|

市場調查報告書

商品編碼

1432670

防爆行動通訊設備:市場佔有率分析、產業趨勢、成長預測(2024-2029)Explosion Proof Mobile Communication Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

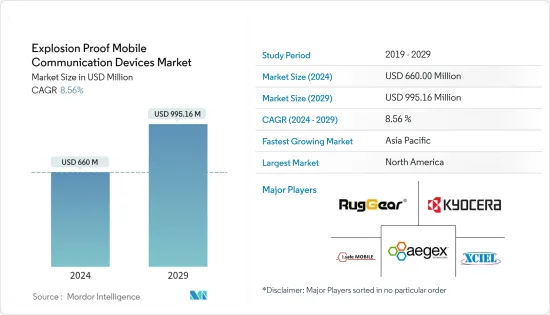

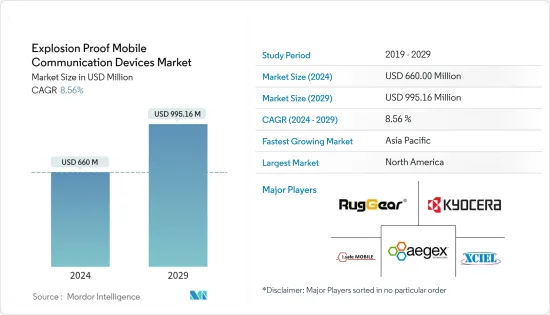

防爆行動通訊設備市場規模預計到2024年為6.6億美元,預計到2029年將達到9.9516億美元,在預測期內(2024-2029年)複合年成長率為8.56%。

疫情期間,電子設備需求受到干擾,設備市場受到較大影響。由於各國在疫情大流行的最初幾個月停止生產,電子業發現電子設備供不應求。 2020年第一季季和第二季度,由於全球商業活動下降,這些設備的出貨全面下降。然而,OEM維持的電子設備的額外庫存足以生產到四月底的電氣產品。預計此類趨勢將影響所研究市場在預測期內的成長。

主要亮點

- 對於在危險區域運作的公司來說,安全通訊是最重要的領域之一。從本質上講,這些公司需要獲取資訊並隨時了解情況,以避免爆炸或災難的風險。爆炸具有毀滅性,造成巨大的生命、財產和資本損失,並對環境造成破壞。

- 由於有大量高度易燃材料,精製、石化廠、採石場、化工廠和玉米加工廠非常危險。必須持續監控以確保安全和生產力。傳輸影像、資料和音訊的防爆通訊設備可用於監控和控制此類位置。

- 隨著危險地點的遠端和綜合工作變得普及,從海上設施傳輸到岸上設施的資訊量持續增加。因此,對整合智慧型手機、平板電腦、個人電腦、相機和無線網路的安全、防爆控制和監控系統的需求不斷成長。

- 此外,製造業惡劣環境下發生的爆炸事故不斷增加。因此,人們對存在化學品、有毒油漆、易燃粉塵等危險場所的安全性越來越感興趣,防爆通訊設備也越來越受到關注。

- 然而,世界各地不同的安全法規限制公司開發與所有國家不相容的產品。這限制了防爆行動通訊設備市場的成長。

防爆行動通訊設備市場趨勢

石油和天然氣產業預計將顯著成長

- 即使在最有利的條件下,石油和天然氣產業也會培養強大的安全文化。美國職業安全與健康管理局 (OSHA) 等管理機構將石油和天然氣行業分為不同的部分:石油和天然氣開採、石油和天然氣鑽井以及石油和天然氣營運的支援活動。任何這些類別的工人都可能在危險條件下工作,包括化學品暴露、火災和爆炸危險、偏遠地點以及井、管道和機械等密閉空間。這是高度性的。

- 此外,全球汽車、能源、機械製造、電力、化學和冶金行業對原油和成品油(包括暖氣油和柴油)的需求不斷增加,進一步增加了對石油和天然氣探勘過程的需求。推動防爆行動通訊設備的需求。

- 通訊設備透過即時資料傳輸和通訊來提高生產,在工業中發揮著至關重要的作用。業界擴大採用物聯網設備將降低營運成本和時間。它還將改善海上工人的安全環境。

- 對此,美國政府對必須使用的政策和安全設備有嚴格的規定。這些保單還包括使用防爆設備來提供安全。安全政策的實施預計將增加對防爆設備的依賴,間接推動全球市場的成長。

- 2020年5月,醫療和工業電腦供應商Wincomm推出了WTPE系列防爆平板電腦。 WTPE系列為具有爆炸性考慮的環境提供了完美的解決方案,並且設計用於適用於危險環境,經過嚴格的測試以確保安全性和最佳性能。據該公司介紹,WTPE適用於石油和天然氣工業、化學製造、發電、釀酒廠和其他危險工業應用。

