|

市場調查報告書

商品編碼

1432983

真空幫浦:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Vacuum Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

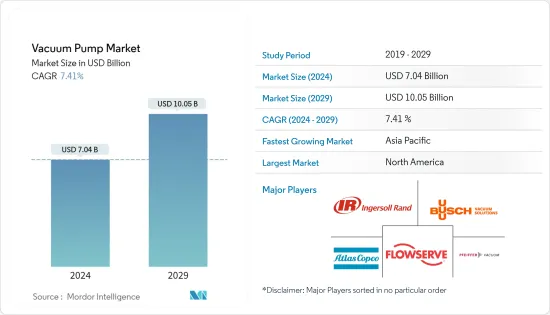

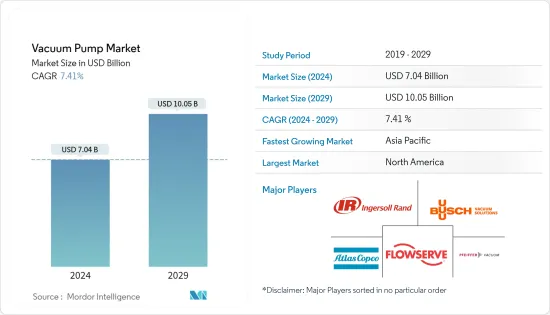

真空幫浦市場規模預計到 2024 年將達到 70.4 億美元,預計到 2029 年將達到 100.5 億美元,在預測期內(2024-2029 年)複合年成長率為 7.41%。

主要亮點

- 真空幫浦是一種從密封體積中吸入氣體顆粒並在零件中產生真空的幫浦。真空幫浦在眾多產業中都有廣泛的應用。真空幫浦對各種應用的適應性是全球真空幫浦市場的關鍵成長引擎。此外,真空幫浦還可用於多種應用,包括清洗、密封等。

- 真空幫浦用於各種工業和科學應用。用於製造CRT、真空管、電燈、航空設備、印刷機、玻璃及石材切割設備、真空醫療應用、電子顯微鏡、光刻、鈾濃縮、複合材料成型等。

- 真空幫浦由於其多功能性而被用於多種應用。石油和天然氣行業採用這種機械進行天然氣開採和壓縮,對市場產生了重大影響。全球真空幫浦市場的主要成長動力是原油產量的增加和新油田的發現。

- 此外,真空幫浦對於半導體裝置的製造至關重要。智慧型手機和其他消費性電子產品、汽車和其他應用程式正在推動對半導體 IC 的需求。這些將由 5G 無線和人工智慧等技術創新驅動。而且,隨著目前基於物聯網的設備的普及,半導體產業有望對這台機器進行投資。

- 真空幫浦也對製藥領域產生重大影響。這些泵浦用於所有製造過程,包括乾燥、蒸餾、結晶、結晶、昇華和填充。每個真空幫浦都是用於製造中間產品、原料藥和原料藥產品的真空灌注系統的組成部分。真空幫浦是在價值鏈中執行重要任務的重要組件,因為它們被用於各種最終用戶產業的這些應用中。

- 此外,為了保持市場競爭力,許多供應商繼續透過各種聯盟、產品發布、收購和其他活動進行投資。例如,阿特拉斯科普柯於 2022 年 1 月完成了對 HHV Pumps Pvt. Ltd 的收購。該業務開發和製造用於多種行業的真空泵和真空系統。 THHV Pumps 是旋輪葉泵的領先供應商,其產品用於製造冷凍和空調、化學和製藥行業、電力設備和一般行業的真空泵。

- 此外,由於醫療產業中真空幫浦使用的研究和開發不斷增加,市場可能擁有利潤豐厚的成長機會。此外,由於真空幫浦在海水淡化中的使用不斷增加以及在太陽能價值鏈中的重要性日益增加,預計真空幫浦將為市場參與者提供成長機會。

