|

市場調查報告書

商品編碼

1441688

碳酸鈣:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Calcium Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

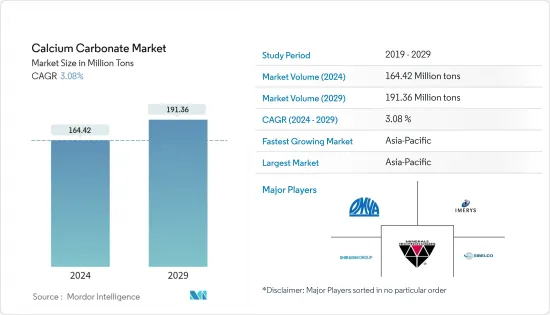

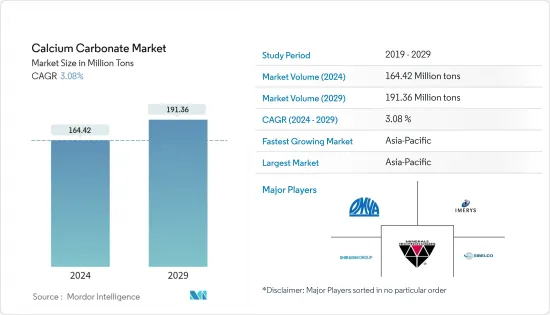

預計2024年碳酸鈣市場規模為1,6,442萬噸,預估至2029年將達到19,136萬噸,預測期間(2024-2029年)複合年成長率為3.08%。

冠狀病毒感染疾病(COVID-19) 的爆發以及由此產生的封鎖和社會疏遠規範導致汽車、建築和其他製造業等多個行業完全關閉。然而,目前估計市場已達到疫情前的水準。

主要亮點

- 從中期來看,推動全球碳酸鈣市場的主要因素是亞太地區建設活動的成長以及造紙工業中碳酸鈣取代高嶺土。

- 與碳酸鈣相關的健康危害預計將阻礙預測期內的市場成長。

- 綠色應用的重要性日益增加,預計將為所研究的市場提供新的機會。

- 亞太地區包括中國、印度、日本等主要消費國,主導全球市場。

碳酸鈣市場趨勢

造紙業主導市場

- 碳酸鈣是造紙工業應用中考慮的基本成分之一,因為它用於填料和塗料目的。 CaCO3 具有不透明度、亮度和平滑度等優異特性,使其成為生產書寫、印刷和包裝用紙的理想成分。

- 這是一種礦物填料,可顯著降低造紙成本。礦物質比纖維更容易乾燥,這也降低了基礎材料的成本。碳酸鈣也用於紙張塗料,賦予印刷紙表面光澤和平滑度。

- 在目前的情況下,CaCO3 比其他紙張填充材占主導地位。偏好碳酸鈣的主要原因是對光澤度更高、體積更大的紙張的需求。在鹼性造紙製程中使用CaCO3具有很大的優勢。

- 在造紙工業中,碳酸鈣用作高嶺土的替代品。合成沉澱碳酸鈣比高嶺土更亮、更白,因此許多製造商將其用於紙張填充和塗層用途。實現更好的不透明度、光澤度、高亮度和表面光潔度,以提高適印性。

- 碳酸鈣不僅用作高嶺土的替代品,而且還用於木漿和作為添加劑。在鹼性造紙過程中,碳酸鈣在造紙廠中用作填充材。碳酸鈣佔造紙用填料和顏料總合的32%。

- 目前,亞太地區引領著造紙業碳酸鈣的市場需求,其中中國是最大的消費國。紙包裝和紙巾產品的需求不斷成長預計將推動亞太地區的市場。根據印度造紙製造商協會(IPMA)統計,印度造紙工業約佔世界紙張產量的4%。該產業預計營業額為7,000 億印度盧比(約847,456 萬美元)(國內市場規模為8,000 億印度盧比(約968,521 萬美元)),財政貢獻約為500 億印度盧比(約968,521 萬美元)。美元)。

- 該地區經濟的快速成長和食品消費的增加推動了對包裝材料的需求。對紙巾的需求是由人口成長和衛生標準提高所推動的。

- 所有上述因素預計將在預測期內增加碳酸鈣的需求。

亞太地區預計將主導全球市場

- 由於該地區建設活動的增加,預計亞太地區將引領碳酸鈣市場。

- 隨著該地區建築業的成長,碳酸鈣的需求預計將受到經濟活動增加和新投資機會的推動,特別是在中國、印度和印尼等新興國家。

- 中國是全球最大的紙漿和紙張生產國,森林資源豐富,覆蓋國土面積的22.5%。工業現代化、機械化程度高、勞動廉價。在中國,由於政府的植樹造林計劃,森林面積正在增加。

