|

市場調查報告書

商品編碼

1432431

真空絕熱板 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Vacuum Insulation Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

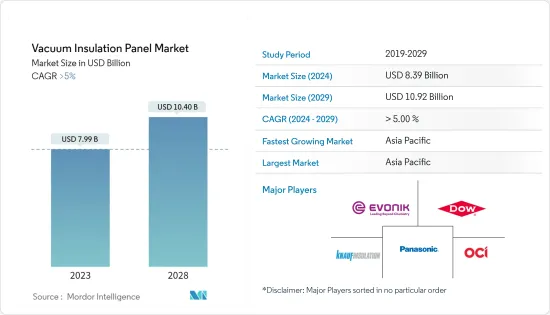

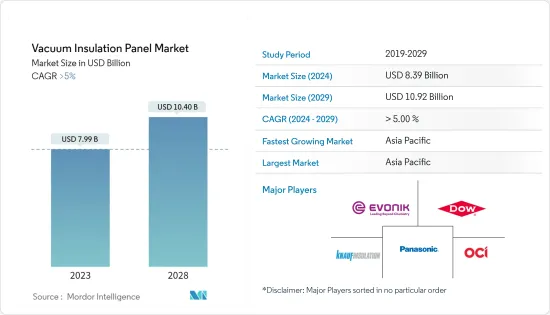

真空絕熱板市場規模預計到 2024 年為 83.9 億美元,預計到 2029 年將達到 109.2 億美元,在預測期內(2024-2029 年)複合年成長率將超過 5%。

由於封鎖和限制導致製造設施和工廠關閉,COVID-19 大流行對市場產生了負面影響。供應鏈和運輸中斷進一步阻礙了市場。但2021年,產業復甦,市場需求恢復。

主要亮點

- 從短期來看,建設產業的強勁需求以及全球採用真空隔熱板進行自動儲存和搜尋是推動所研究市場成長的因素。

- 另一方面,非標準尺寸面板的高成本和重量可能會阻礙市場成長。

- 然而,促進節能材料的日益嚴格的法規以及引入自動化面板以降低真空隔熱板成本的研發舉措為預測期內接受調查的市場提供了機會,而且很有可能會出現這種情況。

真空絕熱板市場趨勢

建築板塊實現強勁成長

- 真空絕熱板(VIP)是目前絕緣能力最高、最有前途的隔熱材料之一,在建設產業中廣受接受。

- 真空隔熱板在建築領域還有其他優勢,例如更薄的建築構件、增加的室內空間和最佳化土地利用,以及在使用壽命結束時回收組成材料的可能性。

- 根據美國人口普查局統計,2022年美國商業建築價值為1,147.9億美元,與前一年同期比較增加17.63%。

- 此外,亞太、中東和非洲等地區正在吸引大量國內外投資,用於設立工業單位、醫院、商場、劇院、旅館和IT產業,刺激了對真空隔熱板的需求,這可能需要一段時間。

- 在沙烏地阿拉伯,不斷成長的房地產開拓、不斷成長的住宅需求以及政府改善社會經濟基礎設施的舉措正在推動該國真空隔熱板市場的發展。沙烏地阿拉伯住宅部長 Majid Al-Hogail 表示,該國計劃在未來五年內建造 30 萬套住宅。沙烏地阿拉伯根據 2030 年願景制定的關鍵舉措之一是住宅。未來幾年,真空隔熱板市場可能會受到該國建設產業的需求。

- 根據土木工程師學會 (ICE) 的一項研究,到 2030 年,全球建設產業預計將達到 8 兆美元,主要由中國、印度和美國推動。

- 此外,越來越多的建築規範和政策要求採用節能結構,也鼓勵建築業更多地使用環保和節能材料。

- 因此,建設產業的上述趨勢預計將在預測期內推動真空絕熱板市場的成長。

亞太地區主導市場

- 亞太地區在全球市場佔有率佔據主導地位。印度、中國、菲律賓、越南和印尼對住宅和商業建設活動的投資不斷增加,預計未來幾年市場將會成長。

- 2011年至2022年中國建築業產值顯示該產業正在成長。例如,根據中國國家統計局的數據,2022年,中國建築產值將達到峰值,約27.63兆元人民幣(4.1兆美元)。

- 由於家庭收入的提高以及人口從農村地區向都市區的遷移,預計中國的住宅建設需求將會增加。公共和私營部門對經濟適用住宅的更多關注將刺激住宅建設行業的發展。

- 目前中國有多個機場建設計劃正在開發或規劃中。例如,新疆維吾爾自治區正在規劃興建8個新機場,形成現代化機場網路體系。新疆機場集團宣布,計畫於2023年至2025年在巴彥布拉克、八廓、烏斯、霍博薩爾和奇莫興建機場。