- 由於其廣泛的應用和優勢,預計該市場將受到多個行業的巨大需求。然而,真空幫浦安裝不當、能耗高以及產品運作和維護成本增加可能會限制市場擴張。

- 真空技術市場最初受到 COVID-19 大流行造成的供應鏈和物流中斷的影響。但隨後其他解決方案的採用有所增加。阿爾特斯·科普柯表示,設備訂單也有所增加,主要是由於半導體產業多個地區對真空設備的需求增加。隨著各行業開始恢復至或高於大流行前的水平,預計市場將繼續擴大。

真空幫浦市場趨勢

旋轉真空幫浦預計將佔據主要市場佔有率

- 旋轉真空幫浦是應用在多種場合的幫浦之一,並被各領域的專業人士所使用。該泵浦採用正排量系統,最常用於商業、工業、汽車和商業行業。它也可用於實驗室和工業環境。在這些情況下最常被泵送的流體是天然氣、石油和水。

- 旋片輪葉泵最常用於汽車產業。此類型幫浦用於汽車煞車系統、動力方向盤系統、自動排檔變速箱、增壓系統等。旋轉真空幫浦也用於各種車輛系統,例如飛機。空調、濃縮咖啡和無酒精飲品分配器也是此類幫浦的應用。

- 此外,轉葉真空幫浦最常用於汽車產業,是各種車輛零件的重要組成部分。例如,動力方向盤系統中的液壓流體由旋輪葉泵加壓。它也用作自動排檔變速器中的固定和可變輸出單元。隨著汽車工業的成長,旋輪葉泵的需求預計將大幅增加。例如,根據 SIAM 的數據,印度境內派遣的車輛數量從上一會計年度的 1,414,277 輛增加到 2022-23 年的 1,706,831 輛,增加了 21%。

- 除了真空之外,旋轉真空幫浦還可以使用清潔空氣乾運轉或泵送液體(例如石油和天然氣)。石油和天然氣產業是一個顯著推動旋轉真空幫浦需求的產業。此外,由於真空泵與石油和天然氣行業整合的研究和開發不斷增加,市場可能會受益於利潤豐厚的擴張機會。

- 中東和非洲是石油產量最高的地區,預計將為真空幫浦供應商提供巨大的成長機會。例如,根據英國石油公司 (BP) 的數據,沙烏地阿拉伯 2021 年原油產量為 10,954 桶/日。這些趨勢可能會支持受訪市場的未來成長。

- 空氣和氣體也可以使用旋轉真空幫浦從密閉或密閉空間中抽出。許多行業都使用旋轉真空泵,包括食品和飲料、加工、化學和製藥、汽車、石油和天然氣以及其他行業。此外,隨著真空泵整合到這些行業的研究和開發的不斷增加,市場可能會受益於利潤豐厚的擴張機會。

- 例如,2022 年 11 月,普發真空推出了首款帶有封閉泵殼的質譜專用旋片輪葉泵。 SmartVane 是用於環境、食品、製藥和臨床分析的質譜儀(ICP-MS、LC/MS)的備用幫浦。真空幫浦採用無漏油設計,以防止污染。典型的工作壓力低於 10hPA,因此比用於此類應用的其他幫浦更安靜。

北美佔據主要市場佔有率

- 由於需求未滿足、水資源短缺加劇以及對清潔飲用水的需求不斷增加,預計在預測期內,北美將佔據真空幫浦市場最大的市場佔有率,以美國為首。此外,在預測期內,製藥、醫療保健、工業製造和許多其他行業的大量研究和開發可能有助於滿足不斷成長的需求。

- 對石油和天然氣、化學品和發電等最終用戶行業的投資增加對北美地區的真空泵市場產生了重大影響。油砂是包括美國和加拿大在內的該地區國家豐富的石油來源。例如,根據加拿大自然資源部的數據,加拿大已探明蘊藏量的 97% 是在油砂中發現的。

