|

市場調查報告書

商品編碼

1273466

智能太陽能解決方案市場——增長、趨勢和預測 (2023-2028)Smart Solar Solutions Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,智能太陽能解決方案市場預計將以 14.8% 的複合年增長率註冊。

主要亮點

- 世界上不斷增長的城市人口正在增加對資源的需求。由於自然資源的枯竭,組織正在創新利用替代能源來滿足他們的基本需求。此外,政府補貼和提高轉換效率推動了市場增長。

- 智能太陽能解決方案通過實時監控和通信幫助用戶減少電費並提高太陽能組件的效率。傳統發電技術嚴重依賴不可再生能源,產生大量污染。此類資源的有限供應引發了對可再生能源日益增長的需求。

- 此外,不斷上漲的電價和政府對太陽能的補貼正在推動智能太陽能解決方案市場的發展。此外,智慧城市的普及和綠色能源倡議的增加等各種趨勢正在進一步增加發達國家和新興經濟體對智能太陽能解決方案的需求。

- 隨著光伏 (PV) 安裝成本的下降,提供更高效率和實時監控的智能太陽能解決方案的採用正在蓬勃發展。例如,根據國際可再生能源署(IRENA)的數據,全球太陽能光伏的平均安裝成本已從2010年的4808美元/千瓦降至2021年的857美元/千瓦。

- 此外,隨著世界化石燃料的枯竭,可再生能源在能源領域發揮著重要作用。太陽能正在成為滿足不斷增長的消費者需求以及對更可靠和低成本能源供應的需求的首選解決方案。智能太陽能解決方案的市場供應商在集成基於雲的產品、物聯網 (IoT)、人工智能 (AI) 和機器學習 (ML) 等先進技術方面取得了更大的進步,並且正在擴展商業、工業和住宅應用中對智能太陽能解決方案的需求預計將進一步增加。

- 由於 COVID-19 導致各種商業和工業部門的業務關閉,對智能太陽能解決方案的需求已大大減少。另一方面,隨著全球活動恢復正常,預計全球智能太陽能市場將在預測期內顯著增長。

智能太陽能解決方案的市場趨勢

政府對太陽能的補貼推動市場增長

- 住宅、商業和工業終端用戶對能源的需求不斷增長,自然資源日益枯竭,因此需要抑制能源消耗並轉向更高效、更清潔的能源生產。世界各國政府紛紛出台優惠政策和補貼政策,大力推廣太陽能、風能等可再生能源。

- 世界各國政府都在尋找具有成本效益的解決方案。通過提供補貼和轉向綠色解決方案,它鼓勵公眾採用智能太陽能解決方案。例如,新能源和可再生能源部 (MNRE) 已採取多項政策措施幫助印度實現其 2022 年的太陽能發電目標。

- 國家關稅政策 (NTP) 已修改為包括可再生能源發電義務 (REGO) 和可再生能源購買義務 (RPO) 條款。該政策要求國有配電公司到 2022 年從太陽能中購買 8% 的能源。此外,火電廠運營企業有義務在新安裝的發電設備中安裝一定數量的可再生能源組件。

- 中國光伏產業是近年來增長最快的市場。通過一些政策變化和激勵措施,中國在太陽能技術和製造方面取得了長足進步。儘管中國繼續使用常規能源作為其能源結構的主要來源,但其作為可再生能源主要生產國的作用不容低估。此外,根據其氣候變化承諾,該國的目標是到 2030 年擁有 1,200GW 的太陽能和風能裝機容量。這種市場發展進一步刺激了市場增長。