北美地區佔比最大

- 預計在預測期內,北美將在全球防爆行動通訊設備市場中佔據重要地位。

- 該地區的製程工業,特別是化學、石油和天然氣以及精製,面臨許多可能引起大規模爆炸的危險情況。例如,美國特里凱姆工業公司和英國石油公司德克薩斯城煉油廠發生爆炸,主要是因為缺乏準確及時的資訊來正確應對這些危險地點發生的情況,我做不到。

- 聯邦緊急災難管理署可能會增加資金,採取必要措施減少災害數量。這可能會增加對防爆即時通訊設備的需求並推動市場成長。

- 對此,美國政府對政策和使用的安全設備都有嚴格的規定。這些保單包括使用防爆設備來提供安全。安全政策的實施預計將增加對防爆設備的依賴,間接推動全球市場的成長。

防爆行動通訊設備產業概況

防爆行動通訊設備市場由京瓷等少數幾家大公司服務,市場集中度正走向整合。然而,提供這些產品的新參與者也已進入市場,並預計在預測期內遵循類似的趨勢。

- 2020 年 11 月 - ECOM Instruments GmbH 宣布推出新一代本質安全型 4G/LTE Android 智慧型手機 Smart-Ex 02。該設備擁有5吋大顯示螢幕,支援21個LTE頻譜。該公司表示,該設備是一款適用於 Zone 1/21 和 Div.1 區域的最先進的防爆智慧型手機,可簡化員工、後端系統和控制中心之間的通訊。

- 2020 年 10 月 - 倍加福宣布推出新一代本質安全 4G/LTE Android 智慧型手機 Smart-Ex 02。新開發的Smart-Ex 02配備5吋大顯示螢幕,是該公司先進的防爆智慧型手機,相容於Zone 1/21和Div.1。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 工業中對快速、無縫語音、影像和資料傳輸的需求

- 有關危險場所安全設備使用的政府規則和法規

- 市場限制因素

- 安全法規因地區而異

- COVID-19 對市場的影響

- 技術簡介

第5章市場區隔

- 產品

- 智慧型手機和行動電話

- 雙向無線對講機

- 手持電腦

- 耳機

- 藥片

- 其他產品

- 最終用戶產業

- 油和氣

- 礦業

- 製造/加工

- 化學/製藥

- 防禦

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Aegex Technologies LLC

- I.Safe MOBILE GmbH

- Xciel Inc.

- Kyocera Corporation

- RugGear

- Zebra Technologies Corporation(Xplore Technologies Corp.)

- Getac Technology Corporation

- Panasonic Corporation

- Caterpillar Inc.

- Sonim Technologies Inc.

- Airacom Limited

- Bartec GmbH

第7章 投資分析

第8章市場的未來

The Explosion Proof Mobile Communication Devices Market size is estimated at USD 660 million in 2024, and is expected to reach USD 995.16 million by 2029, growing at a CAGR of 8.56% during the forecast period (2024-2029).

Amid the pandemic, the demand for electronics is disrupted, owing to which the equipment market has been severely influenced. The production shutdown in various countries during the initial months of the pandemic resulted in the electronics industry observing a shortage of supply of electronics. The overall shipment of these devices during Q1 2020 and Q2 2020 slumped due to a decrease in business activities across the world. However, the additional inventory of electronics maintained by the OEMs was sufficient for the production of electrical products until the end of April. Such trends are expected to affect the growth of the studied market in the forecast period.

Key Highlights

- Secure communications are one of the most critical areas for businesses operating in hazardous areas. Inherently, these companies need access to information and remain informed continuously on avoiding dangers of explosions and catastrophes, due to the complexity of operations involved. Explosions can be devastating and cause huge losses of life, property, and capital, and damage the environment.

- Oil refineries, petrochemical plants, mining quarries, chemical factories, and corn mills are prone to high risks, due to the presence of highly inflammable substances in large quantities. They need to be continuously monitored to ensure safety and productivity. Explosion proof communication devices may be used to transmit images, data, and voice to monitor and control such places.

- As the remote and integrated operations in hazardous locations are becoming more widespread, an ever-increasing amount of information is being exchanged from offshore to onshore facilities. Hence, the demand is growing for explosion-proof safe smartphones, tablets, PCs, cameras, and control and monitoring systems offered with integrated wireless networking.

- Additionally, the number of explosions occurred in the extreme environment of manufacturing industries is increasing. Hence, the focus on the safety of hazardous locations is growing because of the presence of chemicals, toxic paints, and other combustible dust has prompted an increased focus on explosion-proof communication devices.

- However, varying safety regulations country to country across the globe is restricting companies to develop products incompatible with all countries. This factor somewhere restricting the explosion-proof mobile communication devices market growth.