- 中國是世界上最大的塑膠、黏劑和密封劑、橡膠、油漆和塗料的生產國和消費國。大多數塑膠、黏劑和密封劑、油漆和塗料被汽車和建築行業消耗。汽車工業是橡膠的主要消費產業。

- 印度政府的「2022 年全民住宅」計畫也改變了該產業的遊戲規則。此外,聯邦內閣核准設立35.8億美元的替代投資基金(AIF),以重振全國主要城市約1,600個停滯的住宅計劃。

- 據印度造紙製造商協會(IPMA)稱,儘管印度的紙漿和紙張市場每年以6-7%左右的速度成長,但該行業的產量在過去三年中卻出現了下降。這與消費穩定成長形成鮮明對比。

- 總體而言,由於該地區各個最終用戶行業的需求不斷增加,預計亞太地區碳酸鈣市場將主導全球市場。

碳酸鈣產業概況

碳酸鈣市場本質上是部分整合的。市場主要企業包括 Omya AG、Mineral Technologies Inc.、Imerys、Shiraishi Group、Sibelco 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大亞太地區的建設活動

- 快速成長的包裝和造紙工業

- 在造紙工業中以碳酸鈣取代高嶺土

- 抑制因素

- 與碳酸鈣相關的健康危害

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 類型

- 研磨碳酸鈣 (GCC)

- 沉澱碳酸鈣(PCC)

- 目的

- 建築材料原料

- 飲食補充劑

- 熱塑性塑膠添加劑

- 填料和顏料

- 黏劑成分

- 瓦斯脫硫

- 土壤中和劑

- 其他用途

- 最終用戶產業

- 紙

- 塑膠

- 黏劑和密封劑

- 建造

- 油漆和塗料

- 藥品

- 車

- 農業

- 橡皮

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- Chemical &Mineral Industries Pvt. Ltd

- FUJIAN SANMU NANO CALCIUM CARBONATE CO. LTD

- GLC Minerals

- Gulshan Polyols Ltd

- Huber Engineered Materials

- Imerys

- Kemipex

- Lhoist

- Maruo Calcium Co. Ltd

- Minerals Technologies Inc.

- Mississippi Lime Company

- Newpark Resources Inc.

- OKUTAMA KOGYO CO. LTD

- Omya AG

- Provale Holding SA

- SCHAEFER KALK GmbH &Co. KG.

- Shiraishi Kogyo Kaisha Ltd

- Sibelco

第7章市場機會與未來趨勢

- 塑膠和橡膠產業對奈米碳酸鈣的需求不斷成長

- 綠色應用的新重要性

The Calcium Carbonate Market size is estimated at 164.42 Million tons in 2024, and is expected to reach 191.36 Million tons by 2029, growing at a CAGR of 3.08% during the forecast period (2024-2029).

The outbreak of COVID-19 and resultant lockdowns and social distancing norms led to the complete shutdown of various industries in the automotive, construction, and other manufacturing segments. However, the market is currently estimated to have reached pre-pandemic levels.

Key Highlights

- Over the medium term, major factors driving the global calcium carbonate market are growing construction activities in the Asia-Pacific region and the replacement of kaolin with calcium carbonate in the paper industry.

- Health hazards associated with calcium carbonate are expected to hinder the market's growth during the forecast period.

- The emerging importance of green applications is expected to provide new opportunities for the market studied.

- The Asia-Pacific region, which includes the major consumption countries, such as China, India, and Japan, dominates the global market.

Calcium Carbonate Market Trends

Paper Sector to Dominate the Market

- Calcium carbonate is one of the essential ingredients considered for applications in the paper industry, as it is employed as fillers and for coating purposes. The working qualities of CaCO3, like opacity, brightness, and smoothness, make it an ideal component for the manufacturing of writing, printing, and packaging-grade paper.

- It is a mineral filler, which substantially reduces the production cost of paper. As the minerals are easier to be dried than fibers, it also reduces the cost of basic materials. Calcium carbonate is also used in paper coating, as it brings out the brightness and smoothness on the surface of printing paper.

- In the present scenario, CaCO3 is dominant over other papermaking filler materials. The main reason behind the preference for calcium carbonate is the demand for brighter and bulkier paper. There are significant advantages to the use of CaCO3 in the alkaline papermaking process.

- In the paper industry, calcium carbonate is used as a replacement for kaolin. Since the synthesized precipitated calcium carbonate is brighter and whiter than kaolin, many manufacturers have been using it for paper filling and coating purposes. It offers better opacity, gloss, high brightness, surface finishing, and improves printability.

- Calcium carbonate is not only used as a substitute for kaolin but also for wood pulp and additives. In the alkaline papermaking process, calcium carbonate is used in a paper mill as a filler material. Calcium carbonate amounts for 32% of the total share of filler and pigments used in paper production.

