|

市場調查報告書

商品編碼

1437491

化妝品/香水玻璃瓶:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cosmetics And Perfumery Glass Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

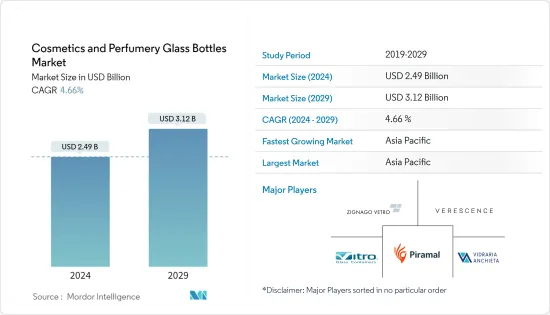

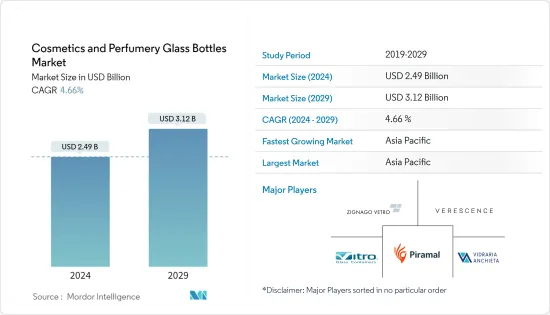

化妝品/香水玻璃瓶市場規模預計到 2024 年為 24.9 億美元,預計到 2029 年將達到 31.2 億美元,在預測期內(2024-2029 年)市場規模增加 46.6 億美元。將以複合年成長率成長的%。

化妝品行業的包裝要求是所有行業中最多樣化的,化妝品包裝正在穩步成長。化妝品行業現在似乎正在聯合起來,透過深思熟慮的新包裝策略和複雜的配方來減少塑膠污染的影響。

主要亮點

- 玻璃是最古老的包裝材料之一,無孔且不滲透。具有惰性的特性。玻璃增強了產品的高階吸引力,讓買家可以看到裡面的東西及其顏色,這樣他們就知道他們得到的東西。這是許多化妝品包裝使用玻璃的主要原因之一。

- 隨著公司積極尋求化妝品包裝中常用的傳統塑膠(如熱固性材料)的替代品,對可持續解決方案的需求正在迅速增長。 這些材料不可回收。 因此,由於政府實施的各種包裝法規,您可能會面臨限制。 此外,某些材料,如ABS,將受到即將到來的特定地區條件的影響,這促使公司轉向更可持續的解決方案,如玻璃包裝。

- 優質包裝的使用在提高消費者對品牌的滿意度方面發揮著重要作用,這反過來又增加了他們再次購買該產品或推薦給其他人的可能性。全球化妝品和香水玻璃包裝市場的主要企業致力於透過推出專為化妝品和香水應用設計的各種優質玻璃包裝產品來擴展其產品線。預計這將在預測期內增加對此類包裝的需求。

- 傳統上,化妝品包裝的首選材料是鋁和玻璃。隨著時間的推移,這些材料由於原料價格和其他因素而變得昂貴,並且不再為大眾消費的包裝產品提供經濟可行的解決方案。這引入了塑膠作為一種選擇。

- COVID-19 危機表明,世界可能會迅速變化並導致需求大幅波動。在某些情況下,供應跟不上需求。甚至在大流行之前,個人護理公司就面臨著改變其產品創新管道的壓力,這是受到數位原民面向消費者公司在不到一個月的時間內從概念到櫥櫃的能力的啟發。

化妝品/香水玻璃瓶的市場趨勢

香水區隔市場預計將大幅成長

- 由於對天然香料的需求超過合成成分以及豪華香水的日益普及,預計該市場在預測期內將大幅成長。這種需求的增加促使公司投資於香水瓶的創新設計。另外,香水玻璃瓶因其圓潤的造型和良好的反光度,成為高級奢侈品瓶。

- 消費者越來越意識到自己對全球環境的影響,並尋求永續且減少廢棄物的產品。因此,可再填充玻璃瓶的需求不斷增加。可再填充香水瓶可透過消除一次性包裝的需要並減少塑膠廢棄物來體現這些價值。玻璃是可再填充香水瓶的可靠選擇,因為它可以完全、永久地回收,而不會造成任何品質劣化。

