、安全性和低維護成本能力而優於電動和液壓。空氣壓縮機的運動部件比電動或液壓動力系統少。然而,空氣壓縮機需要對其供應的空氣進行特殊處理。空氣中的污垢會損壞供電管道,導致洩漏腐蝕,最終降低發電量。

- 此外,新興市場的公司繼續投資開發節能空氣壓縮機。例如,阿特拉斯科普柯表示,其重點開發加油技術,整合智慧控制和監控系統,提供節能壓縮機解決方案。

- 此外,這些壓縮機的使用取決於壓縮機的應用和位置。例如,往復式壓縮機需要安裝在牆壁上的輪圈、封閉的皮帶防護罩以及方面的維護空間。對於旋轉式壓縮機,必須安裝吸氣格柵和通風風扇,以免冷卻空氣再循環至壓縮機。

- 這些工業中使用的空氣壓縮機需要特殊的冷卻設備來散發產生的熱量,從而增加了企業的初始設置成本。因此,該公司正在尋求更高性能的壓縮機來降低能源和維護成本。

- 除這些應用外,空氣壓縮機還用於精製、石化合成、管道運輸和注氣等領域。擴大石油和天然氣探勘以及增加行業投資是推動市場成長的主要因素。

- 根據英格索蘭的說法,壓縮空氣系統中只有 10% 到 20% 的能量達到使用點;剩餘的能量由於熱量和洩漏而被浪費。剩餘的能量被浪費在熱和洩漏上。對於擁有大型業務的組織來說,這可能高達數百萬美元。

- 安裝和維護空氣壓縮機的成本非常高。由於各種空壓機的監控系統複雜,價格不斷上漲。因此,預計近期市場擴張將放緩。

- 然而,由於COVID-19的爆發,中國供應商關閉了工廠並暫停了生產設備。隨著中國 COVID-19 病例數量下降,由於工廠關閉導致供不應求,在該地區擁有製造設施的供應商將零件價格提高了近 2% 至 3%。這影響了來自中國的整個供應鏈。 COVID-19 的普及也刺激了壓縮機領域的創新,供應商紛紛提高產量以滿足快速成長的需求。

工業空氣壓縮機市場趨勢

迴轉式空壓機佔較大佔有率

- 旋轉式空氣壓縮機,也稱為旋轉螺桿式空氣壓縮機,是正排量壓縮系統,具有顯著的重量減輕和易於維護(因為可以簡化維護程序)、低消費量以及嚴苛的幾個優點,比其他壓縮機更受青睞例如在環境中經過驗證的可靠性、低熱量產生等。

- 旋轉式空氣壓縮機主要受到需要長時間恆壓的用戶的青睞。它用於各種工業環境,包括物料輸送、噴漆和工具機使用。此外,製造、食品飲料和製藥等多個行業正在採用無油空氣壓縮機來最佳化流程並降低生產成本。

- 此外,需要大量中壓空氣的使用者通常使用加油空氣壓縮機。例如,全球 BIC 集團的墨西哥子公司 No Sabe Fallar, SA de CV 生產安全可靠的 BIC 產品,使用 GA 壓縮機系列、節能 ES 控制系統和 AirConnect視覺化系統。。油潤滑空氣壓縮機提供相同水準的可靠性,並透過智慧使用能源顯著降低成本。

- 無油旋轉螺桿型號用於生產、工業或醫療應用,以防止油進入氣流,例如食品包裝或醫用氧氣。無油旋轉式空氣壓縮機價格昂貴,因為它們需要兩個壓縮級才能達到與充油旋轉式系統相同的壓力。

- 工業空氣壓縮機在現代石油和天然氣行業的大大小小的業務中發揮著重要作用。例如,據 Q Air-California 稱,95% 的石油和天然氣在通過管道運輸之前都經過壓縮。

- 石油和天然氣產業需要永續且可靠的壓縮空氣設備。由於COVID-19大流行,石化和精製油需求放緩,影響了各下游石油和天然氣公司。精製利潤下降將導致BPCL、HPCL、IOCL和RIL等石油下游公司的利潤下降。相較之下,印度石油公司和ONGC等上游公司則看到,由於旅行和工業活動減少,石油和天然氣需求成長放緩,石油和天然氣行業的工業空氣壓縮機受到了影響。

亞太地區佔主要市場佔有率佔有率

- 中國預計將成為亞太地區乃至全球工業空氣壓縮機生產和消費最大的市場之一。該國優勢的主要因素是國內擁有多家空壓機製造商,包括浙江開山壓縮機、VMAC公司、江蘇DHH壓縮機和德耐爾節能科技(上海)有限公司。