- Currently, the Asia-Pacific leads the market demand for calcium carbonate in the paper industry, with China being the leading consumer. Increasing demand for paper packaging and tissue products is expected to drive the market in the Asia-Pacific region. According to the Indian Paper Manufacturers Association (IPMA), the Indian paper industry accounts for about 4% of the world's production of paper. The estimated turnover of the industry is INR 70,000 crore (~USD 8,474.56 million) (domestic market size of INR 80,000 crores (~USD 9,685.21 million)), and its contribution to the exchequer is around INR 5,000 crore (~USD 605.33 million).

- The packaging demand is driven by rapid economic upticks and growing food consumption in the region. The tissue demand is driven by population growth and improving hygiene standards.

- All the aforementioned factors are expected to boost the demand for calcium carbonate during the forecast period.

Asia-Pacific Expected to Dominate the Global Market

- The Asia-Pacific region is projected to lead the market for calcium carbonate owing to increasing construction activities in the region.

- Along with the growing construction industry in the region, the demand for calcium carbonate is expected to be driven by increasing economic activities and new investment opportunities in emerging economies, such as China, India, and Indonesia, among others.

- China is the largest pulp and paper producing country in the world, owing to large forest reserves, which amount to 22.5% of the land area. The industry is modern and highly mechanized, and labor is cheap. Forest cover is increasing in China owing to the government's afforestation initiatives.

- China is globally the largest manufacturer and consumer of plastics, adhesives and sealants, rubber, and paints and coatings. The majority of plastics, adhesives and sealants, and paints and coatings are consumed by the automotive and construction industries. The automotive industry is the major consumer of rubber.

- The Indian government's 'Housing for All by 2022' scheme is also a major game-changer for the industry. Additionally, the Union Cabinet has approved the setting up of a USD 3.58 billion alternative investment fund (AIF) in order to revive around 1,600 stalled housing projects across the top cities in the country.

- According to the Indian Paper Manufacturers Association (IPMA), even though India's pulp and paper market has been growing around 6-7% per annum, the industry witnessed a drop in production over the past three years. This contrasts with the consumption, which is exhibiting a steady rise.

- Overall, with the demand increasing from various end-user industries in the region, the Asia-Pacific market for calcium carbonate is projected to dominate the global market.

Calcium Carbonate Industry Overview

The calcium carbonate market is partially consolidated in nature. Some of the major players in the market include Omya AG, Mineral Technologies Inc., Imerys, Shiraishi Group, and Sibelco, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in the Asia-Pacific Region

- 4.1.2 Rapidly Increasing Packaging and Paper Industry

- 4.1.3 Replacement of Kaolin with Calcium Carbonate in Paper Industry

- 4.2 Restraints

- 4.2.1 Health Hazards Associated with Calcium Carbonate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Ground Calcium Carbonate (GCC)

- 5.1.2 Precipitated Calcium Carbonate (PCC)

- 5.2 Application

- 5.2.1 Raw Substance for Construction Material

- 5.2.2 Dietary Supplement

- 5.2.3 Additive for Thermoplastics

- 5.2.4 Filler and Pigment

- 5.2.5 Component of Adhesives

- 5.2.6 Desulfurization of Fuel Gas

- 5.2.7 Neutralizing Agent in Soil

- 5.2.8 Other Applications

- 5.3 End-user Industry

- 5.3.1 Paper

- 5.3.2 Plastic

- 5.3.3 Adhesives and Sealants

- 5.3.4 Construction

- 5.3.5 Paints and Coatings

- 5.3.6 Pharmaceutical

- 5.3.7 Automotive

- 5.3.8 Agriculture

- 5.3.9 Rubber

- 5.3.10 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Australia and New Zealand

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemical & Mineral Industries Pvt. Ltd

- 6.4.2 FUJIAN SANMU NANO CALCIUM CARBONATE CO. LTD

- 6.4.3 GLC Minerals

- 6.4.4 Gulshan Polyols Ltd

- 6.4.5 Huber Engineered Materials

- 6.4.6 Imerys

- 6.4.7 Kemipex

- 6.4.8 Lhoist

- 6.4.9 Maruo Calcium Co. Ltd

- 6.4.10 Minerals Technologies Inc.

- 6.4.11 Mississippi Lime Company

- 6.4.12 Newpark Resources Inc.

- 6.4.13 OKUTAMA KOGYO CO. LTD

- 6.4.14 Omya AG

- 6.4.15 Provale Holding SA

- 6.4.16 SCHAEFER KALK GmbH & Co. KG.

- 6.4.17 Shiraishi Kogyo Kaisha Ltd

- 6.4.18 Sibelco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from the Plastic and Rubber Industry for Nano-calcium Carbonate

- 7.2 Emerging Importance of Green Applications