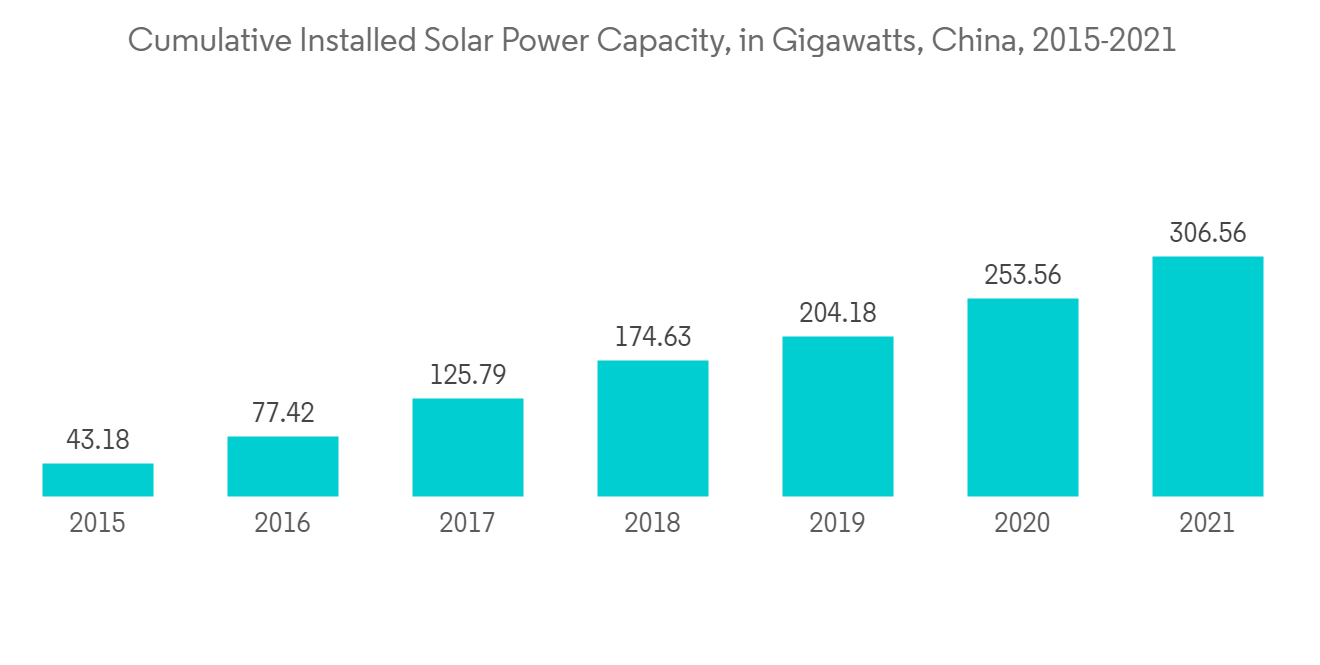

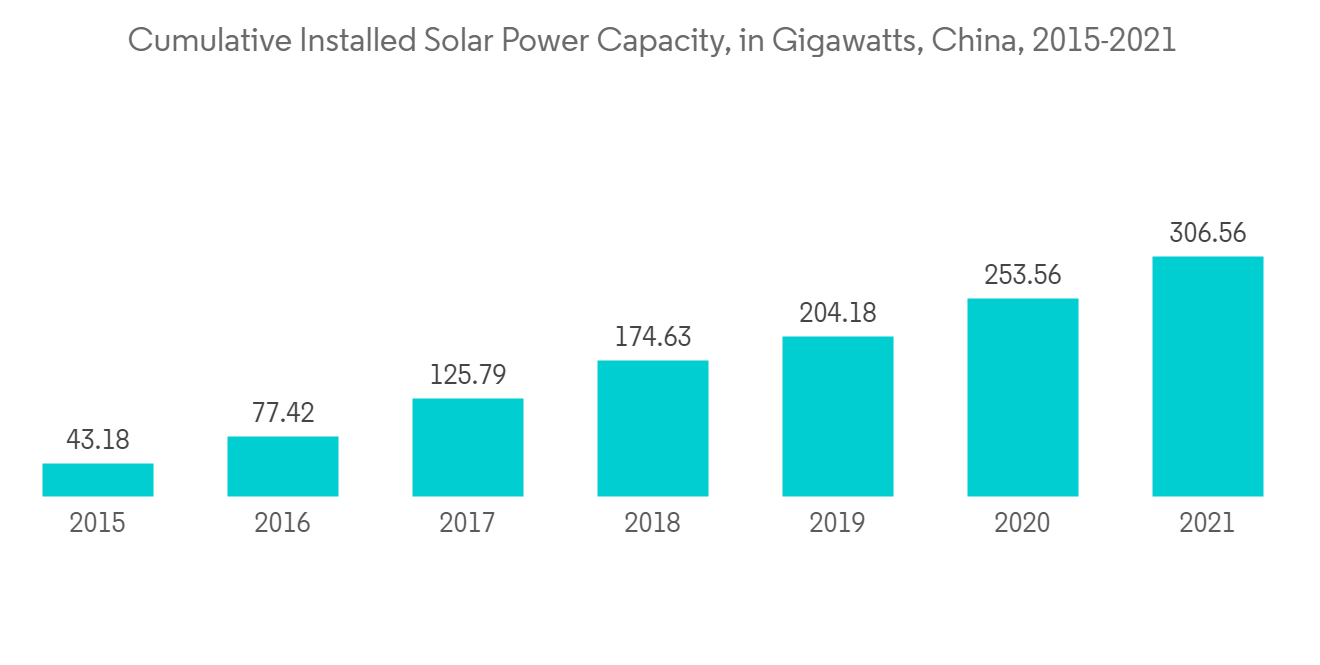

- 例如,根據China Electronics Corporation(CEC)和China Energy Portal(CEP)的數據,中國太陽能光伏累計裝機容量從2015年的4318萬千瓦增加到2021年的3065萬千瓦。此外,根據國家能源局 (NEA) 的數據,中國在 2022 年安裝了 87.4GW 的太陽能。

