|

市場調查報告書

商品編碼

1432940

即時定位系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Real Time Location System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

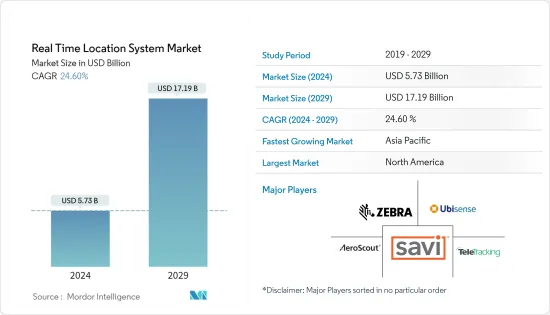

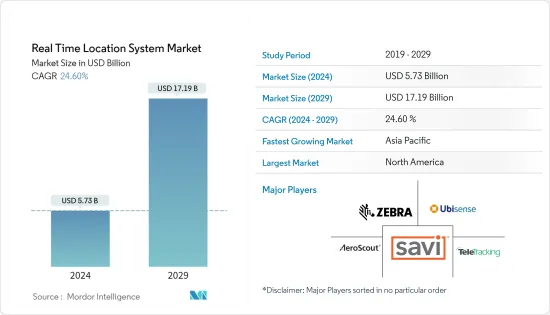

即時定位系統市場規模預計到2024年為57.3億美元,預計到2029年將達到171.9億美元,在預測期內(2024-2029年)複合年成長率為24.60%。

主要亮點

- 即時定位系統根據透過無線系統收集的即時資訊可協助確定物體的當前位置。它對於室內物體追蹤也很有用。因此,由於室內追蹤成為可能,該系統擴大在醫療保健領域被採用,並有望促進醫療保健領域 RTLS 市場的成長。

- 例如,據思科稱,預計到 2030 年將有 5,000 億台設備連接到網際網路。物聯網和穿戴式裝置的不斷發展趨勢使組織能夠做得更多、更快、提高生產力,並提供洞察以實現更好的用戶體驗和參與度。

- 各行業正在選擇 RTLS 來降低工作場所事故的風險。 RTLS 可協助您隨時了解堆高機、車輛和操作員的確切位置。根據收集的資料,RTLS 分析流量,識別並消除工作場所事故,並消除工作流程瓶頸,以節省時間和金錢。

- 即時定位系統也可以是醫院監控業務的有效方式,作為防範潛在訴訟的保險。大多數醫院與患者都有約定,例如工作人員檢查患者的頻率以及患者接受醫療程序的頻率。這些在患有嚴重和各種精神疾病的患者中尤其常見。 RTLS 可用作此類訴訟的保險。

- 藍牙標準已在世界各地廣泛採用。低功耗藍牙 (BLE) 解決方案比其他技術更便宜,更容易與現有系統和裝置整合。使用藍牙標籤的 RTLS 可提供高達 1.5 公尺(約 5 英尺)的偵測精度,適用於各種醫療保健應用。高昂的初始設定和維護成本可能會阻礙預測期內的市場成長。

- 由於 COVID-19 爆發,醫院正在利用 RFID 技術在疫情期間更好地管理患者和員工。 RFID 工具使用無線通訊來識別和追蹤資產和設備,在醫療保健領域中廣泛採用。隨著公共衛生緊急情況的持續,RFID 提高了護理團隊的效率和課責。

即時位置資訊系統市場趨勢

醫療保健產業具有成長潛力

- 隨著世界人口和患者數量的增加,病人安全已成為首要且關鍵的公共衛生議題。據世界衛生組織稱,到 2022 年,用藥錯誤預計將成為每百萬人中有 1 人死亡的原因。在擁有 4.47 億人口的歐盟,這意味著每年有 163,000 人死亡。根據西班牙、德國和美國的統計,歐洲每年有6萬至13.1萬人死亡。

- 根據世界衛生組織(WHO)的統計,患者因醫療失誤而遭受醫療損害的幾率為三百分之一。許多醫療差錯是由不利事件、檢體誤認、詐欺輸血等引起的,而主要原因是患者和藥物的誤判。食品藥物管理局(FDA) 估計,透過實施整合的IT基礎設施可以避免一半因錯誤識別而導致的醫療錯誤。

