|

市場調查報告書

商品編碼

1432952

情緒檢測與識別 (EDR) -市場佔有率分析、產業趨勢與統計、成長預測 (2024-2029)Emotion Detection And Recognition (EDR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

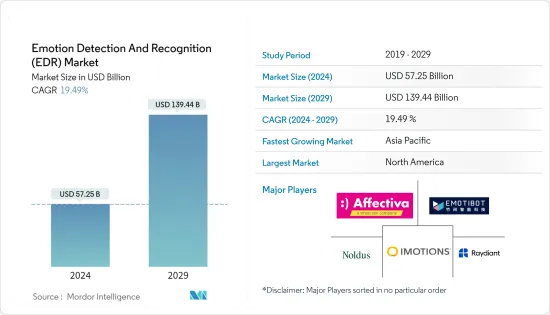

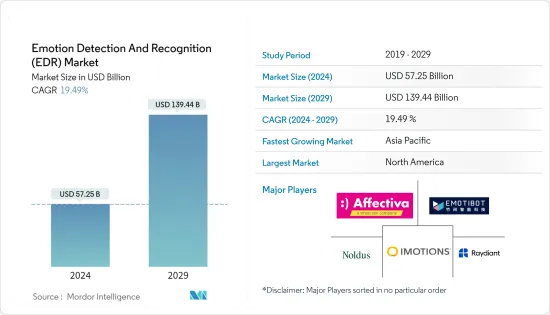

情緒偵測與辨識(EDR)市場規模預計在 2024 年為 572.5 億美元,預計到 2029 年將達到 1394.4 億美元,在預測期(2024-2029 年)複合年成長率為 19.49%。

情緒檢測和識別 (EDR) 市場是一個快速成長的領域,涉及識別和分析人類情緒的技術的開發和實施。 EDR 系統利用多種技術,包括臉部表情辨識、語音分析、生理訊號和自然語言處理,來偵測和解釋情緒狀態。

主要亮點

- 公司越來越認知到了解客戶情緒對於改善其產品、服務和整體客戶體驗的重要性。 EDR 技術使企業能夠透過分析客戶情緒和情緒來收集有價值的見解。

- 智慧型手錶和健身追蹤器等穿戴式裝置的普及為 EDR 技術創造了新的機會。這些設備可以收集心率和皮膚電導等生理資料,可用於情緒檢測演算法。

- 對先進行銷工具不斷成長的需求極大地推動了情緒檢測和識別 (EDR) 市場的發展。情緒檢測和識別技術使負責人能夠更深入地了解客戶的情緒、情緒和偏好。負責人可以透過分析行銷宣傳活動、廣告和產品體驗的情緒反應來了解客戶如何與自有品牌互動。這些資料有助於制定更個人化和針對性的行銷策略,提高客戶參與和轉換率。

- 情緒檢測和識別系統收集和分析個人資料,例如臉部表情、錄音、生理訊號和文字資料。此類敏感個人資訊的收集和使用引發了隱私問題。個人越來越意識到自己的資料權利,並要求對其個人資訊進行更大的控制。

- 由於COVID-19,市場放緩,因為戴口罩已成為社會參與的必需品,並阻礙了日常生活中的情感識別。此外,面具設定下的辨識率最低,且不同的情緒類型與臉部的不同部位相關聯,這阻礙了檢測率。大流行後,由於連網型設備的增加,市場正在蓬勃發展。

情緒檢測與識別 (EDR) 市場趨勢

採用物聯網主導的穿戴式設備來推動市場成長

- 物聯網和穿戴式裝置日益增強的連接性和整合度提供了大量資料,EDR 系統可以利用這些數據來提供對人類情感的寶貴見解。這種資料主導的方法有可能徹底改變各個行業,包括醫療保健、遊戲、智慧家庭和個人化體驗。

- 物聯網徹底改變了設備和事物相互連接和通訊的方式。根據GSMA預測,到2025年,全球物聯網連接數預計將達到250億,同期物聯網市場收益預計將超過1.1兆美元。將 EDR 技術整合到智慧型手機、智慧家庭系統和聯網汽車等物聯網設備中,可偵測和分析各種環境中的情緒。例如,支援物聯網的智慧家庭系統可以使用 EDR 了解居住者的情緒狀態,並相應地調整他們的環境,以提高舒適度和幸福感。