- 此外,可再填充的罐子還可以為消費者和製造商節省資金。 消費者可以購買這些瓶子作為具有成本效益的長期解決方案,因為他們可以以比每次購買新瓶子更低的價格購買香水補充裝。 此外,這種可再填充的瓶子是一個穩定的收入來源,因為它會定期購買香水補充裝。

- 對男女皆宜的奢華香水的需求不斷成長,預計也將增加化妝品行業對玻璃瓶的需求。世界各地的客戶希望自己的願望和偏好得到認可,而不是性別。世界各地推出的多種產品也出現了類似的趨勢,增加了玻璃瓶的需求。

- 根據Trefis.com統計,全球香水市場近年來穩定成長,從2017年的398億美元成長到2025年的524億美元。預計在預測期內香水和香精產品將持續成長。 ,玻璃瓶及容器的需求將成比例上升。

亞太地區預計將經歷最高成長

- 由於國家經濟的快速成長和購買力不斷增強的中階的出現,中國的包裝產業正在快速穩定地發展。近年來,隨著中國化妝品市場的大幅成長,對化妝品包裝的需求不斷增加。化妝品和香水包裝類別將面臨課題和機遇,而中國消費者生活方式的新趨勢正在影響對玻璃包裝的需求。

- 玻璃包裝可保護護膚品免受濕氣、空氣和紫外線的影響。許多護膚品都含有敏感成分,應盡量保存。保護護膚品的最佳方法是使用玻璃包裝。這使產品盡可能保持清潔和最有效。

- 此外,人們對韓國產品感興趣的原因之一是他們認為韓國護膚品注重消費者的健康和福祉。這些產品被認為是用包裝標籤上列出的天然成分製成的。該產品因其實惠的價格和有吸引力的設計而具有吸引力。隨著消費者越來越意識到社群媒體的好處、影響力以及產品的獨特性,人們更有可能投資這些產品。

- 隨著趨勢和消費者喜好的變化,玻璃在化妝品和香水行業的使用不斷發展。該領域的知名品牌正在嘗試新的設計和技術,以創造獨特而優雅的包裝解決方案,以體現其產品的高品質。

化妝品/香水玻璃瓶產業概況

化妝品/香水玻璃瓶市場競爭激烈且分散,由多家大型企業組成。從市場佔有率來看,目前很少大公司佔據市場主導地位。這些領先的公司憑藉主導的市場佔有率,專注於在多個國家/地區擴大客戶群。市場上的供應商正在利用策略合作舉措推動包裝產業的創新,包括 Verense France、Vidraria Anchieta、Vitro SAB de CV、Zignago Vetro SpA 和 Piramal Glass Private Limited。

2023 年 9 月,Veresens 與 Albea Cosmetics and Fragrances 合作提供 Albea 可再填充 TWIRL 化妝品罐的高級版本。該底座由西班牙 Verescent 製造,採用玻璃成分「Infinite Glass」20,其中整合了 20% 的消費後回收 (PCR) 玻璃,並提供滿足奢侈品牌美學要求的色調。

2023 年 2 月,瑞士優質品牌 La Colline 選擇 Stolzle 的標準「Classic Slim」瓶來生產其新款 Native Age 精油。 Classic Slim 是一款 30 毫升的薄圓柱形瓶。 La Colline 選擇 Stölzl 作為可靠的製造商,並要求 Stölzl 為瓶子製作特殊裝飾。油採用標準 30 毫升圓柱形瓶裝,稱為 Classic Slim。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 滴管瓶的需求不斷成長

- 更加重視包裝以實現產品差異化

- 市場限制因素

- 塑膠包裝作為玻璃瓶替代品的成長

第6章市場區隔

- 依產品類型

- 香水

- 指甲保養

- 護膚

- 其他

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 韓國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Verescence France

- Vidraria Anchieta

- Vitro SAB De CV

- Zignago Vetro SpA

- Piramal Glass Private Limited(Piramal Group)

- Pragati Glass Pvt Ltd

- Berlin Packaging LLC

- Nekem Packaging

- SGB Packaging Group Inc.