- 隨著疫情的發展,醫院目前面臨前所未有的課題。醫療保健行業面臨的其他嚴重課題是人口老化和人員短缺,給醫療保健提供者、醫生、工人、患者和社區帶來巨大壓力。

- 醫生、醫院和診所正在尋找降低成本和提高效率的方法,同時提供患者所需的護理品質。據世界衛生組織稱,到2030年,全球醫療保健勞動力短缺可能達到1400萬,臨床醫生預計將面臨不斷增加的工作量。

- 除了財務課題外,還存在安全課題。在繁忙的醫院環境中,無法保證所有患者都能隨時受到監控,導致患者意識不到自己處於危險之中。因此,對即時管理和監控患者的即時定位系統的需求在未來幾年可能會增加。

- 自從引入 RTLS 以來,許多行業都採用了該系統,並透過減少資源浪費而受益。 RFID和Wi-Fi系統是目前RTLS中最常使用的設備。隨著製造業積極採用並向工業 4.0、連網型設備和物聯網過渡,醫療產業的需求預計也會成長。

亞太地區將經歷最快的成長

- 由於印度和中國等世界新興經濟體勞動力的增加和醫療保健產業的蓬勃發展,亞太市場預計在預測期內將以最快的速度成長。

- 亞太地區的製造業擴大採用工業 4.0 和物聯網,刺激了 RTLS 系統的採用。醫療保健、運輸和物流、工業製造、政府和國防工業正處於實施基於無線技術的 RTLS 的風口浪尖。

- 印度品牌股權基金會估計,到2025年,印度製造業規模將達1兆美元。因此,即時定位系統為倉儲、出貨和物流提供了重要的機會。

- 據Cisco稱,預計到 2022 年,亞太地區使用的穿戴式設備將佔全球穿戴 5G 連接的約 28.7%。因此,對穿戴式裝置的需求不斷成長正在推動即時定位系統市場的成長。

即時定位系統產業概況

即時定位系統市場高度分散。主要參與者包括 Zebra Technologies Corporation、Ubisense Group PLC、AeroScout Inc.(Stanley Healthcare)、TeleTracking Technologies Inc. 和 Savi Technology。企業看到了發展中地區的龐大商機,並透過併購和產品創新來制定策略。主要市場開拓情形如下:

- 2022 年 3 月 - 感測器製造商 SICK AG 與在超寬頻 (UWB) 技術方面擁有豐富經驗的捷克新興企業Sewio 合作,擴大了其定位設備產品組合。 SICK 還可以為客戶提供全面的室內定位解決方案,用於非自動化或半自動化環境中的追蹤應用。

- 2022 年 2 月 - Zebra 技術公司是全球領先的定位解決方案提供者之一,其解決方案涵蓋從簡單的包裝上被動 RAIN RFID 標籤到最複雜的運動員即時主動監測。 Zebra Technology 宣布推出易於部署的整合式 RFID 入口網站的新產品組合。整合 RFID 入口網站可提高各種工業和商業性環境中的業務效率、工作流程準確性和效能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 主要相關人員分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 需要降低成本和最佳化流程

- 醫療保健領域的快速採用

- 追蹤技術的創新和車隊追蹤的最新進展推動了成長

- 市場課題

- 最終用戶之間存在遺留基礎設施

- 隱私和安全問題

- 市場機會

- 透過自動接觸者追蹤控制社區相關疾病的傳播

第6章市場區隔

- 依行業分類

- 衛生保健

- 主要應用

- 依技術區隔

- Bluetooth

- Wi-Fi

- RFID

- 超寬頻 (UWB)

- 紅外線(IR)

- 製造業

- 主要應用

- 依技術區隔

- Bluetooth

- RFID

- Wi-Fi

- UWB

- 零售

- 主要應用

- 依技術區隔

- Wi-Fi

- UWB

- Bluetooth

- 運輸和物流

- 主要應用

- 依技術區隔

- RFID

- UWB

- Bluetooth

- 政府和國防

- 主要應用

- 依技術區隔

- RFID

- UWB

- 油和氣

- 主要應用

- 依技術區隔

- RFID

- UWB

- 衛生保健

- 依成分

- 硬體

- 軟體和服務

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Zebra Technologies

- Ubisense Group PLC

- AeroScout Inc.

- TeleTracking Technologies Inc.

- Savi Technology

- CenTrak Healthcare company

- Ekahau Inc.

- Midmark Corporation

- Identec Group AG

- Sonoitor Technologies Inc.

- Awarepoint Corporation(Centrak Inc.)