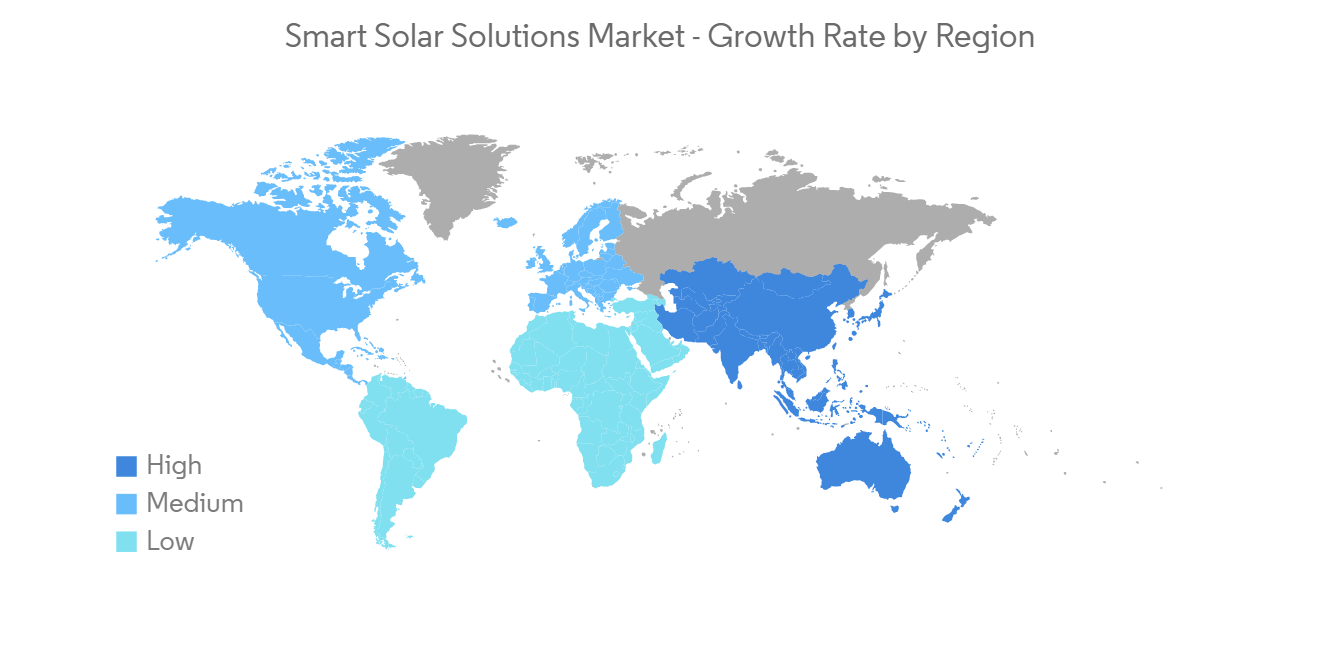

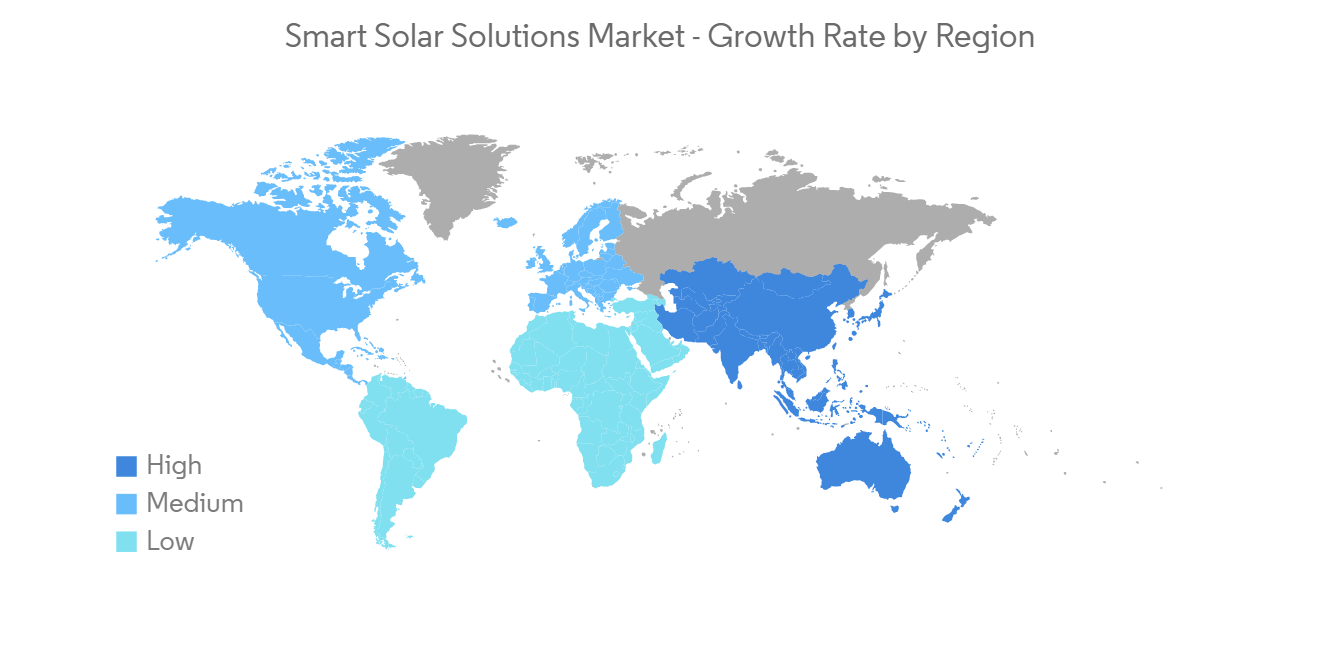

亞太地區在預測期內顯示出顯著的增長率

- 智能太陽能解決方案在亞太地區廣泛流行。該地區的許多國家將智能太陽能解決方案視為創新的中間增長。還分析了各種政府舉措以及對太陽能發電的補貼,以影響未來幾年的市場增長。

- 隨著能源行業的重心轉向可再生能源,該地區的太陽能行業需求不斷增加,最近日本的上網電價 (FIT) 等優惠政策就表明了這一點。日本、印度和韓國增加對電網自動化和需求響應的投資正在促進該行業的發展。

- 此外,中國和印度等國家已顯著加快太陽能和風能等可再生能源的部署,以實現其氣候目標。預計這些發展將推動這些國家對智能太陽能解決方案的需求。例如,根據中國國家能源局(NEA)的數據,截至2022年10月末,中國太陽能光伏裝機容量達到360GW,同比增長29%。中國在 2022 年前 10 個月的累計新增容量為 58.2GW,其中 10 月份部署了超過 5.6GW 的太陽能。