- SKS Bottle &Packaging Inc.

- Stoelzle Oberglas Gmbh(CAG-Holding Gmbh)

- Apackaging Group LLC

- Baralan International SpA

- Bormioli Luigi SpA

- Roetell Group(Jiangsu Rongtai Glass Products Co. Ltd)

- Continental Bottle Company Ltd

- DSM Packaging Sdn Bhd

- Gerresheimer AG

- Heinz-Glas Gmbh &Ko. Kgaa

- Lumson SpA

第8章投資分析

第9章市場的未來

The Cosmetics And Perfumery Glass Bottles Market size is estimated at USD 2.49 billion in 2024, and is expected to reach USD 3.12 billion by 2029, growing at a CAGR of 4.66% during the forecast period (2024-2029).

The cosmetic industry has the most varied packaging requirements among all sectors, and the packaging for cosmetics has been increasing steadily. The cosmetics industry now seems united to reduce the impact of plastic pollution with new thoughtful packaging strategies and refined formulations.

Key Highlights

- Glass is one of the oldest packaging materials, which is nonporous and impermeable. It does not degrade, providing chemically inert properties. Glass adds to the premium appeal of the products and allows buyers to see the content and its color, giving them an idea of what they are getting. This is one of the main reasons why glass is used in the packaging of many cosmetics.

- The pace of demand for sustainable solutions is rapidly increasing as companies are actively searching for alternatives to conventional plastics commonly used in cosmetics packaging, including thermoset materials. These materials are not recyclable; therefore, they may face restrictions under various packaging regulations imposed by the government. Additionally, certain materials, such as ABS, are subject to upcoming region-specific conditions, prompting companies to shift toward more sustainable solutions such as glass packaging.

- The utilization of premium packaging plays a crucial role in elevating consumer satisfaction with a brand, and consequently, it increases the likelihood of them purchasing the product again and recommending it to others. The key players operating in the global cosmetic and perfume glass packaging market focus on expanding their product lines by introducing diverse luxury glass packaging products designed for cosmetic and perfume applications. This is expected to drive up the demand for this type of packaging over the forecast period.

- Traditionally, the preferred materials across cosmetic packaging have been aluminum and glass. Over time, these materials became expensive due to raw material prices and other factors and could not provide economically viable solutions for packaging products across mass consumption. That marked the advent of plastics as an option.

- The COVID-19 crisis demonstrated that the world may change quickly, causing significant fluctuations in demand. Sometimes, supply cannot keep up with demand. The personal care firms were under pressure to alter their product-innovation pipelines even before the pandemic, inspired by the ability of digital-native direct-to-consumer firms to move from concept to cabinet in less than a month.

Cosmetics And Perfumery Glass Bottles Market Trends

The Perfume Segment is Expected to Register Significant Growth

- With the demand for natural fragrances over synthetic-based ingredients and the increased popularity of luxury perfumes, the market is expected to grow significantly during the forecast period. This increased demand has made companies invest in innovative designs for perfume bottles. Also, perfume glass bottles are high-end luxury bottles because of their well-rounded shapes and good reflectivity.

- With consumers becoming more aware of their impact on the global environment, they are looking for products that are sustainable and reduce waste. Consequently, there is a growing demand for refillable glass bottles. Refillable perfume bottles reflect these values by eliminating the need for disposable packaging and reducing plastic waste. Since glass is completely recyclable indefinitely without degrading in quality, it is an uncontested choice for refillable perfume bottles.

- In addition, refillable bottles also offer cost savings for consumers and manufacturers. Consumers can buy these bottles for a cost-effective long-term solution, as they can buy perfume refills for a lower price than buying new bottles every time. Also, these refill bottles provide a steady income stream, as they buy perfume refills regularly.

- The growing demand for unisex luxury perfume is also expected to drive the need for glass bottles in the cosmetic sector. Customers across the globe want to be recognized for their wants and tastes, not for their gender. Several worldwide launches are witnessing similar trends, expanding the demand for glass bottles.