- Kontact.io

- Alien Technology

- Stanley Healthcare

- Impinj

第8章投資分析

第9章 市場機會及未來趨勢

The Real Time Location System Market size is estimated at USD 5.73 billion in 2024, and is expected to reach USD 17.19 billion by 2029, growing at a CAGR of 24.60% during the forecast period (2024-2029).

Key Highlights

- A real-time location system helps determine the current position of an object based on real-time information gathered through a wireless system. It helps in indoor tracking of the thing as well. Therefore, owing to the availability of indoor tracking, the healthcare sector is adopting this system, which is expected to contribute to the growth of the RTLS market for the healthcare vertical.

- For instance, according to Cisco, 500 billion devices are expected to be connected to the Internet by 2030. With the increasing trend of IoT and wearable devices, organizations can quickly get more things done, boosting productivity and delivering insight for better user experiences and engagement.

- Industries are opting for RTLS to lower the risk of workplace accidents. An RTLS helps to know the exact position of forklifts, vehicles, and operators at any given time. Based on the collected data, an RTLS analyzes the traffic, enabling it to identify and eliminate workplace accidents and eradicate workflow bottlenecks, saving time and money.

- RTLS can also be an effective way for hospitals to monitor their operations as insurance against potential lawsuits. Most hospitals have patient promises (for instance, how often staff checks up on patients and how often they receive medical attention). These are particularly common in patients with critical conditions or various mental illnesses. RTLS can be used as insurance against such lawsuits.

- The Bluetooth standard has been widely adopted worldwide. Bluetooth Low-Energy (BLE) solutions are cheaper and easier to integrate with existing systems and devices than other technologies. RTLS employing Bluetooth tags offers a detection accuracy of up to 1.5 meters (approximately 5 feet), making them suitable for diverse healthcare applications. High initial setup and maintenance costs are likely to hinder the market's growth during the forecast period.

- Owing to the outbreak of COVID-19, hospitals have been leveraging RFID technology to better manage patients and employees during the pandemic. RFID tools that use wireless communication to identify and track assets and equipment have witnessed a strong adoption in the healthcare sector. As public health emergencies continue, RFID drives care teams' efficiency and accountability.

Real Time Location System Market Trends

Healthcare Industry Offers Potential Growth

- With the increasing population and patients worldwide, patient safety has become a paramount and critical public health concern. According to WHO, medication errors are expected to cause one death per one million people in 2022. A population of 447 million equals 163,000 deaths per year in the EU. According to statistics from Spain, Germany, and the United States, between 60,000 and 131,000 people die in Europe yearly.

- Numbers from the World Health Organization state that there is a 1 out of 300 chance of a patient being harmed in healthcare due to medical errors. Most medical errors are attributed to adverse drug events, specimen misidentification, and incorrect blood transfusion, mainly caused by the misidentification of patients and medication. The Food and Drug Administration (FDA) has estimated that half of the medical errors caused by misidentification are preventable by introducing integrated IT infrastructure.

- At present, hospitals are facing unprecedented challenges with the ongoing pandemic. The other serious challenges the healthcare sector faces are aging populations and staff shortages that place enormous pressure on institutions, doctors, workers, patients, and communities.

- Doctors, hospitals, and clinics are looking for ways to cut costs and improve efficiency while still providing the quality of care their patients require. According to the WHO, the global healthcare workforce shortage could reach 14 million by 2030, with clinicians expected to face ever-increasing workloads.

- In addition to the financial challenges, there are safety challenges. In a hectic hospital environment, it cannot be guaranteed that every patient may be monitored at any time, leading to patients going unnoticed in dangerous situations. Hence, the demand for real-time location systems may grow in the coming years to manage and monitor patients in real time.

- Since the inception of RTLS, many industries have employed systems and benefitted from the reduced wastage of resources. RFID and Wi-Fi systems are currently the most-used devices in RTLS. With the sector actively adopting and moving toward Industry 4.0, connected devices, and IoT in manufacturing, the demand is expected to grow in the health industry.

Asia-Pacific to Witness the Fastest Growth

- The Asia-Pacific market is expected to grow at the fastest rate during the forecast period because of the increasing working population and the booming healthcare industry in emerging economies of the world, i.e., India and China.

- The growing adoption of Industry 4.0 and IoT in manufacturing in the Asia-Pacific region has fueled the implementation of RTLS systems. The healthcare, transportation and logistics, industrial production, government, and defense industries are at the edge of radio technology-based RTLS implementation.

