|

市場調查報告書

商品編碼

1403126

雲端基礎的電子郵件安全 -市場佔有率分析、行業趨勢與統計、2024-2029 年成長預測Cloud-based Email Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

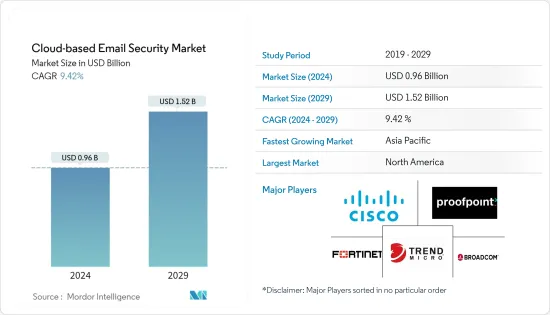

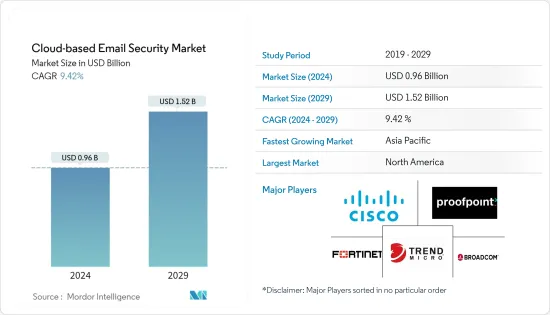

雲端基礎的電子郵件安全市場規模預計到 2024 年為 9.6 億美元,預計到 2029 年將達到 15.2 億美元,預測期內(2024-2029 年)複合年成長率預計成長 9.42 % 。

主要亮點

- 雲端安全軟體是雲端服務供應商和使用者部署的用於保護整個雲端基礎設施的重要工具之一。依賴網路作為資訊交流主要來源的公司,例如亞馬遜等電子商務公司,更容易受到網路攻擊。金融機構和醫療保健產業是提供高財務回報的公司之一,也是駭客利潤豐厚的目標。然而,外包電子郵件安全具有固有的風險,因為它需要依賴和信任第三方提供者的服務。

- 雲端基礎的電子郵件安全軟體有助於防止網路釣魚和欺騙威脅,自動識別無惡意軟體欺騙和商業電子郵件洩露攻擊的目標組織的配置文件,並對訊息內容進行機器學習分析。阻止攻擊。

- 根據全球市場著名電子郵件市場供應商99 Firms的數據,2019年全球電子郵件使用者約為39億,預計2023年將達到約43億。據資料稱,45% 的電子郵件是垃圾郵件,每年造成企業約 205 億美元的損失。網路環境和相關技術的發展為新威脅鋪平了道路。網路攻擊具有高度標靶化、持續性和技術先進性。

- 此外,外包電子郵件安全可能會因技術問題或財務故障而受到破壞。安全提供者的嚴重電子郵件故障可能會降低組織對雲端基礎的安全性的信心。據 IBM 稱,60% 的電子郵件是在行動裝置上開啟的,具體取決於產業,垃圾郵件和網路釣魚電子郵件等電子郵件威脅正在上升。諸如需要減少現場資料中心佔用空間和降低成本、垃圾郵件、病毒和電子郵件中不當內容的發生率增加以及靈活的部署選項等因素正在推動市場成長。

- 此外,隨著雲端電子郵件服務普及,安全供應商正在與雲端供應商合作,提供更快、更無縫的方式來部署安全解決方案。例如,威脅情報管理和網路融合解決方案供應商 Cyware 於 2023 年 6 月宣布與 Mimecast 建立策略合作夥伴關係,以透過先進的電子郵件安全擴展網路整合。此聯合解決方案為客戶提供主動防護,抵禦勒索軟體、網路釣魚、惡意軟體和其他不斷發展的網路威脅。

- 由於 COVID-19 的爆發,隨著組織在各國封鎖期間實施遠端工作訪問,雲端基礎的電子郵件安全市場對雲端基礎的服務和工具的採用有所增加,預計將顯著成長。微軟注意到,其 Teams 產品在義大利的月用戶數在一個月內成長了 775%,通話和會議次數也有所增加。根據谷歌提供的資料,該公司每天攔截約 1800 萬封 COVID-19 垃圾郵件。在大流行期間,基於雲端基礎的服務的使用有所增加,由於數百萬人在不熟悉和不太安全的條件下工作,他們正在成為網路攻擊的熱點。