- 此外,該地區的市場供應商正在開發創新解決方案,將傳統太陽能係統升級為智能太陽能係統,對亞太地區的市場增長產生積極影響。例如,2022 年 6 月,Servotech Power Systems 開發了一款名為 ComPort 的太陽能性能監測和控制設備。該設備識別缺陷、發出通知、診斷問題並建議操作和維護操作。此外,該設備可以集成到任何家用混合/離網太陽能係統中,將其變成智能太陽能係統。

智能太陽能解決方案行業概覽

智能太陽能解決方案市場高度分散,Siemens AG、ABB Ltd、General Electric、Schneider Electric SE 等許多利基參與者和行業領導者佔據了市場份額。隨著公司尋求針對特定挑戰量身定制的多種解決方案,而不是可以同時做多項事情的技術解決方案,太陽能軟件領域的趨勢正變得更加分散。

2023 年 1 月,Itron 擴展了其分佈式智能 (DI) 平台,為任何設備啟用智能並加速能源轉型。該公司推出了一種新的 DI 網絡接口卡 (NIC),可以為第三方設備啟用邊緣計算,將網格分析、決策制定和控制轉移到網格邊緣,顯著縮短行動時間,顯著提高態勢感知能力,更準確的分析和高級事件檢測。世界上第一個 DI NIC 將在創建將電動汽車和太陽能等分佈式能源整合到低壓網絡的新應用方面發揮關鍵作用。