- The Indian Brand Equity Foundation estimates that India's manufacturing sector has the potential to reach USD 1 trillion by 2025. As a result, RTLS has a huge opportunity in warehouse management, shipping, and logistics.

- According to Cisco Systems, in 2022, wearables used in Asia-Pacific are forecast to account for approximately 28.7% of the wearable 5G connections globally. Therefore, the increasing demand for wearables drives the growth of the real-time location system market.

Real Time Location System Industry Overview

The real-time location system market is highly fragmented. The major players include Zebra Technologies Corporation, Ubisense Group PLC, AeroScout Inc. (Stanley Healthcare), TeleTracking Technologies Inc., and Savi Technology. The companies see tremendous opportunities in developing regions, thus strategizing their operations accordingly with mergers and acquisitions or product innovations. Some of the key developments in the market are:

- March 2022 - SICK AG, a sensor manufacturing company, expanded its portfolio of localization devices with help from Sewio, a Czech start-up with substantial experience with ultra-wideband (UWB) technology. SICK can also provide its clients with a comprehensive array of indoor localization solutions for track and trace applications in non-automated or semi-automated environments.

- February 2022 - Zebra Technology Corporation is one of the global providers of location solutions ranging from simple passive RAIN RFID tags on packages to the most complicated real-time active monitoring of athletes. Zebra Technologies announced a new portfolio of simple-to-deploy integrated RFID Portals. The integrated RFID portals will improve operational efficiency, workflow accuracy, and performance across various industrial and commercial contexts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key Stakeholder Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Cost Reduction and Process Optimization

- 5.1.2 Rapid Adoption in the Healthcare Segment

- 5.1.3 Innovations in Tracking Technology and Recent Advancements in Fleet Tracking to Aid Growth

- 5.2 Market Challenges

- 5.2.1 Presence of Legacy Infrastructure Across End Users

- 5.2.2 Privacy and Security Concerns

- 5.3 Market Opportunities

- 5.3.1 Automated Contact Tracing to Mitigate the Spread of Community-related Diseases

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Healthcare

- 6.1.1.1 Major Applications

- 6.1.1.2 Segmentation by Technology

- 6.1.1.2.1 Bluetooth

- 6.1.1.2.2 Wi-Fi

- 6.1.1.2.3 RFID

- 6.1.1.2.4 Ultra-wideband (UWB)

- 6.1.1.2.5 InfraRed (IR)

- 6.1.2 Manufacturing

- 6.1.2.1 Major Applications

- 6.1.2.2 Segmentation by Technology

- 6.1.2.2.1 Bluetooth

- 6.1.2.2.2 RFID

- 6.1.2.2.3 Wi-Fi

- 6.1.2.2.4 UWB

- 6.1.3 Retail

- 6.1.3.1 Major Applications

- 6.1.3.2 Segmentation by Technology

- 6.1.3.2.1 Wi-Fi

- 6.1.3.2.2 UWB

- 6.1.3.2.3 Bluetooth

- 6.1.4 Transportation and Logistics

- 6.1.4.1 Major Applications

- 6.1.4.2 Segmentation by Technology

- 6.1.4.2.1 RFID

- 6.1.4.2.2 UWB

- 6.1.4.2.3 Bluetooth

- 6.1.5 Government and Defense

- 6.1.5.1 Major Applications

- 6.1.5.2 Segmentation by Technology

- 6.1.5.2.1 RFID

- 6.1.5.2.2 UWB

- 6.1.6 Oil and Gas

- 6.1.6.1 Major Applications

- 6.1.6.2 Segmentation by Technology

- 6.1.6.2.1 RFID

- 6.1.6.2.2 UWB

- 6.1.1 Healthcare

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software and Services

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zebra Technologies

- 7.1.2 Ubisense Group PLC

- 7.1.3 AeroScout Inc.

- 7.1.4 TeleTracking Technologies Inc.

- 7.1.5 Savi Technology

- 7.1.6 CenTrak Healthcare company

- 7.1.7 Ekahau Inc.

- 7.1.8 Midmark Corporation

- 7.1.9 Identec Group AG

- 7.1.10 Sonoitor Technologies Inc.

- 7.1.11 Awarepoint Corporation (Centrak Inc.)

- 7.1.12 Kontact.io

- 7.1.13 Alien Technology

- 7.1.14 Stanley Healthcare

- 7.1.15 Impinj