雲端基礎的電子郵件安全市場趨勢

BFSI 行業擴大使用雲端基礎的電子郵件安全,推動市場發展

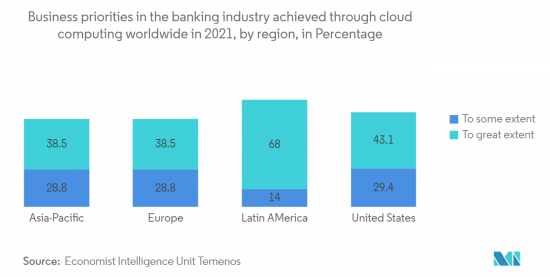

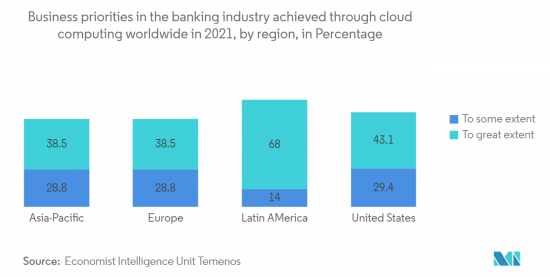

- 金融部門從客戶產生大量資料。銀行和金融機構擴大使用服務來儲存和分析複雜資料,以利用跨各種資料點收集的資料並提高客戶滿意度。此外,客戶期望的提高、技術力的提高以及監管要求的收緊,迫使銀行機構採取積極主動的安全措施。因此,雲端基礎的安全平台擴大被採用。

- 網路安全對於 BFSI 公司來說更為重要,它們必須始終確保合規性並保護客戶的敏感財務資訊。領先的銀行和資本市場越來越認知到雲端基礎的安全平台不僅僅是技術,還創造了進一步的市場成長機會。

- 雲端基礎的電子郵件解決方案可以幫助尋求滿足管理存取控制法規的銀行減少實施時間和成本。隨著電子商務的興起,資料呈指數級成長。 BFSI 部門員工與客戶之間的電子郵件通訊包含利潤豐厚、重要且有價值的資訊,可以為駭客帶來可觀的利潤。此外,使用電子郵件作為內部和外部通訊主要手段的投資銀行部門的組織正在對其電子郵件帳戶進行加密,並採取措施限制竊聽和駭客攻擊。

- 為了確保 IT 流程和系統的安全、保護敏感的客戶資料並遵守政府法規,私人和公共銀行正在專注於實施最新技術來防止網路攻擊。此外,客戶期望的提高、技術力的提高以及監管要求的收緊,迫使銀行機構採取積極主動的安全措施。網路犯罪分子變得越來越狡猾。對於金融服務公司來說,代價最高的攻擊類型是拒絕服務、網路釣魚電子郵件攻擊和社會工程。

- 此外,隨著網路犯罪分子利用類似的能力進入,機器學習和人工智慧 (AI) 將成為最受歡迎的解決方案。我們期望看到組織在加強安全能力方面進行更多投資,以應對和減輕這些風險。

北美佔最大市場佔有率

- 北美是世界各地主要組織的主要樞紐。各種最終用戶行業的擴張和物聯網的成長正在推動該地區對智慧型設備和手機的需求。攻擊風險可能會影響從個人、政府到企業的各種市場。因此,資料安全是該地區的首要任務。

- 電子郵件是最常見的工具之一,也是企業每天使用的工具。根據 FBI 的網路犯罪報告,洩漏的企業電子郵件和電子郵件帳戶是惡意網路釣魚宣傳活動的一部分,該活動使美國企業損失了約 24 億美元。

- 此外,北美尤其美國的網路攻擊正在迅速增加。這一數字創下歷史新高,很大程度上是由於該地區連網設備數量的快速增加。微軟表示,美國仍然是最受攻擊的國家,全球 46% 的網路攻擊發生在美國。

- 美國對網路安全解決方案以及偵測網路威脅的軟體和平台的投資正在增加。隨著從小型企業到大型企業的意識不斷增強,美國政府正在推出更嚴格的解決方案來防止網路攻擊、保護資料並實施偵測詐欺和威脅的計劃。我們正在採取多項舉措例如,2023年3月,美國政府宣布了國家網路安全戰略,以確保所有美國都能充分受益於安全的數位生態系統。

- 此外,一些地區公司正致力於提供新的解決方案來滿足不斷成長的需求。例如,2022年11月,Barracuda Networks宣布將提供與Amazon Security Lake整合的電子郵件安全功能,以協助客戶降低電子郵件安全資料的複雜性。該公司的電子郵件保護解決方案簡化了對客戶安全資料的訪問,降低了成本,並涵蓋了各種安全用例,包括透過電子郵件安全解決方案進行調查、威脅檢測和事件回應。

雲端基礎的電子郵件安全產業概述

全球雲端基礎的電子郵件安全市場已完全整合,幾乎沒有參與企業佔據主要市場佔有率。新參與企業尋求進入現有市場。市場的主要參與企業包括 Cisco Systems Inc.、Proofpoint Inc.、Trend Micro Inc. 和 Fortinet Inc.。最近的市場開拓包括:

- 2023 年 5 月,LogRhythm 宣布與 Mimecast 建立技術合作夥伴關係,提供電子郵件安全、企業安全和威脅管理功能的進階組合。該公司計劃將 Mimecast 的電子郵件安全功能與 LogRhythm 的企業威脅管理功能整合。透過這種整合,兩家公司的目標是幫助世界各地的組織防範最新的網路攻擊。

- 2022 年 10 月,網路安全與合規公司 Proofpoint 在 2022 年 Microsoft Ignite 大會上宣布了其威脅防護平台的多項創新。這些改進為電子郵件詐騙偵測、第三方和供應商違規保護、機器學習(ML) 和行為分析提供了無與倫比的洞察力,所有這些都以一種新的、易於部署的內聯API 格式提供。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 擴大物聯網技術的採用

- 更低的資本成本和更快的部署

- BFSI 行業擴大使用雲端基礎的電子郵件安全,推動市場發展

- 市場抑制因素

- 資訊遺失的風險

第6章市場區隔

- 按部署模型

- 公共

- 私人的

- 混合

- 按最終用戶產業

- BFSI

- 政府機關

- 資訊科技/通訊

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Proofpoint Inc.

- Trend Micro Inc.

- Fortinet Inc.

- Broadcom Inc.

- Forcepoint LLC

- Mimecast Inc.

- Sophos Group PLC

- Dell Technologies Inc.

- FireEye Inc.

第8章投資分析

第9章市場的未來

The Cloud-based Email Security Market size is estimated at USD 0.96 billion in 2024, and is expected to reach USD 1.52 billion by 2029, growing at a CAGR of 9.42% during the forecast period (2024-2029).

Key Highlights

- Cloud security software is one of the essential tools deployed by cloud service providers and users to protect the overall cloud infrastructure. Companies that rely on the Internet as a vital source of information exchange, such as e-commerce companies like Amazon, are more vulnerable to cyberattacks. Financial institutions and healthcare sectors are among the other businesses with high financial gains and lucrative targets for hackers. However, email security outsourcing has an inherent risk, as organizations must rely on and trust a third-party provider for service.

- Cloud-based email security software helps to prevent phishing and imposter threats, and it automatically identifies an organization's profile targets for malware-free impersonation and business email compromise attacks and blocks the attack with machine learning analysis of message content.

- According to 99 Firms, a prominent email market vendor in the global market, there were about 3.9 billion email users worldwide in 2019, which is expected to reach approximately 4.3 billion in 2023. According to the data port, 45% of emails are spam, which costs businesses about USD 20.5 billion annually. The growth of the cyber environment and related technologies paved the way for new threats. Cyberattacks are highly targeted, persistent, and technologically advanced.

- Moreover, technical issues or financial bankruptcy may interrupt email security outsourcing. A severe email failure of security providers can lower an organization's confidence in cloud-based security. According to IBM, 60% of emails are opened on mobile devices, depending on the industry, which increases the threat of spam mail, phishing mail, and other threats related to email. Factors such as a need for decreasing onsite datacentre footprints and cost savings, coupled with increasing incidences of spam, viruses, inappropriate content through email, and flexible deployment options, are spurring the market growth.

- Furthermore, with the widespread adoption of cloud email services, security vendors collaborate with cloud providers to offer faster and more seamless ways of rolling out security solutions. For instance, in June 2023, Cyware, a provider of threat intelligence management and cyber fusion solutions, announced a strategic partnership with Mimecast to extend cyber fusion with advanced email security. The joint solution will provide customers with proactive defense against ransomware, phishing, malware, and other evolving cyber threats.

- With the outbreak of COVID-19, the cloud-based email security market was expected to grow significantly as cloud-based services and tools were increasingly adopted due to organizations deploying remote work access amid lockdowns in various countries. Microsoft noticed an increase of 775% in Italy, calling and meeting monthly users for the Teams product in one month. According to data provided by Google, the company blocked about 18 million COVID-19 spamming emails daily. The increasing usage of cloud-based services during the pandemic is becoming a hotspot for cyberattacks, as millions work in unfamiliar and less secure circumstances.

Cloud-based Email Security Market Trends

Increasing use of cloud based email security in BFSI sector to drive the market.

- The financial sector generates a massive volume of data generated by its customers. Banks and financial organizations increasingly employ services to store and analyze complex data to use the collected data through various data points and improve customer satisfaction. Additionally, with higher customer expectations, growing technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive approach to security. This has resulted in the incorporation of cloud-based security platforms.