2022 年 12 月,全球領先的智能太陽能跟蹤器和軟件解決方案提供商 Nextracker 與 Amara Raja Power Systems Limited 簽署了主供應協議 (MSA),以支持 National Thermal Power Corporation (NTPC) Limited 的 Nokh Solar 項目交付了一項屢獲殊榮的項目太陽能跟蹤器(即將成為印度最大的太陽能公園之一)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 工業吸引力——波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 的市場影響評估

- 行業價值鏈分析

第五章市場動態

- 市場驅動力

- 政府對太陽能的補貼推動增長

- 降低安裝成本,提高轉換效率

- 市場製約因素

- 維護和運營成本高

第六章市場細分

- 按產品

- 太陽能電池

- 太陽能板

- 逆變器

- 發電機

- 其他產品

- 按溶液

- 資產管理

- 網絡監控

- 儀表數據管理

- 遙測

- 按最終用戶應用

- 商業的

- 行業

- 住房

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第七章競爭格局

- 公司簡介

- Siemens AG

- ABB Ltd

- GENERAL ELECTRIC

- Schneider Electric SE

- Itron, Inc.

- Vivint, Inc.

- Smart Solar Ltd.

- Trilliant Incorporated

- UGE International Ltd.

- Aclara Software Inc.

第八章投資分析

第 9 章 市場機會和未來趨勢

The smart solar solutions market is expected to register a CAGR of 14.8% over the forecasted period.

Key Highlights

- The increase in urban population worldwide has created an increase in resource demand. The depletion of natural resources is making organizations innovate to utilize alternative resources to extract energy for the necessities of life. Further, government subsidies and increasing conversion efficiency drive the market's growth.

- Smart solar solutions help users reduce their electricity expenses and increase the efficiency of solar components by monitoring and communicating in real time. Traditional power generation techniques depend a lot on non-renewable energy sources and generate a lot of pollution. The limited supply of these resources triggered the need for renewable energy sources.

- Moreover, increasing power tariffs and government subsidies on solar power drive the smart solar solutions market. In addition, various trends, such as the proliferation of smart cities and growth in green energy initiatives, further spur the demand for smart solar solutions in developed as well as developing economies.

- Decreasing installation costs of solar photovoltaics (PVs) has led to the proliferation in the adoption of smart solar solutions for better efficiency and monitoring in real-time. For instance, according to the data from International Renewable Energy Agency (IRENA), the average installed cost of solar photovoltaics worldwide declined from USD 4,808 per kW in 2010 to USD 857 per kW in 2021.

- Moreover, renewable energy sources play a vital role in the energy sector due to the depletion of fossil fuels in the world. Solar power is emerging as a preferred solution to fulfill ever-increasing consumer demand and the need for a more reliable and low-cost energy supply. Market vendors in smart solar solutions are further making significant strides in integrating advanced technologies such as cloud-based offerings, Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), which is further expected to grow the demand for smart solar solutions in commercial, industrial, and residential applications.

- Owing to the closure of various commercial and industrial sector businesses due to COVID-19 led to a significant fall in demand for smart solar solutions. On the other hand, with global activities returning to normal, the global market of smart solar is expected to grow considerably during the forecast period.

Smart Solar Solutions Market Trends

Government Subsidies on Solar Power to Drive the Market Growth

- The ever-growing energy demand from residential, commercial, and industrial end users and depleting natural resources have resulted in the need to control energy consumption and switch to more efficient and cleaner energy generation sources. Governments worldwide are introducing favorable policies and subsidies for deploying renewable power sources such as solar and wind power.

- Governments around the world are looking for cost-effective solutions. They are encouraging the public by giving subsidies and shifting to green solutions, pushing the adoption of smart solar solutions. For instance, several policy measures were set in place by the Ministry of New and Renewable Energy (MNRE) to support achieving India's 2022 solar goals.

- An amendment was made to the National Tariff Policy (NTP) to include provisions for renewable generation obligations (RGOs) and renewable purchase obligations (RPOs). The policy requires state-owned power distribution companies to purchase 8% of their energy from solar by 2022. It mandates thermal power plant operators to have a certain amount of renewable components in any newly installed capacity.