- 此外,連接的穿戴式設備的數量也在增加。這些設備配備了感測器,可以收集、監控和分析心率、脈搏和體溫等生命徵象。據Cisco稱,到 2022 年,全球連網穿戴裝置數量預計將達到 11.05 億台。

- 智慧型手錶、健身追蹤器和虛擬實境耳機等穿戴式裝置最近非常受歡迎。這些設備通常包括收集心率、皮膚電導和體溫等生理資料的感測器。透過結合其他資料分析這些生理訊號,EDR系統可以推斷佩戴者的情緒狀態。穿戴式裝置提供了一種方便且非侵入性的方式來收集資料以進行情緒檢測和識別。

- 將 EDR 技術與物聯網和穿戴式裝置整合在醫療保健和福利領域尤其重要。 EDR 可用於監測和分析患者的情緒狀態,為心理健康診斷、壓力管理和個人化治療計劃提供有價值的見解。具有 EDR 功能的穿戴式裝置可以追蹤情緒模式並幫助更好地了解個人的健康狀況。

- 整合到物聯網設備和穿戴式裝置中的 EDR 技術有可能顯著改善使用者體驗。例如,EDR 可以使虛擬實境應用程式使虛擬環境適應使用者的情緒反應,從而創造更身臨其境和引人入勝的體驗。此外,在人機介面中使用 EDR 可讓裝置和系統智慧地回應使用者情緒,從而改善互動和整體使用者滿意度。

北美有望成為最大市場

- 北美是 EDR 技術市場規模和成長的關鍵地區之一。領先的科技公司、創新新興企業和研究機構的存在正在為該地區 EDR 解決方案的開發和採用做出貢獻。在對先進行銷工具、個人化客戶體驗以及醫療保健和健康應用的需求的推動下,該市場正在經歷穩定成長。

- 北美處於人工智慧 (AI)、機器學習 (ML) 和電腦視覺等技術進步的前沿,這些對 EDR 技術的發展至關重要。該地區擁有強大的研發中心、大學和高科技公司生態系統,有助於 EDR 系統的持續創新和改進。

- 到 2025 年,該地區的物聯網連接預計將達到 59 億。這種成長預計負責人能夠獲得真實的消費者洞察並改善廣告定位。隨著物聯網、智慧穿戴裝置、零售和廣告支出的需求不斷成長,該地區缺乏嚴格的資料監管,這進一步影響了成長。

- 對先進行銷和廣告工具不斷成長的需求正在推動北美 EDR 市場的發展。透過分析客戶的情緒和情緒,EDR 技術使負責人能夠創建個人化且引人入勝的宣傳活動、最佳化廣告成效並改善客戶體驗。零售、電子商務和娛樂等多個行業的北美公司正在採用 EDR 解決方案來提高其在市場中的競爭力。

- 北美EDR市場受益於該地區的技術進步、市場對先進行銷工具和個人化體驗的強勁需求,以及EDR技術在醫療保健領域的應用。然而,公司必須遵守資料隱私法規並考慮道德因素,以確保在該地區負責任和透明地使用 EDR 技術。

情緒檢測與識別 (EDR) 產業概述

由於存在多個供應商,情緒檢測和識別市場是半固定的。此外,由於高投資成本和對熟練技術人員的高需求,新進入者仍然困難。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 1 月 - 領先的人類行為分析 AI 企業 nViso SA (NVISO) 宣布將在 CES2023 的 Socionext 展會上推出 Neuro SDK。 NVISO 擴大了其基於 BrainChip Akida 事件的全數位神經擬態處理平台支援的人類行為人工智慧應用頻譜,從其產品組合中轉移了新的人工智慧應用。這些功能包括動作單元、身體姿勢和手勢識別,以及先前發布的頭部姿勢、臉部地標、凝視和情緒 AI 應用程式以及評估套件(EVK) 版本的發布。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 市場促進因素

- 利用物聯網的穿戴式裝置的普及

- 對先進行銷工具的需求不斷成長

- 市場課題

- 資料隱私問題和全球資料法規的引入

- COVID-19 市場影響評估

第5章市場區隔

- 透過軟體和服務

- 軟體

- 臉部辨識

- 語音辨識

- 生物感

- 服務

- 軟體

- 依行業分類

- 政府機關

- 衛生保健

- 零售

- 娛樂

- 運輸

- 依行業分類的其他最終用戶

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 世界其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Affectiva Inc.(Smart Eye)

- Emotibot Technologies Limited

- iMotions

- Noldus

- Sightcorp.