- 飲料加工是另一個受益於真空幫浦使用的行業。由於最近的技術發展和投資水平的上升,預計該地區的飲料加工行業將為市場提供許多機會。例如,2023年1月,雀巢宣布斥資4,300萬美元擴建威斯康辛州工廠,以增加Boost和Carnation Breakfast Essentials即飲(RTD)產品的產量。此類投資可能會增加該產業對真空幫浦的需求。

- 此外,美國是開發新的可再生能源技術的領導者之一,並開拓了多個太陽能計劃。在美國,能源生產持續快速成長。例如,美國主要石油生產商之一埃克森美孚最近宣布,計劃在2024年在德克薩斯州西部的二疊紀盆地生產約100萬桶/日石油當量,以擴大其生產業務。這些因素可能會增加製造商滿足需求的機會,從而加速市場擴張。

- 真空幫浦最常用於汽車領域,是各種汽車零件必不可少的。根據加拿大統計局數據,2021年加拿大登記的道路車輛總數增加至2,620萬輛,較2020年增加1.9%。 2021年登記的10輛汽車中有9輛是小型車,總合2410萬輛。由於該地區汽車工業和擴建設施的投資,預計對真空幫浦的需求將大幅增加。

- 真空幫浦廣泛應用於採礦廠,隨著北美地區煤炭銷量的增加,採礦公司的投資可能會增加。美國能源情報署估計 2022 年第一季美國煤炭消費量為 133.7 MMst。 2021 年第四季報告的 114.1 MMst 比該數值低 17.2%。這項措施可能會促使燃煤電廠安裝大量傳統和現代真空泵,從而增加該行業對真空泵的需求。

真空幫浦產業概況

真空幫浦市場呈現片段化,全球和本地知名企業的存在。此外,全球對發電基礎設施研發的投資以及油氣設備升級是競爭對手之間激烈競爭的重要驅動力。主要參與者包括 Gardner Denver Inc.、阿特拉斯·科普柯集團和福斯公司。

2022 年 5 月,阿特拉斯科普柯推出了新系列的 GHS VSD+ 真空幫浦。新型 GHS 1402-2002 VSD+ 系列幫浦採用新設計,可提高性能、縮小佔地面積、實現最佳油分離,並採用創新控制器來支援工業 4.0使用案例。該公司提供三種抽速等級的速度驅動螺旋泵。

2022年5月,主要汽車零件製造商Advic Hitech宣布與西班牙Entecnia公司簽署小客車煞車系統電動真空幫浦獨家技術授權協議。透過此次合作,Advic預計將支援OEM進入xEV領域,並為減少內燃機火車頭的二氧化碳排放做出貢獻。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 產業政策

- COVID-19 對真空幫浦市場的影響

第5章市場動態

- 市場促進因素

- 增加石油產量和新油田

- 對乾式真空幫浦的需求增加

- 市場課題

- 高成本和相容性問題

第6章市場區隔

- 依類型

- 旋轉真空幫浦

- 旋片輪葉泵

- 螺旋泵和爪泵

- 羅茨幫浦

- 往復式真空幫浦

- 隔膜泵

- 活塞泵

- 動力真空幫浦

- 噴射幫浦

- 渦輪分子泵浦

- 擴散泵浦

- 動力泵

- 液環幫浦

- 側通道泵浦

- 特殊真空幫浦

- 吸氣幫浦

- 低溫泵

- 旋轉真空幫浦

- 依最終用戶使用情況

- 油和氣

- 電子產品

- 醫療保健

- 化學處理

- 食品和飲料

- 發電

- 其他最終用戶應用(木材、紙張/紙漿等)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Ingersoll Rand Inc.

- Atlas Copco AB(Edwards)

- Flowserve Corporation

- Busch Vacuum Solutions(Busch group)

- Pfeiffer Vacuum GmbH(Pfeiffer Vacuum Technology AG)

- ULVAC Inc.

