|

市場調查報告書

商品編碼

1444236

苯乙烯-市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Styrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

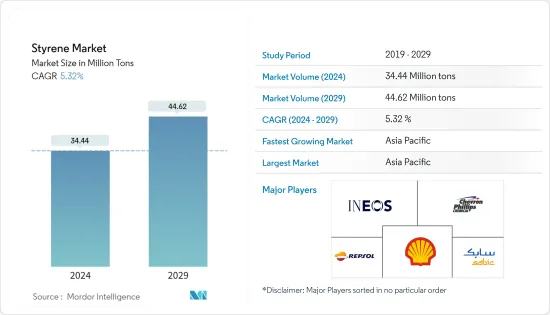

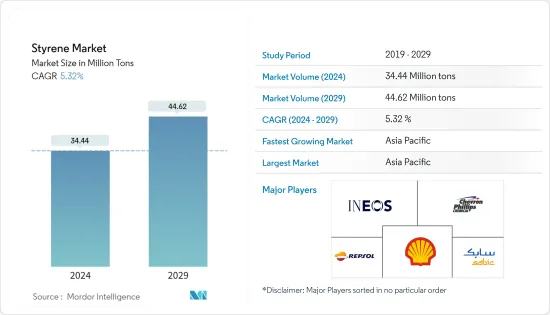

預計2024年苯乙烯市場規模為3,444萬噸,預計2029年將達到4,462萬噸,在預測期間(2024-2029年)年複合成長率為5.32%。

COVID-19大流行對苯乙烯市場產生了負面影響。然而,由於包裝、建築、汽車等各行業的消費增加,2021年市場顯著復甦。

主要亮點

- 短期來看,消費性電器產品產業需求的成長是推動所研究市場成長的關鍵因素。

- 然而,包裝行業中生物基塑膠的使用增加可能會限制市場成長。

- 儘管如此,正在進行的生物基聚苯乙烯研究可能很快就會為全球市場創造利潤豐厚的成長機會。

- 亞太地區主導苯乙烯市場,最大消費國包括中國、日本和東南亞國協。

苯乙烯市場趨勢

包裝產業引領市場

- 苯乙烯由於其優越的性能而常用於包裝行業。一種多功能輕質塑膠,具有優異的透明度、抗衝擊性和絕緣性能。這些特性使其適用於廣泛的包裝應用。

- 苯乙烯在包裝產業最常見的用途之一是生產聚苯乙烯泡沫,通常稱為發泡聚苯乙烯 (EPS) 或發泡聚苯乙烯。 EPS 泡棉廣泛用於保護性包裝,如緩衝材料、生鮮產品的隔熱材料和輕型運輸容器。

- 苯乙烯也用於製造硬質聚苯乙烯,通常用於食品包裝。透明聚苯乙烯容器(例如翻蓋式容器、杯子和托盤)在外食行業中很受歡迎,因為它們的透明度使顧客可以輕鬆看到裡面的東西。

- 此外,聚苯乙烯也用於醫療和保健行業的各種包裝應用。 IQVIA顯示,全球醫藥市場近年來成長顯著。到 2022 年,全球醫藥市場總額預計將達到 1.48 兆美元。這僅比 2021 年的市場規模估計為 1.42 兆美元略有增加。

- 在亞太地區,由於生活方式的改變、人們可支配收入的增加、專業人士數量的增加以及對快餐的日益偏好,對加工食品的偏好正在增加。

- 由於國內電商收入上升等因素,中國已成為全球最大的包裝材料消費國。據印度塑膠工業協會稱,印度包裝工業位居世界第五,每年以22-25%左右的速度成長。由於高技術純熟勞工和低廉的人事費用,食品包裝和加工成本可比歐洲低40%。人口的成長和對包裝的需求的增加預計將推動市場的發展。

- 同樣,到2022年,歐洲食品和飲料業將僱用460萬人,創造收益11,590億美元,付加價值2,300億歐元(2,423.7億美元),成為歐洲最大的製造業之一。歐洲。由於該地區食品和飲料行業的成長,導致對食品包裝的需求增加,擴大了所覆蓋的市場。