- Cybersecurity is even more important for BFSI companies, which need to ensure regulatory compliance and protect the sensitive financial information of their customers at all times. Large banks and capital markets increasingly recognize that the cloud-based security platform is more than just technology, further creating growth opportunities for the market.

- Cloud-based email solutions can help reduce implementation time and costs for banks trying to keep pace with regulations regarding administrative access control. The data is exponentially growing, with an increase in e-transactions. Email exchanges between employees and customers in the BFSI sector contain highly lucrative, important, and valuable information and can greatly benefit hackers. Additionally, organizations in the investment banking sector that use email as their primary means of communication internally and externally have encrypted their email accounts and taken steps to limit eavesdropping and hacking.

- To secure their IT processes and systems, secure customer critical data, and comply with government regulations, private and public banking institutions are focused on implementing the latest technology to prevent cyberattacks. Furthermore, with higher customer expectations, growing technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive approach to security. Cybercriminals are increasingly using a sophisticated range of tactics. Financial services firms' most expensive attack types are denial of services, phishing email attacks, and social engineering.

- Further, Machine learning and Artificial Intelligence (AI) are expected to emerge as the most sought-after solutions, as cybercriminals are also using similar capabilities to break in. It is expected to attract more investments in strengthening security capabilities by organizations to counter and mitigate such risks.

North America Accounts For the Largest Market Share

- North America is a primary hub for all the major organizations worldwide. The expansion of the various end-user industries and the growth of IoT drive the region's demand for smart devices and mobiles. The attacks' risks can impact the market varying from individuals and government to corporates. Thus, securing the data has become a priority in the region.

- Email is one of the most popular tools and one that businesses use every day. According to the FBI's Internet Crime Report, the compromised business email and email accounts were part of malicious phishing campaigns, costing U.S. businesses about USD 2.4 billion.

- In addition, cyberattacks in North America, especially in the United States, are rapidly increasing. The number reached a record high, largely due to the rapid increase in the number of connected devices in the region. According to Microsoft, the United States remains the most highly targeted country, with 46% of global cyberattacks in the region.

- The United States is marked with increased investments in cybersecurity solutions and cyber threat-detecting software and platforms. With the increased awareness amongst companies from small to large enterprises, the U.S. government is taking several initiatives to prevent cyberattacks and deploy stricter solutions to protect data and install fraud and threat detection programs. For instance, in March 2023, the U.S. government announced the release of the National Cybersecurity Strategy to ensure that all Americans enjoy the full benefits of a secure digital ecosystem.

- Furthermore, several regional companies are focusing on offering new solutions to meet the growing demand. For instance, in November 2022, Barracuda Networks, Inc. announced it offered email security integrated with Amazon Security Lake to help customers reduce the complexity of email security data. The company's email protection solutions streamline access to customer security data through email security solutions, reduce costs, and cover a variety of security use cases such as investigation, threat detection, and incident response.

Cloud-based Email Security Industry Overview

The global cloud-based email security market is entirely consolidated due to fewer players occupying the larger market share. The new players are trying to penetrate the established market. Some key players in the market are Cisco Systems Inc., Proofpoint Inc., Trend Micro Inc., and Fortinet Inc. Some recent developments in the market include:

- In May 2023, LogRhythm announced a technology partnership with Mimecast to offer an advanced combination of email security, enterprise security, and threat management capabilities. The company will likely integrate Mimecast's email security capabilities with LogRhythm's enterprise threat management. Through this integration, both companies aim to help organizations around the globe protect against modern cyber-attacks.

- In October 2022, at the 2022 Microsoft Ignite Conference, the cybersecurity and compliance firm Proofpoint Inc. unveiled several innovations across its Threat Protection Platform, empowering organizations to counter the most advanced and pervasive threats like Business Email Compromise (BEC) and supply chain attacks. The improvements give businesses unparalleled insight into email fraud detection, defense against third-party and supplier compromise, machine learning (ML), and behavioral analytics, all made available via a new, simple-to-deploy inline API format.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Internet-of-Things (IoT) Technology

- 5.1.2 Reduced Capital Expenses and Faster Deployments

- 5.1.3 Increasing use of cloud based email security in BFSI sector to drive the market.

- 5.2 Market Restraints

- 5.2.1 Risk of Information Loss

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Government

- 6.2.3 IT and Telecommunications

- 6.2.4 Retail

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 South Korea

- 6.3.3.6 Rest of APAC

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Proofpoint Inc.

- 7.1.3 Trend Micro Inc.

- 7.1.4 Fortinet Inc.

- 7.1.5 Broadcom Inc.

- 7.1.6 Forcepoint LLC

- 7.1.7 Mimecast Inc.

- 7.1.8 Sophos Group PLC

- 7.1.9 Dell Technologies Inc.

- 7.1.10 FireEye Inc.