- Realeyes OU

- NVISO SA

- Kairos AR Inc.

- Nemesysco Ltd

- audEERING GMBH

第7章 投資分析

第8章 市場機會及未來趨勢

The Emotion Detection And Recognition Market size is estimated at USD 57.25 billion in 2024, and is expected to reach USD 139.44 billion by 2029, growing at a CAGR of 19.49% during the forecast period (2024-2029).

The Emotion Detection and Recognition (EDR) market is a rapidly growing sector that involves developing and implementing technologies capable of identifying and analyzing human emotions. EDR systems utilize various techniques such as facial expression recognition, speech analysis, physiological signals, and natural language processing to detect and interpret emotional states.

Key Highlights

- Businesses increasingly recognize the importance of understanding customer emotions to enhance their products, services, and overall customer experience. EDR technologies enable companies to gather valuable insights by analyzing customer emotions and sentiments.

- The widespread use of wearable devices, such as smartwatches and fitness trackers, has created new opportunities for EDR technology. These devices can collect physiological data, such as heart rate and skin conductance, which can be used in emotion detection algorithms.

- The increasing need for advanced marketing tools drives the Emotion Detection and Recognition (EDR) market significantly. Emotion detection and recognition technology enables marketers to gain deeper insights into customer emotions, sentiments, and preferences. Marketers can understand how customers engage with their brand by analyzing emotional responses to marketing campaigns, advertisements, and product experiences. This data helps create more personalized and targeted marketing strategies, improving customer engagement and conversion rates.

- Emotion detection and recognition systems collect and analyze personal data, including facial expressions, voice recordings, physiological signals, and textual data. The collection and use of such sensitive personal information raise privacy concerns. Individuals are becoming increasingly aware of their data rights and are demanding greater control over their personal information.

- Due to COVID-19, the market is slowdown because wearing masks has become necessary for social engagement, interfering with emotional recognition in everyday life. Furthermore, it hindered detection rates because identification rates were lowest under mask settings, and different emotion types were associated with different parts of the face. Post-pandemic, the market is growing rapidly due to increased connected devices.

Emotion Detection and Recognition (EDR) Market Trends

Adoption of IOT driven Wearable Devices Driving the Market Growth

- The increasing connectivity and integration of IoT devices and wearable devices offer a vast amount of data that EDR systems can leverage to provide valuable insights into human emotions. This data-driven approach can revolutionize various industries, including healthcare, gaming, smart homes, and personalized experiences.

- The IoT has revolutionized the way devices and objects connect and communicate with each other. According to GSMA, the global IoT connections are estimated to reach 25 billion by 2025, and the IoT market revenue is expected to cross USD 1.1 trillion by the same period. With the integration of EDR technology into IoT devices, such as smartphones, smart home systems, and connected cars, it becomes possible to detect and analyze emotions in various contexts. For example, IoT-enabled smart home systems can use EDR to understand the emotional state of residents and adjust the environment accordingly for enhanced comfort and well-being.

- Additionally, the number of connected wearable devices is also increasing. Such devices have sensors that collect, monitor, and analyze biological vitals, such as heart rate, pulse, and body temperature. According to Cisco Systems, the number of connected wearable devices globally is expected to reach 1,105 million in 2022.

- Wearable devices, including smartwatches, fitness trackers, and virtual reality headsets, have recently gained significant popularity. These devices often include sensors that collect physiological data, such as heart rate, skin conductance, and body temperature. By analyzing these physiological signals in conjunction with other data, EDR systems can infer the wearer's emotional state. Wearable devices offer a convenient and non-intrusive way to gather data for emotion detection and recognition.