- 根據聯邦統計局統計,2022年德國包裝產業收益達350.4億歐元(377.1億美元),較前一年成長。

- 這些因素被認為支持了所研究市場的包裝領域的需求。

預計亞太地區將主導市場

- 亞太地區在市場上佔據主導地位,並可能在預測期內繼續保持主導地位。

- 全部區域包裝應用的增加、對電氣和電子產品的強勁需求以及汽車和運輸行業的快速成長正在積極推動苯乙烯市場的發展。

- 據ZEVI稱,2021年亞洲電子市場規模達3.11兆歐元(3.67兆美元),成長10%。預計 2022 年需求將成長 13%,2023 年將成長 7%。中國的市場是全世界最大的,比所有已開發國家的總和還要重要。 2021年,中國市場貢獻了2.7兆美元(2.45兆美元),佔全球市場的41.6%。此外,中國電子產業到2022年將成長14%,預計到2023年將成長8%。

- 根據中國工業協會統計,中國擁有全球最大的汽車生產基地,2022年汽車產量將達2,700萬輛,比去年的2,600萬輛成長3.4%。

- 中國是世界主要包裝工業之一。由於客製化包裝的興起和食品業對包裝消費品的需求不斷增加,預計該國在預測期內將持續成長。根據Interpack預測,2023年中國食品包裝產業包裝總數預計將達到4,470億件。

- 據行業出版物稱,總合超過350萬噸的聚苯乙烯和ABS塑膠新工廠將於2021-2022年投產,其中包括中石化古雷、浙江石化和山東利華亞等公司的新設施。那然而,由於國內能源危機,可能會出現延誤。

- 同樣,根據印度包裝工業協會(PIAI)的數據,印度包裝行業在預測期內預計將以 22% 的速度成長。此外,預計到2025年,印度包裝市場將達到2,048.1億美元,2020年至2025年的年複合成長率為26.7%。因此,該地區的塑膠射出成型市場預計將成長。

- 就電子領域而言,根據電子情報技術產業協會(JEITA)預測,2022年全球電子資訊科技產業產值預估為3.44兆美元,較2017年的3.36兆美元與前一年同期比較,成長率為2021年將達1兆美元。

- 因此,上述因素顯示該地區各終端用戶對苯乙烯的需求不斷增加。

苯乙烯產業概況

所研究的市場在主要企業中部分分散。主要企業包括(排名不分先後)殼牌公司、雪佛龍菲利普斯化學公司、SABIC、雷普索爾和英力士。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 消費性電器產品產業需求不斷成長

- 包裝產業需求增加

- 其他司機

- 抑制因素

- 包裝行業擴大使用生物基塑膠

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 產品類別

- 聚苯乙烯

- 丙烯腈 丁二烯 苯乙烯

- 苯乙烯-丁二烯橡膠

- 其他產品種類(苯乙烯-丙烯腈)

- 最終用戶產業

- 包裝

- 建造

- 消費品

- 汽車和交通

- 電氣和電子

- 其他最終用戶產業(紡織)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 沙烏地阿拉伯

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Chevron Phillips Chemical Company

- Covestro AG

- Hanwha Group

- INEOS(INEOS Styrolution)

- LG Chem

- LyondellBasell Industries Holdings BV

- Reliance Industries Ltd

- Repsol

- SABIC

- Shell PLC

- Versalis SpA(Eni SpA)

第7章市場機會與未來趨勢

- 持續研究開發生物基聚苯乙烯

- 其他機會

The Styrene Market size is estimated at 34.44 Million tons in 2024, and is expected to reach 44.62 Million tons by 2029, growing at a CAGR of 5.32% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the styrene market. However, the market recovered significantly in 2021, owing to rising consumption of various industries, such as packaging, construction, automotive, and others.

Key Highlights

- Over the short term, the growing demand from the consumer electronics industry is a major factor driving the growth of the market studied.

- However, increasing usage of bio-based plastics in the packaging industry is likely to restrain the growth of the market.

- Nevertheless, ongoing research to develop bio-based polystyrene is likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region dominates the styrene market, with the largest consumption coming from countries such as China, Japan, ASEAN countries, etc.

Styrene Market Trends

Packaging Industry to Drive the Market

- Styrene is commonly used in the packaging industry due to its favorable properties. It is a versatile, lightweight plastic with excellent clarity, impact resistance, and thermal insulation. These characteristics make it suitable for a wide range of packaging applications.