Explosion Proof Mobile Communication Devices Market Trends

Oil and Gas Industry Expected to Show Significant Growth

- The oil and gas industry nurtures a robust safety culture, even under the most benign circumstances. Governing bodies, such as the US Occupational Health and Safety Administration (OSHA), classifies the oil and gas industry into distinct segments: oil and gas extraction, drilling oil and gas wells, and support activities for oil and gas operations. A worker working on any of these segments is likely to work in hazardous conditions, including exposure to chemicals, risk of fire or explosion, remote locales, and confined spaces such as wells or pipelines and machines.

- Additionally, the increasing demand for crude oil and finished oils, including heating oil and diesel fuel in the automobile, energy, machinery manufacturing, electricity, chemicals, and metallurgy sectors worldwide further boosted the need for more oil and gas exploration processes, indirectly driving the demand for explosion-proof mobile communication devices.

- Communication devices have a crucial role in the industry in terms of enhancing production with real-time data transfer and communication. The increasing adoption of IoT devices in the industry offers a reduction in cost and time of operation. It also improves the safe environment for the offshore workforce.

- In response to this, the US government has laid out some stringent regulations about the policies and safety equipment to be used. These policies included the usage of explosion-proof devices to provide safety. The implementation of safety policies is anticipated to increase the dependence on explosion-proof equipment, indirectly boosting the growth of the global market.

- In May 2020, Wincomm, a medical and industrial computer provider, launched the Explosion Proof Panel PC, WTPE series, built to suit hazardous environments undergoing rigorous testing to ensure safety and top performance offering the best solution for environments with explosion considerations. According to the company, the WTPE works well in oil & gas industry, chemical manufacturing, power generation, distilleries and other hazardous industrial applications.

North America to Hold the Largest Share

- North America is set to hold a significant position in the global explosion-proof mobile communication devices market over the forecast period, owing to the government's strict regulations, especially in the United States, toward hazard safety measures.

- The regional process industries, especially chemicals, oil and gas, and refining plants, face numerous hazardous situations with the potential to cause massive explosions. For instance, explosions incidents at Tri-Chem Industries in the United States and BP's Texas City Refinery occurred mainly due to a lack of correct and timely information, leading to an inability to act appropriately to arise situations in these hazardous locations.

- The Federal Emergency Management Agency is likely to increase the funding to reduce the number of disasters by taking necessary measures. This may lead to a demand for explosion-proof real-time communication devices, thereby boosting the market growth.

- In response to this, the US government has laid out some stringent regulations about the policies and safety equipment to be used. These policies included the usage of explosion-proof devices to provide safety. Implementing safety policies is anticipated to increase the dependence on explosion-proof equipment, indirectly boosting the growth of the global market.

Explosion Proof Mobile Communication Devices Industry Overview

The explosion-proof mobile communication devices market concentration is inclined towards the consolidation with a few major players like Kyocera Corporation in the market offering the products. But new players are entering into the market offering these products, and it is expected to follow a similar trend in the forecast period.

- November 2020 - ECOM Instruments GmbH announced a new generation of its intrinsically safe 4G/LTE Android smartphone Smart-Ex 02. The device consisted of a large 5-inch display and is said to support 21 different LTE frequency bands. The company claims that the device is the most advanced explosion-proof smartphone for Zone 1/21 and Div. 1 areas and simplifies communication between employees, backend systems, and the control center.

- October 2020 - Pepperl+Fuchs introduced the new generation of its intrinsically safe 4G/LTE Android smartphone Smart-Ex 02. With a large 5-inch display, the newly developed Smart-Ex 02 is the company's advanced explosion-proof smartphone for Zone 1/21 and Div. 1.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Need for Fast and Seamless Voice, Image, and Data Transfer in Industries

- 4.4.2 Government Rules and Regulations on the Use of Safe Equipment in Hazardous Places

- 4.5 Market Restraints

- 4.5.1 Safety Regulations Vary Across Different Regions

- 4.6 Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Smartphones and Cellphones

- 5.1.2 Two-way Radios

- 5.1.3 Handheld PC

- 5.1.4 Headsets

- 5.1.5 Tablets

- 5.1.6 Other Products

- 5.2 End-User Industry

- 5.2.1 Oil and Gas

- 5.2.2 Mining

- 5.2.3 Manufacturing and Processing

- 5.2.4 Chemical and Pharmaceutical

- 5.2.5 Defense

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Aegex Technologies LLC

- 6.1.2 I.Safe MOBILE GmbH

- 6.1.3 Xciel Inc.

- 6.1.4 Kyocera Corporation

- 6.1.5 RugGear

- 6.1.6 Zebra Technologies Corporation (Xplore Technologies Corp.)

- 6.1.7 Getac Technology Corporation

- 6.1.8 Panasonic Corporation

- 6.1.9 Caterpillar Inc.

- 6.1.10 Sonim Technologies Inc.

- 6.1.11 Airacom Limited

- 6.1.12 Bartec GmbH