- 此外,2021年建設產業新簽約金額為1,345億元人民幣(195.2億美元),較去年同期成長2.5%,成長速度為7.1%。 2022年1月,中國宣布了「十四五」(2021-2025)期間建築業發展計劃,為國家經濟走上更綠色、更聰明、更安全的道路樹立了支柱。因此,建築合約的增加預計將對真空絕熱板市場產生積極影響。

- 此外,印度政府於 2022 年 1 月核准在該國開發 21 個待開發區機場。該國最大的機場將建在北方邦的高塔姆佛陀納加爾地區。民航部計劃未來幾年在印度各地增建 21 個機場。

- 此外,印度機場管理局 (AAI) 計劃在未來四到五年內建造新機場,並對一些現有機場進行擴建和升級,耗資 3.38 億美元。這包括現有航站樓的擴建和改造、新航站樓的建設、現有跑道、技術區、停機坪和機場導航服務控制塔的擴建和加固。

- 此外,到 2025 年,德里、班加羅爾和海得拉巴這三個 PPP(官民合作關係)機場將在擴建計畫中投資 3,000 億印度盧比(38.1 億美元)。因此,真空絕熱板市場的需求將會不斷上升。

- 在印度,隨著政府目標投資1,205億美元活性化27個產業叢集,該國商業建設預計將回升。

- 因此,亞太國家的所有此類投資和計劃計劃都正在促進該地區的建設活動,並預計將在預測期內推動對真空隔熱板的需求。

真空絕熱板產業概況

真空絕熱板市場較為分散。該市場的主要企業(排名不分先後)包括贏創工業股份公司、Panasonic Corporation、陶氏化學、可耐福絕緣、OCI有限公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業需求旺盛

- 採用真空絕熱板自動搜尋

- 其他司機

- 抑制因素

- 非標準尺寸VIP高成本

- 真空絕熱板重量重

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 核心材料

- 二氧化矽

- 玻璃纖維

- 其他核心材料

- 結構類型

- 平坦的

- 特殊形狀

- 目的

- 建築學

- 冷卻/冷凍設備

- 後勤

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AVERY DENNISON CORPORATION

- Chuzhou Yinxing Electric Co. Ltd

- Csafe

- Dow

- Etex Group

- Evonik Industries AG

- KCC CORPORATION

- Kevothermal

- Kingspan Group

- Knauf Insulation

- Morgan Advanced Materials

- Panasonic Corporation of North America

- Recticel Insulation

- TURNA doo

- Vaku-Isotherm GmbH

- Va-Q-Tec AG

第7章 市場機會及未來趨勢

- 引進自動化面板的研發工作

- 用於永續建築的真空隔熱板

The Vacuum Insulation Panel Market size is estimated at USD 8.39 billion in 2024, and is expected to reach USD 10.92 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market due to the shutdown of manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, robust demand from the construction industry and the adoption of vacuum insulation panels for automated storage and retrieval worldwide are factors driving the studied market's growth.

- On the flip side, the high cost for non-standard sizes and the heavy weight of the panels will likely hinder the studied market's growth.

- However, increasingly stringent regulations promoting energy-efficient materials and R&D initiatives to introduce automated panels to reduce vacuum insulation panel costs will likely provide opportunities for the market studied during the forecast period.

Vacuum Insulation Panel Market Trends

Construction Segment to Witness Strong Growth

- Vacuum insulation panels (VIPs) are one of the most promising insulation materials with the highest thermal insulating capacity and are widely accepted in the construction industry.

- Vacuum insulation panels also offer other advantages in the construction sector, like the reduced thickness of building components, increased indoor space and land use optimization, and recyclability of constitutive materials after their service life.

- According to the US Census Bureau, the value of commercial construction in the United States amounted to USD 114.79 billion in 2022, which showed an increase of 17.63% compared to the previous year.

- Additionally, regions like Asia-Pacific, the Middle East, and Africa are attracting huge domestic and foreign investments for setting up industrial units, hospitals, malls, theaters, hotels, and the IT sector, which may add to the demand for vacuum insulation panels.

- In Saudi Arabia, the growing number of real estate developments, increasing demand for residential property, and governmental initiatives to develop socio-economic infrastructure drive the vacuum insulation panel market in the country. According to Majid Al-Hogail, the Saudi Housing Minister, the Kingdom of Saudi Arabia plans to construct 300,000 extra housing units over the next five years. One of Saudi Arabia's significant initiatives under Vision 2030 is housing. It will likely create demand for the vacuum insulation panel market from the country's construction industry in the upcoming years.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States.