- 其他對該地區成長做出重大貢獻的因素包括政府法規和政策,這些法規和政策預計將進一步推動市場並增加空氣壓縮機的採用以提高能源效率。例如,《能源政策和節約法案》為各種消費品以及商業和工業設備(包括空氣壓縮機)制定了能源效率標準。

- 此外,由於自身工業的發展以及隨之而來的出口加速、嚴格標準的推出和快速都市化,中國已成為一個有吸引力的國家。中國的工業生產力非常高,名列28個成長最快的國家。這些因素是該國製造設施採用工業空氣壓縮機的驅動力。

- 此外,還計劃進行多項投資,以提高該地區的成長品質、解決環境問題並減少產能過剩。它在食品和飲料、電子、建築和採礦等多個最終用戶行業中佔據主導地位。

- 儘管替代能源不斷發展,但隨著世界人口的成長,對石油和石油基產品的需求不斷增加,主要是在中國、印度和日本。因此,為了滿足這一需求,工業空氣壓縮機和氣體壓縮機在確保這些任務的正確壓力水平以及保持競爭優勢方面變得非常重要。創新集中在更低的能源需求、更高的速度和承受惡劣鑽井環境的能力更加明顯。

- 此外,印度預計到年終將成為世界第五大製造業國。作為擴大策略的一部分,西門子、通用電氣和波音等製造業巨頭已經或正在印度設立新的製造工廠。這些趨勢顯示工業空氣壓縮機在該國的採用日益增多。

- 根據OPEC最近的預測,根據目前的預測,印度預計將首次成為未來能源需求的最大單一貢獻者,石油產品產量預計將達到22-23mboe/d,僅次於中國和其他國家。這些精製和儲存設施安裝在海岸附近和氣候條件惡劣的地區,預計將增加國內對工業空氣壓縮機的需求。

工業空壓機產業概況

工業空氣壓縮機市場競爭激烈,多家廠商進入市場。阿特拉斯·科普柯集團、英格索蘭公司 (Gardner Denver Inc.)、Kaeser Kompressoren, Inc. 和三菱重工壓縮機公司等市場競爭對手致力於保持市場競爭力。因此,市場競爭者之間的敵意加劇,市場集中度較低。

2022 年 5 月,ELGi 宣布推出兩個新系列:ELGi AB 11-22kW,這是 AB 系列無油螺桿空氣壓縮機的最新成員。該裝置專門滿足食品和飲料、小型製藥和乳製品產業的壓縮空氣要求。我們還有LD系列2.2kW至11kW潤滑直驅往復式空氣壓縮機。新型LD系列是活塞空氣壓縮機技術的創新。

2022 年 6 月,英格索蘭推出了新型 MSG Turbo Air NX 1500 (NX 1500) 壓縮機,這是其離心壓縮機產品組合的最新創新。憑藉經過驗證的技術和功能,NX 1500 可滿足能源密集型場所的需求,同時大幅提高您的企業收益。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間敵對關係的強度

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 全球石油和天然氣投資增加

- 節能壓縮機的需求

- 市場限制因素

- 環境和安全使用問題

第6章市場區隔

- 按類型

- 旋轉式空氣壓縮機

- 往復式空氣壓縮機

- 離心式空氣壓縮機

- 按最終用戶

- 油和氣

- 食品與飲品

- 製造業

- 衛生保健

- 發電

- 建築/採礦

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Atlas Copco Group

- Ingersoll Rand Inc.

- FS-Curtis

- Howden Group Ltd.

- Gardner Denver Inc.

- Mitsubishi Heavy Industries Compressor Corp.

- Kaeser Kompressoren

- Zhejiang Kaishan Compressor Co. Ltd(Kaishan Group)

- Sullair, LLC(Hitachi Group)

- Bauer Kompressoren GmbH

- Aerzener Maschinenfabrik GmbH

- Hanwha Power Systems

第8章投資分析

第9章 市場機會及未來趨勢

The Industrial Air Compressors Market size is estimated at USD 35.62 billion in 2024, and is expected to reach USD 42.72 billion by 2029, growing at a CAGR of 3.70% during the forecast period (2024-2029).

Increases in the oil and gas, petrochemical, transportation, agricultural, and automotive industries globally, as well as increased government support for developing industrial compressor technology, are some important reasons that significantly speed up market expansion.