- Graham Corporation

- Global Vac

- Becker Pumps Corporation

- Ebara Corporation

- Wintek Corporation

- Tsurumi Manufacturing Co. Ltd

第8章投資分析

第9章市場的未來

The Vacuum Pump Market size is estimated at USD 7.04 billion in 2024, and is expected to reach USD 10.05 billion by 2029, growing at a CAGR of 7.41% during the forecast period (2024-2029).

Key Highlights

- A vacuum pump is a type of pump that draws gas particles from a sealed volume and leaves a partial vacuum behind. There are numerous applications for vacuum pumps across numerous industries. Vacuum pumps' adaptability in various applications is a crucial growth engine for the global vacuum pump market. Additionally, it is utilized in multiple applications, including cleaning, sealing, and others.

- Vacuum pumps are used in a wide variety of industrial and scientific applications. They manufacture CRTs, vacuum tubes, electric lamps, flight instruments, print presses, glass and stone cutting factories, suction-based medical applications, electron microscopy, photolithography, uranium enrichment, and composite molding.

- Due to their versatility, vacuum pumps are used in various applications. The oil and gas industry has adopted this machine to extract and compress the gas, which significantly impacts the market. The main growth drivers for the global vacuum pump market are rising crude oil production and the discovery of newer oilfields.

- Additionally, vacuum pumps are crucial to the manufacturing of semiconductor devices. Smartphones and other consumer electronics, automotive, and other applications drive the demand for semiconductor ICs. These are brought on by technological changes, including 5G wireless and artificial intelligence. Additionally, the semiconductor industry is anticipated to invest in this machinery due to the current popularity of Internet of Things-based devices.

- Vacuum pumps also have a significant impact on the pharmaceutical sector. All manufacturing processes use these pumps, including drying, distillation, degassing, crystallization, sublimation, and filling. Each vacuum pump is a component of a vacuum prime system used to create intermediate goods, active pharmaceutical ingredients, and large-scale pharmaceuticals. Vacuum pumps are essential components that perform essential tasks in the value chain because of these applications in various end-user industries.

- Moreover, to maintain a competitive edge in the market, many vendors continuously invest through a range of partnerships, product launches, acquisitions, and other activities. For instance, Atlas Copco completed the acquisition of HHV Pumps Pvt. Ltd in January 2022. The business develops and produces vacuum pumps and systems for use in a variety of industries. THHV Pumps is a top supplier of rotary vane pumps used in the production of refrigeration and air conditioning, vacuum pumps for the chemical and pharmaceutical industries, electrical power equipment, and general industry.

- Additionally, the market may have a profitable opportunity for growth due to growing research and development into the use of vacuum pumps in the medical industry. Additionally, vacuum pumps are expected to present growth opportunities for the market's players due to their increasing use in seawater desalination and their increasing significance in the photovoltaics value chain.

- Due to their wide-ranging applications and advantages, the market is anticipated to experience significant demand from several industries. However, improper vacuum pump installation, high power consumption, and increased product operation and maintenance costs could restrain market expansion.

- Due to supply chain and logistics disruptions brought on by the COVID-19 pandemic, the market for vacuum technologies was initially impacted. Later on, however, it saw a rise in adopting several other solutions. According to Altas Copco, order volumes for equipment also increased, primarily due to an increase in vacuum equipment demand across several regions in the semiconductor industry. The industries have begun to resume operations at levels equal to or higher than before the pandemic, so the market is anticipated to continue to expand.

Vacuum Pump Market Trends

Rotary Vacuum Pump Expected to Hold Significant Market Share

- The rotary vacuum pump is one of these types of pumps that is useful in various situations and used by professionals in multiple fields. These pumps, which use a positive displacement system, are most frequently used in the commercial, industrial, automotive, and Commercial industries. It can be used in laboratory and industrial settings as well. The fluids that are pumped most frequently in these situations are gas, oil, and water.