- The Chinese solar power industry has been the fastest-growing market for the past few years. China has taken giant strides in solar technology and manufacturing due to several policy changes and incentives. Even though it continues to use conventional energy as a major source in its energy mix, the country's role as a major producer of renewable energy cannot be underestimated. Further, under its climate pledge, the country aims to have 1,200 GW of solar power and wind capacity by 2030. Such developments further spur the market's growth.

- For instance, according to the data from China Electronics Corporation (CEC) and China Energy Portal (CEP), China's cumulative installed solar power capacity increased from 43.18 GW in 2015 to 306.56 GW in 2021. Moreover, according to the National Energy Administration (NEA) data, China installed 87.4 GW of solar in 2022.

Asia-Pacific to Witness a Significant Growth Rate Over the Forecast Period

- Smart solar solutions are gaining momentum extensively in Asia-Pacific. Many nations in this region consider smart solar solutions as a middle-out innovation growth. In addition, various government initiatives coupled with subsidies on solar power are analyzed to influence the market growth in the coming years.

- With the focus of the energy industry shifting toward renewable energy sources, the solar industry is witnessing increased demand from this region, as favorable policies like the feed-in tariff (FIT) scheme in Japan have shown in the recent past. Growing grid automation and demand response investments in Japan, India, and South Korea are helping this industry progress.

- Further, countries like China and India are significantly speeding up renewable installations such as solar and wind power to reach climate targets. Such developments are expected to boost these countries' demand for smart solar solutions. For instance, according to the data from China's National Energy Administration (NEA), installed solar capacity in China reached 360 GW at the end of October 2022, a 29% increase year-on-year. China's cumulative additions for the first ten months of 2022 were 58.2 GW, deploying more than 5.6 GW solar in October.

- Moreover, market vendors in the region are developing innovative solutions to upgrade the legacy solar system into smart solar systems, thus positively influencing the market's growth in the Asia-Pacific region. For instance, in June 2022, Servotech Power Systems developed a solar performance monitoring and controlling device called ComPort. The device will identify defects, issue notifications, diagnose issues and suggest operation and maintenance tasks. Further, the device can be integrated into any domestic hybrid/off-grid solar system and turn it into a smart solar system.

Smart Solar Solutions Industry Overview

The smart solar solutions market is highly fragmented, with many niche players and industry leaders like Siemens AG, ABB Ltd, General Electric, and Schneider Electric SE occupying the market share. The trend in the solar software space is towards fragmentation as companies are looking for multiple tailored solutions to their specific challenges instead of technology solutions that can do multiple things simultaneously.

In January 2023, Itron, Inc. extended its distributed intelligence (DI) platform to enable intelligence in any device, accelerating the energy transition. The company unveiled its new DI network interface card (NIC) that enables edge computing in third-party devices, moving grid analysis, decision-making, and control to the grid's edge, resulting in a significant improvement in time to action, greatly improved situational awareness, more accurate analysis, and advanced event detection. The first-of-its-kind DI NIC will be pivotal in creating new applications for integrating distributed energy resources, such as electric vehicles and solar, into the low-voltage network.

In December 2022, Nextracker, the leading global provider of intelligent solar tracker and software solutions, signed a master supply agreement (MSA) with Amara Raja Power Systems Limited to deliver its award-winning solar trackers for National Thermal Power Corporation (NTPC) Limited's Nokh Solar Project - soon to be one of India's largest solar parks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Subsidies on Solar Power Will Drive Growth

- 5.1.2 Decreasing Installation Cost and Increasing Conversion Efficiency

- 5.2 Market Restraints

- 5.2.1 High Maintenance and Operation Cost

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Photovoltaic Cells

- 6.1.2 Photovoltaic Panels

- 6.1.3 Inverters

- 6.1.4 Generators

- 6.1.5 Other Products

- 6.2 By Solution

- 6.2.1 Asset Management

- 6.2.2 Network Monitoring

- 6.2.3 Meter Data Management

- 6.2.4 Remote Metering

- 6.3 By End-User Application

- 6.3.1 Commercial

- 6.3.2 Industrial

- 6.3.3 Residential

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 ABB Ltd

- 7.1.3 GENERAL ELECTRIC

- 7.1.4 Schneider Electric SE

- 7.1.5 Itron, Inc.

- 7.1.6 Vivint, Inc.

- 7.1.7 Smart Solar Ltd.

- 7.1.8 Trilliant Incorporated

- 7.1.9 UGE International Ltd.

- 7.1.10 Aclara Software Inc.