Key Highlights

- A wide range of businesses worldwide generally uses air compressors to deliver compressed air to power complex industrial processes. Heavy-duty industrial air compressors are developed to provide higher pressure levels, as they rely on high horsepower motors and heavy-duty components. In agricultural facilities, these are used to spray crops and ventilate silos, power pneumatic machinery in the manufacturing industries, and oil and gas operations, among others.

- Air compressors have an advantage over electric power and hydraulic power due to their capability to offer flexibility, safety, and low-maintenance cost. Air compressors require fewer moving parts than electrical and hydraulic power systems. However, air compressors need special treatment for the supplied air, as any contamination in the air can damage the supply pipes, leading to corrosion in leakages, ultimately resulting in power output.

- The companies in the market are also continuously investing in developing energy-efficient air compressors. For instance, Atlas Copco mentioned that it is focusing on developing oil-injected technology for offering energy-saving compressor solutions by integrating intelligent control and monitoring systems.

- Moreover, these compressors are used based on the application and location of the compressor to be installed. For instance, reciprocating-type compressors must be installed with flywheels on the side of the wall and an enclosed belt guard, and they need spaces on the sides for maintenance. In the case of the rotary type, the compressors need to be installed so that their inlet grids and ventilation fan may not recirculate the cooling air to the compressor.

- These air compressors used in industries require special cooling units to dispense the heat generated, adding to the companies' initial setup cost. Hence, the companies are looking forward to better-performance compressors to cut down on energy and maintenance costs.

- Apart from these applications, air compressors are also used for petroleum refining, petrochemical synthesis, pipeline transportation, and gas injection. The increasing expansion of oil and gas exploration and investment in the industry are the major factors driving the market growth.

- According to Ingersoll Rand, only 10% to 20% of the energy input to the compressed air systems reaches the point of use, whereas the rest of the energy gets wasted in heat or leaks. This may account for millions of dollars for organizations having large operations.

- Air compressor installation and maintenance costs are very high. Due to the upkeep of intricate monitoring and control systems for various air compressors, the price keeps increasing. This is anticipated to slow market expansion in the near future.

- However, due to the outbreak of COVID-19, Chinese vendors closed their factories, temporarily suspending production facilities. Since the number of COVID-19 cases has reduced in China, the vendors having manufacturing plants based in the region have increased component prices by nearly 2-3%, owing to a shortage of supplies due to factory shutdown. Therefore, this has impacted the entire supply chain from China. The COVID-19 spread has also driven innovations in the compressors segment, with vendors ramping up their production to meet the sudden demand increase.

Industrial Air Compressor Market Trends

Rotary Air compressors to Hold Significant Share

- Rotary air compressors, also known as rotary screw air compressors, are a positive displacement compression system and are adopted above other compressors due to several advantages it offers, like a significant reduction in weight and easier maintenance (owing to the availability of simplified maintenance procedures), lesser overall oil consumption, proven reliability in harsh environments, and less heat generation.

- Rotary air compressors are mainly preferred by users requiring constant pressure for usually extended periods. It is used in various industrial settings for applications such as material handling, spray painting, and use with machine tools. In addition, multiple industries, such as manufacturing, food, beverage, and pharmaceutical, are deploying oil-free air compressors to optimize their processes and reduce costs in production.

- Moreover, Oil-injected air compressors are generally used by users requiring large volumes of medium-pressure air. For instance, No Sabe Fallar, SA de CV, the Mexican subsidiary of the global BIC Group, manufactures safe, reliable BIC products and uses a group of GA-type compressors, an energy-saving ES control system, and the AirConnect Visualization System. The oil-lubricated air compressor provides equal levels of reliability and substantially drives down costs through the smart use of energy.

- Oil-free rotary screw models are used in production, industrial, or medical applications to disable oil from entering the airflow, like food packaging or medical oxygen. Oil-free rotary air compressors are expensive as they require two compression stages to reach the same pressures as an oil-injected rotary system.

- Industrial air compressors play a significant role in the modern oil and gas industry for large and small operations. For instance, according to Q Air-California, 95% of petroleum gas is processed through compression before transporting in a pipeline.

- The oil and gas industry demands sustainable and reliable compressed air equipment. Various downstream oil & gas companies are impacted due to a slowdown in demand for petrochemical and refined products due to the COVID-19 pandemic. Lower refining margins lead to lower profits for downstream oil companies such as BPCL, HPCL, IOCL, and RIL. In contrast, upstream companies such as Oil India and ONGC are impacted due to less gas and oil demand growth due to a reduction in travel and industrial activities, thereby affecting industrial air compressors in the oil and gas industry.