- The automotive sector is the one that employs rotary vane pumps the most. This kind of pump is used in the car's braking system, power steering system, automatic transmission, and supercharging system, among other places. Rotary vacuum pumps are used in the systems of different vehicle types, such as airplanes. Some air conditioners, espresso, and soft drink dispensers are other applications for this kind of pump.

- Moreover, the automotive industry is where rotary vane vacuum pumps are most frequently used, where they are essential parts of many different vehicle parts. For example, hydraulic fluid in power steering systems is pressurized using rotary vane pumps. Additionally, they are employed as fixed and variable output units in automatic transmissions. The demand for Rotary vane pumps is anticipated to increase significantly with the growth of the automotive industry. For instance, according to SIAM, domestic dispatches in India increased by 21% to 17,06,831 units in 2022-23 from 14,14,277 units in the preceding fiscal year.

- Rotating vacuum pumps can run dry with clean air or pump oil, gas, and other liquids in addition to the vacuum. The oil and gas industry is a sector that significantly boosts demand for Rotary vacuum pumps. Additionally, the market may benefit from a lucrative expansion opportunity due to growing research and development into the integration of vacuum pumps into the oil and gas industry.

- Middle-East and Africa, the region with the highest oil production, is anticipated to present vacuum pump suppliers with significant growth opportunities. For instance, Saudi Arabia produced 10,954 barrels of crude oil per day in 2021, according to British Petroleum (BP). These trends will help the market under study grow in the upcoming years.

- Air and gases can also be pumped out of a sealed or constrained space using rotary vacuum pumps. Food and beverage, processing, chemical and pharmaceutical, automotive, oil and gas, and a wide range of other industries all use them. Additionally, the market may benefit from a lucrative expansion opportunity due to growing research and development into the integration of vacuum pumps into these industries.

- For instance, Pfeiffer Vacuum released the first mass spectrometry-specific rotary vane pump with a hermetically sealed pump housing in November 2022. The SmartVane is a backup pump for mass spectrometers (ICP-MS, LC/MS) used in environmental, food, pharmaceutical, and clinical analytics. The vacuum pump is made to make sure there are no oil leaks, which prevents contamination. It is quieter than other pumps used for this type of application because its typical operating pressure is less than 10 hPA.

North America to Hold Significant Market Share

- North America is expected to hold the largest market share of the Vacuum Pump Market over the forecast period, led by the United States, owing to high unmet needs, growing water scarcity, and increased demand for clean drinking water. Additionally, over the forecasted period, significant research and developments in pharmaceutical, healthcare, industrial manufacturing, and many other industries will help to meet the rising demand.

- The rising investments in end-user industries like oil and gas, chemical, and power generation significantly impact the vacuum pump market in the North American region. Oil sands are a plentiful source of oil for the region's nations, including the US and Canada. For instance, 97% of Canada's proven oil reserves are found in the oil sands, according to Natural Resource Canada.

- The processing of beverages is yet another industry that gains from using vacuum pumps. The beverage processing industry in the region is expected to offer the market plenty of opportunities due to recent technological developments and rising investment levels. For instance, Nestle announced in January 2023 that it would expand a Wisconsin factory by USD 43 million in an effort to increase production of its Boost and Carnation Breakfast Essentials ready-to-drink (RTD) products. Such investments will increase the demand for vacuum pumps in the industry.

- Additionally, the US has been one of the leaders in developing new renewable energy technologies and has pioneered several solar energy projects. In the United States, energy production is still rising quickly. For instance, ExxonMobil, one of the major oil producers in the nation, recently announced plans to increase production activity in the West Texas Permian Basin by producing roughly 1 million BPD of oil equivalent by 2024. Such factors will accelerate market expansion by giving manufacturers more opportunities to meet demand.