- One of the most common uses of styrene in the packaging industry is in producing polystyrene foam, often referred to as expanded polystyrene (EPS) or Styrofoam. EPS foam is widely used for protective packaging, including cushioning materials, insulation for perishable goods, and lightweight shipping containers.

- Styrene is also used to produce rigid polystyrene, which is commonly employed in food packaging. Clear polystyrene containers, such as clamshells, cups, and trays, are popular in the food service industry due to their transparency, allowing customers to view the contents easily.

- Furthermore, polystyrene is also used in the medical and healthcare industries for various packaging applications; IQVIA shows that the global pharmaceutical market has grown significantly in recent years. The total global pharmaceutical market was valued at USD 1.48 trillion by 2022. This is only a slight increase from 2021 when the market was valued at USD 1.42 trillion.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food.

- China is the world's largest packaging consumer across the world owing to the factors such as growing per capita income, coupled with rising e-commerce giants in the country. India's packaging industry is the fifth-largest in the world, and it is growing at about 22-25% per year, as per the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Similarly, in 2022, the Europe food and beverages industry employs 4.6 million people and generates EUR 1.1 trillion (USD 1.159 trillion) in revenue and EUR 230 billion (USD 242.37 billion) in value-added, making it one of the largest manufacturing industries in Europe. Thereby, the growing food and beverages industry in the region is increasing the demand for food packaging, as well as boosting the market studied.

- According to Statistisches Bundesamt, the revenue of the packaging industry in Germany has reached EUR 35.04 billion (USD 37.71 billion) in 2022 and has registered growth when compared to previous years.

- Such factors are likely to support the demand for the studied market from the packaging segment.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market and will likely continue its dominance during the forecast period.

- Increasing packaging applications across the region, robust demand for electrical and electronic products, and the rapid growth of automotive and transportation sectors are actively boosting the styrene market.

- According to ZEVI, the Asian electro market reached EUR 3.11 trillion (USD 3.67 trillion) in 2021, a 10% rise. The demand increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even more significant than the combined markets of all industrialized countries. In 2021, the Chinese market contributed EUR 2.07 trillion (USD 2.45 trillion), or 41.6% of the world market; additionally, the Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year.

- China is one of the key packaging industries in the world. The country is expected to witness consistent growth during the forecast period due to the rise of customized packaging and increased demand for packaged consumer goods in the food segment. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023.

- According to industry publications, in 2021-2022, new factories for polystyrene and ABS plastics were expected to launch with a combined capacity of over 3.5 million tons, including new facilities for companies like Sinopec Gulei, Zhejiang Petrochemical, and Shandong Lihuaya. However, a delay may be observed due to the energy crisis in the country.

- Similarly, according to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the plastic injection molding market is expected to grow in the region.

- Considering electronics, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3.44 trillion in 2022, registering a growth rate of 1% year on year, compared to USD 3.36 trillion in 2021.

- Thus, the abovementioned factors indicate the rising demand for styrene from various end users in the region.

Styrene Industry Overview

The market studied is partially fragmented among the top players. The key players (not in any particular order) include Shell PLC, Chevron Phillips Chemical Company LLC, SABIC, Repsol, and INEOS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Consumer Electronics Industry

- 4.1.2 Increasing Demand from Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Usage of Bio-based Plastics in the Packaging Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Polystyrene

- 5.1.2 Acrylonitrile Butadiene Styrene

- 5.1.3 Styrene Butadiene Rubber

- 5.1.4 Other Product Types (Styrene-Acrylonitrile)

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Construction

- 5.2.3 Consumer Goods

- 5.2.4 Automotive and Transportation

- 5.2.5 Electrical and Electronics

- 5.2.6 Other End-user Industries (Textile)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company

- 6.4.2 Covestro AG

- 6.4.3 Hanwha Group

- 6.4.4 INEOS (INEOS Styrolution)

- 6.4.5 LG Chem

- 6.4.6 LyondellBasell Industries Holdings BV

- 6.4.7 Reliance Industries Ltd

- 6.4.8 Repsol

- 6.4.9 SABIC

- 6.4.10 Shell PLC

- 6.4.11 Versalis SpA (Eni SpA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research to Develop Bio-based Polystyrene

- 7.2 Other Opportunities