- Integrating EDR technology with IoT and wearable devices has particular relevance in the healthcare and well-being sectors. EDR can be utilized to monitor and analyze the emotional state of patients, providing valuable insights for mental health diagnosis, stress management, and personalized treatment plans. Wearable devices with EDR capabilities can track emotional patterns and help individuals better understand their well-being.

- EDR technology integrated into IoT devices and wearable devices has the potential to enhance user experiences significantly. For instance, EDR can enable virtual environments to adapt to the user's emotional responses in virtual reality applications, creating more immersive and engaging experiences. Additionally, EDR can be used in human-computer interfaces to enable devices and systems to respond intelligently to the user's emotions, improving interaction and overall user satisfaction.

North America is Expected to Register the Largest Market

- North America has been one of the leading regions in market size and growth for EDR technology. The presence of major technology companies, innovative startups, and research institutions has contributed to the development and adoption of EDR solutions in the region. The market has witnessed steady growth driven by the demand for advanced marketing tools, personalized customer experiences, and applications in healthcare and wellness.

- North America has been at the forefront of technological advancements, including artificial intelligence (AI), machine learning (ML), and computer vision, which are critical for developing EDR technology. The region has a robust ecosystem of research and development centers, universities, and tech companies that contribute to the continuous innovation and improvement of EDR systems.

- The IoT connections in the region are expected to reach 5.9 billion by 2025. Such growth is expected to enable marketers to attain authentic consumer insights and improve ad targeting. In line with such growth in the demand for IoT, smart wearables, retail sales, and ad spending, the region does not have major stringent data regulations, which further influences the growth.

- The North America EDR market has been fueled by the increasing need for advanced marketing and advertising tools. By analyzing customer emotions and sentiments, EDR technology enables marketers to create personalized and engaging campaigns, optimize advertising effectiveness, and enhance customer experiences. North American companies across various industries, including retail, e-commerce, and entertainment, are adopting EDR solutions to gain a competitive edge in the market.

- The North America EDR market benefits from the region's technological advancements, strong market demand for advanced marketing tools and personalized experiences, and the application of EDR technology in healthcare. However, companies need to navigate data privacy regulations and address ethical considerations to ensure the responsible and transparent use of EDR technology in the region.

Emotion Detection and Recognition (EDR) Industry Overview

The emotion detection and recognition market is semi-consolidated owing to the presence of multiple vendors in the market. Moreover, market entry for new entrants remains challenging due to higher investment and demand for skilled technicians. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2023 - nViso SA (NVISO), one of the leading Human Behavioural Analytics AI businesses, announced that its Neuro SDK would be presented at the Socionext display at CES2023. NVISO has expanded the spectrum of Human Behavioural AI Apps that it supports on the BrainChip Akida event-based, fully digital neuromorphic processing platform by transferring new AI Apps from its portfolio. These features include Action Units, Body Pose, and Gesture Recognition, in addition to the previously announced Headpose, Facial Landmark, Gaze, and Emotion AI Apps with the release of the Evaluation Kit (EVK) version.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Market Drivers

- 4.4.1 Adoption of IOT driven Wearable Devices

- 4.4.2 Increasing Need for Advanced Marketing Tools

- 4.5 Market Challenges

- 4.5.1 Data Privacy Concerns and data Regulation Adoption across the World

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Software and Services

- 5.1.1 Software

- 5.1.1.1 Facial Recognition

- 5.1.1.2 Speech and Voice Recognition

- 5.1.1.3 Bio-sensing

- 5.1.2 Services

- 5.1.1 Software

- 5.2 By End-user Vertical

- 5.2.1 Government

- 5.2.2 Healthcare

- 5.2.3 Retail

- 5.2.4 Entertainment

- 5.2.5 Transportation

- 5.2.6 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 UAE

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.6 Rest of the world

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Affectiva Inc. (Smart Eye)

- 6.1.2 Emotibot Technologies Limited

- 6.1.3 iMotions

- 6.1.4 Noldus

- 6.1.5 Sightcorp.

- 6.1.6 Realeyes OU

- 6.1.7 NVISO SA

- 6.1.8 Kairos AR Inc.

- 6.1.9 Nemesysco Ltd

- 6.1.10 audEERING GMBH