- Vacuum pumps are most frequently used in the automotive sector, where they are essential in a range of automobile parts. According to Statistics Canada, the total number of road motor vehicles registered in Canada increased to 26.2 million in 2021, up 1.9% from 2020. Nine out of every ten motor vehicles registered in 2021 were light-duty, totaling 24.1 million. The need for vacuum pumps is anticipated to increase significantly due to investments in the region's automobile industry and expansion facilities.

- Due to their widespread use in mining plants, vacuum pumps may see an increase in investment by mining companies as coal sales in the North American region increase. The Energy Information Administration estimates that the United States consumed 133.7 MMst of coal in the first quarter of 2022. The 114.1 MMst reported in the fourth quarter of 2021 was 17.2% lower than this. Such developments could result in installing numerous conventional and cutting-edge vacuum pumps by coal plants, increasing the demand for vacuum pumps in this area.

Vacuum Pump Industry Overview

The vacuum pump market is fragmented due to the presence of prominent global and local players. Also, global investment in R&D in power generation infrastructure and facility upgrades in the oil and gas are the essential drivers that are giving intense rivalry among competitors. Key players are Gardner Denver Inc., Atlas Copco Group, Flowserve Corporation, etc.

In May 2022, Atlas Copco launched a new range of GHS VSD+ vacuum pumps. The new GHS 1402-2002 VSD+ series pumps have a new design for better performance, a smaller footprint, optimal oil separation, and an innovative new controller to support the use cases of Industry 4.0. The company offers these speed-driven screw pumps in three pumping speed classes.

In May 2022, Advik Hi-Tech, a leading automotive component manufacturer, announced that it had entered into an exclusive technology licensing agreement with Entecnia, Spain, for electric vacuum pumps for the braking systems of passenger cars. The partnership is expected to enable Advik to cater to OEMs entering the xEV's space as well as help them reduce CO2 emissions for ICE vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Policies

- 4.5 Impact of COVID-19 on the Vacuum Pumps Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Crude Oil Production and the Newer Oilfields

- 5.1.2 Increasing Demand for Dry Vacuum Pump

- 5.2 Market Challenges

- 5.2.1 High Cost and Compatibility Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Vacuum Pumps

- 6.1.1.1 Rotary Vane Pumps

- 6.1.1.2 Screw and Claw Pumps

- 6.1.1.3 Roots Pumps

- 6.1.2 Reciprocating Vacuum Pumps

- 6.1.2.1 Diaphragm Pumps

- 6.1.2.2 Piston Pumps

- 6.1.3 Kinetic Vacuum Pumps

- 6.1.3.1 Ejector Pumps

- 6.1.3.2 Turbomolecular Pumps

- 6.1.3.3 Diffusion Pumps

- 6.1.4 Dynamic Pumps

- 6.1.4.1 Liquid Ring Pumps

- 6.1.4.2 Side Channel Pumps

- 6.1.5 Specialized Vacuum Pumps

- 6.1.5.1 Getter Pumps

- 6.1.5.2 Cryogenic Pumps

- 6.1.1 Rotary Vacuum Pumps

- 6.2 By End-user Application

- 6.2.1 Oil and Gas

- 6.2.2 Electronics

- 6.2.3 Medicine

- 6.2.4 Chemical Processing

- 6.2.5 Food and Beverage

- 6.2.6 Power Generation

- 6.2.7 Other End-user Applications (Wood, Paper and Pulp, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingersoll Rand Inc.

- 7.1.2 Atlas Copco AB (Edwards)

- 7.1.3 Flowserve Corporation

- 7.1.4 Busch Vacuum Solutions (Busch group)

- 7.1.5 Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG)

- 7.1.6 ULVAC Inc.

- 7.1.7 Graham Corporation

- 7.1.8 Global Vac

- 7.1.9 Becker Pumps Corporation

- 7.1.10 Ebara Corporation

- 7.1.11 Wintek Corporation

- 7.1.12 Tsurumi Manufacturing Co. Ltd