Asia-Pacific to Account for a Significant Market Share

- China is expected to be one of the largest markets in the Asia-Pacific region and globally for industrial air compressors in terms of production and consumption. The primary factor for the country's dominance is the presence of several air compressor manufacturers in the country, such as Zhejiang Kaishan Compressor Co. Ltd, VMAC Company, DHH Compressor Jiangsu Co. Ltd, and DENAIR Energy Saving Technology (Shanghai) PLC, among others.

- The other factors that are highly responsible for the growth in the region are the Government regulations and policies expected to boost the market further, increasing air compressors' adoption for energy efficiency. For instance, The Energy Policy and Conservation Act prescribed energy conservation standards for various consumer products and commercial and industrial equipment, including air compressors.

- Moreover, China has become attractive by developing indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization. China has a very high industrial production rate and ranks among the 28 fastest-growing nations. These factors act as drivers for adopting industrial air compressors in manufacturing facilities in the county.

- In addition, Several investments are being planned to aid the quality of growth in the region, address environmental concerns, and reduce overcapacity, for the same. It has a leading presence in several end-user industries, such as food and beverage, electronics, construction, and mining.

- Despite enormous development in alternative energy sources, oil and oil-based products' demand increases with the rising global population, predominantly in China, India, and Japan. Consequently, to keep up with the demand, industrial air and gas compressors have become invaluable for ensuring the appropriate pressure levels for these operations, with innovations focused on lower energy requirements, increased speed, and a more remarkable ability to withstand harsh drilling environments to maintain a competitive edge.

- Furthermore, India is expected to become the fifth-largest manufacturing country globally by the end of 2021. Manufacturing giants, such as Siemens, GE, and Boeing, have either set up or are setting up new manufacturing plants in India as part of their expansion strategy. These trends indicate the growth in the country's adoption of industrial air compressors.

- According to the recent forecast of OPEC, for the first time in current projections, India is expected to stand as the single most significant contributor to future energy demand, followed by China and other countries, standing in the product range of oil from 22 to 23 mboe/d. Establishing these refineries and storage in seashore areas and areas of harsh climatic conditions is expected to push industrial air compressor demand in the country.

Industrial Air Compressor Industry Overview

The Industrial Air Compressors Market is competitive, with several players in the market. The players in the market, such as Atlas Copco Group, Ingersoll Rand Inc.(Gardner Denver Inc.), Kaeser Kompressoren, Inc., and Mitsubishi Heavy Industries Compressor Corp, are engaged in maintaining a competitive edge in the market. This has intensified the competitive rivalry in the market, and therefore, the market concentration is low.

In May 2022, ELGi introduced two new ranges of Air Compressors, ELGi AB 11 - 22kW, the latest addition to the AB-Series range of oil-free screw air compressors. The units specifically address the compressed air requirements of the food and beverage, small pharmaceutical, and dairy industry, and LD Series 2.2 - 11kW lubricated direct drive range of reciprocating air compressors. The new LD Series is an innovation in piston air compressor technology.

In June 2022, Ingersoll Rand unveiled the latest innovation in its centrifugal portfolio, the new MSG Turbo-Air NX 1500 (NX 1500) compressor, engineered to deliver the lowest total cost of ownership for sites seeking a long-lasting, low-maintenance and 100 percent oil-free solution. The NX 1500 can meet the demands of energy-intensive sites while making a substantial difference to a business's bottom line through a range of proven technologies and features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Global Investment in Oil and Gas

- 5.1.2 Demand for Energy Efficient Compressors

- 5.2 Market Restraints

- 5.2.1 Environmental and Safe Use Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Air Compressors

- 6.1.2 Reciprocating Air Compressors

- 6.1.3 Centrifugal Air Compressors

- 6.2 By End-user

- 6.2.1 Oil and Gas

- 6.2.2 Food and Beverages

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Power Generation

- 6.2.6 Construction and Mining

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia- Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco Group

- 7.1.2 Ingersoll Rand Inc.

- 7.1.3 FS-Curtis

- 7.1.4 Howden Group Ltd.

- 7.1.5 Gardner Denver Inc.

- 7.1.6 Mitsubishi Heavy Industries Compressor Corp.

- 7.1.7 Kaeser Kompressoren

- 7.1.8 Zhejiang Kaishan Compressor Co. Ltd (Kaishan Group)

- 7.1.9 Sullair, LLC (Hitachi Group)

- 7.1.10 Bauer Kompressoren GmbH

- 7.1.11 Aerzener Maschinenfabrik GmbH

- 7.1.12 Hanwha Power Systems