- According to Trefis.com, the global fragrance market has witnessed steady growth in the past few years, from USD 39.80 billion in 2017 to USD 52.40 billion in 2025. This constant growth in perfume and fragrance products is expected to be witnessed during the forecast period, which would proportionally push the demand for glass bottles and containers.

Asia-Pacific is Expected to Witness the Highest Growth

- China's packaging industry is expanding rapidly and steadily due to the country's fast-growing economy and the rising middle class with increased purchasing power. Cosmetic packaging is in high demand as China's cosmetic market has experienced significant growth in recent years. The cosmetic and perfume packaging category will face challenges and opportunities, but new trends in the Chinese consumer lifestyle are influencing the demand for glass packaging.

- Glass packaging protects the skincare products from moisture, air, and UV rays. Many skincare products contain sensitive ingredients that must be preserved as much as possible. The best way to protect skincare products is to use glass packaging. This ensures that the products are in the cleanest and most effective condition possible.

- Additionally, one of the reasons why people are interested in Korean products is because they believe that Korean skincare products focus on the health and well-being of consumers. These products are believed to be made with natural ingredients mentioned on the packaging label. The affordable price and attractive design of these products have made them irresistible. With the growing awareness of the benefits, the social media influence, and the uniqueness of the products among consumers, people are more likely to invest in these products.

- The use of glass in the cosmetics and perfume industry continues to evolve with changing trends and consumer preferences. Leading brands in the sector are experimenting with new designs and techniques to create a unique and elegant packaging solution that reflects the high quality of their products.

Cosmetics And Perfumery Glass Bottles Industry Overview

The cosmetics and perfumery glass bottles market is highly competitive and fragmented, consisting of several major players. In terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across several countries. The vendors in the market are leveraging strategic collaborative initiatives to drive innovations in the packaging industry, and some of them are Verescence France, Vidraria Anchieta, Vitro S.A.B. de C.V, Zignago Vetro SpA, and Piramal Glass Private Limited.

In September 2023, Verescence and Albea Cosmetics and Fragrance joined forces to offer the premium version of Albea's refillable TWIRL cosmetic bottle. The base, produced by Verescence in Spain, features its glass composition "Infinite Glass"20," integrating 20% Post-Consumer Recycled (PCR) glass and providing a tint that meets luxbrands'nds' aesthetic demands.

In February 2023, La Colline, a Swiss premium brand, selected Stoelzle's standard 'Classic Slim' bottle for its new Native Age oil. The Classic Slim is a thin, cylindrical 30 ml bottle. La Colline chose Stoelzle as a trusted manufacturer, and they also asked Stoelzle to create a special decoration for their bottle. The oil is available in a standard 30 ml bottle called the Classic Slim, which is a cylindrical bottle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Dropper Bottles

- 5.1.2 Increased Emphasis on Packaging for Product Differentiation

- 5.2 Market Restraints

- 5.2.1 Growth of Plastic Packaging as a Substitute for Glass Bottles

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Perfumes

- 6.1.2 Nail Care

- 6.1.3 Skin Care

- 6.1.4 Other Product Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 South Korea

- 6.2.3.3 India

- 6.2.3.4 Japan

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verescence France

- 7.1.2 Vidraria Anchieta

- 7.1.3 Vitro S.A.B. De C.V.

- 7.1.4 Zignago Vetro SpA

- 7.1.5 Piramal Glass Private Limited (Piramal Group)

- 7.1.6 Pragati Glass Pvt Ltd

- 7.1.7 Berlin Packaging LLC

- 7.1.8 Nekem Packaging

- 7.1.9 SGB Packaging Group Inc.

- 7.1.10 SKS Bottle & Packaging Inc.

- 7.1.11 Stoelzle Oberglas Gmbh (CAG-Holding Gmbh)

- 7.1.12 Apackaging Group LLC

- 7.1.13 Baralan International SpA

- 7.1.14 Bormioli Luigi SpA

- 7.1.15 Roetell Group (Jiangsu Rongtai Glass Products Co. Ltd)

- 7.1.16 Continental Bottle Company Ltd

- 7.1.17 DSM Packaging Sdn Bhd

- 7.1.18 Gerresheimer AG

- 7.1.19 Heinz-Glas Gmbh & Ko. Kgaa

- 7.1.20 Lumson SpA