- Furthermore, the rising number of building codes and policies mandating energy-efficient structures is further facilitating an increase in the construction sector's usage of eco-friendly and energy-conserving materials.

- Hence, the trends above in the construction industry are expected to drive the growth of the vacuum insulation panel market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing investments in residential and commercial construction activities in India, China, the Philippines, Vietnam, and Indonesia, the market is expected to grow in the coming years.

- The output value of construction in China from 2011 to 2022 indicates progressive growth in the industry. For instance, according to the National Bureau of Statistics of China, in 2022, the construction output value in China peaked at around CNY 27.63 trillion (USD 4.10 trillion).

- Rising household income rates and population migration from rural to urban areas are expected to increase demand for residential construction in China. Increased emphasis on both public and private sector affordable housing would fuel development in the residential construction sector.

- There are currently several airport construction projects in China, either in the development or planning stage. For instance, the Xinjiang Uygur autonomous region plans to construct eight new airports to form a modern airport network system. Xinjiang Airport Group announced its plan to build airports in Bayanbulak, Barkol, Wusu, Hoboksar, and Qiemo from 2023 to 2025.

- Moreover, in 2021, the value of newly signed contracts in the construction industry was CNY 134.5 billion (USD 19.52 billion), an increase of 2.5% year-on-year, and the growth rate narrowed by 7.1% compared with the same period last year. In January 2022, China unveiled plans to develop its construction industry during the 14th Five-Year Plan (2021-2025), paving a pillar of the country's economy on a greener, smarter, and safer path. Therefore, increasing contracts from construction is expected to include an upside for the vacuum insulation panel market.

- Moreover, in India, the government approved the development of 21 greenfield airports in the country in January 2022. The country's largest airport will be built in Uttar Pradesh's Gautam Buddha Nagar area. The Ministry of Civil Aviation intends to build 21 additional airports across India in the next few years.

- Furthermore, in the next four to five years, the Airports Authority of India (AAI) plans to create new airports and expand and upgrade many existing airports for USD 338 million. It comprises the expansion and alteration of existing terminals, the construction of new terminals, and the expansion or strengthening of existing runways, technical blocks, aprons, and the control towers of the Airport Navigation Services.

- In addition, by 2025, three PPP (Public-Private Partnership) airports in Delhi, Bengaluru, and Hyderabad will invest INR 30,000 crore (USD 3810 million) in expansion plans. Therefore, creating an upside demand for the vacuum insulation panel market.

- In India, the government's target for investing USD 120.5 billion in developing 27 industrial clusters is expected to boost commercial construction in the country.

- Hence, all such investments and planned projects in the Asia-Pacific countries are boosting construction activities in the region, which are anticipated to drive the demand for vacuum insulation panels during the forecast period.

Vacuum Insulation Panel Industry Overview

The vacuum insulation panel market is fragmented in nature. The major players in this market (not in any particular order) include Evonik Industries AG, Panasonic Corporation, Dow, Knauf Insulation, and OCI Company Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Demand from Construction Industry

- 4.1.2 Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of VIPs for Non-standard Sizes

- 4.2.2 Heavy Weight of Vacuum Insulation Panels

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Core Material

- 5.1.1 Silica

- 5.1.2 Fiberglass

- 5.1.3 Other Core Materials

- 5.2 Structure Type

- 5.2.1 Flat

- 5.2.2 Special Shape

- 5.3 Application

- 5.3.1 Construction

- 5.3.2 Cooling and Freezing Devices

- 5.3.3 Logistics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AVERY DENNISON CORPORATION

- 6.4.2 Chuzhou Yinxing Electric Co. Ltd

- 6.4.3 Csafe

- 6.4.4 Dow

- 6.4.5 Etex Group

- 6.4.6 Evonik Industries AG

- 6.4.7 KCC CORPORATION

- 6.4.8 Kevothermal

- 6.4.9 Kingspan Group

- 6.4.10 Knauf Insulation

- 6.4.11 Morgan Advanced Materials

- 6.4.12 Panasonic Corporation of North America

- 6.4.13 Recticel Insulation

- 6.4.14 TURNA d.o.o

- 6.4.15 Vaku -Isotherm GmbH

- 6.4.16 Va-Q-Tec AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 R&D Initiatives to Introduce Automated Panels

- 7.2 Vacuum Insulated Panels for Sustainable Buildings